Author The Lilly Commercial Team

Artis Real Estate Investment Trust Releases Third Quarter Results

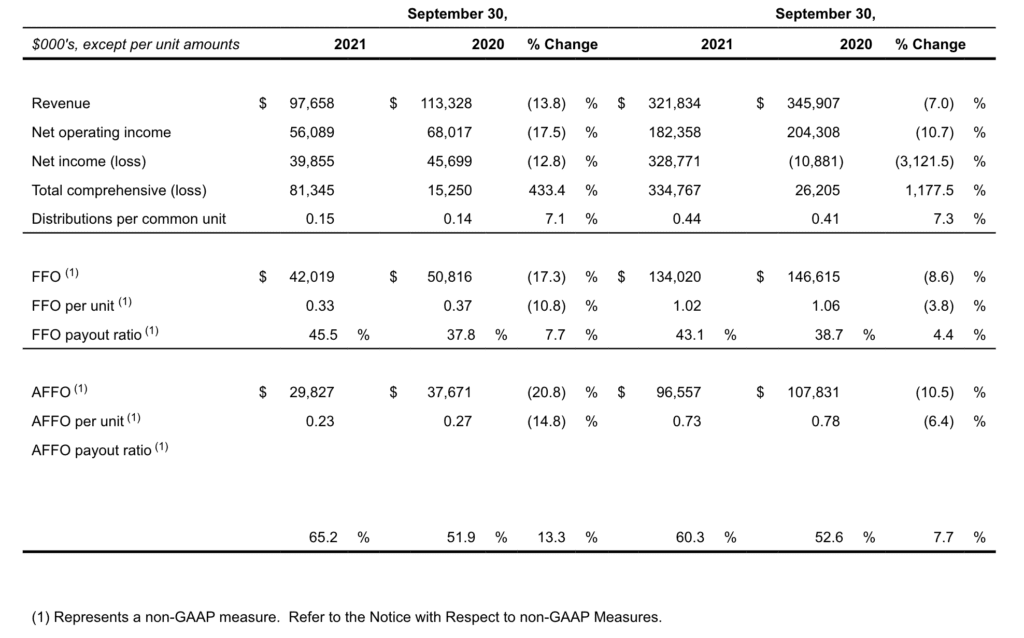

Artis Real Estate Investment Trust announced today its financial results for the three and nine months ended September 30, 2021. The third quarter press release should be read in conjunction with the REIT’s consolidated financial statements and Management’s Discussion and Analysis (“MD&A”) for the period ended September 30, 2021. All amounts are in thousands of Canadian dollars, unless otherwise noted.

“We are pleased with the progress we’ve made to date in the execution of our new vision and strategy for Artis,” said Samir Manji, President and Chief Executive Officer of Artis. “During the third quarter, we closed the sale of 32 properties for an aggregate sale price of $761.3 million, including the sale of the GTA industrial portfolio which represented a significant milestone in the implementation of our Business Transformation Plan. These dispositions were key to providing the REIT with the financial flexibility we now have to execute on our return of capital and value investing strategies, while allowing us to meaningfully reduce our debt to gross book value to 44.0% and to achieve an increase in NAV per unit to $17.45 at September 30, 2021. During the quarter, we acquired a parcel of industrial development land in the Twin Cities Area where we’ve identified an attractive opportunity to develop modern, high-demand industrial real estate that aligns with our value creation plan. We are confident in our strategy, and look forward to continuing to demonstrate our ability to unlock and create value for our owners in the quarters ahead.”

THIRD QUARTER HIGHLIGHTS

Business Strategy Update

- Subsequent to the end of the quarter, announced that a consortium led by Canderel Real Estate Property Inc., had, through a newly-formed entity, entered into an arrangement to acquire Cominar Real Estate Investment Trust (“Cominar”) for consideration of $11.75 in cash per unit (the “Cominar Transaction”). Artis has committed up to a total of $214.1 million to the Cominar Transaction’s capital structure, including $100.0 million of junior preferred units and $114.1 million in common equity units. The Cominar Transaction is expected to close in the first quarter of 2022, subject to the approval of Cominar unitholders, court and required regulatory approvals and customary closing conditions.

Portfolio Activity

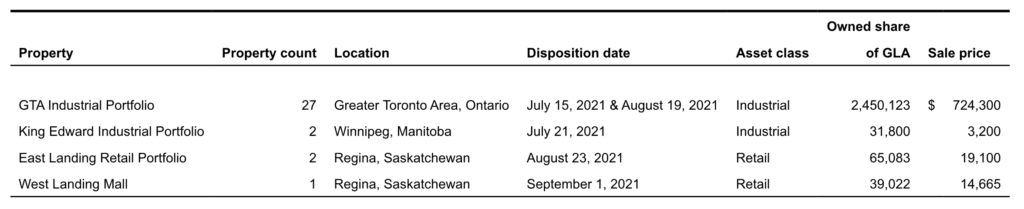

- Disposed of 27 industrial properties in the Greater Toronto Area, Ontario, two industrial properties in Winnipeg, Manitoba, and three retail properties in Regina, Saskatchewan, for an aggregate sale price of $761.3 million.

- Acquired a parcel of industrial development land in the Twin Cities Area, Minnesota, for a purchase price of US$2.2 million.

Balance Sheet and Liquidity

- Increased NAV per unit to $17.45 at September 30, 2021, compared to $15.03 at December 31, 2020.

- Improved secured mortgages and loans to GBV to 25.8% at September 30, 2021, compared to 27.7% at December 31, 2020.

- Improved total long-term debt and credit facilities to GBV to 44.0% at September 30, 2021, compared to 50.2% at December 31, 2020.

- Improved total long-term debt and credit facilities to Adjusted EBITDA to 8.3 at September 30, 2021, compared to 9.4 at December 31, 2020.

- Improved Adjusted EBITDA interest coverage ratio to 3.71 for the third quarter of 2021, compared to 3.66 for the third quarter of 2020.

- Utilized the normal course issuer bid (“NCIB”) to purchase 4,929,552 common units at a weighted-average price of $11.64 and 37,748 preferred units at a weighted-average price of $24.03.

- Invested in equity securities for an aggregate cost of $44.5 million.

Financial and Operational

- Reported a conservative AFFO payout ratio of 65.2% for the third quarter of 2021, compared to 51.9% for the third quarter of 2020.

- Reported FFO per unit of $0.33 for the third quarter of 2021, compared to $0.37 for the third quarter of 2020.

- Reported AFFO per unit of $0.23 for the third quarter of 2021, compared to $0.27 for the third quarter of 2020.

- Same Property NOI in Canadian dollars for the third quarter of 2021 decreased 4.7% compared to the third quarter of 2020.

- Same Property NOI in functional currency for the third quarter of 2021 decreased 1.4% compared to the third quarter of 2020.

- Reported portfolio occupancy of 88.8% (90.8% including commitments) at September 30, 2021, compared to 90.3% (91.8% including commitments) at June 30, 2021.

- Renewals totalling 332,619 square feet and new leases totalling 113,564 square feet commenced during the third quarter of 2021.

- Weighted-average rental rate on renewals that commenced during the third quarter of 2021 increased 1.7%.

BALANCE SHEET AND LIQUIDITY

The REIT’s balance sheet highlights and metrics, on a Proportionate Share basis, are as follows:

At September 30, 2021, NAV per unit was $17.45, compared to $15.03 at December 31, 2020.

At September 30, 2021, Artis had $280.3 million of cash on hand and $591.7 million available on its revolving term credit facilities. Under the terms of the revolving credit facilities, the REIT must maintain certain financial covenants which limit the total borrowing capacity of the revolving credit facilities to $638.2 million.

Liquidity and capital resources may be impacted by financing activities, portfolio acquisition, disposition and development activities, debt repayments, or other activities in accordance with the Business Transformation Plan occurring subsequent to September 30, 2021.

FINANCIAL AND OPERATIONAL RESULTS

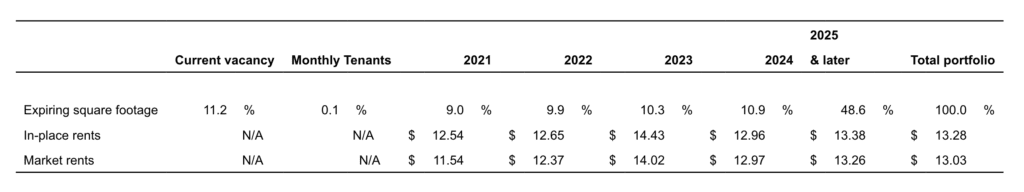

Artis reported portfolio occupancy of 88.8% (90.8% including commitments) at September 30, 2021, compared to 90.3% (91.8% including commitments) at June 30, 2021. Weighted-average rental rate on renewals that commenced during the third quarter of 2021 increased 1.7%.

Artis’ portfolio has a stable lease expiry profile with 48.6% of gross leasable area expiring in 2025 or later. Weighted-average in-place rents for the total portfolio are $13.28 per square foot and are estimated to be 1.9% above market rents. Information about Artis’ lease expiry profile is as follows:

PORTFOLIO ACTIVITY

Acquisition

On September 24, 2021, the REIT acquired a parcel of industrial development land in the Twin Cities Area, Minnesota, for a purchase price of US$2.2 million.

Dispositions

During Q3-21, Artis disposed of the following properties:

New Developments

At September 30, 2021, the REIT had four ongoing development projects: 300 Main, Park 8Ninety V, Park Lucero East and Blaine 35.

300 Main is a mixed-used commercial and residential/multi-family property located in Winnipeg, Manitoba. Park 8Ninety V is the final phase of an industrial development project in the Greater Houston Area, Texas, and is expected to comprise three buildings totalling 677,000 square feet once complete. Artis has a 95% interest in Park 8Ninety V in the form of a joint venture arrangement. Park Lucero East is a state-of-the-art industrial development project located in the Greater Phoenix Area, Arizona, which is expected to comprise three Class A industrial buildings totalling approximately 561,000 square feet upon completion. Artis has a 10% interest in Park Lucero East in the form of an investment in an associate. Blaine 35 is a two-phase industrial development project located in the Twin Cities Area, Minnesota, with prominent interstate frontage at the intersection of I-35W and 85th Ave N. The first phase of the project, Blaine 35 I, consists of one building anticipated to total approximately 118,500 square feet of leasable area. The second phase, Blaine 35 II, will comprise two buildings expected to total approximately 198,900 square feet of leasable area.

IMPACT OF COVID-19

As a diversified REIT, Artis’ portfolio comprises industrial, office and retail properties which, at September 30, 2021, were 88.8% leased (90.8% including commitments on vacant space) to high-quality tenants across Canada and the U.S. with a weighted-average remaining lease term of 5.3 years.

Rent collection has been a key focus during this time. As at September 30, 2021, 98.9% of rent charges (both excluding and including deferred rent charges) have been collected for the three months ended September 30, 2021.

Due to government-mandated capacity restrictions and temporary closures of certain non-essential businesses throughout the course of the COVID-19 pandemic, a number of tenants had to limit operations. To support tenants through this difficult time, qualifying tenants who were in need of assistance were given the option to defer a portion of their rent, with an agreement to repay the amount at a specified later date. As at September 30, 2021, the outstanding balance of rent deferrals granted to tenants was $1.3 million ($1.3 million on a Proportionate Share basis).

The REIT anticipates that the majority of rent deferrals and rents receivable will be collected, however, there are certain tenants that may not be able to pay their outstanding rent. As at September 30, 2021, an allowance for doubtful accounts in the amount of $1.8 million ($1.8 million on a Proportionate Share basis) has been recorded, compared to $2.0 million ($2.0 million on a Proportionate Share basis) at December 31, 2020.

Overall, Artis’ first priority is to maintain a safe environment for its tenants, employees and the community. During this unprecedented and uncertain time, Artis is committed to minimizing the impact on its business, and as a diversified REIT, Artis is confident that it is well-positioned to handle the economic challenges that may lie ahead.

NOTICE WITH RESPECT TO NON-GAAP MEASURES

In addition to reported IFRS measures, the following non-GAAP measures are commonly used by Canadian real estate investment trusts as an indicator of financial performance: Proportionate Share, Property NOI, Same Property NOI, FFO, AFFO, FFO and AFFO Payout Ratios, NAV per Unit, Debt to GBV, Adjusted EBITDA Interest Coverage Ratio and Debt to Adjusted EBITDA. “GAAP” means the generally accepted accounting principles described by the CPA Canada Handbook – Accounting, which are applicable as at the date on which any calculation using GAAP is to be made. Artis applies IFRS, which is the section of GAAP applicable to publicly accountable enterprises. These non-GAAP measures are not defined under IFRS and are not intended to represent operating profits for the period, or from a property, nor should any of these measures be viewed as an alternative to net income, cash flow from operations or other measures of financial performance calculated in accordance with IFRS.

Readers should be further cautioned that these non-GAAP measures as calculated by Artis may not be comparable to similar measures presented by other issuers. These non-GAAP measures are defined in the REIT’s Q3-21 MD&A.

CAUTIONARY STATEMENTS

This press release contains forward-looking statements. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “expects”, “anticipates”, “intends”, “estimates”, “projects”, “seeks”, and similar expressions or variations of such words and phrases or state that certain actions, events or results ”may”, ”would” or ”will” occur or be achieved are intended to identify forward-looking statements.

Particularly, statements regarding the Business Transformation Plan, the steps required to implement the Business Transformation Plan, the terms and conditions of the Cominar Transaction and Artis’ participation therein, the timing of the Cominar Transaction, Artis’ return of capital and value investing strategies, building Artis into a best-in-class asset management and investment platform focused on value investing in real estate, the REIT’s ability to execute its strategy, the REIT’s ability to maximize long-term value and anticipated returns, expected distributions by the REIT, planned divestitures, the use of proceeds from divestitures, prospective investments and investment strategy, Artis’ plans to optimize the value and performance of its assets, Artis’ goals to grow net asset value (“NAV”) per unit and distributions, efficiencies and cost savings, the tax treatment of Artis, Artis’ status(es) under the Tax Act, the tax treatment of divestitures, are forward looking statements.

Forward-looking statements are based on a number of factors and assumptions which have been used to develop such statements, but which may prove to be incorrect. Although Artis believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance or achievement since such expectations are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Assumptions have been made regarding, among other things: the general stability of the economic and political environment in which Artis operates, treatment under governmental regulatory regimes, securities laws and tax laws, the ability of Artis and its service providers to obtain and retain qualified staff, equipment and services in a timely and cost efficient manner, currency, exchange and interest rates, global economic, financial markets and economic conditions in Canada and the United States will not, in the long term, be adversely impacted by the COVID-19 pandemic, disruptions resulting from the temporary restrictions that governments imposed on businesses to address the COVID-19 pandemic will not be long term.

Artis is subject to significant risks and uncertainties which may cause the actual results, performance or achievements of the REIT to be materially different from any future results, performance or achievements expressed or implied in these forward-looking statements. Such risk factors include, but are not limited to, risks associated with the possibility that the proposed Cominar Transaction will not be completed on the terms and conditions, or on the timing, currently contemplated, and that it may not be completed at all, due to a failure to obtain or satisfy, in a timely manner or otherwise, required unitholder, court and regulatory approvals and other conditions of closing necessary to complete the Cominar Transaction or for other reasons; risk related to tax matters; and, credit, market, currency, operational, liquidity and funding risks generally and relating specifically to the Cominar Transaction; the COVID-19 pandemic, real property ownership, geographic concentration, current economic conditions, strategic initiatives, debt financing, interest rate fluctuations, foreign currency, tenants, SIFT rules, other tax-related factors, illiquidity, competition, reliance on key personnel, future property transactions, general uninsured losses, dependence on information technology, cyber security, environmental matters and climate change, land and air rights leases, public markets, market price of common units, changes in legislation and investment eligibility, availability of cash flow, fluctuations in cash distributions, nature of units, legal rights attaching to units, preferred units, debentures, dilution, unitholder liability, failure to obtain additional financing, potential conflicts of interest, developments and trustees. Further, the Business Transformation Plan has additional risk factors including, but not limited to: failure to execute the Business Transformation Plan in part or at all, the ability to achieve certain efficiencies to generate savings in general and administrative expenses, pace of completing investments and divestitures, the ability of Sandpiper Asset Management Inc. (“Sandpiper”) to provide services to Artis, risk of not obtaining control or significant influence in portfolio companies, risks associated with minority investments, reliance on the performance of underlying assets, operating and financial risks of investments, ranking of Artis’ investments and structural subordination, follow-on investments, investments in private issuers, valuation methodologies involve subjective judgments, risks associated with owning illiquid assets, competitive market for investment opportunities, risks upon disposition of investments, reputation of Artis and Sandpiper, unknown merits and risks of future investments, resources could be wasted in researching investment opportunities that are not ultimately completed, credit risk, tax risk, regulatory changes, foreign security risk, foreign exchange risk, potential conflicts of interest with Sandpiper and market discount.

For more information on the risks, uncertainties and assumptions that could cause the Artis’ actual results to differ from current expectations, refer to the section entitled “Risk Factors” of Artis’ Annual Information Form for the year ended December 31, 2020, the section entitled “Risk and Uncertainties” of Artis’ MD&A for the interim period ended September 30, 2021, as well as Artis’ other public filings, available at www.sedar.com.

Artis cannot assure investors that actual results will be consistent with any forward-looking statements and Artis assumes no obligation to update or revise such forward-looking statements to reflect actual events or new circumstances other than as required by applicable securities laws. All forward-looking statements contained in this press release are qualified by this cautionary statement.

ABOUT ARTIS REAL ESTATE INVESTMENT TRUST

Artis is a diversified Canadian real estate investment trust with a portfolio of industrial, office and retail properties in Canada and the United States. Artis’ vision is to build a best-in-class asset management and investment platform focused on growing net asset value per unit and distributions for investors through value investing in real estate.

Source Artis Real Estate Investment Trust & Newswire. Click here to read a full story

Marlin Spring buys Toronto property with new Development Fund

Marlin Spring has announced more than $115 million in commitments to its new Development Fund, made two Toronto acquisitions over the past two months, and has an additional fund closing at the end of this month.

The Toronto-based real estate investment and development firm set out to raise funds in December 2020 but didn’t know how well it would go in the midst of a pandemic. Undeterred, it set a goal of $100 million and approached investors who share its optimistic vision for growth and development in the Greater Toronto Area (GTA).

“What absolutely helped us launch the fund was a cornerstone investor, Osmington,” Marlin Spring president Ashi Mathur told RENX. “With their support and, notwithstanding the challenges of the pandemic, we felt there was a good opportunity to launch and see what kind of traction we could get.”

Osmington Inc. is a privately owned commercial real estate and investment company controlled by David Thomson, the chairman of Thomson Reuters and Canada’s wealthiest person.

Marlin Spring found favour from both longtime and new investors — including institutions, high-net-worth individuals and family offices — and ended up raising more than $115 million by April. Manulife Investment Management is also a major investor in the fund.

While it hasn’t set a goal, Marlin Spring is targeting another closing at the end of this month for the Development Fund.

“We see an opportunity for the existing investors to increase their allocations to the fund and we’re always open to bringing in new investors as well,” said Mathur.

Goals of the Development Fund

“The strategy of the fund is to build great communities with great access to transit and amenities in a growing market. We think this provides a strong value proposition for our investors, but also for our homeowners.

“That’s core to how we look at all of our potential acquisition opportunities.”

Marlin Spring is looking to build a diversified portfolio of GTA residential properties with the Development Fund. It’s interested in mid-rise and high-rise projects in the downtown core, or within 15 minutes of the core, which offer great public transit accessibility.

It’s also looking at using the fund for low-rise development and townhomes in Vaughan, Richmond Hill, Oshawa and other suburban markets within an hour of the core.

“We’re constantly looking at new acquisitions that meet that criteria and we remain open to new opportunities because we have a nice war chest of capital,” said Mathur.

“We also have the flexibility to do partnerships. The fund can partner with other organizations and support them with their development projects.”

Marlin Spring has acquired more than 40 projects consisting of 12,000 units in various stages of development, construction, repositioning and completion across Canada and the U.S.

Its projects represent more than 11 million square feet of gross floor area and a value of more than $5.7 billion upon completion.

Partnerships have always been important to Marlin Spring.

“We’d like to think of ourselves as very much a nimble and entrepreneurial organization and a great partner that continues to be well-capitalized and flexible in coming up with creative ways to structure transactions and do deals,” said Mathur.

First property acquired with Development Fund

The first property acquired with the Development Fund was purchased for an undisclosed price from Alimentation Couche-Tard-owned Circle K, which operates a convenience store and gas station on the site at 2189 Lake Shore Blvd. W. in the Humber Bay Shores neighbourhood.

The retail operations will remain until redevelopment moves forward.

The acquisition was originally structured with Osmington and some of its partners having smaller stakes before the Development Fund’s first closing. The partners are still involved, but the fund now owns a majority stake in the site and Marlin Spring will be responsible for development and construction.

Marlin Spring is finalizing its plans and development applications, which should be submitted shortly.

“It’s a great site that will be in high demand for folks who are looking for city dwelling,” said Mathur. “It will be very much in keeping with the surrounding buildings that we have.”

Marlin Spring has other nearby projects at various stages on Lake Shore and The Queensway and plans to take advantage of synergies from those with this latest acquisition.

St. Clair West acquisition and activity

Marlin Spring and Greybrook Realty Partners acquired 2255-2283 St. Clair Ave. W., in August for an undisclosed price. The 1.9-acre property is occupied by a meat packing and retail operation owned by Corsetti Meat Packers Ltd. in the Upper Junction neighbourhood of Toronto’s Stockyards District.

Greybrook is a long-standing partner that’s also involved in other Marlin Spring projects in the same area. They’re finalizing development plans to submit to the City of Toronto to build a condo with more than 500 units.

“It’s an area that we know and it’s going to be very much in keeping with the area and the demand that exists for that area for housing,” said Mathur.

The site is close to public transit, RioCan REIT’s Stock Yards Village shopping centre, restaurants, parks, community centres and craft breweries.

“It’s very consistent with Marlin Spring’s approach to investing in growing communities,” said Mathur. “For us, it’s never about doing just one deal in an opportunistic way.

“It’s a strategy of finding locations and building communities. This site adds to what we already have in the area. We’re in the final stages of the construction of our Stockyards project, where we’re targeting occupancy in the first quarter of 2022. We also have another development at 2231 St. Clair.”

Stockyards District Residences is a 202,000-square-foot, 242-unit condo at 2306 St. Clair Ave. W. that’s a partnership with Greybrook.

The other project Mathur referred to is also in partnership with Greybrook. It’s in the planning and approvals stage for a proposed 235,000-square-foot, 276-unit condo.

Source Real Estate News Exchange. Click here to read a full story

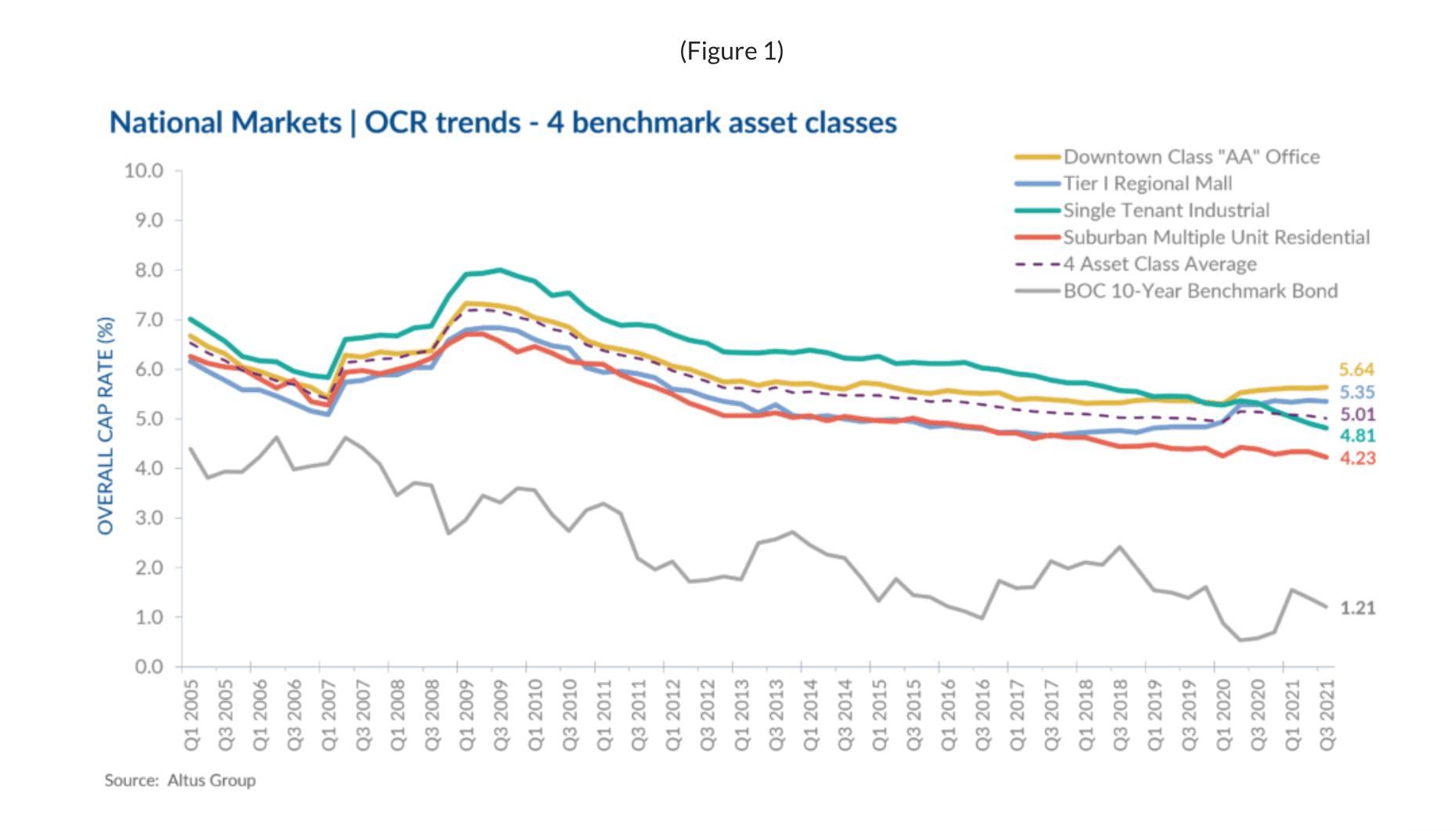

Economic recovery and market uncertainty remains due to pandemic and disruptions

The latest results from Altus Group’s Investment Trends Survey (ITS) for the four benchmark asset classes show that the Overall Capitalization Rates (OCR) dropped slightly to 5.01% in Q3 2021 compared to the previous quarter which was at 5.06%, and from 5.14% in Q3 2020 (Figure 1).

Although vaccination efforts are helping to temper a fourth wave and the spread of the contagious delta variant, some markets are still vulnerable to imbalances and atypical drivers. In August, inflation levels peaked at a nearly 20-year high of 4.1% due to the effects of the pandemic and economic disruptions, which the Bank of Canada sees as temporary.

Amid labour shortages, the Canadian economy added another 157,000 jobs to the economy in September, finally recovering the jobs lost during the pandemic. The unemployment rate also dropped to 6.9% compared to 7.1% in August, the lowest rate since the start of the pandemic.

Although labour market conditions appear to be shifting, employment vacancies continued to peak to new highs in the second quarter of 2021 representing about 26% more vacancies compared to the same quarter two years ago. Job vacancies were up across all provinces predominantly in Quebec, Ontario, and BC, largely attributed to increases in the health care and social assistance sector. Vacancies in the construction and manufacturing industries also increased to its highest level since 2015. However, total investment in building construction increased by 7.3% in the second quarter, a fourth consecutive quarterly increase indicating signs of renewed activity and worker confidence.

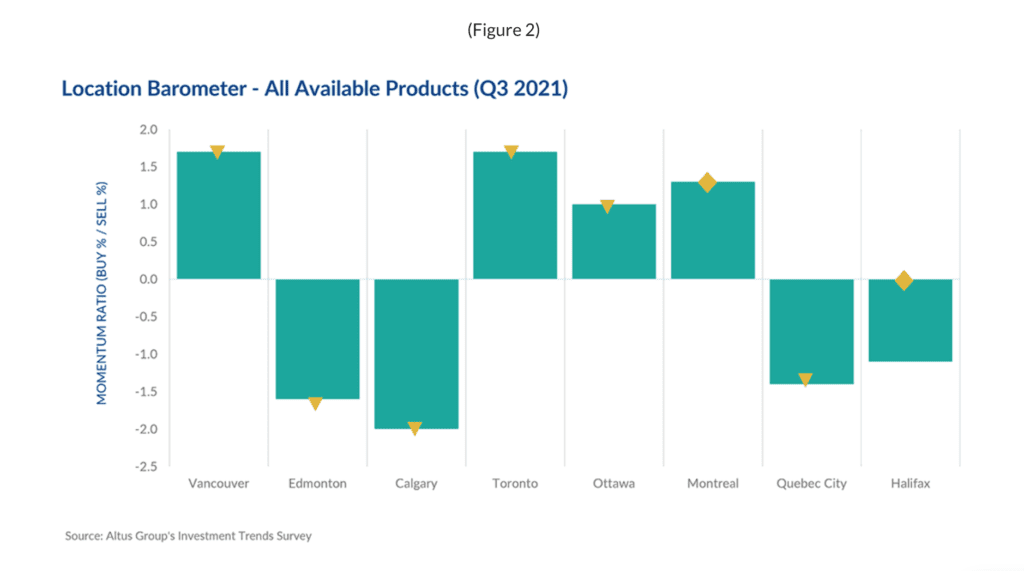

Real estate markets across Canada have had to face ongoing challenges as the pandemic drags on highlighting market vulnerabilities and shifts in demand for high yielding investments, especially office and retail. Compared to the previous two quarters, the location barometer for available products in the third quarter showed a decrease in all markets except for Montreal and Halifax, which remained unchanged. In Altus Group’s Investment Trends Survey for Q3 2021, the top 3 markets preferred by investors, Toronto, Vancouver, and Montreal, respectively (Figure 2), were also the most active in investment volume representing a combined 74% of the total market share for the first half of 2021. Still, many other regions have remained resilient and managed to push ahead in the first half of 2021, primarily due to low interest rates, pent up demand and lack of inventory.

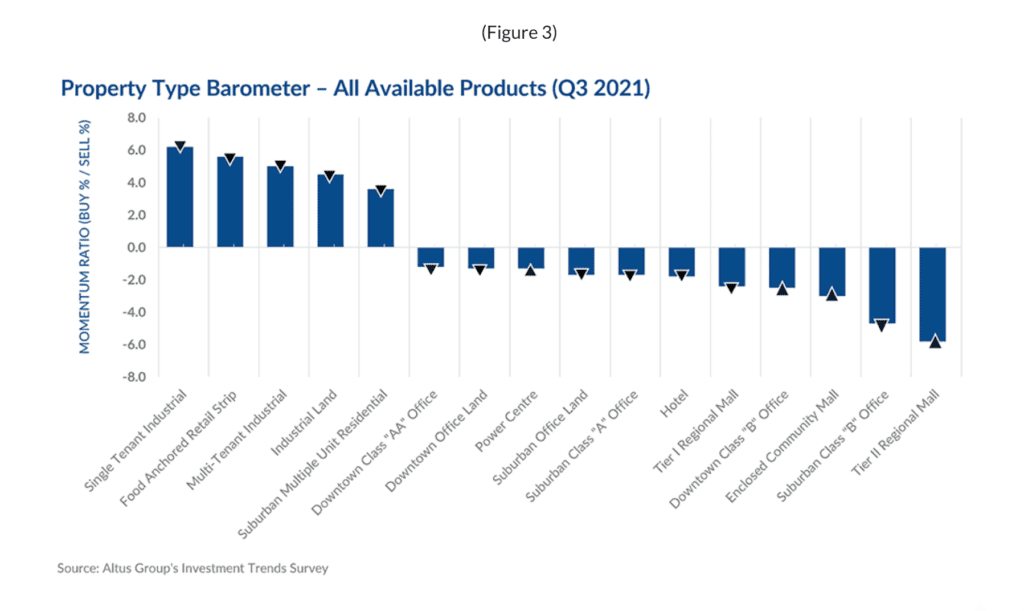

The top assets preferred by investors was unchanged from the previous quarter which were Single Tenant Industrial, Food Anchored Retail Strip, Multi-Tenant Industrial and Industrial Land, respectively (Figure 3). These products have continued to generate investor interest throughout the pandemic and can only be seen as primed for further growth as they adapt to new trends and post-lockdown expectations.

However, investor and market sentiment cooled across most assets with the third quarter showing signs of a general decrease compared to the first two quarters of 2021. Concerns over the delta variant, infection and vaccination rates, inflation spikes and monetary policy interrupting economic recovery have led investors to take some pause in their decision making.

Yet, with M&A activity increasing, there is still plenty of available capital out there waiting to be spent on the right assets as economic activity normalizes. The assets with an increase in investor momentum were also some of the less preferred products which were Power Centres, Downtown Class B Office and Enclosed Community Malls. The office and retail sectors had some of the most challenges although investors have taken a medium to long term view when scoping out product.

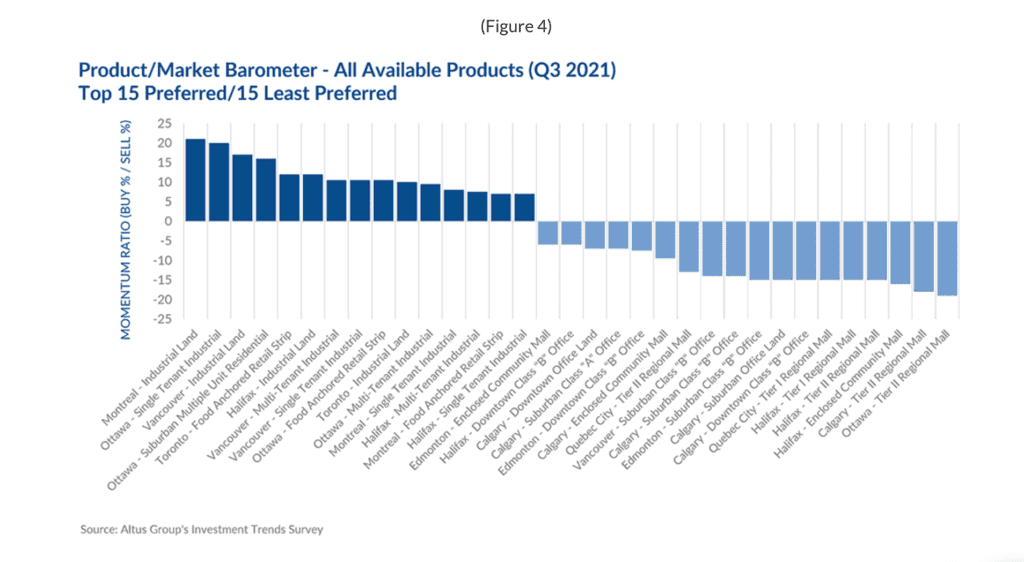

Retail, as one of the more struggling assets, posted as some of the least preferred products, specifically for Montreal’s Tier II Regional Mall, Quebec City’s Enclosed Community Mall and Tier I and Tier II Regional Mall, and Ottawa’s Enclosed Community Mall and Tier II Regional Mall (Figure 4). With investors still looking for high yielding product, struggling assets in secondary markets are likely to be those positioned for potential redevelopment given some of their prime locations.

Market highlights for the quarter include:

- Since the onset of the pandemic, overall cap rates have been decreasing and continued to decrease in the third quarter of 2021. Investment momentum has been steady and Canadian CRE is showing signs of recovery with national investment volume clocking in at $33B, a 57% increase in the first half of the year compared to the same period last year. Overall cap rates compressed across most asset classes, aside from Downtown Class “AA” Office which pushed up slightly from the previous quarter. Halifax and Calgary were the only two markets that showed a moderate increase quarter-over-quarter.

- There will be ongoing uncertainty in the office sector as employees and companies delay plans to return to the office with the onset of the delta variant and will continue to work via a hybrid workplace model. The office sector was the only asset class with a year-over-year decline in investment volume, a 32% falloff for the first half of 2021. Downtown Class “AA” Office cap rates moved up to 5.64% this quarter from 5.61% in Q2. Quarter-over-quarter, Vancouver and Quebec City were the only two markets to record decreasing cap rates, while Toronto, Ottawa and Montreal remained stable, and Edmonton, Calgary and Halifax increased.

- Demand for industrial product continues to soar as online shopping surges and distribution and logistics networks expand with single-tenant industrial product cap rates compressing and prices rising. Cap rates for Single-Tenant Industrial assets dipped this quarter across most markets from 4.91% in Q2 to 4.81% in Q3, aside from Montreal and Halifax which remained unchanged from the previous quarter.

- Although the retail sector has seen some signs of improvement as lockdown measures loosen, the sector still has a ways to get to pre-pandemic levels until in-person shopping behaviour and travel and tourism returns to somewhat normal. Food-anchored retail product continued to be an attractive product among investors due to its essential nature during the pandemic and potential for expansion. Tier I Regional Mall cap rates compressed slightly from the previous quarter from 5.38% to 5.35% in Q3. Calgary and Halifax saw an increase in rates, while Edmonton, Toronto, Montreal, and Quebec City saw a decline, while Vancouver remained stable.

- With exuberant housing prices, lower levels of rent defaults due to government support programs, and the prospect of increased immigration in the near future, rental housing will continue to be in high demand and attract a significant amount of capital. This quarter, Suburban Multi-Unit Residential cap rates compressed from 4.34% in Q2 2021 to 4.23%. Meanwhile prices have risen, and investors show no signs of a diminishing appetite as multifamily sales increased by 72% in the first half of 2021 compared to the same period last year. For Suburban Multi-Unit Residential assets, the Ottawa market reported the highest momentum, a significant increase from the previous quarter. Vancouver was the lone market that remained steady, while all other markets shifted downwards in cap rates this quarter.

Other highlights include:

Of the 128 combinations of products and markets covered in the Investment Trends Survey:

- 55 had a “positive” momentum ratio (i.e., a higher percentage of respondents said they were more likely to be a buyer than a seller in that particular segment), an increase compared to 60 in Q2 2021; 73 had a “negative” momentum ratio, a decrease from 68 in the previous quarter; and none were neutral, the same as the previous quarter.

- The top 15 products/markets, which showed the most positive momentum were (Figure 4):

- Ottawa – Multi-Tenant Industrial, Single-Tenant Industrial, Industrial Land, Food Anchored Retail Strip, and Suburban Multi-Unit Residential

- Montreal – Single Tenant Industrial and Industrial Land

- Halifax – Multi-Tenant Industrial and Suburban Multi-Unit Residential

- Vancouver – Industrial Land, Suburban Multi-Unit Residential, Single Tenant Industrial, and Multi-Tenant Industrial

- Quebec City – Multi-Tenant Industrial

- Toronto – Industrial Land

Source Altus Group. Click here to read a full story

Low interest rates tempting for investors in commercial real estate

With superlow interest rates, prices rising constantly and a pandemic that has upended the way we work and shop, investing in commercial real estate right now can seem unusually tricky.

But it also can offer unusually good opportunities for those who navigate the low-interest environment and uncertain economy, people in the sector say.

The fundamentals remain the same in the commercial market even during these unusual times, says Jay Jiang, chief financial officer at Dream Office, a Toronto-based real estate investment trust (REIT) with holdings across Canada and in the U.S. and Europe.

“We stayed on the sidelines during the first part of the COVID pandemic. But in the low-interest environment we’ve been more active in acquisitions. We think the value of great office buildings in the best locations in the country will forever be valuable,” he says.

It’s true that work patterns are changing, with many people who have worked at home during the pandemic unsure of when or how often they will use the office. “But we think the office will remain a key part of the way companies work – a place for attracting, retaining and collaborating with employees,” Mr. Jiang says.

In its most recent statement, released on Sept. 8, the Bank of Canada said it’s keeping interest rates low and that this is not about to change soon. The bank has kept its key overnight lending rate at a bottom-scraping 0.25 per cent, concerned about a shaky economic recovery that saw Canada’s gross domestic product actually contract by about 1 per cent in the second quarter and inflation running above 3 per cent.

The bank is also continuing its quantitative easing program – increasing the money supply by about $2-billion per week.

This makes money available and cheap for commercial investors, yet on the other hand, no one is sure exactly how much and how strongly the economy will recover from the pandemic.

“It’s an interesting time because we’ve got some real investment risks in the sector because of the pandemic. At the same time, governments and the bank are trying to mitigate the risks,” says Justin Forgione, commercial broker at Rexton Commercial Realty Advisors Inc. in Toronto.

With low rates and a bank-backed pillow, it can be tempting for commercial real estate investors to go on a shopping spree, but they should still be prudent, Mr. Jiang says.

“It’s generally a good idea to buy good assets, but you need to manage your risk and not carry too much debt. Interest rates may be low now, but it’s hard to speculate on where they will go eventually. If you keep your debt low and retain a lot of liquidity, you can refinance if things change.”

How the future of commercial real estate in Canada and internationally will unfold is still open to a wide range of speculation, but there is a lot of optimism.

In late February, CBRE’s 2021 Real Estate Market Outlook forecast that “office and retail markets, which bore most of the brunt of the pandemic, will find their footing, while industrial and multifamily [residential properties such as apartment buildings] are clearly benefiting from the reallocation of capital into defensive, stable sectors.”

Investment in industrial real estate, such as factories, warehouses and logistical depots, has been especially strong and active, CBRE said.

In a statement accompanying the report’s release, CBRE chairman Paul Morassutti said that “industrial [transactions] outperformed everything in 2020,” and that CBRE expects that by the end of this year, investors will snap up or plough funds into an additional 40 million square feet of office space.

The risk to commercial real estate investors is lower in Tier 1 markets, such as the Greater Toronto Area and Vancouver, Mr. Forgione says.

“If interest rates do go up, the correction won’t be as significant in these big markets as it would be in secondary or third-level markets,” he says.

Some types of commercial assets have become more attractive than others during the pandemic, Mr. Forgione adds.

“The move to working at home and to not going shopping at malls during lockdowns has been punishing some of these assets,” he says. On the other hand, in addition to the boost in value of logistical and industrial spaces that the CBRE describes, outdoor factory outlet commercial properties are doing well, he says.

As long as rates continue to be low, investors should expect that demand for commercial real estate will be generally high, boosting prices, Mr. Forgione says. Even vacant industrial-zoned land is relatively costly now, and rising construction labour and material costs, as well as general inflation, are keeping sale values high.

Mr. Jiang agrees. “Every month it looks like there’s a high water mark for prices, and then there’s a new one. Your land and building material costs are all more expensive, too,” he says.

When interest rates eventually do go up, smaller investors might be affected more severely than larger ones, says Benjamin Shinewald, president and chief executive officer for BOMA Canada, the umbrella group for building operators and managers.

Big institutional investors are able to hedge by holding big cash reserves even as they go shopping for properties, he says.

“The good news about our industry is that it is extremely well capitalized and it takes an extremely long-term view. That’s why institutions such as insurance companies and pension funds invest in us,” Mr. Shinewald says.

Source The Globe And Mail. Click here to read a full story

Dazzling New Condo And Hotel Complex To Be Niagara Falls’ Biggest And Tallest

Known for its namesake natural wonder and kitschy tourist draws, Niagara Falls could soon be getting a shimmering new addition to its skyline, complete with a breathtaking attraction offering a new way to view the falls.

For over a decade, an approved plan to build condo and hotel towers with heights of 32, 42 storeys, and 57 storeys around the current Loretto Academy on Stanley Avenue building has idled due to an apparent lack of demand.

Niagara Falls saw a boom in hotel construction in the years before and immediately after 9/11, but aside from the Hilton Niagara Falls North tower, the city’s skyline has stagnated while Toronto’s skyline booms with new construction just 65 kilometres to the north.

Enter Three Bridges Development Corp., which purchased the 7.4-acre property on Stanley Avenue in early 2019.

The developer immediately began to forge an even more ambitious plan for the site known as The Great Falls, injecting $1 billion in investment into the hotel strip.

A design from Toronto-based Hariri Pontarini Architects was revealed in 2020, showing off a flowing, futuristic complex with luxury condo and hotel towers rising 38, 45, and 60 storeys. The plan continues to evolve with an updated application tabled this summer.

The Great Falls towers would combine for a total of 508 hotel rooms and 1,027 residential units, along with a significant infusion of retail and restaurant space within a restoration of the former Loretto Academy building and a new four-storey podium.

Among the highlights of the plan is a collection of proposed observation decks that would offer some heart-pounding views over Niagara Falls from all three towers. Plans include observation decks at heights of 17, 20, 45, and 59 levels above the falls.

And these aren’t the low-octane, enclosed observation decks of the past. Nope, these fully outdoor decks are planned to project precariously off the edges of towers.

If that wasn’t enough, at least a few of the decks appear to be planned with entirely glass floors.

At heights 220 and 183 metres, the 60 and 45-storey towers would overtake the 53-storey/177.1-metre north tower of the Hilton Niagara Falls to become the city’s tallest buildings.

The development may never achieve this title even if approved, as a 72-storey, mixed-use building has already been given the green light just a few blocks away at 6609 Stanley Avenue.

Source BlogTO. Click here to read a full story

Concord Adex Take Over a Cresford Development Site at Yonge and Gerrard

An 85-storey development on the southeast corner of Yonge and Gerrard Streets in Downtown Toronto is moving forward following a change of ownership. Originally a Cresford project, the formerly 85-storey condo previously known as Yonge Street Living (YSL) has been acquired by Concord Adex. The site of the development has been relatively quiet since Cresford ran into liquidity issues that resulted in its financial collapse in 2020, causing the construction of many of its developments to be put on hold. Since then, four of Cresford’s projects—in various stages of development—have been sold off to other developers, the most recent being YSL to Concord Adex.

The project has been renamed Concord Sky, and it will stand 299 metres high, housing a total of 1,100 units. The original YSL designs were created by New York-based Kohn Pedersen Fox Associates (KPF) working with Toronto’s architects—Alliance. Now, the Toronto-based firm will be moving forward with the project, while KPF is still involved in the design process. Upon its expected completion in 2026, it will be one of the tallest buildings in the country.

“We are working hard on all fronts to complete the building permit plans we inherited so we can begin construction as soon as possible,” Gabriel Leung, Vice President of Development at Concord Adex told UrbanToronto.

According to Concord Adex, the new version of the building continues to be a work in progress, so we do not have the architectural plans, and therefore the ability to share final details re: most exact numbers. What we do know from the rendering released by the developer, however, is that the design of the new Concord Sky differs somewhat from the previous YSL design–mainly through a more stepped profile. We can confirm that the east and north facing sides of the building do have balconies, but we cannot say the same for the south or west facing sides based on the provided rendering.

Another thing we can say for certain, is that the building will not be rising taller than its proposed 299 metres to accommodate the “addition” of 10 floors, nor will it result in shorter ceiling heights on any of the levels to cram more floors in; the purchasers of about 700 suites in the project under Cresford who have decided to maintain their contract with Concord Adex will not suffer from lower ceiling heights.

The 95 storey claim that Concord Adex is making for the building is in line with maintaining Concord’s floor numbering scheme, which removes all the levels ending in the number four, as well as the thirteenth level. As the result, a building which actually stands 84 floors tall–as is the case for Concord Sky–ends up in Concord’s terms as 95-storey building.

Even if developers wanted to, the building would not be allowed by the City to exceed its previously approved height of 299 metres, for the reason that an increase would cast a shadow over Allan Gardens park grounds, located a couple blocks east of the project site. This is also the reason for the slanted design of the top of the building; the southeast corner is lower than the southwest corner—in fact the whole of the east side begins tapering two storeys sooner than the west side—so as to hold the shadow shy of reaching the public space.

It has been confirmed that Ryerson University will still be taking office space the base of the building, as was the case in previous incarnation of YSL. “Ryerson is still part of Concord Sky’s plans,” says Leung. “Concord is also working with Ryerson to better integrate the school by opening up the development at grade. This more seamless approach will create more animation on Yonge Street, benefiting everyone involved.”

Source Urban Toronto. Click here to read a full story

H&M to join Amazon at GTA East Industrial Park in Ajax

Swedish clothing company H&M will be the sole tenant of a 716,646-square-foot industrial building being constructed at the GTA East Industrial Park in Ajax, just east of Toronto. The announcement was made during a groundbreaking ceremony for the project Thursday afternoon.

Blackwood Partners, Crestpoint Real Estate Investments Ltd. and its pension fund partner bought the GTA East Industrial Park site in an off-market transaction in May 2019 from a private family which is a large landowner in Durham Region. The land was already zoned and serviced when they purchased it.

“The intent of this facility is to service not only H&M’s existing retail outlets throughout Eastern Canada, but also to facilitate some of their online demand as well,” Blackwood development vice-president Minesh Dave told RENX in a call which also included Crestpoint director of acquisitions and asset management Lara Di Gregorio.

CBRE represented H&M in the transaction. The H&M group, which was founded in 1947 and is publicly traded on the Nasdaq Stockholm stock exchange, also oversees the COS, Monki, Weekday, & Other Stories, H&M HOME, ARKET and Afound brands.

The H&M group has 53 online markets and approximately 4,900 stores in 75 markets. It has about 153,000 employees.

Building B specifications

The second of what will be three buildings on the site at the corner of Salem Road and Kerrison Drive is dubbed Building B.

The facility offers 40-foot clear heights, 113 truck-level and four drive-in doors, high-efficiency LED lighting, early suppression, fast response (ESFR) sprinklers and parking spaces for 187 trailers and 342 vehicle parking stalls.

“The site is quite beautiful and surrounded by a ravine, so that also helps from an employee wellness perspective,” said Di Gregorio.

Durham Region Transit bus routes service the site, which is 1.7 kilometres from Highway 401, two kilometres from Highway 412, 7.3 kilometres from Highway 407 and just under 50 kilometres from Toronto’s downtown core.

H&M is expected to employ hundreds at the facility. Recruiting workers shouldn’t be an issue with 355,000 living within a 15-minute drive and 1.56 million within a 30-minute drive.

The building is scheduled for substantial completion in September 2022. The rent H&M will pay was undisclosed.

Industrial growth in Ajax

“We had a fair bit of interest from AAA covenant tenants, mostly multinationals,” said Dave. “We weren’t surprised because Durham Region is really coming alive. It has some great sites and great infrastructure and tenants are recognizing that.”

“The pace of interest in the Durham market, especially in Ajax, has increased substantially in the two-and-a-half years that we’ve been a player in the market,” said Di Gregorio. “As all of the product is being absorbed in the rest of the GTA, Durham is really rising to the top.”

Dave and Di Gregorio praised the Town of Ajax’s willingness to work with developers bringing jobs to their sites. The town’s PriorityPATH program, designed to facilitate development, has led to more than $250 million in new construction to this point.

Di Gregorio said other municipalities are looking at incorporating a similar program as a way to achieve successful development in a timely manner and bring jobs to their communities.

Blackwood and Crestpoint utilized PriorityPATH for the first building at GTA East Industrial Park, a 1.04-million-square-foot Amazon fulfillment centre which Broccolini completed construction on last month. They will also use the program for Building B.

GTA East Industrial Park’s Building C

The still-to-be-built Building C will be 189,247 square feet and offer: 40-foot clear heights; 26 truck-level doors; one drive-in door; ESFR sprinklers; parking spaces for 12 trailers; and 182 vehicle parking stalls.

“We’re ticking all of the boxes and, as a result, the leasing interest is very strong on the Building C site and we’re hoping to get that underway as soon as possible,” said Dave.

“We’ve had interest from multinational AAA covenant tenants and from smaller businesses that want a portion of the building, but not the entire building.”

Although Dave said Blackwood designs its buildings to be demisable as a way of future-proofing, he expects to lease the entire space to one tenant due to the low vacancy rates and appetite for industrial space in Ajax.

Building C is going through the site-plan approvals process and Dave said the best-case scenario would be movement starting on the project before the end of the year. Construction is expected to take eight months.

“We’re trying to leverage constructing Building B and then going straight into Building C,” said Dave.

TriAxis Construction will build both facilities.

Blackwood and Crestpoint

Blackwood is a real estate investment advisory, asset management and transaction management services firm that advises pension funds, private investors and public and private sector corporations to achieve their commercial real estate objectives.

It transacts throughout North America for both domestic and international clients.

Blackwood was recently acquired by Nicola Wealth.

Crestpoint is a commercial real estate investment manager which invests in the industrial, office, retail and multiresidential sectors and has $6.1 billion of gross assets under management.

Connor, Clark & Lunn Financial Group Ltd. — a multi-boutique asset management firm whose affiliates collectively manage more than $96 billion in assets for individuals, advisors and institutional investors — owns 50 per cent of Crestpoint.

Crestpoint’s senior management owns the other half.

Source Real Estate News Exchange. Click here to read a full story

Dream closes on Toronto acquisitions, 912 apartments

Three Dream entities have closed on the acquisitions of two Toronto apartment properties, comprising 912 units, for $378 million. The partners also have another Toronto acquisition under contract.

The acquisitions of the 912 apartments were originally announced during the summer, but at the time Dream did not provide further information about the properties. The sites are Weston Common, a two-tower mixed-use apartment complex with 841 units, and a smaller building at 262 Jarvis St.

The properties have been acquired in a joint venture between Dream Unlimited Corp., Dream Impact Trust and the Dream Impact Fund. Each of the entities holds a one-third interest in the portfolio.

“The successful acquisition of these apartments accelerates the growth of our income property portfolio and increases the proportion of our assets that generate recurring income,” Michael Cooper, chief responsible officer of Dream Unlimited and portfolio manager of Dream Impact, said in the announcement.

Dream Unlimited and the trust also have a 228-unit, multi-building portfolio of multiresidential assets in Toronto under contract. The ownership structure is expected to mirror those of Weston Common and 262 Jarvis.

Dream’s Weston Common acquisition

Weston Common is comprised of 22 John St., a 369-unit, class-A, purpose-built rental building completed in 2019, as well as a 472-unit apartment building completed in 1974, 42,000 square feet of fully leased commercial space and an 8,800-square-foot community hub occupied and programmed by Artscape, a non-profit community organization.

It includes 53 affordable housing units and 26 live/work artist studios.

Weston Common won the BILD Award for Best New Planned Community in 2017.

Dream’s intention is to increase the number of affordable units provided on-site as per CMHC’s definition of affordable rent for the area.

It has also pledged to “implement specific initiatives from each of its three impact verticals (Affordable & Attainable Housing, Environmental Sustainability & Resilience, and Inclusive Communities) at each property).”

Included among the plans are decarbonization and building modernization retrofits to reduce greenhouse gas emissions by 15 per cent within the next three years.

It also plans to implement social programming and other supports for the community and its residents. Details are to be included in the 2022 Dream Impact Report.

262 Jarvis is a six-storey, 71-unit, art deco-style apartment building located near Ryerson University.

About Dream Unlimited and Dream Impact Trust

Dream is a Toronto-based developer of office and residential assets which owns stabilized income generating assets in both Canada and the U.S., and has an asset management business.

The firm has $12 billion of assets under management across three TSX-listed trusts, its private asset management business and partnerships.

Dream also develops land and residential assets in Western Canada.

Dream Impact Trust is an open-ended trust dedicated to impact investing.

Dream Impact’s underlying portfolio is comprised of real estate assets reported under two operating segments: development and recurring income.

Source Real Estate News Exchange. Click here to read a full story

Triovest set to build 562K sq. ft. of Brampton industrial

Triovest has just started marketing a 22-acre Brampton site in the northern Greater Toronto Area where it plans to build two mid-bay industrial buildings totalling about 562,000 square feet.

The property is owned by a pension fund, but Triovest will be doing much of the legwork and heavy lifting to get the almost identically sized buildings at 20 and 30 Ironside Dr. to market.

“We’re a third-party property management, leasing and asset management group so we’re managing this on behalf of our client and our construction team will be doing the development of the property,” Triovest senior vice-president of leasing and sales representative Tracy Macdonald told RENX.

“We’ll do all of the entitlements, the demolition of the existing buildings that are there and the construction.”

What Ironside Drive development will offer

The development will offer flexible size configurations ranging from 68,926 to 282,266 square feet.

Two per cent of 20 Ironside Dr. will be office space, with the rest dedicated to warehouse space. It will include 36-foot clear ceiling heights, 40 8×10-foot truck-level doors, one 12×14-foot drive-in door and 154 parking stalls.

All of those numbers will be the same for 30 Ironside Dr., except the latter will have 218 parking stalls.

A LEED C&S certification is being targeted upon completion.

Environmental measures being taken will include light pollution reduction, six electric vehicle charging stations, water-efficient landscaping, sensored LED lighting, low-emitting finishing materials and post-consumer recycled content.

The goal is to have site-plan approvals from the City of Brampton before the end of 2021, demolition of the existing buildings beginning in March and construction starting in April or May. The buildings should be substantially ready for occupancy by June or July 2023.

Macdonald said the site is occupied by both industrial- and retail-oriented tenants who have been given notice to vacate and the new best-in-class industrial buildings will make much better use of the land.

The property is located just north of Bovaird Drive West and within 3.5 kilometres of Highway 410. Four other 400 series highways are within 30 kilometres, while the Queen Elizabeth Way is 32.4 kilometres away.

Brampton Transit Züm bus stops on two different routes are located very close to the site.

Brampton’s 611,000 people make it Canada’s ninth-largest city, and it’s also the second-fastest-growing major city in the country, so the Ironside Drive development will have access to a large workforce.

Industrial leasing plans

Macdonald said there’s been early interest from both brokers and end-users for the site. She expects companies involved with importing, exporting and distribution to be the most likely tenants, but Triovest is in no rush to sign a lease.

“You don’t want to be inking a deal today and then find out that you’re leaving two bucks on the table a year from now,” said Macdonald.

“I’m not sure we would paper anything immediately unless it was for a full user.

“We’ll probably take a little pause given what’s happening in the market with the increase in rental rates that we’re seeing quarter-over-quarter.”

Panattoni is building a 1.3-million-square-foot distribution centre for Canadian Tire and Pure Industrial is developing a 625,000-square-foot industrial facility on a 28-acre site in Brampton.

“I don’t think this is going to compete with those types of distribution centres,” said Macdonald. “This is a little bit smaller and we’ve positioned it so the size can be demised down.”

Once the building shells are constructed, it won’t be too difficult to divide them into smaller units if that’s what leasing demand dictates.

“We’ll probably bring a couple of services into each building just to have that flexibility,” said Macdonald. “There’s quite a bit of demand out there and a lack of supply.”

Source Real Estate News Exchange. Click here to read a full story

Northland acquires T.O.’s King Blue Hotel from Greenland

Northland Properties has acquired the soon-to-be-completed King Blue Hotel in Toronto from Greenland Canada, which is developing the 118-suite boutique facility as part of its twin-tower King Blue Condominiums.

Located at the corner of King St. West and Blue Jays Way in the downtown core, the King Blue development comprises 48- and 44-storey towers connected by a six-storey podium constructed from the remains of the historic Westinghouse manufacturing plant which was built in 1927.

Financial details of the transaction were not released.

“Northland’s acquisition of the King Blue Hotel is a great addition to our family-owned portfolio of hotels, restaurants, resorts and sports assets,” said Tom Gaglardi, CEO of the family-owned Northland Properties Corp., in the announcement.

“With an existing collection of 60 hotels across five countries, this impressively constructed hotel serves as a landmark expansion at an important address in Toronto’s Entertainment District.”

Northland is an international hotel/resort and entertainment owner which is active in five countries, employs about 13,000 and owns 63 properties as well as operating 175 restaurants and venues.

The company is also the owner of the Dallas Stars NHL franchise.

King Blue in final stages of development

The upscale, contemporary-modern boutique hotel is near completion and slated to open later this fall.

“We are pleased to have completed the final stage of this exciting development and wish Northland much success with the hotel,” said Henry Cao, general manager of Greenland Group Canada, in the release.

“It is a special location in such a culturally dynamic city and the hotel will be a great addition to the Toronto market for both business and leisure guests.

“Greenland is proud for its first project in Canada to be recognized by a market leader like Northland Properties. We hope to continue to develop and deliver more properties in Canada.”

Located in the podium area of the development, the hotel includes an upcoming premium onsite restaurant, meeting and social spaces, and modern, fully equipped recreational facilities.

A rooftop terrace offers views along both King Street West and Blue Jays Way.

Blake, Cassels & Graydon LLP acted as legal counsel for Greenland and Stikeman Elliott LLP acted for Northland. Colliers Hotels acted as exclusive real estate advisors in this transaction.

About Northland and Greenland

Vancouver-headquartered Northland Properties is a family-operated Canadian hotel and entertainment investor and operator formed in 1963. It has assets across Canada, the U.K., Ireland and the U.S.A.

It is the force behind such brands as Sandman Hotel Group, The Sutton Place Hotels, Moxie’s Grill & Bar, Denny’s Restaurants, Chop Steakhouse & Bar, Shark Club Sports Bar & Grill, the Dallas Stars, Revelstoke Mountain Resort, Grouse Mountain Resort and the Northland Asset Management Company.

Since its founding in 1992, Greenland Holding Group Co., has established a diversified structure through both industrial and capital operations, with a focus on real estate.

Greenland Group is also active in other industries including finance, infrastructure construction, international trading and energy resources. Greenland Group placed No. 142 on the 2021 Fortune Global 500 list.

Source Real Estate News Exchange. Click here to read a full story