Author The Lilly Commercial Team

Oxford Properties and CPPIB seek to sell one of Toronto’s largest office buildings

Oxford Properties Group and co-investor Canada Pension Plan Investment Board (CPPIB) have hired RBC Capital Markets to explore a potential sale of Toronto’s Royal Bank Plaza, according to a spokesperson for Oxford.

The downtown office complex is among Toronto’s largest, totalling almost 1.5 million square feet across two towers, with RBC leasing 40% of the building.

Famed for a series of windows covered with a 24-carat gold coating, the building was built in the 1970s and is a stand-out feature in Toronto.

Oxford, the real estate business for the Ontario Municipal Employees Retirement System (OMERS), has owned and managed the property since 1999, while CPPIB became a co-investor in 2005.

The sale is part of Oxford’s move to increase its assets in logistics, multifamily and life sciences, according to the spokesperson.

Proceeds will be used to fund Oxford’s Greater Toronto Area development pipeline.

“The anticipated sale is part of our global diversification strategy and we will look to redeploy the proceeds to fund our growth in Toronto, where we continue to have a favorable long-term view,” said Randy Hoffman, Senior Vice President, Canada at Oxford Properties, in an emailed statement.

Oxford declined to comment on pricing but a source close to the matter said the building should sell for more than C$1 billion ($797 million).

“From time to time, we evaluate opportunities to realize gains on our investments, including real estate,” said a spokesman for CPPIB.

Source Financial Post. Click here to read a full story

BAZIS buys midtown T.O. plaza, plans high-rise redevelopment

BAZIS has acquired a midtown Toronto strip mall property from an unnamed private vendor in a $37-million off-market deal.

“In my opinion, the vendor probably realized that, with all the development happening in the neighbourhood, this particular asset had outlived its true potential as an investment and the highest value would be achieved through it being sold based on the redevelopment potential,” Lennard Commercial Realty, Brokerage vice-president Vincent King, who brokered the transaction, told RENX in an email interview.

The plaza at 744-758 Mount Pleasant Rd. has six tenants: a restaurant; a pet store; a shoe store; a nail and hair salon; a gym; and a pizza outlet. It has approximately 190 feet of frontage on Mount Pleasant Road just south of Eglinton Avenue.

The site is in close proximity to the Eglinton subway station, a future Eglinton Crosstown light rail transit stop and the Kay Gardiner Beltline Trail, as well as a school and office, commercial, retail and residential uses.

Plans for the Mount Pleasant site

BAZIS representatives declined to be interviewed, but King said “the purchaser probably viewed this property as a great income-producing property in the short term. In the long term, it’s for a high-rise condominium development in one of the most affluent neighbourhoods in the city.”

The Mount Pleasant Road property is zoned Commercial Residential. BAZIS recently submitted a rezoning application to the City of Toronto for a 35-storey mixed-use residential building with a six-storey podium and a seventh-floor indoor and outdoor amenity area.

The proposal is for 398 residential units: 53 bachelors; 180 one-bedrooms; 122 two-bedrooms; and 43 three-bedrooms. It would include space for retail and service tenants at grade as well as parking for 104 motor vehicles and 442 bicycles.

The project is expected to yield a total gross floor area of approximately 311,000 square feet.

“I’ve always felt that midtown is one the greatest areas in Toronto,” said King. “In recent years, there have been many new developments in the area and, by the looks of it, there are many more to come.

“I believe this specific site, coupled with BAZIS’ reputation for designing and building such beautiful buildings, will be a welcomed change to the neighbourhood.”

Other BAZIS developments

BAZIS is a Vaughan-based luxury condo developer with past Toronto projects including Crystal Blu, eCondos (in partnership with Metropia and RioCan REIT), Exhibit and Emerald Park. The latter two developments were in partnership with Metropia and Plazacorp.

The company has a number of other projects under development or in the planning stages.

Bartley Towns is an 84-unit townhouse complex with homes ranging in size from 1,081 to 1,710 square feet that’s under construction near Eglinton and Victoria Park Avenue.

BAZIS and CentreCourt are partners on 8 Wellesley Residences at Yonge, a 55-storey, 599-unit condo that’s sold-out after going on the market in February. It’s scheduled for completion in 2025.

A 30-storey, 287-unit condo at 100 Bond St. is in the pre-construction phase.

Queen and Church, at 60 Queen St. E., is a 57-storey, 447-unit condo in the pre-construction phase.

BAZIS and Tridel are partnering on Bayview and Finch, a 12-storey, 206-unit condo at 630 Finch Ave. E. That project is also in the pre-construction phase.

Source Real Estate News Exchange. Click here to read a full story

Real estate investment surges to record with Canada rebounding

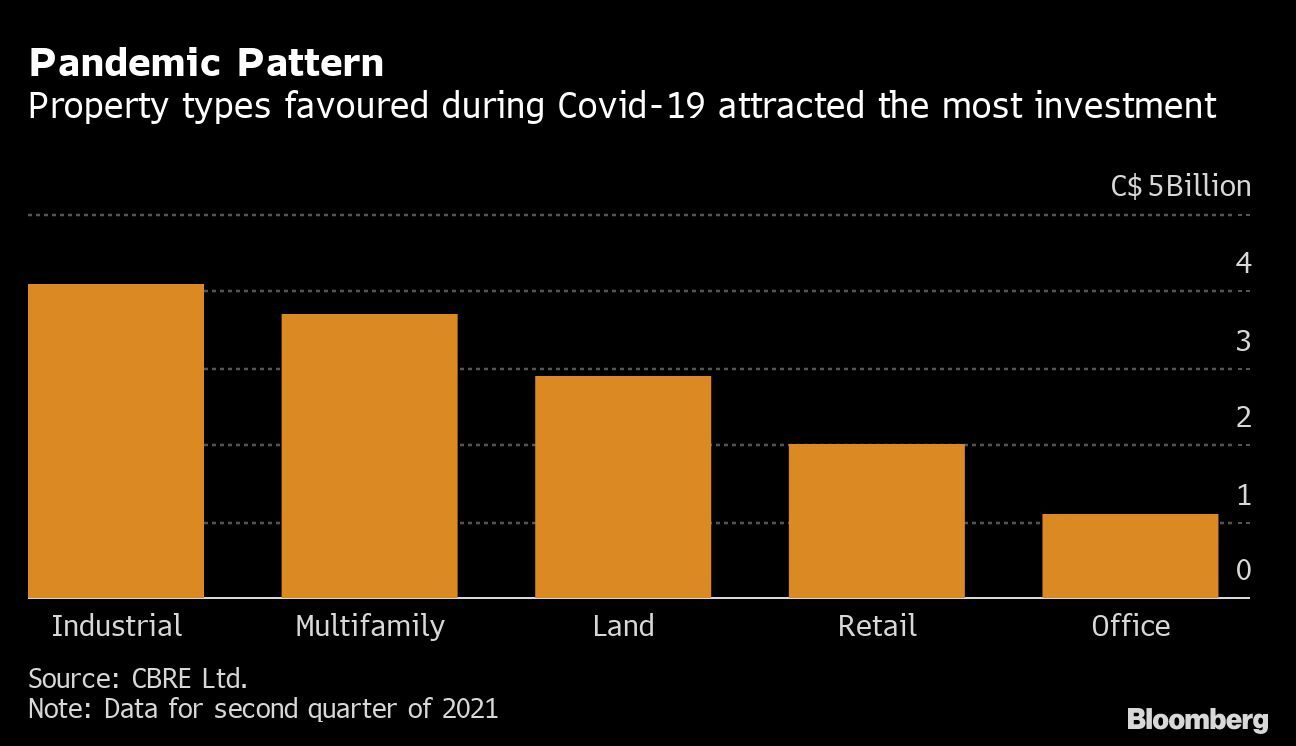

Canada saw record investment in commercial properties in the second quarter as the easing of the COVID-19 pandemic pushed buyers and sellers off the sidelines.

With the country’s economy rebounding, $14 billion (US$11 billion) worth of commercial real estate changed hands in the three-month period, a 29 per cent increase over the previous quarter, according to a report Monday from commercial brokerage CBRE Group Inc.

Investors targeted apartment buildings and warehouses, driving a surge of deals that has Canada on pace to post nearly $50 billion in commercial real estate investment this year. That would be a new annual record, according to the report.

“Capital can’t remain on the sidelines forever — it has to be deployed and put to work at some point,” Paul Morassutti, vice chairman of CBRE’s Canadian business, said in a telephone interview. “Over the last two quarters, there has been a very strong sense that we are at least getting close to some degree of normalcy.”

Even as vaccinations give Canada’s economy a boost, commercial real estate investors continued to gravitate to properties that have been resilient during the pandemic. Warehouses have been popular because of the e-commerce boom. Apartments, long considered dependable assets, have gotten a boost in recent months as surging home prices shut out many would-be buyers.

While retail and office buildings saw renewed interest in the second quarter, Canadian investment in those properties lagged behind other corners of the market.

“For a lot of investors out there, there was a desire to rotate out of retail and office investments, where there are bigger question marks over those asset classes,” Morassutti said.

The CBRE report focused on transactions for individual buildings, leaving out mergers where entire companies change hands. Even with those deals factored in, last quarter’s torrent of investment was enough to make it the third-busiest on record, the CBRE report said.

Source BNN Bloomberg. Click here to read a full story

Ontario to give license on commercial mortgages

Sophisticated borrowers and lenders will be able to negotiate commercial mortgages through unlicensed channels if proposed regulatory amendments are enacted in Ontario. The draft regulation, currently posted for public comment on the provincial registry, arises from 2019 legislative recommendations pertaining to Ontario’s Mortgage Brokerages, Lenders and Administrators Act (MBLAA).

Drawing on stakeholder input at the time, Members of Provincial Parliament Doug Downey and Stan Cho maintained that some mechanisms meant to protect uninitiated consumers are unnecessary and cumbersome for entities such as large real estate companies, REITs, pension funds and property fund managers. In particular, they cited “requirements to receive or sign disclosure documents” as undue red tape.

The amendments would exempt qualifying lenders and mortgage brokers/dealers from the requirement to hold a mortgage brokerage license if they do business exclusively with designated sophisticated clients. Accompanying analysis notes that Sun Life Financial requested this exemption on behalf of its real estate subsidiary, BentallGreenOak, during the 2019 legislative review.

Thus far, policy drafters have identified seven existing licensed brokerages that could qualify for the exemption, but they do not have complete data on eligible lenders. Along with the opportunity to comment, the posting with the proposed amendments poses questions in an effort to gauge uptake. Submissions can be made until October 4.

The analysis concludes that the amendments should reduce regulatory burden and costs “for financially sophisticated entities whose mortgage transactions pose a low risk to consumers” and ensure that regulators’ efforts and resources are more efficiently targeted to the needs of consumers.

Source The Remi Networks. Click here to read a full story

Blackstone to buy Toronto’s WPT Industrial in $3.1 billion deal

The REIT focuses on distribution and logistics properties, a hot commodity in commercial real estate.

Blackstone Real Estate Investment Trust Inc. is acquiring WPT Industrial Real Estate Investment Trust in a cash deal valued at US$3.1 billion, including debt.

BREIT, a non-public real estate investment trust, is paying US$22 per unit for Toronto-based WPT, a 17 per cent premium over the closing price on Aug. 6, according to a statement on Monday.

WPT focuses on distribution and logistics properties, a corner of commercial real estate that has drawn increasing interest from investors. The shift toward online shopping is altering supply chains and giving a boost to industrial landlords, especially those with space around major cities.

The company owns about 110 properties in the U.S., including warehouse and distribution centers in and around Atlanta, Chicago and Houston. Even before the Blackstone offer, WPT had joined this year’s rebound in real estate stocks, rising 28 per cent through Friday in Toronto, ahead of the 24 per cent gain of the S&P/TSX REIT Index.

WPT rose nearly 16 per cent to $27.37 in early afternoon trading in Toronto.

“Logistics remains one of our highest conviction themes as the sector continues to benefit from strong tailwinds driven by e-commerce,” David Levine, a senior managing director at Blackstone, said in a statement. “We look forward to expanding our logistics presence across key U.S. markets with the acquisition of this high-quality portfolio that WPT has built.”

Source Financial Post. Click here to read a full story

The future of retail real estate . . . is exciting

Innovation, often thought of as the future of business, has given rise to everything from new programming languages in software engineering all the way down to just-in-time manufacturing.

The same holds true for real estate; innovation has been changing things since before COVID-19, but the pandemic has given even more fuel to that fire.

How we shop today is a great example – we buy more online than ever before! E-commerce changed retail real estate as people are finding they love shopping on their phones.

The birth of the department store

One of the most important innovations in retail real estate was the invention of the department store. These stores stocked all kinds of products or services under one roof, making shopping easier.

This new kind of establishment changed how we shop because it lowered transaction costs for customers and vendors alike. Economist Michael C. Munger defines transaction costs by three categories:

– “Triangulation” is how potential buyers and sellers find one another.

– “Transfer” implies getting the goods from the seller to the buyer; and

– “Trust” means buyer and seller are both assured they will receive what they expect.

Successful innovations of the 1890s department store also included laying out merchandise and allowing shoppers to browse, aggregating different categories of products in the same space, spending on advertising and paying commissions. Today we take these ideas for granted, but back then they were new and inventive.

These new innovations in the retail space, however, also led to an unexpected problem – shoplifting by white middle-class women.

In December 1898 at the Siegel-Cooper department store in New York City, two women entered and picked up an umbrella and perfume and walked out without paying.

They were arrested but were not charged with a crime. Their defence was that it wasn’t their fault they committed a crime – rather it was the enticing setting of merchandise, which made people want things, that led to the thefts.

New way of shopping, but an old problem

The Internet has again revolutionized the way people buy and sell goods. The innovation of e-commerce has been a massive success. Like the invention of department stores, it created a new level of convenience and consumerism and lowered the cost of transacting.

“Triangulation” is accomplished with the Internet connecting millions of vendors to millions of buyers with the click of a button.

“Transfer” occurs often with one-day shipping.

‘Trust’ has been growing through experience. We trust customer reviews (often more than brands), we trust that browsers are secure and that our credit cards are safe. We trust Amazon will stand behind its products (even if those products aren’t actually theirs!).

Yet not so long ago, there were videos on YouTube of thieves taking packages delivered by Amazon from our doorsteps. These thefts diminished the trust that goods would be received. New way of shopping, but same old problem.

The pandemic’s impact on brick-and-mortar retail

During the pandemic, the shift to e-commerce was accelerated with store closures and limits on how many people could shop in-person. This not only forced many to shop for food and other essential items online, it also forced more retailers to pivot to online sales.

It helped us anticipate which brick-and-mortar stores would survive the change from physical shopping to digital shopping. “Bedrock real estate”, as we like to call it at Denciti, has continued to do well. Examples include highway commercial amenities like fast food, gas and liquor stores.

Despite the dramatic shift to online sales, we are seeing physical retail isn’t dead either. It continues to evolve with technology.

Unsurprisingly, Amazon.com is experimenting with physical stores and a “Just Walk Out” shopping experience.

No, we are not talking about five-finger discount shopping this time! “Just Walk Out” technology automatically detects when products are taken from, or returned to the shelves, and keeps track of them in a virtual cart. When you’re done shopping, you can just leave the store.

Again we see transfer and trust are both improved with this new technology.

What’s next for retail real estate?

Innovation has always been about solving problems. Innovation in any sector involves improving your industry by setting a vision about where you want to take that industry. For real estate developers, innovation also involves predicting what retailers may want tomorrow, next year – or in 20 years.

This may sound impossible, but it’s not.

One of the most interesting changes in retail over the last decade has been an ever-increasing reliance on smartphones.

Now, thanks to smartphone cameras and virtual reality (VR) technology, we’re experiencing another change – changing how we “try things on”. We can now see how a shoe looks on our foot through a virtual reality rendering displayed on our smartphone screen.

For now, this isn’t yet factoring in other revolutionary technologies, such as artificial intelligence (AI), which will undoubtedly affect countless industries including retail real estate.

When thinking about the future of retail real estate we need to remember:

– innovation and high-street shopping are not mutually exclusive;

– the high street has been around for centuries, but it’s still evolving in response to new technologies like the Internet of Things (IoT). With IoT technology on our side, retailers will be able to utilize data from smartphones, smart products and other high-tech devices to provide a seamless and convenient customer experience;

– from the moment we walk out our front door in the morning until we get back home at night, technology connects us with everything from shopping centres to restaurants;

– the future is convenience or experience, there is no third option. E-commerce and technology made sure of that.

While the future of retail will be defined by technology, the “high street” is not going anywhere. It provides an experience that cannot be replicated by devices. And we’ll always need a convenient retailer so you can purchase necessary items when you’re in a hurry.

With AI, IoT, and VR technology driving down transaction costs, we will see a merging of physical and online shopping.

The future of retail is exciting!

Source Real Estate News Exchange. Click here to read a full story

Why REITs deserve another look even as the fourth COVID-19 wave hits

The big appeal of real estate investment trusts is stable income, but the pandemic hammered revenues.

To capture more than market returns, investors need to take calculated risks. This doesn’t mean betting the farm on a hot tip, but looking for and capitalizing on market opportunities.

For those looking to adjust their portfolio in the face of an inflation threat, perhaps it’s time to give real estate investment trusts (REITs) another look.

A REIT is an investment portfolio owned (and often operated) by a company with the sole purpose of generating earnings from the real assets held in the portfolio. The real estate market can be divided into two categories, commercial and residential, but REIT portfolios further subdivide property markets, helping to create more opportunities for portfolio and sector diversification.

For example, some REITs only invest in Canadian-based apartment buildings, others focus on warehouse facilities, and still others hold office buildings, shopping centres and hotels, among other facilities.

Investors purchase units (similar to shares) in the REIT and then receive earnings based on the rent collected and the underlying appreciation of the property assets. The advantage of REITs is that the trust is obligated to distribute generated cash flow back to the shareholders in order to keep its tax-preferred status.

The most reliable REITs generally have a good track record of paying dividends, making them an attractive investment option.

For more than a decade, REITs have been stable income generators for all types of investors, but the uncertainty of the global pandemic really hit hard.

The effect was twofold: an almost immediate loss of revenue from uncollected rents, and then there’s the longer-term uncertainty of how Canadians will work and shop in the future, which could dampen any recovery for the underlying assets within these trusts.

Some investors felt these losses and got out. The exodus was summed up by Carolyn Blair, managing director at RBC Capital Markets Real Estate Group, in her September 2020 virtual presentation at the RealREIT conference.

“Q2 2020 brought the largest ever year-over-year decline for quarterly earnings at -13 per cent,” Blair said. She went on to add that as a result of pandemic losses and a few tough years for a few industries, the average aggregate earnings growth for all REITs over the past 19 years was an anemic 1.7 per cent.

Not exactly a ringing endorsement, and the headwinds that the most battered REIT sectors face haven’t exactly abated.

Since COVID-19 hit, REITs have been battered, particularly those trusts highly exposed to commercial real estate. Despite the market’s rally from the lows in March and April 2020, REITs focusing on the hospitality, office, residential and retail sectors haven’t bounced back.

As we head closer to 2022, office and retail REITs are having trouble with their tenants. Even with government-backed relief, these tenants continue to struggle, which has meant a loss of revenue (and confidence) in both sectors.

Hit with a loss of revenue, office-focused REITs are bracing for potential shifts in work culture. A report by real estate consultancy CBRE Group Inc. pegs the national office vacancy rate, as of the end of 2020, at 13.4 per cent, the highest level since 2004.

Retail centres were also hit hard, with many stores closing because of lockdown restrictions, but the real dilemma is whether or not Canadians will return to in-person shopping, given the ease and accessibility of online shopping and home delivery.

Before pandemic restrictions, the Canadian REIT sector was experiencing a boom. The S&P/TSX Capped REIT Index — a sector-based sub-index of the broad-based S&P/TSX Income Trust Index that focuses on REITs — peaked at its highest value in a decade. By September 2020, the annualized return for the index had plummeted to -13 per cent.

To adjust to the market, many of Canada’s largest commercial REITs opted to cut their distributions to unitholders, a strong signal that course corrections were required if they were to weather the storm.

All of this could be a signal that the REIT party is over, but not everyone agrees.

In a June 2021 webinar hosted by commercial real estate investment firm CBRE, vice-chair Paul Morassutti pointed out that after the dramatic -13-per-cent return in 2020 for the TSX REIT index, it was already up 25 per cent in 2021.

“Net asset values have not moved at that pace, they’ve only moved moderately, but the momentum is absolutely going in the right direction,” he said.

Whether or not REITs are appropriate investments in a post-COVID-19 recovery depends on several factors, including the type of REIT, sector and geographical diversity of the assets. There are also economic realities impacting the overall market to consider when determining which REITs might work best with your investment goals. Here are four of them:

Inflation

As participants in the CBRE webinar noted, “inflation could be a key factor for investors, businesses and individuals for the first time in decades. Hard assets continue to act as a hedge against financial market fluctuations while businesses building out and renting space face rising costs.”

Another short-term factor is that an increase in prices for goods and services isn’t being met with a corresponding wage increase. This is prompting industry veterans to look for better hedges against inflation combined with anemic economic growth. In the past, the three sectors that offered worried investors some respite have been gold, technology and real estate.

This could mean a comeback for residential-focused REITs. Housing prices continue to rise (or stay highly unaffordable) and incomes remain stagnant, so apartment rentals in larger urban centres will see continued demand and need — giving well-positioned apartment-rental REITs a boost.

Higher interest rates

There is an assumption that higher interest rates will negatively impact REIT returns. This assumption is based on the idea that higher rates mean higher mortgage rates and this slows both residential real estate sales and rising valuations.

However, in an economy with slow to no wage growth, higher rates will further erode housing affordability, putting increased demand on rental housing in Canada’s largest urban centres.

Higher rates could also be a positive for REITs focused on commercial holdings. If rates rise due to an improving economy, commercial real estate landlords can then choose to raise rents to keep pace with rising rates. This increases rent revenues and helps bolster the portfolio’s underlying value of its assets.

Of course, there’s no guarantee that landlords will get their increased rent requests if their tenants are still struggling. A push to increase revenue could also prompt a depreciation in property values. Still, it’s a good idea for investors to keep an eye on the underlying reasons for higher rates and not immediately assume it’s a nail in the REIT coffin.

Government bond yields

Another reason for optimism when it comes to office and retail REITs is that the Government of Canada 10-year bond yield is still quite low. These bond yields heavily influence the price of commercial real estate mortgages, and the availability of cheap debt means well-positioned and well-managed REITs have more opportunity to find short-term stopgap solutions using access to cheap money.

Sector gains

Before the pandemic, companies in the United States were already moving north of the border to acquire Canadian REIT holdings, while strong Canadian REIT managers were shopping the global market for the right deals. Pandemic restrictions haven’t curbed these trends.

Throughout 2020 and 2021, well-positioned REITs snapped up properties from struggling funds, even in the hardest-hit office, retail and hospitality industries.

Advertisement

This doesn’t mean the future for these sectors is certain. More aggressive virus variants and a flattening vaccination curve still make the overall situation very unstable, and the industries most reliant on people and proximity are going to feel the pain.

But some industries and sectors are seeing a huge uptick in growth and demand, and this is translating into double-digit returns for investors.

In general, REITs with a focus on industrial property holdings did well, reporting an average weighted return of 11 per cent between September 2019 and September 2020. Compare this to the -10-per-cent average weighted return of Canadian residential REITs or the -60-per-cent year-over-year return of hospitality REITs.

To capitalize on market opportunities, investors also need to consider what market sectors are undervalued and what industries are poised for growth. Here are a few areas to consider:

Tap the digital economy

One clear winner during the pandemic were facilities that helped house the digital economy. For the digital economy to function and grow, it needs access to data centres and this requires reliable communication infrastructure and stable industrial units.

What’s better is that this need won’t disappear even with the move towards cloud computing, since every dollar that moves to software as a service (SaaS) and away from traditional hardware and software infrastructure means more demand by these SaaS companies for processing power and storage.

We already know that rapidly growing cloud companies like the flexibility of scaling their operations in colocation data centres, poising data centre-focused REITs for future growth.

In Canada, two solid options in this space are Summit Industrial Income REIT and Brookfield Infrastructure Partners LP, which pays distributions to unitholders.

Summit owns a portfolio of industrial properties across the country and has entered a partnership with Urbacon to build data centres in key Canadian markets.

Brookfield Infrastructure Partners only just started to invest in the data management sector in 2019, with its acquisition of AT&T Inc.’s data centres for US$1.1 billion. Still, this introduction into the space puts them in a good position to grow as this market segment grows.

Go in on industrial space

We already know that industrial REITs were the port in the economic storm over the past 18 months. These REITS don’t offer investors any bargains, but they do offer real estate exposure that appears to be economically healthy.

One example is Granite REIT, which specializes in industrial units. Over the past 10 years, it has offered investors consecutive cash distribution increases and its five-year dividend-growth rate is 4.8 per cent.

Another option here is Summit Industrial Income REIT, already mentioned above.

Get in on logistics

One area that looks promising for future growth — assuming digital shopping is here to stay — are facilities dedicated to logistics.

One Canadian REIT in this space is WPT Industrial REIT, which acquires, develops, manages and owns distribution and logistics properties in 20 states in the U.S. In Q4 2020, WPT collected 99.8 per cent of the rents billed while its occupancy rate stood at 98.2 per cent — a clear winner despite pandemic difficulties.

Snap up a bargain

Depressed valuations mean there could be an incredible buying opportunity for those willing to invest in the hardest-hit REIT sectors: office, retail, residential and hospitality.

Remember, REIT values aren’t fixed: active managers select and manage the underlying assets and contracts. In an uncertain economy, a management team can grow a REIT’s value by increasing rents, adding income-generating services to the properties they own, and other measures.

If you believe the worst is over and that the ever-increasing availability of COVID-19 vaccines will usher in a new era, this might be the proverbial buying opportunity to add or increase your REIT exposure.

Source Financial Post. Click here to read a full story

Oxford Properties buys KKR warehouses in $2.2-billion deal acquiring 149 distribution properties in 12 U.S. markets

Oxford Properties Group agreed to buy a portfolio of industrial properties from KKR & Co. for about US$2.2 billion as online shopping continues to drive investors toward warehouses.

Oxford, the real estate arm of the Ontario Municipal Employees Retirement System, is acquiring 149 distribution properties in 12 U.S. markets, including Dallas, Phoenix, Chicago and Tampa, according to a statement Tuesday.

Warehouses were a hot corner of commercial real estate even before the pandemic, with investors betting on the rise of e-commerce and demand for quick shipping. COVID-19 pushed consumers to shop online even more, fuelling more investment in logistics properties.

“This transaction is an important next step for Oxford to build a large scale industrial business in the U.S.,” Ankit Bhatt, Oxford’s vice president of investments, said in the release. “Growing our U.S. industrial business is one of Oxford’s highest conviction global investment strategies as we continue to build, buy and invest in the physical infrastructure that serves the digital economy.”

The purchase by Oxford comes after a hard year for OMERS, with the pension fund posting its worst annual loss since the 2008 global financial crisis.

OMERS blamed the 2.7 per cent decline on its exposure to “old economy” investments, including retail properties, and said its plan was to invest in to what it termed the “new economy.”

Though mid-year results released last week showed a turnaround, with an 8.8 per cent gain across the portfolio, it hasn’t been enough yet to ease some members’ concerns about the fund’s longterm performance.

Source Financial Post. Click here to read a full story

Commercial real estate developers grapple to adapt climate-change measures

Commercial developers across Canada say they’re determined to meet the challenges of climate change come hell or high water, but it’s not always easy being green.

“There’s more of an inherent responsibility among developers than ever before to build in ways that are climate friendly. That extends to operating buildings as well, using renewable resources to run the property,” says Jonathan Gitlin, president of RioCan Real Estate Investment Trust, a $14-billion enterprise that owns 289 properties, mostly retail.

According to Richard Joy, executive director of the non-profit Urban Land Institute, which provides advice and information to some 2,000 public- and private-sector members in the GTA, the entire sector is frustrated, and the “mishmash” of regulations and policies make it hard for builders and property managers to know what climate measures they should deploy, and which ones will be effective.

“It’s a confusing road map, with policies that range from good intentions to low intentions, and misalignments of policies at different levels of government,” Mr. Joy says.

“There’s nothing that approaches standardization [of carbon measures], and therefore there’s nothing yet that approaches accountability in our industry,” he says.

Anything from bicycle storage in an office parking garage to a commitment to use cement that produces using less carbon might count as a climate measure, but it can be hard to know what will make a difference and should become standard practice.

To try to bring some sense to this confusion, in early November, the ULI is holding a local industry-wide symposium on greenhouse gas and sustainability measures, just in advance of a United Nations summit meeting in Glasgow, where world leaders aim to develop tougher, enforceable climate measures.

Buildings and construction contribute nearly 40 per cent of energy-related greenhouse gas emissions, and Canada’s buildings, which require both heating and cooling, are particularly reliant on energy use, which in most cases produces carbon.

Earlier this month, the UN Intergovernmental Panel on Climate Change (IPCC) reported that: “It is indisputable that human influence has warmed the climate system, raising global surface temperature … Many weather and climate extremes such as heatwaves, heavy rainfall, droughts and tropical cyclones have become more frequent and severe.”

As if to confirm the report’s findings, more than 270 fires have been burning in British Columbia this summer, destroying homes and towns. Also this summer, severe flooding in Henan, China, killed more than 300 people after 201.9 millimetres of rain fell in one hour, while Western Canada’s farmers are stricken by what may be the worst drought in history.

Meanwhile, giant firms such as RioCan are looking for ways to lower the carbon footprints of their properties and protect them from potential climate-related ravages. While not all weather-related building disasters are directly attributable to climate change, there is ample circumstantial evidence.

In June, 2021, for example, the Champlain Towers South building in Surfside, Fla., collapsed suddenly, killing 98 people, including four Canadians. Investigators have already said that sea levels in that area have been rising at three times the global average, which can affect a building’s structural foundations.

Companies that invest and build real estate are noticing that the cost of ignoring climate change can mean higher insurance premiums and maintenance costs, as was pointed out in a 2019 study by investment firm BlackRock.

“Extreme weather and other climate-related events pose a risk to commercial real estate” that could also mean “reduced or even denied coverage if insurers shy away from underwriting risks that have become too great or uncertain. Investors need to get ahead of these risks,” BlackRock’s study said.

Investment firm Brookfield Asset Management Inc. has named former Bank of Canada and Bank of England governor Mark Carney as its head of transition investing toward a postcarbon world.

“Climate change is an existential threat,” Mr. Carney said, in a 2019 interview conducted by the United Nations under his other role as the UN’s Special Envoy on Climate Action and Finance. Companies that invest in solutions “will be rewarded,” he said.

“Those who are lagging behind and are still part of the problem will be punished.”

It’s a message that smaller companies across Canada are taking to heart as well.

“We’re a real estate company, but we’re more. Real estate is a tool we use to create better neighbourhoods and to create a better planet,” says Leslie Najgebauer, vice-president of impact and engagement for Tas, a developer with projects in the GTA.

“We’ve developed an ‘impact framework’ to incorporate environmental, social and governance [ESG] factors across our business,” she says.

The company’s commitments include becoming carbon-neutral by 2045 and adopting benchmarks for operations that mesh with the UN Sustainable Development Goals, agreed on by the world body as the measures needed to secure a better future even sooner, by 2030.

In Western Canada, developers such as Cape Group say they are training their site staff in Passive House – a voluntary standard developed in Europe to reduce a building’s energy footprint.

“We’re also using cross laminated timber [instead of steel girders],” says company president Reisa Schwartzman. “We have several buildings on the go and we’re working toward being a leader in this method of construction, which cuts carbon footprints substantially,” she says.

Developers need to take a holistic approach to building and managing properties, says Zeina Elali, associate and senior sustainability adviser at the Toronto office of Perkins & Will, a global design studio.

“We look at a building as a living design,” she says. “We look at its sustainability – its impact – and then its resilience, how to adapt and forecast changes in climate and build this into the design.

“We also look at what the building will be like for the people inside, and we look at regeneration – using renewable resources, whether it’s the sun’s heat or reusing storm water. We look too at a building’s embodied carbon – how much carbon is coming out of our design, what materials we can reuse and which materials are produced with less carbon,” Ms. Elali adds.

“The development industry is trying not just to keep up with sustainability, but to raise the bar,” says Jonathan Westeinde, chief executive officer of Windmill Developments, which has sustainability-focused projects in Toronto, Guelph, Ont., and Ottawa. He says he has been watching politicians dither about climate change for years – he started the company in 2003 – but he’s optimistic that even if politicians waver, companies will get it together.

“What’s driving sustainability now is capital markets,” Mr. Westeinde says. “They’re afraid about the risk profile of developments susceptible to climate and that’s changing the types of investments they’re willing to make.”

“That’s what will make a difference,” he adds. As planet Earth continues its precarious journey toward sustainability, “will we do enough to steer the boat?”

Source The Globe And Mail. Click here to read a full story

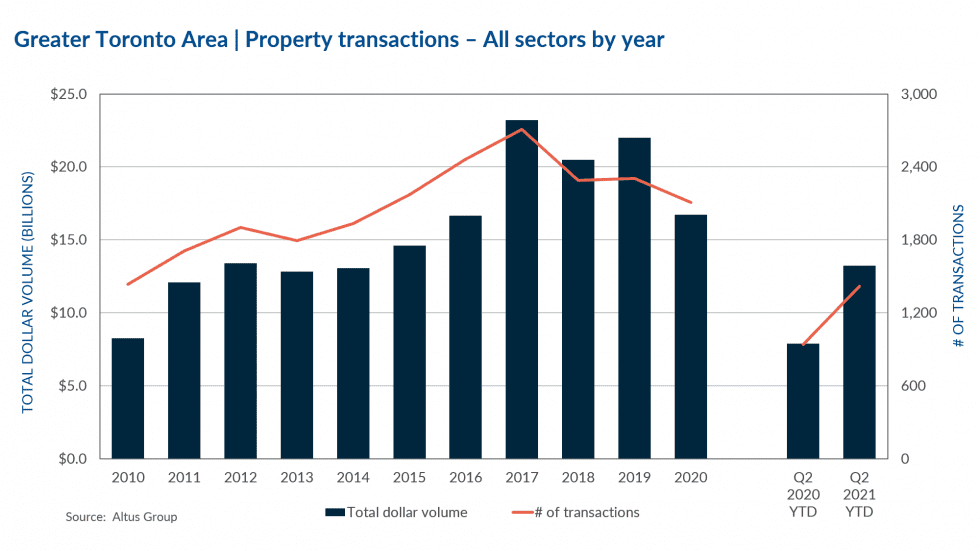

GTA commercial real estate market registers a record-setting first half

The Greater Toronto Area continues to remain strong and resilient as it registers record-breaking volumes in the first half of 2021 despite enduring a third wave of COVID-19 and continued restrictions. With mass vaccinations taking place and a return to normalcy on the horizon, the conclusion of the first half of 2021 saw an astounding investment total of $13.2 billion, which represents the largest first half recorded in the GTA market on record. Compared to the first half of 2020, this represents an increase of 68%.

The first half not only saw a significant increase in activity, with a total of 1,417 transactions, it also witnessed the return of significant transactions – registering 13 deals coming in at over $100 million. The combination of low interest rates and high demand prompted investors to prioritize the GTA market, creating a buying frenzy that translated into growing transaction volume across all asset types compared to the same period last year.

With the continued demand for both residential units and industrial space, it was no surprise that the industrial and land sectors (residential land, ICI land and residential lots) were the most desired assets once again. Land sector investment volume topped $6.7 billion in Q1 and Q2 2021, which represents 51% of total investments seen in the first half of the year. With disruptions and uncertainty brought on by the global pandemic in 2020, the development industry has once again resumed at a blistering pace in the GTA, especially in the City of Toronto, where a total of 138 development applications were submitted in the first half of 2021, an 18% increase compared to the 117 submissions seen in the same period last year. Of the 138 development applications, 66% of the applications were for apartment condominium or purpose-built rental developments.

As industrial availability remains tight in the current market conditions, industrial assets continue to be highly sought after by investors, as evident by the $2.9 billion invested in this asset class in the first half of 2021. According to Altus Group’s Investment Trends Survey results for Q2 2021, all three industrial assets (Single-Tenant, Multi-Tenant and Industrial Land) remain as the top preferred asset classes by investors. Survey results also see the GTA market re-gaining its spot as the most preferred Canadian market amongst investors. Overall, after steady growth in the GTA across asset classes in the first two quarters, momentum is likely to last as investors continue to take advantage of current market conditions and lifted restrictions throughout the back half of the year.

Notable Q2 transactions:

501 Consumers Road, North York – Industrial

With a building size of 417,000 square feet, this multi-tenant industrial building was acquired by Amazon for $56 million. The property sits on 10.4 acres of land and is ideally situated within close proximity to Highway 401 and Highway 404. The property was originally acquired by the vendor in April 2015 for $20.5 million and will likely be re-developed by Amazon for a future fulfillment centre. This acquisition by Amazon was one of three GTA properties they acquired in the first half of 2021. Other locations of their acquisitions included Pickering and Etobicoke. In all, the three properties were acquired for a total consideration of $161 million.

8000 Dixie Road, Brampton – ICI Land

This 980,000 square-foot industrial building located in south Brampton sits on approximately 58.8 acres of land. Sold by the current tenant Ford Motor Company of Canada who utilized the site as a distribution centre, the property was acquired for $195 million by Panattoni Development Company Canada who will look to re-develop this sizeable site for future industrial uses.

Toronto Buttonville Municipal Airport, Markham – ICI Land

With a sale price of $193 million, the 50% interest sale of the 169-acre Buttonville Municipal Airport to Cadillac Fairview Corporation was one of the largest deals seen in the second quarter in the GTA. Originally a joint venture development by the vendor Armadale Properties and Cadillac Fairview, this transaction saw Armadale divest their interest in the development site to Cadillac Fairview, now the sole owner of the property. Development applications for this site were originally submitted in 2011 which proposed a Master Planned phased development which would add approximately 10 million square feet of mixed-use space to the site. The applications were appealed to the Ontario Municipal Board and were subsequently withdrawn. At the time of sale, no new applications had been submitted to the City of Markham regarding re-development of the property.

261-283 Queen Street East, 360 & 410 Richmond Street East, Old Toronto – Residential Land

This 2.1-acre site located in the east end of downtown Toronto was acquired by Tricon Residential for $129 million. Current development applications submitted to the City of Toronto proposes the development of two purpose-built rental apartment buildings containing a total of 824 residential units with building heights of 33 and 24-storeys.

8350 Lawson Road, Milton – Industrial

Sold by Oxford Properties Group and acquired by GWL Realty Advisors, this $90.6 million sale represents the largest industrial transaction seen in the second quarter in the GTA. At the time of sale, the 321,000 square-foot property was fully occupied with a WALT under 3 years. The property was originally acquired by Oxford Properties in September 2008 for a total consideration of $27.6 million.

At the midway mark of 2021, the lone major asset class yet to crack the billion-dollar mark in total investments is the office sector, which is understandable given the uncertainty and struggles driven by the pandemic. As seen in previous quarters, investors in the GTA market continue to seek out multi-residential, industrial and land assets. As confidence in the GTA market grows, the second half of 2021 looks to continue its rebound from the slump seen in 2020. Pent-up demand from investors combined with current low borrowing costs and the lack of inventory will continue to drive the red-hot GTA commercial real estate market.

Source AltusGroup. Click here to read a full story