The amount of office sublease space on the market in downtown Toronto has quadrupled during 2020 to almost 2.5 million square feet, and there’s no short-term turnaround in sight.

Across the Greater Toronto Area (GTA), office sublease space on offer has more than doubled this year to over five million square feet.

Avison Young principal and Canadian research practice leader Bill Argeropoulos, who’s been closely monitoring sublease activity since COVID-19 started impacting the real estate market in March, doesn’t see available sublease space returning to previous lows until, perhaps, the end of 2023.

Argeropoulos wrote about the trend in a recent blog post and expanded on his analysis of the peaks and valleys from three past availability cycles in an interview with RENX.

“At the very beginning of the process, people were reluctant to put space on the sublease market because they didn’t know what the outlook was going to be like,” said Argeropoulos, who believes many companies were caught off guard by the length of the COVID-19 pandemic and the slow return of employees to offices.

Sublease space may appeal to some tenants because they can often get shorter and more flexible lease terms. Also, if they can take over space that’s already built out, they’ll save on related capital costs.

Companies have realized if some or all of their employees can work from home until the COVID-19 crisis clears up, they might as well try to relieve themselves of excess space and earn revenue through subleasing. However, lease-up of these spaces has been slow.

Rate of sublease space availability increases

Since last writing about the topic in August, Argeropoulos said available sublease space across the GTA office market increased from 3.7 million square feet to 5.1 million square feet. That’s up from 2.4 million square feet at the end of 2019.

Downtown Toronto sublease availability has risen from 1.7 million square feet to nearly 2.5 million square feet, which is about four times the 652,000 square feet available at the end of last year.

“Deals done with sublease spaces are usually at lower rates than direct landlord space, but we haven’t seen that sort of softening in the rents yet,” said Argeropoulos. “They’re basically on par with direct landlord space for now.

“However, I think the scales will likely tip in the tenants’ favour as more larger blocks hit the market, forcing some landlords to adjust their pricing.

“I think that will come, but given that the majority of the real estate in downtown Toronto is held by well-financed institutions, they’re willing to weather the storm a little bit and not necessarily give up on the rates yet.”

Where sublease space is coming from

Fifty-six per cent of the office sublease availability in downtown Toronto so far is for spaces of less than 5,000 square feet, according to Argeropoulos. Forty-six per cent is in class-A, 32 per cent is in class-B and 22 per cent is in class-C buildings.

“The piece of the pie that we’re closely watching right now is in that greater-than-20,000-square-feet range,” said Argeropoulos. “That number, which we’ve been following over several months, is in the five per cent category.

“Once we see that number rising, then I think there will be pressure on landlords to perhaps come off because they’re going to be competing with larger blocks of space, which can then be used as leverage to drive down rents.”

Argeropoulos said sublease space on the market now is coming from a range of business types, including technology, financial services, telecommunications and professional service firms.

“Even within the technology sector, it’s not just startups. It’s also established blue-chip technology companies that have decided to reduce their footprint — some on a temporary basis and some on a more permanent basis.”

Looking to the past for possible answers

Argeropoulos said there was no relationship between the rate of sublease availability take-up in the last three peak-to-valley cycles, spanning 20 years, in either downtown Toronto or the GTA as a whole.

For the current GTA office sublease market to return to its previous valley by the end of 2023, 256,000 square feet of take-up per quarter would be needed. That wouldn’t be far beyond the fastest take-up rate seen in the last 20 years.

Downtown, however, the necessary figure would be 159,000 square feet per quarter. That would be double the fastest rate recorded in any peak-to-valley period during the last 20 years.

Significant pent-up demand would be required, especially given the amount of new office space which will be delivered downtown between now and 2024.

In its just-released Canada 2021 Forecast report, Avison Young notes about seven million square feet of new office space is being delivered in 2020 and 2021 in the GTA. That report predicts a slightly higher 7.2 per cent overall vacancy rate for GTA office space in 2021 (it was 6.6 per cent at the end of Q3 2020).

Sources of future sublease space

Much of that new space is already pre-leased, but companies that have made those commitments may realize they don’t need all of it and look to the sublease market to take them off the hook.

Companies moving into new offices will also make significant backfill space available. Much of that could come from major banks, especially CIBC, and Infrastructure Ontario, as it moves back into its former buildings which have been under renovation.

“Rumours are that that Infrastructure Ontario space could be as much as an additional million square feet of availability perhaps coming on the market,” said Argeropoulos.

The City of Toronto has also announced it will implement a workplace modernization program, which includes both leased and owned facilities. That could reduce its office space footprint and introduce up to another million square feet to the sublease market.

“Heading into this crisis, Toronto and the downtown market in general was very, very tight and we couldn’t wait to get some availability to come online so we could transact,” said Argeropoulos. “But no one saw this amount of space coming back.”

Argeropoulos is concerned office demand has dried up and the newly available space isn’t moving.

It’s not yet panic time, he added, but smaller landlords or those with near-term risk due to lease rollovers are in an unenviable position.

“Once there’s greater clarity, the pent-up demand that’s waiting will definitely start to eat up the space,” said Argeropoulos. “How quickly is another question.”

Toronto suburbs are experiencing a boom in condo project launches and preconstruction sales, as the pandemic’s work-from-home trend entices homebuyers to look outside the city.

Suburban condo projects accounted for 65 per cent of all launches in the Toronto region in the third quarter of this year, according to the latest data from industry research group Urbanation Inc.

This is not the first time suburban condo development has surpassed the city’s but marks the widest margin on record. As well, sales of preconstruction condos more than doubled in the suburbs compared with the third quarter of last year, while sales dropped 16 per cent in the city of Toronto over the same time period.

“Downtown Toronto projects are not seeing the same level of enthusiasm from buyers as they were pre-COVID,” said Kash Pashootan, chief executive of Emblem Developments, which recently launched a 17-storey, 336-unit condo project in Mississauga. “For the time being, the premium that you pay for being downtown is not being realized,” he said.

Interest in the Toronto suburbs, also known as the 905 because of its area code, has been growing for years as homebuyers could get larger homes at much cheaper prices. But since the pandemic started, the desire for homes with more space for an office and backyard supercharged competition in the 905.

And with office employees forced to work from home and businesses considering permanent remote work, it has become easier for workers to live outside the city of Toronto.

Home resale prices across all types of properties have risen at a faster pace in the regions surrounding the city. For condos in the city, the home price index was up 5 per cent in October, compared with the same month last year, according to the Toronto Regional Real Estate Board. In contrast, to the west in the Halton area, the price index for condos was up 11 per cent. To the east in Durham region, the index climbed 12 per cent.

That has influenced developers and preconstruction condo investors and homebuyers. Although homes are becoming more expensive in the 905, prices are still lower in general. For example, the price of a preconstruction condo sold on average for $915 per square foot in the 905 versus $1,275 in Toronto, according to Urbanation.

“Part of the trend can be connected to the more general shift in demand across the resale market for suburban properties as a result of COVID-19,” said Urbanation president Shaun Hildebrand.

Meanwhile, the downtown office district is currently a ghost town. The office vacancy rate has been steadily climbing, as a sea of businesses from PricewaterhouseCoopers to Ritual Technologies, put some of their space on the sublet market.

Condo resales and rental rates have taken a hit in the city of Toronto. In October, condo resales dropped 8.5 per cent and the average selling price was up just 0.8 per cent compared with the same month last year, according to the local real estate board. In contrast, condo resales in the 905 were up 28 per cent and the average selling price increased by 7 per cent over the same time period.

“People wanted to be close to where they work. But the nature of work is changing a little,” said Matt Elkind, senior broker with Connect Realty, who works with investors and has observed more interest in the 905. ”Even though COVID is a temporary thing, people are rethinking if they have to go to the office,” he said.

Rental vacancies are up and rental prices are down in the city. As well, many owners of Airbnb units have put their properties on the long-term rental market or up for sale after tourism disappeared. That has increased supply in the downtown core, just as the market was being flooded with a stream of new condo units. The glut of condos has given some developers pause.

“Any sort of inventory is a deterrent to launching a project,” said Mr. Pashootan, who like other real estate players believes that interest in the core will quickly recover when the pandemic subsides and the economy reopens.

Source The Globe And Mail. Click here to read a full story

Industrial condominiums don’t yet have the same prominence in the Greater Toronto Area as they do in Metro Vancouver, but that may be starting to change.

Berkshire Axis Development and Fiera Real Estate have collaborated on two such projects and will be launching a third in the GTA based on their early successes.

“A partnership relationship between two entities always starts with the profitability of carrying out a project,” Fiera fund manager and senior vice-president of opportunity and development Pierre Pelletier told RENX.

Berkshire Axis has completed more than 30 industrial projects in the GTA over the last 10 years, while Fiera is a global real estate investment management platform serving investors in Canada and the United Kingdom. It globally manages more than $5.9 billion of commercial real estate through its investment funds and accounts.

While the two companies may vary in size, they’ve found an alignment in interests.

Benefits of industrial condos

The industrial real estate sector has shown strong resilience through this year’s COVID-19 crisis, and Pelletier noted the GTA’s availability rate of two per cent is 150 basis points below the national average.

Rents have risen substantially over the past two years and good industrial space is now leasing for more than $10 per square foot in the GTA.

Industrial buildings constructed in the 1960s through the 1980s aren’t likely to be as in good condition, or offer as much, as a newly built industrial condo. Maintenance costs for those older properties are also rising on top of increasing rents.

“You’re either living with a building that has deficiencies, or a broken-up parking lot, or poor power and an old roof, or you’re fortunate enough to be in a situation where everything is in good shape but the landlord is amortizing all of the costs back to you,” Berkshire Axis vice-president Craig Wagner told RENX.

Business owners want to control their real estate, build liquidity and keep costs in check, he added. “Industrial condos really provide that, particularly for small business owners.”

Wagner said condos account for less than five per cent of industrial space in the GTA, so there’s plenty of room for growth in the sector. He believes developments between 100,000 and 250,000 square feet are “a pretty sweet spot for condos.”

Pelletier said industrial condos don’t require a lot of capital to build and have relatively short construction times, so banks like them.

“It’s a product that’s here to stay and to take even more space in the GTA market,” said Pelletier.

225 Gibraltar

Fiera was launching a new development strategy for the GTA and Berkshire Axis was looking for a financial partner for an industrial condo project at 225 Gibraltar Rd. in Vaughan which it planned to sell on a speculative basis.

Their partnership resulted in the project moving through land acquisition, site plan approval process, construction and selling of all 10 of its units in under 28 months.

The 104,000-square-foot, class-A light industrial building located in the Vaughan and Brampton municipal boundary was recognized as the industrial development of the year at the 2020 NAIOP Greater Toronto Chapter’s Real Estate Excellence (REX) Awards.

REX Awards recognize excellence and innovation in office, industrial and mixed-use real estate in Toronto and the surrounding region.

The focus of the seven development or transaction award categories is on results (quality and performance), skills (teamwork, collaboration, innovation and creativity) and values (community and environmental awareness).

The building offering a 28-foot clear height, an ample power supply, drive-in and truck-level loading, and a large truck court is fully occupied.

It’s located near both Hwy. 427 and Hwy. 407.

Wagner said some purchasers were able to occupy their 10,000-square-foot units one to three months after closing, because they could start the permitting process for their build-outs in advance.

Others had extensive work to do and didn’t occupy until six or seven months after closing.

Wagner said sale prices averaged about $280 per square foot in late 2018 and through 2019.

Lightbeam

Berkshire Axis and Fiera closed the sales of all 35 units in their 154,400-square-foot, small-bay Lightbeam industrial condo at the end of August. It realized higher-than-forecasted returns for the Fiera Properties GTA Opportunity Fund LP and its investors.

Lightbeam is comprised of two industrial condos with 24-foot clear heights, steel frames and metal roof decks. Units range in size from 2,700 to 10,000 square feet, of which 25 per cent are larger than 6,000 square feet.

The facilities are supported by service areas, 183 car parking spaces and a saw-tooth loading area.

Lightbeam launched a year later than 225 Gibraltar, but the project had a very similar timeline from start to finish. It was another project built on spec and Wagner said 20 per cent of the units sold before a shovel went into the ground.

“By the time we got to putting up the pre-cast, which was the big catalyst at Gibraltar, we were approximately 65 per cent sold. The velocity we had there was tremendous.”

Wagner said sale prices averaged about $320 per square foot toward the end of the sales cycle.

The bulk of Lightbeam’s units are now occupied.

New Markham project

The partners recently purchased 34 acres at 11050 Woodbine Ave. in Markham which will be used for two different industrial developments: two for-lease buildings of 330,000 and 300,000 square feet on 28 acres; and a 100,000-square-foot industrial condo project comprised of two buildings and a shared truck court on six acres.

“We continued the relationship with Berkshire with two new funds,” said Pelletier. “I think it’s a good answer to Berkshire’s needs for having a financial partner for development in the Greater Toronto Area, but also for our investors.”

The property purchase closed in early September. The goal is to have site plan approval by the end of the year, begin speculative construction in spring 2021, then deliver a substantial portion of occupancy in the spring of 2022.

Wagner expects prices to be in the mid-$300s per square foot.

Units can be as small as 28,000 square feet or as large as 300,000 square feet in the larger development, which will have a 36-foot clear height.

Wagner said it will be one of the few class-A mid-bay options in the market and he hasn’t seen anything else that can deliver the same solutions for medium-sized businesses.

The condo buildings will have 24-foot clear heights. Units will range from 3,000 to 4,500 square feet and can be combined to increase space. All will have drive-in doors, which Wagner said was rare in Markham and Richmond Hill.

Source Real Estate News Exchange. Click here to read a full story

RioCan REIT (REI-UN-T) is selling a 50 percent non-managing interest in its residential rental and retail eCentral/ePlace property in Toronto, and its Rhythm rental apartment development in Ottawa to WoodBourne Capital Management for a total of $156.2 million, the trust announced Wednesday night.

Woodbourne is already a partner with RioCan on other projects and is making the purchase on behalf of itself and one of its institutional pension fund clients.

The price includes $154.8 million for the interest in eCentral and ePlace, and $5.4 million for the interest in Rhythm. It represents cap rates of 3.5 percent and 4.5 percent for the residential and retail components in the Toronto properties, RioCan says in the release.

The price for Rhythm, which is located on the Westgate Shopping Centre property, is equivalent to $51 per square foot of buildable gross floor area. Woodbourne will also reimburse RioCan for a portion of Rhythm’s pre-closing development and construction costs.

RioCan reports Q3 financial results

“Amidst a global pandemic and economic slowdown, these transactions and strong deal pricing are a testament to the strength of our mixed-use assets,” said Edward Sonshine, RioCan’s CEO, in the announcement.

“The quality of our assets and our in-house development expertise continue to attract investment from well-respected partners and institutional funds.

“Such transactions not only allow us to realize the inherent value and drive net asset value growth, but also reduce the amount of capital required to build out our urban mixed-used development pipeline, enhance our balance sheet and liquidity position, and generate additional fee income.”

RioCan says it is in negotiations for the sale of interests in more than $100 million of other properties.

The trust also released its Q3 2020 results, reporting a net income of $117.6 million for the quarter.

For the year so far it reports a loss of $130.4 million, due mainly to $350 million in asset write-downs during Q2 associated with the pandemic and its impact on retail operations and valuations.

The same property NOI declined 9.1 percent in the quarter and is down six percent through the first nine months of 2020. Diluted FFO per unit was 41 cents in the quarter, down from 47 cents in Q2 and $1.21 in Q3 2019.

The eCentral, ePlace transaction

Upon closing, Woodbourne will assume 50 percent of the existing CMHC mortgage for the property, estimated to be $165.3 million as of the closing date. The loan consists of two tranches, both maturing October 2030, at an interest rate of 2.27 percent.

Maximizing CMHC financing is a key component of RioCan’s debt strategy as it provides access to a new source of financing and lowers the overall cost of debt.

Completed in 2019, eCentral is RioCan Living’s first purpose-built rental.

The 36-storey, 466-unit building includes 65 affordable housing apartments.

It has direct access to two rapid transit lines and is in close proximity to RioCan’s Yonge-Eglinton Centre.

Also nearby is the 623-unit, fully sold-out and completed e8 Condos, RioCan’s office and retail at 2323 Yonge St., and e2 Condos, a 440-unit condo development in which RioCan has a partial interest.

“As one of Canada’s most densely populated urban nodes, the highly trafficked Yonge and Eglinton area, where RioCan has a commanding presence, offers attractive growth opportunities,” RioCan states in its release.

eCentral is 92 percent leased, with rents averaging $3.90 per square foot for market rental units.

ePlace contains 23,600 square feet of new retail at the base of the luxury condominium tower e8 Condos. It is anchored by a TD Bank and includes 131 commercial parking stalls.

The available commercial space is fully leased and only concourse space remains to be leased once the direct connection to the Yonge-Eglinton Subway reopens in late 2021.

The transactions remain subject to standard closing conditions and are expected to close in January 2021.

The Rhythm transaction

Located adjacent to Westgate, Rhythm is currently under construction with completion expected in 2022-’23. It will feature a 24-storey, 213-unit residential rental building with approximately 20,000 square feet of podium retail and will also be served by existing retail and services at Westgate.

RioCan will remain the development manager for the project and upon completion, the property manager of the commercial component of Rhythm.

Located just west of downtown Ottawa, Westgate tenants include Shoppers Drug Mart, Royal Bank, and TD Canada Trust.

The site has immediate access to major arterial roads including Highway 417 and will benefit from stage two of the city’s Light Rail Transit system which is under construction.

RioCan acquired the nine-acre Westgate site in 1997 and plans a complete, phased redevelopment of the property.

Current plans call for approximately 729,000 square feet of residential distributed over 1,180 units and approximately 88,000 square feet of retail with parking.

The transaction is expected to close in late February 2021, subject to customary closing conditions.

This co-ownership will mark the fifth co-owned project between RioCan and Woodbourne, including the three existing projects plus eCentral / ePlace.

About Woodbourne, RioCan

Woodbourne Capital Management is a Canadian private real estate fund with capital commitments from a base of institutional partners in Canada and the U.S.

It has already partnered with RioCan on three urban mixed-use developments in Toronto currently under construction or development, including the residential tower FourFifty The Well, Litho at 740 Dupont St., and 3180 Dufferin St.

RioCan is one of Canada’s largest real estate investment trusts. RioCan owns, manages, and develops retail-focused, increasingly mixed-use properties located in prime, high-density transit-oriented areas concentrated in Canada’s six largest urban centers.

As of June 30, 2020, its portfolio was comprised of 221 properties with an aggregate net leasable area of approximately 38.6 million square feet (at RioCan’s interest) including office, residential rental, and 15 development properties.

Source Real Estate News Exchange. Click here to read a full story

Dream Industrial REIT (DIR-UN-T) released a series of updates this week reporting $188 million in closed and pending acquisitions, 1.3 million square feet of leasing activity, and its first financial rating from DBRS Morningstar – BBB with stable trend.

Dream Industrial anticipates the investor-grade rating will allow it to reduce borrowing costs by 25 basis points on future draws on its $330-million revolving credit facility, and by five basis points on its standby fee.

“We are pleased to have achieved this investment-grade credit rating from DBRS,” said Brian Pauls, Dream Industrial’s CEO, in the announcement. “We believe the rating from DBRS reflects our continued focus on building a high- quality portfolio, diversifying the business throughout Canada, the United States and Europe and strengthening our balance sheet.

“This initiative provides opportunities for DIR to access new sources of capital as we continue to execute on our growth strategy.”

Loan strategy lowers debt costs

Also on the financial side of things, Dream Industrial has obtained a $200-million unsecured three-year loan from a Canadian chartered bank, which it intends to swap into debt in Euros at an interest rate of about 0.90 per cent.

This facility is scheduled to close in Q4 2020, bringing Dream Industrial’s debt to about 50 per cent of its European property values.

This would open up more room for future acquisitions, the repayment of higher-debt North American mortgages and other credit facilities, the announcement states.

“With our portfolio showing resilience during the COVID-19-related disruption, we have resumed the execution of our capital deployment and debt strategy announced earlier in the year,” said Lenis Quan, chief financial officer of Dream Industrial, in the release.

“The commencement of our European debt strategy is a unique driver of cash-flow-per-unit growth for (Dream).

“The average interest rate on our total outstanding debt is poised to decline by approximately 10 per cent by year-end 2020 as we obtain Euro-denominated debt, and we expect it to reduce further over time.”

Dream Industrial acquisitions

On the acquisitions and leasing front, the trust has acquired properties in Canada and the Netherlands, and is in firm or exclusive negotiations to acquire several more in coming weeks. It also closed on a previously announced $25-million acquisition in Germany.

“Despite the market disruption this year, we continue to increase occupancy, grow rental rates, and are poised to close on over $600 million of acquisitions this year in Toronto, Kitchener, Montreal and our core European markets,” said Pauls in announcing the acquisitions.

This 300,000-square-foot logistics building in Breda, the Netherlands, has been acquired by Dream Industrial REIT. (Courtesy Dream)

In Breda, the Netherlands, Dream acquired a 300,000-square-foot, single-tenant logistics building that was extensively renovated in 2018. With a clear height of 42.7 feet, it’s leased to a third-party logistics provider involved in e-commerce fulfillment.

The remaining lease term is 9.3 years and the going-in cap rate is 5.8 per cent.

In Mississauga just west of Toronto, Dream has purchased a class-A industrial building on Financial Drive, near Highways 401 and 407. Built in the mid-1990s, the 116,000-square-foot building has a clear height of 30 feet.

Approximately 100,000 square feet is expected to be vacated in Q4 2020 and Q1 2021. With market rents over 60 per cent higher than expiring rents, Dream Industrial hopes to capitalize on the robust demand for distribution space to acquire new tenant(s) and stabilize the asset at a cap rate of over 5.5 per cent in 2021.

The total purchase price for the three properties (Germany, the Netherlands, Mississauga) was $86 million.

The trust is also firm or exclusive on four assets in Europe and one in Ontario, for a total purchase price of $102 million. Subject to diligence and any other required conditions, it hopes to close on these properties by the end of 2020.

Looking further ahead, the acquisition pipeline is “robust,” with $500 million of acquisitions in Canada, Europe and the U.S. under consideration.

“Pro forma these acquisitions, the trust will have acquired over $600 million of assets in 2020, showcasing the strength of its acquisition platform and its unique expertise in sourcing high-quality opportunities in North America and Europe, through off-market deals at attractive economics,” said Quan in the release.

“We expect that we could complete approximately $300 million in additional acquisitions before reaching our target leverage levels.”

Leasing highlights in Toronto, U.S.

Among the leasing highlights, Dream Industrial has filled a couple of large vacancies and has been completing many of its leasing deals at spreads 30 to 60 per cent higher than previous rates.

It leased a 98,000-square-foot vacancy in the GTA to a U.S.-based logistics company at a rate 50 per cent higher than the prior rental. That is among 300,000 square feet of new leasing since the end of Q2.

In Louisville, another new lease is pending with a “Fortune 500 company” on a 303,000-square-foot vacancy. The trust expects to finalize the new tenant before the end of 2020.

Dream Industrial also completed 650,000 square feet of renewals since the end of Q2.

“Our leasing activity in the third quarter highlights the strength of our portfolio and reinforces our investment thesis as occupiers across Canada, the U.S. and Europe continue to seek modern, high-quality industrial space in urban locations,” said Alexander Sannikov, Dream Industrial’s chief operating officer, in the release.

About Dream Industrial

Dream owns and operates a portfolio of 266 industrial properties comprising approximately 26.6 million square feet of gross leasable area in key markets in Canada and the United States.

Based in Toronto, the REIT also has a growing presence in strong European industrial markets.

While employment numbers have improved and restrictions were lifted over the third quarter, the second wave of the pandemic may now impede Canada’s road to recovery. Statistics Canada reported a decreasing unemployment rate in August at 10.2%, down slightly from 10.9% in July, and from the record high of 13.7% recorded in May at the height of COVID-19 shutdowns. Despite re-openings, employment recovery has been slow among accommodation, food services, and retail sectors – a trend that may persist into the final quarter this year amid the second wave.

The strongest employment gains have been seen in the manufacturing sector, growing to reach 95.3% of pre-pandemic levels, with the most notable gains seen in Ontario, Quebec and British Columbia, as reported by Statistics Canada. Retail sales across the country have shown signs of recovery through the third quarter, and as e-commerce sales continue to spike, they are set to further increase as we move into the holiday season. The national office availability rate for all classes jumped to 12.6% in Q3 2020, up from 11.6% in the previous quarter, and 11.3% in the same quarter last year (Figure 1). National industrial availability remained stable at 3.1% this quarter, still marking an increase from 2.6% at the same time last year (Figure 4).

(Figure 1)

The transition into work-from-home that came into effect with the onset of COVID-19 in March of this year has persisted and will likely last in the short-to medium term resulting in continued under-utilization of office space, as well as increasing vacancy rates. As tenants consider next steps that prioritize both productivity and employee safety, sublease space is still growing in downtown markets, especially among smaller private companies, with many larger firms still wary of giving up physical office space all together. Although many retailers and entertainment offerings have reopened throughout the third quarter, the second wave will pose continued challenges for in-person amenities thus further boosting e-commerce demand, and in turn, driving the need for high quality industrial assets. Investors and developers are increasingly looking to expand their industrial portfolios as demand for space climbs across the country.

(Figure 2)

New office supply jumped nearly three times in volume from the previous quarter, with 15 completed buildings in Q3 2020 totaling almost 2.2 million square feet, at a 15.1% availability rate (Figure 2). The bulk of new completion volume was seen in the Toronto and Montreal markets, with 1.3 million and 554,681 square feet of new office completions, respectively. Cadillac Fairview’s York Centre in Downtown Toronto was the most notable office completion this quarter. Located at 16 York Street, the tower includes 878,937 square feet of office space across 33 storeys, of which 85% is already leased with HBSC announced as an anchor tenant. The building is accessible via the underground PATH network connecting most of the financial core in the area as well as Union Station and the neighboring ICE Condominiums complex. It also features state of the art raised flooring and enhanced HVAC systems, as well as a LEED platinum certification.

Another notable completion this quarter, also located in Toronto, was the restoration and redevelopment of the landmark West Block building located at 500 Lakeshore Boulevard West. The site includes seven stories of office space totaling 160,989 square feet that is fully leased, as well as retail space of which Loblaws will be the anchor tenant, including storefronts for its Shoppers Drugmart and Joe Fresh banners.

In Montreal, Broccolini’s Maison Radio-Canada completed in the third quarter, with 418,000 square feet of office space that is fully leased. Located at 1500-1700 René-Lévesque Boulevard East, the new broadcast hub for anchor tenant Radio-Canada was built to foster collaboration and creativity and to contribute to the booming neighborhood at the edge of Montreal’s downtown core.

(Figure 3)

Vacancy rates have continued to rise as work from home practices are projected to last through to 2021, further driving the sublease trend in the third quarter. Nationally, sublet availability jumped from 15.7% in the previous quarter to 17.2% in Q3 2020 (Figure 3), with 12 million square feet of sublet space on the market. Calgary and Toronto have the most sublet space available among major markets, with 3.8 million and 4.4 million square feet, respectively. Still, the Vancouver market has the highest sublet availability rate at 32.5% this quarter, a jump from 31.9% in the previous quarter, and from 21.8% recorded at the same time last year (Figure 3). While subleasing has been one way that tenants have tried to overcome pandemic challenges, many are still questioning whether or not to reduce their office space permanently as uncertainty in the market mounts. Since some employees and employers place a strong value on in-person collaboration and culture, additional challenges with in-office COVID-19 detecting, contact tracing, and the legalities associated with returning to work remain to be seen.

(Figure 4)

Although national industrial availability remains stable compared to the previous quarter (Figure 4), growing demand has created a tight industrial market. This quarter saw 29 industrial buildings completed nationally with an availability rate of 17% (Figure 5), falling from 27.6% in the previous quarter. The Toronto market recorded the majority of completions with 17 new buildings totaling just under 3.2 million square feet, followed by Edmonton with 1 million square feet across only 2 new buildings that are fully leased. Among other major markets, Vancouver saw six new completions totaling 329,105 square feet, Calgary saw three new completions totaling 614,435 square feet, and Montreal saw only one completion of 118,000 square feet. Ottawa did not record any new completions this quarter.

Two notable completions this quarter occurred in Alberta, one of which being Amazon’s newest 1 million square foot distribution center in Edmonton’s Leduc County. Located at 1440 39th Avenue SW, this is the second Amazon facility in the province, with a similar center currently located just North of Calgary. Another significant completion in Alberta is located at 260258 High Plains Boulevard in Calgary’s Rocky View County, with 409,360 square feet of light industrial space currently available for lease.

(Figure 5)

The industrial sector continues to fare well compared to others with the ongoing rise in e-commerce sales driving steady demand for warehouse space across the county. With what some have dubbed as the “Amazon effect”, the third quarter has seen the development of multiple new distribution centers from grocery retailers to manufacturing companies. Many investors are leaning into this demand and have already begun planning industrial projects for the next year. This growth is not expected to slow down any time soon with already-high demand now bolstered by both the second wave of the pandemic and the upcoming holiday season. Still, with consumer priority on delivery times, location will play a crucial role in new developments moving forward.

Despite re-openings bringing back some stability over the third quarter, market uncertainties continue to take a toll on investments, especially in the office sector, as the end of the year approaches. While some employees have begun a slow transition back into the office, vacancy rates are likely to keep on an upward trend as companies assess the benefits of a return to work plans against the cost of maintaining office spaces moving forward. Although industrial availability rates remain relatively unchanged from the previous quarter, more space will be required to keep up with rising demand. Retail distributors had the past few months to adjust to this heightened demand and prepare for what will be a unique final quarter, combining already high e-commerce sales with the cold weather, holiday season, and increasing pandemic case numbers.

Source Altus Group. Click here to read a full story

.

.

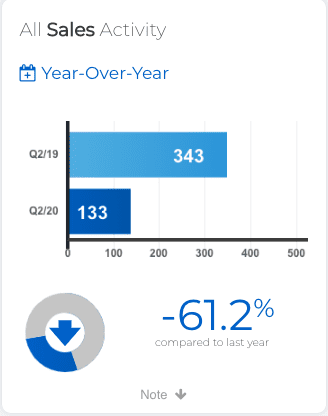

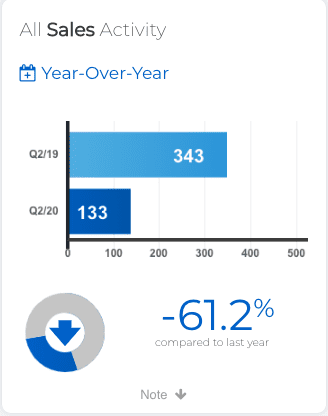

This chart summarizes total industrial, commercial/retail and office square feet leased through TorontoMLS regardless of pricing terms.

This chart summarizes total industrial and commercial/retail and office sales through TorontoMLS regardless of pricing terms.

Source TREB. Click here to read a full story

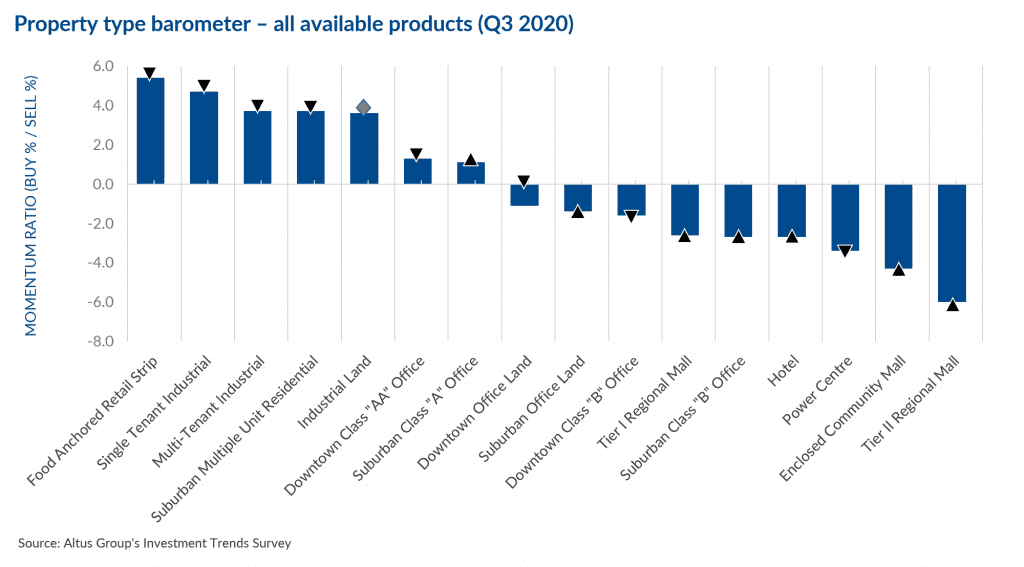

The latest results from Altus Group’s Investment Trends Survey (ITS) for the 4 Benchmark asset classes show that the Overall Capitalization Rate (OCR) was little changed at 5.14% in Q3 2020, but grew from 5.01% in the same quarter last year (Figure 1).

While the impact of COVID-19 on market conditions persists, investors are cautiously optimistic as the end of the year approaches. With strong industrial demand being boosted by the pandemic, the industrial sector continues to remain resilient amid changing market conditions. The office sector still faces unprecedented challenges with work from home constraints likely existing until at least 2021, leading both landlords and tenants to consider new solutions moving forward. Despite businesses slowly re-opening over recent summer months, the retail and entertainment sector anticipates additional challenges moving forward as the weather gets colder, leaving less room for outdoor physical distancing. Although there has been a decrease in total transaction volume, down by 20% for the first half of 2020 compared to 2019, overall commercial real estate remains stable as deals continue to close. With a second wave now declared in some areas, as well as the end of some government assistance programs, the delay in real estate decisions may continue.

(Figure 1)

As predicted by the Bank of Canada earlier this year, economic growth has resumed, but at a slow rate. While unemployment levels steadied after reaching a record high in May, the Conference Board of Canada forecasts that some jobs will not return, requiring the creation of additional jobs in new segments along the road to recovery. The board reports notable employment gains within the accommodation and food services sector as businesses made adjustments to meet new avenues of demand such as take-out and outdoor dining, as well as in the manufacturing sector which is well in alignment with increasing demand for industrial space across the country. Still, the Canadian unemployment rate sits at 10.2% at the end of August, according to Statistics Canada. Interest rates continue to remain low, and are forecasted by the Conference Board of Canada to stay that way long-term as the Canadian economy is unlikely to fully recover until 2022 or 2023. Food anchored Retail Strip and Single-Tenant Industrial are the top preferred products this quarter. The location barometer for all available products indicates positive momentum within the Calgary, Montreal and Halifax markets, while momentum has slowed in Vancouver, Toronto, Ottawa and Quebec City, and remains stable in Edmonton (Figure 2). Toronto and Vancouver remained among the top preferred markets, now accompanied by Montreal. With the ongoing struggles in the Alberta economy, Edmonton is the least preferred market by investors.

(Figure 2)

Market highlights for the quarter include:

-

- Cap rates remain relatively stable amid pandemic-induced changes. Investors are cautiously optimistic moving into the end of 2020 as deals continue to close, albeit at a lower volume, and as the market pivots to overcome recent challenges. Overall cap rates showed virtually no change at 5.14% this quarter following a jump seen across all markets in the previous quarter. Vancouver, Calgary and Toronto showed the greatest increase from the previous year. Calgary and Edmonton experienced the largest drop compared to the previous quarter, while other markets remained stable.

- With many offices likely to remain empty until at least the end of this year due to pandemic restrictions, landlords continue to search for solutions as more tenants consider returning some space to the market, further driving the sublease trend in downtown Toronto and Vancouver. Downtown Class “AA” office cap rates rose to 5.58% this quarter, up slightly from 5.53% in the previous quarter and 5.36% in the same quarter last year. Edmonton was the only market to see a decrease compared to the previous quarter. On a year-over-year comparison, all markets shifted upwards with Ottawa seeing the highest increase.

- Industrial assets continue to fare well, in line with ongoing increases in e-commerce activity, driving the need for more space to meet rising levels of demand as investors are motivated to expand their industrial portfolios and acquire top-quality assets. Both single- and multi-tenant industrial assets are among the top three preferred products by investors again this quarter. Single-tenant industrial cap rates decreased slightly to 5.33% this quarter, down from 5.36% in the previous quarter. Compared to the same quarter last year, almost all markets saw cap rates compress, with Halifax and Quebec City experiencing the largest decrease, Edmonton and Toronto remaining stable, and Vancouver inching slightly upwards. Montreal was the only market to see a slight uptick compared to the previous quarter.

- Despite some signs of a rebound, pandemic effects continue to batter the retail sector. While multiple retailers filed for bankruptcy early in the pandemic, some have adjusted operations to meet new consumer expectations. As predicted, food-anchored retail has performed well this quarter, the top most preferred product by investors (Figure 3), and those with necessity-based offerings are likely to maintain strong results. Still, the approach of colder weather will introduce new challenges for retailers and restaurants to maintain physical distancing while fully indoors, as well as finding ways to draw consumers in for entertainment offerings throughout the fall and winter months. Tier I regional mall cap rates remain stable at 5.29% this quarter with Halifax, Quebec City and Toronto inching upwards, and Vancouver, Ottawa and Montreal moving down. Compared to the same quarter last year, all markets experienced an overall rise, with Halifax increasing the most, followed by Calgary.

- While multi-res assets still appeal to investors, demand continues to be influenced by pandemic effects, such as enduring international travel restrictions, continued threats of rent arrears, and the projected end of CERB and mortgage deferrals as we move into the final quarter of 2020. Suburban apartment cap rates fell to 4.39% this quarter, down from 4.43% in the previous quarter, but remaining stable compared to the same quarter last year. Vancouver and Montreal were the lone markets with an increase in cap rates, while Edmonton experienced the largest drop from the previous quarter. The greatest increase year-over-year was recorded in the Vancouver market.

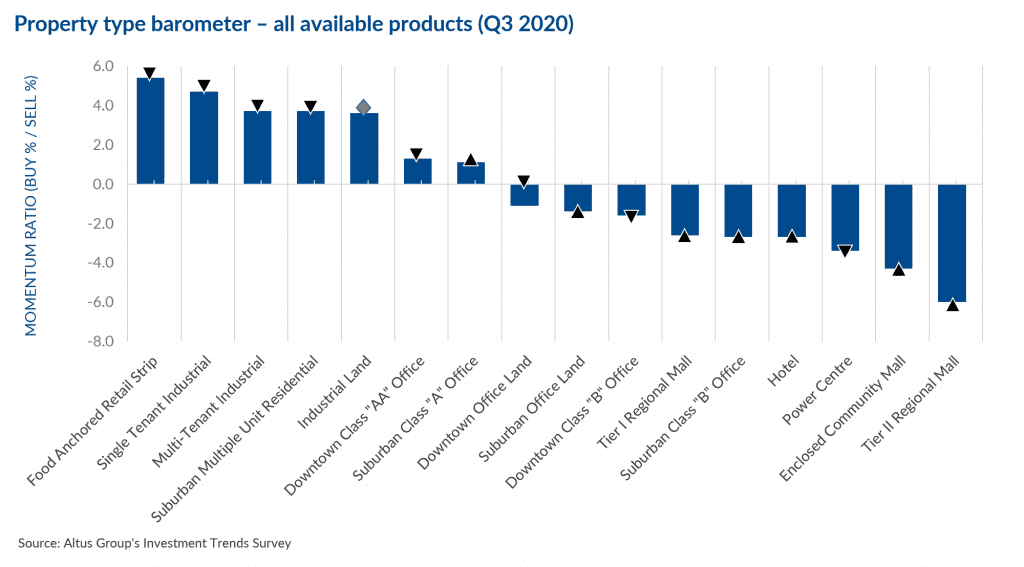

(Figure 3)

Other highlights include:

- Of the 128 combinations of products and markets covered in the Investment Trends Survey:

- 57 had a “positive” momentum ratio (i.e., a higher percentage of respondents said they were more likely to be a buyer than a seller in that particular segment), an increase compared to 48 in Q2 2020; 69 had a “negative” momentum ratio, a decrease from 70 in the previous quarter; and 2 were neutral compared to 10.

- The top 15 products/markets, which showed the most positive momentum were (Figure 4):

- Halifax Single-Tenant Industrial, Suburban Multiple Unit Residential, and Food Anchored Retail Strip

- Quebec City Single- and Multi-Tenant Industrial, and Suburban Multi-Unit Residential

- Ottawa Suburban Multiple Unit Residential, and Single- and Multi-Tenant Industrial

- Toronto Food Anchored Retail Strip, Suburban Multiple Unit Residential, and Industrial Land

- Vancouver Food Anchored Retail Strip

- Montreal Suburban Multiple Unit Residential and Food Anchored Retail Strip

(Figure 4)

Source Altus Group. Click here to read a full story

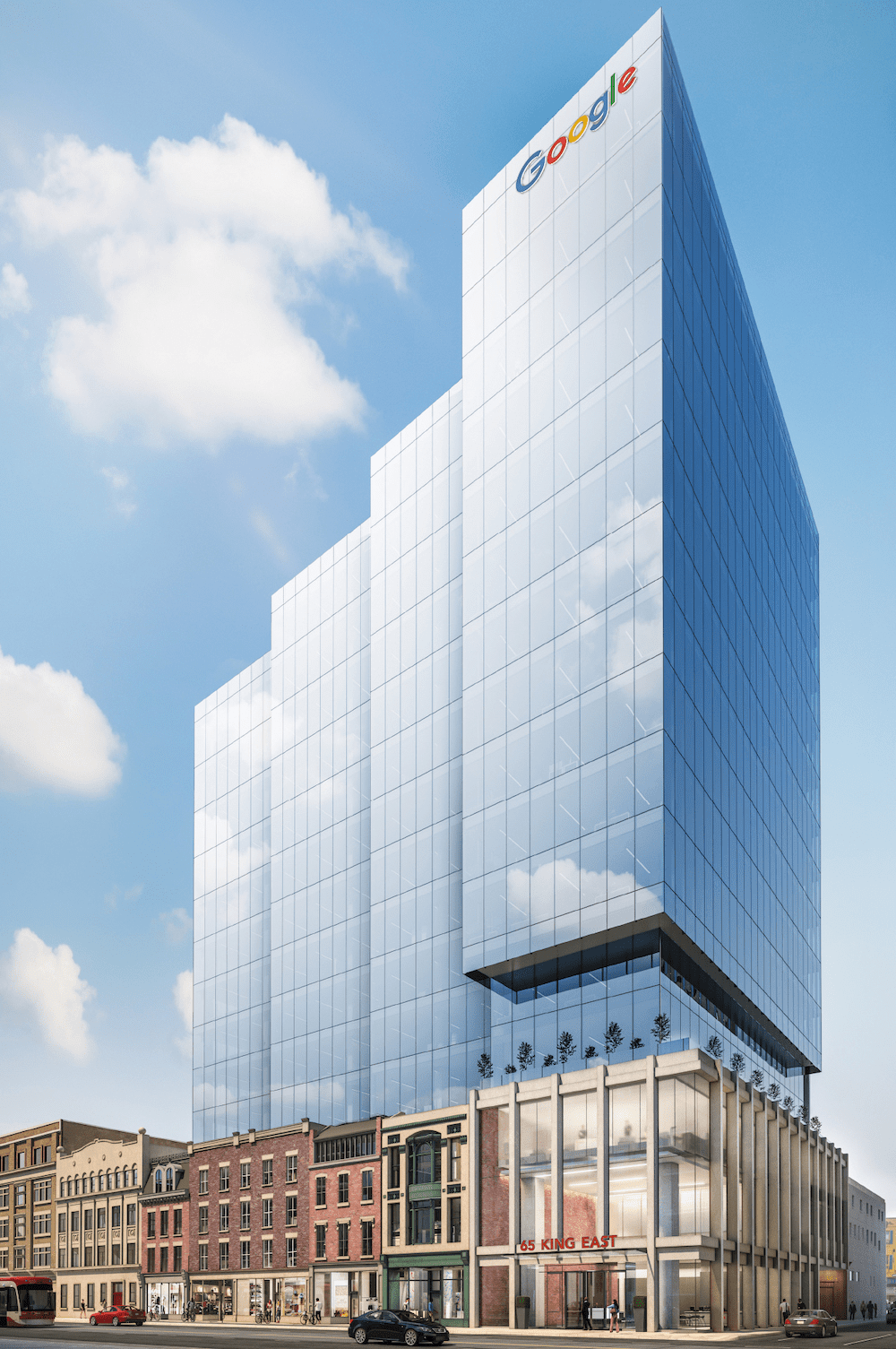

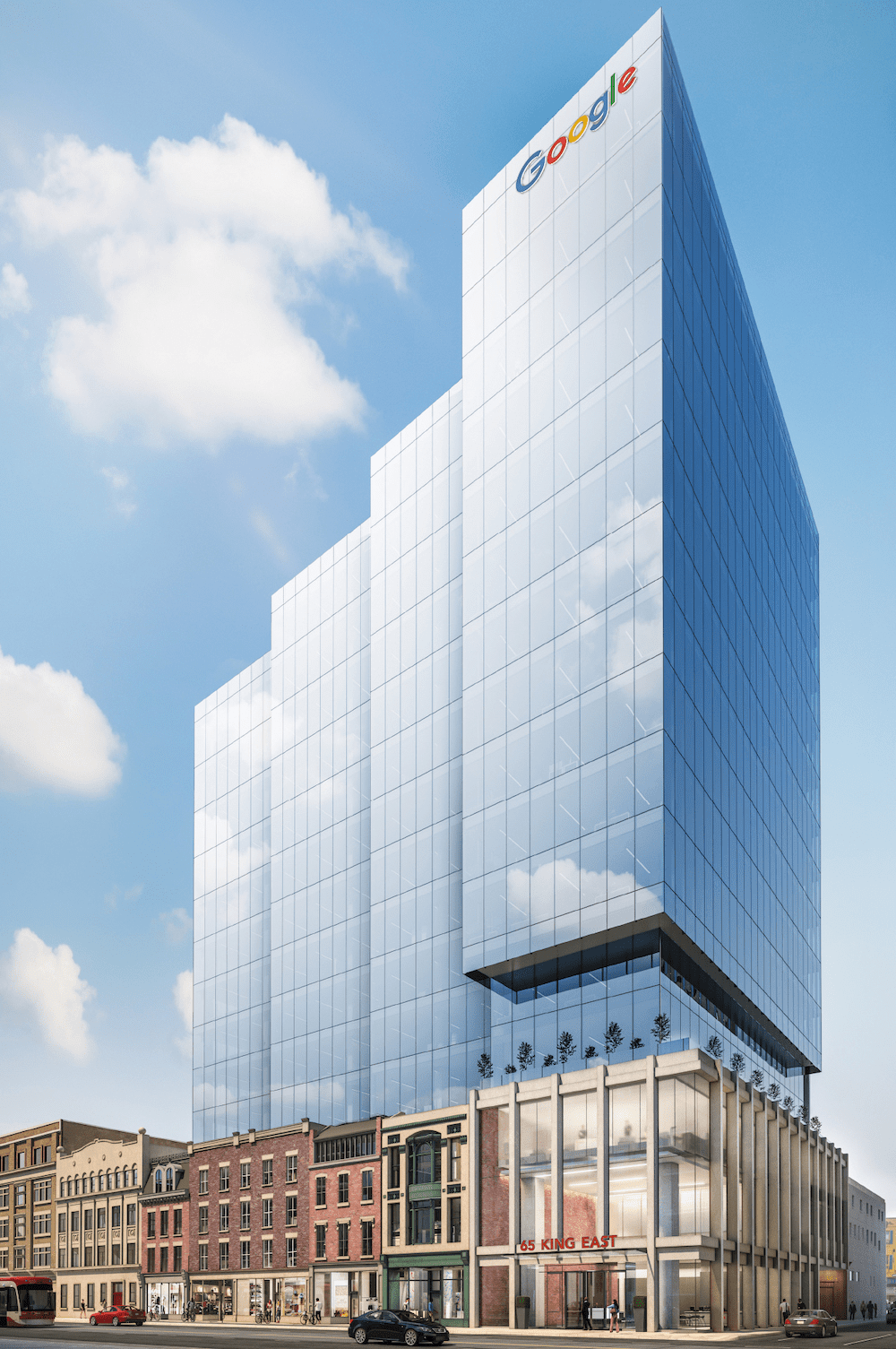

Just east of the financial core in Downtown Toronto, Carttera Private Equities is bringing a new 18-storey office tower to 65 King East. Under construction, a few buildings west of Church Street, the IBI Group and WZMH Architects-designed tower is set to house 400,000 ft² of new office space for ubiquitous tech giant Google upon its completion in late 2021.

Looking southwest to 65 King East, image by Ryan Debergh

Looking southwest to 65 King East, image by Ryan Debergh

Seven months ago, shortly after the announcement that the entire building would be leased to Google, the first signs of above-grade progress were being recorded when we last checked in on the building’s construction. The early 2020 leasing agreement represents part of Google’s Canadian expansion that will triple their national workforce. The latest renderings of the building show prominent Google signage along the tower’s roofline.

65 King East with Google signage, image courtesy of Carttera

65 King East with Google signage, image courtesy of Carttera

Now late in 2020, the tower’s three-storey base connecting to four preserved heritage frontages is structurally complete, and the first of the tower floor-plates has risen above the podium.

Looking southeast to 65 King East, image by Forum contributor Benito

Looking southeast to 65 King East, image by Forum contributor Benito

Views captured from an elevated position to the northeast show that two of the tower floors—4 and 5—have been formed, while work has also reached level 6. As crews get into the swing of forming the repeating floor footprints, the speed of the tower’s ascent should increase in the coming months.

Looking southwest to 65 King East, image by Ryan Debergh

Looking southwest to 65 King East, image by Ryan Debergh

65 King East will eventually top out at just shy of 83 metres in height, adding to a collection of medium-scaled towers that step down the heights and densities of the Financial District to the west with mid-rise densities of the St. Lawrence area to the east. Fronting King Street East at street level, restored heritage walls retained from previous buildings on the site will frame new retail spaces.

Source Urban Toronto. Click here to read a full story

Demand for apartments remains strong

Toronto-based PineMount Developments has completed one of the first new apartment building sales in the post-COVID-19 environment, divesting the 64-unit Ferndale Gardens in Barrie, Ont., for $24 million.

The buyer is Toronto’s Starlight Investments, an active acquirer in the apartment market in recent months.

“I think it might be the first new construction deal done post-COVID. Other deals got under contract (prior to the pandemic-related economic shutdowns in March), and then closed after COVID,” Derek Lobo of SVN Rock Advisors in Toronto told RENX.

SVN’s Carolyn Ennest facilitated the transaction.

Lobo said the price of $375,000 per unit does not represent a reduction from pre-COVID pricing, despite deal volume across Canada having declined by about 40 per cent during the past six months.

“The price is essentially the same as we would’ve expected pre-COVID,” Lobo said. “Trade volume is down, but prices have held.”

Demand for apartments remains strong

Although Lobo believes transaction volumes might remain lower for several more months due to the usual lag time getting deals done, he doesn’t expect the market itself to cool. The first two reasons involve demand, both from renters and investors, which remains strong.

“No. 3, interest rates are at historic lows and they were before COVID. And here’s the point now, everyone expects them to stay low. We are in the zombie apocalypse of interest rates,” he noted.

“The fourth thing is, maybe, land costs come off and maybe construction costs come off because no one is going to be building hotels, retail and office.”

Ferndale Gardens is located at 430 Ferndale Dr., in the south end of Barrie, a fast-growing city of 150,000 residents about 45 minutes north of Toronto.

The concrete-construction, four-storey building was designed as a higher-end rental with a mix of one- and two-bedroom apartments and outdoor parking.

It has extensive amenities including social room with kitchen, lobby lounge and cafe bar, outdoor pergola sitting area, outdoor rooftop terrace, onsite fitness studio, pet spa and electric car charging facilities.

“We wanted to build a rental product, but we were always focused on the demographic of the empty-nester,” said PineMount founder and president Eli Turkienicz.

He said the market is under-serviced for this type of new product for people moving out of longtime residences, but who don’t want to buy a condo.

“So we’ll provide them with an alternative, a higher-end apartment with condo-quality finishes that they can rent.”

When the building was sold, only a few apartments remained to be leased-up.

PineMount’s background

Turkienicz’s company has developed single-family and smaller projects in several other GTA and GGHA cities. He became familiar with Barrie while driving through the city to reach his cottage in the Muskoka region.

PineMount acquired the property after it had sat vacant for several years while being owned by other developers.

“It was done specifically to start development on it. It was not long between closing and then going forward with the redevelopment,” he said.

PineMount was founded in 2010 when Turkienicz left the family business to strike out on his own. Originally trained as a lawyer, Turkienicz soon entered the family development business, then known as Milton Turk and Sons, about 30 years ago.

The family focused more on the commercial side of things, so when Eli set out on his own, he wanted to do something different.

“I did not want to overtly compete with what my family was doing. They were not involved much in residential at the time so I decided to pursue that. I did see it as a good opportunity.”

After several years constructing single-family and smaller multires projects, he met Lobo a few years ago and is now moving into larger-scale apartment development.

“I guess I got converted,” Turkienicz said.

Strong interest in Ferndale Gardens

Ennest said SVN marketed the Ferndale building to “a select group of new construction buyers,” setting off a sale process that took just 18 weeks. Both she and Turkienicz said there was strong interest in the property — even before it was actually put on the market.

“There always was interest before COVID and right through the whole shutdown and up to now,” Turkienicz said.

“There were a number of players interested in purchasing this building and COVID did not seem to have an impact on their interest.”

Ennest said the development had many attractive elements, including its location both with respect to Barrie (linked to Toronto and the GTA by Hwy. 400 and GO train commuter service) and the neighbourhood.

“It’s new construction and institutions are looking to make their portfolio younger,” she noted. “Barrie is a growing market, in close proximity to the GTA. We’re always receiving calls with interest in being in the GTA.”

The building is located next to the environmentally protected Ardagh Bluffs, an extensive forested area.

More development planned for Barrie

Turkienicz isn’t done with the city, either. Although his next project is slated to be a nine-storey, 170-apartment development on Sheppard Avenue West in Toronto, he’ll soon be returning to Barrie.

PineMount owns a site that’s about an acre in size at 129 Collier St., overlooking the nearby Lake Simcoe / Kempenfelt Bay waterfront.

“We have a pipeline of projects that we’ve built up and one of them is another site in Barrie,” he said. “This one is in the downtown, between Collier and Dunlop . . . it runs between both streets.”

PineMount plans a phased, 260-unit development which fits into current zoning for the site.

“We are looking to build two towers, in two phases. The first one would be about 100 units with some podium parking and then the second phase after that, the balance of the units.”

Having tasted success with PineMount’s largest project so far, Turkienicz plans to continue helping fill the need for more purpose-built rental developments.

“I know there is a desire, hunger out there for new product. Some of the larger, institutional landlords are constantly looking for new buildings to add to their portfolio and there is not a lot out there,” he said.

.

.