Author The Lilly Commercial Team

COVID-19 – OFFICE Sector Implications – Commercial Real Estate

As a result of the COVID-19 pandemic, investors, landlords and tenants are assessing impacts, adjusting operations and building and executing contingency plans to support people and their businesses.

The following assesses the impact of COVID-19 on the Office sector in the Canadian commercial real estate space and how key considerations can help through this changing climate.

OFFICE

Impact: Areas of impact for the office sector include remote working adoption and support of technology required to make remote work productive.

Most large organizations and tech-savvy companies have already established remote working options for their employees, but others haven’t.

In these cases, this period serves as a catalyst for workplace transformation as such companies rapidly learn and adopt new practices and perspectives on where and how employees can work.

Key Considerations: Diminished face-to-face interaction may present challenges for employee engagement and collaboration. Maintaining communication should be a top priority, as should ensuring technical infrastructure and support are in place to enable large employee bases to work remotely.

Companies are also beginning to plan for cost-reduction and containment. Some relocation decisions are being deferred through shorter-term extensions.

In the long term, however, organizations may be faced with having to downsize or leave their office space. In these cases, communication with an advisor would be essential, as potential options could include sublease agreements.

Landlords will continuously monitor the safety and risk levels of their buildings and effectively communicate this information to tenants. Landlords are also going to need to assess how to respond to requests for rent relief.

Source Real Estate News Exchange. Click here to read a full story

Commercial real estate will ‘hold up relatively well’ amidst coronavirus fears

Commercial real estate investments will fare well in the face of the coronavirus, which has sent equity markets plummeting to record lows.

Fears over the coronavirus will cause a short-term slowdown in commercial real estate transactions, but investments in office, retail and warehouse properties will be more resilient than other asset classes, say experts.

Compared to other industries, like tech, commercial real estate investments will “hold up relatively well,” said Heidi Learner, chief economist at Savills, a global real estate services provider based in London, adding that real estate is less reactive to market conditions.

“It’s not something that’s going to be disrupted by intermediate products or lack of manufacturing capability in Asia,” said Learner. She noted that there is still demand for data centers even considering the virus’s impact on Microsoft and Apple’s supply chains.

Additionally, “it’s a little bit too early to see valuations be affected, but I would be shocked if we didn’t see a decrease in transaction volume,” said Learner.

Some Chinese investors are trying to finish existing deals virtually, according to experts, but new transactions will likely be delayed to the second half of 2020, assuming travel bans and quarantines lift, according to Learner.

“New commercial transactions will likely decline because of the preference of Chinese investors to visit a property in person at least once before a deal closes,” said Jacky He, CEO of DMG Investments, the U.S. subsidiary of DoThink Group, a Hangzhou, China-based developer.

Prices would only be impacted if the virus became a more “pronounced problem,” forcing investors to sell their real estate holdings, said Learner.

“It’s largely going to be a short-term reaction. I think if you think of real estate as a long-term asset, losing income… for the next six months shouldn’t really affect long-term valuations,” said Learner.

Source Yahoo Finance Click here to read a full story

Prime Minister announces more support for workers and businesses through Canada’s COVID-19 Economic Response Plan

Support for businesses

In the face of an uncertain economic situation and tightening credit conditions, the Government is taking action to help affected businesses. To support Canadian businesses and help them retain their workers during this difficult time, the Government is announcing measures to:

- Allow all businesses to defer, until after August 31, 2020, the payment of any income tax amounts that become owing on or after today and before September 2020. This relief would apply to tax balances due, as well as installments, under Part I of the Income Tax Act. No interest or penalties will accumulate on these amounts during this period. This measure will result in businesses having more money available during this period.

- Increase the credit available to small, medium, and large Canadian businesses. As announced on March 13, a new Business Credit Availability Program will provide more than $10 billion of additional support to businesses experiencing cash flow challenges through the Business Development Bank of Canada and Export Development Canada. The Government is ready to provide more capital through these financial Crown corporations.

- Further expand Export Development Canada’s ability to provide support to domestic businesses.

- Provide flexibility on the Canada Account limit, to allow the Government to provide additional support to Canadian businesses, when deemed to be in the national interest, to deal with exceptional circumstances.

- Augment credit available to farmers and the agri-food sector through Farm Credit Canada.

- Launch an Insured Mortgage Purchase Program to purchase up to $50 billion of insured mortgage pools through the Canada Mortgage and Housing Corporation (CMHC). As announced on March 16, this will provide stable funding to banks and mortgage lenders and support continued lending to Canadian businesses and consumers. CMHC stands ready to further support liquidity and the stability of the financial markets through its mortgage funding programs as necessary. The Government will enable these measures by raising CMHC’s legislative limits to guarantee securities and insure mortgages by $150 billion each.

-

Support for workers

Canadians should not have to worry about paying their rent or mortgage or buying groceries because of the COVID-19 crisis. To support workers and their families, the Government of Canada is taking action to:

- Provide additional assistance to families with children by temporarily boosting Canada Child Benefit payments. This measure would deliver almost $2 billion in extra support.

- Introduce an Emergency Care Benefit of up to $900 bi-weekly for up to 15 weeks to provide income support to workers who must stay home and do not have access to paid sick leave. This measure could provide up to $10 billion to Canadians, and includes:

- Workers, including the self-employed, who are sick, quarantined, or who have been directed to self-isolate but do not qualify for Employment Insurance (EI) sickness benefits.

- Workers, including the self-employed, who are taking care of a family member who is sick with COVID-19, such as an elderly parent or other dependents who are sick, but do not qualify for EI sickness benefits.

- EI-eligible and non EI-eligible working parents who must stay home without pay because of children who are sick or who need additional care because of school closures.

- Introduce an Emergency Support Benefit delivered through the Canada Revenue Agency to provide up to $5 billion in support to workers who are not eligible for EI and who are facing unemployment.

- Provide additional assistance to individuals and families with low and modest incomes with a special top-up payment under the Goods and Services Tax (GST) credit. This measure would inject $5.5 billion in the economy.

- Waive, for a minimum of six months, the mandatory one-week waiting period for EI sickness benefits for workers in imposed quarantine or who have been directed to self-isolate, as announced on March 11.

- Waive the requirement for a medical certificate to access EI sickness benefits.

- Extend the tax filing deadline for individuals to June 1, and allow all taxpayers to defer, until after August 31, 2020, the payment of any income tax amounts that become owing on or after today and before September 2020. This relief would apply to tax balances due, as well as installments, under Part I of the Income Tax Act. No interest or penalties will accumulate on these amounts during this period. This measure will result in households having more money available during this period.

- Provide eligible small businesses a 10 per cent wage subsidy for the next 90 days, up to a maximum of $1,375 per employee and $25,000 per employer. Employers benefiting from this measure would include corporations eligible for the small business deduction, as well as not-for-profit organizations and charities. This will help employers keep people on their payroll and help Canadians keep their jobs.

- Provide increased flexibility to lenders to defer mortgage payments on homeowner government-insured mortgage loans to borrowers who may be experiencing financial difficulties related to the outbreak. Insurers will permit lenders to allow payment deferral beginning immediately.

In addition, to provide targeted support for vulnerable groups, the Government is investing to:

- Reduce minimum withdrawals from Registered Retirement Income Funds (RRIFs) by 25 per cent for 2020 in recognition of volatile market conditions and their impact on many seniors’ retirement savings.

- Implement a six-month, interest-free, moratorium on Canada Student Loan payments for all individuals who are in the process of repaying these loans.

- Provide $305 million for a new distinctions-based Indigenous Community Support Fund, to address immediate needs in First Nations, Inuit, and Métis Nation communities.

- Support women and children fleeing violence by providing up to $50 million to women’s shelters and sexual assault centres to help with their capacity to manage or prevent an outbreak in their facilities. This includes funding for facilities in Indigenous communities.

- Provide an additional $157.5 million to address the needs of Canadians experiencing homelessness through the Reaching Home program.

The six largest financial institutions in Canada have made a commitment to work with personal and small business banking customers on a case-by-case basis to provide flexible solutions to help them manage through challenges, such as pay disruption due to COVID-19, childcare disruption due to school or daycare closures, or those suffering from COVID-19. As a first step, this support will include up to a six-month payment deferral for mortgages, and the opportunity for relief on other credit products. The Government of Canada will continue to monitor evolving economic conditions and seek greater relief measures should it be necessary.

In order to move forward with implementing these new measures needed to provide timely support for Canadians and to ensure the Government has every tool at its disposal to address potential challenges that may arise, the Government intends to introduce special legislation and seek the approval of Parliament.

The Government of Canada will continue to take further action as required to prioritize the health and safety of Canadians, stabilize the economy, and mitigate the economic impact of this pandemic.

Source pm.gc.ca. Click here to read a full story

The Big 6 Banks say they will allow customers to defer mortgage payments for up to 6 months among other changes.

TORONTO — Canada’s big banks are moving to provide financial breathing room to customers hurt by disruptions from the steps taken to slow the spread of COVID-19.

The big six banks say they will allow customers to defer mortgage payments for up to six months among other changes.

The banks urged Canadians or business owners facing hardship to contact their bank directly to discuss options that may be available.

The move comes as the large banks work together in their efforts to limit the spread of the novel coronavirus by temporarily limiting branch operating hours and reducing the number of branches, while maintaining critical services.

Public health officials have urged people to limit contact with others in an effort to limit the threat of the novel coronavirus.

Businesses across the country have responded by cutting back, changing their operations and finding ways to allow employees to work from home.

This report by The Canadian Press was first published March 18, 2020

Source CTV News. Click here to read a full story

Coronavirus: Toronto city councillor calls for postponement of commercial property taxes

A Toronto city councilor is calling for commercial property taxes, water and waste collection bills to be postponed for local businesses in the city amid the novel coronavirus pandemic.

Coun. Brad Bradford, who represents Beaches-East York, called on Mayor John Tory to support the measures in a letter sent on Saturday.

“In the days and weeks since the COVID-19 (outbreak) began affecting daily life in Toronto, I have been hearing from business owners who are under serious pressure as a result of the outbreak,” Bradford said.

“On behalf of my community, I am urging you to place the City’s full support behind the businesses through the difficult weeks and months ahead.”

In addition to recommending that commercial property taxes, water bills and waste collection bills be deferred, Bradford called for the use of capital reserves to provide “emergency relief” for local businesses.

Bradford said landlords should be urged to use discretion and flexibility in collecting rent, and programs should be prepared to help businesses after the outbreak subsides.

“Local businesses employ some 650,000 people in this city. Maintaining the health of these businesses as we maintain our personal health is critical for the long-term strength of our communities,” he said.

Lawvin Hadisi, a spokesperson for Tory, responded to the letter in a statement sent to Global News on Sunday.

“Mayor Tory has repeatedly said that the City’s businesses and employees need support from their government during the COVID-19 pandemic,” Hadisi said.

“He has pledged to have the backs of residents and businesses during this difficult time. The mayor is encouraged by the action taken by both the federal and provincial governments so far but knows there is more work to be done. As the mayor said last week, over the coming weeks he will be leading the City’s efforts to help residents and businesses with the help of Deputy Mayor Michael Thompson and other city officials.”

Hadisi said Tory will also be engaging with business leaders this week to discuss ways to help residents and businesses.

“The mayor also announced Friday — and repeated the message today on Twitter — that he is calling on landlords to offer accommodation to tenants with a focus on small business tenants,” Hadisi said.

On Friday, in an address to the nation from self-quarantine, Prime Minister Justin Trudeau announced that the federal government would be creating an economic aid package to help mitigate financial effects from the pandemic, the full details of which have not yet been revealed.

Reuters reported the package could be valued up to $20 billion.

Finance Minister Bill Morneau said $10 billion would be available through the Business Development Bank of Canada, most of which would go towards “small and medium-sized enterprises.”

The Bank of Canada also cut its overnight rate target by half a percentage point to 0.75 per cent.

Ontario Premier Doug Ford welcomed both actions by the federal government but called for further reassurance for businesses and families.

“Our priority is ensuring coordination between the provinces, territories and the federal government to safeguard the health and well-being of Canadians and protect jobs in the short term and our economy in the long term,” Ford said in a statement after a first ministers call.

Meanwhile, Tory remains in self-quarantine after a recent business trip to the United Kingdom.

Source Global News. Click here to read a full story

Canada can easily handle more flex office space – Large companies incorporating flex space

Canada can easily handle more flex office space.

The amount of flex office space in Canada increased by 59 per cent over the past three years, but a new Colliers study asserts the sector still has a lot of room to grow in the country’s major cities.

“Growth is accelerated right now because, other than IWG, there are so many new players to the Canadian market which are just getting started,” Dan Holmes, Colliers’ senior managing director of office for the Toronto Region, told RENX. “Although we don’t expect it to continue at the pace it’s been currently going at for the long term, we can expect this upward trajectory in demand.”

A total of 2.4 million square feet and 110 new locations were added during that time. Despite this growth, flex space accounted for 6.6 million square feet in 12 core markets at the end of last year — representing just 1.1 per cent of national office inventory.

That compares to penetration rates of 5.1 per cent in London and 2.1 per cent in Manhattan at the end of 2018.

“We’re still a laggard in terms of our adoption rate in Canada and there’s still tons of opportunity,” said Holmes.

Large companies incorporating flex space

This flexibility doesn’t only appeal to freelancers and startup companies. Holmes provided examples of large companies incorporating flex space into their leased real estate portfolios:

* Amazon took 100,000 square feet in a WeWork location at Bentall II and Bentall III in Vancouver;

* Deloitte took 80,000 square feet in Spaces Granville in Vancouver;

* BMO took 45,000 square feet in WeWork Hudson’s Bay Queen Street in Toronto;

* and Google took 26,000 square feet in Spaces Bay Street in Toronto.

“These types of early adopters and large-scale tenants are setting a trend for all tenants to consider securing a portion of their space to be fixed and a portion to be flex,” said Holmes.

“We don’t expect large tenants to decrease the amount of flex space in their portfolio, as it’s becoming the new norm.”

Flex space lease rates

Across the 12 markets surveyed by Colliers, monthly averages for a shared desk, dedicated desk and private office were $297, $443 and $854 respectively. Rates, unsurprisingly, were highest in Toronto and Vancouver.

During periods of uncertainty, rigid lease terms can end up having costly consequences. The benefits of flex office space include the ability to easily upscale or downsize a business or exit obligations on short notice.

Other motivations for choosing flex space include location, networking opportunities, the elimination of capital expenditures and an efficient and streamlined process for end-users.

Holmes said flex space providers try to pay landlords as close to market rates as possible, but will generally charge end-users a premium in exchange for more flexible terms.

That premium can vary based on the operator, the number of desks or offices required in a flex space and features the end-user chooses.

“Tenants are paying for flexibility, they’re paying for amenities, they’re paying for a culture, they’re paying for an environment that they want to offer to their employees,” said Holmes.

“Depending on the type of industry and the type of tenant, if your company is in growth mode, you’re prepared to pay a 30 to 50 per cent premium just to secure flexibility and secure the right employees.”

Flex office inventory

The Greater Toronto Area’s 2.7 million square feet of flex office inventory represents 40.8 per cent of the country’s total. This is largely due to IWG’s long-standing presence in the market, as it accumulated flex space prior to the 2000s.

Toronto is also the national leader in growing its inventory, bringing nearly 912,000 square feet to market since 2017.

Looking at major markets in the United States and Europe, Holmes thinks a realistic ratio of flex office inventory in major Canadian cities is between three and five per cent.

For the GTA, that would mean between 7.6 million and 13 million square feet.

“If it was my money, I would be investing in downtown Toronto, where there are still significant opportunities and significant demand, before I went into Atlantic Canada,” said Holmes.

Canada’s next three largest flex office markets — Vancouver, Montreal and Calgary — respectively take up 1.4 million (20.8 per cent), 836,000 (12.7 per cent) and 784,000 square feet (11.9 per cent) of the national inventory.

The majority of Canadian markets remain in the infancy stage, with eight of the 12 markets totaling less than 300,000 square feet of flex office inventory.

Cities where there’s a lot of growth by technology companies and venture capital investment — primarily Toronto, Vancouver, Montreal, Ottawa and Kitchener-Waterloo — are great candidates for more flex office space.

Waterloo has the highest saturation level of the 12 markets surveyed at two per cent, followed by Vancouver at 1.9 per cent.

Flex office space providers

Colliers’ survey identified more than 200 different exclusive flex office operators, with a total of 465 locations nationwide. However, 51 per cent of the inventory is dominated by IWG and WeWork.

IWG has the highest number of Canadian flex sites, with 122 open locations totaling 2.3 million square feet and representing 35 per cent of the total inventory. IWG operates five brands, but within Canada is widely recognized for its Regus and Spaces brands.

Regus provides professional spaces designed for optimal efficiency and productivity, whereas Spaces offers a more creative and entrepreneurial feel.

WeWork has leased 19 Canadian locations totaling 1.1 million square feet, representing 16 per cent of the national flex market.

WeWork started a financial restructuring program last year after it pulled its initial public offering and was burning through funds at an unsustainable rate. Holmes doesn’t expect this to affect its current Canadian operations, but it could slow expansion and stop plans to move into new markets.

“WeWork’s current locations represent approximately 0.17 per cent of Canada’s office inventory,” said Holmes. “Even if they were to pull out of all their leases tomorrow, which they won’t, the Canadian market would still be fine.

“The Toronto, Vancouver and Montreal markets would take the brunt of that hit, though.”

The remaining top 10 flex office space providers each offer less than 130,000 square feet spread over their respective locations. They cumulatively represent 12 per cent of the total inventory.

That leaves 37 per cent of flex space which is provided by other operators, primarily small, single-site providers.

Aside from Communitech’s single 120,000-square-foot site in Kitchener and 312 Main’s single 100,000-square-foot site in Vancouver, WeWork offers the largest average facility at nearly 55,000 square feet.

Spaces is next at 39,000 square feet. Among single-site operators, the average size is around 8,700 square feet.

Holmes said IWG and WeWork have 90 to 95 per cent occupancy rates and space is often 80 to 90 per cent spoken for before they even open the doors for new locations.

Even smaller operators such as WorkplaceOne and iQ Offices have 90 per cent occupancy rates, according to Holmes.

Source RENX. Click here to read a full story

Massive Downsview Development Gets Green Light

A pension fund and a federal government corporation have come together to develop 520 acres in Downsview, in what could turn out to be the largest urban development project in the country.

Northcrest, a real estate arm of the Public Sector Pension Investment Board, and the federal landowner, Canada Lands Company, are now in the early stages of a massive business and residential community on sites each own in the Downsview area.

The huge properties include the Downsview Airport, the Sheppard and Chesswood Districts and a portion of the Allen District lands west of Allen Road. The land has been used by the Canadian Forces and by aircraft manufacturers for a century, and is currently occupied by Bombardier Inc.

The property recently made news when the city, which had long set aside the land for employers only, appeared to reverse its position, with Mayor John Tory saying the site would “more than likely” be redeveloped to include residential uses.

In a press release, Canada Lands said it and Northcrest will spend 2020 working on an updated land use and development plan to present to the city for approval.

“The first 12 months is only the beginning of what will be a multi-year process, to re-imagine and redevelop an area of the city that has dramatically evolved over time and will continue to evolve in the coming decades,” the statement said.

Source Bisnow. Click here to read a full story

‘Largest mixed-use downtown development’ in Canada is planned to be in Mississauga

Oxford and AIMCo target Mississauga to develop ‘largest mixed-use downtown development’ in Canada Pension funds plan to transform a swath of parking lots around the Square One mall into a high-density living and working zone

Developers backed by Ontario and Alberta pension funds plan to transform a swath of parking lots around a Mississauga mall into a high-density living and working zone in one of Canada’s largest urban redevelopments, apparently drawn by the booming city next to Toronto.

Oxford Properties Group and Alberta Investment Management Corp. said they will develop “the largest mixed-use downtown development in Canadian history.” There’s no cost estimate on the project, Oxford said Wednesday in an emailed reply to questions.

Toronto-based Oxford has $60 billion in global real estate assets and is the real estate arm of the Ontario Municipal Employees Retirement System (OMERS) pension fund, while Edmonton-based Alberta Investment Management Corp. controls about $115 billion in assets and is a Crown corporation of the Western province.

The plan to turn underutilized land into offices, apartments and shops will measure 1.67 million square metres, compared with the 929,000 square metres planned for Toronto’s East Harbour, Oxford said. Its plan will house about 35,000 people across some 53 hectares around the Square One Shopping Centre in downtown Mississauga, the companies said.

The developers are betting on the lack of housing in the Greater Toronto area to drive demand where Mississauga, a city of about 722,000 people in 2016, serves as a bedroom commuter city for the wider region, attracting new immigrants with home prices cheaper than the big city next door, and businesses keen for its highways and proximity to Toronto’s Pearson International Airport.

“The population of downtown Mississauga is expected to double over the next 20 years,” Oxford spokesman Daniel O’Donnell said by email. “That means we need to build more homes for people to live in and provide greater rental options to make renting a long-term option for families.”

Construction by the Daniels Corp. is to start this summer on two residential towers of 36 and 48 storeys, with the full development including office blocks to take place over decades as it ties in with the planned Hurontario Light Rapid Transit system, the developers said.

Mississauga, Canada’s sixth-largest city, according to Statistics Canada, is already backing another large redevelopment, the 72-hectare Lakeview Village where a coal-power generating station used to operate on the Lake Ontario shore.

Rogers Real Estate Development has started building a $1.5-billion project of 10 condo towers a stone’s throw from Square One. The city, Sheridan College and Ryerson University are partnering to create a business innovation hub in the downtown.

More than half of the 18,000 units planned for the Square One development are to be for rent, the developers said. The project will centre on a pedestrian-friendly civic space called The Strand as well as the existing mall, which boasts $500 million in improvements over the past five years including an expanded restaurant and bar area, the builders said.

Condominiums are to go on sale this spring when Oxford will also begin marketing office space, it said. The developer will use its experience building zero-carbon office towers to make Square One’s sustainable, it said.

“With the Hurontario LRT being built and a transit mobility-hub a key part of our plans, it gives us the opportunity to create a transit-connected and walkable downtown for Mississauga,” O’Donnell said. “The entire development will be anchored by Square One Shopping Centre, which is one of the best performing malls in North America.”

Source Financial Post. Click here to read a full story

Commercial real estate outlook for 2020

The bright lights of the 2019 Canadian commercial real estate market have been the industrial and downtown office categories and the Toronto and Vancouver markets, analysts say.

“The office leasing category has been really strong, other than Calgary, with Toronto leading the way and Vancouver not far behind,” says Scott Addison, president of brokerage services for Colliers Canada.

Vancouver and Toronto had downtown office vacancy levels below 3 per cent, among the lowest in North America this year. Montreal and Ottawa have had a strong office year as well, buoyed by the tech sector that also elevated Toronto and Vancouver. Calgary and Edmonton continued to be saddled with high office vacancies, thanks to the stagnant energy sector.

Lease rates have favoured the landlord nationally, say the analysts.

Bill Argeropoulos, principal and practice leader, research, Canada for Avison Young (Canada) Inc., says, based on third-quarter 2019 figures, Vancouver lease rates for the best space in class A office buildings have been in the $55 to $95 per-square-foot range gross, $50 to $90 on average in Toronto, and in the $43 to $45 range gross for Montreal.

“There is significant new product coming on line, especially in major downtown markets, with much of that product already pre-leased, which is another indicator of a healthy market,” says Mr. Argeropoulos. “The only caveat would be if we entered a recession in the near term – a scenario which would align with significant levels of new office space coming on line in some markets – potentially resulting in oversupply and delay in the lease up of any backfill space.”

Mr. Addison says Montreal has been a surprisingly strong market in the office space market this year as Quebec enjoys a stable economy.

The industrial category is the darling of the 2019 market. Frank Magliocco, partner, real estate and assurance for Pricewater-house Coopers Canada, says the e-commerce sector is driving demand for large-scale warehouse space for distribution and fulfillment centres. A recently released PwC survey of real-estate executives indicated investors are keenly interested.

“It’s all about beds and sheds – beds being multifamily and sheds being industrial. That’s where they put their money,” says Mr. Magliocco.

Rents in the industrial sector, after years of being flat, have sharply increased.

“The average rental rate is $9 a square foot [in Toronto],” says Mr. Addison. “For years, people didn’t think Toronto would break out of the $5 a square-foot range.”

He adds that the industrial vacancy rate in the Greater Toronto Area is running at 1.1 per cent.

The flip side of the e-commerce driven boom is a softening of the retail real-estate category.

“There is still a strong link to the physical aspect of retail,” says Mr. Argeropoulos, “E-commerce as a percentage overall of sales is still small, but growing exponentially. Retail, more than other asset classes, is being approached with caution, as the long-term implications of e-commerce are uncertain – keeping some investors at bay for now.”

Mr. Addison says one retail class not taking a hit is likely the power centre. “People still like to go to the big regional malls. … That’s a social event.”

For 2020, most analysts think the commercial real-estate market will continue strong as long as external events, such as Brexit and U.S. trade issues, don’t lead to recession.

Mr. Magliocco says that 69 per cent of the real-estate executives consulted by PwC felt that 2020 would be a good to excellent year, while 6 per cent predicted a poor year.

In the past five years, less than 1 per cent of those surveyed predicted a poor year, he says. “The general consensus is it’s going to be better in 2020. But there’s a growing number that think it’s going to be poor.”

Mr. Magliocco predicts the transaction volume will be lower next year as investors and managers become cautious.

“We’ve been on such a long run. … We’re definitely on the long end of this. If you look at every cycle in the past, there should be something coming down the pipe,” he says.

The industrial category is predicted to remain strong, however, and analysts say the e-commerce warehouse buildings will get physically bigger as well.

“Vancouver is going to be very interesting,” says Mr. Addison. “It’s so land-tight, you might see some multistorey warehouses out there.”

The Alberta market is expected to remain slow, but there could be some upturn, particularly if tech companies come into the market.

“There remains some hesitation in Alberta,” says Mr. Argeropoulos. “Calgary and Edmonton continue to have double-digit office vacancies, but the markets appear to have stabilized. Their eventual recovery periods will probably take a little longer than we’re used to.”

Source The Globe and Mail. Click here to read a full story

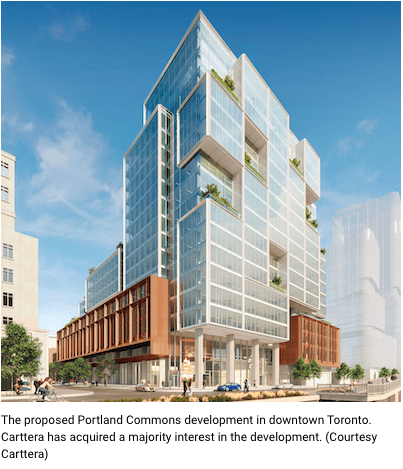

530 Front St. W. in Toronto – majority stake is bought by Carttera

Carttera has acquired a majority interest in a block of property at 530 Front St. W. Toronto, slated to become the site of a 530,000-square-foot office development currently known as Portland Commons.

The property is in the King West neighbourhood at the intersection of Front Street West and Portland Street and backs onto Wellington Street West. The proposed development will focus on technology, wellness, and sustainability, according to a release from Carttera Monday.

Carttera said in the release the project will proceed though no anchor tenant is yet in place.

“Building on our recent successful leasing transaction with Google at 65 King Street East, we are thrilled to announce another downtown Toronto acquisition at 530 Front Street West,” said Dean Cutting, partner at Carttera.

“Planning approvals are in place, meaning speculative construction will commence this summer, allowing for tenant occupancy in 2023.”

Financial details of the acquisition were not released. The project was originally proposed about two years ago by Portland Property Group.

The Portland Commons development

Among the features of the campus-style Portland Commons development are shared outdoor collaborative gathering spaces and courtyards, multiple elevator lobbies and entry points, 12 outdoor terraces ranging from 227 to 9,500 square feet, a raised-floor HVAC system with individual controls and floor-to-ceiling windows.

The complex will feature floor plates ranging from 19,000 to over 56,000 square feet. Other amenities include 230 underground vehicle parking stalls, 221 bike stalls and front-of-house shower and change room facilities, and connectivity to public transit, Union Station, Billy Bishop Airport and the Gardiner Expressway.

The location also offers easy access to the financial, entertainment and waterfront districts.

Architects Sweeny & Co., led the design of the buildings.

The neighbourhood itself offers world-class restaurants, coffee shops and boutique retail. Portland Common’s courtyards and terraces, along with surrounding parks, will provide outdoor green space environments for tenants.

About Carttera

Carttera is a Canadian real estate investment fund manager and developer.

The firm invests in innovative urban intensification development projects and is a leader in environmental sustainability in the Canadian development industry. Carttera’s expertise is in originating, structuring and executing complex development projects.

Carttera has developed projects extending to over $3.3 billion in total value since its inception in 2005, with primary holdings concentrated in the GTA and in Montreal.

The firm’s projects include a wide range of product types including office, mixed-use, industrial, condominiums and rental apartments.

Source RENX. Click here to read a full story