Managing CRE Property Taxes: Unlocking The Levers That Impact Valuations

Managing CRE Property Taxes: Unlocking The Levers That Impact Valuations

Key highlights

-

Property tax is the largest, single expense for most property owners, representing nearly 25% of net operating income (NOI) on average, and is often overlooked as an important “lever” that can be pulled to impact commercial real estate valuations

-

Property owners who are not proactively managing their real estate taxes, particularly in the current market climate, may be contributing to a decline in their property values

-

When real estate assessors value a property, they use mass appraisal techniques whereas property tax experts dig deeper to get to the real value; that includes doing research, analyzing data, and conducting comparisons with similar properties

-

Managing your property tax liability must begin when the notice of assessed value is received. When the tax bill arrives, it is too late

Property tax as a valuation lever

The value of a commercial real estate property is one of the most important metrics — if not the most important — that any manager, finance team, or owner must continually track. A higher property value can mean increased occupancy, higher rental income, and a more attractive selling price if the building is sold.

While valuations are often dictated by market forces outside a property owner’s control, there are several “levers” an owner can pull to impact valuation. Things like building maintenance costs, ESG upgrades, insurance and tenant-friendly amenities are all examples of areas where smart management can impact CRE values. Property tax is one of the most significant costs that CRE firms face, however it is oftentimes overlooked as one that can be managed.

Your property tax management strategy can have a big impact

Property taxes make up a substantial portion of a commercial building’s operating expenses, and therefore, have a major impact on its profitability.

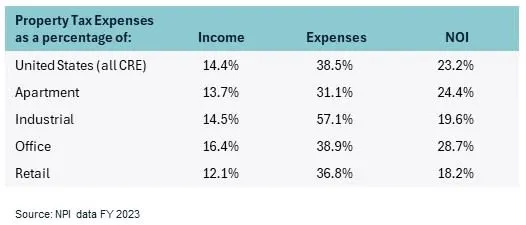

In fact, property tax is the largest, single expense for most property owners. According to the NCREIF property index, in 2023 property tax represented nearly 25% of net operating income (NOI) on average across all commercial real estate sectors in the US.

Figure 1: NCREIF Property Index FY2023 – The significance of property tax expenses

If an owner or investor can proactively reduce their tax bills, they can make a big impact on NOI, and potentially on the value of their property.

A simple calculation illustrates how reducing property tax impacts NOI. For example, assume an office building is valued at $5 million, using a 5% cap rate. If property taxes on that building are $100,000 per year, a 10% reduction in property taxes can lead to a 4% increase in NOI in a gross lease environment. In a net lease environment, the property tax reduction lowers tenants’ gross occupancy costs. This can assist with tenant retention or provide room to increase base rents. In each case, there is a substantial positive impact on the value of the property.

However, if a building owner or investor does not actively manage property tax expenses, the increasing costs will negatively impact NOI and/or gross occupancy costs. There will be less capital available to improve the property, tenants will be less motivated to stay, and higher gross occupancy costs will mean you can charge less rent. All of these will have a negative impact on the building’s valuation.

Source Altus Group. Click here to read a full story.

You must be logged in to post a comment