Canada’s commercial real estate sector is as unsettled as it has ever been. With CECRA struggling to work up a detectable heartbeat, there is growing anxiety that when federal and provincial efforts to support small businesses through the COVID-19 pandemic come to an end, it will leave thousands of business owners unable to pay their employees or their rent.

Retail and restaurant tenants are already having the life squeezed out of them – and social distancing will mean more discomfort for both shops and shoppers going forward – but the damage coming to the office sector is a little harder to gauge since most renters of office space have been able to carry on operations by leveraging a work from home model to generate some form of income. Companies with their leases about to expire, however, will have a large part to play in the future of office real estate.

“Those companies whose leases have come to an end, they’re looking at what the future is,” says Luciano D’lorio, Cushman & Wakefield’s director of operations in Quebec. “They’re in the process of negotiating with their existing landlord or they’re looking at a new space.”

Office real estate faces several unknowns that could negatively impact demand. Social distancing means more space will be needed per employee, but smaller businesses may not be able to justify the added expense of renting larger spaces. Working from home has proven a productive, if not entirely fulfilling, alternative to the typical office 9-to-5, giving companies the opportunity to greatly reduce their rent expenses.

But D’lorio remains optimistic that the pre-COVID-19 office paradigm is here to stay.

“There’s still a need for office space,” he says. “Think of all the money that companies spend on team-building and building a corporate culture. I think that’s hard to do in a remote situation.”

D’lorio says maintaining office space is also valuable in attracting millennial and Gen Z workers. According to Cushman & Wakefield’s recent Future of Workplace study, neither group particularly likes working from home. D’lorio says if employers want to attract a steady stream of willing young candidates, it’s in their interest to resist a complete work-from-home framework and provide office space, even if it’s on a part-time basis.

“I think, in the long-run, there’s going to be a mix,” he says, “of people who want to work from home – and employers are going to accommodate them – and groups who want to work in the office.”

D’lorio is particularly optimistic about suburban office space. Downtown offices are still better suited to provide that coveted work-live-play balance, but they are also problematic in a world rocked by COVID-19. Few people will be excited by the prospect of riding in a packed subway car for 45 minutes just to get to an office building where they’ll have to share an elevator with eight other people.

“The public transit issue is what’s keeping many employees from wanting to return,” he says.

A two- or three-storey building in the ‘burbs would alleviate two major concerns. Abundant, often free parking would mean employees could drive themselves to work. A short walk up the stairs would eliminate those uncomfortable, “Should-I-be-inhaling?” elevator rides.

D’lorio says Cushman & Wakefield plans to bring 25 percent of its staff back initially, with the next phase of reopening to be determined by the path COVID-19 takes. A vaccine or treatment for the disease would speed things up considerably – and clear much of the fog obscuring the future of Canadian office space. Until one materializes, office tenants and owners will be forced to wander another few months in the dark.

Source Mortgage Broker News. Click here to read a full story

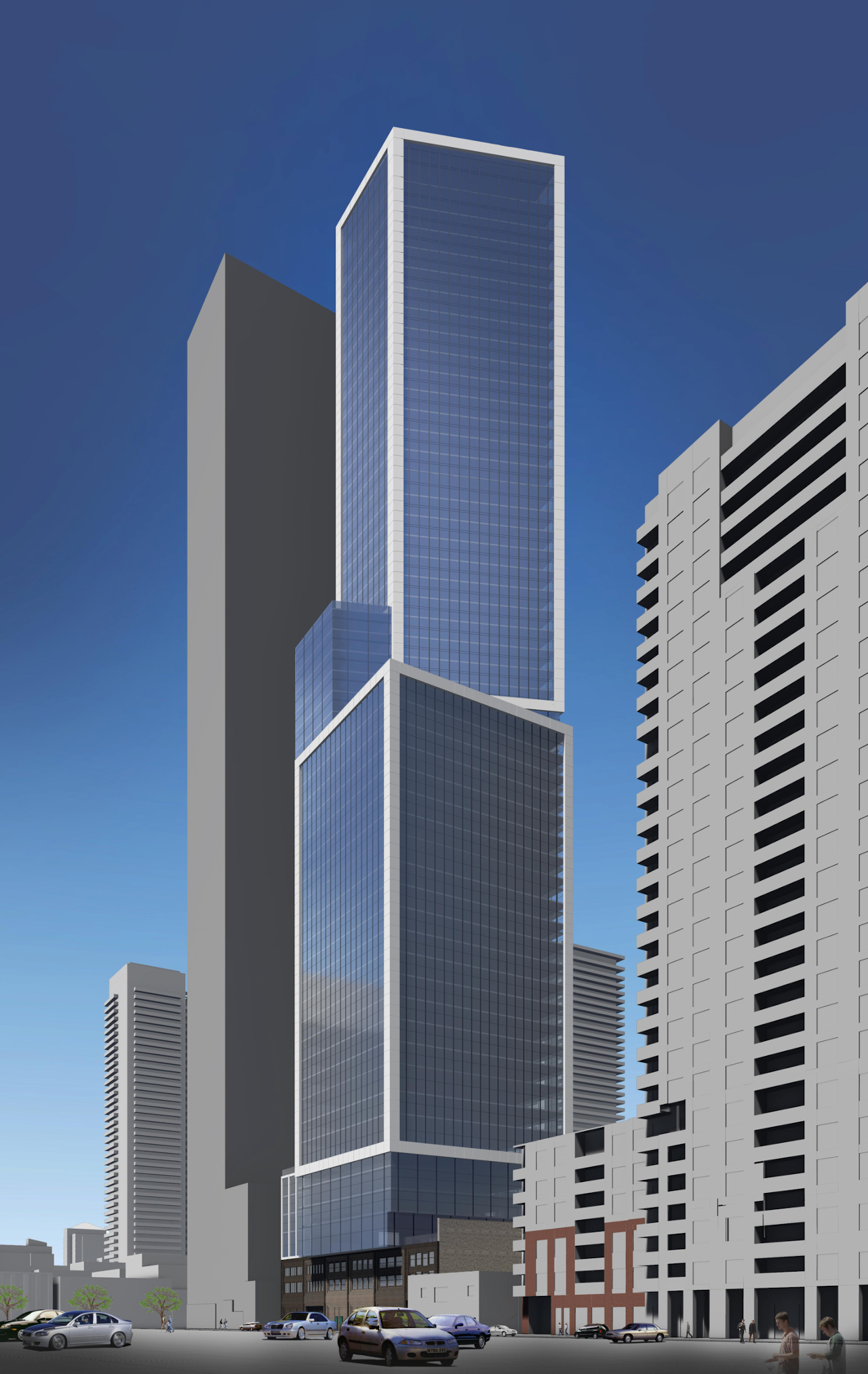

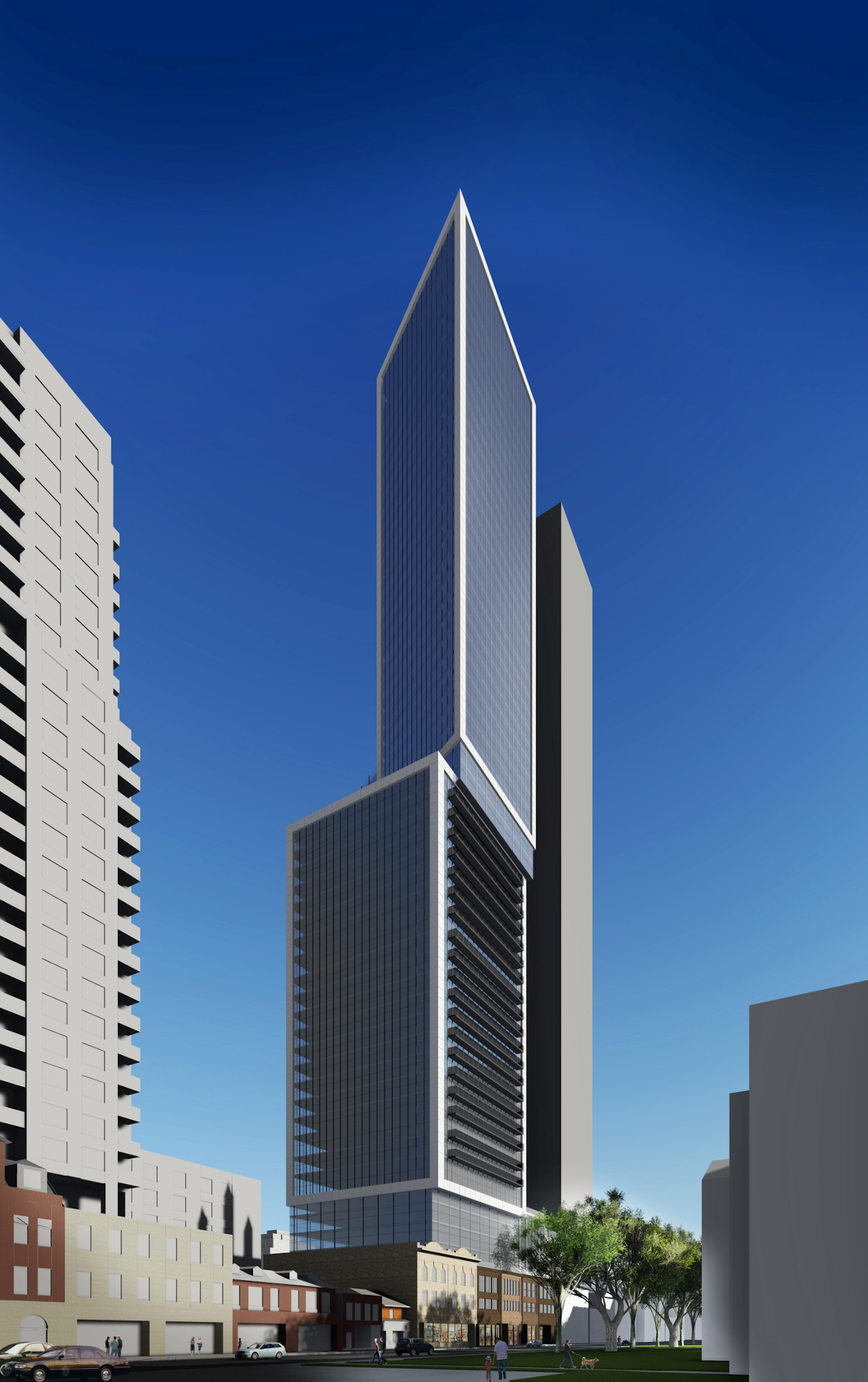

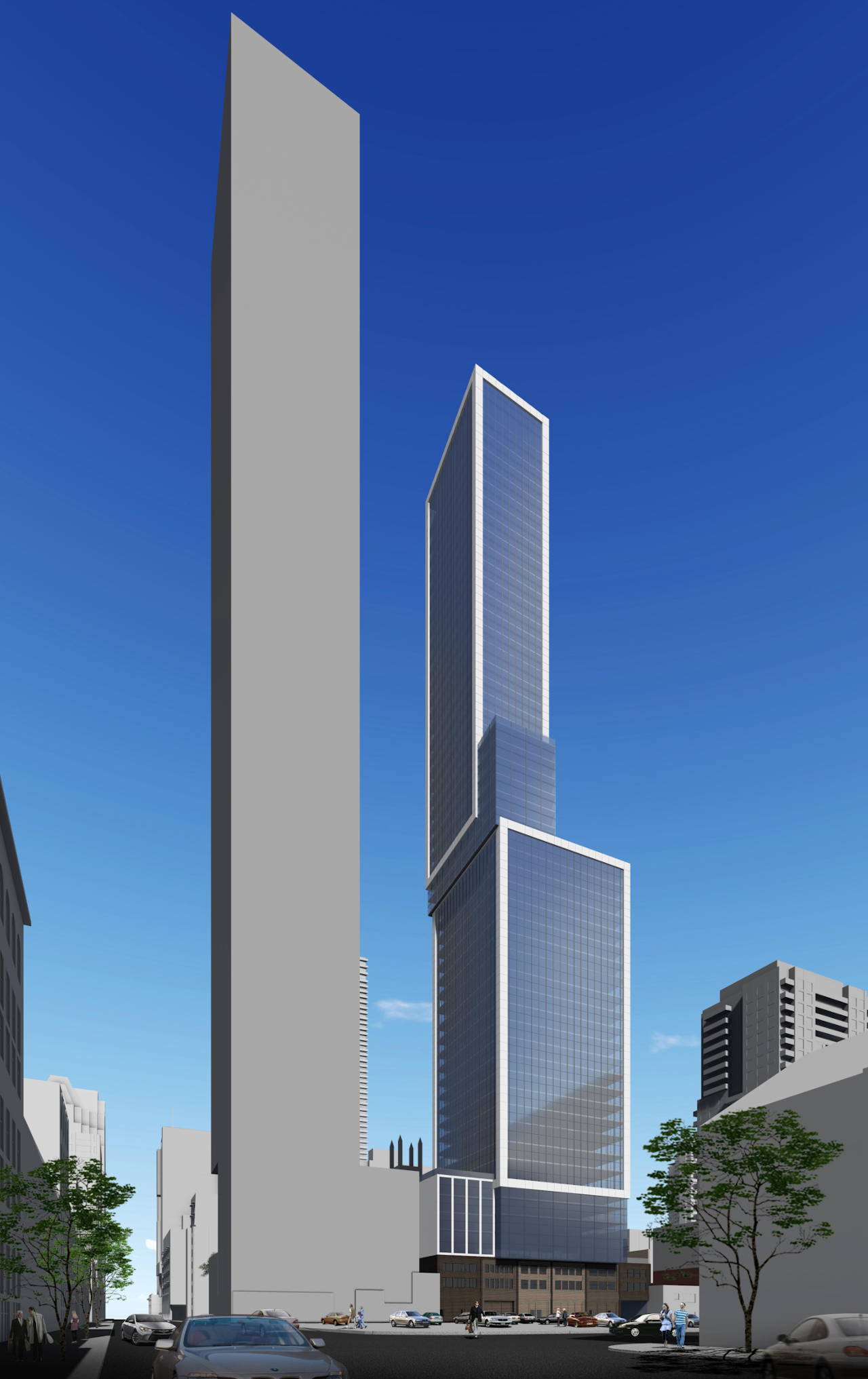

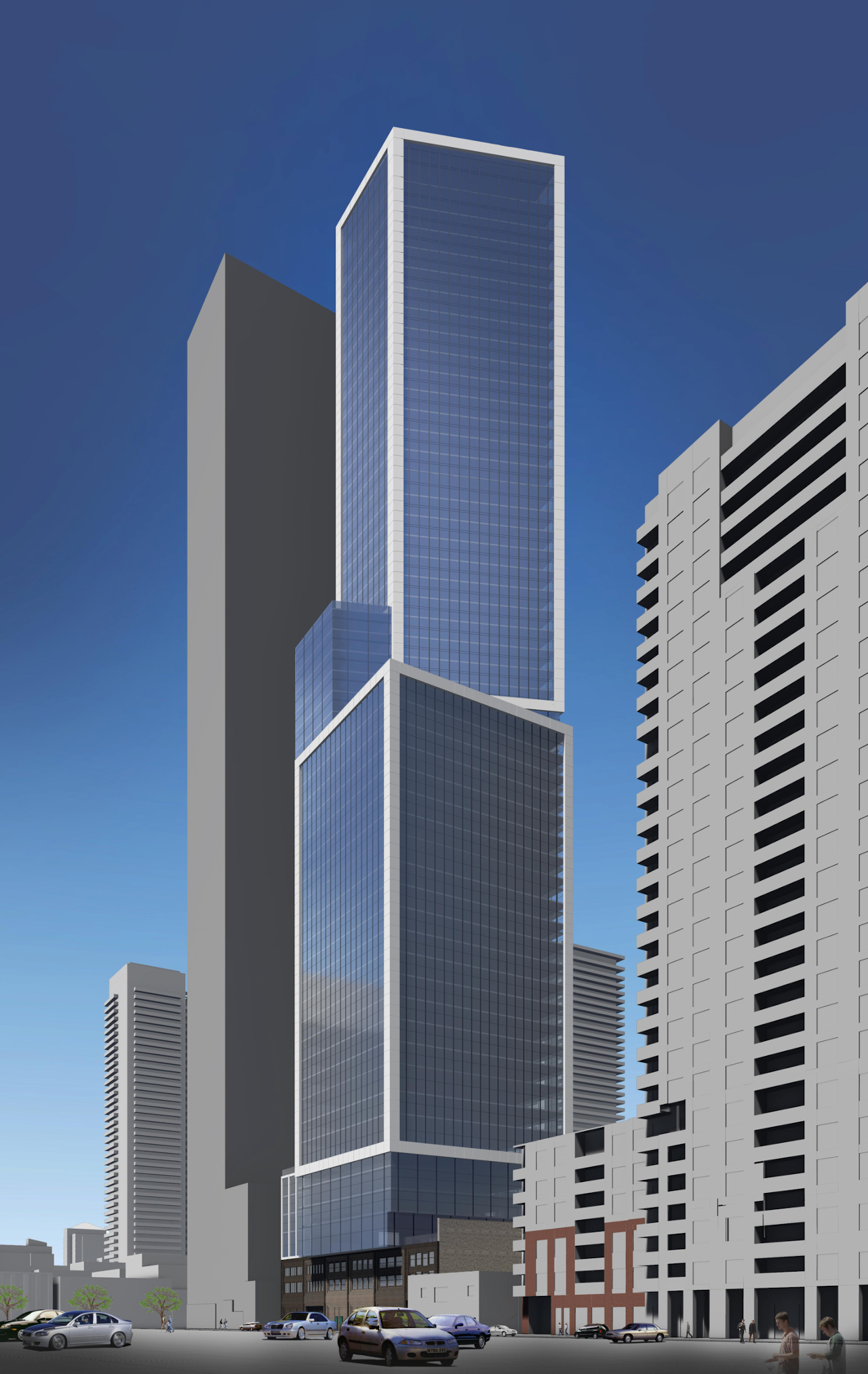

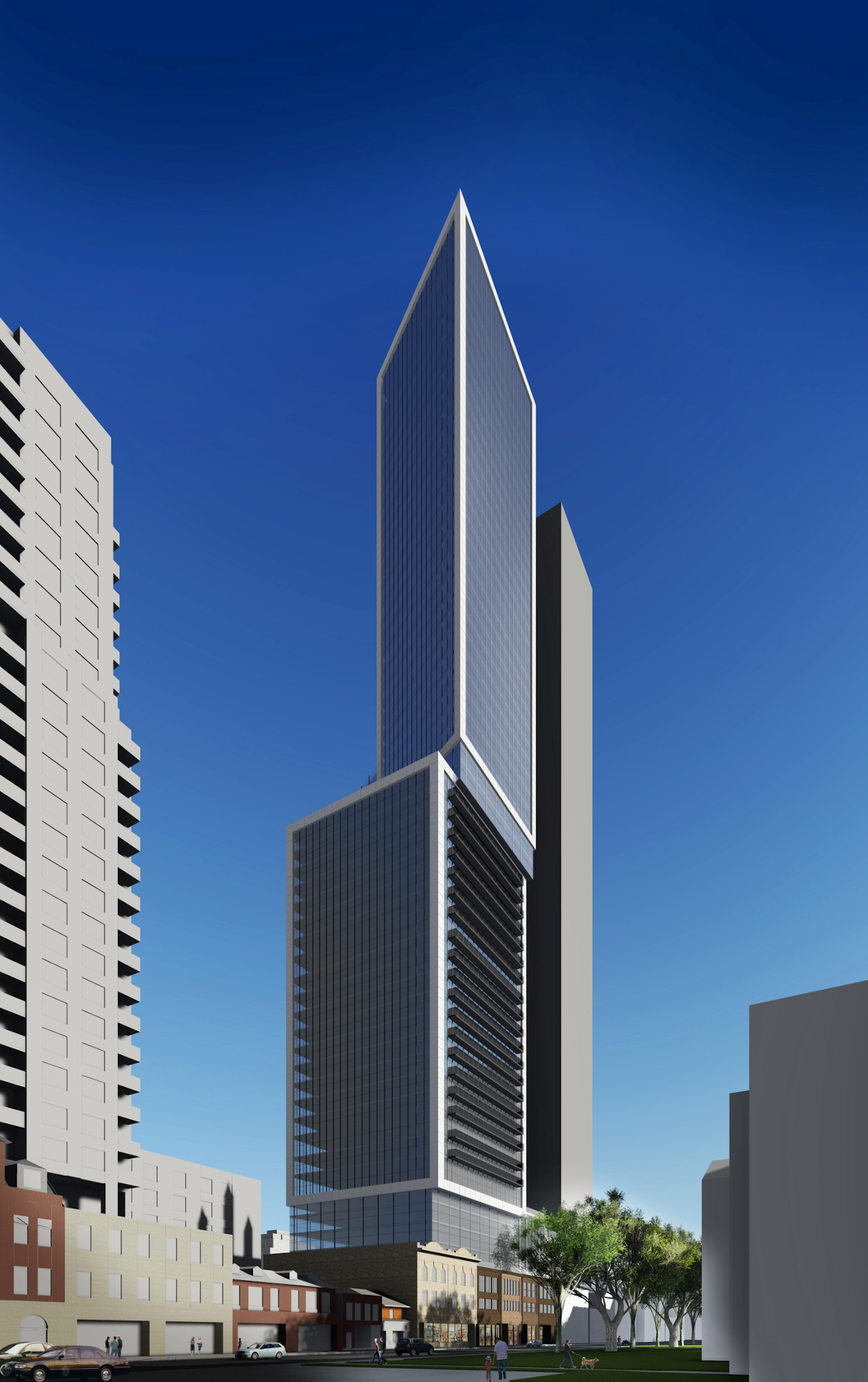

Last week, Dutch developers Kroonenberg Group and ProWinko made a big splash on the development scene with their proposal to redevelop the narrow property at 1200 Bay, replacing the existing 12-storey mid-century office building with a skinny 87-storey tower that, at 324 metres in height, is the second-tallest tower proposal in the country. Enlisting world-renowned Swiss architects Herzog & de Meuron alongside local firm Quadrangle, the mixed-use development is reminiscent of the ultra-luxury ‘pencil towers’ populating the Manhattan skyline. Following their announcement last week, a development application has officially been submitted to the City for Official Plan Amendment and rezoning approvals, and a closer look at the documents reveals further details about the landmark project.

Rendering of 1200 Bay showing adjacent proposed and approved developments, image via submission to the City of Toronto.

Rendering of 1200 Bay showing adjacent proposed and approved developments, image via submission to the City of Toronto.

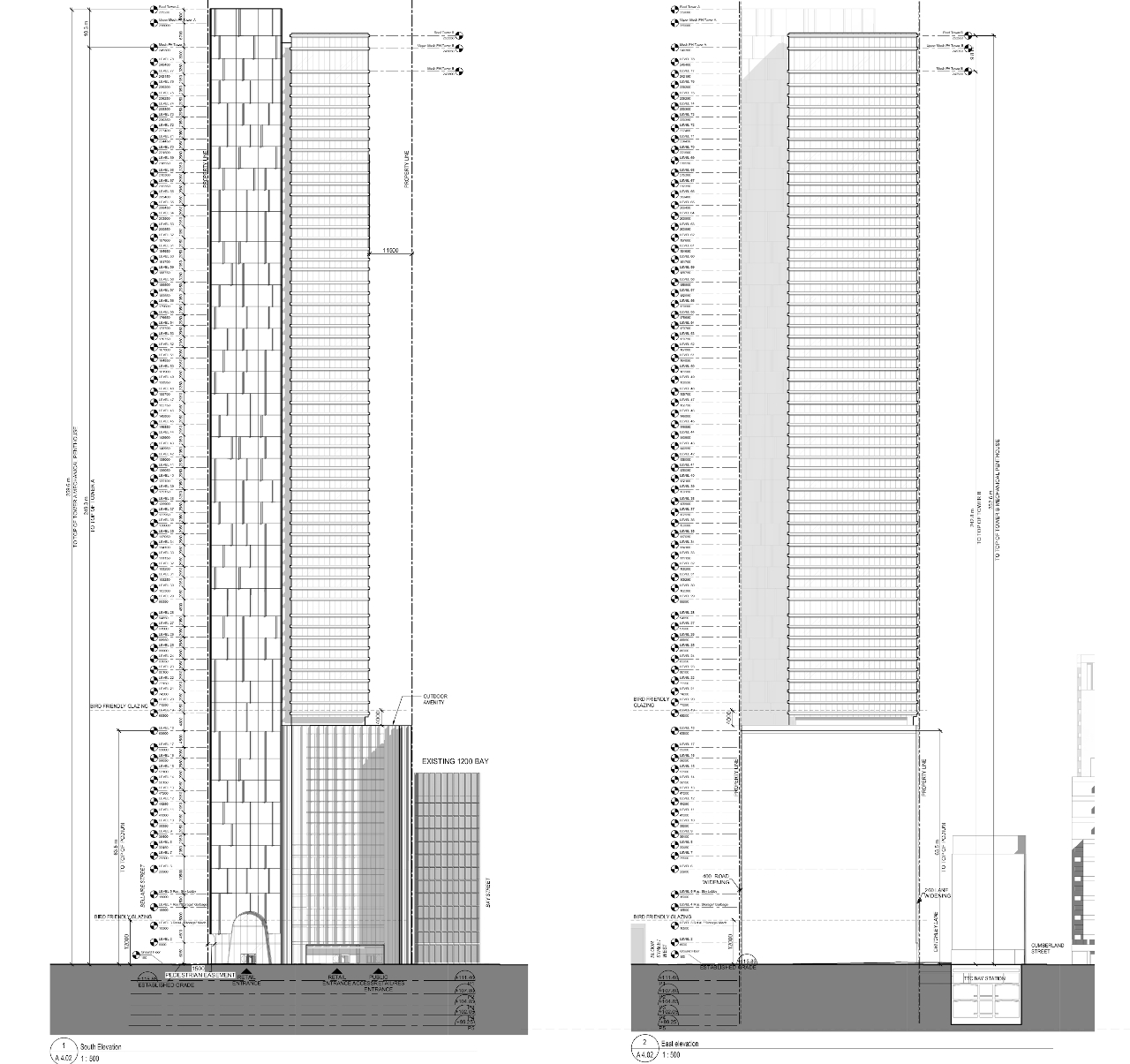

Several statistics have now been made clear in the planning documents. The width of the tower is 17.58 metres at its base on the north and south elevations, shrinking down to a mere 14.08 metres above the 16th floor. For context, 1 King West clocks in at a width of 15.38 metres at its thinnest portion with a height-to-width ratio of approximately 1:11, making 1200 Bay the skinniest tower in the city. The tower falls short, however, of taking the title of thinnest in the world; those honours go to the Steinway Tower at 111 West 57th St in New York, whose height-to-width ratio of 1:24 is higher than 1200 Bay’s ratio of 1:18.

With floor plate sizes of 825 m² at the base and 680 m² in the tower, the proposal squeezes nearly 54,900 m² of GFA onto a site of only 890 m², resulting in an FSI of a whopping 61.67 – the highest yet seen in the city.

Rendering of 1200 Bay at ground level, image via submission to the City of Toronto.

Rendering of 1200 Bay at ground level, image via submission to the City of Toronto.

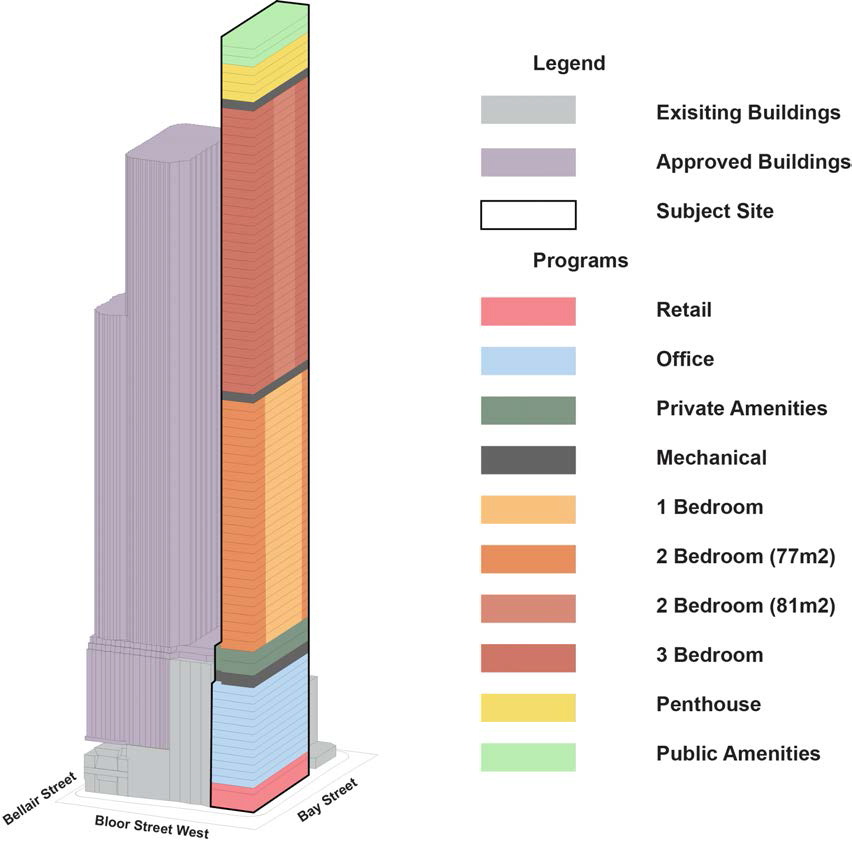

Contained within the tower is a mix of uses, beginning with a 1,104 m² retail space on the ground and second floors, which is also afforded secondary service space on the basement level. The remainder of the ground floor is occupied by a double-height residential lobby and an office lobby. Floors 3 through 15 contain 10,274 m² of office space, fully replacing all of the office space being demolished in the existing office tower on the site.

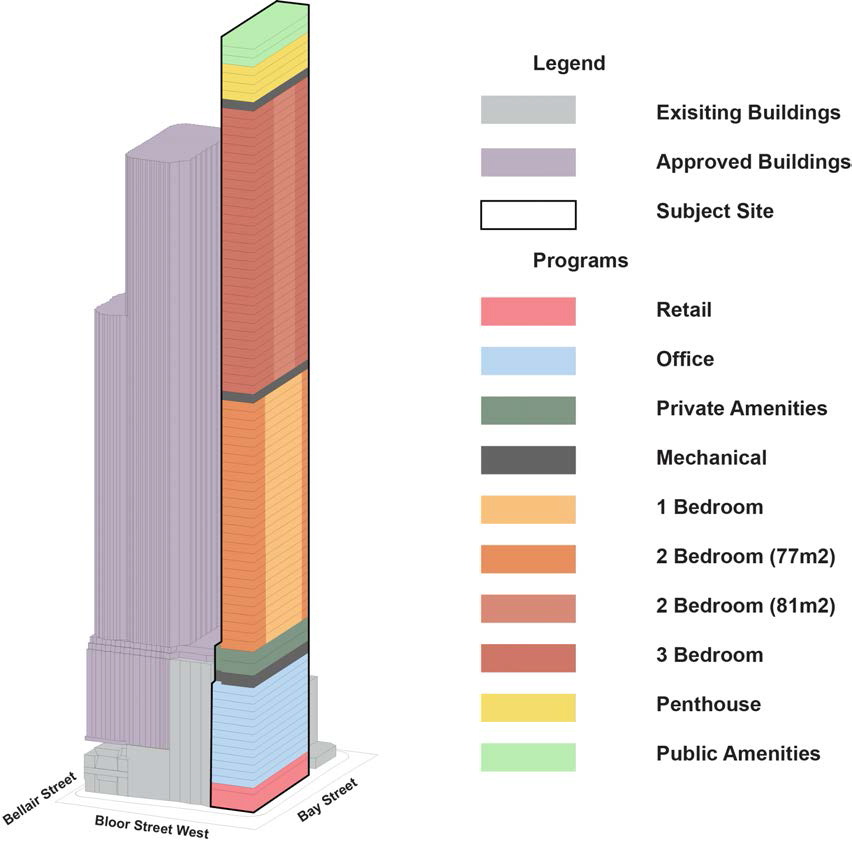

Program diagram, image via submission to the City of Toronto.

Program diagram, image via submission to the City of Toronto.

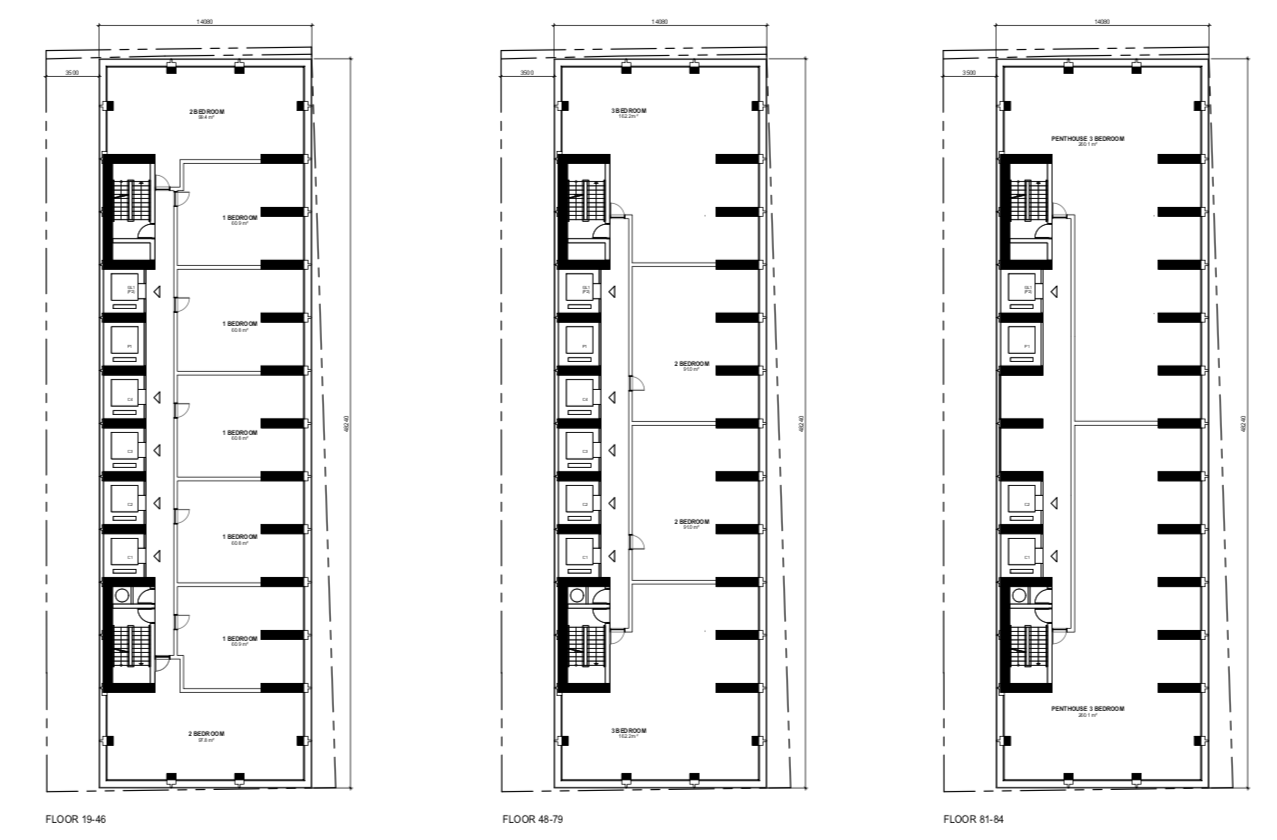

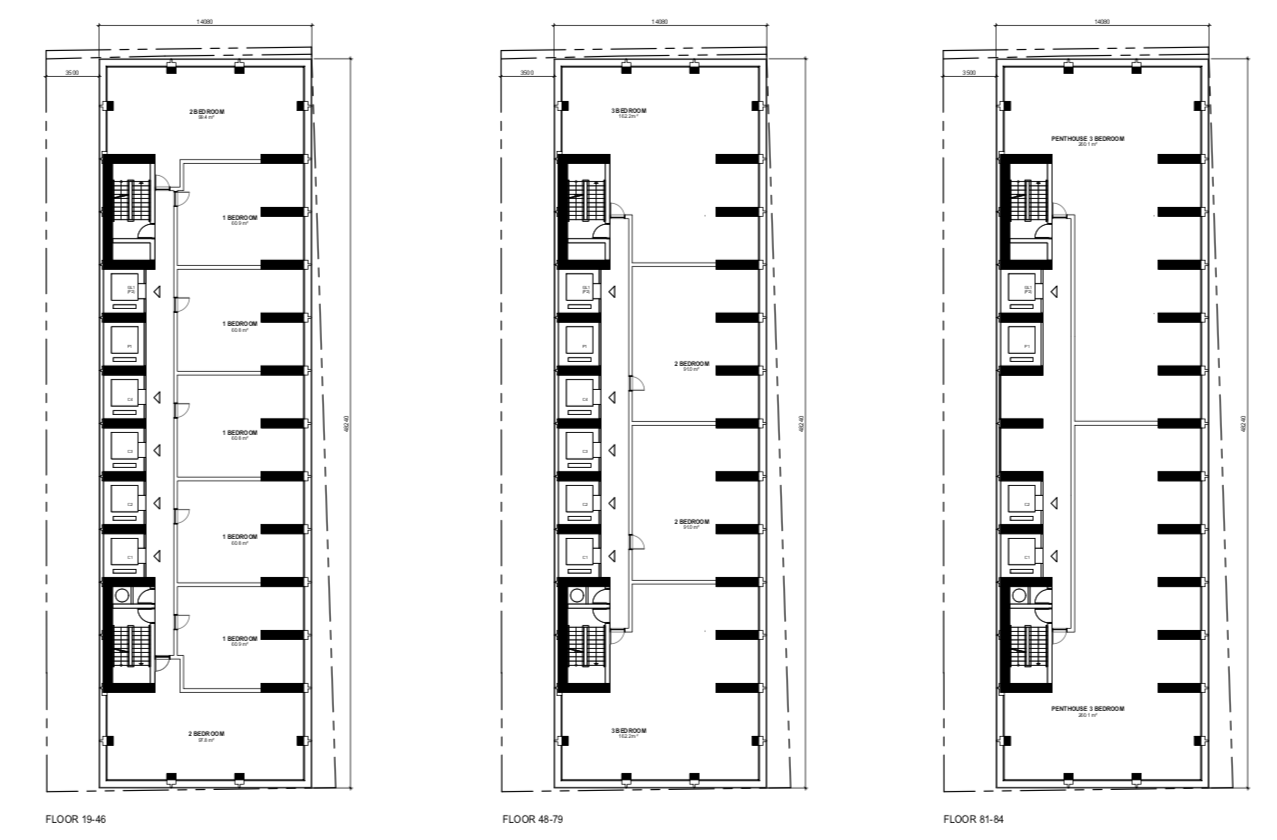

Floors 17 and 18 contain residential amenities, including a fitness centre and a pool, the latter of which occupies the entirety of the 18th floor. Floors 19 through 84 contain 332 condo units, with a breakdown of 140 one-bedrooms (42%), 120 two-bedrooms (36%), and 72 three-bedrooms (22%), including 8 three-bedroom penthouse units on the 81st through 84th floors, each comfortably measuring 260.1 m² (2,800 sf) in size.

Residential tower floor plans, image via submission to the City of Toronto.

Residential tower floor plans, image via submission to the City of Toronto.

Crowning the building is a restaurant and event space on the 85th through 87th floors. With the main dining room located on the top floor of the building, the restaurant will be the second-highest observatory in the city after the CN Tower. The design team is also considering “rentable spaces” as part of the public amenities at the tower top, shown in plan on the 85th floor.

Rendering of the top of 1200 Bay, image via submission to the City of Toronto.

Rendering of the top of 1200 Bay, image via submission to the City of Toronto.

Perhaps what is most notable about the building program is what it does not contain, with zero vehicular parking spots provided. The building will only contain bicycle parking, storage lockers, and mechanical services on four basement levels, with a ‘travelator’ providing direct access from a designated bicycle entrance on the ground floor down to the bike parking on the B1 level.

The development also proposes a direct connection to Bay subway station to the north with a tunnel below Critchley Lane connecting to the B2 level. Also included in the documents is the potential for an eastward connection below Bay Street to link up with the Yonge-Bloor PATH network, though the development team has not yet been in contact with the building owners across the street to discuss the feasibility of this.

Section of the ground and basement levels showing travelator and TTC connection, image via submission to the City of Toronto.

Section of the ground and basement levels showing travelator and TTC connection, image via submission to the City of Toronto.

The architecture of the building is unique in its detailing. Opting for a simple, clean, modern facade, the complexity is in the details with Herzog & de Meuron proposing a triple-layered building envelope. No detailed drawings are available yet, but according to a description provided by the architects, the innermost layer, referred to as the “thermal envelope”, is comprised of full-height operable glazed panels, to “provide ventilation and allow occupants to clean the glass from the inside”. The second layer contains wooden shutters, which can each be controlled individually by the occupants of the building and which still allow a “pleasant, filtered light” in the space when closed. This, according to the architects, gives the building a dynamic appearance from the exterior and some variation in the largely homogeneous facade.

The third layer is a protective outer layer of glass, which shields the wooden shutters from the elements and also controls air flow for natural ventilation. The architects also describe the outer layer of the building as giving it an “abstract quality in certain light conditions”, likely meaning that the glazing type will be carefully chosen based on its reflective qualities and hue.

The documents tout the sustainable aspects of the facade system, though the project as a whole in its current form only meets Toronto Green Standard Tier 1 requirements.

Close-up of the building facade, image via submission to the City of Toronto.

Close-up of the building facade, image via submission to the City of Toronto.

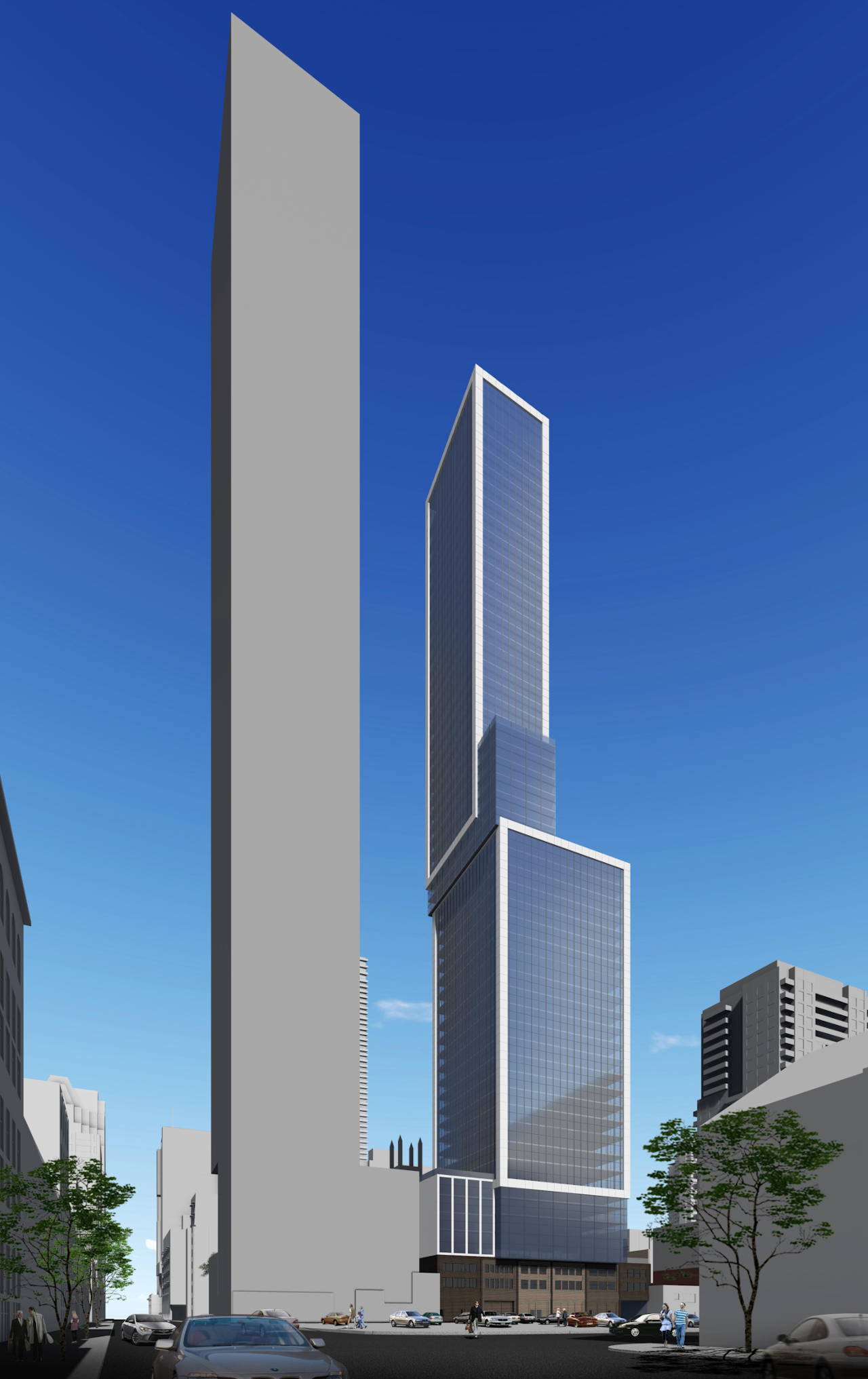

Perhaps most notable about the development application is a proposed Block Plan put forth by the 1200 Bay team that includes the 80 Bloor West proposal next door and which takes a more holistic approach to the surrounding context. Back in November 2019, the Krugarand Corporation submitted a development application for a 79-storey mixed-use tower at 80 Bloor West, whose eastern podium facade would butt up against the western wall of 1200 Bay. That project was revised and resubmitted just this week, with a completely new design from Giannone Petricone Associates that does not address the proposal at 1200 Bay. It would include 1,430 condo units with retail at grade.

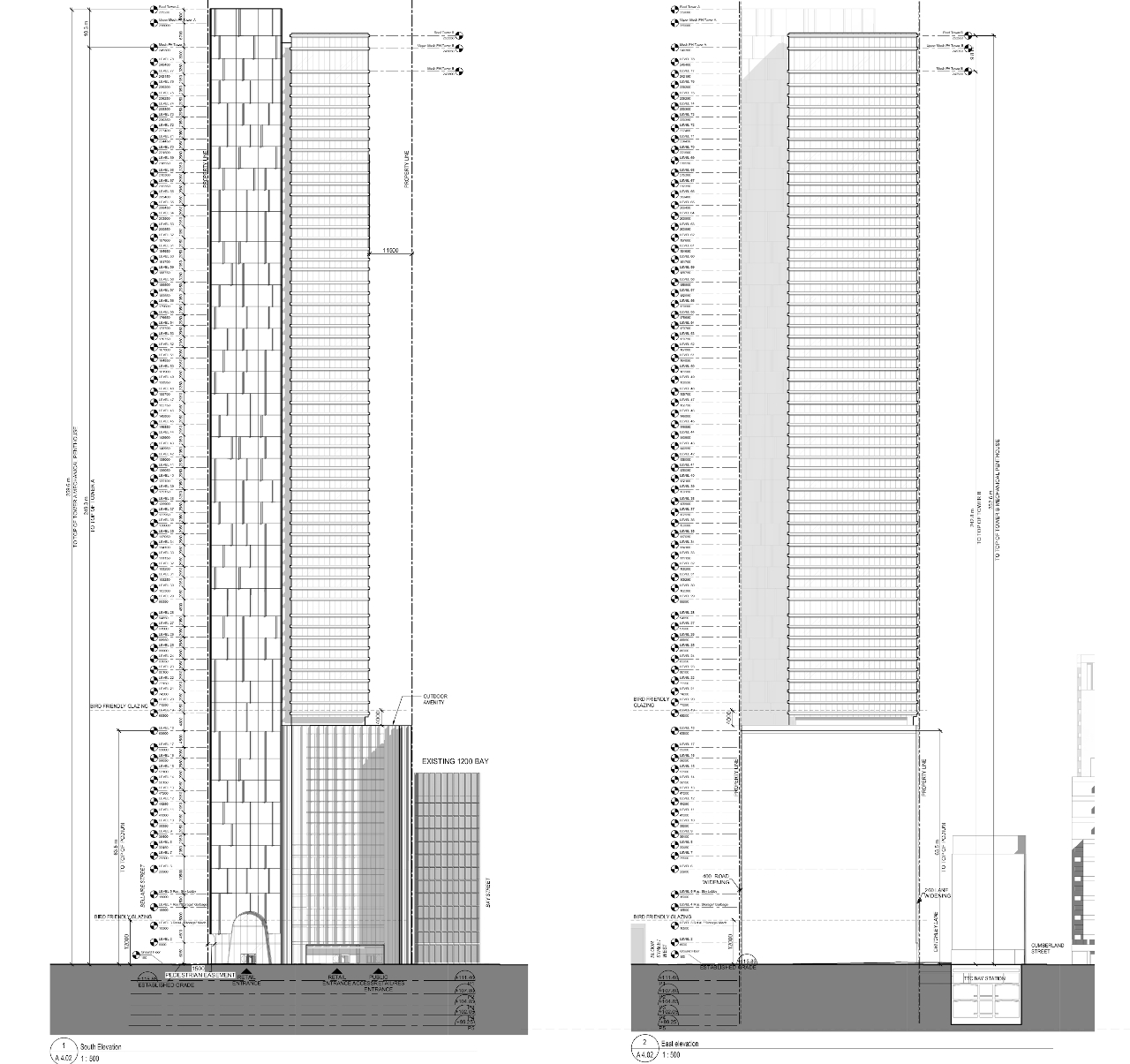

South and east elevations of the June 2020 resubmission of 80 Bloor West, image via submission to the City of Toronto.

South and east elevations of the June 2020 resubmission of 80 Bloor West, image via submission to the City of Toronto.

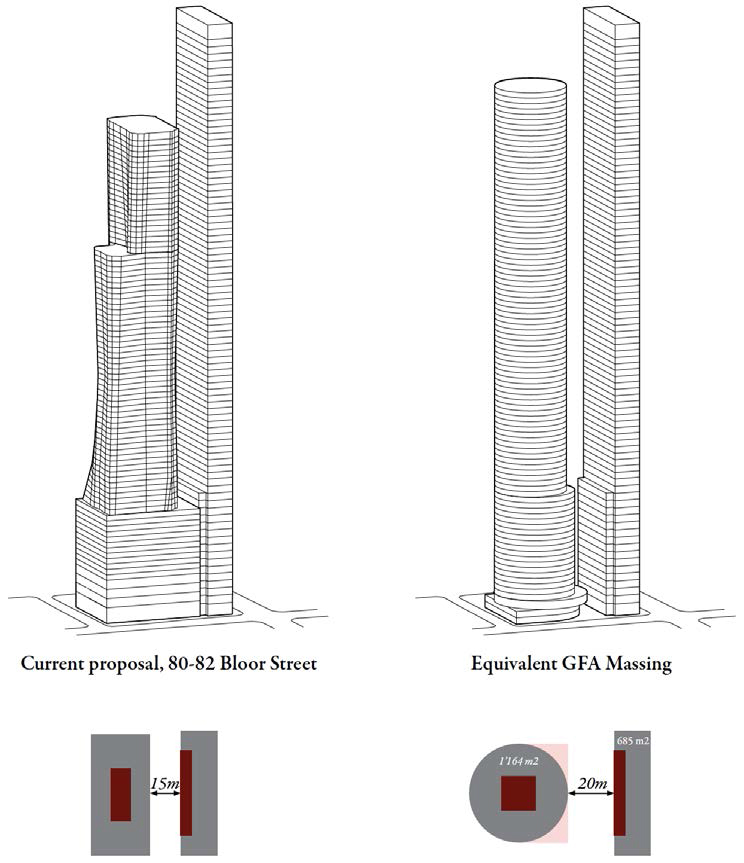

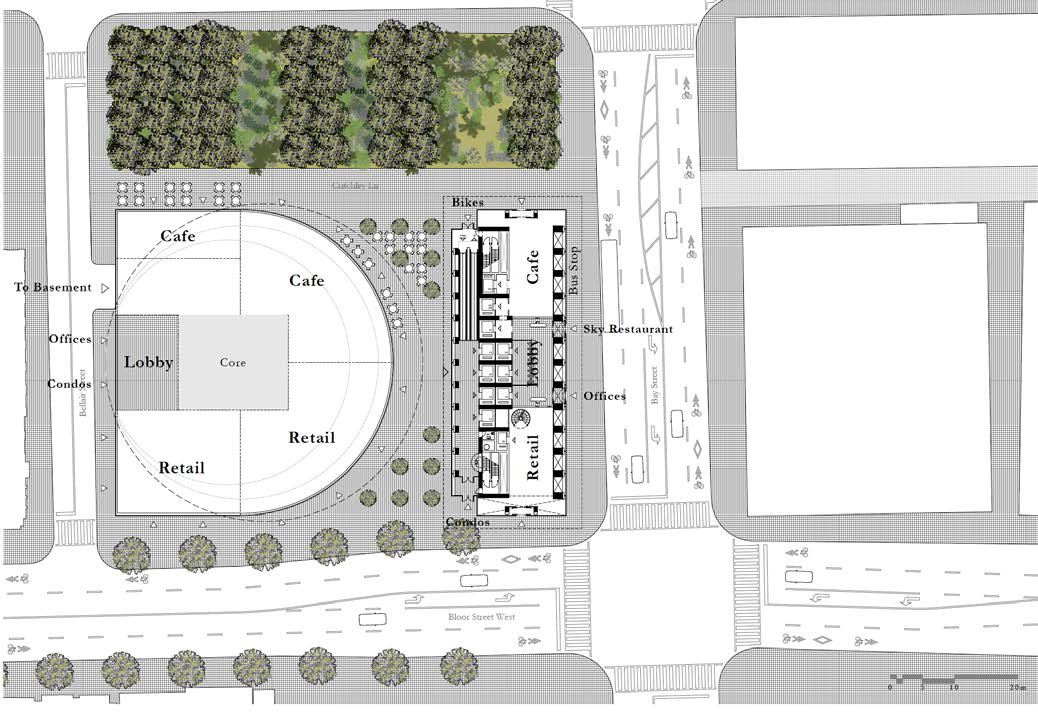

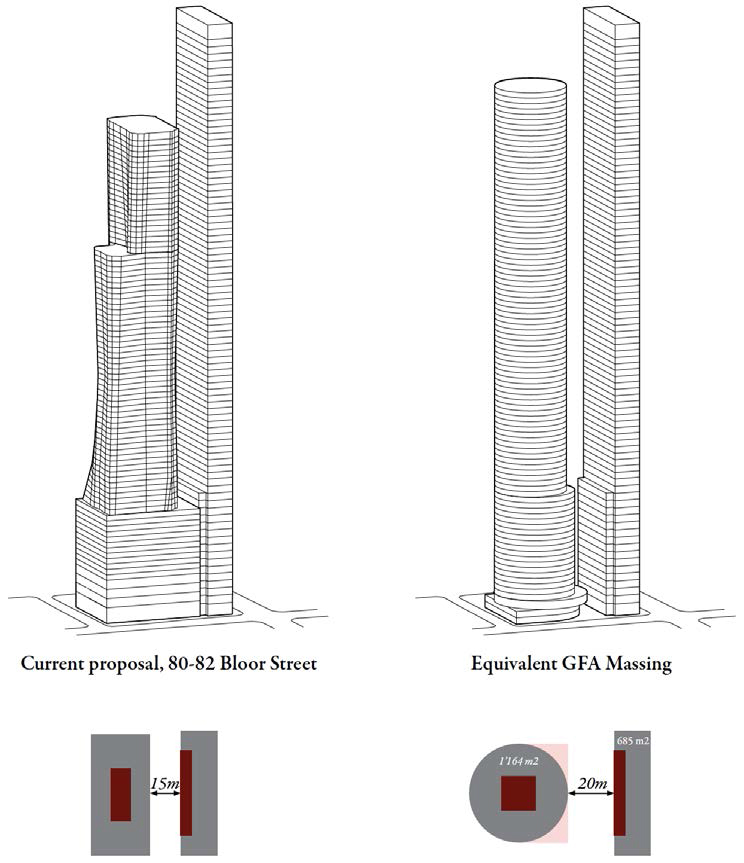

In the 1200 Bay Block Plan, the design team has reimagined the 80 Bloor West proposal as a circular tower with a smaller floor plate in an effort to maximize the separation distance between the two towers. As it stands, the two current proposals are only 15 metres apart, but if a circular floor plate were used on the larger 80 Bloor West site, that distance can be increased to 20 metres – still 5 metres shy of the City’s standard recommendation of 25 metres – while maximizing privacy and views from both buildings. According to the Block Plan, the revised massing of 80 Bloor West maintains the same overall GFA for the development, although the tower would be a few floors taller. (Note that the diagram below was produced before the June 2020 resubmission of 80 Bloor West.)

Diagram showing proposed revision to massing of 80 Bloor West, image via submission to the City of Toronto.

Diagram showing proposed revision to massing of 80 Bloor West, image via submission to the City of Toronto.

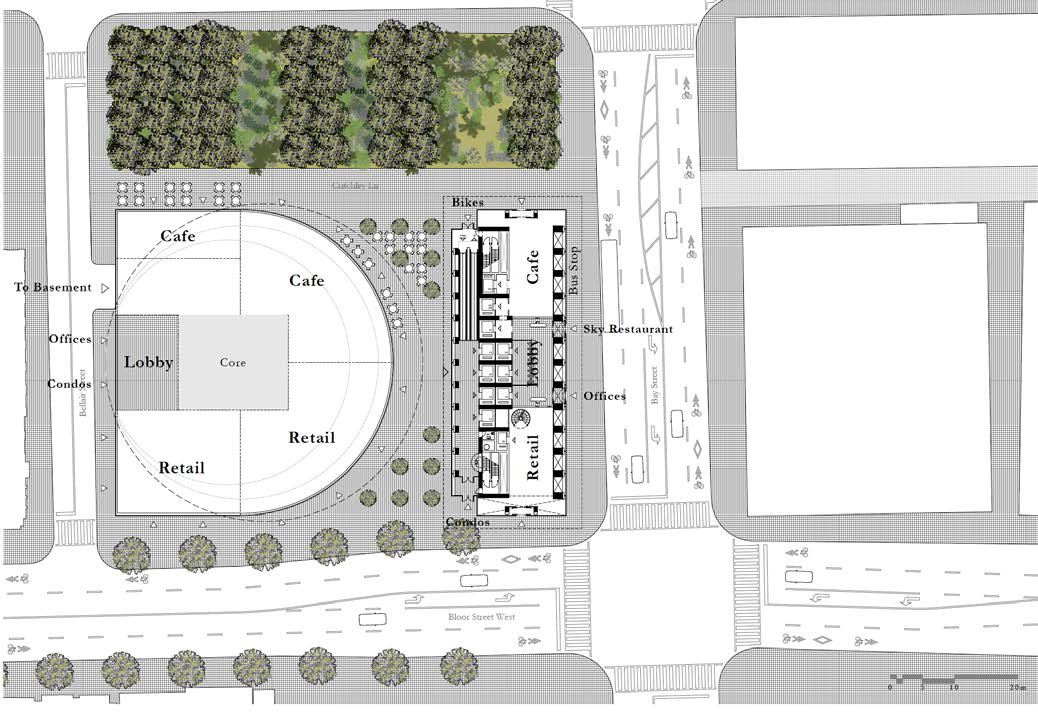

More significantly, the Block Plan reimagines a more porous public realm on the site of the two developments. The northern portion of the block along Critchley Lane is envisioned as an extension of Village of Yorkville Park to the west, offering new public parkland in the dense neighbourhood. As well, a north-south pedestrian walkway would slot between the two buildings connecting Critchley Lane to Bloor, described by the design team as evoking the “Yorkville permeability” of retail-lined laneways found elsewhere in the neighbourhood.

Rendering of north-south pedestrian connection in the Block Plan, image via submission to the City of Toronto.

Rendering of north-south pedestrian connection in the Block Plan, image via submission to the City of Toronto.

The Block Plan also proposes to connect the two buildings at the basement levels. Underground parking would be provided under 80 Bloor West, with direct connections to the elevator bank of 1200 Bay. Both 80 Bloor West and 1200 Bay have proposed direct connections to Bay subway station in their individual proposals, which would likely be consolidated into one in the Block Plan.

Proposed ground floor plan of Block Plan, image via submission to the City of Toronto.

Proposed ground floor plan of Block Plan, image via submission to the City of Toronto.

The documents are vague as to whether the 1200 Bay team attempted talks with the 80 Bloor West team to coordinate their proposals, or whether this Block Plan is a purely speculative exercise developed independently of the adjacent development. 80 Bloor West is currently being contested at the LPAT with a hearing scheduled in August, and the recent redesign of that proposal does not acknowledge the existence of 1200 Bay or the conceptual Block Plan.

There are also the properties north of Critchley Lane to consider, that are included in the Block Plan and that would be demolished to make way for the park extension, which are not currently included in either tower proposal. Regardless, the Block Plan signals that the 1200 Bay team is open to collaborating and is at least taking into consideration the wider context, something that is not always seen with other development proposals in the city.

Proposed tower floor plan of Block Plan, image via submission to the City of Toronto.

Proposed tower floor plan of Block Plan, image via submission to the City of Toronto.

Other submitted documents worth mentioning include the shadow study, which characterizes the impact of the building on the surrounding parks as minimal. The tower would cast a narrow shadow over parts of Jesse Ketchum Park for no more than 2 hours mid-day in March and September, while in June, the tower would add further shadowing on Village of Yorkville Park in the morning only. No other significant shadow impacts were identified in the study.

Rendering of 1200 Bay, image © Herzog & de Meuron.

Rendering of 1200 Bay, image © Herzog & de Meuron.

As it is still very early in the planning and design phases, there are likely changes on the way, whether they be minor tweaks or major overhauls, as the building moves through the approvals process.

Source Urban Toronto. Click here to read a full story

Government to introduce changes to the Commercial Tenancies Act to protect small businesses

TORONTO — The Ontario government announced today that it intends to take action to protect commercial tenants from being locked out or having their assets seized by their landlords due to the negative impacts of COVID-19.

The proposed changes to the Commercial Tenancies Act would, if passed, temporarily halt evictions of businesses that are eligible for federal/provincial rent assistance. If passed, the legislation would reverse evictions that occurred on or after June 3, 2020. The government intends to bring this legislation forward as soon as possible.

In partnership with the federal government, Ontario is committing $241 million to the Canada Emergency Commercial Rent Assistance (CECRA) for small businesses which is providing more than $900 million in support. CECRA for small businesses provides forgivable loans to eligible commercial landlords to help cover 50 per cent of commercial rent for tenants for the months of April, May and June 2020.

The tenant will be responsible for covering up to 25 per cent of rent, so that up to 75 per cent of the rent is covered. Tenants and landlords can learn how much they may be eligible for by visiting Ontario.ca/rentassistance.

“We need everyone working together to overcome COVID-19,” said Steve Clark, Minister of Municipal Affairs and Housing. “Commercial tenants who can pay their rent, must do so. Landlords should work with their tenants to come to an agreement and use this joint program. Ontario’s small businesses are the backbone of our economy and we need them to flourish.”

If passed, the proposed legislation would make it illegal to evict a commercial tenant until August 31, 2020.

“Working with the federal government, we are providing more than $900 million in relief to tenants and landlords,” said Rod Phillips, Minister of Finance. “We’ve been clear we would support small businesses and today’s action does just that.”

“Ensuring the immediate future of our small businesses is critical to helping our economy recover and rebound,” said Prabmeet Sarkaria, Associate Minister of Small Business and Red Tape Reduction. “A moratorium on commercial evictions will bring stability to our small businesses and the employees and families they support. Their success is Ontario’s success.”

Source News Ontario. Click here to read a full story

Dutch developers Kroonenberg Groep and ProWinko are proposing an 87-storey, mixed-use high-rise which would tower over the downtown Toronto intersection of Bay and Bloor Streets. If approved and built as proposed, it would be Canada’s tallest building.

The companies have appointed Swiss-based architectural firm Herzog & de Meuron and Canadian architects Quadrangle to design the building, which is proposed for the northwest corner of the intersection. The project is in the early planning stages and would require approval from the City of Toronto.

“This is an iconic block in the neighbourhood and Toronto at large. We have an opportunity to deliver a project that sets a new benchmark for design and strives to give something back to the city,” said Lesley Bamberger, owner of Kroonenberg Groep, in a release Wednesday which announced the proposed tower.

The long, narrow property is currently the site of a 12-storey office building.

It sits next to another site where private developer Krugerand Corp., proposed last year to construct a stepped, 79-storey tower containing about 1,400 condominium units and three storeys (about 77,ooo square feet) of retail and commercial space.

The Bay-Bloor high-rise

The first 16 floors of the Kroonenberg / ProWinko project would replace the existing retail, office and technical functions.

A private amenities level will separate these functions from the condominium levels above, which the companies say will be characterized by “generous daylight through the floor-to-ceiling operable windows which provide natural ventilation.”

External shutters would allow each individual user to regulate the daylight and heat load into their apartment.

A large restaurant, sky lounge and rentable spaces will occupy the highest three floors of the building with spectacular panoramic views over the City of Toronto.

At street level, residents will enter a triple-height lobby from Bloor Street and take one of four dedicated lifts to their condo level. Residences will range from one-bedroom to multi-level penthouses, totaling 332 condominium units spread over 64 floors.

If approved and constructed at its proposed height of 1,063 feet, the development would be taller even than the proposed Sky Tower, a 1,027-foot, 95-storey high-rise planned for the Pinnacle One Young development.

The CN Tower remains Canada’s tallest freestanding structure at 1,815 feet.

First Toronto project

The tower marks Herzog & de Meuron’s first design in Toronto, with Quadrangle serving as project architect and Urban Strategies rounding out the design team.

The Bloor Street location places the building on a major east-west axis at the northern edge of the downtown core. It is also adjacent to one of the best-known shopping areas in Toronto.

The intersection with Bay Street is a strategic site within the neighbourhood and at the heart of a cluster of major new developments in the area.

The release says a “linear core at the western façade is proposed which maximizes the usable area of the floorplate, the aspect over Bay Street to the east and simultaneously provides privacy from any adjacent development to the west.”

The building will feature interior glazing (thermal envelope), exterior timber roller shades and an outer layer of transparent, open-jointed glass.

“The effect is a building which at times appears transparent and expressive – revealing the scale and activity within the building; and at other times, the reflective outer layer of glass gives the building an abstract quality, emphasizing its dramatic proportion,” the release states.

About Kroonenberg Groep

Kroonenberg Groep is an international developer, real estate investor and manager of retail space, workspace and residential space. It “realizes creative and sustainable tailor-made solutions that are completely in line with the needs of the market.”

About ProWinko

ProWinko’s roots lie in the Netherlands, where the company has been active since 1990. Its portfolio consists of “high-quality real estate at top locations in major city centres,” the company says.

It is currently active in six countries (Canada, the Netherlands, Belgium, Portugal, Luxembourg and Switzerland).

About Herzog & de Muron

Established in Basel in 1978, Herzog & de Meuron is a partnership led by Jacques Herzog and Pierre de Meuron together with senior partners Christine Binswanger, Ascan Mergenthaler, Stefan Marbach, Esther Zumsteg, and Jason Frantzen.

An international team of nearly 500 collaborators including the two founders, five senior partners, eight partners and 42 associates work on projects across Europe, the Americas and Asia.

The main office is in Basel with additional offices in London, New York, Hong Kong, Berlin and Copenhagen.

The practice has designed a wide range of projects from private homes to large-scale urban design. Many projects are highly recognized public facilities, such as museums, stadiums and hospitals, along with private projects including offices, laboratories and apartment buildings.

Awards received include the Pritzker Architecture Prize (U.S.A.) in 2001 and the Mies Crown Hall Americas Prize (U.S.A.) in 2014.

SourceReal Estate News Exchange. Click here to read a full story

After a record breaking quarter in Q4-2019, sales tapered off in Q1-2020 to a total value of $3.9 billion across the Greater Toronto Area, representing an increase in value of 8% year-over-year. The total volume of sales increased 12% from a year ago to 318 transactions.

Annual gains were experienced by most Regions, with Peel experiencing the largest growth this quarter at 35% (+$205 million), followed by Toronto (+$105 million; 5%) and Durham (+$9 million; 6%). Both Halton and York experienced modest declines, with Halton decreasing by 6% (-$16 million) and York by 3% (-$16 million).

Apartment sales experienced the largest growth in the quarter, climbing 49% year-over-year to $1.2 billion in Q1-2020. The largest sale was Freed Developments acquisition of 175 Wynford Drive for $102 million. A 2013 application proposed two residential apartment buildings of 32 and 39 storeys with 755 residential units, 40,838 sf of non-residential uses and four levels of underground parking accommodating 766 parking spaces. These apartments would be connected to the existing Don Valley Hotel via a shared ground level/lobby area.

For apartment site transactions in Q1-2020, the average proposed price per proposed GFA in Toronto was $132 psf.

Rental apartments experienced a growth of 209% year-over-year to $561 million, followed by house lots (+$96 million; 82%), commercial land (+$63 million; 26%) and rural land (+$11 million; 37%). Rental apartments in Toronto had an average cap rate of 4.22% Q1-2020.

Annual declines were experienced by office buildings (-$313 million; 43%), industrial buildings (-$191 million; 26%), residential land (-$134 million; 37%), and retail buildings (-$17 million; 7%).

Source Urbanation. Click here to read a full story

First submitted to the City in 2018 as a 49-storey residential tower, The Pemberton Group’s vision for a string of properties on Church just north of Queen has evolved in several ways. Updated materials for 18 Dalhousie now detail a development with a larger footprint, increased height, and an updated design by Graziani + Corazza Architects.

Comparison between the previous and current designs, images via submission to the City of Toronto

Comparison between the previous and current designs, images via submission to the City of Toronto

The site is located along the east side of Church Street and the west side of Dalhousie Street between Queen Street East and Shuter Street. It is currently occupied by several three-storey commercial buildings, and neighbours a 57-storey condominium proposal by Bazis to the immediate south.

Looking southwest at 18 Dalhousie, image via submission to the City of Toronto

Looking southwest at 18 Dalhousie, image via submission to the City of Toronto

The original rezoning application for the development, stretching across 18-20 Dalhousie and 139-149 Church Street, contemplated a 49-storey primarily residential building with 414 units and 480 m² of ground-level retail space.

Looking east towards 18 Dalhousie, image via submission to the City of Toronto

Looking east towards 18 Dalhousie, image via submission to the City of Toronto

In the time since the July, 2018 application, The Pemberton Group acquired the property at 137 Church Street, extending the area of the development from 1,305 to 1,545 square metres. The expanded frontage along both Church and Dalhousie Streets, combined with feedback from City staff and local residents, has resulted in significant changes to the original proposal.

Looking southeast at 18 Dalhousie, image via submission to the City of Toronto

Looking southeast at 18 Dalhousie, image via submission to the City of Toronto

The floor count of the building has jumped from 49 to 54 storeys, translating to an increase in measured height from 156.2 metres to 173.2 metres, including the six-metre-tall mechanical penthouse. Although the gross floor area of the development has increased to 33,845 m², the overall density has been reduced from 23.6 to 21.9 FSI.

Looking northwest at 18 Dalhousie, image via submission to the City of Toronto

Looking northwest at 18 Dalhousie, image via submission to the City of Toronto

Height restrictions imposed by the St. Michael’s Hospital helicopter flight path continue to inform the articulation of the tower volume. The tower is comprised of a lower element from levels eight through 27, a reduced floor plate central portion from levels 28 to 33, and a further reduced upper element from levels 34 to 54, giving the project a stacked and shifted box aesthetic. The central and upper tower components are setback two metres from the flight path to provide an additional buffer, a move not contemplated in the original scheme.

Distinct changes in the materiality of the tower signal transitions between the podium and tower elements. A simple glazed facade is implemented for the upper podium and central tower elements, while a white border design has been applied to frame the lower and upper tower components. The revised proposal eliminates the majority of the projecting balconies originally conceived, with the only projecting balconies remaining located on the west facade of the lower tower facing Church Street.

Looking southeast at the Church Street frontage, image via submission to the City of Toronto

Looking southeast at the Church Street frontage, image via submission to the City of Toronto

Floor plates have generally increased in size. The lower tower element features plates of 823 square metres between levels eight and 27, compared to the original’s 750 m² between levels nine and 28. The central tower element has floor plates measuring 580 m², while the upper tower element has a reduced floor area of only 469 m².

The number of units have increased from 414 to 479, with 33 studios, 260 one-bedrooms, 114 two-bedrooms, and 72 three-bedrooms planned. The proposed development includes 1,105 m² of indoor amenity spaces and 658 m² of outdoor amenities, to be located on the fourth and eighth floors.

The massing of the seven-storey podium has been redesigned to provide a consistent three-storey low-rise expression along Church and Dalhousie. The ground plane of the project has been rearranged to avoid vehicular access conflicts with the proposal at 60 Queen East and to “ensure active uses are incorporated along the Dalhousie Street frontage at-grade.”

Looking east towards the western elevation of 18 Dalhousie, image via submission to the City of Toronto

Looking east towards the western elevation of 18 Dalhousie, image via submission to the City of Toronto

The existing facade at 147-149 Church Street will also be retained and integrated into the podium design, and additional stepbacks employed above the third level are designed to establish a pedestrian-scale built form along Church. The remainder of the three-storey base element now features architectural elements which characterize the retained facade and the other adjacent low-rise buildings.

While the primary residential entrance remains on Dalhousie Street, a secondary lobby entrance has been proposed on Church Street, where a number of grade-related retail units with individual entrances are also envisioned.

Vehicular access to the loading area and parking ramp has been relocated to the north end of the building. The number of vehicular parking spaces has increased slightly from 117 to 121. There would be 48 short-term bicycle spaces compared to the initial 41, and 432 long-term spaces compared to the original 373.

Source Urban Toronto. Click here to read a full story

Owning approximately 3,500 acres of land at prime intersections in all provinces across the country, SmartCentres REIT is pursuing an aggressive expansion of its SmartLiving residential sub-brand, diversifying and optimizing its portfolio through redevelopment of its vast roster of properties. A $12.1 billion development program announced in 2019 is now underway, and will see 94 of the 165 SmartCentres’ properties undergo intensification. One of 256 individual development projects, SmartCentres Pickering will transform a 48-acre site at the intersection of Brock Road and Pickering Parkway, located just five minutes from Pickering GO Station.

The property is bounded by Brock Road to the west, Pickering Parkway to the south, a mature single-family neighbourhood to the east, and a service road to the north. Featuring easy access to Highway 401 and the Durham Live entertainment district, the existing Pickering SmartCentre contains a number of high-profile tenants, including Walmart Supercentre, Lowe’s, Winners, LCBO and PetSmart.

Phase 1 will produce towers of 34 and 33 storeys, image courtesy of SmartCentres

Phase 1 will produce towers of 34 and 33 storeys, image courtesy of SmartCentres

The lands were identified in the South Pickering and Kingston Road Corridor Intensification Studies for high-density mixed-use development, aligning with the principles and long-term growth strategy established by SmartCentres. Recognizing the changing landscape of retail, the REIT is taking a leadership role in extracting value and maximizing the potential of its assets, while contributing towards the urbanization of several GTA municipalities, including Pickering.

Looking southeast at the first phase, image courtesy of SmartCentres

Looking southeast at the first phase, image courtesy of SmartCentres

The first phase of the comprehensive multi-phase masterplan will see the northeast corner of Brock Road and Pickering Parkway—currently occupied by two standalone retail buildings separated by a surface parking lot—redeveloped into a two-tower residential project.

Official Plan and Zoning Bylaw Amendment applications have been recently submitted with the City of Pickering, seeking permissions to build 33 and 34-storey condominiums on the first six-acre lot, with heights of 106 and 109 metres.

Looking northeast from the corner of Brock Road and Pickering Parkway, image courtesy of SmartCentres

Looking northeast from the corner of Brock Road and Pickering Parkway, image courtesy of SmartCentres

Designed by Turner Fleischer Architects, the two towers will stand atop a multi-storey podium stretching the full length of the property. A total of 377 and 360 one-to-three-bedroom residences are proposed between the two buildings, with 14,500 ft² of retail space to be provided in the podium.

A total of 703 parking spaces have been proposed. An expansive amenities program will include a fitness centre, party room, guest suite, and an outdoor roof deck.

A multi-storey podium hosts retail space along Brock Road, image courtesy of SmartCentres

A multi-storey podium hosts retail space along Brock Road, image courtesy of SmartCentres

The remaining blocks within the 48-acre property will be developed in phases, allowing the bulk of the retail to continue operating as construction progresses. The lands to the immediate east, occupied by additional surface parking and three individual single-storey commercial buildings, comprise the remainder of Block 1.

Source Urban Toronto. Click here to read a full story

19 Duncan’s Underground Levels Take Shape Behind Heritage Facades.

A mixed-use project in Toronto’s Entertainment District will soon bring a mix of office, residential rental, and hotel uses to the southeast corner of Duncan Street and Adelaide Street West. Westbank Corp and Allied Properties REIT’s 19 Duncan Street will close the gap between height peaks in the Entertainment and Financial districts with a 58-storey, Hariri Pontarini Architects-designed tower incorporating two heritage walls from the warehouse building that stood on the site.

Looking northwest over site of 19 Duncan, image by Forum contributor Red Mars

Looking northwest over site of 19 Duncan, image by Forum contributor Red Mars

Work at the site commenced early last year with the partial demolition of the 1908-built Southam Press Building. The building was torn down other than its north and west walls, which have been preserved in-situ and will be reincorporated into the podium of the new building in a process overseen by heritage specialists ERA Architects. This was followed by shoring activity, paving the way for the mid-2019 start of excavation.

Looking west on Adelaide to 19 Duncan, image by Forum contributor Red Mars

Looking west on Adelaide to 19 Duncan, image by Forum contributor Red Mars

We last checked in on construction at the start of August, 2019 when excavation had just begun to dig down below grade. In the almost ten month since, excavation has wrapped up, a tower crane installed, foundations are in place, and forming has begun for the building’s underground levels. The building will have five underground levels, four for parking plus a level with a health club and retail space.

View west over site of 19 Duncan, image by Forum contributor Red Mars

View west over site of 19 Duncan, image by Forum contributor Red Mars

Crews are now forming the slab for level P2. A double-height P1 level and a the retail/amenity basement will follow before forming reaches the surface. Views into the pit show the process in action. In the image above, a large floor form can be seen being hoisted into place. In the images below, a pump can be seen feeding liquid concrete onto a bed of rebar to form the first sections of the P2 floor slab at the site’s west end.

Underground forming at site of 19 Duncan, image by Forum contributor Red Mars

Underground forming at site of 19 Duncan, image by Forum contributor Red Mars

Underground forming at site of 19 Duncan, image by Forum contributor Red Mars

Underground forming at site of 19 Duncan, image by Forum contributor Red Mars

Once at grade, the structure of the nine-storey podium will then begin to be formed behind the preserved facades, to be topped by the 49 tower floors. The completed building will include offices in the podium, to be the new Toronto home of news media giant Thomson Reuters, who have leased the space for 12 years in a $100M USD deal. Residential rental units will occupy the majority of the tower above, while a hotel will occupy levels 52 through 55. The tower will be topped by a two-level indoor and outdoor residential amenity area perched 180 metres above the city.

Source Urban Toronto. Click here to read a full story

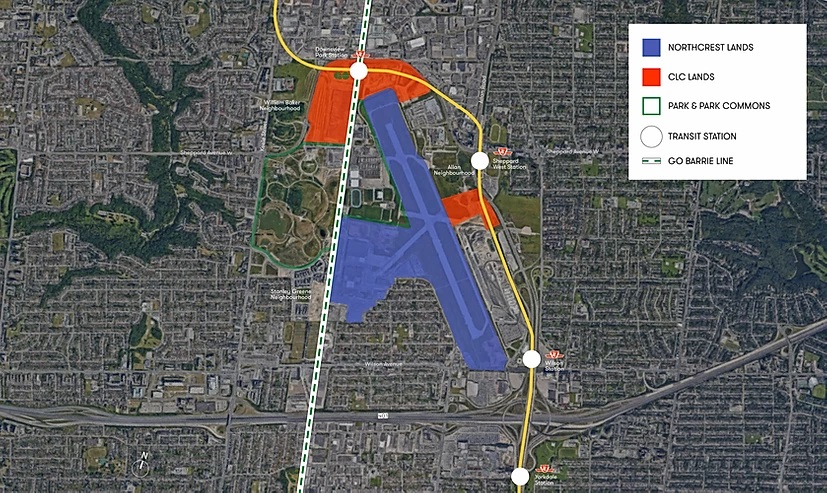

A myriad of notable Toronto city-builders are coming together to plan the future of over 500 acres of property at Downsview. In the wake of the TTC subway extension, GO service expansion, Bombardier selling its Downsview manufacturing facility in 2018, and the airport ceasing operations in 2023, a planning framework designed to shape the lands into a vibrant, sustainable, and complete community is now in its infancy.

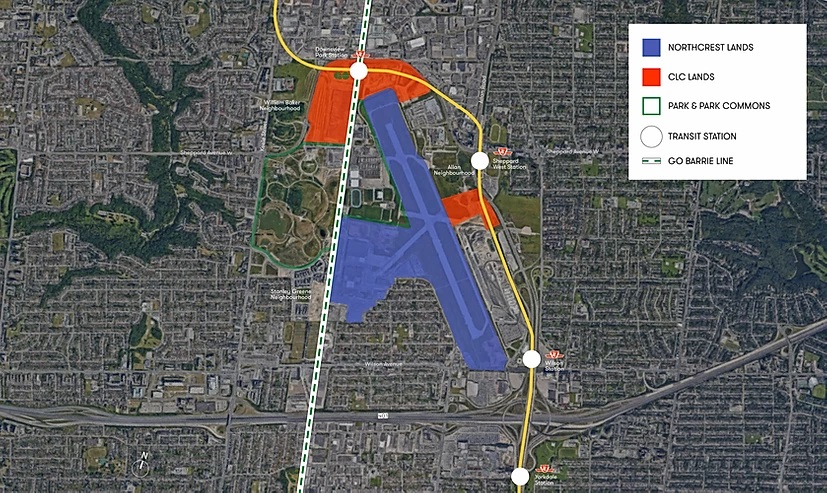

The site includes a 370-acre swath of property that currently comprises Downsview Airport and the hangar lands, which are managed by Northcrest Developments, a wholly-owned subsidiary of the Public Sector Pension Investment Board, while Federal Crown corporation Canada Lands Company owns 150 acres of the former Canadian Forces base lands. The 291-acre Downsview Park to the west will remain unchanged and will be positioned as the heart of the community.

The two development partners have retained Urban Strategies, Henning Larsen, KPMB Architects, and SLA Architects to begin a collaborative visioning exercise, ultimately resulting in a multi-phase redevelopment of the sprawling site.

Current development on the Downsview site is informed by the City of Toronto’s Downsview Area Secondary Plan, which was last updated in 2011. Northcrest and Canada Lands are devoting the coming year to evolving new land uses and a development framework for the site, and launching a website to collect public feedback. A number of public benefits and public policy priorities have been identified early, placing focus on economic development, transit-oriented development, housing affordability and sustainability, and parks and community amenities.

Ownership of the subject site, image via id8downsview.ca

Ownership of the subject site, image via id8downsview.ca

Downsview is constantly evolving, but aerospace activities continue to play an important role in characterizing the legacy and future of the lands. Centennial College recently celebrated the opening of its Centre for Aerospace and Aviation, and a consortium of aerospace companies and post-secondary schools from across the Greater Toronto Area are developing an Aerospace Research and Innovation Hub on the property. Canada Lands is also building a dedicated dog park at Downsview in 2020 as the company prepares to relocate Downsview Park’s urban farm to a permanent 10-acre agricultural campus.

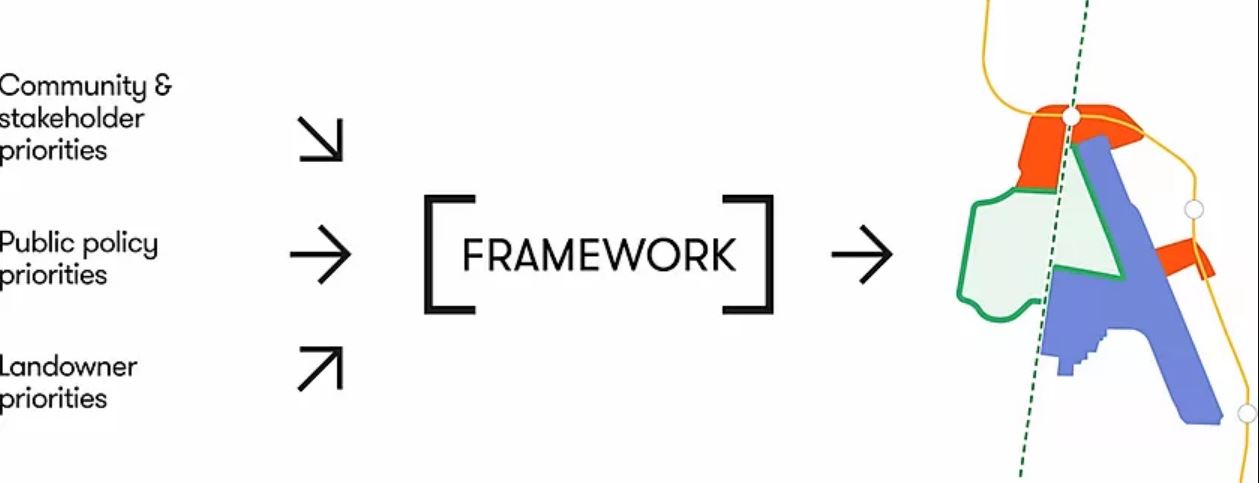

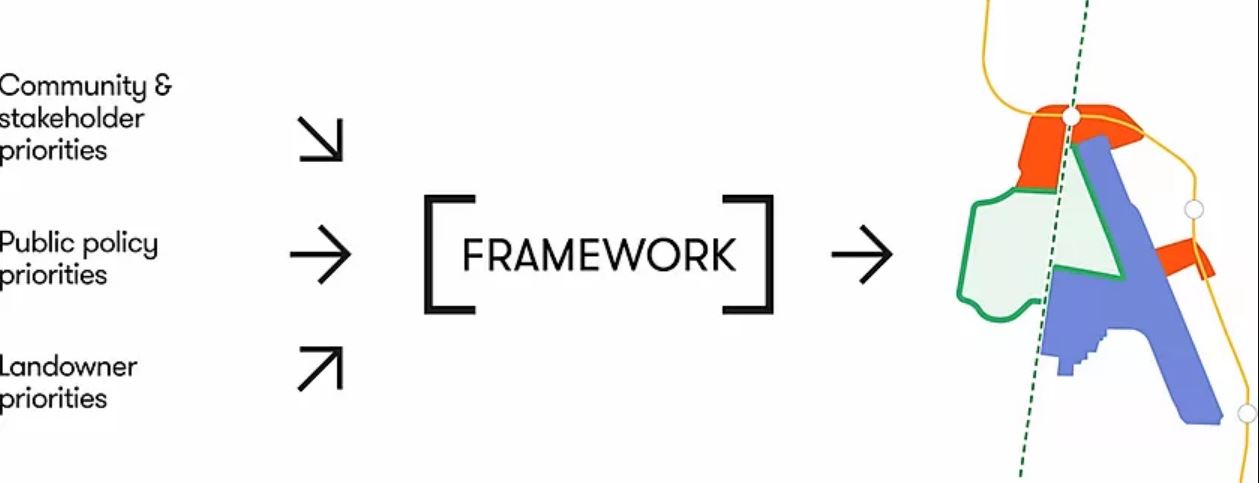

The planning process, which the development team has called “id8 Downsview”, will be guided by feedback from multiple stakeholders, public policy objectives, and the priorities of Northcrest and Canada Lands. Over the next year, the two partners will engage communities and other stakeholders over three rounds of consultation.

The id8 Downsview planning process, image via id8downsview.ca

The id8 Downsview planning process, image via id8downsview.ca

The first round introduces the project and highlights the values of respondents, the challenges people face, and the opportunities they have identified for the future. Round two uses the feedback heard in round one and the technical work completed to share and seek opinions on different ideas to include in the framework. The third round will share and seek feedback on a draft framework proposed by Northcrest and Canada Lands, which will then be employed to guide future development of the lands.

Representing the assembled design team, Michael Sørensen of Henning Larsen Architects, Rasmus Astrup of SLA Architects, and Emily Reisman of Urban Strategies discuss their initial observations of Downsview:

The website provides a number of ways to engage with the consultation process. Participants are encouraged to share their thoughts, be part of an online telephone or videoconferencing event, contribute their personal stories about the people and events that have shaped Downsview, and contact the team directly.

A virtual townhall has been scheduled for Wednesday, June 10th from 7:00-8:00 PM. Three virtual small group discussions will also be held the following week, on June 17th.

If you’d like to, you can join in on the conversation in UrbanToronto’s associated Project Forum thread, or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

The total return on investment of all assets measured by the MSCI/REALPAC Canada Annual Property Index slipped to 4.6 per cent in Q1 2020 from the 7.5 per cent annual rate for 2019.

“As of near the end of March, public markets have clearly taken a very sharp decline, but have come back a bit since then,” said MSCI executive director of client coverage Simon Fairchild during a May 12 online presentation. “We see a trend in returns moving downward.”

The property index measures unlevered total returns of directly held, standing property investments from one valuation to the next. It enables comparisons of real estate relative to other asset classes and comparisons of Canadian real estate performance to other private real estate markets globally.

The property index includes buying, selling, development and redevelopment activity data provided by major pension funds, insurance companies and large real estate owners in Canada. It encompasses 2,369 assets with a gross capital value of $164.71 billion.

Data has been collected since 1985 and the total average return since has been 8.9 per cent. It’s been 9.1 per cent over the past 10 years.

Industrial top-performing asset class

While the industrial, residential, office and retail asset classes combined for a 4.6 per cent total return in the quarter, there was a wide divergence in performance.

Industrial was the top performer with a 15.8 per cent return, though Fairchild said he doesn’t believe that high return rate will be sustainable going forward.

The sector was followed by residential at 10.3 per cent, office at six per cent and retail at -1.8 per cent.

“The weakness of retail is nothing new,” said Fairchild.

He noted the return for super regional shopping centres was -1.6 per cent and the return for mid-range regional malls was -5.1 per cent. Community and neighbourhood malls, often anchored by grocery stores and pharmacies, were in positive territory with a four per cent return.

“There’s certainly a distinction between discretionary and sustenance shopping,” said Fairchild.

Calgary pulls down national average

Halifax was the best-performing Canadian market with a 10.8 per cent return, followed by Toronto at 9.1 per cent, Ottawa at 5.6 per cent, Vancouver at 5.3 per cent, Montreal at 4.7 per cent, Edmonton at -0.6 per cent, Winnipeg at -2.5 per cent and Calgary at -4.3 per cent.

The sharp slowdown in Calgary has pulled the overall national average down.

Fairchild pointed out Calgary’s return was close to 25 per cent and led the nation in 2012, which illustrates the large swings in performance which can occur due to economic conditions.

MSCI/REALPAC Property Fund Index

The MSCI/REALPAC Property Fund Index was created in 2014 and now includes nine open-ended funds: BentallGreenoak Prime Canadian Property Fund; GWL Canadian Real Estate Investment Fund; Fiera Real Estate CORE Fund LP; Fiera Real Estate Small Cap Industrial Fund LP; Greystone Real Estate Fund Inc.; LaSalle Canada Property Fund; London Life Real Estate Fund; Manulife Canadian Property Portfolio; and Manulife Canadian Pooled Real Estate Fund.

There were 1,038 assets under management, worth approximately $38 billion, in the funds at the end of March. The property fund index had a total return of 8.3 per cent during the quarter and the return since its inception is 9.2 per cent.

Every asset in the property fund index is revalued every quarter. The property index has rolling cycles of valuations so only about half of the assets were revalued during Q1. The most recent quarterly valuations took place in March as the economy was undergoing a major downturn due to the pandemic.

Fairchild said the property fund index has more industrial and less retail exposure than the wider index. It also has less representation in Calgary and more in Vancouver, which accounts for its better performance.

REALPAC chief executive officer Michael Brooks asked Fairchild about Vancouver, where performance slipped somewhat during the quarter.

“Vancouver has performed extremely well and prices have become extremely expensive, so maybe there’s been a bit of a correction,” said Fairchild. “Retail was certainly hit hard in the city, so that had a big impact on the overall city numbers.”

MSCI Global Index

The MSCI Global Index was created in 2001. The 2019 edition was released in April.

It includes results from 25 countries and has shown 10 years of positive returns, although they’ve softened somewhat over the past two years and could end that streak in 2020 due to fallout from COVID-19.

Hungary had the best total return in 2019 at around 15 per cent, while the United Kingdom was the worst at just above zero.

There’s also been an increasing gulf between different property types globally. Industrial performed best with a return of around 11 per cent, with office, residential and hotel around six to seven per cent, and retail at less than one per cent.

“Changes in consumer behaviour and increasing amounts of online shopping have been headwinds for the retail sector and have been tailwinds for warehousing and distribution assets in the industrial sector,” said MSCI executive director of real estate solutions research Bryan Reid, who believes the pandemic may accelerate these trends.

Investment allocations have been evolving on the index.

Retail and office, which Reid said had traditionally formed the cornerstones of portfolios, have decreased in importance while residential, industrial, hotel and other asset classes now account for a larger share of the index.

MSCI and REALPAC

MSCI has provided decision support tools and services for the global investment community for more than 45 years. It offers expertise in research, data and technology to power investment decisions and improve transparency across the investment process.

Toronto-headquartered REALPAC is a national industry association dedicated to advancing the long-term vitality of Canada’s real property sector. Members include publicly traded real estate companies, REITs, private companies, pension funds, banks and life insurance companies each with investment real estate assets in excess of $100 million.

The association is further supported by large owner/occupiers and pension fund managers, asset managers, lenders, government real estate agencies, individually selected investment dealers, real estate brokerages, consultants and data providers.

Source Real Estate News Exchange. Click here to read a full story