Q1 2020 Commercial Mortgage Commentary

Q1 2020 Commercial Mortgage Commentary

CMLS Mortgage Analytics Group

The Commercial Mortgage Commentary aims to inform the market about commercial real estate finance news. It focuses on the following capital sources for commercial real estate: Conventional Mortgages, CMHC-Insured Mortgages, Commercial Mortgage Backed Securities (CMBS), High Yield Mortgages, First Mortgage Bonds, and Senior Unsecured debt for REITs and REOCs.

CMLS Lenders Survey

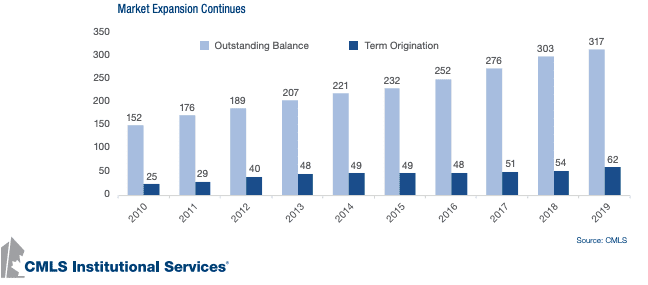

The CMLS Mortgage Analytics Group (MAG) recently completed its 10th annual survey of the Canadian Commercial Mortgage Lending market. This year’s survey marked our highest participation rate to-date, with 37 different lenders participating and about 90% of the market covered. As of the end of 2019, our survey indicates the Canadian Commercial Mortgage market sits at $317 billion in outstanding loans, up from $303 billion at the end of 2018. New origination in 2019 (which excludes construction loans) came in at $62 billion, a 15% increase over last year’s total.

Lender sentiment was upbeat heading into 2020. Over 90% of survey respondents indicated that they were planning to maintain or increase origination volumes this year. The outbreak of COVID-19, however, has significantly altered market perceptions. MAG recently published its Q1 Commercial Mortgage Lenders Survey, in which it discusses how lenders are handling this unprecedented state of affairs.

Making News

COVID-19

The first quarter of 2020 was marked by massive challenges to the global economy due to the outbreak of COVID-19. In terms of the commercial mortgage space, borrowers across the nation have faced mounting pressure to provide payment assistance to beleaguered tenants. Lenders in turn have seen the number of requests from borrowers for loan concessions grow rapidly. The extent to which the national shutdown will ultimately affect real estate investment cashflows remains to be seen. This uncertainty has led to increased challenges in valuation as investors and borrowers try to determine if the impact to NOI will persist or correct itself in the short term.

The growing uncertainty in financial markets has led to a rapid deterioration in the lending space for the time being. Some lenders have closed up shop for the next few months, while others have tightened their underwriting standards significantly. Many lenders have instituted floor rates and those still open for business are floating offers for new deals with rates guaranteed for only a few days as the overall market landscape changes at unprecedented speed.

CDPQ Looks to Move Out of Retail

After its real estate portfolio posted a -2.7% return in 2019, Ivanhoe Cambridge – the real estate arm of Caisse de dépôt et placement du Québec – announced it will look to sell about a third of its 25 Canadian shopping centres over the next two to three years. Those Canadian shopping centres are valued at $12-$15 billion, meaning the sale will mark a significant shift in Ivanhoe Cambridge’s $64 billion real estate asset mix. Along with the planned sale, Ivanhoe Cambridge will look to transform its remaining malls, adding residential and logistics space in an effort to make their retail assets more of a community hub rather than simply a shopping centre.

The moves come as e-commerce in Canada continues to eat into bricks-and-mortar sales at a rapid pace. Data from statistics Canada shows e-commerce sales have grown by 13% annually since 2016. Its share of total retail sales has grown by more than 9% annually over that same period.

Economic Environment

BOC Rate Cuts and QE

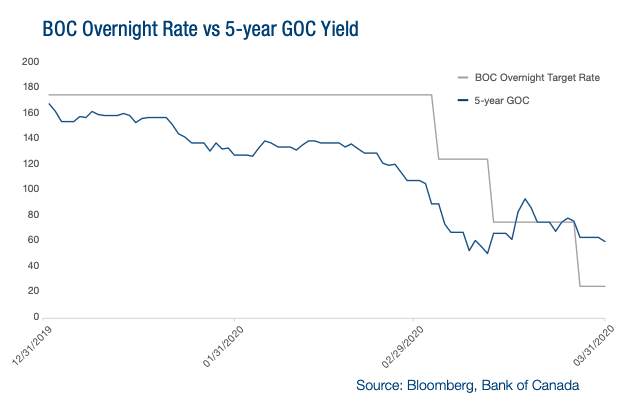

In an unprecedented move, the Bank of Canada (BoC) slashed its overnight interest rate by 150bps over the course of March. The current rate of 0.25% is the lowest since the 2008/09 financial crisis. In tandem with the BoC cut, yields on Government of Canada (GOC) bonds tumbled as investors scrambled to move capital to safer asset classes.

The BoC also announced the implementation of two new asset purchase programs that it hopes will help spur liquidity in the economy. The first program, called the “Commercial Paper Purchase Program”, aims to assist beleaguered companies with their short-term financing needs. The second will see the BoC purchase Canadian government debt of at least $5 billion/week across tenors of the yield curve. To put that in perspective, the minimum weekly purchase amount by the BoC equates to approximately 1% of GDP per month.

Oil Prices Plummet Amid Price War

Global energy markets were left reeling at the end of Q1 as most major oil indexes touched 18-year lows to end the quarter. Oil faced downward pressure on two fronts: the global shutdown due to COVID-19 and an oil price war between Russia and OPEC that led to sustained oversupply throughout March. The impact on Canadian oil has been severe at a time when the Oil and Gas industry in Canada struggles to stay afloat after years of low oil prices and stalled projects.

Commercial Mortgages

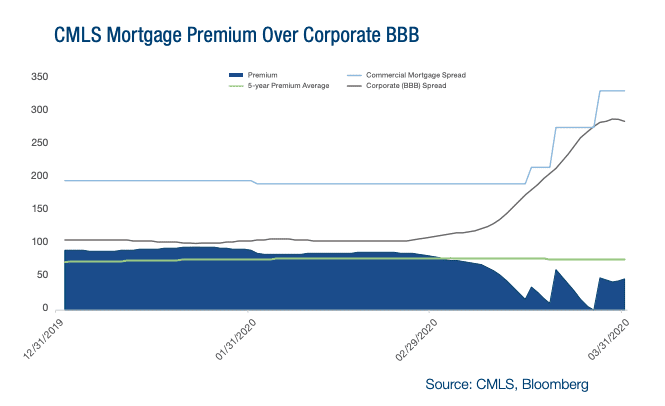

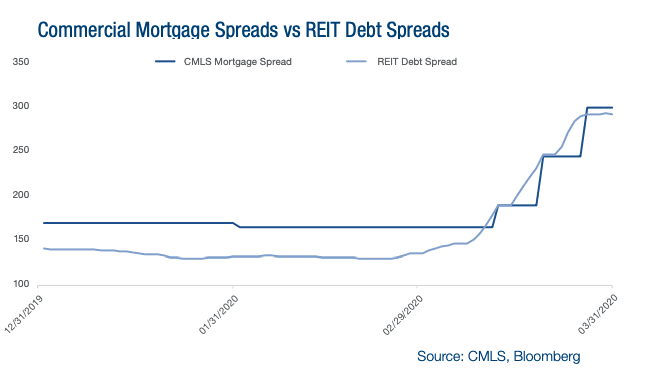

After two quarters of nearly flat commercial mortgage spreads, March saw the largest shift in over a decade. Market liquidity quickly deteriorated as lenders assessed the uncertainty around borrowers’ ability to service debt and the government’s response to COVID-19. Several institutions paused lending activity entirely until a sense of normalcy returns to markets.

Given the increased uncertainty and lower supply of capital, markets quickly reflected upward pressure on commercial mortgage spreads. Several key fixed income indexes, often leading indicators for the commercial mortgage space, had their spreads widen substantially at the end of Q1.

Government regulators have attempted to ease operational stress on the financial system with several policies. In March, the Office of the Superintendent of Financial Institutions (OSFI) announced it will allow banks to continue to classify loans with deferred payments as ‘performing’ for borrowers affected by COVID-19. The announcement means banks will not be forced to hold additional capital on their books to offset these loans. OSFI also announced a reduction in the domestic stability buffer of 125bps, bringing it down to 1.00% to end the quarter. OSFI estimates the reduction will support more than $300 billion of additional lending capacity by Canada’s largest financial institutions.

CMHC

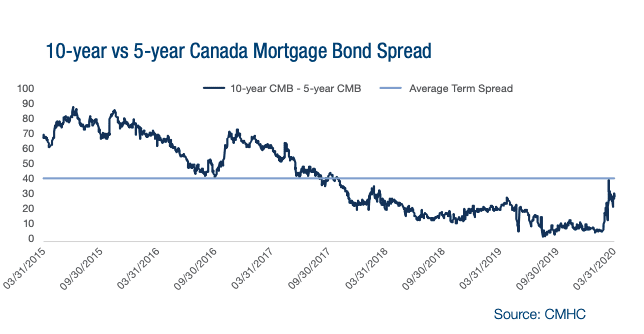

Since 2017, the term premium for 10-year CMHC-insured loans versus 5-year has steadily narrowed, resulting in high borrower demand for 10-year terms. However, at the end of Q1 the difference between 5-year and 10-year Canada Mortgage Bonds (CMB) – the base rate quoted by many lenders – widened significantly. Coupled with growing market uncertainty, borrower demand and lender supply may finally be converging on the 5-year space.

Compared to the previous quarter, spreads have increased substantially for CMHC products across all tenors. This recent market volatility has led the Government to implement several policy changes to support the CMHC-insured loan market. In March, the Government expanded its Insured Mortgage Purchase Program (IMPP) to purchase up to $150 billion of insured mortgage pools. The stimulus effectively triples their mortgage purchases from the previous year and more than doubles the amount purchased during the last financial crisis. The move aims to expand stable funding available to banks and mortgage lenders in order to ensure continued lending to consumers and business.

On March 24th, CMHC purchased $5 billion in 5-year insured mortgage pools as part of the IMPP. To date, there have been no comparable purchase programs announced in the 10-year CMHC space, leading to a notable lack of funding for longer duration loans.

The BoC has also announced it will buy back CMHC-guaranteed CMBs in the secondary market in an attempt to increase liquidity in that space (CMBs are backed by pools of insured mortgages). The BoC announced it will target purchases of up to $500 million per week to support market liquidity.

CMBS

In January, Real Estate Asset Liquidity Trust issued REAL-T 2020- 1, the first CMBS issuance in 2020. REAL-T 2020-1 is a $532 million CMBS consisting of 52 loans secured by 86 commercial properties. The issuance features a 4.019% weighted average interest rate, a 100-month weighted average term to maturity, and AAA subordination of 13.25% (86.75% of the pool is rated AAA).

According to the DBRS pre-sale report, the collateral consists of 23.9% anchored retail and 24.2% office. The underlying properties are 47% in Ontario and 20% in Quebec. Our intel suggests it is unlikely that we will see any further substantial securitizations until the COVID-19 pandemic subsides.

REITs

The S&P/TSX Capped REIT Index closed the quarter down 27.47% from the start of 2020. In the US, the MSCI US REIT Index was down 26.99% over the same period. The impact on the debt side of Canadian REIT’s has also been substantial. Yields on existing unsecured debentures increased by more than 100% month-over-month to end the quarter, according to data from our proprietary index.

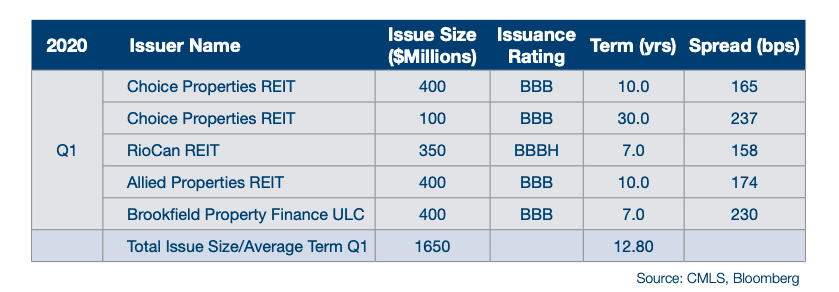

Issuances of new REIT debt totaled $1,650 million in Q1. With their equity valuations at 10-year lows, and the spread on REIT debt at 10-year highs, many REITs will be hard pressed to raise new capital until market volatility subsides.

Source CMLS Financial. Click here to read a full story

You must be logged in to post a comment