Author The Lilly Commercial Team

ViveRE is acquiring a newly built, multi-unit residential property at 75 Emma St in Oshawa.

Halifax-based ViveRE Communities Inc. (VCOM-X) has confirmed it will proceed with its two most recent purchases of apartment properties in Oshawa and Moncton for $37.3 million.

The acquisitions will double the size of ViveRE’s portfolio to 446 units in Eastern Canada. It was formed in 2017 from the remnants of the former NSX Silver mining company.

The Oshawa sale was first announced in January. The much larger Moncton transaction was disclosed in February.

ViveRE says it has a definitive agreement to acquire 100 per cent interest in 10 multi-unit properties in Moncton, located at 145-155 McLaughlin Rd., 27 Edmond St., 50 Maplewood Dr. and 2380 Mountain Rd. All are owned by ATMJ Properties Inc.

ViveRE said the purchase price is $30 million, making the acquisition its largest single purchase.

ViveRE is funding the acquisition via: 4,166,667 ViveRE shares issued to ATMJ at $0.24 per share, representing $1 million; issuing to ATMJ a $1 million unsecured convertible debenture, with a two-year term at seven per cent per annum convertible into ViveRE shares at a price of $0.27 per share; issuing to ATMJ four million share purchase warrants, with a three-year term and an exercise price of $0.27 per share; a $23,062,000 mortgage; and the balance paid to ATMJ via a deposit, and in cash on closing.

The acquisition is expected to close in May, pending customary approvals.

Other ViveRE updates

In Oshawa, ViveRE is acquiring a newly built, multi-unit residential property at 75 Emma St. The property includes 20 units; 19 are three-bedroom units and the other is a two-bedroom.

It will pay $7.3 million for the property and financing for the deal includes cash, ViveRE shares and a $4.78 million mortgage.

The transaction is scheduled to close April 23.

The company also offered two additional updates. First, it completed a previously announced non-brokered private placement offering to raise $1.325 million.

On the COVID-19 pandemic front, the impact on company operations so far is “minimal.”

In a release, the company said its vacancy rate is less than one per cent and noted all of its April rent was collected in full.

ViveRE is focused on carving out a niche in the 55-and-over rental sector. During a recent interview with RENX, CEO Mike Anaka said the company plans to create “naturally occurring retirement communities” or NORCs.

The company wants to acquire clusters of low- and mid-rise, amenity-rich, mid-market properties in secondary markets. ViveRE is seeking buildings with condominium-quality finishes which are close to health-care facilities, shopping and public transit.

The resident base should already have a significant 55-plus cohort, he said.

Source Real Estate News Exchange. Click here to read a full story

Revised Plans Submitted for Wellesley-Parliament Square Revitalization

A proposal to add a new high-rise residential tower and a number of complementary mid- and low-rise buildings to Toronto’s St. James Town area has been revised since it was first submitted to the City by Greatwise Developments in April, 2018. The Official Plan and Zoning Bylaw Amendment applications call for a comprehensive revitalization of Wellesley-Parliament Square through the introduction of new public streets, open spaces, and a range of housing typologies.

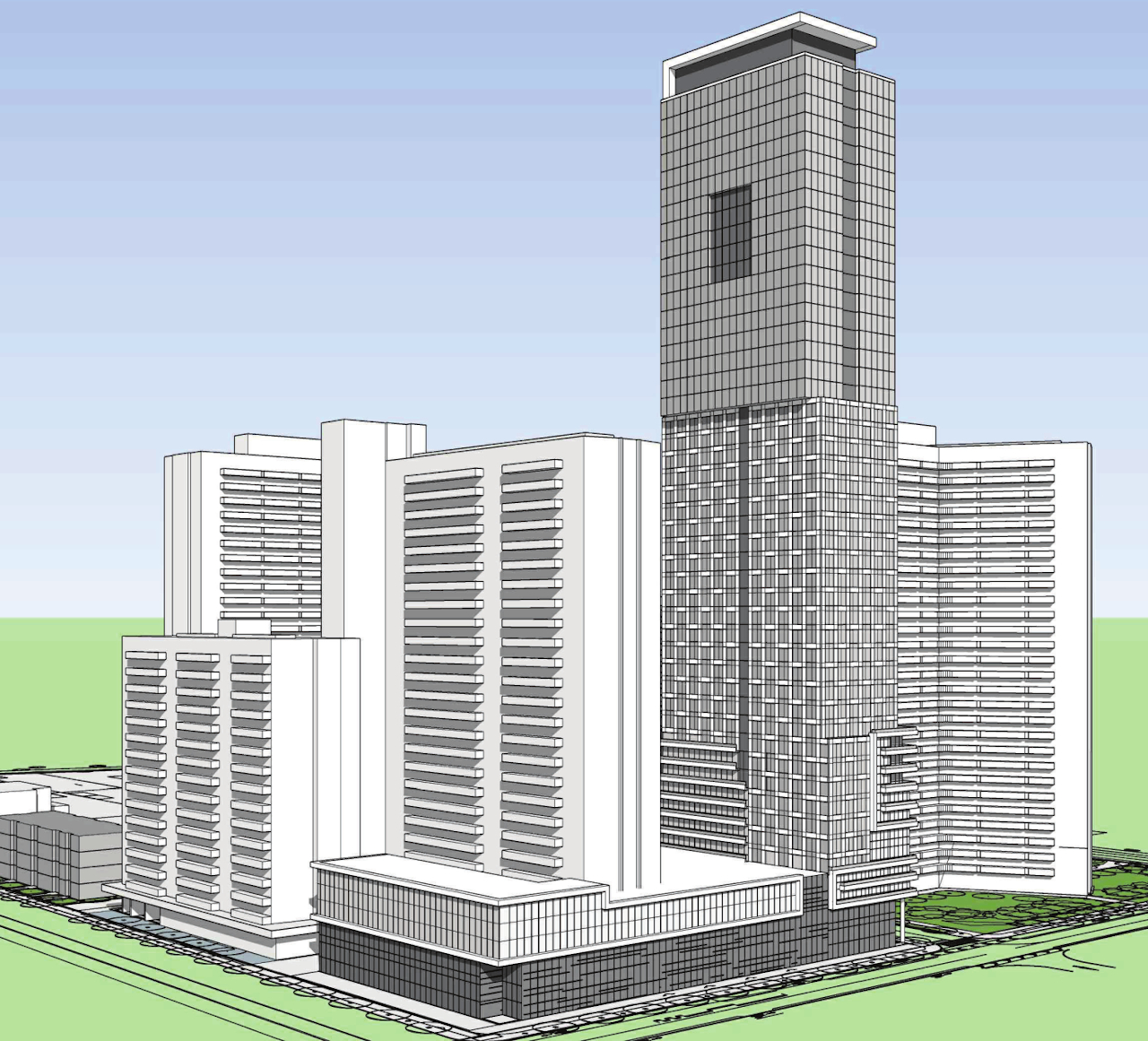

Looking northeast to Wellesley-Parliament Square, image via submission to the City of Toronto

Looking northeast to Wellesley-Parliament Square, image via submission to the City of Toronto

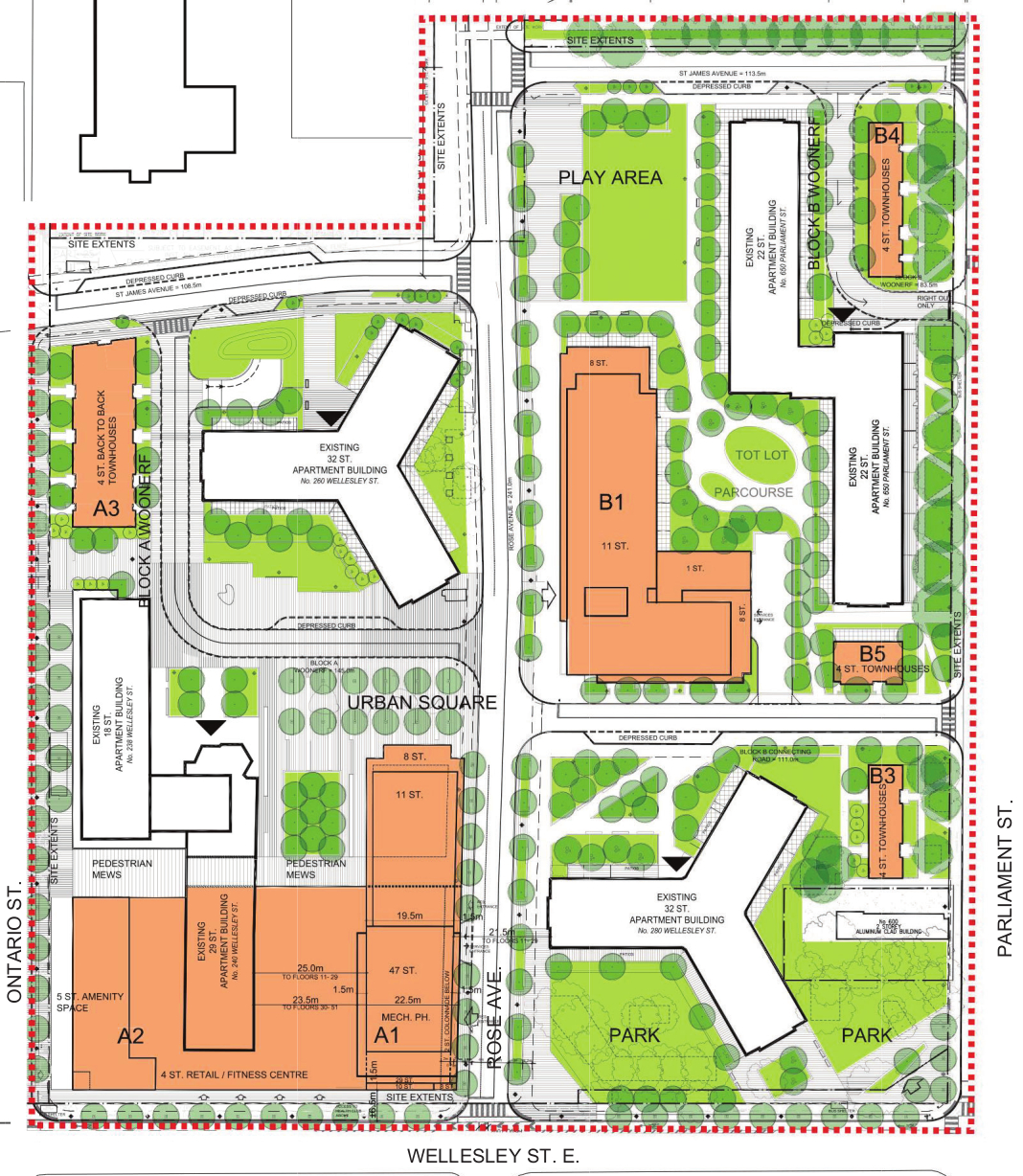

The property is large, bounded to the west by Ontario Street, to the south by Wellesley Street East, to the east by Parliament Street, and to the north by neighbouring St. James Town apartment properties. There are currently 2,224 units across four high-rise blocks within the site in a ‘Tower-in-the-Park’ setting with open spaces, residential amenities, and surface parking lots providing separation between the buildings.

Context plan, image via submission to the City of Toronto

Context plan, image via submission to the City of Toronto

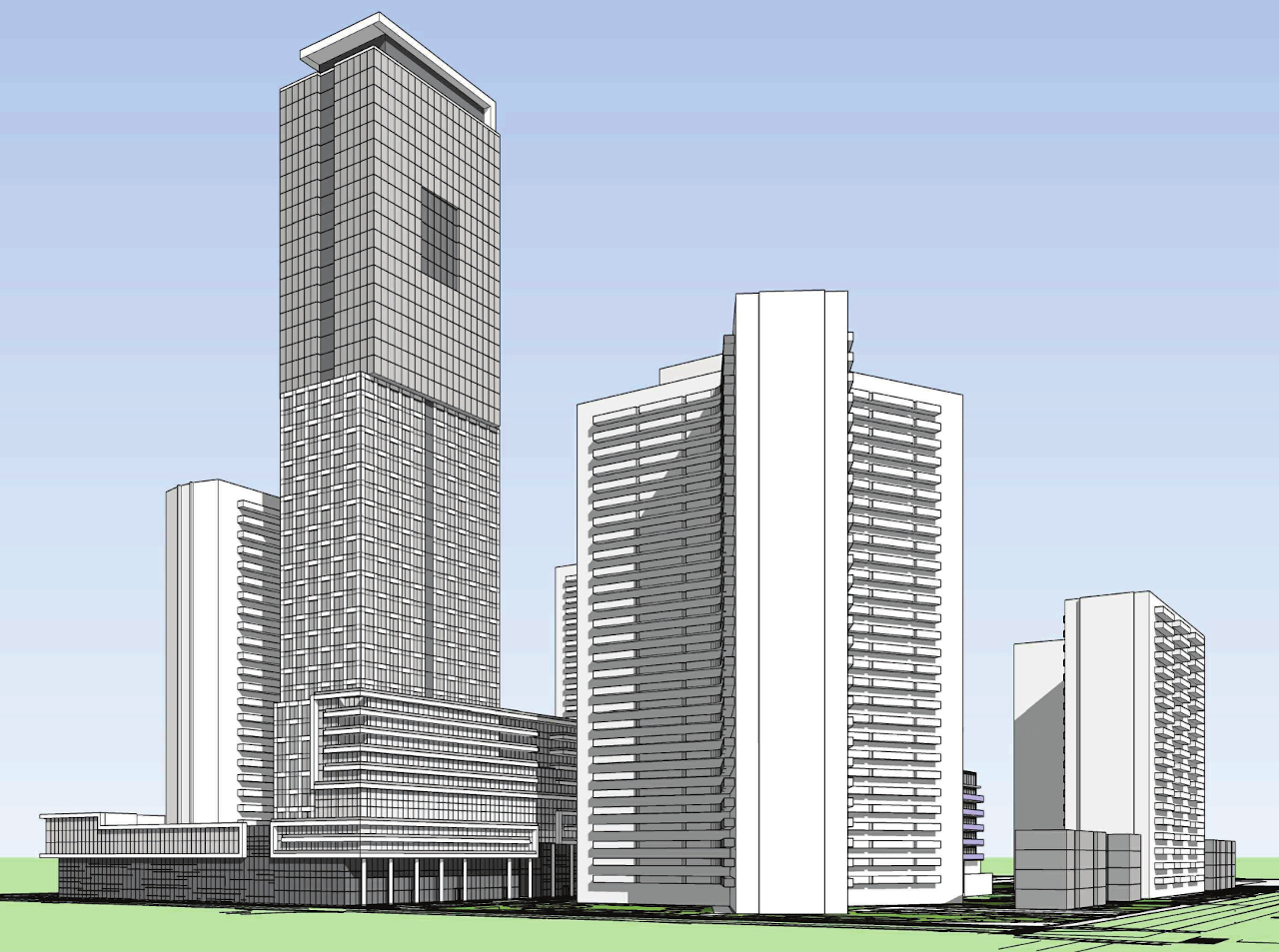

Greatwise Developments is seeking approvals to introduce six new IBI Group-designed buildings to the property. The original application included a 51-storey tower at the southern end of the site along Rose Avenue. The revised application reduces the height of the tower to 47 storeys, stepping down to 11 and eight storeys at its north end. A four- to five-storey podium containing amenity spaces and retail would wrap the existing building at 240 Wellesley Street East and link to the lower levels of the new tower.

Looking northwest to Wellesley-Parliament Square, image via submission to the City of Toronto

Looking northwest to Wellesley-Parliament Square, image via submission to the City of Toronto

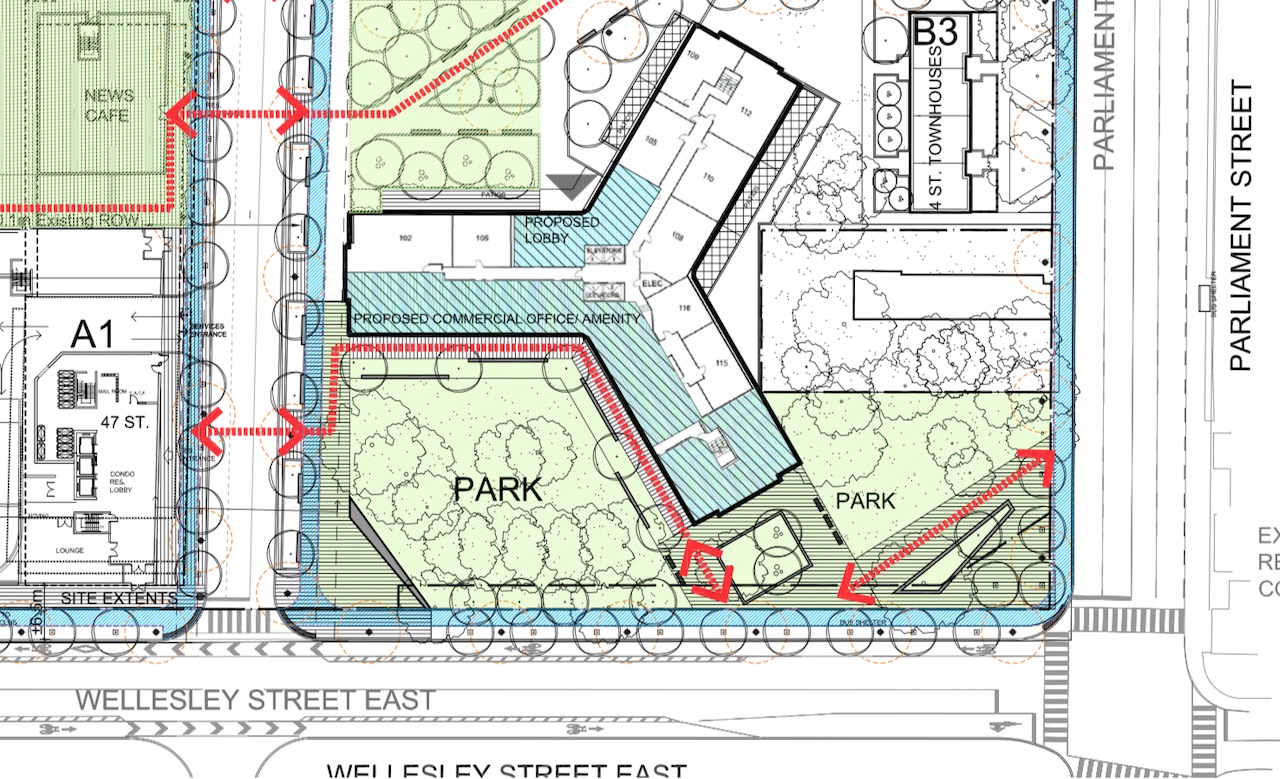

Planning for the site has been undertaken by IBI Group, Bousfields, and NAK Design Group. An approximately 1,210 m² park at the northeastern corner of Wellesley Street East and Rose Avenue—currently a strip of private land owned by Greatwise—would contain several soft and hard landscaping elements, including shade streets and street furniture. A five-storey office building with retail and a community facility was slated for this southeast corner of the site at Wellesley and Parliament in the initial proposal, but has been removed from the revised submission in favour of enhancing the new park.

Area proposed to be given to the City as park space, image via submission to the City of Toronto

Area proposed to be given to the City as park space, image via submission to the City of Toronto

Three publicly-accessible private open spaces (POPS) are also proposed within the revitalized Wellesley-Parliament Square. The most prominent would be an ‘urban plaza’, to be located adjacent to an existing pedestrian mews that would be enhanced to provide a direct connection between Ontario Street and Rose Avenue. The urban plaza will be designed to host a variety of programmed functions and informal gatherings.

West view through the proposed urban square, image via submission to the City of Toronto

West view through the proposed urban square, image via submission to the City of Toronto

The plaza fronts the extension of Rose Avenue from the south, a new public street that would replace the porte cochères for 240 and 260 Wellesley Street East. This new roadway will link north to St. James Avenue, where an elongated block of four-storey back-to-back townhouses is proposed to the west. The street could be extended north again in the future through adjacent Tower-in-the-Park properties, reconnecting the area back into the surrounding city road network.

South view from St. James Avenue to proposed POPS, image via submission to the City of Toronto

South view from St. James Avenue to proposed POPS, image via submission to the City of Toronto

Another street network improvement on the site is the realignment of St. James Avenue to create a normalized intersection with the extended Rose Avenue. The second POPS will be located at the southeast corner of this new intersection. A new private street between the easternmost tower blocks at 650 Parliament and 280 Wellesley would bisect two more four-storey townhouse blocks. An 11-storey mid-rise rental building would front this new roadway to the north.

Aerial view of the proposed mid-rise, image via submission to the City of Toronto

Aerial view of the proposed mid-rise, image via submission to the City of Toronto

The proposal would add 817 new residential units, 24 percent of which would contain two and three bedrooms. We’ll continue to track the development as it makes its way through the approvals process.

North view to Rose Avenue from Wellesley, image via submission to the City of Toronto

North view to Rose Avenue from Wellesley, image via submission to the City of Toronto

Source Urban Toronto. Click here to read a full story

What is Retail Industry facing now during COVID-19?

While the retail sector has had its share of challenges over the past few years, they pale in comparison to what it’s facing now.

“Never have we experienced a threat as acute as what we’re experiencing today, living with COVID-19,” said RBC Capital Markets Real Estate director Nurit Altman, who moderated an April 21 Canadian Real Estate Forums webinar dealing with the impact of the pandemic.

“The virus and corresponding shutdown are threatening the entire retail ecosystem, from supply chain to the retailers themselves, their landlords and their lenders.”

Jay Freedman is the executive vice-president of client relations and business development for real estate services firm Oberfeld Snowcap. Its retail advisory services include site selections, portfolio optimizations and retail restructuring in Canada and the United States for more than 200 retail banners.

Freedman expects the pandemic to force some retailers into bankruptcy.

“Seasonal product that is currently in the retailers’ locations is now worth basically 10 to 20 cents on the dollar,” said Freedman. “Beyond that is the product that they purchased for spring, and it doesn’t look like we’ll have much of a spring to operate and sell product.

“So all of those costs are now thrown out the door and the retailers are eating the cost of that product.”

Online shopping has risen considerably while physical retail outlets deemed non-essential have been closed.

Freedman said three-out-of-10 current e-commerce shoppers are new to it, which could hurt bricks-and-mortar retailers when they reopen if those people continue to shop online. He believes many of them will.

Government assistance to retail

Government assistance so far has helped small businesses or franchisees, and more relief is expected for retailers.

The federal government announced the Canada Emergency Commercial Rent Assistance Program on April 16.

It will provide loans, including forgivable loans, to commercial property owners who lower or forgo the rent of small businesses for April (retroactive), May and June.

Implementation requires partnerships between the federal and provincial and territorial governments responsible for owner-tenant relationships.

The program will eventually have an impact, but details are still being finalized.

Freedman said a large percentage of retailers will need bank loan restructuring, government relief programs, landlord assistance with rents and revised payment terms with suppliers to make it through.

Take the food and beverage sector, for example.

Restaurants Canada, a not-for-profit association representing the country’s food service industry, said two-thirds of the 1.2 million workers in the sector – a $93-billion industry – have lost their jobs.

In an April 2 update, it said nearly 10 per cent of restaurants had already closed permanently and another 18 per cent would permanently close within a month if current conditions continue.

Upon reopening, restaurants could face occupancy limits and may have to reconfigure tables to enable physical distancing, which could go on for a significant period of time. This limiting of clientele will cause further pain for owners.

Rent relief and negotiations

Like many retail CRE owners, Oxford Properties’ retail rent collections for April were hit hard by the effects of the COVID-19 pandemic. (Courtesy Oxford Properties)

Brad Jones is the head of retail for Oxford Properties Group, which owns 10 shopping centres and 14 million square feet of retail space.

More than 65 per cent of its retail tenants are fashion-related, the retail sector hardest hit by the pandemic. Thus, Oxford collected only about 20 per cent of its retail rents for April. Jones believes some retailers had the financial capacity to pay, but simply didn’t.

With April rent collection so low, and May’s due date rapidly approaching, Jones said Oxford will have to “compensate or assist retailers in the best way we can. We’ve looked at deferrals, we’ve looked at abatements and, quite frankly, we’re waiting to see what our federal government is going to propose in order to assist our industry.”

Oxford is owned by the OMERS pension fund, which must pay more than 500,000 pensioners each month: “We have an incredible amount of financial obligations to fulfill, just as the retailers do,” said Jones.

Jones said Oxford has received rent relief requests from about three-quarters of its retail tenants and is working with those businesses.

However, Oxford can’t deal with rent abatements or rebates now because it doesn’t know how long or deep this downturn will be, or what government assistance may be offered.

Banks must also be involved in negotiations, Jones added.

The one positive is essential service providers, needs-based retailers and banks, which governments have allowed to remain open, are operating and paying full rents at Oxford’s shopping centres.

Sunita Mahant is senior director of legal services for Ivanhoé Cambridge, which owns more than 20 shopping centres in Canada.

Institutional fund manager Caisse de dépôt et placement du Québec owns Ivanhoé Cambridge and has pension payment obligations similar to those of OMERS.

Mahant said Ivanhoé Cambridge has received a “large volume” of requests from retail tenants for rent deferrals. It offered them to some tenants for April and is monitoring the situation for May.

Requests are being evaluated and Mahant stressed the importance of mutual respect and effective communication to find workable solutions.

Minden Gross LLP partner Christina Kobi has been practicing commercial leasing law for 23 years, representing both tenants and landlords.

She said most landlords are dealing with tenant rent relief requests on a case-by-case basis instead of making blanket policies, which makes sense.

When it’s time for retail to reopen

Jones said Oxford is dealing with tenants through webinars and conversations to discuss staffing, cleaning and other protocols to prepare for the eventual reopening of shopping centres – hopefully this summer.

Jones stressed health and safety will be the top priority and openings may be graduated. Enhanced cleaning will take place, physical distancing measures will be in place and stores and malls won’t likely let as many people through their doors as in the past.

Oxford is considering opening its malls between 11 a.m. and 7 p.m. instead of 9:30 a.m. and 9 p.m. so stores can save money on staffing, as the earlier and later hours aren’t generally as busy.

Shopping centres with higher night traffic might stay open to 9 p.m., Jones said.

Jones hopes to be at 70 to 90 per cent of pre-COVID-19 customer traffic levels in September or October, and that sales will be at a similar ratio.

Freedman said in Asia, where stores have begun to reopen, foot traffic and sales are at 40 to 45 per cent of pre-pandemic levels so far. If that happens in Canada, it would make covering rent and other expenses difficult for retailers.

It will take a few weeks for retailers to ramp up and reopen, Freedman added, as they’ll have to clean and disinfect stores, obtain new product, hire back staff and change store layouts and protocols to better enable physical distancing.

Quiet enjoyment covenants

Kobi said some retail tenants have been looking at quiet enjoyment covenants and force majeure clauses in their leases to seek rent relief.

The quiet enjoyment covenant is an “expressed or implied covenant from a landlord which grants the tenant quiet enjoyment of its premises,” she said.

“This means the tenant has exclusive possession of the premises and access to the premises subject to the terms of the lease, without substantial interference by the landlord or any person claiming through the landlord.”

If the government forces building closures, or it is unlawful for buildings to remain open, this would be an owner’s defence against any breach of quiet enjoyment allegation, Kobi said.

“If your particular landlord has closed a mall or restricted access before the government-mandated closures began, or it continues with the restrictions after the closures are lifted, then maybe there’s an argument.

“But it’s important to remember that most quiet enjoyment clauses are qualified by the words ‘subject to the terms of the lease.’ ”

That means not being in default of your lease requirements: “tenants beware that you may lose your quiet enjoyment rights simply by not paying rent.”

Even if a tenant is successful in a legal action involving the quiet enjoyment covenant, Kobi said it’s only likely to receive a claim for damages at best, and not a rent abatement or termination right unless that was bargained for in the lease.

Force majeure clauses

Mahant said other tenants think they may have a case for rent relief through a force majeure clause in their lease.

“A force majeure is basically described as an event that is beyond a party’s control, preventing that party from performing its obligations under a contract or a lease.”

Force majeure clauses can vary and Kobi said those that don’t specifically mention pandemics or health emergencies don’t necessarily mean they’re not included.

“A triggering event has to make performance impossible,” she said.

“If you can rely on and choose to rely on your force majeure clause, just be mindful that you have a duty to mitigate the effects of the triggering event and take commercially reasonable efforts to minimize your losses.”

Kobi also pointed out most force majeure clauses are drafted to suspend rent obligations for a short period of time while an event is taking place: “It’s not an abatement and it’s not a termination unless it’s specifically provided for.”

The role of insurers

Kobi said many retail tenants have reached out to insurers to see if their financial hardships may be covered, but so far they haven’t had much success.

The precise wording of policies and coverage exclusions is important, and she recommends having lawyers look at policies.

Kobi said a national class-action lawsuit was filed on April 6 against some of Canada’s largest insurance companies for their “alleged refusal to pay coronavirus-related business interruption claims.”

Source Real Estate News Exchange. Click here to read a full story

RioCan, SmartCentres offer insight into pandemic impact

As unit prices take a hit from the general market downturn and measures to control COVID-19 — RioCan was off more than 40 per cent year-to-date (as of close April 21), SmartCentres down over 30 per cent, Choice down about nine per cent — the companies are focusing efforts to assist tenants and prepare their business to ride out the turmoil.

RioCan says it collected 66 per cent of expected rents (as of April 20) from its business tenants. It approved two-month rent deferrals for an additional 17 per cent (about $15 million in monthly revenues).

“The majority of our properties are considered beacons of the surrounding neighbourhoods where they are located and provide necessity-based essential goods and services during this health crisis,” said CEO Ed Sonshine in a release.

“We are committed to a high level of responsibility, access and support for our stakeholders so that these critical and essential services can be maintained.”

The numbers are similar for SmartCentres, which reported 70 per cent of expected rents collected, after deferrals which were granted to some tenants.

Update from RioCan

RioCan’s portfolio has undergone a significant repositioning during the past two years, with the divestment of most holdings in secondary or tertiary markets to focus on Canada’s six largest urban markets. It is diversifying the portfolio through new developments and redevelopment at existing retail properties.

“More than 90 per cent of RioCan’s portfolio is comprised of grocery-anchored centres, mixed-use / urban centres and open-air centres,” the release states. “Grocery-anchored centres alone accounted for 40.9 per cent of annualized rental revenue as of year-end 2019.”

Many of these anchor retailers are deemed essential services, so they remain open.

On the diversification front, RioCan received 96 per cent of expected rent from its two new multiresidential properties, eCentral in Toronto and Frontier in Ottawa.

The REIT’s support and rent deferral program has been focused on small business, independent tenants and smaller national tenants on a “case-by-case basis.”

As impacts from the pandemic continue, it is also willing to work with any national tenants “while protecting the trust’s rights and financial positions.”

$1B in liquidity

RioCan reports about $1 billion in liquidity as of the end of Q1 2020 consisting of cash, undrawn portions of its revolving unsecured line of credit and construction lines of credit. The trust also has $9.2 billion of unencumbered assets.

During the remainder of 2020, RioCan has about $126 million of mortgage maturities remaining, but it expects these to be refinanced “in due course.”

Its $400 million in debenture maturities in June and August 2020, RioCan says, have been effectively refinanced with a $350-million, seven-year inaugural Green Bond issue completed in March.

“RioCan’s solid foundation is its resilient, major markets-focused portfolio, which was built to withstand challenges and adversity,” Sonshine said in the release. “We are in good financial health with a strong balance sheet and ample liquidity.”

To preserve cash, RioCan’s crisis management team has reduced spending, including: municipal tax and HST/QST deferrals, energy reductions, maintenance and revenue-enhancing capital expenditure reductions, staffing level adjustments, and streamlining procurement and operating costs management.

Construction at most of RioCan’s current projects continues, albeit at a slower pace, but the trust is stopping “new or early-stage projects.” This will reduce planned spending on development by $100-to-$150 million during 2020, to the $350-to-$400 million range.

Finally, RioCan has withdrawn its growth guidance, and plans to provide a further update during its Q1 2020 investor conference call on Tuesday, May 5.

RioCan’s 2020 AGM is subsequently scheduled for Tuesday, June 2. It will be conducted as a “virtual” meeting.

RioCan’s portfolio includes 220 properties with a net leasable area of approximately 38.4 million square feet (at RioCan’s interest) including office, residential rental and 14 development properties.

SmartCentres update

Transit City Condos at the Vaughan Metropolitan Centre. (Rendering courtesy SmartCentres)

Like RioCan, SmartCentres is also engaged in a major overhaul and repositioning of its portfolio, including an extended $12-billion development program.

Sixty per cent of its current tenant base is deemed essential, including its largest single tenant WalMart which accounts for 25 per cent of SmartCentres’ rental income.

For businesses which are heavily impacted, the REIT has been “proactively reaching out” with support through a rent deferral program.

“The majority of our tenants are healthy and paid their rent. While we are disappointed by the non-payment of rent by some strong capable companies, we still believe that we will collect April’s rent in due course,” said president and CEO Peter Forde in a release. “We expect strong retailers to pay their rent obligations.

“This also enables us and our peers to support the smaller more vulnerable retailers through this difficult time.”

To provide additional liquidity if needed, SmartCentres has nearly $6 billion in unencumbered assets, a $500-million operating line of credit and project specific-financing for its ongoing developments.

While construction of several self-storage developments is on hold due too the pandemic, development at the Vaughan Metropolitan Centre continues within government restrictions. The first two condo towers remain on pace for unit closings in late 2020.

“SmartCentres was built for heavy weather,” said executive chairman Mitchell Goldhar in the release. “We have ample liquidity to weather the storm, for an extended period of time, if necessary . . .”

SmartCentres REIT has a portfolio of 157 Canadian properties valued at $9.9 billion. They comprise 34 million square feet of income-producing retail space with over 98% occupancy at December 31, 2019, on 3,500 acres of land.

Source Real Estate News Exchange. Click here to read a full story

VANDYK Mixed-Use Development with Integrated Mimico GO Station.

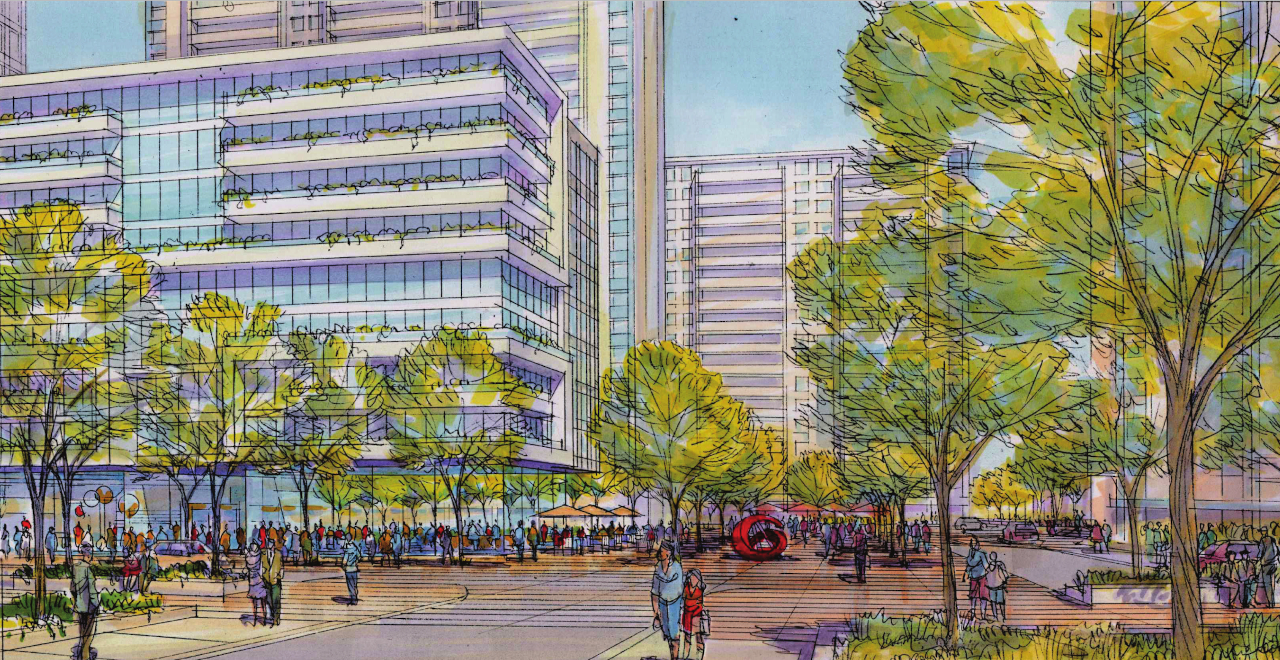

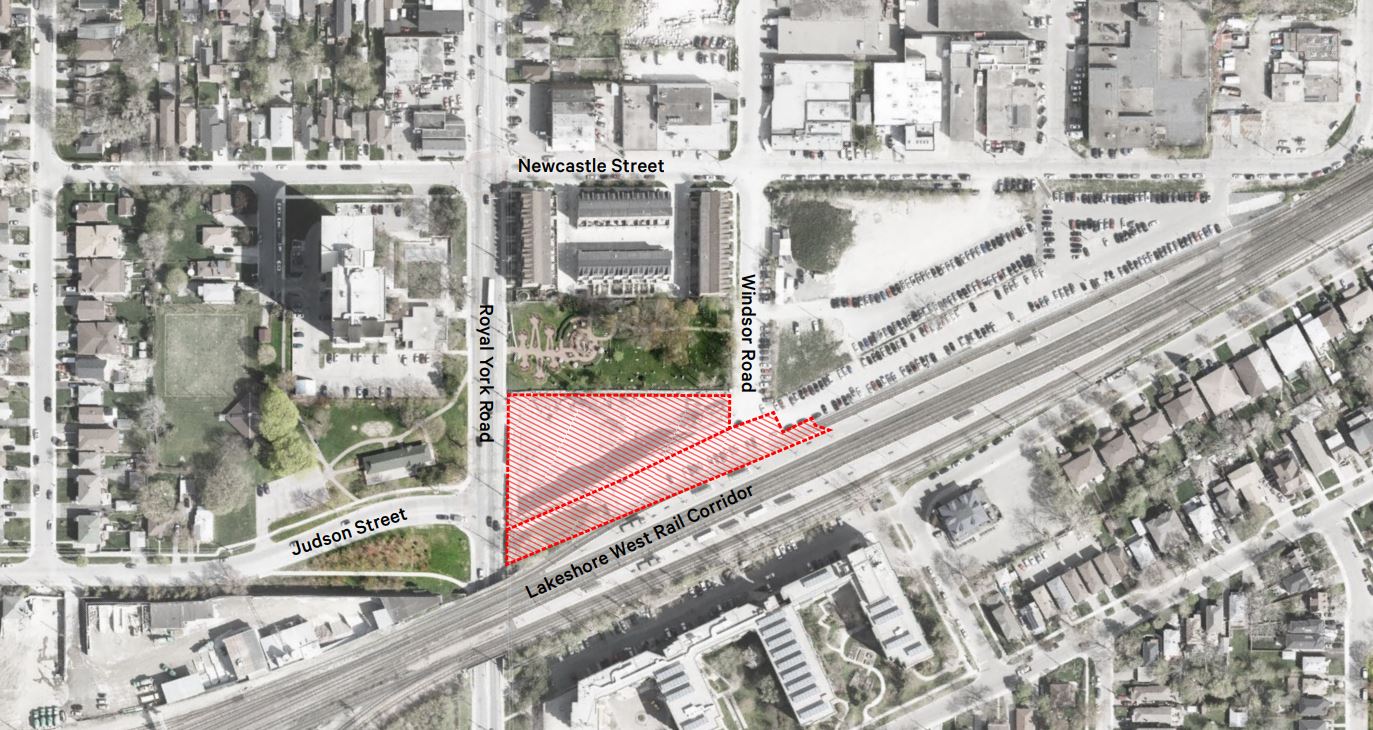

The languishing site of the On The GO Mimico condo development—which ceased construction before reaching grade when its developer failed—could soon be host to a two-tower mixed-use project. A rezoning application was submitted for the property at 327 Royal York Road in October, 2019 by VANDYK Group of Companies which envisions 29 and 44-storey residential towers and commercial space along with a reconstructed Mimico GO Station integrated into the podium.

The 27-storey, 242-unit On The GO Mimico project was placed into court-receivership in 2017 after developer Stanton Renaissance ran into financial problems. Metrolinx had partnered with the developer on the project, which would have contained 141 underground parking spots for GO commuters.

The site at 327 and 315 Royal York, image via submission to the City of Toronto

The site at 327 and 315 Royal York, image via submission to the City of Toronto

The development site is located directly north of the existing Mimico GO Station at 315 Royal York Road in the Mimico Triangle, an area currently characterized by light industrial land uses. Purchasing the property in 2017, VANDYK is the largest landowner in the area, and has proposed other high-density developments at 23 Buckingham Street and 39 Newcastle.

Looking northeast to 327 Royal York, image via submission to the City of Toronto

Looking northeast to 327 Royal York, image via submission to the City of Toronto

In October, 2018, Metrolinx announced that they had partnered with VANDYK in a deal which would see the developer pay for the construction costs of a revamped Mimico GO Station in exchange for the air rights above the transit hub. Mimico Station was built in 1967, the same year GO Transit began operation. Serving about 1,200 riders daily, ridership at the station is expected to triple by 2031.

VANDYK’s plan calls for 104.4 and 146.4-metre-high residential towers designed by SvN. There would be 499 one-bedroom units, 121 two-bedroom units, and 67 three-bedroom units for a total of 687 residences. Along the south face of the project facing the rail corridor, VANDYK proposes 8,809 m² of office space. A further 276 m² of retail and 1,096 m² of transit-related space is proposed. A combined 514 parking spaces for residential, visitor, office and retail users would be held within a three-level below-grade and a three-level above-grade garage. 103 of these on-site parking spaces would be reserved for commuters on the 315 Royal York portion of the site.

The reconstructed Mimico GO Station would include direct connectivity to Royal York Road, pick-up and drop-off spaces, a west tunnel providing platform access, a transit plaza, and bicycle facilities. A multi-use pedestrian and cyclist path would form part of the Mimico-Judson Greenway contemplated by the Mimico-Judson Secondary Plan.

View of the west facade along Royal York Road, image via submission to the City of Toronto

View of the west facade along Royal York Road, image via submission to the City of Toronto

Paying deference to the height of the townhouses to the north, adjacent to Christ Church Cemetery, the podium would rise four storeys. On the east and west sides, the podium climbs to eight storeys to accommodate parking and office spaces. The long east-west massing of the podium also has the benefit of mitigating noise for condo residents. Diagonal precast concrete fins are employed to frame views outwards and reduce solar heat gain. The cantilevered podium provides protection from the elements for GO commuters and Greenway users below.

Glazing, wood framing and wood fins are proposed as the primary materials cladding the new station. The north wall of the station building, which faces the Greenway, is imagined as a canvas for public art.

Sectional perspective of the podium, image via submission to the City of Toronto

Sectional perspective of the podium, image via submission to the City of Toronto

The towers adhere to the 750 m² floor plate and 25-metre tower separation policies under the City of Toronto’s Tall Building Guidelines. Two-storey faceted precast panels are applied uniformly across the two towers, continuing the architectural expression established on the podium. Indoor amenity spaces are proposed on the fifth and ninth floors and would provide for views to the exterior terraces and green roof spaces.

In their 2018 announcement, Metrolinx said a temporary station will be in place by 2023 while the new building is constructed. The rezoning application is currently being reviewed by the City.

Source Urban Toronto. Click here to read a full story

Commercial Office and Residential Development Complex Proposed at Jane and Hwy 7 in Vaughan

Approaching two and a half years after the TTC subway’s first train to its new northwestern terminus at Vaughan Metropolitan Centre station, the surrounding area is a hotbed of construction activity and large-scale development proposals, part of the suburban city’s new Downtown forming around Jane Street and Highway 7. At the northwest corner of that intersection, an approximately 1.2 hectare/2.9 acre site is the location of a recent proposal from developers Aspen Ridge Homes and Metrus Properties that would bring three towers with residential and office uses to 7800 Jane Street.

Site of 7800 Jane, image via submission to City of Vaughan

Site of 7800 Jane, image via submission to City of Vaughan

Currently, home to a gas station and low-rise commercial and retail building, the site’s prominent location is poised for a major boost in density, with the Quadrangle-designed project proposing 50 and 60-storey residential towers with heights of 163 and 193 meters, along with a 17-storey office building rising 81.5 metres. These buildings, joined by a block-long mid-rise podium, would contain approximately 126,743 m² of combined gross floor area (GFA).

Looking northwest over 7800 Jane, image via submission to City of Vaughan

Looking northwest over 7800 Jane, image via submission to City of Vaughan

The tower heights increase from south to north. The 60-storey north tower would contain a total of 576 units, proposed in a mix of 48 studios, 270 one-bedrooms, 199 two-bedrooms, and 59 three-bedrooms. To the south, the 50-storey tower would contain 456 units in a mix of 38 studios, 210 one-bedrooms, 159 two-bedrooms, and 49 three-bedrooms. An eight-storey podium connecting the residential and office towers would contain ground-floor retail space, as well as another 171 units in a mix of 15 two-storey townhomes, 12 studios, 122 one-bedrooms, 21 two-bedrooms, and a single three-bedroom unit. In total, 1,203 residential units are proposed across the site.

At the south end of the site, fronting the Jane and Highway 7 intersection, the 17-storey office tower would contain 20,093 m²/216,279 ft² of commercial space.

A mix of underground and above-ground parking is proposed, with all buildings to be served by a combined two levels of underground parking containing 565 spaces for visitors, office and retail uses, and 678 residential spaces on the ground floor that would be wrapped by residential units.

The lone rendering included with the planning documents, and supplemented by massing diagrams, shows off a prominent rooftop design feature for the two residential towers, with cube-like cutaways from the traditional rectilinear condo massing, forming a series of upper level terraces.

7800 Jane, image via submission to City of Vaughan

7800 Jane, image via submission to City of Vaughan

The office tower to the south would feature a mostly rectangular massing but marked by rounded corners, responding to the intersection and helping to frame a new public space proposed at ground-level.

Source Urban Toronto. Click here to read a full story

Canadian hotels have been major victims of COVID-19

Canada’s hotel sector was hit early and hard by the COVID-19 crisis, and a March 16 webinar addressed stakeholders seeking solutions and grappling with challenges.

How bad are things? Colliers Hotels managing director Robin McLuskie, who co-moderated the webinar with CFO Capital president Mark Kay, outlined these hard facts to 1,000 viewers — the maximum amount of people who could access the stream:

* More than half of all hotels are now closed across Canada.

* The hotel industry has laid off 80 per cent of its workforce . . . about 250,000 employees.

* The national hotel occupancy rate for the week of April 5-11 was just 12 per cent.

* Revenue per available room is down 85 per cent to just $12.

“We are a resilient industry and have experienced being on the front end of downturns before, so we will recover from this,” said McLuskie. “It’s just going to take some creativity and collaboration so that we can really make an impact.”

What follows is an overview of what the five panelists had to say about their organizations and the sector.

Accent Inns

Victoria-based Accent Inns has been owned and operated by the Farmer family since 1986. Mandy Farmer succeeded her father Harry as president and chief executive officer in 2008.

Five of Accent’s British Columbia properties are open, two have been closed and there’s one under construction. Farmer said the chain’s occupancy rate is about 50 per cent, including the closed locations.

Accent established protocols and procedures for keeping employees safe and welcoming guests early on, and Farmer said it’s “weathering this crisis fairly well.”

Accent is focusing on healthcare and other front-line workers concerned about putting family members at home at risk, but who were reluctant to utilize hotel rooms for a variety of reasons, including cost. It has partnered with United Way to raise money to house some of these people.

Accent has also involved community members and elementary school students to show support for front-line workers at its properties, including writing and leaving thank-you notes on their doors and giving them chocolate for Easter.

A restaurant in Victoria provides free meals to healthcare workers staying at the local Accent Inn.

Farmer has spoken with other hotel operators considering repurposing their properties into condominiums, rental apartments or seniors facilities because “we’re going to have a major recession following this.”

Even if expenses can be deferred, some hotels still might not have the revenue to cover them, according to Farmer. She thinks business travel will decrease next year and is concerned about the risk of future pandemics.

“Even when the crisis is over, I think that the hotel industry is going to suffer longer,” said Farmer. “I’m not as optimistic as I used to be.”

D.P. Murphy Group of Companies

Charlottetown-based D.P. Murphy Group of Companies was founded in 1980. It owns and manages 13 hotels with 1,400 rooms in Eastern Canada, as well as 60 restaurants under brands including Tim Hortons, Wendy’s, The Keg Steakhouse + Bar and Boston Pizza.

CEO Jeff Appleton joined the company three years ago after prior experience as a hotel developer, owner and operator in Canada and the U.S.

He said D.P. Murphy started making COVID-19 plans on March 8 and has since closed nine of its hotels. The four that remain open have single-digit occupancies and many guests are corporate clients.

The Atlantic Canada hotel market has a heavy seasonal component, and D.P. Murphy occupancies were in the 50 to 60 per cent range before COVID-19 really took hold, ending most travel.

D.P. Murphy has developed new cleaning policies, and Appleton said it’s keeping engaged with staff and guests and building plans for when “somebody hits the green button.” May 15 is the most optimistic date for a partial reopening to begin, according to Appleton, but that will still involve restrictions.

Many big functions normally held in the summer won’t happen this year, and international traveller numbers will be down considerably.

So, D.P. Murphy will focus on marketing and catering to local markets, including relationships “with all of the major nursing home providers and folks who may or may not need our services at some point.”

Appleton expects more government programs for the hotel industry will also gradually help right the ship.

“2020 is already in the bag and it’s going to be pennies on the dollar in revenue,” said Appleton. “But we’re going to use our time and our efforts to be ready for 2021.”

By 2022, Appleton expects business to return to at least 75 per cent of 2019 numbers.

“It’s multi-year, it’s not multi-quarter,” he said of the recovery. “I don’t think that any of us have to be converting ourselves to other uses or worrying that our industry is going to die.

“It’s going through a rough period and we’re going to be some of the hardest hit, but this too shall pass.”

Groupe Daca

Bertrand LeBoeuf founded Groupe Daca — a general contractor, developer and operator of Quebec real estate projects — in 1979. The firm has:

* developed and sold more than 1,500 condominium units;

* developed, owns and operates 800 apartment units;

* and developed and owns more than 1,000 hotel rooms, primarily Hilton and Marriott franchises in Montreal.

Some of Groupe Daca’s hotels remain open, while those catering primarily to tourists were closed following a cash-flow analysis. Stringent hygiene protocols have been put in place for employees and guests.

“We’re looking for the business market, but of course there’s not a lot of business in Montreal now, so the occupancy is extremely low,” said LeBoeuf. “But, we’re trying to get some of the government market and medical market.”

LeBoeuf said Groupe Daca is also looking at getting residents of nursing homes not affected by COVID-19 into its hotels. Some seniors residences have been hit particularly hard by outbreaks of the virus.

The low apartment vacancy rate in Montreal has also led Groupe Daca to establish 30-day, extended-stay programs that can include meals and amenities at its hotels.

LeBoeuf believes American tourists will return to Quebec once travel restrictions between Canada and the United States are lifted, though he thinks more will drive than fly.

He’s hopeful a vaccine will become available next year, leading to a turnaround through 2021 and return to pre-COVID-19 levels in 2022.

Pomeroy Lodging

Pomeroy Lodging CEO Ryan Pomeroy. (Courtesy Pomeroy)

Grande Prairie, Alta.-based Pomeroy Lodging employs 2,000 at more than 20 hotels and resorts in smaller markets in Alberta, B.C. and Alaska.

CEO Ryan Pomeroy said the executive team turned into a COVID-19 task force on March 9. Each member focused on different areas, covering fixed-cost reductions, labour plans for each property, government aid, customer and employee communications, liquidity planning, cash-flow forecasting, lender relationships, cleaning standards and more.

Pomeroy said daily conference calls were held for the first three weeks, and are now held weekly.

While the company has been forced into layoffs, Pomeroy said it continues to extend benefits to all employees. Any employees living on Pomeroy properties are allowed to stay rent-free.

Pomeroy is focused on maintaining strong relationships with oil and gas industry and infrastructure construction customers, major occupants of its limited service properties in secondary and tertiary markets.

Many workers want to get out of large workforce housing sites and camps near some of those markets because it’s difficult to maintain physical distancing. He sees Pomeroy properties as a viable alternative.

Pomeroy’s marketing and staffing strategies at its resorts will also be locally focused.

Summer job offers have been revoked at the Kananaskis property so laid-off, full-time employees can get back to work first. Food, beverage and catering have been merged into one large department.

“You have to be prepared to be in a very difficult situation for years,” said Pomeroy, who doesn’t see a return to pre-COVID-19 global travel levels until 2022.

“If you stay focused and accept your current realities and don’t get too in love with the system or process you’ve built, and you’re able to dismiss that and say in the next quarter ‘I need a new system and process to survive my new reality,’ you’ll be ready when things turn around.”

Hotel Association of Canada

The Ottawa-based Hotel Association of Canada serves the industry through member engagement, advocacy and the provision of programs and services.

President Susie Grynol said its virus response team has “been intimately engaged with our owner community in the formulation of our key asks to government.”

Grynol said the hotel industry was one of the first “sounding the alarm bells that we were about to hit an iceberg.” It continues working with federal officials on three areas of focus: employment, liquidity and recovery.

“We’re looking for a stimulus package from the government to ensure that we can rebound quickly and strongly out of this pandemic,” said Grynol, who’s been HAC president since 2016.

“The biggest wins for our sector to date are probably the wage subsidy program, GST and mortgage deferrals, and the $40,000 loan for some of our smaller members, and we just saw some extensions of that program.”

HAC will continue to push for additional federal support for the hotel sector, and Grynol believes it will come.

“The government is partial to supporting small business, and there’s a perception of our industry that we’re a big business of big American chains,” but Grynol said that’s not the case. She said 60 per cent of the Canadian hotel industry is independently owned and 87 per cent fits the government’s definition of small and medium-sized businesses.

HAC regularly posts updates and information at its COVID-19 portal. It has also extended free membership to anyone who wants to join and access information, and hosts weekly webinars.

Source Real Estate News Exchange. Click here to read a full story

“How to appraise commercial properties while considering the impact of COVID-19?”

Most are concerned that commercial properties have substantially decreased in value.

It has been said to me: “How is it possible to appraise properties while considering the impact of COVID-19?”

Many have suggested that appraising real estate in this environment is equivalent to appraising with a blindfold on. The reality is, the job of an appraiser is more difficult than it has been in many years, but the job is not impossible.

As appraisers, we rely on historical property data, but rarely is this data perfect.

This profession is an art, not a science, and thus we must use data and information available to us, as well as our experience, to provide our opinion on a property’s value. This is the new normal in the appraisal profession and as appraisers, we must adapt.

That being said, what is my opinion? Have commercial property values dropped 15 to 25 per cent, similar to the stock market? Are cap rates now seven per cent-plus across Canada for all asset classes? Should I sell my real estate and buy gold?

No, no and no.

Breaking down asset classes

Commercial real estate in Canada is a stable and secure means of investment and the vast majority of properties will be impacted nominally by the COVID-19 pandemic.

The most substantial impact will be on retail properties where multiple tenants are distressed and seeking rent relief. The retail market will see the biggest shift as a result of COVID-19.

This asset class was already undergoing a massive transformation with more and more purchasers moving to online shopping as their primary means of acquiring goods.

The COVID-19 pandemic has accelerated this trend, and as a result, many retail developments will need to be repositioned or redeveloped.

Nonetheless, those retail developments with strong tenancies – like grocery-anchored retail developments with smaller tenant bays – will continue to perform well and be in demand from purchasers.

The impact on the office market is the most difficult to predict. The world is currently undergoing the largest work-from-home experiment in history.

Every company in Canada was forced to adapt to a work- from-home system in a few short weeks and many may embrace that it is both cheaper and more efficient to have staff work from their homes on a full- or part-time basis.

The result on office vacancy and rental rates remains to be seen.

Nonetheless, office buildings with strong tenant covenants and little vacancy will continue to be sought after by buyers.

Multifamily likely to be in demand

Multifamily assets will likely experience increased demand from investors given their resilience for weathering the economic downturn.

The income risk is spread over a large number of units and landlords can use potential requests for rent relief as a tool to lock in tenants at today’s rental rates for extended terms, resulting in strong, longer-term occupancy.

Further, many national owners with large shares of office and retail product may look to multifamily assets as a way to stabilize and diversify their portfolios.

Industrial assets will generally go back to normal upon resolution of the COVID-19 pandemic, as demand for the products and services they provide stabilizes.

Further, this asset class will benefit from the inevitable explosion of demand for online shopping fulfillment facilities.

The number of online shoppers has increased exponentially in the last three weeks but with that, the consumer expectation for delivery times will also increase.

Customers will no longer wish to wait multiple days to receive their goods and will flock to online retailers that can provide the shortest delivery time.

This situation will further increase demand for industrial distribution facilities in markets across Canada.

Ultimately, properties whose net operating incomes and stability are impacted will see the greatest decreases in value. Irrespective of the asset class, if multiple tenants require rent relief or go dark, the immediate term net income will be impacted, as will the value.

Creative landlords who can find ways to preserve tenancies without a substantial reduction to income will weather this storm best.

Thankfully, Canada has no shortage of creative and capable landlords who will certainly find ways to preserve and stabilize income streams from their commercial assets.

Key factors in appraisals

As appraisers, when valuing these assets, we must work to determine what the net operating income is today, and for the next 10 years.

Increased focus will be placed on the Discounted Cash Flow method as it allows us to effectively estimate the current and future income of a property.

When valuing an income-producing asset with a large number of tenants seeking rent relief, increased consideration will need to be placed on the following points:

- How likely is it that a particular tenant will go dark?

Multiple businesses are going to close permanently in the coming months; others will go dark in the coming years, unable to recover from the impacts of COVID-19. There will now be a much larger focus on the financial covenants and anticipated performance of the tenants within a particular building, such that we can project the likelihood of them fulfilling the rental obligations set out within their lease agreements.

- If the tenant is not anticipated to go dark, what does the rent relief provision offered by the landlord look like and how does it impact income?

Landlords will take many different routes in attempting to retain struggling tenants. It’s crucial that appraisers intimately understand any rent relief provisions provided and accurately consider them within an appraisal.

- For those tenants that do vacate, how long will it take to lease up the newly vacant space?

Appraisers will need to consider total market vacancy and anticipated new demand. In many cases, lease-up times for newly vacant space may be well in excess of one year.

- What is a reasonable stabilized vacancy allowance for the asset?

In some cases, where historically we may have used three to five per cent, certain assets may now be stabilized at 10% to 15%.

- What rates of return are reasonable to apply to the projected income?

As the capitalization rate is a function of upside and risk, it’s important to note that the more speculative an income stream is, the higher the expected return rates will be. That being said, assets with a strong mix of tenants, all of whom continue to pay rent, should not see an increase in capitalization rates although assets with increasingly speculative income will see a notable increase in the utilized capitalization rate.

With all this being said, is being an appraiser today more difficult than it was four weeks ago? Yes.

Is it impossible? No.

We will adapt to this new reality, and continue to provide well-informed and reasonable opinions on property values. Please feel to reach out to me with any questions or comments.

Source RENX. Click here to read a full story

The Commercial Real Estate sector could take as long as 30 months to rebound.

Commercial Real Estate recovery will trail the economic rebound and will span 12 to 30 months, depending on the sector.

As Recession Timeline Emerges, Canadian Sectors Scramble For Relief.

The commercial real estate sector could take as long as 30 months to rebound from the world’s ensuing recession, a new report says.

“CRE recovery will trail the economic rebound and will span 12 to 30 months, depending on the sector,” concludes a recent CBRE report from the U.S.

The report also projects that markets like industrial and logistics on a 12 month recovery plan, while multifamily will take longer at 18 months. “Facing a longer recovery of up to 30 months are the retail, food and beverage and hotel sectors,” it reads.

“Wow. That’s a big number,” said Erik Joyal, a spokesperson for the independent restaurant group SaveHospitalityCA. “That’s a little unsettling.”

To be fair, Canada is not the United States. The coronavirus is not and did not affect us quite the same way, nor will it likely in the future.

Still, the hospitality business is not in business and likely won’t be in the near future.

“We need a government commitment before we even reopen,” said Joyal, who speaks for 90,000 members of the Canadian independent restaurant industry. “If recovery could take a year or more, we need to address the specific needs of this industry now. We need to move forward to prevent mass closings.”

SaveHospitalityCA has already contacted the Prime Minister’s Office, the Ministry of Finance and the Ministry of Small Business. Its message, contained in a detailed recovery action plan, is blunt.

“This is not a cash flow shortage, but a complete termination of cash flow,” it reads.

“Our businesses are like freight trains: they take a lot of energy to start up and a lot of energy to slow down; and now we have suddenly experienced a violent derailment. For the sake of all of our employees and their families, we implore your immediate support and attention in helping us get back on track.”

Joyal said that in this case, there is strength in numbers, particularly for a sector that has had difficulty coalescing in the past. “

There’s 90,000 of us. Something with real teeth,” Joyal said. “We never had a voice before.”

To be clear, the organization is not talking about short-term solutions like the federal government’s weekend announcement of a $73B small business program.

Instead, the group is also putting forward a comprehensive recovery and long-term plan for the restaurant industry, which Joyal said is unlike any other business.

”Restaurants are different in a lot of ways. We are very cash-flow intensive. There’s a big capital expenditure to open. [You have to] buy food, rehire labour. We require a huge amount of money and labour to achieve $1M in revenue.”

As the fourth largest employer in Canada, holding an estimated 1.3 million jobs, restaurants account for 7% of the country’s workforce.

They are also the largest segment of EI right now, making getting them back to work all the more important, economy-wise.

“We need an industry-specific response from all levels of government at the same scale or higher as that [afforded] to so many other industries in their times of crisis,” Joyal said.

Still, just because you open for business doesn’t mean people will show up. Or eat.

A recent survey by McKinsey & Co. showed that Canadian consumers have a negative view about the economic recovery, more so than their southern counterparts.

The report said that almost 80% of Canadians are unsure or pessimistic about Canada’s economic recovery following the coronavirus crisis, while 53% live pay cheque to pay cheque. ”

[Recovery] is not like turning on a light,” Joyal said. “People aren’t going to come back to restaurants in the same way as before. They won’t have the discretionary income to do that. We need a government commitment before we even reopen.”Source BisNow. Click here to read a full story