Bill Pratt hasn’t paid some $70,000 in rent for his restaurants in Atlantic Canada since April after having to shutter operations due to the COVID-19 pandemic and experiencing a “critical” sales drop.

“There’s no way I can make it,” said Pratt, the CEO of Chef Inspired Group of Restaurants and Food Trucks. “I can’t pay 100 per cent rent with no income.”

When the federal government announced a new measure aimed at reducing rent for small businesses by three quarters, it sparked hope of survival among restaurateurs like Pratt. However, without buy-in from landlords — some of whom have decided to take a wait-and-see approach due to what they say is a lack of clarity — the program will fail to provide relief to those who need it most.

The Canada Emergency Commercial Rent Assistance program will allow landlords to apply for government funds to cover half of rent payments for small businesses, up to $50,000 a month, with tenants paying 25 per cent. Landlords would forfeit the remaining 25 per cent.

Pratt deals with seven landlords across 10 locations for his 22 restaurants spread out across Nova Scotia, New Brunswick and Prince Edward Island.

He wrote to all of them to inform them he wouldn’t be able to pay April’s rent, but said most didn’t respond. Once April 1 arrived, so did some default letters. Pratt told his landlords he wanted to work out an arrangement other than rent deferral as he can’t afford to push the bills into the future.

As he started reopening some locations for takeaway and delivery, the government announced its rent relief measure. Pratt was hopeful he could use the money from the limited sales he’s making to pay his share of rent on all his properties — so long as his landlords agreed to apply.

“So far … I’m six for six that don’t want to do this,” he said.

Other landlords, including big real estate trusts like RioCan, have said they’d be open to considering the program.

“We believe it’s incumbent upon us to actively consider participating,” said RioCan president Jonathan Gitlin on a conference call last week.

But RioCan and others in the industry say there’s still too little detail to decide yet.

“It’s too early to tell how cumbersome it’s going to be,” said Michael Brooks, CEO of landlord industry group Realpac.

“No one can make a decision, they’re frozen, until such time as we see all of the details, and we just don’t have them.”

Some of the unknowns include how landlords will verify that tenant earnings are down, what happens if a tenant doesn’t pay their share, and what happens if tenant revenues recover partway through the program. The application process has not yet opened, though it is expected this month according to the CECRA website.

Some landlords will likely also hold off on the program in the hope of recouping full rental fees, said Brooks.

“You’re going to have some who foolishly, I think, will think that if they refuse to cut any slack for a tenant the tenant’s just going to pay anyway and they’ll still be there when the smoke clears. I don’t think that’s the case.”

Other landlords might choose instead to continue with the rent deferral programs they’ve already set up, said Brooks.

Raffaele Morana re-opened Bar Volo at a new Toronto location in October 2019, only to close down mid-March due to the pandemic. He’s since re-opened as a retailer, selling alcohol and some food, such as spices and fish tins, in an effort to make some money.

He worked out an agreement with his landlord, whom he would not name because he doesn’t want to damage their relationship, to pay rent twice a month as opposed to in one monthly sum, but won’t qualify for CECRA in part because he re-opened for some sales.

In order for landlords to qualify, tenants must be closed temporarily or have experienced at least a 70 per cent drop in revenue compared to the same time last year, according to The Canada Mortgage and Housing Corporation’s website. The CMHC administers the program on behalf of the federal, provincial and territorial governments.

Since Morana’s bar wasn’t open between April and June 2019, he must compare his current revenues against an average of this past January and February — two of the slowest months of the year, and a period that saw a two-week closure at Bar Volo for staff vacations.

He falls a few per cent shy of the 70 per cent revenue drop requirement.

“They have to change it,” he said, noting he’s being penalized for staying open.

Even if the government changed the criteria, it’s unclear if Morana’s landlord would even apply, let alone qualify.

His landlord’s “initial impressions” of the program are that the “eligibility rules are in need of explanation and clarification, and … there are fundamental flaws that need to be overcome,” according to a letter shared on Bar Volo’s Twitter account, dated May 5, that Morana says is from his landlord.

“Accordingly, the landlord is not, at this time, in a position to make a decision of whether or not they will opt into CECRA.”

Morana said he found the letter disappointing, though he is sympathetic to the fact that the program is creating confusion.

One of Pratt’s landlords agreed to apply for the CECRA program if Pratt repaid him the 25 per cent in rent that’s meant to be forgiven, which amounts to a little over $560 monthly, throughout 2021.

“… I would like to defer this portion of the payments for one year, and have repayments commence January 1, 2021 and ending December 31, 2021,” reads an email from landlord Abe Salloum dated May 7 and provided by Pratt to The Canadian Press.

“This will provide you the opportunity to get the business up and running successfully and give you time to prepare the adjustment to your monthly rent payments.”

The email had a rent deferral contract attached, which Pratt refused to sign. He has also received a default notice for the location.

According to CMHC’s website, Salloum’s demand that the outstanding 25 per cent of the rent be paid back is contrary to the rules of the program, which state that property owners are “to not seek to recover rent abatement amounts after the program is over.”

Salloum did not reply to requests for comment.

“I said it flies in the face of the prime minister and the premier, you know, the spirit of this program,” said Pratt.

Neither Pratt nor Morana know any restaurant owners whose landlord has agreed to apply for CECRA.

“I’ve talked to a lot of people. No one’s heard anything from their (landlord),” said Morana.

“Well, they’ve heard from their landlords. They’re not doing it.”

Eve Schwarz manages a few properties in Toronto that she and her father own, and has already cut rent for her struggling tenants. She hopes to be able to apply to a government program to ease the loss of income, but with no mortgage she’s waiting on details for a promised second program since the main initiative requires one.

She said she doesn’t understand landlords who aren’t being flexible during these times, and that it’s important to think about the longer-term health of local business.

“How is that going to benefit me to have empty space that I can’t rent in the next two or three months, because things aren’t going to normalize until late summer, early fall.”

She said that delays in rolling out the program, however, are already having an effect.

“Given the fact that so many small businesses haven’t survived the first two months, there’s going to be a lot of vacant storefronts, so I guess that would be the frustrating part, that it took so long.”

Source The Star. Click here to read a full story

The COVID-19 pandemic is affecting commercial real estate investment in different ways in different areas of the world.

A May 6 Real Estate Forums webinar examined how, through the early days of the pandemic, major Canadian and international investors are adjusting portfolio and investment strategies. The panel was moderated by Brad Olsen, founder and president of Atlantic Partners, Ltd., who has been active in international real estate investment for more than 35 years.

The Cary, N.C.-headquartered firm was founded in 1995. It helps clients design and implement cross-border real estate strategies and is active in the United States, Germany, the United Kingdom and the Netherlands.

Olsen spoke to executives from five companies who signed in from different parts of the world.

Manulife Investment Management

Ted Willcocks is global head of asset management for real estate for Toronto-headquartered Manulife Investment Management, which invests in North America and Asia.

The global wealth and asset management segment of Manulife Financial Corporation has $956 billion (all figures Cdn, unless otherwise noted) in assets under management and administration globally.

Manulife has continued to be active with deals originated before the COVID-19 crisis. It closed on a $140-million logistics property in Wuhan, China, generally considered ground zero for COVID-19, a month ago.

Manulife’s Asian teams are now two months ahead of its North American teams as that part of the world was hit hard by the virus earlier and has started its recovery.

Willcocks sees great opportunities in Australia, Indonesia and Vietnam and expects to see Asian deals brought to the investment committee in the next quarter.

Manulife is selling properties in Tokyo and Willcocks said it has received solid bids.

Willcocks also expects to close its next deal in the U.S. logistics property sector late this quarter, or early in Q3.

Willcocks said Manulife has been examining its portfolio and trying to get a better handle on pricing, rent rolls and credit quality of assets when underwriting deals.

Bouwinvest Real Estate Investors

Stephen Tross is chief investment officer (CIO) of international investments for Amsterdam-headquartered Bouwinvest Real Estate Investors, one of the largest real estate investors in The Netherlands and a major international real estate investor.

It manages $18.5 billion in assets in five Dutch property sector funds and three international real estate investment mandates in Europe, North America and Asia-Pacific.

Bouwinvest just made a major investment in a Chinese logistics property in a deal that was in place before COVID-19 struck.

One of its strategies is to invest in key logistics assets in selected Chinese cities within four regions with attractive macro-economic fundamentals and strong supply and demand dynamics.

Tross said the Chinese logistics sector is growing, driven by continued urbanization, increasing disposable incomes and a rise in e-commerce.

Just four per cent of Chinese logistics facilities are professionally managed and with modern, international specifications, according to Tross. The supply of logistics land is restricted, which limits the risk of oversupply.

Bouwinvest may be able to take advantage of the financial damage COVID-19 has caused and Tross expects to close on its first such deal this quarter.

“A market correction creates interesting opportunities, because some parties get into financial distress or otherwise need liquidity. We are very well-funded and capitalized, so we still have money available to invest in all three regions.”

Twenty-five per cent of Bouwinvest’s international portfolio is in publicly listed real estate securities.

REITs have been recovering after unit values in the sector dropped by about 30 per cent in March, but Tross sees them as long-term investments and believes there may be purchase opportunities in undervalued logistics and housing REITs.

Bouinvest invests on behalf of more than 20 pension funds. Tross said the largest of those funds has historically made a large allocation to real estate and will continue to do so because it’s more stable and reliable than stock markets.

Netherlands multifamily assets comprise the biggest part of Bouwinvest’s portfolio and Tross said the large majority of tenants have paid rents as normal.

Bouwinvest’s pension fund investors advised it to be accommodating when dealing with tenants with rent payment problems, he said.

“They’re well aware that we need to come out of this crisis together, and they are giving us the leeway we need to act accordingly,” Tross said.

“We have agreed not to evict any tenants who cannot pay their rent during this period and we’re being flexible on deferrals. We have also decided to postpone the annual rent increases.”

Baring Private Equity Asia Real Estate

Mark Fogle is the Singapore-based managing director and head of real estate for Baring Private Equity Asia (BPEA), one of that continent’s largest independent private equity firms, with $28 billion worth of assets under management.

The company was established in 1997 and has offices in Hong Kong, China, India, Singapore, Australia and Japan.

BPEA Real Estate is an extension of the company and has invested more than $7.8 billion in 125 properties.

“We believe that China is recovering much faster than the rest of the region,” said Fogle, who noted the firm closed an acquisition on March 31 and had to do its due diligence virtually due to COVID-19 restrictions.

BPEA Real Estate believes in China, will continue to invest in Japan and is hoping to see activity in Australia, according to Fogle.

It will look at Singapore if it can enter at the right cycle, but he said the city-state has plenty of office development and retail has always been overbuilt in Asia.

Fogle said BPEA Real Estate’s first two funds have no exposure to the hospitality or retail asset classes outside of one 1,500-square-foot coffee shop. Its investment mix is approximately 60 per cent logistics, 25 per cent multifamily and 15 per cent office.

Fogle said some sellers’ expectations are above where his company thinks they should be, and the pandemic should lead to lower property valuations.

BNP Paribas Real Estate

Nathalie Charles is deputy CEO in charge of investment management for Paris-headquartered BNP Paribas Real Estate, which manages $46 billion in European real estate on behalf of more than 200 institutional clients and more than 100,000 individual clients. It’s present in 32 countries, mainly in Europe.

BNP Paribas closed a deal in Europe at the end of March while the continent was essentially locked down.

It has remained active during the pandemic, Charles said. BNP Paribas looks at the specific fundamentals and upside when considering an acquisition, as opposed to shopping for a specific asset class or looking in a particular market.

BNP Paribas has a big presence in Paris, Frankfurt, Munich and Milan. Charles stressed the importance of having local teams because, despite being part of the European Union, governments in different countries have taken different measures during the pandemic applicable specifically to tenants.

She said there can also be regional differences within countries when it comes to dealing with landlord-tenant relationships.

There has been much pressure in some European countries regarding postponing rents for small businesses and retailers to support the economy and employment.

Charles said BNP Paribas is trying to balance these concerns with those of investors looking for quarterly returns and continued profits.

BNP Paribas is the third-largest real estate investor in Italy and will continue to be a major player there while also remaining active in Germany, according to Charles.

Union Investment Real Estate GmbH

Martin Brühl is the CIO and a member of the management board for Union Investment Real Estate GmbH. The Hamburg-based company is the largest German real estate investment manager and is active in multiple property sectors in Europe, Asia and the Americas.

Union has 381 properties worldwide valued at $66.4 billion.

The company signed a $305-million deal for a core office asset in Hamburg in early May that will be announced soon. Brühl said the investment committee will soon look over a large logistics deal in Germany.

“I think business will become more local for the foreseeable future because there are still travel restrictions, a fear of people crossing borders, and there can be an inability to access buildings,” said Brühl. “That is going to change the way we operate.”

Union’s ambitious growth plans, however, can only be achieved by investing outside of Germany. It has invested more than $1.5 billion in the U.S. in some years because of that market’s depth and liquidity.

Union has a market share of at least 30 per cent in the private open-ended fund business in Germany, according to Brühl.

It raised about $420 million in equity for a global fund in the midst of the COVID-19 crisis and has constant inflows of $70 million a month from investors.

“We currently have US$7 billion in liquidity, US$3 billion of which is dry powder to invest,” said Brühl. “The problem is to find the right deals.”

Source Real Estate News Exchange. Click here to read a full story

CEO Brian Kingston said company is negotiating with nearly 2.5K tenants, including those seeking deferrals and abatements.

Brookfield Property Partners is now negotiating with 2,400 of its retail tenants across the country who have been unable to come up with the rent. That inability to pay has cut deeply into Brookfield’s bottom line.

Its first quarter was dismal.

The real estate wing of the Canadian giant Brookfield Asset Management had a net loss of $373 million from January through March, compared with $713 million in net income over the same period last year.

The earnings report comes as credit rating agencies consider downgrading its retail real estate investment trust, which has $1.7 billion in debt coming due this year.

“We’re in active dialogue with all of our tenants,” BPP chief executive Brian Kingston said during the Friday earnings call with investors, referring to tenants who have been unable to pay. He said the discussions involve retailers who have requested deferrals and abatements.

It stood in contrast to the company’s fourth quarter earnings call in early February, when Kingston sounded an upbeat note for the year ahead. “Our expectation is that 2019 was the peak for bankruptcies and 2020 will get a little better,” he said at the time, as the company reported net income of $1.5 billion from October through December, compared to $858 million for the same period in 2018.

Now, as states begin reopening their economies, it remains to be seen which retailers will be able to bounce back and adapt to the new retail landscape.

But Brookfield also appears to see opportunities amid the distress. Brookfield Asset Management this week said it was looking to invest $5 billion in retail companies hit hard by the pandemic, the Wall Street Journal reported. The company will target brands whose revenues exceeded $250 million before the virus took full effect in March.

“Retailers with weak balance sheets or weak business models will restructure,” Kingston told investors, referring to high-profile retail bankruptcies that have recently unfolded, such as J. Crew and Neiman Marcus. In February, a bankruptcy judge approved Brookfield Property, Simon Property Group and Authentic Brands Group’s $81 million acquisition of Forever 21.Brookfield and Simon were two of the fast-fashion retailer’s landlords and unsecured creditors.

“Weak retail real estate that is poorly located, that might have been able to hang around for longer, will quickly see values diminish and something different happen with it,” he said. “And that’s a good and bad thing.”

Source The Real Deal New York Real Estate News. Click here to read a full story

While it’s still too early to know long-term repercussions, companies are currently carrying out stress tests, forecasts, analyses and covenant-checks of assets to try to avoid surprises later.

Theoretically, property values should be moving lower as risks have increased and cash flow has likely weakened. However, as long as companies and high-net-worth investors seek to deploy large amounts of capital to buy real estate, the trend of high property valuations could continue.

Following is an examination of various sectors and how the panelists think they may be affected.

Retail valuations

The retail sector has been challenged in recent years, and COVID-19 is accelerating existing trends, said Otera Capital executive vice-president and chief investment officer Paul Chin.

Otera is the real estate lending arm for Caisse de dépôt et placement du Québec, the second-largest pension fund manager in Canada.

While trophy assets such as CF Toronto Eaton Centre and Yorkdale Shopping Centre should still be very strong, there will be a widening gap between good and bad malls, according to Colin Johnston, Altus Group president of research, valuation and advisory. The commercial real estate services, software and data company does about 10,000 valuations, worth about $300 billion, annually.

Enclosed malls in secondary and tertiary markets that were already ripe for redevelopment opportunities may have those plans hastened.

Johnston said some already had weaker tenancies and leases with rents based on a percentage of sales, which amounts to nothing for the large percentage of retailers which have been closed due to COVID-19 restrictions.

Not all of these tenants are likely to return when malls reopen, and many of those that do could need rental support moving forward. Rent collections for some retail landlords were as low as 15 to 20 per cent in April, Johnston said, and many rent deferrals could turn into abatements.

Grocery and pharmacy-anchored retail strips have generally performed well, as those stores have remained open to provide essential goods. However, those locations often also feature small businesses such as salons, bakeries, and dry cleaners that may be in for tough times.

Experiential retail was becoming more prominent at shopping centres, but Johnston is unsure if people will rush back to the food halls, restaurants, entertainment centres, bowling alleys and movie theatres which were driving traffic before the pandemic.

Johnston said higher vacancy allowances and longer lease-up horizons for vacant spaces are being factored into valuations. While some retail properties could become very attractive because of lower valuations, he noted it would depend on whether the pricing is appropriate for the risk.

Migration to online shopping isn’t likely to end.

Other factors which could make it difficult for retail owners to raise rents over the next five years or so include an expected higher tenant churn rate and global retailers who have no commitment to particular malls or markets and thus have flexibility to move around.

“I think it’s going to turn into a tenants’ market for some period of time,” said Sender.

Multifamily

“Multifamily real estate has historically been the most resilient asset class and we think that continues today,” said Anna Kennedy, chief operating officer of KingSett Capital, a private equity real estate firm with $13 billion of assets under management.

Kennedy cited low vacancy rates, upward pressure on rents and an existing need for more rental apartments in key Canadian urban markets, which she believes portend continued strong performance.

Sender said people who are renting typically don’t have a lot of alternatives, and need to live somewhere, so “it makes sense that multifamily will be more resilient than commercial asset classes.”

Office

The majority of office workers across Canada have been working from home for about two months, and Kennedy said it’s been “quite remarkable” how they’ve adapted.

However, the consensus of the panel members was people still long for human interaction, working in teams and innovating, as well as creating new business relationships instead of just maintaining existing ones. All of this can best be done in office environments.

“If anything, they may well need more space because they’re concerned about the higher densities in their office space,” said Kennedy.

Increased workplace flexibility through hoteling systems and having more people work from home, at least part-time, could reduce demand for office space. However, Johnston believes it will be balanced by the desire for increased buffering and distancing.

Seniors housing

Johnston said Altus was doing a lot of feasibility work for companies interested in building more seniors housing, which had been acknowledged as a growth sector because of Canada’s aging population.

The large COVID-19 death tolls in seniors homes has likely put a pause on that. Down the road, however, there will continue to be a need for such facilities — albeit with increased staffing, cleaning, security and other improvements.

“It’s not all seniors housing that’s being hit hard,” said Chin. “It’s long-term care which is the most vulnerable.”

Johnston said the children of seniors often decide if their parents will go into these facilities. Their personal wealth has potentially been decreased in this pandemic-caused recession and they may no longer be able to afford to pay for it.

Industrial

Johnston believes the industrial sector should remain relatively unscathed and companies will want to build more if they can find the land. Industrial space close to cities will continue to be especially important for last-mile delivery of goods.

Small-bay properties may be challenged, depending on where they fit in the supply chain, according to Johnston.

Chin said supply chain issues might prompt some companies to stockpile certain goods to ensure availability, and places will be needed to store them.

“We’ve lost some of our confidence in relying on global supply chains,” said Kennedy. “I think we may bite the bullet and pay more for certain strategic goods that we may want to manufacture at home.”

Hotels

Hotels will get “kicked in the teeth the hardest,” according to Sender, who believes the asset class is “in for a tough go for a period of time.”

Johnston said tourist-oriented hotels will suffer because people may be wary of going to them, travel may continue to be restricted to some extent, and disposable income could be impacted over the next few years.

Downtown hotels in major cities catering to diverse clientele – business clients as well as vacationers – may recover more quickly.

Development

Some new development has been temporarily put on hold due to COVID-19-mandated construction stoppages or slowdowns, which is likely to impact project budgets. Chin said the primary issue with development is delayed registrations because of municipal offices being closed.

Johnston said Altus is still performing development appraisals, however, and it’s too early to say if land values have been negatively impacted.

Although Otera is being conservative with its loan structures, Chin said the company is “looking at new development on a very selective basis. It depends on who the sponsors are.”

Otera has been repaid on three large condominium loans through the COVID-19 crisis and Chin expects to be repaid on two more in the next month, which are positive signs.

Source Real Estate News Exchange. Click here to read a full story

TORONTO(Reuters) – Some Canadian banks have frozen new lending for smaller commercial property purchases, in some cases withdrawing letters of intent, as the coronavirus crisis raises concerns about owners’ ability to make payments, mortgage and real estate brokers said.

The tighter lending environment will likely result in a rise in distressed sales of commercial properties in coming months as buyers vanish, industry players said.

With most businesses shut due to public health measures aimed at curbing the pandemic, major banks are also declining to refinance property for owners who are trying to move from more expensive alternative lenders as their rental income dries up.

“If you’re a landlord, and looking to refinance, you can’t get that,” said Roelof van Dijk, director of market analytics at CoStar Group. “So you’re probably going to have to sell. But they’re also limiting new owners who might want to buy that space.”

Some owners who are unable to sell their properties are refinancing with alternative lenders at higher rates, adding to pressure on the struggling small to medium business sector.

Mortgage Outlet broker Shawn Stillman said two clients who had letters of intent signed to refinance with Bank of Montreal were told the bank was no longer financing commercial rental properties. His clients, whose mortgages were up for renewal at private lenders, refinanced with another alternative lender, at three percentage points higher than BMO’s rate, he said.

BMO did not respond to requests for comment.

Alternative lender Equitable Group has seen steady loan volumes versus an expected decline, driven by fewer new originations by the big banks, said Darren Lorimer, vice-president for commercial lending at the bank.

Equitable anticipates the migration of borrowers spurned by the big banks will lead to “better quality opportunities than we would have seen in the past,” he said.

Canada’s largest bank, Royal Bank of Canada, and Canadian Imperial Bank of Commerce said they are both honoring offers made before the COVID-19 crisis.

Bank of Nova Scotia and National Bank of Canada declined to comment. Toronto-Dominion Bank did not respond to requests for comment.

Where banks are still lending, many are asking for additional proof of ability to make payments, particularly those in hard-hit industries like retail, said Mark Cascagnette, managing partner at commercial real estate firm Lee & Associates Toronto.

Concerns about valuations of properties are also giving lenders pause, as appraisals typically use sales from 45 to 60 days ago, said Anthony Contento, chief executive of Sherwood Mortgage Brokers.

“For properties that were purchased two months ago … what are they worth today during this crisis?” he said.

The federal government’s commercial rent assistance program – forgivable loans to help landlords reduce rent owed by struggling tenants – could make it more difficult for applicants to get financing for commercial properties, CoStar’s van Dijk said.

“To be eligible for (the rent relief) program you have to prove that your tenant has had a dramatic loss of business, and is really suffering,” van Dijk said. “(But) then to go to the banks, and say ‘don’t worry, the tenant is going to continue doing business when we get out of this’ is a hard sell.”

Source Yahoo Finance. Click here to read a full story

Commercial landlords should prepare for hard days ahead as tenants face months of reduced business, according to the head of one of Canada’s largest real estate groups.

It will be 2022 before a “new normal” takes hold in the property market, said Michael Cooper, chief executive officer of Dream Office REIT and president of Dream Unlimited Corp.

“I’m planning for tough, tough times ahead, just because I think it’s prudent,” Cooper said on BNN Bloomberg TV. “People talk about what per cent of rent they got in April. That was only two weeks” of the economic shutdown.

Companies still need to get through July and into winter. When they do open up it won’t be easy for them to “make enough money in their restaurants or elsewhere to cover their variable costs, let alone their rent,” he said.

Canada’s federal and provincial governments crafted a plan to help companies with rent for April, May and June. The program offers forgivable loans to commercial landlords, while business tenants pay no more than 25 per cent of their usual rent.

But only firms with less than $20 million (US$14 million) in gross annual revenue can apply for the subsidy. And those who are eligible must show at least a 70 per cent drop in revenue compared with pre-virus times.

Cooper said his companies would try to use the program. “But in the meantime, people have paid April’s rent, tomorrow’s May 1, so there’s a lot of confusion,” he said. “Hopefully it will work out over time, but it won’t be working out smoothly.”

Dream Office REIT holds a portfolio of office buildings with about 6 million square feet of space, the majority of it in downtown Toronto. His group also runs Dream Industrial REIT, which owns industrial property in Canada, the U.S. and Europe.

The commercial real estate market won’t return to normal for a couple of years, Cooper said.

“Really, 2022 is going to be a time frame where you can look at what the value of a building is and deal with it with confidence — you know what the rental rates are, what the demand is,” he said.

Source Business Financial Post. Click here to read a full story

The severity of COVID-19’s impact on the Canadian commercial real estate market is not yet known as the situation continues to unfold and forecasts are adjusted. As an industry benchmark, one of the most pressing questions is what the pandemic will mean for cap rates.

Why cap rates are likely to go up

The capitalization rate of a real estate investment is calculated by dividing the property’s net operating income by the current market value. It’s the most popular measure for how real estate investments are assessed for profitability and rate of return.

“When we see greater risk due to businesses being impacted, due to tenants or property owners having their businesses impacted, capitalization rates as a reflection of that risk are impacted by COVID-19 because they are that reflection of risk,” Bowden said.

“Our expectation is that they will start to go up, because people are going to start to see more risks. The days of looking at an asset and painting it with a broad brush . . . are evaporating.

“It’s really about digging deeper into what’s going on in a specific property that’s going to matter.

“What people want is something that can be digested and what they don’t want to hear is ‘it depends’.”

However, he said the greatest factor for cap rates universally is the strength of a landlord’s tenants to pay their rent.

He cautioned people not to adopt a sky-is-falling mentality to the COVID crisis because real estate is a marathon, not a sprint. Looking at something over a longer horizon tends to tell a clearer story about the real estate asset.

Bowden said in the last 10 years the capitalization rate of almost every asset class has compressed dramatically.

“Back when I started, people would look at a 6.5 per cent capitalization rate for a shopping centre and say, ‘You’re nuts, that’s way too low.’ And now people in the industry are saying, ‘You’re nuts, that’s way too high’,” he observed.

“As the capitalization rate gets lower – so your perceived risk gets lower and lower – if there is a change to the capitalization rate, the impact on value becomes that much more pronounced.”

Some key CRE sectors

It’s apparent assets such as retail and hotels have been immediately impacted more than any other asset class, the report states, and it’s possible the recovery for these asset types could drag out longer depending on the duration and severity of the pandemic.

“Conversely, while there may be some disruption to localized assets within the industrial sector it is widely believed that this particular asset type will flourish in most parts of the country once life returns to normal.

“Multifamily apartment assets should continue to be highly sought after as they’re generally less risky, but there may be some short-term cash flow issues as some tenants struggle to make rental payment,” said the report.

“Lastly, the widespread work-from-home circumstances we’re all currently experiencing will likely change the office sector to some degree in the future, but it’s not certain to what extent at this point.

“Government aid packages may act as mitigating factors for some asset classes, but their success will not be known for some time.

“Certainly, the longer social distancing remains in force, the higher the likelihood that more and more asset types will become adversely affected.”

The report also said shifting and volatile markets have historically led to a gap between vendor and purchaser expectations.

This typically results in diminished sales activity. Colliers expects that situation to unfold in the second quarter, with a reduced level of conventional arms-length transactions.

“Most investors are currently taking a wait-and-see approach as it relates to new acquisitions and potential dispositions.

“However, the volatility of the stock market may also drive capital to commercial real estate as investors look for a more stable, risk-weighted return for their money,” said the report.

“We have never found ourselves within such an unprecedented situation. . . . The impacts on asset valuation could vary greatly from one property to the next depending on a combination of factors.”

A sampling of Q1 Canadian cap rates

The cap rates quoted in the Colliers report reflect investor sentiment prior to the COVID-19 pandemic in March.

Here are some of the Q1 2020 cap rates for select Canadian major markets and asset classes, from low to high ranges:

Downtown office class-A

* Vancouver – 3.5 per cent to 4.50 per cent;

* Calgary – 6.0 per cent to 6.75 per cent;

* Toronto – 3.75 per cent to 4.75 per cent;

* Montreal – 4.50 per cent to 5.50 per cent.

Suburban office class-A

* Vancouver – 4.75 per cent to 5.75 per cent;

* Calgary – 6.25 per cent to 6.75 per cent;

* Toronto – 5.50 per cent to 6.25 per cent;

* Montreal – 6.00 per cent to 7.00 per cent.

Industrial single-tenant class-A

* Vancouver – 3.50 per cent to 4.75 per cent;

* Calgary – 5.25 per cent to 6.00 per cent;

* Toronto – 3.75 per cent to 4.75 per cent;

* Montreal – 5.00 per cent to 5.75 per cent.

Industrial multi-tenant class-B

* Vancouver – 3.75 per cent to 5.00 per cent;

* Calgary – 5.50 per cent to 6.75 per cent;

* Toronto – 4.50 per cent to 5.50 per cent;

* Montreal – 5.50 per cent to 6.50 per cent.

Multifamily high-rise

* Vancouver – 2.75 per cent to 3.25 per cent;

* Calgary – 4.00 per cent to 4.75 per cent;

* Toronto – 3.50 per cent to 4.50 per cent;

* Montreal – 3.00 per cent to 4.25 per cent.

Multifamily low-rise

* Vancouver – 2.75 per cent to 4.25 per cent;

* Calgary – 4.25 per cent to 5.25 per cent;

* Toronto – 3.00 per cent to 4.00 per cent;

* Montreal – 4.00 per cent to 5.00 per cent.

Retail regional/power

* Vancouver – 4.00 per cent to 5.50 per cent;

* Calgary – 5.25 per cent to 6.00 per cent;

* Toronto – 4.25 per cent to 5.00 per cent;

* Montreal – 4.75 per cent to 6.50 per cent;

Retail community

* Vancouver – 4.00 per cent to 5.75 per cent;

* Calgary – 5.25 per cent to 6.00 per cent;

* Toronto – 5.25 per cent to 6.00 per cent;

* Montreal – 6.25 per cent to 7.00 per cent.

Retail strip mall

* Vancouver – 3.50 per cent to 5.50 per cent;

* Calgary – 5.50 per cent to 6.50 per cent;

* Toronto – 4.75 per cent to 5.75 per cent;

* Montreal – 6.50 per cent to 7.50 per cent.

Source Real Estate News Exchange. Click here to read a full story

MONTREAL, April 30, 2020 (GLOBE NEWSWIRE) — Goodfood Market Corp. (“Goodfood” or “the Company”) (TSX:FOOD), a leading online grocery company in Canada, announced today it has signed a lease for its first fulfillment centre in the Greater Toronto Area, further expanding its countrywide operating footprint. Fulfilment of orders at the facility will begin before the end of May 2020 and will create over 300 new jobs.

“In the wake of accelerating penetration of online grocery in Canada resulting from the current pandemic, we are thrilled to have found a facility to service our current and future members in the GTA and Southern Ontario. We are excited to launch this new 42,000 square feet facility, our first fulfillment centre in Toronto, to help grow our capacity and get closer to our customers while providing employment to over 300 people,” said Neil Cuggy, President and Chief Operating Officer of Goodfood. “Our previously announced plans to build out a larger fulfillment centre in Toronto also remain on track for 2021,” concluded Mr. Cuggy.

“The demand for online grocery delivered directly to customers’ doors has seen a strong uptick in recent weeks. This rapid acceleration in adoption is changing how Canadians shop for groceries now and in the future, and it has motivated us to be closer to our members and to offer our services with more flexibility to a larger number of Canadians,” added Jonathan Ferrari, CEO of Goodfood. “We firmly believe these changes in consumer habits are here to stay and that Goodfood is well positioned to play a leading role in this transformation,” concluded Mr. Ferrari.

About Goodfood

Goodfood (TSX:FOOD) is a leading online grocery company in Canada, delivering fresh meal solutions and grocery items that make it easy for members from coast to coast to enjoy delicious meals at home every week. Goodfood’s mission is to make the impossible come true, from farm to kitchen, by enabling members to do their weekly meal planning and grocery shopping in less than 1 minute. Goodfood members get access to a unique selection of products online as well as exclusive pricing made possible by its world class direct to consumer fulfillment ecosystem that cuts out food waste and expensive retail overhead. The Company has a production facility and administrative offices in Montreal, Quebec, two production facilities out West, in Calgary, AB and Vancouver, BC, and a breakfast facility in Montreal, Quebec. Goodfood had 246,000 active subscribers as at February 29, 2020. www.makegoodfood.ca

FORWARD-LOOKING INFORMATION

This release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking information includes, but is not limited to, information with respect to our objectives and the strategies to achieve these objectives, as well as information with respect to our beliefs, plans, expectations, anticipations, estimates and intentions. This forward-looking information is identified by the use of terms and phrases such as “may”, “would”, “should”, “could”, “expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”, “believe”, or “continue”, the negative of these terms and similar terminology, including references to assumptions, although not all forward-looking information contains these terms and phrases. Forward-looking information is provided for the purposes of assisting the reader in understanding the Company and its business, operations, prospects and risks at a point in time in the context of historical and possible future developments and therefore the reader is cautioned that such information may not be appropriate for other purposes. Forward-looking information is based upon a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information.

These risks and uncertainties include, but are not limited to, the following risk factors which are discussed in greater detail under “Risk Factors” in the Company’s Annual Information Form for the year ended August 31, 2019 available on SEDAR at www.sedar.com: limited operating history, negative operating cash flow, food industry, quality control and health concerns, regulatory compliance, regulation of the industry, public safety issues, product recalls, damage to Goodfood’s reputation, transportation disruptions, product liability, ownership and protection of intellectual property, evolving industry, unionization activities, reliance on management, factors which may prevent realization of growth targets, competition, availability and quality of raw materials, limited number of products, environmental and employee health and safety regulations, online security breaches and disruption, reliance on data centres, open source license compliance, future capital requirements, operating risk and insurance coverage, management of growth, conflicts of interest, litigation, and catastrophic events.

Although the forward-looking information contained herein is based upon what we believe are reasonable assumptions, readers are cautioned against placing undue reliance on this information since actual results may vary from the forward-looking information. Certain assumptions were made in preparing the forward-looking information concerning availability of capital resources, business performance, market conditions, and customer demand. In addition, information and expectations set forth herein are subject to and could change materially in relation to developments regarding the COVID-19 pandemic and its impact on product demand, labour mobility, supply chain continuity and other elements beyond our control. Consequently, all of the forward looking information contained herein is qualified by the foregoing cautionary statements, and there can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the expected consequences or effects on our business, financial condition or results of operation. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained herein is provided as of the date hereof, and we do not undertake to update or amend such forward-looking information whether as a result of new information, future events or otherwise, except as may be required by applicable law.

Source CMLS Financial. Click here to read a full story

CMLS Mortgage Analytics Group

The Commercial Mortgage Commentary aims to inform the market about commercial real estate finance news. It focuses on the following capital sources for commercial real estate: Conventional Mortgages, CMHC-Insured Mortgages, Commercial Mortgage Backed Securities (CMBS), High Yield Mortgages, First Mortgage Bonds, and Senior Unsecured debt for REITs and REOCs.

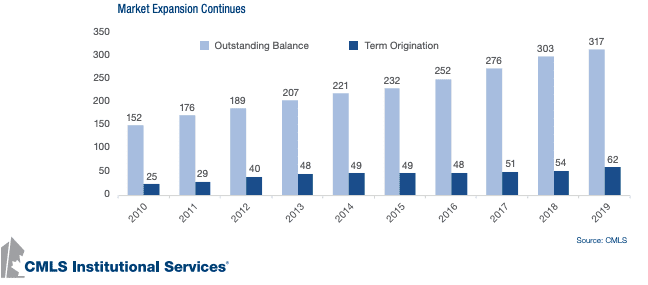

CMLS Lenders Survey

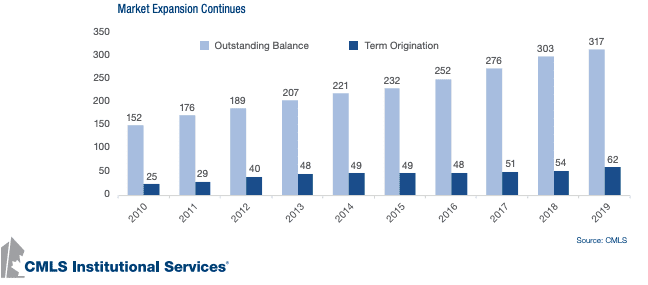

The CMLS Mortgage Analytics Group (MAG) recently completed its 10th annual survey of the Canadian Commercial Mortgage Lending market. This year’s survey marked our highest participation rate to-date, with 37 different lenders participating and about 90% of the market covered. As of the end of 2019, our survey indicates the Canadian Commercial Mortgage market sits at $317 billion in outstanding loans, up from $303 billion at the end of 2018. New origination in 2019 (which excludes construction loans) came in at $62 billion, a 15% increase over last year’s total.

Lender sentiment was upbeat heading into 2020. Over 90% of survey respondents indicated that they were planning to maintain or increase origination volumes this year. The outbreak of COVID-19, however, has significantly altered market perceptions. MAG recently published its Q1 Commercial Mortgage Lenders Survey, in which it discusses how lenders are handling this unprecedented state of affairs.

Making News

COVID-19

The first quarter of 2020 was marked by massive challenges to the global economy due to the outbreak of COVID-19. In terms of the commercial mortgage space, borrowers across the nation have faced mounting pressure to provide payment assistance to beleaguered tenants. Lenders in turn have seen the number of requests from borrowers for loan concessions grow rapidly. The extent to which the national shutdown will ultimately affect real estate investment cashflows remains to be seen. This uncertainty has led to increased challenges in valuation as investors and borrowers try to determine if the impact to NOI will persist or correct itself in the short term.

The growing uncertainty in financial markets has led to a rapid deterioration in the lending space for the time being. Some lenders have closed up shop for the next few months, while others have tightened their underwriting standards significantly. Many lenders have instituted floor rates and those still open for business are floating offers for new deals with rates guaranteed for only a few days as the overall market landscape changes at unprecedented speed.

CDPQ Looks to Move Out of Retail

After its real estate portfolio posted a -2.7% return in 2019, Ivanhoe Cambridge – the real estate arm of Caisse de dépôt et placement du Québec – announced it will look to sell about a third of its 25 Canadian shopping centres over the next two to three years. Those Canadian shopping centres are valued at $12-$15 billion, meaning the sale will mark a significant shift in Ivanhoe Cambridge’s $64 billion real estate asset mix. Along with the planned sale, Ivanhoe Cambridge will look to transform its remaining malls, adding residential and logistics space in an effort to make their retail assets more of a community hub rather than simply a shopping centre.

The moves come as e-commerce in Canada continues to eat into bricks-and-mortar sales at a rapid pace. Data from statistics Canada shows e-commerce sales have grown by 13% annually since 2016. Its share of total retail sales has grown by more than 9% annually over that same period.

Economic Environment

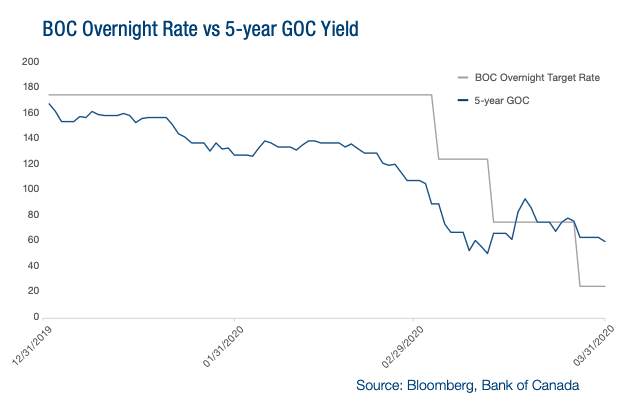

BOC Rate Cuts and QE

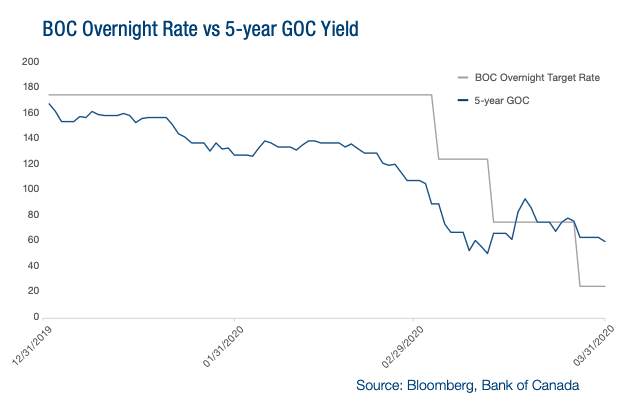

In an unprecedented move, the Bank of Canada (BoC) slashed its overnight interest rate by 150bps over the course of March. The current rate of 0.25% is the lowest since the 2008/09 financial crisis. In tandem with the BoC cut, yields on Government of Canada (GOC) bonds tumbled as investors scrambled to move capital to safer asset classes.

The BoC also announced the implementation of two new asset purchase programs that it hopes will help spur liquidity in the economy. The first program, called the “Commercial Paper Purchase Program”, aims to assist beleaguered companies with their short-term financing needs. The second will see the BoC purchase Canadian government debt of at least $5 billion/week across tenors of the yield curve. To put that in perspective, the minimum weekly purchase amount by the BoC equates to approximately 1% of GDP per month.

Oil Prices Plummet Amid Price War

Global energy markets were left reeling at the end of Q1 as most major oil indexes touched 18-year lows to end the quarter. Oil faced downward pressure on two fronts: the global shutdown due to COVID-19 and an oil price war between Russia and OPEC that led to sustained oversupply throughout March. The impact on Canadian oil has been severe at a time when the Oil and Gas industry in Canada struggles to stay afloat after years of low oil prices and stalled projects.

Commercial Mortgages

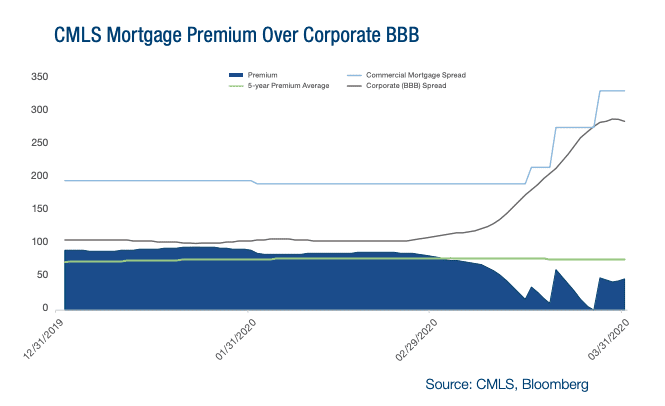

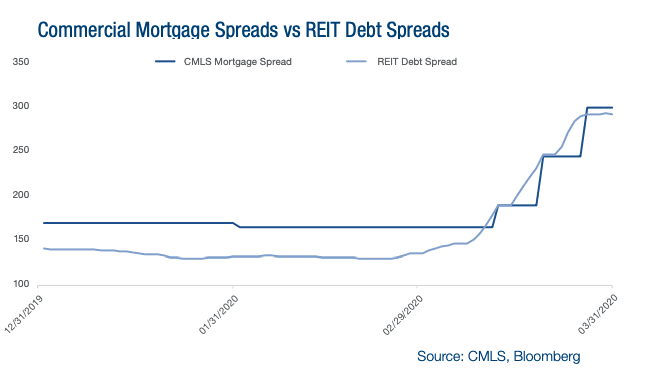

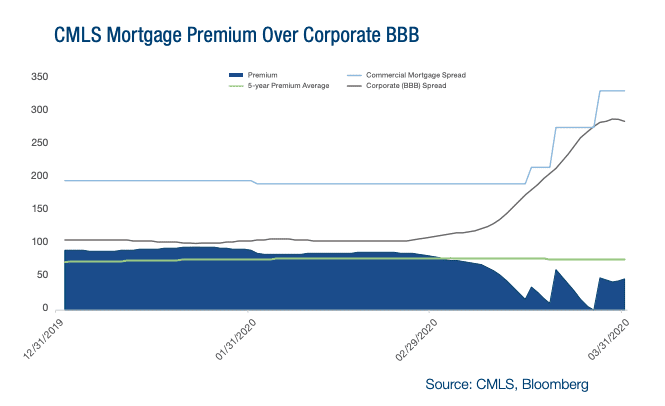

After two quarters of nearly flat commercial mortgage spreads, March saw the largest shift in over a decade. Market liquidity quickly deteriorated as lenders assessed the uncertainty around borrowers’ ability to service debt and the government’s response to COVID-19. Several institutions paused lending activity entirely until a sense of normalcy returns to markets.

Given the increased uncertainty and lower supply of capital, markets quickly reflected upward pressure on commercial mortgage spreads. Several key fixed income indexes, often leading indicators for the commercial mortgage space, had their spreads widen substantially at the end of Q1.

Government regulators have attempted to ease operational stress on the financial system with several policies. In March, the Office of the Superintendent of Financial Institutions (OSFI) announced it will allow banks to continue to classify loans with deferred payments as ‘performing’ for borrowers affected by COVID-19. The announcement means banks will not be forced to hold additional capital on their books to offset these loans. OSFI also announced a reduction in the domestic stability buffer of 125bps, bringing it down to 1.00% to end the quarter. OSFI estimates the reduction will support more than $300 billion of additional lending capacity by Canada’s largest financial institutions.

CMHC

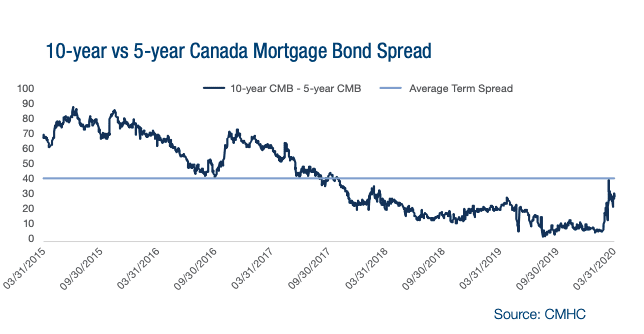

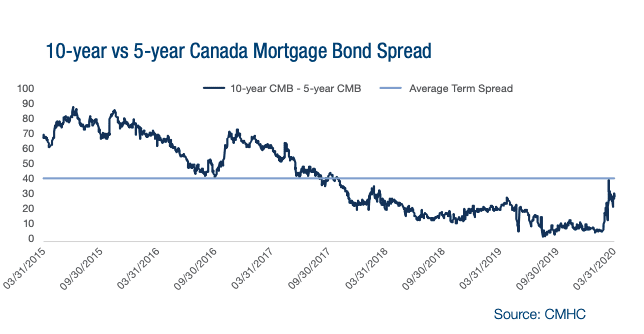

Since 2017, the term premium for 10-year CMHC-insured loans versus 5-year has steadily narrowed, resulting in high borrower demand for 10-year terms. However, at the end of Q1 the difference between 5-year and 10-year Canada Mortgage Bonds (CMB) – the base rate quoted by many lenders – widened significantly. Coupled with growing market uncertainty, borrower demand and lender supply may finally be converging on the 5-year space.

Compared to the previous quarter, spreads have increased substantially for CMHC products across all tenors. This recent market volatility has led the Government to implement several policy changes to support the CMHC-insured loan market. In March, the Government expanded its Insured Mortgage Purchase Program (IMPP) to purchase up to $150 billion of insured mortgage pools. The stimulus effectively triples their mortgage purchases from the previous year and more than doubles the amount purchased during the last financial crisis. The move aims to expand stable funding available to banks and mortgage lenders in order to ensure continued lending to consumers and business.

On March 24th, CMHC purchased $5 billion in 5-year insured mortgage pools as part of the IMPP. To date, there have been no comparable purchase programs announced in the 10-year CMHC space, leading to a notable lack of funding for longer duration loans.

The BoC has also announced it will buy back CMHC-guaranteed CMBs in the secondary market in an attempt to increase liquidity in that space (CMBs are backed by pools of insured mortgages). The BoC announced it will target purchases of up to $500 million per week to support market liquidity.

CMBS

In January, Real Estate Asset Liquidity Trust issued REAL-T 2020- 1, the first CMBS issuance in 2020. REAL-T 2020-1 is a $532 million CMBS consisting of 52 loans secured by 86 commercial properties. The issuance features a 4.019% weighted average interest rate, a 100-month weighted average term to maturity, and AAA subordination of 13.25% (86.75% of the pool is rated AAA).

According to the DBRS pre-sale report, the collateral consists of 23.9% anchored retail and 24.2% office. The underlying properties are 47% in Ontario and 20% in Quebec. Our intel suggests it is unlikely that we will see any further substantial securitizations until the COVID-19 pandemic subsides.

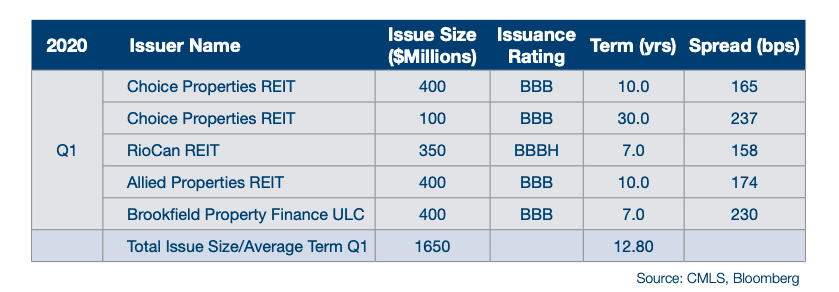

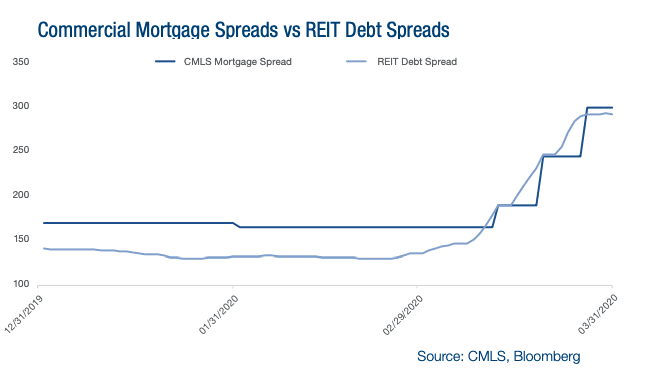

REITs

The S&P/TSX Capped REIT Index closed the quarter down 27.47% from the start of 2020. In the US, the MSCI US REIT Index was down 26.99% over the same period. The impact on the debt side of Canadian REIT’s has also been substantial. Yields on existing unsecured debentures increased by more than 100% month-over-month to end the quarter, according to data from our proprietary index.

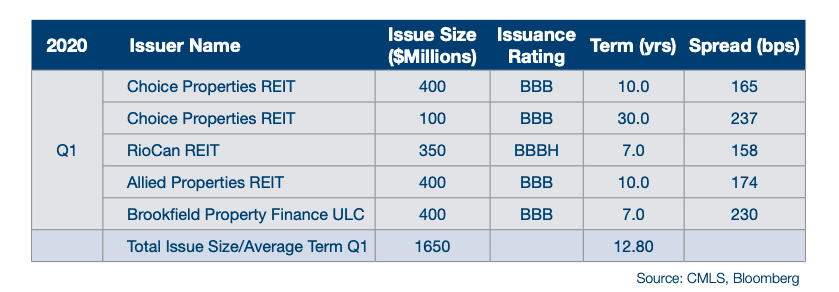

Issuances of new REIT debt totaled $1,650 million in Q1. With their equity valuations at 10-year lows, and the spread on REIT debt at 10-year highs, many REITs will be hard pressed to raise new capital until market volatility subsides.

Source CMLS Financial. Click here to read a full story

BentallGreenOak is expanding its relationship with Menkes Developments at major downtown Toronto properties, acquiring a 50 per cent interest in the Waterfront Innovation Centre. The 475,000-square-foot office and retail development on Toronto’s east waterfront is currently under construction and scheduled for occupancy in 2021.

BentallGreenOak made the transaction on behalf of the Sun Life Assurance Company. Financial details were not disclosed.

Menkes and BentallGreenOak are longstanding partners and also joined forces on another major ongoing development at the One York Street office tower (the Sun Life Financial Tower) in the South Core neighbourhood.

The Waterfront Innovation Centre, which broke ground in September 2018, is currently 71 per cent pre-leased. In 2018, global communications services firm WPP plc became the anchor tenant, leasing 260,000 square feet.

Menkes also announced in September 2018 that MaRS, Toronto’s fast-growing innovation community, will lease about 55,000 square feet at the centre. The building will also include approximately 25,000 square feet of beachfront retail space currently available for lease.

It is adjacent to the popular Sugar Beach area.

The Waterfront Innovation Centre

“This partnership will further expand our relationship with Sun Life, a valued partner since 2014,” said Peter Menkes, the president of commercial/industrial with Menkes, in a release.

“With One York Street, we reconnected Toronto’s downtown to the waterfront with improved pedestrian infrastructure and a dynamic amenity offering.

“The Waterfront Innovation Centre represents another city building opportunity for Menkes and Sun Life to revitalize Toronto’s waterfront for the benefit of tenants, residents and visitors to the city.”

Designed by architects Sweeny & Co, the state-of-the-art complex will be comprised of two buildings, with three interconnected components: The Exchange, The Hive and The Nexus, a collaboration space that will serve as a public square and directly connect the two buildings.

Amenities will include high-speed broadband networking (fueled in part by self-generating solar power), floor-to-ceiling windows and expansive collaboration spaces.

It is designed to accommodate some 3,000 workers.

“We are pleased to expand on our successful partnership with Menkes through the acquisition of the Waterfront Innovation Centre,” said Christina Iacoucci, managing partner, portfolio management at BentallGreenOak, in the release.

“This opportunity allows us to continue to support the growth of Toronto’s emerging downtown south node and build on the vibrant live, work, play community that has emerged on Toronto’s waterfront.

“It also further demonstrates Sun Life’s commitment to being a long-term investor in Canada’s top cities.”

Construction of the complex commenced in August 2018.

About Menkes, BentallGreenOak, SLC

Menkes Developments Ltd. is a fully integrated real estate company involved in the construction, ownership and management of office, industrial, retail and residential properties.

Founded in 1954, it is one of the largest private developers in Canada, with a primary focus in the GTA.

Past projects include the Empress Walk entertainment, shopping and residential complex in North York City Centre and two landmark projects in Toronto’s South Core district, 25 York (TELUS Harbour) office tower and the two-million-square-foot One York commercial retail complex.

The company’s latest project Sugar Wharf is a waterfront community on an 11.5-acre site in downtown Toronto, which will be anchored by a new two-acre park.

BentallGreenOak is a global real estate investment management advisor and provider of real estate services. It serves more than 750 institutional clients with $49 billion US of assets under management (as of Dec. 31, 2019) and expertise in the asset management of office, retail, industrial and multiresidential property.

It has offices in 24 cities across 12 countries.

BentallGreenOak is a part of SLC Management, the institutional alternatives and traditional asset management business of Sun Life.

SLC Management is a global institutional asset manager that offers institutional investors traditional, alternative and yield-orientated investment solutions across public and private fixed income markets, as well as global real estate equity and debt.

As of Dec. 31, 2019, it had assets under management of $227 billion Cdn.

Source Real Estate News Exchange. Click here to read a full story