Author The Lilly Commercial Team

Avenue31 plans to build 1.95M sq. ft. of Ottawa industrial

Do your homework, be organized and plan. It’s a straightforward formula and one that is paying off for Ottawa-based developer Avenue31 as it begins its plan to deliver almost two million square feet of space into the National Capital Region.

In May, local media reported that Avenue31 had submitted a development proposal for a roughly 650,000-square-foot warehousing and logistics facility across from Amazon’s giant million-square-foot fulfillment centre on Boundary Road in Ottawa’s East End.

What those reports didn’t note was that Avenue31 had just put shovels in the ground at another major development site – its National Capital Business Park at Hunt Club Road and Highway 417.

Located in the southeast sector of the city, like the Boundary Road site it is also along the highway corridor to Montreal.

The developer is marketing more than 1.3 million square feet of class-A industrial space for lease. National Capital Business Park is the first project from Avenue31 to start construction.

The pandemic didn’t start this fire

Avenue31 and its investors see a huge opportunity in the growth of e-commerce, in hand with Ottawa’s growing importance as a centrally located warehousing and logistics hub between Montreal, Toronto and points of entry into the U.S.

It’s a dynamic that’s only accelerated with the pandemic. The Avenue31 team has been paying close attention to how these winds are blowing for some time. It all began in 2016 with the vision of founder and CEO Michel Pilon.

“Avenue31 came to be in response to the economic and social factors that are shifting our cities,” said Ryan Semple, Avenue31’s director of business development.

“The movement of goods and people and talking specifically about e-commerce, automation, climate change and urbanization.”

In pursuit of that end, Avenue31’s development focus spans Eastern Ontario in three verticals – warehousing and logistics, mixed-use multiresidential and infrastructure.

On the industrial front, Avenue31 has assembled a portfolio of logistics sites capable of accommodating up to eight million square feet of class-A industrial space.

Simple supply and demand

In addition to the National Capital Business Park site, Avenue31 has that other site across from Amazon – the 44-acre Boundary Road Industrial Area.

The site is being rezoned to allow for uses such as highway commercial, a truck transport terminal and a wide range of other rural industrial purposes. Construction is expected to start sometime in 2022.

A third development site lies on the 401 corridor near Cornwall – the Long Sault Logistics Village. This site straddles both the logistics and infrastructure verticals given its access to rail.

Avenue31 envisions Long Sault as “a 680-acre, master-planned, trans-modal logistics village to be anchored with a 50- to 100-acre railyard, bordered to the north by Highway 401, the busiest goods movement corridor for transport trucks in Canada, and a CN main cargo line to the south, the busiest cargo rail corridor in North America.”

A fourth warehousing and logistics site of 30 acres will soon be announced in the south end of Ottawa.

“It’s as simple as a supply-and-demand case for more logistics development,” Semple said. “When you look at the stats on e-commerce and business in general and what percentage of sales are now online, it’s been trending upward for a long time.

“COVID-19 has also really shown a few holes in our supply chains.”

“Bursting at the seams”

While he didn’t drop any names, Semple acknowledged that Avenue31 is fielding more and more calls from big brands in food distribution, retail and e-commerce.

The challenge and opportunity with Ottawa is that it still suffers from a shortage of available industrial space in the large footprints desired by these prospective tenants.

“Ottawa is increasingly being seen as a location for same-day delivery,” Semple said. “These organizations are bursting at the seams with their current locations.”

The key to having the right product at the right time all comes down to planning, organization and ensuring a strong network of investors and advisors.

“As a new developer, we are making sure to align ourselves with people who have the experience to help us make the right decisions and build a product that will stand the test of time,” Semple said.

If Semple’s name sounds familiar, it’s no surprise. A Canadian Alpine Ski Team member for 12 years, he competed at two Olympic Games. Prior to joining Avenue31, he spent five years in the real estate industry, founding and operating his own real estate firm.

Pilon, the firm’s president and CEO, has over 25 years of experience in the development industry. He started out as a market analyst at the Canada Mortgage and Housing Corporation, then moved up the ranks with several companies before also launching Simplicity Development in 2004.

He’s been involved in residential subdivisions, land assemblies, mixed-use transit-oriented developments, community retail plazas, infill residential, industrial buildings and business parks, and public/private partnerships.

Avenue31’s investor base includes representation from Montreal, Toronto, Halifax, Charlottetown and Saint John’s, as well as Ottawa.

Investors represent a wide range of economic sectors and professional services to ensure the company has solid advice it can trust. This extends to sustainability, to meet and even exceed standards such as LEED.

Those who fail to prepare . . .

“Of course, you want to provide a great product, but we want to push to provide a product that will also be sustainable with the challenges that we have in today’s world,” Semple said.

While the pandemic may have accelerated the growth and evolution of the warehousing and logistics business, it has also sparked supply chain disruptions that can derail new development.

The key to keeping timelines on schedule has been Avenue31’s approach from the outset to plan ahead. For example, to ensure a consistent flow of steel for construction, Avenue31 secured a supply deal with a Canadian manufacturing partner early on.

“You really have to lock in six months in advance, and I believe that wasn’t the standard in the past, but if you wait and the supply is not then available, you can’t build,” Semple said. “Once you finally put a shovel in the ground, you have likely done about 75 per cent of the work.”

But, what about that other market vertical – mixed-use multiresidential?

The 15-minute neighbourhood

While Avenue31 doesn’t have anything to announce yet on that front, there’s plenty of activity behind the scenes. Semple said the ideal opportunity will qualify as a “15-minute neighbourhood,” with amenities and mass transit access all within walking distance.

“It’s always about finding a future-proof site. The big picture is Ottawa is a great place to live. The city continues to grow and there will always be a place for new multires.”

For now, the focus is on delivering a strong industrial product to the market and firmly establishing the Avenue31 brand.

“As a new company, we have to demonstrate that we can deliver and that is what we are doing now,” Semple said. “We are a small but mighty team.”

Source Real Estate News Exchange. Click here to read a full story

Data, Decision Making, and Opportunity in the GTA Industrial Market

An In-Depth Analysis of Values, Rental Rates, and Historical Trades

When looking to invest, develop, purchase, or lease commercial real estate assets, CRE professionals often fail in their pursuits when they let a widespread belief get in the way of sound decision-making.

Making the right move is simple but extremely difficult; with hindsight humbling even the savviest of investors. Going against the grain can be incredibly lonely and attract criticism, yet it’s often also a prerequisite for creating big wins (assuming equal access to information), especially in a market with so many intelligent and dialled-in pros.

That being said, with the rise of social media and online communities over the past couple of years, we’ve seen a growing transparency and collaboration between brokers and investors in terms of process, data, and completed trades; a good thing. However, as people compete for attention on all the mainstay platforms, the noise is astounding, often influencing people to ignore their gut instincts and forget fundamental first principles. For example, yes, there is a desperate shortage of space. At the same time, leaders in the industry continually defy the odds and get projects done. We see so many familiar faces on the trade records and social media announcements.

So what’s behind this phenomenon? Well…

You know most folks just love a good story. A carefully crafted narrative.

With all that’s happening around the world and in business—and constantly being bombarded by information—telling stories is one of the simplest methods in which to make sense of it all. Humans are programmed to tell tales. Thus, we tend to convert complex cause-effect relationships and deep data into anecdotes.

This tradeoff of simplicity versus accuracy allows us to communicate with one another in an efficient manner, without having to build up the narrative from the ground-up each time we wish to discuss a nuance or isolated issue.

In the context of business, these ‘nuances’ are what can give an investor, developer, or user an ‘edge’ or insight that can lead to supernormal profits and first-mover advantage. Why endlessly debate zoning laws or labour pool data when we can leverage them to find the next prime development pockets of land?

Sometimes, however, we repeat sound bites that are not factually true. We reject data that doesn’t fit the model and cherry-pick to avoid conflict. We outsource too much computing power. We oversimplify and grant too much credence to those in positions of authority. There, our naïvety of the fact that they too can be fallible or possess bad intentions clouds our judgment. Or at the very least, it makes us lazy thinkers who forget that professional skepticism is not just a ‘career skill’ but also a survival tool. Take your pick from history to prove this point.

That is why we wanted to embark on an exploration of the GTA industrial market – not just by looking at the broad-stroke narratives being circulated in your run-of-the-mill social media mastermind groups, but by examining the cold hard data.

Hopefully, we can each derive our own story regarding the evolution of these individual sub-markets over time… and possess the facts to back it up. So without further ado, let’s take a closer look…

Toronto Central Markets (North York, Etobicoke, Scarborough)

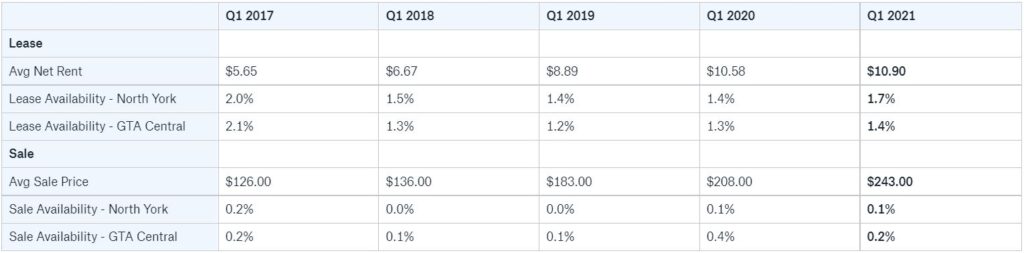

GTA Central Markets (North York)

Valuation and Rental Rate Analysis Q1 2017 to Q1 2021

North York – Sample Lease Transactions – (10,000 SF+)

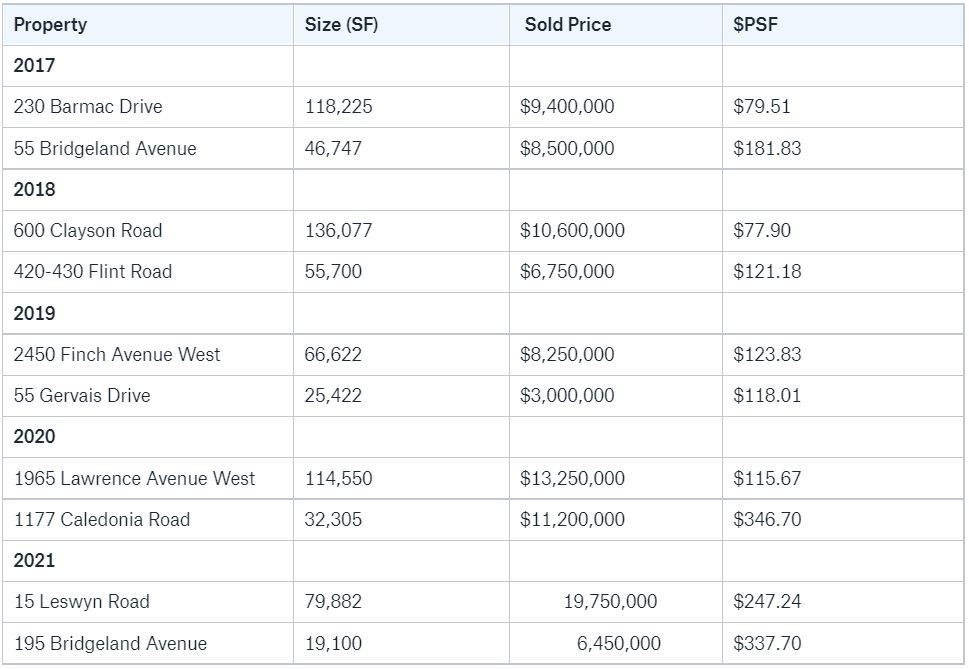

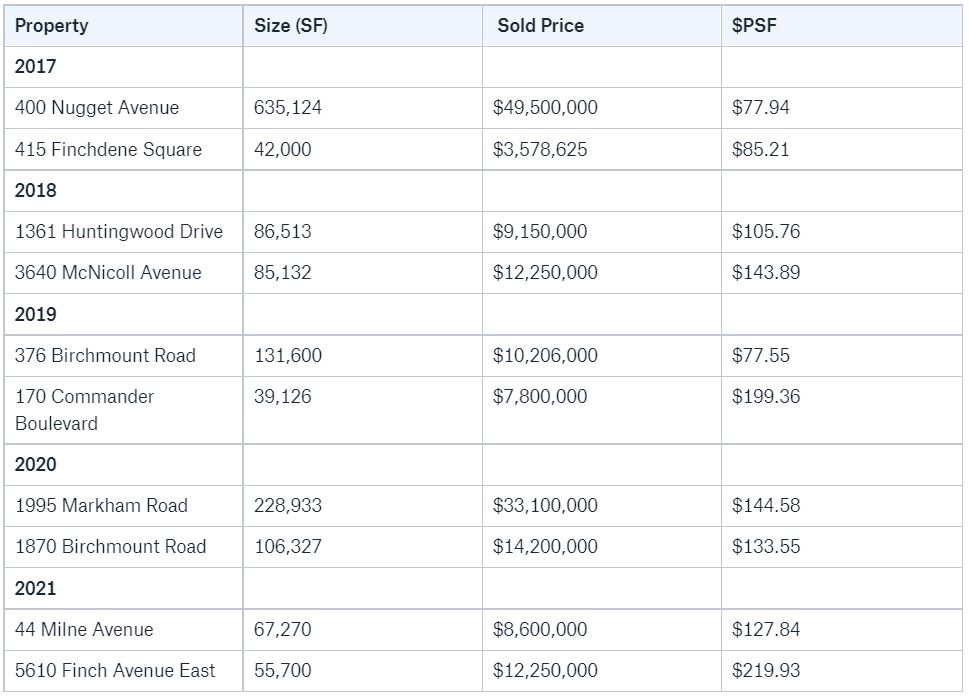

North York – Sample Sale Transactions – (10,000 SF+)

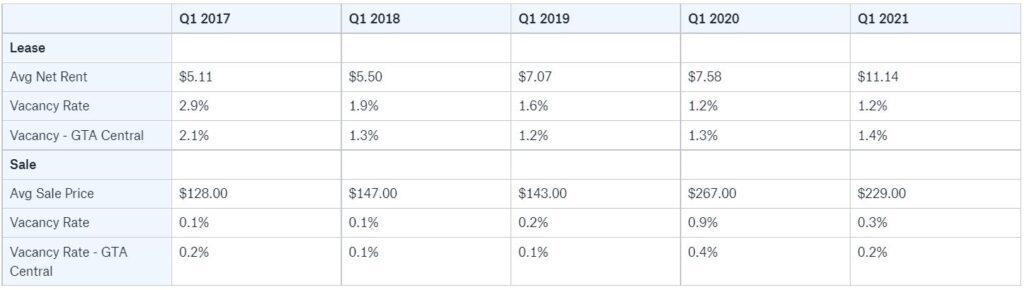

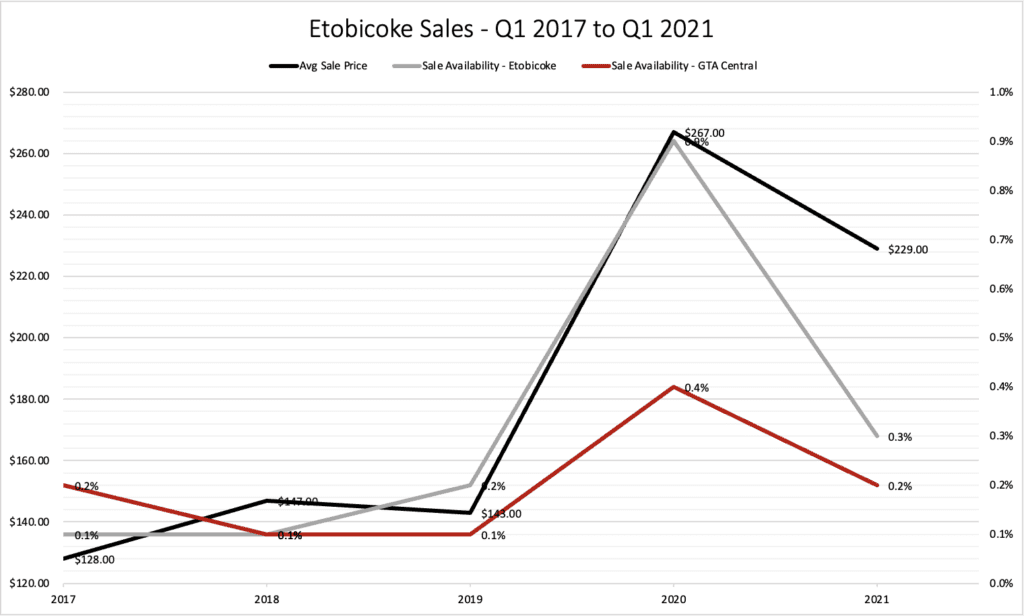

GTA Central Markets (Etobicoke)

Valuation and Rental Rate Analysis Q1 2017 to Q1 2021

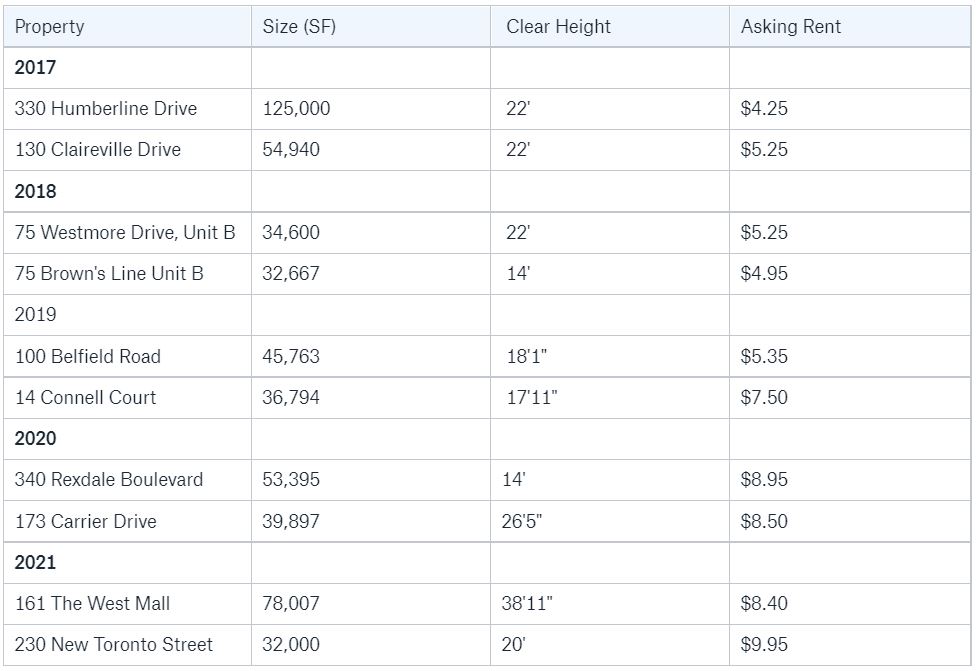

Etobicoke – Sample Lease Transactions – (10,000 SF+)

Etobicoke – Sample Sale Transactions – (10,000 SF+)

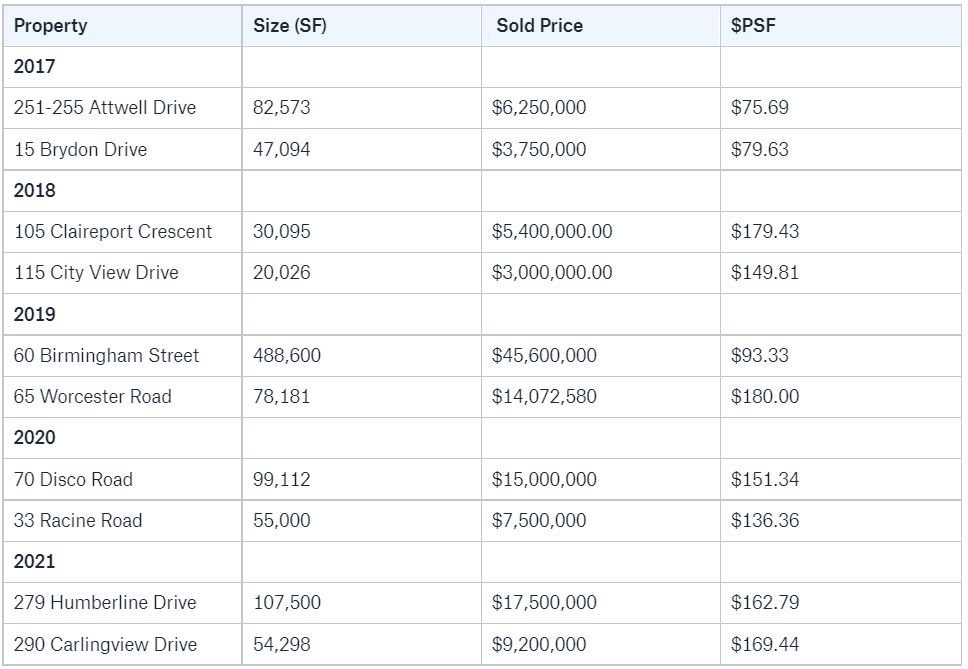

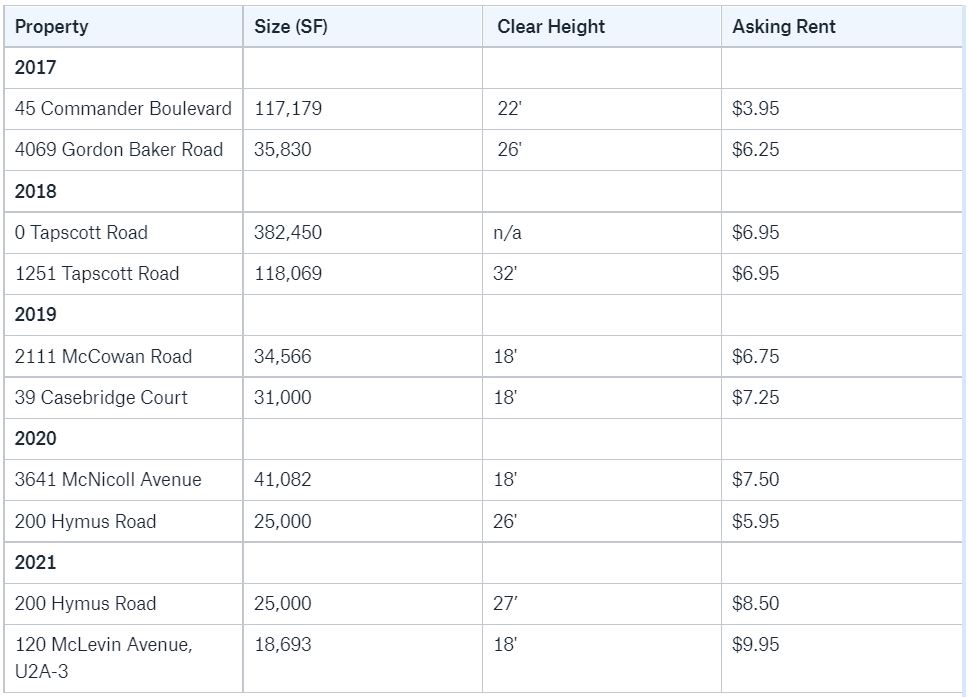

GTA Central Markets (Scarborough)

Valuation and Rental Rate Analysis Q1 2017 to Q1 2021

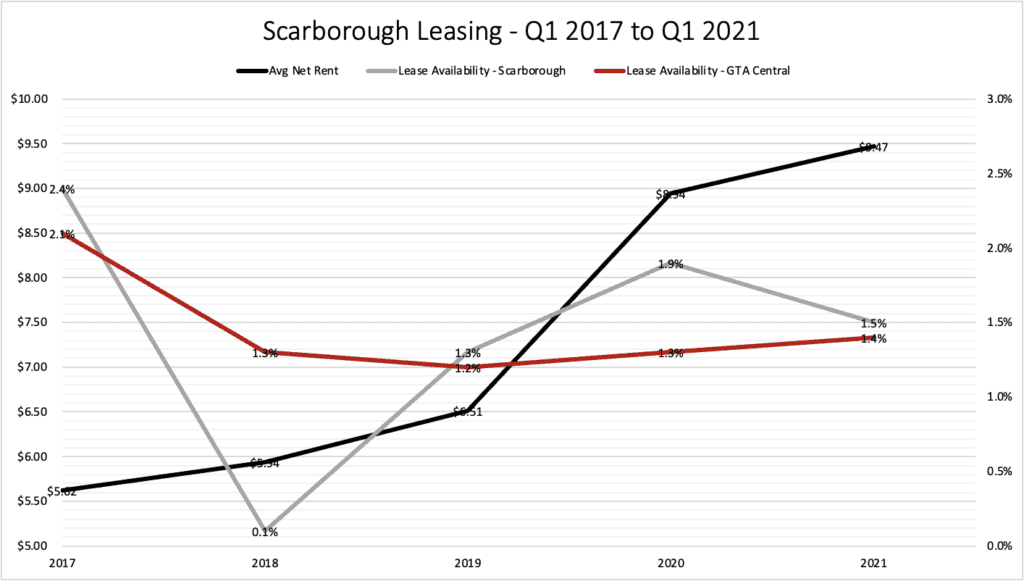

Scarborough – Sample Lease Transactions – (10,000 SF+)

Scarborough – Sample Sale Transactions – (10,000 SF+)

Conclusion

After looking through the data, we hope you can not only begin to see some of the broader patterns but perhaps also create hypotheses as to why things may have played out the way they did. Keep in mind that much of the data collected is imperfect and should be taken with a grain of salt. Further, we hope you can also begin to make soft predictions about where the market is headed.

Our thoughts are this:

- Industrial is definitively being fuelled by E-commerce demand, as well as other verticals such as online grocery sale, transportation, and even film production;

- Supply chain disruptions are causing many businesses to on-shore their operations;

- These disruptions are also causing businesses to increase inventories where possible;

- Land is scarce, as is available product;

- New supply is being hamstrung by labour and material shortages, as well as delayed permitting and zoning processes.

- Leadership is needed at the table to bring new supply on board: from the developer to the potential user to the city and economic planning or municipal boards.

Key Takeaways

For investors: Now that we seem to be caught in a supply trap, one should expect to see values increase further, albeit at a decelerating pace relative to the jump we saw over the past 5 years. Only future data will tell how much further values have to go… That being said, it’s very likely that cap rates will continue to compress and pricing will go up further.

For Occupiers: Similarly, one should expect further increases in pricing. If you want to lease, you’ll have to pay more. If you want to own, you’ll have to pay more. In addition, it will be more difficult to find opportunity and the deals may take more time to complete unless you are lucky or hit the timing perfectly. Further to this, if you cannot find anything, you may have to develop; only if you can find any land available to do so.

Overall, prepare to pay more. Introduce more time into your pursuits of deals. And be prepared to build (two years or more in advance) or complete an early renewal (18 to 24 months out) if you want to stay at your current location.

You can leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Blackwood Partners and Nicola Wealth Real Estate announce another major industrial land acquisition

The alliance acquired a prime 34-acre industrial development site, their second deal together.

Blackwood Partners (Blackwood) and Nicola Wealth Real Estate (NWRE) acquired a 34-acre industrial development site located in Grimsby, southwest of Toronto. The acquisition, which closed July 26, 2021, marks the second co-venture deal by the partnership since Nicola Wealth acquired Blackwood Partners in late 2020. The vision for the property includes the development of over 700,000 square feet of employment-generating industrial space across two buildings.

The proposed industrial development will accommodate mid to large-bay users who will benefit from the location immediately fronting the Queen Elizabeth Way (QEW) with convenient access to the Greater Toronto Area (GTA) and Hamilton, as well as the US Border. Given the scarcity of leasing options for large users and escalating land prices in the GTA, the industrial market in the Greater Golden Horseshoe offers a significant value proposition and is expanding rapidly. The Hamilton, Stoney Creek, and Grimsby submarkets are all well-positioned to capitalize on strong demand from users given the excellent regional highway connectivity.

“This property is well-positioned with prominent frontage and exposure along the QEW at an attractive cost base,” explains Blackwood Partners Managing Director, John Hayes, “the proposed development will be suitable for both single and multi-tenant buildings providing good optionality.”

This transaction leveraged the strengths of both sides of the strategic partnership between Blackwood Partners and Nicola Wealth Real Estate. The project marks the second venture between Nicola Value Add Real Estate LP (NVARE LP), one of Nicola Wealth’s proprietary real estate funds, and Blackwood Partners. The first joint project, an acquisition of 105-acres of industrial land located in the township of King, North of Toronto, closed in January 2021.

“The strategy of developing modern industrial projects creates great alignment between Blackwood and NWRE,” Nicola Wealth Real Estate, Managing Director Mark Hannah confirmed, “and our partnership with Blackwood will continue to grow as NWRE expands its footprint in the Ontario market.”

About Blackwood Partners

Blackwood Partners provides real estate investment advisory services, asset management services, and transaction management services to Canadian pension funds, foreign investors, private investors, and both public and private sector companies to assist them in achieving their investment and corporate real estate objectives.

About Nicola Wealth Real Estate

Nicola Wealth Real Estate (NWRE) is the in-house real estate team of Nicola Wealth, a premier Canadian financial planning and investment firm with over $10 billion (CAD) of assets under management. NWRE has an experienced and innovative team that sources and asset-manages a growing portfolio of properties in major markets across North America spanning a diversified range of asset classes which include office, retail, industrial, multi-family residential, self-storage, and seniors housing. The current real estate portfolio exceeds $5.0 billion gross asset value.

Source Yahoo Financial. Click here to read a full story

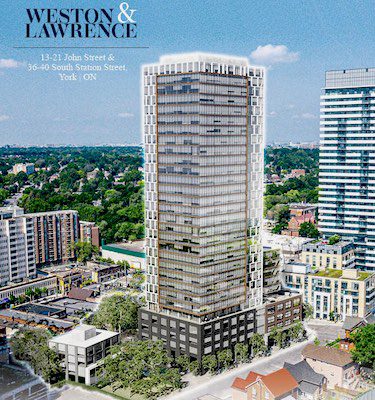

Potential west-end Toronto redevelopment site for sale

A 0.95-acre commercial property with multifamily redevelopment potential and easy public transit access in Toronto’s west-end Weston neighbourhood is for sale.

“The site is, and has been, owned by a private family for many years,” JLL Capital Markets Group executive vice-president Elliot Medoff told RENX in an email interview.

Medoff and sales associate Nick Steele are the leads of the JLL Capital Markets advisory team handling the file.

“In 2013, the Weston GO/UP Express station was opened, bringing new residential demand for residents seeking connectivity to the downtown core in an area with moderate end-unit pricing,” said Medoff. “In turn, land values and the urban planning landscape have evolved favourably, which prompted this sale.”

The corner site at 13-21 John St. and 36-40 South Station St. is occupied by a diverse group of eight tenants — including a pharmacy, a driving school and an Islamic association centre — that can provide significant holding income to offset carrying costs during the entitlements process if redevelopment is sought. Vacant possession can take place in September 2022.

“The site is presently unzoned,” said Medoff. “However, our planning consultants, Urban Strategies, have presented a range of development scenarios that contemplate a 30-storey tower with varied podium heights.”

The anticipated density scenarios play out to a gross floor area of between 281,478 and 330,990 square feet.

Weston Village

The gentrifying neighbourhood surrounding the property is a growing condominium and rental submarket that’s being driven, in part, by immigration. Weston Village had 316,480 residents in 2020 and its population was projected to grow by 27 per cent during the next decade, according to Statistics Canada.

Highway 401 is a three-minute drive from the site and the area also includes national and local retailers, Humber River trails, Weston Golf and Country Club, Weston Farmers’ Market and Artscape Weston Common.

“Institutional and private capital have been priced out of many of the city’s core markets, so transit-connected sites in gentrifying areas like Weston Village are a great strategic fit and offer real upside in end-unit sales pricing,” said Medoff.

“Interest has been very positive to date and we’ve had early conversations with an array of both institutional and private capital developers.

“In all likelihood the site will trade as future purpose-built rental product, but there are also a number of condominium developers looking at this opportunity.”

Other neighbourhood developments

Rockport Group recently completed and stabilized a 30-storey, 369-unit purpose-built rental building at 22 John St. that offers precedent for attainable density and projected rental rates in the node.

Local development applications have also been submitted by: Weston Asset Management Inc. for two 29-storey towers at 1956-1986 Weston Rd.; and BSäR Group of Companies for a 36-storey tower at 1821-1823 Weston Rd.

Medoff said privately held transit-oriented, high-density sites like this one he’s involved with are rapidly diminishing, making it an extremely rare and highly sought-after offering.

The Weston property has no existing financing, providing an opportunity to secure new first mortgage financing at attractive interest rates. The bid date for the site will be after Labour Day, according to Medoff.

Source Real Estate News Exchange. Click here to read a full story

StorageVault Completes Purchase of Two GTA Storage Assets for $8.2 Million

Storage Vault Canada Inc. is pleased to announce that, further to its March 3, 2021 (all transactions from this news release are now closed) and July 8, 2021 news releases, it has completed the acquisition of two stores in the GTA from two vendor groups (the “Acquisitions”), for an aggregate purchase price of $8,150,000. The Acquisitions were arm’s length transactions.

The purchase price for the Acquisitions, subject to customary adjustments, was paid by the issuance of 447,385 common shares of StorageVault (“Payment Shares”) at an aggregate price of $2.15 million with the remainder being paid with funds on hand. The Payment Shares are subject to a hold period that expires four months and a day from the date of issuance of such shares.

With the completion of these two purchases, StorageVault has now closed $132.0 million of transactions to date this year.

About StorageVault Canada Inc.

StorageVault now owns and operates 223 storage locations in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, and Nova Scotia. StorageVault owns 184 of these locations plus over 4,400 portable storage units representing over 10.2 million rentable square feet on over 600 acres of land. StorageVault also provides last mile storage and logistics solutions and professional records management services, such as document and media storage, imaging and shredding services.

Source Financial Post. Click here to read a full story

Waterfront Toronto Announces Shortlist of Partners for the Quayside Development

We’re moving a little closer to seeing the Quayside Development Opportunity become a reality.

The Quayside Development Opportunity is a 12-acre area located at the foot of Parliament Street and Lake Shore Boulevard East in Toronto. With the initiative, the former industrial site will become a vibrant mixed-use development with housing, promenades, retail space, and boardwalks.

Last year, plans for the coveted land took a turn when original partner, Sidewalk Labs, pulled out of the project and its plans to create a tech-driven, futuristic neighbourhood.

Today, Waterfront Toronto announced a shortlist of four proponents to potentially transform the land. In May, ten compliant submissions for the Quayside Development Opportunity Request for Qualifications (RFQ) were received.

“The number and quality of submissions is a clear indication that Toronto’s waterfront remains a desirable development destination, and that Quayside can and will contribute to the province’s post-pandemic recovery,” said Waterfront Toronto in a press release.

Following the evaluation of the ten (10) RFQ submissions received, four Proponent teams were selected to proceed to the Request for Proposals stage. They are:

Hines Canada Management II ULC

- Lead Developer: Hines Canada with Tridel Builders Inc.

- Lead Architect: Fosters + Partners

KMT Quayside Developments Inc.

- Lead Developer: Kilmer, Mattamy and Tricon

- Lead Architect: MVRDV, Cobe

Quayside Impact LP

- Lead Developer: Dream Unlimited Corp. and Great Gulf

- Lead Architect: Adjaye Associates, Alison Brooks Architects, Henning Larsen

The Daniels Corporation and Hullmark Developments Ltd.

- Lead Developer: The Daniels Corporation and Hullmark Developments

- Lead Architect: Diamond Schmitt Architects Inc.

The Shortlisted Proponents are being invited to respond to a Request for Proposals (RFP). Waterfront Toronto anticipates that the Preferred Proponent will be identified by the end of 2021.

Source Storeys. Click here to read a full story

More Cranes Moving Construction Forward for Galleria 01 & 02

ELAD Canada’s Galleria on the Park mixed-use community at Dupont and Dufferin kicked off last year with a ground breaking ceremony, the first official construction step in the redevelopment of the 1972-opened Galleria Shopping Centre in Toronto’s West End. While the ceremony occurred last year, the site has been active since late 2019, when demolition commenced on initial sections of the mall. Since then, construction has advanced on the community’s initial pair of towers, Galleria 01 and 02. These Core Architects-designed buildings are to rise 24 and 29 storeys at the west end of the 20-acre master-planned community, hugging the curving alignment of Dupont Street.

We last checked in on construction in February when a tower crane was installed on a concrete pad just beyond the shoring walls of the excavated pit. In the time since, forming of the complex’s foundations has visibly progressed, and another construction milestone was reached when in mid-June when a second crane was installed within the base of the pit.

Earlier this month, a third tower crane was installed atop a concrete pad beyond the southwest edge of the pit.

To commemorate these milestones, developer ELAD produced a video documenting the crane installation process with a combination of ground, aerial, and time-lapse photography.

With three cranes in place, the speed of below-grade forming will increase noticeably in the coming months, as crews work to build out the five underground parking levels.

Galleria 01 & 02 will bring 634 homes to the community, while sales continue for the next building in the master-planned community, known as Galleria III. The 31-storey Hariri Pontarini Architects-designed third tower will act as part of a northeastern gateway to the wider Galleria site at Dupont and Dufferin streets, bringing another 429 condominium units to the community.

Source Urban Toronto. Click here to read a full story

Rising home prices bring new attention, ideas to trailer parks

The effects of rising home prices in Canada are reducing the affordability of almost every housing segment, including a part of the market that has long been under-appreciated: trailer parks.

From recreation-only RV parks and campgrounds to those for all-year-round retirement or family living, prices have been rising, spaces are booked solid and real estate investors are bringing new capital and concepts.

Joe Accardi, chief executive of Forge and Foster – a real estate development fund that has in the past focused on commercial properties in the Hamilton area – recently announced he had acquired three land-lease sites in Ontario with more to come.

“We’re definitely ramping up. We want to get to another three this year,” he said. “Everyone knows apartment vacancy is really tight. These RV parks … their occupation history is pretty much the same; some of them are 100-per-cent occupied for the past 20 years. These things are very resilient in good times and bad. They are really loved and enjoyed.”

Mr. Accardi hopes to attract new users to the parks through updated branding, with plans to do new types of landscaping and appeals to tiny home enthusiasts looking for a place to park their boutique living spaces (“We call them tiny cottages,” he said). The parks purchased by Forge and Foster in Ontario also offer a mix of overnight and more permanent stays: Jordan Valley near St. Catherines and Pilgrim’s Rest near Lakefield in the Kawartha Lakes are not open year-round, though Bluewater (formerly known as Princess Huron Trailer Park) is year-round.

In his view, people priced out of the cottage market, which has seen price jumps of 70 per cent since 2019, will increasingly turn to cheaper options.

“A lot of people see that for the next generation it’s unattainable. We are a very good option for a lot of people, at fifth or a tenth of the cost,” Mr. Accardi said.

Some of the existing players are also seeing new demand for trailer parks.

“We’ve definitely seen a spike in interest through the pandemic,” said Lachlan MacLean. He is the senior vice-president property operations with Parkbridge Lifestyle Communities Inc., the largest operator in Canada with 59 residential sites (31 retirement and 28 family that host more than 25,000 residents) and 37 RV camping/cottage resorts with more than 53,000 seasonal customers. They are spread across British Columbia, Alberta, Ontario, Quebec, New Brunswick and Nova Scotia.

“Prepandemic our seasonal occupancy was high 90s – 97-98 per cent,” he said. “This year, we’re full.”

/cloudfront-us-east-1.images.arcpublishing.com/tgam/3PZ4KKDODFCBHIAL4Z7RZG27RE.JPG)

Industry insiders tend to avoid even saying the words “trailer” or “park” when referring to their business model, preferring the term land-lease, calling trailers “manufactured homes” and calling parks communities. Part of the reason for that is the traditional model of what kind of home you’d find in one of these parks is evolving.

In 2020, Parkbridge was acquired by British Columbia Investment Management Corporation (the province’s largest public-sector pension fund manager) for $790-million. Other institutional investors have also placed bets on trailer parks, with major rental market acquirers like Realstar Management Partnership, CAPREIT, and Boardwalk REIT announcing investments over the years. But according to Mr. MacLean, the ownership is still very fragmented, with the largest players owning less than 10 per cent of the sites in a province.

“It’s a more recent trend than in multifamily housing, but it’s not so different than the firms that are consolidating ownership in single-family homes as rentals – it’s just a different type of single-family home,” said Martine August, assistant professor at the University of Waterloo’s School of Planning and an expert in the financialization of housing.

“In every sort of sub-asset class of real estate, the financial firms are just trickling in to try to access everything: self-storage, student housing, seniors housing, land-lease, whatever. They are going everywhere. They are moving across the spectrum from very low-cost options to luxury housing and extracting a value from everyone. Everybody needs a place to live, so it’s got strong fundamentals, to use their language.”

/cloudfront-us-east-1.images.arcpublishing.com/tgam/EWLNRNO5CBFJXO2VWP73KIUHSM.JPG)

In recent years, Parkbridge has begun to evolve beyond manufactured homes in its parks and now builds townhouse and detached homes on rental lots in retirement communities such as The Villas at Wasaga Meadows in Wasaga Beach, Ont., and The Bluffs at Huron in Goderich, Ont. These are the same kind of stick-built houses with a basement you’d find in a suburb, but buyers only own the house – not the land. Not paying for the land makes it more affordable for those who “don’t want to tie up their entire retirement savings in dirt,” Mr. MacLean said.

At one of Parkbridge’s largest trailer parks in Ontario, Sandycove Acres in Innisfil, it has plans to build 2,000 of these homes on land it owns nearby, with deliveries hopefully starting as soon as 2022.

With more permanent homes in some of its parks, residents are seeing the kinds of rapid valuation rises seen elsewhere in the housing market.

“We’ve got a couple retirement communities in and around the GTA – rural setting, single-family homes – [with] one called Antrim Glen another one called Tecumseth Pines. There are homes in those communities trading in and around the $500,000 mark, where two years ago they might have been trading at $300,000,” Mr. MacLean said.

Unlike Forge and Foster, these days Parkbridge is less focused on buying existing parks – which are often family-owned and may require substantial upgrades to water and sewage plants when they go up for sale – and is looking to greenfield building for its future growth.

“The bet is this asset class is not going to depreciate,” Mr. MacLean said. “And we really like our space because we think there are some benefits on both sides. It’s a really stable investment, but also we think it has huge growth as people come to understand the benefits of land-lease.”

Source The Globe And Mail. Click here to read a full story

Broccolini prepares two major S. Ontario industrial builds

Broccolini has begun site work for major industrial construction projects at two large Southern Ontario properties – in Cambridge and in the Township of Southwold near St. Thomas.

The Montreal-based developer, owner and operator is prepping a 61-acre site in Cambridge, just west of Toronto, and has secured the backing of city council for a Ontario government Minister’s Zoning Order to allow it to fast-track construction of a “state-of-the-art warehouse distribution centre.”

The site is at 140 Old Mill Road and several adjacent properties, which is along the Hwy. 401 transportation corridor.

In Southwold, which is outside the City of St. Thomas and just south of London, Broccolini has acquired a 622-acre property which used to be the site of the Ford St. Thomas assembly plant. That facility closed a decade ago, putting over a thousand people out of work, and was later demolished.

Brocccolini has not released any information about potential tenants, but the London Free Press is reporting a distribution centre to be constructed at the Southwold site will be occupied by Amazon.

Broccolini has developed several previous Amazon distribution centres in Eastern Canada and is currently building in Ottawa, the GTA and in Quebec for the e-commerce giant.

The Southwold / St. Thomas development

The Southwold site is situated near the village of Talbotville, putting it just a few kilometres south of the Hwy. 401 corridor linking the GTA, London, Windsor and the U.S. border.

“Broccolini intends to renew the area’s legacy by redeveloping these lands and introducing new uses that reflect the modern industrial real estate landscape,” said James Beach, Broccolini’s vice-president of real estate development, in the announcement this morning.

“This will bring significant and sustained employment opportunities back to the Township of Southwold and Elgin County.”

Grading and soil decontamination is underway at that site “to ensure the land is prepared for immediate redevelopment” the company said in the release.

“Broccolini’s purchase of the Ford property is exciting news,” said Grant Jones, mayor of the Township of Southwold, in the release.

“Their innovative reputation and wealth of experience in the development of large industrial sites is the perfect fit for Talbotville and their approach to construction is well-supported by our outstanding staff.”

The Cambridge distribution centre

In filings with the City of Cambridge, Broccolini says it intends to construct a distribution centre of almost 1.1 million square feet on a land assembly which includes 128, 134, 140 and 228 Old Mill Rd. as well as several adjacent rural and agricultural lands.

It has created the 140 Old Mill Road LP to develop the project, which will be built for a single tenant.

“This is an ideal location for a warehouse distribution centre, as it has direct access to the 401, and has already completed the public consultation process to be designated for industrial use,” said Delis Lus, Broccolini’s VP of real estate development, in a separate release.

“We intend to build a state-of-the-art facility that meets the highest environmental standards both in terms of construction and ongoing operations.”

Broccolini applied for the MZO to allow it to begin construction as early as this month, so the building can be occupied by September 2022.

The plan includes a maximum building height of 49 feet, approximately 100 loading docks, 825 parking spaces and 300 transport trailer parking spaces. Previous zonings for the land included up to 14 potential buildings and/or tenants.

The company says the project will create hundreds of jobs during construction, then about 700 full- and part-time jobs when the facility opens.

The Old Mill Road lands were identified by the city for industrial uses in 1999 and Broccolini is applying to have the individual properties all zoned and included for this single development.

RENX has reached out to Broccolini for further comment and details about the projects.

About Broccolini

Montreal-based Broccolini also has offices in Toronto and Ottawa. It provides construction, development and real-estate services to the industrial, commercial, institutional and residential markets, including acting as general contractor, construction manager, project manager, property manager and developer.

Broccolini’s Real Estate Management subsidiary owns and manages a portfolio of more than 40 properties, representing over 11 million square feet of assets.

Source Real Estate News Exchange. Click here to read a full story

RioCan Living to launch Verge condos in Toronto’s Etobicoke

RioCan Living has announced the imminent launch of Verge Condos in Toronto’s Etobicoke community, with mixed-use residences of 11 and 17 storeys to rise on the site of a parking lot.

The project site is located on the southwest corner of Islington Avenue and The Queensway, with the two new buildings to contain 545 units in total. The project, designed by Turner Fleischer, will include 30,000 square feet of retail space, a new public park and a new service road on the south side of the property.

“Verge Condos aims to transform The Queensway-Islington corner through strong design principles,” said Raza Mehdi, associate at Turner Fleischer, in a statement. “While two separate buildings, our goal was to establish a rhythm and create a dialogue between the developments to add a striking visual dimension for residents and users to enjoy. With a new park separating the two buildings and retail uses at grade, the focus was to inject an animated streetscape along this segment of The Queensway.”

A release states RioCan Living prepared its amenity and features package using portfolio data and additional research. The research led to the inclusion of home offices, meeting rooms, soundproof phone booths and a video content studio with backdrops and green screens as well as a recording studio for podcasts and other presentations.

Other amenities will include a fitness centre, yoga/meditation studio, pet spa, party room, cocktail lounge, an outdoor terrace with barbeques, chess and shuffleboard games and an outdoor lounge.

Interiors were designed by DesignAgency, which has such projects as the St. Regis Toronto, Momofuku Toronto and the Dalmar Fort Lauderdale in its portfolio.

The two-phased community will launch this summer with suites ranging from 430 square feet to 1,060 square feet. RioCan REIT created RioCan Living in 2018; the firm’s portfolio has reached 2,000 units in seven completed rental residential and condominium developments

“With Verge, the RioCan Living team continues to deliver on the principles that inform each of our residential developments, including contextual design in connected locations, best in class communal amenities that cater to future residents, and easy access to major commuter routes,” said Kalliopi Karkas, assistant vice-president of RioCan Living.

Source Construct Connect. Click here to read a full story