Author The Lilly Commercial Team

‘Getting creative’: How the demand for warehouse space is pushing industrial real estate into new territory

The growing popularity of e-commerce and other new business trends has made this space a hot commodity.

The once-stodgy world of industrial real estate is being forced to turn to novel solutions such as vertical warehouses and repurposed retail as the growing popularity of e-commerce and other new business trends drive demand for space.

“If I say industrial, a lot of people think it’s metalworking shops or a big distribution centre,” said Kevin Layden, CEO of Vancouver-based developer Wesbild Holdings Ltd. “But industrial today is changed. The businesses are changing, the economy is shifting.”

The pandemic has forced Canadians to avoid the checkout line at retail stores, but spurred a massive increase in online retail spending, which some estimates show exceeded $50 billion in 2020.

The surge of online activity has meant businesses need more space to conduct their operations, said Kyle Hanna, vice-president of industrial and logistics at CBRE.

“You have the explosion of the food sector, including meal kits and direct-to-home grocery delivery. You have restaurants pivoting from indoor-dining to becoming distribution points,” Hanna said.

“And then, obviously, the change of retail to e-commerce overall, which was a trend before this, but has been accelerated so strongly by COVID.”

However, with a 3.3 per cent vacancy rate across the country last year, industrial property has been in limited supply.

“Industrial today is changed. The businesses are changing, the economy is shifting”

WESBILD CEO KEVIN LAYDEN

About five years ago, Layden’s firm took notice of businesses’ changing needs as well as the dwindling supply of land suitable for warehouses in Vancouver, which has been at forefront of some of these trends, and decided to plan a vertical complex.

The development, named Marine Landing, will be a six-storey, two-building structure that will have 235 units ranging from 600 to 15,000 square feet, which businesses can own instead of lease.

The buildings will come with amenities, such as a fitness centre and a rooftop deck, and even have what Layden calls an “end-of-trip facility” for bike storage and repairs, perfect for bike couriers.

An artist’s depiction of Marine Landing. The development will be a six-storey, two-building structure that will have 235 units ranging from 600 to 15,000 square feet, which businesses can own instead of lease. PHOTO BY WESBILD HOLDINGS LTD.

The types of businesses Wesbild intends to attract — gaming studios and ghost kitchens, to name a few — aren’t the typical industrial users that come to mind. The development, he says, also has the room and flexibility to meet the changing needs of food and grocery services, biotech and even distribution, for businesses that need smaller spaces closer to the downtown core.

“They’re not your traditional office user and they’re not your traditional 200,000-square-foot warehouse user,” Layden said.

Wesbild isn’t the only firm building upward. Oxford Properties Group has already broken ground on a two-storey, 707,000-square-foot structure in Burnaby, B.C.

The building is designed for a single customer, according to a December press release, and features a 270,000-square-foot second-storey that full-size transport trailers can access via a ramp. It also has a truck court with loading docks.

The solution to build vertically to address changing needs is a nice fit for Vancouver because it addresses geographical and cost issues.

Vancouver, surrounded by the ocean and mountains, has very limited industrial land available. As a result, net rents on industrial spaces have been climbing for the past nine years. In the fourth quarter of 2020, net rent increased 5.9 per cent from the year before to $13.92 per square foot, according to CBRE data.

Ontario doesn’t face the same factors as Vancouver, and thus, vertical hasn’t taken off yet, both Hanna and Layden said.

However, Toronto could be on its way. In the fourth quarter of last year, net rents in Toronto reached $10.25 per square foot, an increase of 18.9 per cent year over year, much steeper than Vancouver’s gains.

Hanna said net rents need to hover close to or exceed $20 per square foot to really justify a multi-storey structure and this year, he expects Toronto to enter the mid-teens. (By contrast, rents in the smaller market of London, Ont., sat at $6.17 per square foot).

Another trend that has been accelerated by the pandemic has been the conversion of traditional retail space to industrial uses, with newly vacant stores proving to be tempting locations for users who want to be closer to urban customer bases but who don’t need giant warehouses.

“We’re actually starting to see the first wave of retail repurposed into industrial now,” said CBRE’s Hanna.

Typically, the users taking up shop are food companies in end units of multi-unit plazas or just smaller, regional plazas because of the lack of pure industrial space downtown in a city like Toronto.

“They’re getting creative,” Hanna said. “For them, with perishable goods, it’s all about (getting) into the core, as close to the densely populated areas, for speedy deliveries.”

Diana Hoang, an associate vice-president and broker at Colliers International Canada, said she has heard of recreation companies, such as gymnastics organizations, taking up old, vacant department stores, but notes that retail isn’t the perfect solution for everyone.

“Shipping is a huge factor for the challenges industrial users are having,” she said.

Most retail spaces aren’t equipped with loading docks and doors that are big enough for transport trucks.

As well, net rents in Toronto for retail spaces are six times that of average net rents for industrial, she said.

“Because of that, industrial users tend to hold off, for now, on taking up retail space.”

Until vertical or retail conversions take off, Hanna said, developers and companies will continue sprawling outside of urban cores and into surrounding suburbs.

“The only natural way to defend against this supply and demand imbalances is to grow out of the city,” he said.

Source Financial Post. Click here to read a full story

Amazon is fuelling North America’s worst warehouse shortage — and it’s right here in Canada

Finding warehouse space around Toronto has never been harder, and the e-commerce fuelled shortage is disrupting businesses and threatening the broader economy.

With the pandemic driving a belated embrace of online shopping in Canada, Amazon.com Inc. has been gobbling up warehouses. That’s pushed the vacancy rate in the Toronto area down to just 0.5 per cent, making it the tightest market in North America, if not the world.

Logistics consultant Richard Kunst is seeing the fallout first hand, as companies try to fill orders and move merchandise. One client, a food manufacturer, has been forced to pack roughly a third of its orders in a parking lot. Others are so desperate for warehouse space Kunst has advised they ask local farmers if they can keep goods in their fields.

“It’s cheaper to go to a farmer and say, ‘tell me how much you’re going to make off a crop on a five acre lot, and I will pay you that, plus 10 per cent, in order to drop containers here,’” Kunst said.

While the warehouse shortage is most acute in Toronto, other major cities in Canada aren’t far behind, with Victoria, Vancouver and Montreal rounding out North America’s top four tightest warehouse markets, according to real estate brokerage Colliers International Group Inc.

Amazon fuelled

The single biggest driver of this squeeze has been Amazon.com. The pandemic has seen the e-commerce giant increase its logistics footprint by nearly 12 million square feet across nine major Canadian markets since the end of 2019, according to Colliers.

That includes taking a quarter of all the space that came up for lease in Toronto last year, while boosting its footprint 10 times in Montreal and quadrupling in Ottawa.

With new warehouse supply lagging the soaring demand, the brokerage CBRE has predicted Canada could run out of space entirely by the end of the year. That’s starting to raise alarms that Canada’s overall economy could be dragged down, just as it starts to recover from the pandemic.

“There are fewer jobs, fewer permanent jobs that can be created, because companies aren’t able to fulfill demand”

JAN DE SILVA, CHIEF EXECUTIVE OFFICER, TORONTO REGION BOARD OF TRADE

“We become cost uncompetitive when we don’t have a good availability of warehousing,” said Jan De Silva, chief executive officer of the Toronto Region Board of Trade, which represents local businesses in and around Canada’s largest city. “There are fewer jobs, fewer permanent jobs that can be created, because companies aren’t able to fulfill demand.”

Amazon didn’t respond to a request for comment.

While the outlook for other types of commercial property, including offices and hotels, has been clouded by the coronavirus, investors have plowed money into industrial buildings over the last year, betting on the further rise of e-commerce with shoppers stuck at home.

Canada had lagged other developed economies in online shopping. But since the start of the pandemic, e-commerce nearly tripled its share of total Canadian retail sales to 10.4 per cent, government data show.

That’s increased the need for warehouses and fulfillment centre and has pushed prices higher. Colliers estimates the cost of leasing industrial space in the Toronto area went up 25 per cent in 2020.

Key exports

Because much of what is made in Canada — from car parts, to packaged food, to lumber products — is for export, particularly to the U.S., the increased costs could make Canadian firms less competitive compared to international peers. And for the domestic market, those higher costs could end up being passed on to consumers, quickening inflation.

“Costs to manage the supply chain of the business are going up,” said Mike Croza, the managing partner at Supply Chain Alliance, a consulting firm that works with companies in and around Toronto. “At some point in time as costs go up, there will be some kind of transfer of increase to the consumers.”

To deal with these pressures, developers are starting to explore converting office towers and shopping malls into logistics space. Amazon’s Canadian distribution unit recently purchased a defunct flea market in a suburb of Toronto. Still, the problem may ultimately come down to land.

Housing push

Canada’s warehouse crunch is, in some ways, an extension of another part of the economy currently experiencing short supply and soaring price inflation: Residential real estate.

Though the pandemic has shifted it into high gear, Canada’s housing market has been surging for years, driven by immigration and low interest rates.

With most of these immigrants landing in and around Toronto, Vancouver, and Montreal, local authorities in those cities and their suburbs have steadily converted areas zoned for industrial uses into land for housing to deal with the pressure.

Now, with home prices surging more than 30 per cent around the country, there’s also an acute shortage of warehouse space.

“Really well intentioned levels of government have been saying, ‘OK we have a housing problem, how do we solve that?’ And in solving that, whoops, now we have a warehouse problem, how do we solve that?” De Silva said. “We’ve got this whole chicken and egg situation that we’re trying to unravel.”

Source Financial Post. Click here to read a full story

Sutter Hill Developments CEO happy to keep low profile

Sutter Hill Developments’ recent 50 per cent acquisition of a downtown Toronto office building is the latest in the $1.2 billion of transactions it has very quietly completed since 1992.

“Once in a while we’ll put something out in a press release to let people know that we’re real, but we try to keep it pretty quiet,” Sutter Hill president and chief executive officer Karim Kanji told RENX.

“We’re a private company that doesn’t have any investors or partners, so it’s just my father and myself. We’ve never felt a need to scream who we are or what we do. We let our properties speak for us.

“People will go into a building because it makes sense, they like the location, they like the design, they like the feel or it’s at the right price point. They won’t go in it because it’s owned by me or Cadillac Fairview or Oxford or anybody else.”

Sutter Hill’s evolution

Sutter Hill has gone through a number of iterations over the decades, but the Kanji family’s involvement goes back to 1974 when Nizar Kanji — fresh from arriving in Canada from London — joined Abbey Glen Property Corp. as an accounts payable clerk.

Abbey Glen was later acquired by Genstar Development Company and rolled into an existing real estate entity called Sutter Hill, Karim explained.

The elder Kanji rose up the ranks and became head of Sutter Hill’s Eastern Canada division in 1981. He acquired the company and the management contracts of its assets in 1992.

The real estate development, investment and property management company now has a portfolio worth more than $500 million and comprised of office, industrial, retail, multifamily and senior care properties in Vancouver, Ottawa, Toronto and Atlanta.

The American properties, comprised of 1,300 units in multifamily buildings, were distressed assets acquired in 2010 following the financial crisis.

Nizar, also known as Nik, is now 81. His son said he remains active within Sutter Hill and is asset managing the Atlanta properties from his home. The company’s head office, where seven of its 70 employees usually work, is on Consumers Road in North York.

“We look for properties where we can unlock value,” said Karim Kanji. “We like having assets that give us a sense of pride of ownership as well.

“For quite a while we’ve been trying to acquire office buildings in downtown Toronto, which has been tough to do. Seventy per cent of the office towers in the financial core are owned by five pension funds, so they’re very well locked up. The deals that do trade usually trade institutionally or they involve huge dollar amounts that are out of our reach.”

110 Yonge St. acquisition

Sutter Hill already owned the 12-storey Sun Alliance Building at 48 Yonge St. before its latest acquisition, a 50 per cent stake in a 20-storey building at 110 Yonge St. in partnership with Choice Properties Real Estate Investment Trust (CHP-UN-T).

Its share was purchased for $58 million from a client of BentallGreenOak.

“It was very forward-thinking in its design even though it was built in 1967,” said Kanji. “It’s column-free, has terrific views, beautiful architecture, three levels of underground parking, a PATH connection and a centre-ice location.”

The building has LEED v4 ID+C and Fitwel v2 certifications. Kanji said there are no immediate plans to make any changes, but “all options are on the table when it makes sense.”

Sutter Hill’s investment strategy

Kanji prefers office floor plates of about 10,000 square feet and leasing full floors to tenants so they have more control over their environment.

“They have their own washrooms. They can do their own branding. We see that as a future trend, where office space will be customized and branded for tenants’ needs to fit their specific requirements.”

Sutter Hill is looking to acquire more office and multifamily assets in Canada and the United States, and Kanji believes COVID-19 concerns or hardships on behalf of some property owners may lead to opportunities.

“I’m confident in the office market in major cities,” he said. “Suburban buildings and tertiary markets I’m not so sure about. I have no concerns with multifamily.”

Along with its own money, Sutter Hill’s financing comes from banks and financial institutions. Kanji said the company has considered taking on investors, but “it goes against what we’re trying to achieve, which is long-term family assets.”

Sutter Hill sold a 108-unit apartment building in Oakville last year for $46.5 million. Kanji said the company had owned it for 35 years, as it favours acquiring and repositioning assets for long-term holds. However, it will sell an asset if the right offer comes along.

One of those properties was Parkway Mall in Scarborough.

Kanji had a summer job as a security guard at the mall in the early 1990s when he was attending Western University and Sutter Hill was managing it.

The company lost that management contract but, years later, the Kanjis were walking through the mall, found out it was for sale and bought it. They then sold it a few years later after repositioning it.

Community involvement and philanthropy

Kanji said he’s been on about 10 different charity boards and spends half his time on philanthropic causes, with a focus on those involved in the arts and education.

He’s currently on the board of governors for: Junior Achievement Central Ontario; the Sistema Toronto after-school music and social development program; and Workman Arts, a multidisciplinary arts organization that promotes a greater understanding of mental health and addiction issues through creation and presentation.

Kanji, who has also studied guitar at The Royal Conservatory of Music, is on the board of directors of Seventh Stage Productions. The feminist professional not-for-profit theatre company revolves around women telling stories about women.

“When it would make money, the money would go to different charities involving women’s issues,” said Kanji. “When it would lose, I would just write a cheque and move on to the next. I think it’s important to give back and to have a voice and do what you can to help society in general.”

Kanji has also attended conferences on counter-terrorism and geopolitical issues as vice-president of the NATO Association of Canada, an independent non-governmental organization established to foster a better understanding of the North Atlantic Treaty Organization’s goals and Canada’s role in it.

“You can take skills you learn in different areas and re-apply them to make everything better,” he said.

Source Real Estate News Exchange. Click here to read a full story

Office demand will be ‘off to the races’ after COVID restrictions: Dream Office

The head of one of Canada’s major office landlords said pandemic restrictions have made finding new tenants a big challenge.

Michael Cooper, chair and CEO of Dream Office REIT, said in a broadcast interview Friday he expects to see a surge in leasing activity once emergency measures to curb COVID’s spread are lifted. The real estate company reported Thursday net rental revenue in the latest quarter fell 9.2 per cent year-over-year to $26.2 million. It executed leases totalling 73,000 square feet compared to 46,000 in the first quarter of 2020.

“People have barely been able to use offices for 14 months and we’ve gone from 97 per cent occupancy to 94 per cent,” Cooper said. “We can see that as the world opens up in other places, people are pouring back to the office.”

The company has been forced to stop showing its properties to prospective tenants due to lockdown restrictions particularly in the city of Toronto, which Cooper said makes getting new tenants difficult.

“Most of our portfolio is in the city of Toronto and Toronto’s lockdown is really severe and we’ve really been respectful of what the recommendations are, so we are really not doing much in the way of tours.” He said. “[But] we think within 60 days we’ll be back at it again and off to the races.”

Cooper said he does not expect a trend toward remote work following the pandemic will severely reduce demand for office space.

“We have the strongest IPO market for tech companies in decades; all of those tech companies are growing fast and a lot of them are using office space,” he said. “We’re going to continue to see a rotation on what’s driving office [demand] much more towards technology or fintech.”

Source BNN Bloomberg. Click here to read a full story

GTA commercial real estate market closes record-setting first quarter

With an unprecedented year behind us, the first quarter of 2021 saw the beginning of the COVID-19 third wave due to rapid spreading of new variants across regions. Talks of stay-at-home orders towards the end of March were back on the table, and while it seemed as though additional restrictions would slow activity, similar to what was seen last year, the GTA commercial real estate market is booming this year.

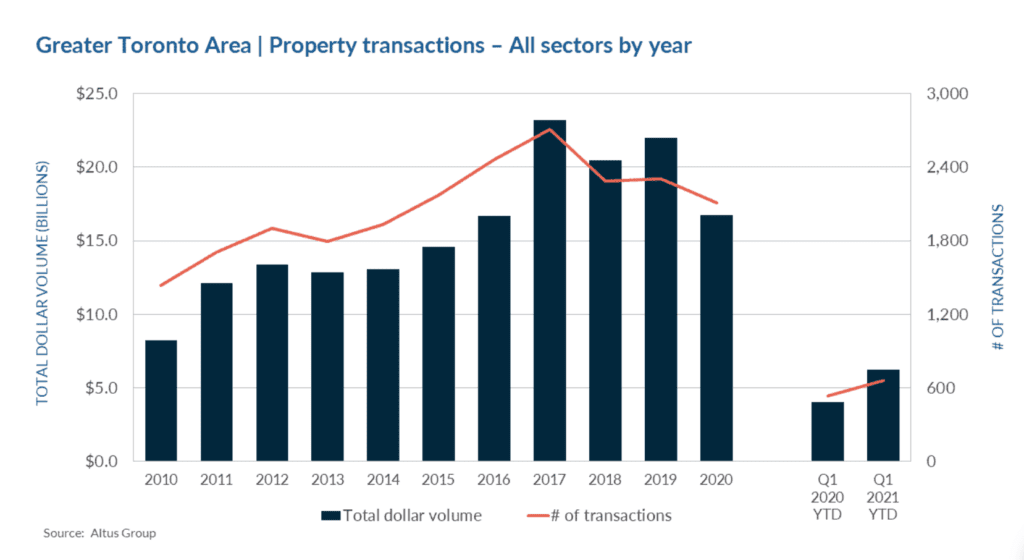

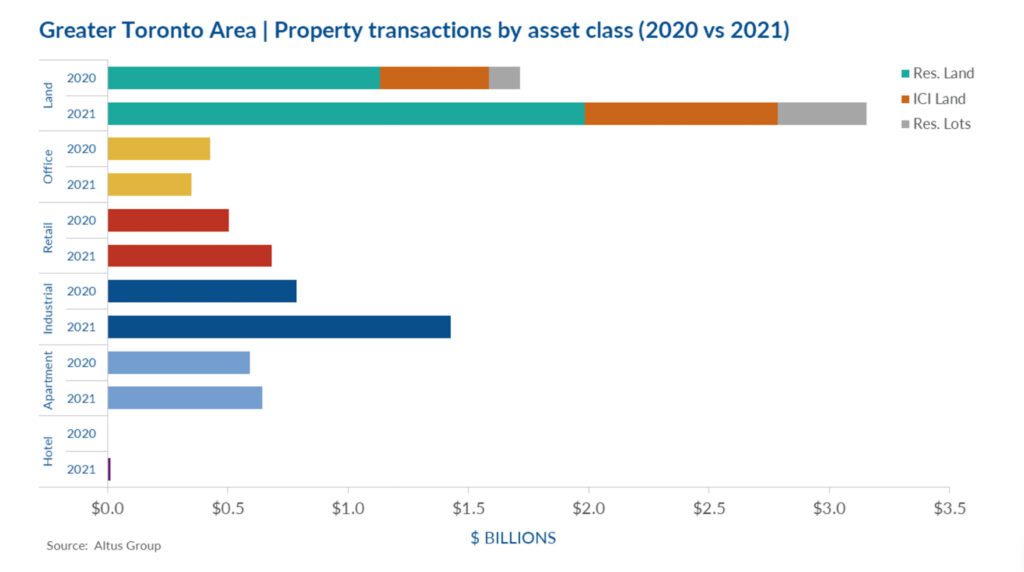

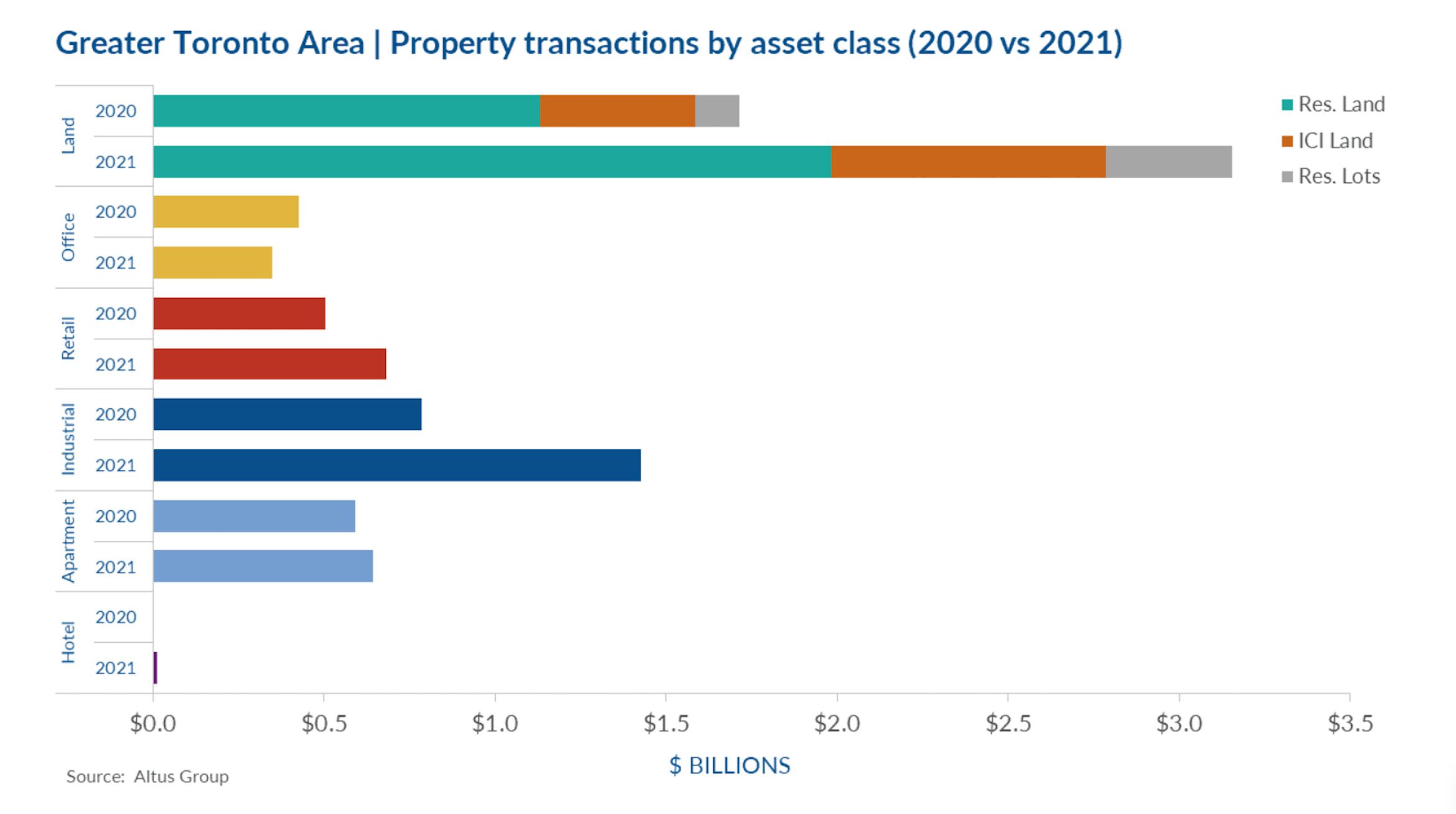

Q1 2021 saw the largest first quarter on record, with GTA investments totalling $6.3 billion, up 56% compared to Q1 2020. Investment momentum carried forward from the end of 2020 with the first quarter registering 663 transactions, a 24% increase compared to the same period last year. As vaccine rollouts began – albeit slowly compared to our US counterparts – work from home has continued, as have conversations of a continued remote work lifestyle even after vaccines are widely available. This uncertainty was evident in office sector activity, which saw an 18% decrease in investment totals compared to the same period last year – the lone asset class to see a decrease in volume this quarter. Overall, market performance to start off the year was strong, and the GTA continues to be one of the most sought-after markets for real estate investment in Canada.

The land sectors (residential land, ICI land & residential lots) led the charge during the first quarter of 2021, totalling nearly $3.2 billion, accounting for 50% of overall investment totals. Residential land was the most invested in, with almost $2 billion in sales, and residential lots recorded $369 million. This trend is expected to continue with rising demand for new homes due in part to record low interest rates still being offered by banks across the country. The ICI land sector came in at $803 million, with the lack of supply for industrial warehouse space persisting in the GTA. On the improved asset side, the industrial sector continued to dominate, with an investment total of $1.4 billion, accounting for 23% of overall Q1 2021 total investments and rising 81% compared to Q1 2020. The retail sector continued to gain back momentum, with $684 million in transaction volume, up 35% from Q1 2020. As confidence in the GTA market never wavered, investor challenges revolved around a lack of available assets for purchase.

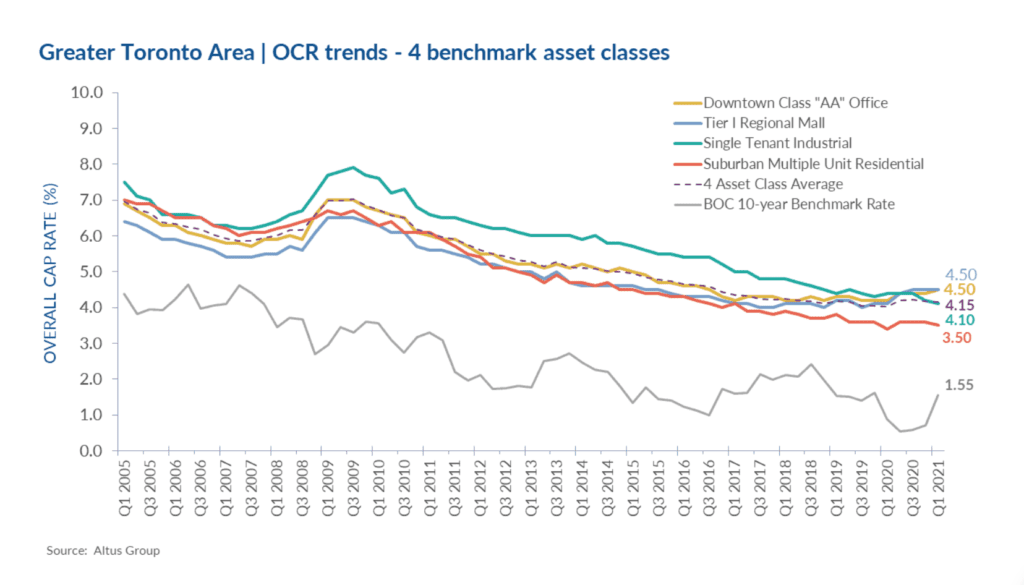

According to Altus Group’s Investment Trends Survey for Q1 2021, all three industrial asset classes (multi-tenant, single-tenant & industrial land) are the most preferred by investors, followed by food-anchored retail strip. Toronto remains the second most preferred market by investors this quarter, following Vancouver. Overall capitalization rates in Toronto compressed slightly compared to the previous quarter, with rates remaining stable among downtown class “AA” office and tier 1 regional mall assets and decreasing in both single-tenant industrial and suburban multiple unit residential.

Notable Q1 transactions:

27, 37 Yorkville Avenue & Cumberland Street, Old Toronto – Residential Land

With a purchase price of $300 million, this property was sold under receivership and was acquired by the Pemberton Group. The 1.4-acre parcel is site plan approved for a gross floor area of approximately 961,161 square feet. The previous owner Cresford Developments originally acquired the property from KingSett Capital in December 2017 for $268.5 million.

357 & 359 Richmond Street West and 120-128 Peter Street, Old Toronto – Residential Land

This 0.4-acre high-density redevelopment site was acquired by China Aoyuan Group for $72 million. The vendor of the property was Carlyle Communities who assembled the site between 2014 and 2019 for a total consideration of $31 million. Prior to the date of sale, the property had been zoning approved for a 39-storey, 270-unit residential condominium building. This purchase represents the second acquisition by the China-based developer who previously acquired the Newtonbrook Plaza in North York for $200.8 million in September 2017.

388 Yonge Street, Old Toronto – Retail

This retail asset acquired by Ingka Group for $100 million represents the largest retail transaction of the quarter in the GTA. The subject property consists of just over 132,000 square feet of retail space within the first three levels of the 78-storey Aura condo building. At the time of sale, the top-level unit was fully occupied by Marshalls and the second-floor unit was recently vacated by Bed Bath and Beyond. The purchaser intends to open the first downtown IKEA store in Canada by occupying the second-floor unit and parts of the first floor. Once renovations are complete, IKEA would occupy approximately 66,175 square feet of space which would be scheduled to open late 2021 or early 2022.

55 & 105 Commerce Valley Drive West, Markham – Office

This two-building office complex located within minutes of Highway 404 and 407 in Markham was acquired by Soneil Investments for $115 million. The eight-storey buildings contain 375,255 square feet and sit on nearly 8.9 acres, which offers the new owners the opportunity of future development on the excess land.

100 – 110 Iron Street, Etobicoke – Residential Land

With a purchase price of $125.3 million, this two-building distribution facility was acquired by Triovest from Mantella Corporation. The property contains approximately 525,000 square feet of space and is ideally situated between Highways 401 and 409 in north Etobicoke. With a weighted average lease term of less than two years and rental rates below market levels, this property offers the new owners rental growth potential in the near term.

With the rollout of vaccines, all sectors except office have started 2021 strong, and show no signs of slowing. Although the third wave was imminent towards the end of the first quarter, this does not seem to be scaring off investors, as the market and overall population continue to look to the future with a more positive outlook. As seen throughout 2020, investors are still most confident in the land and industrial sectors, as these two asset classes have been impacted less by current market conditions, if not driven by it. The bid-ask gap persists between buyers and sellers, as investors do not want to pay top dollar given the risks that still linger. Overall, demand for quality GTA real estate assets is growing and shrewd investors are continuing to use the pandemic and record low interest rates to their advantage.

Source Altus Group. Click here to read a full story

Plug pulled on Five Points condo project in downtown Barrie

BARRIE, ONT. — The 20-storey, 208 unit condominium development that was meant to redefine luxury in downtown Barrie has been shelved.

The developer and its financial partner pulled the plug, blaming the pandemic and several lockdowns for disappointing sales.

In an email issued to those who did buy a unit, Advance Tech Developments president Joseph Santos wrote in part, “Although the project got off to a good start, COVID-19 has proven to be a hurdle that the project cannot overcome.” It continued, “The state of emergency with on-again, off-again lockdowns and restrictions have hampered our ability to achieve meaningful additional pre-sales.”

The contract allowed the company to cancel the project if it could not sell 85 per cent of units by May 1. Investors are being promised their money back.

Barrie’s mayor calls the situation surrounding what’s considered a prime piece of real estate frustrating.

“Especially given how strong the market is, especially given we’ve got cranes going up in the downtown for the first time in many years,” said Mayor Jeff Lehman.

Part of the site at the intersection of Dunlop Street West and Bayfield Street has sat vacant since a massive fire in 2007.

“We want more people living in the downtown,” Lehman added. “It is one of the best ways to make it safer and stronger. The best way for us to get more shops and services into the downtown core.”

The Five Points project had been two years in the making with community benefits, including residential units at affordable rental rates for 20 years.

Source CTV News. Click here to read a full story

Public lands, Part II: CreateTO and Toronto Lands Corp.

PART II: Second part of look at four major stewards of public lands in Canada is focused on the Greater Toronto Area through agencies operated by the City of Toronto and its major school board.

In Part I of this look at public lands utilization strategies, Canada Lands Company and Infrastructure Ontario were explored.

This information was presented during a recent webinar hosted by the Urban Land Institute’s Toronto chapter. The event was moderated by Urban Strategies Inc. partner Cyndi Rottenberg-Walker.

CreateTO

CreateTO was established in 2018 as a City of Toronto agency with the mandate of looking at city-owned properties, thinking about them strategically, coordinating all stakeholders and bringing a consistent level of expertise to the overall portfolio.

That portfolio is comprised of 8,446 properties on 28,823 acres of land, including 6,976 buildings with 106.3 million square feet of space and an assessed value of $27 billion. It’s responsible for about $1 billion in annual capital and development costs and another $1.1 billion in annual operating costs.

The portfolio encompasses 45 divisions, 12 agencies and 25 ward communities. The goal is to control costs, unlock inherent value and improve the service offering to those groups.

“It’s not an investment portfolio,” said portfolio strategy and asset management director Ashmeed Ali. “It’s a complicated mix of assets to serve a complicated mix of needs. And we have to figure out what to do with all of this real estate and figure out how we can make better use of it.”

The portfolio has been broken down into 11 categories and Ali said each asset is evaluated using four objectives:

“First is modernization. That’s about addressing our aging facilities and updating business practices where we find them.

“The second is intensification. We leave a lot of value on the table by building single-storey structures and not taking advantage of the air rights that we own above our lands.

“The third is integration. That’s about promoting more co-location and more partnerships between city divisions and city partners, especially the folks who are on this panel.

“And the fourth is rationalization. That’s really the principle about getting rid of things you don’t need and adding the assets that you do.”

Applying these lenses should help the city create greater financial efficiencies to enable reinvesting value back into its programs, priorities and core assets.

A key priority is creating and supplying more affordable housing, and the Housing Now program leverages under-utilized transit-oriented properties on public land to deliver mixed-income, mixed-use communities.

Housing Now has 17 under-utilized sites with the potential to add 12,426 homes, including 4,667 affordable rental units, as well as community spaces, parks and daycare centres.

“There’s an enormous economic benefit for the city, with billions of dollars in capital construction and all the employment that comes with that,” said Ali. “Plus we get new community infrastructure that’s built right into the concept of mixed-use communities at these locations.

“We have 17 sites in this program right now and we’re going to be adding more this year and then even more in the coming year.”

ModernTO

ModernTO is a self-funding portfolio plan to modernize government and the City of Toronto’s office space.

Its benefits will include: a one million square foot reduction in space; reducing office locations from 55 buildings to 15; creating $1.2 billion in real estate value; re-investing in core city assets; providing modernized working conditions for 14,900 employees; and saving $30 million annually in operating and capital costs.

Ali said space allocation was based on 1980s furniture and floor plans, as well as the use of desktop computers, with no formal policy for allowing employees to work remotely. Partly due to the remote work done over the last year due to COVID-19 precautions, ModernTO has become more aggressive in its space reduction efforts.

City-owned sites at 277 Victoria St., 33 Queen St. E., 931 Yonge St., 1900 Yonge St., 75-81 Elizabeth St., 95 The Esplanade and 18 Dyas Rd., as well as the Bay Street bus terminal, will be made available for city-building opportunities.

These could include affordable housing, commercial and employment purposes, institutional uses such as schools and hospitals, community infrastructure, transit-oriented development, and city programs.

“These are high-value locations, generally downtown, that are hard to come by,” said Ali. “We’re unlocking them as a result of getting more efficient with our office portfolio. We’re going through a consultation process right now to determine how to best utilize these sites for the public good.”

Toronto Lands Corporation

Seven Toronto school boards amalgamated in 1998 to form the Toronto District School Board (TDSB), the largest in Canada and fourth-largest in North America.

By 2008, it realized it needed additional expertise to maximize its real estate holdings and value through dispositions and leasing. Toronto Lands Corporation, a wholly owned subsidiary, was created in 2018.

Toronto Lands isn’t a decision-making body. Its job is to manage the TDSB’s real estate interests and provide its 22 trustees with recommendations and options for modernizing and maximizing the portfolio.

Toronto Lands’ mandate is to manage all TDSB interests in: real estate; land use planning; strategic partnerships; site and facility leasing; non-operational properties and their related assets; schools in mixed-use facilities; site redevelopment; school modernization; and property acquisitions and dispositions.

The TDSB owns 611 properties on 5,082 acres valued at between $15 billion and $20 billion. This includes 13 administration sites and maintenance operation sites, 23 non-school sites and nine vacant properties.

The school network has capacity for 308,000 students but an enrolment of only 247,000. The average age of schools is more than 60 years and 58 are more than 95 years old. The system has a backlog of about $4.2 billion in deferred maintenance.

Toronto Lands has embarked on a modernization strategy to recycle some existing assets into new schools and community development opportunities.

Corporate communications manager Rob Thompson said a five per cent leverage of the TDSB’s asset base would produce approximately $750 million to $1 billion for reinvestment in modernizing TDSB facilities.

Thompson gave examples of potential and actual measures that could be, and have been, taken as part of this modernization.

On a 2.4-acre downtown or midtown site, a school could be located in the podium of a high-rise tower.

“This is a model that is working very successfully in New York, Chicago and in Vancouver, where they have incorporated schools into the podiums of new condominiums or office towers,” said Thompson.

On an eight- to 10-acre site, schools could be part of a collaborative redevelopment project that could include a long-term care facility, housing and recreational component.

“We have already realized this kind of potential at 125 Brockley Drive in Scarborough where, in 2019, the new David and Mary Thomson Collegiate Institute was opened,” said Thompson.

The site has a new athletic field and will have a new city-run daycare. A housing development will be built on land that was severed and sold to a developer.

Thompson also cited the new Davisville Junior Public School at 43 Millwood Rd.

“The school was originally intended to be a two-storey school with an above-ground parking lot. The city indicated they were looking for recreational facilities in the area.

“The meeting of the minds came together and it was decided that an underground parking lot would be built into the school. It would free up space next door for a new city recreation centre.

“The school went from two storeys to three storeys to further shrink the footprint. The city came on board and is now building a new recreation complex adjacent to the school.”

The city has leased the land for a dollar a year for the next 59 years, saving it potentially $20 million to purchase the land. The TDSB gained 49 years of four-hour-a-day access to the recreation centre swimming pool.

“There are many school sites in many neighbourhoods that are within two or three kilometres of each other that are operating at 65 to 75 to 80 per cent capacity that could possibly be examined for consolidation and an opportunity to collaborate with a municipality or developers to create a community destination,” said Thompson.

Source Real Estate News Exchange. Click here to read a full story

Public Lands, Part I: Canada Lands Co., Infrastructure Ontario

PART I: Demand for better utilization of public land is growing, and representatives from four bodies responsible for such portfolios talked about their strategies during a recent webinar presented by Urban Land Institute’s Toronto chapter.

“Land is an increasingly scarce resource and the real estate market is hotter than it’s ever been,” panel moderator and Urban Strategies Inc. partner Cyndi Rottenberg-Walker explained as she introduced the presentations.

“Public sector budgets are under tremendous and growing pressures, but these public bodies often own very well-located land assets, so many of which have become surplus to their core needs. All of that sounds like a perfect match of need and opportunity.”

Following is information about two of the major stewards of Canada’s public lands, along with discussion about some of their properties and their strategies to utilize the assets.

Canada Lands Company

Canada Lands Company has offices across the country and manages publicly owned properties from coast to coast. It’s responsible for repurposing former federal government lands to optimize their financial and community value.

Acting regional director of real estate James Cox focused on two projects in the Greater Toronto Area (GTA).

The first is 1 Port St. E. in Mississauga’s Port Credit neighbourhood, on Lake Ontario and along the east side of the Credit River. It was at one time used for shipping container purposes, but for the last 40 years has been leased out for marina, boating and recreational uses.

The site, acquired by Canada Lands from Fisheries and Oceans Canada in 2011, is industrial in nature, under-utilized and precludes public access.

Canada Lands convened stakeholder and community meetings as part of initiating a master plan. It also entered into a transaction with the City of Mississauga, under which it has an opportunity to secure the land and water lot needed to own and operate a future marina.

The approved master plan supports redevelopment to accommodate: a harbour; a mixed-use site largely comprised of mid-rise buildings; opportunities for taller elements with a landmark building; some taller elements on Fourth Street; affordable housing; a waterfront trail; and new public parks.

It will provide upwards of 1,500 residential units and approximately 200,000 square feet of commercial space.

Cox’s second example is the William Baker neighbourhood in Downsview, a 62-acre site between Downsview Park and the Toronto Transit Commission’s Downsview Park subway station and GO Transit station.

It used to be occupied by military homes, which have now been demolished, and also features a woodlot with walking trails that Canada Lands opened to the public.

Applications have just been submitted to the City of Toronto for a district plan for a compact urban neighbourhood with a community centre, affordable and seniors housing, medical offices, retail and commercial services, while also retaining some of the woodlot.

Infrastructure Ontario

Infrastructure Ontario provides services for managing and building public infrastructure, provides loans, creates commercial solutions with the private sector, and deals with the province’s general real estate portfolio, which is one of the largest and most diverse in Canada.

“We have 4,500 buildings in over 450 cities,” said real estate transactions director Kayann Fernandes, who has divested more than 5,500 acres of land that have generated more than $120 million in revenue across the province.

“That equates to 42.5 million rentable square feet. And above and beyond the buildings, we have over a million acres of land throughout the province. We’ve got old jails, psych hospitals, hydro corridors, parklands, golf courses, you name it.”

Providing public services through its real estate is integral to Infrastructure Ontario, Fernandes said. And while the portfolio is large, elements of it need to be modernized.

Infrastructure Ontario’s accelerated divestment plan includes more than 350 properties to sell. The goal is to collect more than $130 million while reducing liability and bringing surplus lands back to productive use to generate revenue.

Infrastructure Ontario attempts to repurpose government land through a three-step process before it’s offered on the open market for market value. The first step is to see if any other provincial ministries or agencies need it.

If they don’t, the ministries and agencies will be asked if it can be utilized for non-direct uses.

The third step is seeing if there’s interest from federal or municipal governments, non-profit groups, colleges and universities, school boards and eligible Indigenous communities. It will then be put on the market if there are still no takers.

“We make sure it’s an open, fair and transparent process and we list for 45 days, giving everyone a chance to bid,” said Fernandes.

She said there are currently two GTA properties on the market for which the province is willing to give up revenue in exchange for the construction of long-term care facilities.

“It is very important for the province to generate revenue,” she concluded, “but there is also a balance in other important endeavours for the province. So, for example, long-term care is a very important initiative right now.”

Source Real Estate News Exchange. Click here to read a full story

Atria finds niche in downtown Oshawa, builds across GTA

Gyan Chand Jain began developing in Toronto in 1969. His sons Hans and Vipin later founded Atria Development to continue a tradition of revitalizing communities by building new projects and repurposing existing structures.

Atria has now grown to about 40 employees and become a vertically integrated company involved in construction, marketing, sales, rentals, property management and more.

Atria got its start with projects located east of Toronto’s Don Valley, including: the 153-unit Garment Factory Lofts; the 101-unit i-Zone LiveWorkLofts; a multi-tenant commercial building in a former Reliable Toy Company factory; Kimberley Court Townhomes; and Ravine Homes on Senlac.

It has since widened its scope to include Ontario cities outside of the provincial capital.

Oshawa a key market for Atria

And much of Atria’s activity is in downtown Oshawa, which it first entered by acquiring an empty former government office building at 44 Bond St. W. It redeveloped the building into a 10-storey, 120-unit condominium called Parkwood Residences in 2007.

Atria land development director David Pearce was working for the City of Oshawa at the time of that building’s purchase.

“No one was interested in downtown Oshawa, but Hans saw the opportunity,” Pearce told RENX during a Zoom interview that also included Atria president Hans Jain, associate director of development Shane Kennedy and marketing and sales director Sharon Dawson.

Jain said Parkwood Residences was so successful, and Atria developed such a good relationship with Oshawa’s mayor, city council and staff members, that it led to the company acquiring a property beside the courthouse at 100 Bond St. E.

Atria built a 12-storey, purpose-built rental apartment with 239 units on half of the site in 2018. It’s now building a 20-storey, 370-unit rental apartment on the rest of the property at 80 Bond St. E.

The underground parking lot is finished and construction is up to the fifth floor. It will include a party room, outdoor terrace with barbecues, a gym and a dog wash when completed.

“Our investment helped spur other investments,” said Jain, who noted more developers are now embracing Oshawa for its easy access to the 401 and 407 highways, public transit, post-secondary education, health care and manufacturing jobs.

Atria has also developed Central on Emma, an Oshawa rental apartment where each of its 20 units has 1,400 square feet of space, three bedrooms and two bathrooms.

“Our philosophy is to build high-quality rentals that are condo quality,” said Jain.

New Oshawa acquisition for redevelopment

Atria recently acquired a former Canada Post building at 47 Simcoe St. S. which it will redevelop as part of its ongoing involvement with the downtown revitalization and bringing new life to older buildings.

“You have to make it viable and profitable, so you have to think through that and do good for the community and the building,” said Jain. “If you do it right, you’ll have people living there and instead of facing the wrecking ball, you’ll have a thriving building that’s bringing in realty taxes.”

The building, acquired from Canada Post, was constructed in 1954. It will be converted to a mixed-use commercial and residential mid-rise building that will maintain the original façade with a glass component added on top.

Atria hasn’t yet confirmed how many storeys it will add or how many residential units it will include.

Y Lofts in Peterborough

Atria has redeveloped a Peterborough building constructed in the 1800s that was most recently used as a YMCA. It kept the heritage façade, bricks and windows, while adding modern elements to what it named Y Lofts.

It will feature more than 130 rental units and amenities will include a courtyard patio, a rooftop terrace, a barbecue area, a party room, a fitness centre, a business centre and storage.

Y Lofts will implement a number of green building initiatives including: a recycling program; climate control technology; motion detectors for LED lighting in hallways; Energy Star-certified appliances; low-flow water fixtures; bicycle racks; and electric car chargers.

Occupancy at Y Lofts could begin as early as September.

Brimley + Progress Towers

Atria hopes to break ground on Phase 1 of a four-tower development with 1,591 residential units and retail elements on a 4.5-acre site across from Scarborough Town Centre at Brimley and Progress roads before the end of the year. Each of the two phases will include one rental and one condo building.

Tower 1 will have 34 storeys, 363 units and 3,283 square feet of retail. Tower 2 will have 34 storeys, 331 units and 5,823 square feet of retail. They’ll take about three years to build and then the second phase will begin.

Tower 3 will have 41 storeys, 422 units and 2,411 square feet of retail. Tower 4 will have 44 storeys, 475 units and 8,364 square feet of retail.

There will be green roofs throughout the Brimley + Progress Towers complex. The development will also include: two levels of underground parking; above-grade parking; a pool; a gym; rooftop patios; barbecues; and a 65-child daycare facility and playground.

Other upcoming Atria projects

Atria has a number of other projects on the horizon, most in the GTA:

– It has approval to build Beyond, comprised of two 18-storey buildings which will feature about 650 condo units, across the street from 80 Bond.

– A 12-storey, 201-unit “adult lifestyle community” aimed at people 55 and over is also planned for downtown Oshawa. Kennedy said it might also include ground-floor retail.

– Atria will build a seven-storey, 32-unit boutique condo at 1386 Kingston Rd. in Scarborough overlooking The Toronto Hunt golf course.

– Atria is seeking site-plan approval for a stacked townhome project at 76 Kingston Rd., on the edge of Woodbine Park close to Ashbridge’s Bay. Fifteen units with rooftop patios and underground parking will be for sale.

– Registration is open for The Rays, a development of single and semi-detached houses at 390 Leslie St.

– Forty9 Cranfield is a future office and retail space planned for Toronto.

– Registration is open for a site at 120 Metcalfe St. in Aurora, which is close to a GO Transit station, schools, retail, restaurants, spas and fitness facilities.

– Atria has a development planned for 302 Georgian Dr. in Barrie, which is close to Little Lake, parks, restaurants and Georgian College.

– Registration is open for a project at 16 Cannon St. E. in Hamilton, which is close to public transit, coffee shops, entertainment, parks and Burlington Bay.

Source Real Estate News Exchange. Click here to read a full story

Congebec expands for the food supply chain

LAUNCHING CONSTRUCTION: 2nd PHASE FOR CONGEBEC’S COLD STORAGE FACILITY

In order to build its presence in Toronto and increase its pan-Canadian development in temperature-controlled food storage and distribution, Congebec Inc. is proud to announce the construction of a large expansion of its Mississauga facility. This expansion will allow the existing facility’s storage space to grow from 170,000 sq ft to 232,600 sq ft, increasing its storage capacity by 12,000 pallets. Congebec Inc.’s network will reaffirm its 9th position as the largest temperature-controlled storage company in North America, and 13th worldwide.

In early 2018, Congebec became North America’s very first company with the latest generation of central refrigeration systems from Frick, a leading manufacturer for which CIMCO is the exclusive distributor in Canada and the United States. In an industry where the issue of ammonia concentration is crucial to employee safety and a smaller environment footprint, this low charge central system (LCCS), has made it possible to reduce ammonia concentrations by 90% compared with conventional systems. Having worked with the LCCS for 3 years now, Congebec’s team has mastered this new technology, and become experts in this unique refrigeration system that will also be used in the new construction.

To further assist in saving energy and reducing power usage, this facility will be equipped with power conditioning; an electric energy saving system to filter and optimize power quality and maximize energy savings. This will allow the Mississauga facility to avoid blackouts and will provide Congebec with a more reliable operation. This world-class freezer/cooler design will feature market leading physical attributes starting with its efficient building envelop that reduces heat islands with its unique white roof.

To protect new equipment and increase power quality, capacity banks will be installed on the transformer. Additionally, a dehumidification system will be installed for the office space, therefore increasing employee well-being. By creating a green space following the construction of the expansion, Congebec will have achieved numerous environmentally friendly initiatives to balance out its carbon footprint and reverse construction emissions.

“We aim to continue our mission to connect food to the world by working to feature innovative and energy efficient operations in our facilities, therefore aligning with our values and our sustainable development initiatives. Our modern construction in Toronto will ensure high-quality and safe food products to our customers and to consumers,” said Nicholas Pedneault, President & CEO of Congebec.

The LCC system

Frick’s central refrigeration system offers a complete low-charge solution with compressors, evaporators, condensers, and controls. It allows greater performance in addition to remote distributed condensing. The system significantly reduces ammonia charge (1.5-3 lb/TR) and posts strong investment returns. Its water supply via open circuit reduces bacterial growth. It also provides multiple heat recovery possibilities.

The system designed by Frick is be the biggest built on an industrial scale to date. “Congebec is the only Canadian company that has one,” said Peter Reeve, Contract Sales, CIMCO Refrigeration. “Because of this, Congebec is a valuable technology showcase that enables us to develop the North American market efficiently.”

About Congebec Inc.

Congebec is a Canadian based supplier of multi-temperature storage, value added & distribution services supporting the food, retail and CPG industry. Committed to food safety, Congebec is a leader in the Canadian marketplace and is ranked 9th in North America. With more than 500 employees and over 45 years of experience, the company operates 12 modern facilities totaling more than 60 Million cubic feet. These facilities are strategically located in Quebec, Ontario, Manitoba, Saskatchewan & Alberta.

Source Newswire. Click here to read a full story