Author The Lilly Commercial Team

KingSett Proposes Atrium on Bay Residential Tower with 317 new purpose-built rental units

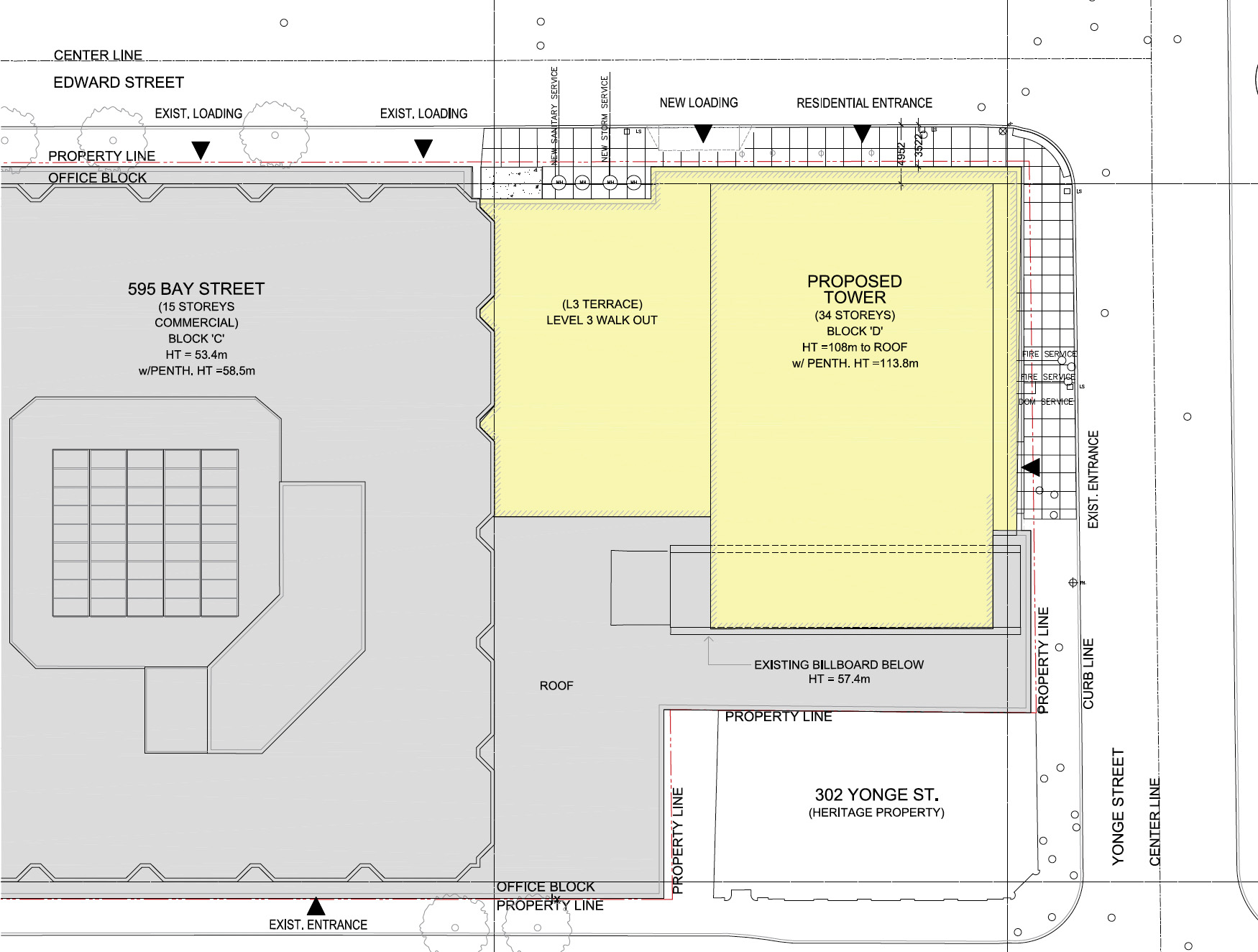

Last week, KingSett Capital submitted a Zoning By-law Amendment application to the City of Toronto seeking to redevelop a portion of the prominent intersection of Yonge and Dundas streets, the northwest corner of which is currently home to a 1980s office complex known as Atrium on Bay. The proposal introduces a 34-storey tower with 317 new purpose-built rental units to the heart of downtown.

Occupying the majority of the block between Bay and Yonge, and Dundas and Edward streets, the Atrium on Bay includes a 2-storey podium and volumes of 9, 13, and 14 storeys. It features a distinctive continuous internal atrium space and retail uses at street and concourse levels, as well as direct connections to the underground pedestrian PATH system, the Eaton Centre, and Dundas subway station.

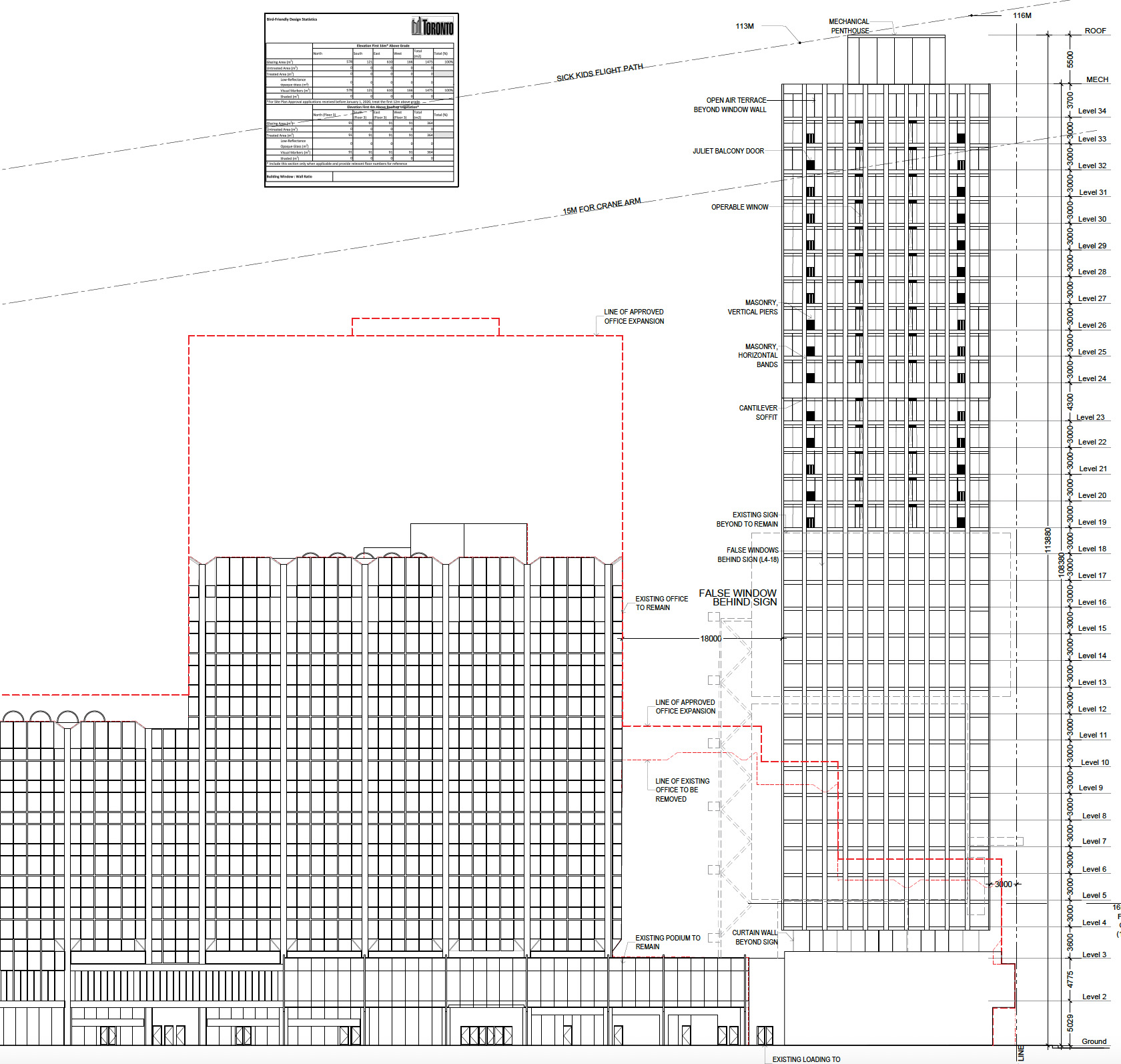

The proposal, designed by Hariri Pontarini Architects with Adamson Associates Architects as Architect of Record, removes and replaces the northeastern portion of the existing building at 595 Bay Street with a 34-storey mixed-use addition consisting of a 2-storey base building and a 32-storey residential tower above.

The plan results in a total gross floor area of 125,967m², including 81,477m² of retained office GFA, 21,974m² of residential GFA and 22,516m² of retail GFA, for a total density of 10 FSI.

The design brief asserts that the new base building design would improve the existing sub-grade and ground levels to achieve better connectivity and accessibility from the street and animate the public realm along Yonge and Edward streets by introducing new active ground floor uses through reconfigured retail/commercial space and connections, including reworked access to Dundas subway station. The reconfigured ground floor introduces a new residential lobby accessed from Edward Street, and new retail spaces along Yonge and Edward streets, while accommodating a new internalized loading area that would serve the residential area. The 2nd floor changes would accommodate retail.

Above the base, the third storey of the building (the first storey of the tower) is inset from the tower floor plate above, emphasizing the distinction between the base and the tower and reinforcing the low-rise commercial character of two-storey streetwall along Yonge Street to the north and south. These step-backs allow for a large outdoor amenity terrace that wraps around the Yonge and Edward street frontages and above the western portion of the base building.

Above the podium, the tower rises to 34 storeys. It is generally rectilinear in plan and massing — with a floor plate of 651m² at Levels 4 to 23 — and expands to 870 m² at level 24 over the existing billboard sign to the south from floors 24 to 34. The cantilevered portion extends 9.24 metres to the south and allows for a clearance of 15m above the top of the media tower at 304-306 Yonge Street. The tower is articulated with a robust grid pattern of vertical and horizontal columns that continue through the length of the tower, and complements the grid-like patterned windows of the Atrium on Bay complex.

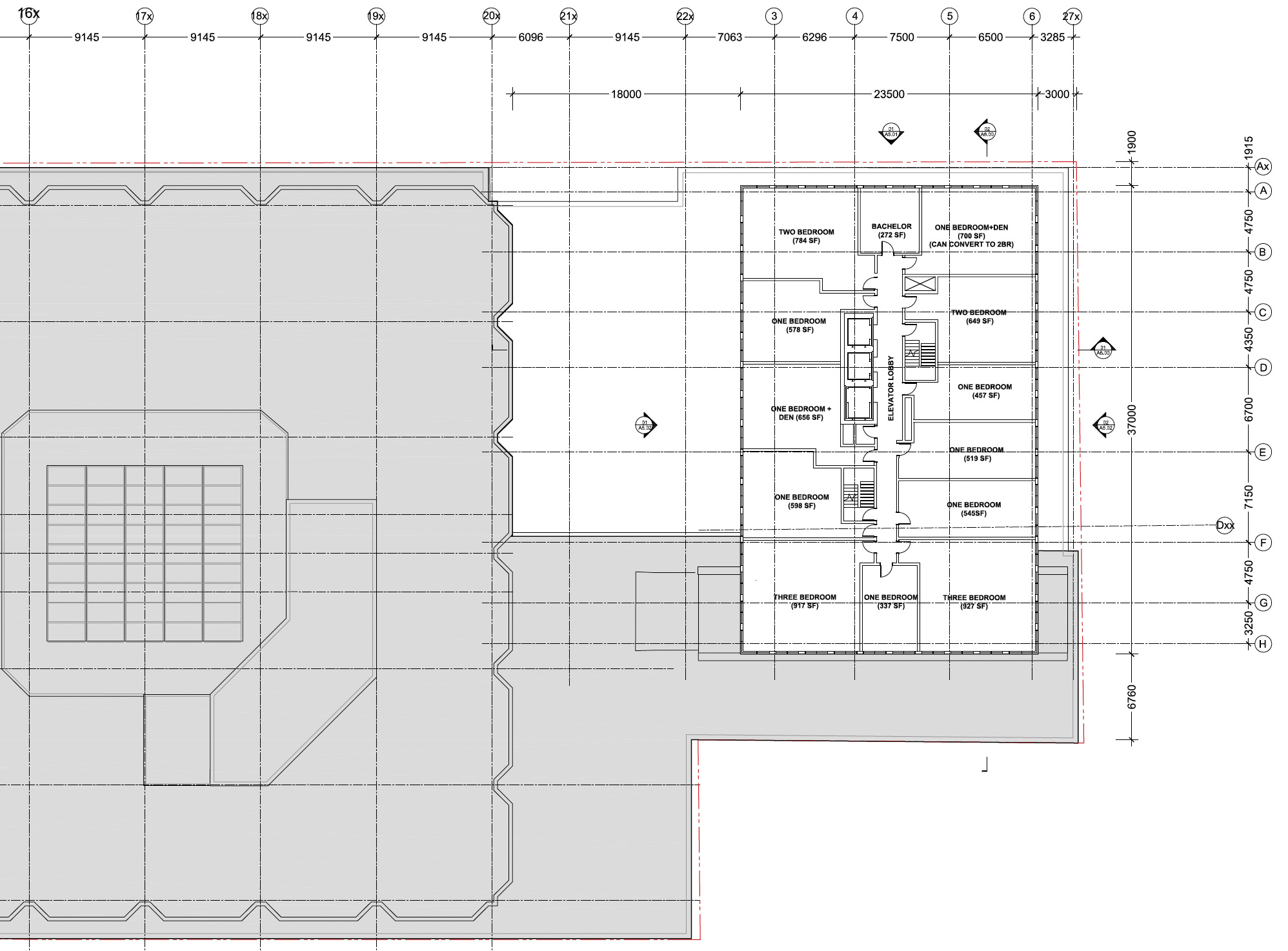

The proposal yields a total of 317 new dwelling units, including 77 bachelors (24 %), 159 one-bedrooms (50%), 50 two-bedrooms (16%), and 31 three-bedroom (10%) units.

A total of 1,502 m² of amenity space is proposed, in nearly equal indoor and outdoor parts. The majority is located on Level 3 and consists of an entertainment room, gym, live-work area, a games room, and a dog spa. It is anchored by the aforementioned terrace that wraps the Yonge and Edward Street frontages and acts as a physical buffer between the new residential tower and the existing-to-remain office tower to the west. ‘Common rooms’ are scattered across various floors. At the top of the building is an indoor and contiguous outdoor amenity terrace that faces south towards the Downtown core, offering views along the Yonge Street corridor.

Vehicular access for the existing uses and new building will continue to be provided from Edward Street. The existing shared below-grade parking garage on the site will also serve the proposed new residential and commercial uses. No additional parking spaces are proposed.

You can learn more from our Database file for the project, linked below. If you’d like to, you can join in on the conversation in the associated Project Forum thread, or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Coming soon to a street near you? Why Toronto’s chief planner wants multi-unit homes in single-family neighborhoods

Toronto’s chief planner is hoping to crack open the city’s long-impermeable “yellowbelt,” adding extra housing supply to neighbourhoods currently dominated by single-family homes.

In a new report headed to a city hall planning and housing committee this week, planning boss Gregg Lintern and his team suggest denser housing supply — duplexes, triplexes, fourplexes and, in some cases, walk-up apartments — can fit into lowrise neighbourhoods across the city.

The idea is a marked shift from the current rules, where roughly 70 per cent of Toronto neighborhoods — the “yellowbelt” — only allow detached and semi-detached houses.

It’s an approach a variety of housing advocates, planners and experts have been calling on the city to take for years, and it’s still at the starting line, with consultations on multiplexes expected to run through 2022, and the final decision in the hands of elected officials.

But of more than 2,100 respondents so far to a city survey on the issue, 88 per cent back multiplexes citywide, and the new report signals support within city hall.

In advance of Thursday’s meeting, the Star spoke with Lintern, who stressed the issue wasn’t about changing the scale of neighbourhoods, but working within the lot and height sizes that already exist in those areas — trying to boost housing, as he put in, “inside the box.”

“People are probably familiar with monster houses … maybe it’s six, seven thousand square feet,” he said. “We think, inside that box, you could have three or four units as an alternative … You would carve it up differently, and actually be able to house a greater diversity of people.”

What could opening all Toronto neighborhoods to multiplexes mean — for current residents there and those looking for a home?

These neighbourhoods are some of our oldest neighbourhoods, built in the late 1800s. And some of our newer neighbourhoods are now approaching 70 years old, the postwar neighbourhoods.

So, I like to think about, well, what is this place going to be in 2051? Who’s going to be living here? Are we going to be happy when we look around and see what happened? I would like our neighbourhoods to be places that are rich and vibrant, full of life and enjoyed by more people.

What concerns have you heard about boosting density, and do you think they’re valid?

(People) often will ask, are there going to be enough services? Infrastructure, where are people going to park? Parking is always a favourite topic in the city of Toronto. What we’ve seen is, over time, many neighbourhoods have either had their population flatlined, or actually declining. They tend to correlate with neighbourhoods that don’t have permissive zoning.

I think that actually, it’s a good thing to add population where the population is declining, because they can enjoy the services that are already there. They can go to the local shops, they probably have kids that keep the schools open, they can frequent the local parks and keep the transit viable. I do understand that infrastructure is important, but I think we can demonstrate that there is actually room in our neighbourhoods to house much larger families.

How big a role should neighbourhood character play in determining what kind of housing gets built in Toronto?

I like to keep it at a high level. I talk about the scale of the neighborhood. I get it. I like low scale neighborhoods, and lots of people do. The challenge is that we get into a lot of detail about character. The overall scale of neighborhoods, I think, is important too because it gives people housing choice and housing options — to live in a low, a medium or a highrise area.

But what are the details of character that people really, really feel are important, and what areas of character are maybe less important? It does come back to the bigger challenge that we’ve got around climate and inclusion and affordability. Are we going to fuss about a dormer or a peak of a roof, when literally we’ve got people who are so challenged to find housing choice in this city? In my sense, we’ve got a bigger priority to worry about.

How much sway do existing neighbourhood residents currently hold over what kind of homes are built around them, and how much say do you think they should have?

We’ve got a process under the Planning Act that is set up around people being able to participate in the conversation, through committee meetings and through statutory meetings. And, ultimately, council decides. But there are some other important factors here.

The provincial policy statement sets out planning guidelines that do encourage the intensification of neighbourhoods. We are obligated to plan in a way that conforms with provincial policy. The other really important part of this is understanding who is in the conversation.

We’ve been very conscious of the fact that many Torontonians have not participated in the conversation about the future of the city — especially more vulnerable people, whether they feel intimidated about the process or whether they feel that they, for economic or social reasons, have been left out. We’ve been very conscious about bringing an equity lens to how we approach consultation.

How likely do you think it is that Toronto sees these changes?

I’m going to let the people decide. I’m pretty confident in the wisdom of people, if we bring them enough information, if people have a chance to see a balanced debate. Sometimes change comes fast, and sometimes things come slow. I don’t exactly know how this will play out.

I do think it comes back to personal experience for people. They are experiencing really significant challenges in where their kids are going to live, where their families are going to live. I really think people are going to be serious about trying to find solutions for this.

Source The Star. Click here to read a full story

What CRE Lenders Wish They Knew in March 2020

When the pandemic forced shutdowns in March 2020, it left commercial real estate finance professionals in limbo as they grappled with how a global health crisis would alter their industry going forward.

Nineteen months later, we have a slightly clearer picture of which property markets are poised for a bright future and which sectors will face ongoing turbulence. While much uncertainty remains, many lenders sure do wish they had had a crystal ball a year and a half ago to foresee at least some of the surprises that have since unfolded.

“I wish I had known how quickly the multifamily lending market would bounce back,” said Kate Byford, head of agency finance for Capital One. “While Capital One was far from out of the market in mid-2020, there was a real opportunity to step in and gain a much larger market share while other lenders were on the sidelines. But that opportunity — like most — was relatively short-lived before the agencies and other lenders came roaring back in the second half of the year.”

Vince Toye, head of agency and off-balance sheet lending at JPMorgan Chase, also cited knowledge of the rapid demand for multifamily in urban markets such as New York City and San Francisco as something he wishes he could have envisioned in March 2020. He said the sector got a surprise boost from remote-working trends that drove some renters to seek out bigger apartments.

“Not only was it impressive to see how quickly most areas bounced back, but also to see the extent to which those areas saw rate increases in multifamily,” Toye said. “With many companies still employing a hybrid-work model, people are upgrading for nicer apartments and more space, driving up rates.”

Federal aid under the $2 trillion Coronavirus Aid, Relief and Economic Security Act, also known as the CARES Act, early in the pandemic helped rejuvenate a struggling economy with direct aid to individuals, businesses and municipalities. The stimulus package also contained provisions designed to assist commercial tenants with rent payments.

Jason Hernandez, managing director and head of U.S. debt at Nuveen Real Estate, noted that in March 2020 it was unknown if the pandemic would lead to an immediate liquidity crisis or morph into a full-blown credit crunch that would result in major repricing of risk. He said having recognition that it would not lead to the credit woes caused by the global financial crisis of 2008 would have meant spearheading more deals in the pandemic’s first few months.

“In hindsight if we knew it was just a liquidity versus credit crisis, we would have been much more active in March to June 2020,” Hernandez said. “The handful of positions we took during this time frame turned out to be some of our best over the last 18 months.”

Hernandez added that the experience spurred Nuveen to be more aggressive on office financings over the past nine to 12 months in order to take advantage of illiquidity in the sector.

Josh Zegen, managing principal and co-founder of Madison Realty Capital, said he would have tackled more deals had he known how successful the CARES Act would be in spurring a rebound in capital markets.

“We were able to close on $1.8 billion in deals in 2020 when a large swath of our competitors were sidelined,” Zegen said. “While I’m very proud of that, I wish we did even more in that time period.”

Source Commercial Observer. Click here to read a full story

Edge development in commercial, industrial sectors sees growth in small urban areas

There’s lots of talk about a commercial building boom in the centre of megacities such as the Greater Toronto Area, but big things are also happening at the edges.

Ontario Power Generation (OPG) plans to break ground early in the new year for its new headquarters in Clarington, Ont., near the Darlington nuclear station it owns and operates, and which is being refurbished. When the headquarters opens in 2024, OPG plans to move more than 2,000 office employees from the 15 different sites where they now work, around the GTA and neighbouring regions.

Edge development – the construction of new commercial and industrial facilities at the fringes of megacities – is not necessarily new, but it’s experiencing a resurgence in many urban areas.

Shifting live-work patterns, the high cost and stress of commuting and the departure from downtown of many younger workers because of high housing costs are all contributing to increased interest in commercial real estate in outer regions.

“We’re in the throes of a major paradigm shift,” says Ken Greenberg, urban designer, teacher and principal at Greenberg Consultants. Speaking at a webinar sponsored by the Urban Land Institute in June, 2020, he explained that Toronto’s satellite cities – once dismissed as car-dependent suburban communities – are now being reimagined as “work, live, play” destinations with vibrant downtown cores of their own.

COVID-19 is “forcing us to do things in a more resourceful and urgent way,” Mr. Greenberg adds.

Clarington is a good example of this kind of future, says its mayor, Adrian Foster. “Getting the OPG head office could be the largest single piece of economic development that has landed here,” he says.

It makes business sense for OPG’s offices to be close to the Darlington Nuclear Generating Station, its flagship, which provides 20 per cent of Ontario’s electric power. But Clarington, which encompasses the towns of Newcastle and Bowmanville and two townships, has lured more companies. For example, it has also become home to a massive Toyota parts distribution centre, opened in December, 2020.

The 350,000-square-foot, 30-acre parts facility serves Toyota and Lexus dealers and customers from Manitoba to Newfoundland.

The traditional 20th-century reasons for a big company choosing a commercial site at the edge were cheap land and easy transportation. Toyota chose the area for different, 21st-century reasons, Mr. Foster says.

“In our discussions, what really attracted them was quality of life for the people who work for them,” he explains. “They wanted to locate in a place where people can live and do things.”

Perhaps as another sign that these corporate moves to the edge are more than a fluke, Clarington has also attracted East Penn Canada, which makes and distributes Duracell batteries for vehicles and large machinery, and is moving its head office here from more centrally located Ajax, Ont. The 200,000-square-foot battery facility will bring an additional 200 jobs.

It still may seem counterintuitive to see such strong growth outside of Toronto, but companies are increasingly lookingfor more than cheap land next to busy highways, says James McKellar, director of the Brookfield Centre in Real Estate and Infrastructure at York University’s Schulich School of Business in Toronto.

“We will never go back to where we were before the pandemic,” Prof. McKellar says.

He sees jobs and development moving in two directions. Workers whose jobs require personal interaction are gravitating toward city centres. People with more generic “hard” skills – jobs that don’t require regular face-to-face meetings – are moving toward the edges of megacities.

“There’s a whole category of jobs now that are tethered to the internet, and they can work anywhere,” Prof. McKellar says. “Being able to connect with everyone, whether they’re in the same location or not, makes it easier for people and companies to locate at the fringes.”

There’s more balance now between downtown areas and the edges in terms of job creation, commercial development and growth, Prof. McKellar adds.

“What we consider the edge of a region is more amorphous now,” he says. “A few decades ago, many companies competed to put up showcase headquarters, but now they’re looking at what location is most practical to develop ideas, manufacture and ship, and that can be either at the centre or the edge, depending on the company.”

Housing costs are a big reason why edges are attractive, too, he adds: “The jobs follow where the people move rather than the people following the jobs.”

The GTA is a notable example of a megaregion with substantial edge development, but it is far from the only one. Cincinnati, for instance, was the fastest-selling housing market in the United States last fall and has gained 7,600 new residents since the beginning of 2021. It has 69 construction projects under way this year, worth $5.2-billion, most of them outside the city core.

“We’ve growing into a mega-region with Dayton, Ohio, 50 miles to the north, and a lot of commercial activity is in the area connecting with us there,” says Kimm Lauterbach, president and chief executive officer of Cincinnati’s Regional Economic Development Initiative. “A lot of companies still look at locating in Cincinnati’s core, but there’s a lot of activity at the edges now, too.”

Many edge regions try to lure businesses by offering tax breaks and incentives such as new highways, but that wasn’t the case in Clarington, Mr. Foster says. Instead, it positioned itself as a good place to live and work without having to commute. For those who do need to travel, he notes that commuter rail service is expanding in the region.

Prof. McKellar says that’s a better approach than building more roads, as Ontario Premier Doug Ford proposes with a new $6-billion highway cutting into the province’s Greenbelt.

“Bad idea, a waste of money. The solution is not to have more roads, it’s to get cars off the roads,” he says.

Source The Globe And Mail. Click here to read a full story

Towering Condo Development To Replace A Block Of Yonge Street Businesses

Toronto has a love-hate affair with the condo, and as much as people love to complain about these glittering towers with shoebox-sized homes, there seem to be just as many willing to dole out big bucks to own one or more of them.

Yonge Street is one major thoroughfare undergoing frenzied condominiumization, and it seems many more towers will line Toronto’s main north-south street in the years to come.

Soon to go the way of the dodo, the latest Yonge Street development targets are a stretch of businesses spanning from 619 to 637 Yonge, wrapping around the corner to include a pair of properties at 7 and 9 Isabella Street.

This half-block includes Miss Fu In Chengdu (within the closed former Aji Sai Plus Resto Lounge location) on Yonge, and a Rabba Fine Foods on Isabella.

A tower has been considered this site for almost a decade now, with plans submitted for a 40-storey building in 2012 from developer Edenshaw.

After being appealed to the OMB (a predecessor to today’s Ontario Land Tribunal), a revised 46-storey version was approved for the site in 2015, though things fell silent until this year.

Designed by Core Architects, the current plan was re-imagined for a new development team, bearing no resemblance to what was approved years ago.

From the original 40 storeys to the approved 46, the plan for this site has grown even taller once again, now proposed to soar 57 storeys to a height of almost 191 metres.

While planning documents all show the branding of Colliers International, a little digging reveals the involvement of YI Developments Ltd.

This name probably won’t ring any bells, but its president’s name just might: The development firm is headed by Rick Rabba, who also happens to be President of Rabba Fine Foods.

Could Rabba be making the ambitious leap from selling late-night groceries to sleepy-eyed condo residents to supplying the condos themselves? Hopefully, this move would come complete with a jingly radio ad for Rabba Fine Condos.

The plans would inject 606 condominium units into a rapidly-densifying stretch of Yonge Street. While about 40 per cent of units would contain two or three bedrooms, it appears this will be yet another investor-driven condo based on the unit breakdown.

Families looking for multi-bedroom units in the heart of the city would be accommodated with 171 two-bedroom and 75 three-bedroom units planned in the mix. Still, the majority of the units are not even close to family-sized, with 310 one-bedrooms and 50 studio units.

The new tower would come at the cost of three existing commercial retail buildings, built between 1905 and 1923. These buildings lack heritage protection and might not be statement pieces, though they have been around for roughly a century of Toronto history.

Source BlogTO. Click here to read a full story

Multifamily withstands pandemic better than most property types

While many sectors of the economy were hit hard by the global pandemic, the multifamily sector, which includes condo and rental, remained a stable investment.

Here are some of the reasons why multifamily real estate is a sound investment strategy.

Investment in multi-unit construction continues to grow, driven by strong activity in Montreal and Toronto, which accounted for a 3.9 per cent growth, translating to an investment of $6.2 billion in Canada, according to Statistics Canada.

As of July 2021, Canada Mortgage and Housing Corporation (CMHC) was reporting 220,002 multifamily units under construction in Canada.

In this article you will learn why you should be invested in the multifamily sector and the variety of ways in which to invest in apartment buildings. Let’s explore this further.

Multifamily market factors

The national vacancy rate in Canada for rental units in 2020 was 3.3 per cent, resulting in demand far exceeding supply for rental units. This reassures investors there will be steady returns on their investments.

However, COVID-19 halted immigration, prevented international students from attending post-secondary institutions and drove some young people back home as their employment disappeared. It had an immediate effect on the multifamily sector.

At the height of the pandemic, Toronto had a vacancy rate of 2.7 per cent in Q2 2020, before soaring to a rate of 8.8 per cent in Q1 2021. It is now averaging 5.2 per cent and continuing to decrease as life slowly returns to pre-pandemic activity.

In addition, the average single-family home price in Vancouver was $1.1 million and Toronto averaged just over $1 million, making home ownership an impossibility for many. Demand for rental accommodation will continue while supply will continue to be low.

Multiresidential construction experienced a 10.1 per cent increase in starts in May 2020, as soon as the earliest COVID-19 restrictions in Ontario were lifted. In contrast, single-detached homes construction starts increased by only 2.6 per cent.

Strong market fundamentals make multifamily real estate in Ontario a smart investment opportunity. Even at the height of the pandemic, rent collections remained around 97 per cent, providing a steady income investment opportunity that provides a rapid return on investment.

Shorter lease terms mean the potential to increase rents more frequently than comparable industrial or commercial real estate properties, which can increase a return on investment and pay down the loan more quickly.

In addition, historic low interest rates can make the initial investment more affordable and it can be easier to qualify for a mortgage on a multifamily unit than a single dwelling because the rental income provides capital while the asset continues steady appreciation.

Emerging multifamily trends

In densely populated urban areas, land is at a premium and city planners are now looking at “vertical urbanism”. This is defined in terms of vertical space, including underground transportation, retail and parking, rather than the traditional horizontal plan of neighbourhoods or sub-divisions.

However, this presents a challenge, as investment activity in the multifamily sector has been concentrated and highly competitive, pushing capitalization rates to the three- to 3.75 per cent range for class-A properties.

Smaller markets attract investors who are more willing to consider class-B or even class-C properties and REITS and capital fund managers actively looking for yield which is harder to find in primary markets.

In Ontario, investors are looking outside the Greater Toronto Area to cities like Kitchener and Waterloo, London and Ottawa that are more affordable than Toronto, but offer good amenities and more affordable development opportunities.

Outside of Ontario, cities like Halifax, Quebec City or Victoria are enjoying similar attention.

PWC Canada reported a seismic shift in multifamily sector priorities due to the global pandemic. COVID-19 normalized work from home and spurred a demand for upgrades in multifamily units such as in-suite laundry, quiet spaces where people can work undisturbed and renewed interest in green spaces, either as a common area or a balcony.

Returns and long-term value of multifamily assets

With the vacancy rate for rental units expected to stay low, the demand for multifamily sector construction will continue to be high. A growing population, housing prices in many locations that make home ownership a distant goal and an aging population which will be looking to downsize are all determining factors in multifamily sector investment volumes.

Here are a couple of keys to maximizing returns on multifamily assets:

Location: The interest in secondary and tertiary markets for multifamily developments is likely to continue as more cities adopt a vertical planning model to house a growing population in shrinking available land. In addition to traditional amenities such as public transit, schools, hospitals and retail, COVID-19 emphasized the ability to enjoy green spaces while maintaining safe social distances. Locations that can incorporate green spaces, walking paths and other outdoor amenities will attract and retain renters.

Multiple potential streams of income: One advantage of the multifamily sector is the ability to generate multiple income streams simultaneously. Long-term tenants provide steady reliable income, while vacancies offer opportunities to increase rents, producing higher returns. In addition, strategic upgrades such as energy-efficient lighting, safety features, water-conserving toilets and showers are capital expenditures that will quickly pay dividends. Other revenue-generating improvements could include laundry facilities, a fitness room requiring a membership or business conference rooms available for rent.

While travel, retail and hospitality sectors struggled in the last 18 months due to the global pandemic, the Canadian multifamily sector remained relatively stable, thanks to low vacancy rates and low interest rates that encourage investment, plus the steady capital and asset appreciation that real estate offers to investors.

With a 10.1 per cent increase in starts in 2020, the sector is showing no signs of slowing down as demand outstrips supply and an urban planning emphasis on vertical development gains traction. The multifamily sector has proven itself to be a solid investment in a volatile time.

Similarly, like stocks, real estate investing allows an investor to be successful through several different strategies.

One of the most popular ways to invest in real estate is to own a collection of rental properties. You can purchase a multifamily building (or buildings) individually, or you can partner with others.

Another approach is passive investing. This plan is perfect for someone who wants to invest in real estate, but does not have the interest, time or expertise to purchase and actively manage it.

Private real estate investing is a straightforward way to gain exposure to large, otherwise inaccessible real estate opportunities which can provide regular monthly income, development profits and investment growth.

Source Real Estate News Exchange. Click here to read a full story

Shelborne Capital buys $90M Ontario industrial portfolio

Shelborne Capital got off to a somewhat impetuous start five years ago, but that initial investment paid off and the growing firm has just acquired a 21-property industrial portfolio in Barrie for $90 million.

Shelborne Capital’s founder, president and chief executive officer Nathan Bierbrier had previously worked in property management and as a real estate broker. Bierbrier found an off-market acquisition opportunity he thought offered value and jumped on it to launch the company in November 2016.

“I tied up three multifamily properties with 155 units and went firm in my offer without a clue where I was going to get the capital from,” Bierbrier told RENX.

The money was eventually secured with the help of investors, the deal closed, and one of the properties that was acquired for $10 million was sold for $19 million seven months later, Bierbrier said.

Shelborne Capital soon bought a 142-unit apartment building and then another one with 87 units. Now, the firm has branched out into the commercial industrial market.

“As Shelborne started growing, the apartment sector became overly expensive so I started looking for other opportunities to continue to create value,” said Bierbrier. “In 2019, we purchased our first commercial industrial property.

“Since then we’ve been mainly focused on commercial industrial properties since I think the opportunity to reposition and create value is there. To date, I’ve acquired over two million square feet of commercial properties valued at more than $750 million since 2019.”

Barrie industrial portfolio acquisition

The latest acquisition is a Barrie industrial portfolio that was built, owned and operated by a private family. It includes properties on Commerce Park Drive and Bryne Drive in the quickly growing city about 70 kilometres north of Toronto.

“They owned it for many years and I’m sure they realized the value,” said Bierbrier. “I was happy to be the buyer because of the portfolio’s size, location and value-add opportunities.

“The portfolio consists of 20 buildings totalling 549,962 square feet on 52.5 acres of land, with the average net rent well below market. The properties were exceptionally well-maintained and the purchase price was well below replacement cost.”

None of the buildings will require capital expenditures for renovations or improvements. They range in age from 12 to 24 years old and in size from 29,178 to 73,923 square feet. All of the properties have surface parking lots and all of the buildings are fully leased to a total of 135 tenants.

There’s also a vacant 2.85-acre plot of income-producing land which is under a long-term lease to one of the tenants of an adjacent property.

“Barrie is growing and there have been a lot of land sales to developers,” said Bierbrier. “I’m sure we’re going to see big growth within Barrie over the next few years.”

The properties are also just a few minutes from Highway 400, a major north-south route which offers easy access to the Greater Toronto Area.

Acquisition and growth strategy

Shelborne Capital’s investors are comprised of individuals and private groups, and the Toronto-headquartered company takes a stake in each acquisition alongside its investors. The firm has also done one joint venture purchase with a partner Bierbrier said does not want to be named.

“I personally tour every single property myself and if I like it, I go for it,” he said. “The strategy is to be nimble and only pursue things where there are opportunities to create value.”

The goal is to maximize value and aim for long-term cash flow. Most of Shelborne Capital’s acquisitions to this point have been off-market deals, but Bierbrier is open to all opportunities.

“To date we haven’t done any development projects,” he said. “However, I have acquired a few income-producing properties where part of the rationale was for the future development value.”

Mark Koenig is the chief operating officer of Shelborne Capital and oversees a growing team at Shelborne Capital Management, a third-party company that manages all of the properties and deals with day-to-day operations.

Shelborne Capital will close on a 70,000-square-foot, $8-million industrial building in Whitby, Ont., on Nov. 30. That’s another market Bierbrier believes is growing and where the company already owns two properties.

“The rents are below market and we see this as another value-add opportunity,” he said of the upcoming addition.

Shelborne Capital is looking at other properties, but there are no other impending deals.

The existing portfolio

Prior to the recent Barrie acquisitions, Shelborne Capital’s 16 commercial buildings were in Toronto, the surrounding municipalities of Mississauga, Brampton, Whitby and York Region.

Shelborne Capital’s current residential portfolio is comprised of three apartment buildings on Eglinton Avenue West and two more on Lawrence Avenue West in Toronto.

“We’ve achieved exceptional results for our partners and we’re excited about the future and look forward to continuing to grow,” Bierbrier said.

Source Real Estate News Exchange. Click here to read a full story

Morguard Corporation Announces 2021 Third Quarter Results and Regular Eligible Dividend

Morguard Corporation announced its financial results for the three and nine months ended September 30, 2021.

Morguard is pleased to report its financial and operating results for the three and nine months ended September 30, 2021, that demonstrate the resilient nature of the Company’s portfolio and also reflect the prudent actions taken by management and staff in our continued response to the ongoing COVID-19 pandemic.

Reporting Highlights

- Net income increased by $146.4 million to $108.8 million for the three months ended September 30, 2021, compared to a net loss of $37.6 million for the same period in 2020. The increase was primarily due to an increase in net fair value gain of $189.5 million, partially offset by an increase in deferred income tax expense of $46.5 million and an increase in impairment on hotel properties of $9.6 million.

- Normalized FFO was $58.7 million, or $5.29 per common share, for the three months ended September 30, 2021. This represents an increase of $14.9 million, or 34.1% compared to $43.8 million for the same period in 2020.

- Total revenue from real estate properties and hotels increased by $10.8 million, or 4.5% to $249.3 million for the three months ended September 30, 2021, compared to $238.5 million for the same period in 2020.

- Net operating income (“NOI”) increased by $5.2 million, or 4.0%, to $135.4 million for the three months ended September 30, 2021, compared to $130.3 million for the same period in 2020, primarily due to higher NOI from the hotel portfolio due to increased revenue per available room (“RevPar”) and many hotels being temporarily closed during 2020. In addition, higher NOI from the retail, office and industrial portfolio was mainly caused by lower bad debt expense. The increase in NOI was partially offset by a decrease in multi-suite residential NOI due to higher vacancies. The change in foreign exchange rate decreased NOI by $2.6 million.

Operational and Balance Sheet Highlights

- Rent collections from all commercial asset classes have been strong with an average of approximately 97% collected since the second quarter of 2020.

- During the year, occupancy was consistent across all commercial and residential asset classes, supporting the Company’s business objective of generating stable and increasing cash flow through its diversified portfolio of real estate assets.

- As at September 30, 2021 the Company’s total assets were $11.2 billion, compared to $11.1 billion at December 31, 2020.

- During the quarter, the Company sold four hotels, one located in Yellowknife, Northwest Territories and three located in Fort McMurray, Alberta for gross proceeds of $21.5 million.

- On September 29, 2021, the Company sold an unenclosed retail property located in London, Ontario, for gross proceeds of $15.0 million.

Financial Highlights

Rental Collection Summary

As at November 4, 2021, the Company’s collection of rental revenues since January 1, 2020 is summarized below by asset class as follows:

Liquidity

The Company has liquidity of approximately $476 million comprised of $129 million in cash and $347 million available under its revolving credit facilities. In addition, the Company has approximately $1.1 billion of unencumbered income producing and hotel properties, and other investments which could be utilized for financing. To further enhance liquidity, the Company has narrowed down the scope of its capital expenditure program to ensure the availability of resources, allocating an amount that enables the Company to maintain the structural and overall safety of the properties. Management has also implemented various initiatives to reduce or defer operating expenses and is monitoring various government assistance programs in Canada and the U.S. structured to provide relief from personnel costs and commercial rent subsidies.

The Company has approximately $639 million of mortgages payable maturing during 2021 and 2022 having an aggregate loan-to-value ratio of 43% and a weighted-average interest rate of 3.73% which management expects to be able to refinance at similar or favourable terms. In addition, the Company has $200 million of senior unsecured debentures maturing in September 2022 and $115 million of MRT convertible debentures maturing in December 2021. The Company expects to be able to issue new debt instruments and use current liquidity sufficient to permit the repayment of its 2021 and 2022 maturities.

Net Operating Income

NOI increase by $5.2 million, or 4.0%, during the three months ended September 30, 2021, to $135.4 million, compared to $130.3 million generated in 2020, and is further analyzed by asset type below.

Adjusted NOI for the three months ended September 30, 2021, increase by $5.4 million, or 4.5% to $125.2 million, compared to $119.8 million in 2020, primarily due to the following:

- A decrease in the Canadian residential portfolio of $1.9 million, primarily due to increased vacancy as a result of lower leasing traffic resulting from social distancing restrictions and current economic conditions;

- A decrease in U.S. residential portfolio of US$0.7 million, primarily due to a decrease of US$2.1 million mainly due to higher vacancy and rental concessions at three properties located in Chicago, Illinois, partially offset by an increase of US$1.4 million mainly due to lower vacancy and higher average rental rates mainly at properties located in Florida;

- An increase in the Canadian retail portfolio of $2.4 million, mainly due to a decrease in bad debt expense of $6.2 million when compared to the same period in 2020, partially offset by a decrease of $3.2 million due to a higher proportion of tenants converting to percentage rent leases resulting in lower recoveries of operating expenses and lower basic rent;

- An increase in the office portfolio of $1.1 million, primarily due to an increase of $0.4 million in lease cancellation fees received, a decrease in bad debt expense of $1.5 million, partially offset by a decrease of $0.8 million due to lower recovery of operating expenses and higher vacancy;

- An increase in the hotel portfolio of $6.0 million, primarily due to an increase of $9.4 million mainly due to increased RevPar as the easing of pandemic restrictions positively impacted travel demand compared to hotel closures during 2020. In addition, three hotels designated under the Government Authorized Accommodation (“GAA”) program provided an increase in RevPar, which was partially offset by a decrease of $2.6 million due to a provision for Canada Emergency Wage Subsidy (“CEWS”); and

- A decrease of $2.1 million due to the change in the U.S. dollar foreign exchange rate.

Funds From Operations

For the three months ended September 30, 2021, the Company recorded FFO of $52.8 million ($4.76 per common share), compared to $43.1 million ($3.84 per common share) in 2020. The increase in FFO of $9.7 million is mainly due to the following:

- An increase in Adjusted NOI of $5.4 million;

- An increase in management and advisory fees of $1.1 million;

- An increase in interest and other income of $8.1 million, primarily due to a one-time special cash dividend from one of the Company’s investments in marketable securities;

- A decrease in equity-accounted FFO of $1.0 million;

- A decrease in interest expense of $3.8 million mainly due to lower interest on mortgages payable and lower interest on the unsecured debentures;

- An increase in property management and corporate expenses of $2.5 million, primarily due to an increase in non-cash compensation expense related to the Company’s Stock Appreciation Rights plan and a decrease in a provision for CEWS;

- An increase in current income taxes of $1.2 million; and

- A decrease in unrealized changes in the fair value of financial instruments of $3.3 million.

The change in foreign exchange rate had a negative impact on FFO of $0.9 million ($0.08 per common share).

The Company believes it is useful to provide an analysis of Normalized FFO which excludes non-recurring items on a net of tax basis and other fair value adjustments. Normalized FFO for the three months ended September 30, 2021, was $58.7 million, or $5.29 per common share, versus $43.8 million, or $3.91 per common share, for the same period in 2020, which represents an increase of $14.9 million, or 34.1%.

Subsequent Events

On October 27, 2021, the Company acquired the 40.9% interest not already owned in Lumina Hollywood, a mixed-use residential property comprising 299 suites and 52,000 square feet of commercial space located in Los Angeles, California, for a purchase price of US$79.4 million, excluding closing costs. Concurrent with the acquisition, the Company closed the mortgage financing in the amount of US$119 million (at the Company’s 100% interest), with a fixed term of three years and a floating interest rate of LIBOR plus 2.50%.

On October 28, 2021, the Company entered into a binding commitment letter for the CMHC-insured refinancing on four residential properties, located in Toronto and Mississauga, Ontario, providing gross mortgage proceeds of up to $194.2 million and for a weighted average term of 10.5 years. The Company expects to close the refinancing on November 10, 2021, providing net mortgage proceeds of approximately $120 million before financing costs.

Fourth Quarter Dividend

The Board of Directors of Morguard Corporation announced that the fourth quarterly, eligible dividend of 2021 in the amount of $0.15 per common share will be paid on December 31, 2021, to shareholders of record at the close of business on December 15, 2021.

Non-IFRS Measures

The Company’s condensed consolidated financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”). The following measures, NOI, Adjusted NOI, Comparative NOI, FFO and Normalized FFO (collectively, the “non-IFRS measures”) as well as other measures discussed elsewhere in this news release, do not have a standardized meaning prescribed by IFRS and are, therefore, unlikely to be comparable to similar measures presented by other reporting issuers in similar or different industries. The Company uses these measures to better assess the Company’s underlying performance and financial position and provides these additional measures so that investors may do the same.

About Morguard Corporation

Morguard Corporation is a real estate company, with total assets owned and under management valued at $19.4 billion. As at November 4, 2021, Morguard owns a diversified portfolio of 198 multi-suite residential, retail, office, industrial and hotel properties comprised of 17,752 residential suites, approximately 16.9 million square feet of commercial leasable space and 5,138 hotel rooms. Morguard also currently owns a 60.9% interest in Morguard Real Estate Investment Trust and a 44.7% effective interest in Morguard North American Residential Real Estate Investment Trust. Morguard also provides advisory and management services to institutional and other investors.

Source Morguard Corporation & Newswire. Click here to read a full story

LaSalle, TAS in $120M Toronto JV: ‘Core real estate with a soul’

A new forward-thinking joint venture between LaSalle Investment Management Canada’s LaSalle Canada Property Fund and TAS has purchased its first three properties in Toronto for an undisclosed price.

The acquisitions represent the first phase of the 50/50 partnership that’s initially targeting the deployment of $120 million focused on adaptive re-use, lease-up and stabilization of properties in up-and-coming neighbourhoods throughout Toronto.

“These are assets that are largely under-leased or vacant older industrial buildings that are in great gentrifying areas with good demographics and good transit fundamentals,” LaSalle Canada chief executive officer John McKinlay told RENX.

The investment thesis for the joint venture is underpinned by environmental and social best practices, he said, while still delivering attractive overall investment returns.

The goals are to:

– improve the acquired properties’ energy efficiency and reduce carbon footprints through adaptive re-use instead of demolition and new construction;

– and promote social initiatives anchored by the transformation of former industrial buildings into lively community hubs in partnership with small businesses and charitable and not-for-profit organizations, some of which will pay below-market rents.

“It’s core real estate with a soul,” said McKinlay.

Genesis of the LaSalle, TAS joint venture

While McKinlay and TAS president and CEO Mazyar Mortazavi were previously acquainted with each other, in an interview with RENX both men named LaSalle Canada senior vice-president of acquisitions Mike Cornelissen and TAS chief investment officer Khan Tran as the driving forces behind creating the partnership.

“We can see gentrification as an opportunity to leverage the character and quality of a neighbourhood and ensure that, as things change, the community is respected and empowered,” said Mortazavi.

“Through this partnership, we are pursuing and identifying opportunities in neighbourhoods for commercial properties that can have a dual role of creating value from an investment strategy but, more importantly, leveraging the assets to drive impact within the neighbourhoods and communities that live in them.

“This is core to TAS’ philosophy of being an impact company first and using real estate to drive social impact.

“It’s that alignment between ourselves and LaSalle that has catalyzed this partnership to identify neighbourhood-based assets to reposition and repurpose and create value through both capital and purpose to drive impact for the partnership.”

The first three properties

A two-storey, 19,000-square-foot light industrial property at 142 Vine Ave. in Toronto’s Junction area will be repositioned to an energy-efficient, in-fill flex office asset for commercial, community and arts uses.

Mortazavi said artists and technology startups are already in the building, which offers an opportunity to add density as part of its repositioning. TAS has been active in the Junction for 15 years and is a fan of the neighbourhood.

A 130,000-square-foot light industrial building on 7.5 acres at 55 Milne Ave. in Scarborough that was previously a single-tenant manufacturing facility will be repositioned into an energy-efficient, community-serving property.

“While the easiest thing would have been to find a single large tenant and do a distribution hub, we’re re-imagining this as a multi-tenanted, multi-use building and positioning it to be one of the greenest industrial buildings in the country,” said Mortazavi.

He believes the diversity of uses will add to the socio-economic diversity of tenants while making a sustainable environmental impact that will help reanimate the surrounding neighbourhood through its programming.

An 84,000-square-foot property at 772 Warden Ave. in Scarborough’s Golden Mile neighbourhood, with access to public transit, will retain its light industrial character and include community-serving uses through a range of programs with a food focus.

“Scarborough has been up-and-coming for a very long time and we now see it at the precipice where it’s about to turn the corner,” said Mortazavi. “The socio-economic diversity of Scarborough is something that we’re both excited about and cognizant of.”

Attributes of the three properties

All three buildings are already zoned for the uses LaSalle and TAS are planning. They can also still be occupied and generate rental cash flow while being repurposed.

“The great thing with these assets is that they have short-, medium- and long-term optionality around them,” said Mortazavi. “We’re already in discussions with tenants and we’ve already started advancing the strategy on them.

“We’re looking at the assets having a 12- to 18-month turnaround to stabilization and being fully repositioned, but they’re already live and active projects.”

“Each project is kind of nimble and has a number of value levers over the time horizon we’ve identified,” McKinlay added.

Both partners are confident they can generate healthy financial returns while creating social value capital and community impact.

Good fit for the LCPF

McKinlay said these initial acquisitions embody the application of LaSalle’s key environmental, social and governance (ESG) initiatives while simultaneously positioning the LCPF for attractive value-add investment returns based on underwriting.

“We’re happy to leverage off the expertise there (TAS) since they’ve been in this space for a while and it’s a great initiative for our fund and reinforces our own active ESG investing program.”

The acquisitions increases the LCPF’s value-add allocation to 5.5 per cent, which is within its 20 per cent value-add cap. They’ll increase its portfolio on a pro-forma basis to approximately $1.8 billion.

McKinlay credits TAS with identifying appropriate assets for the joint venture and said they’re looking at other properties to add to the portfolio. He said they could surpass the initial $120 million target if things continue to go well and the right assets and opportunities present themselves.

LaSalle and TAS

LaSalle Investment Management managed approximately $73 billion US worth of assets in private and public real estate property and debt investments at the end of 2020. Its clients include public and private pension funds, insurance companies, governments, corporations, endowments and private individuals from around the world.

LaSalle Canada has executed more than $7 billion in real estate transactions since 2000. The LCPF launched in 2017 as an open-ended fund targeting commitments from Canadian and global institutional investors to acquire core properties in major Canadian markets.

TAS is an industry leader in impact development with an active pipeline and a portfolio totalling six million square feet across 18 properties throughout the Greater Toronto and Hamilton Area.

It partners with investors to focus on tackling climate change, expanding affordability and equity, and building social capital to create neighbourhoods and cities where people can thrive and belong.

Source Real Estate News Exchange. Click here to read a full story

Signs point to CRE revival in downtown Toronto

Since the official start of the pandemic in March 2020, Toronto’s downtown has been nothing short of a deserted wasteland.

The retail and office CRE sectors saw little activity during the past year and a half, with the majority of the population keeping their distance, isolating and working remotely.

While historically high vacancy rates left little room for optimism, the tides are quickly turning. The “We’re back, Toronto” campaign is gaining traction, and Toronto’s commercial real estate is coming back to life.

CRE vacancy rates dropping

The measures and restrictions posed to stop the spread of the coronavirus pandemic have left quite an impact on Toronto’s CRE market.

The initial wave of lockdowns pushed the historically low vacancy rates to such heights that they’d surpassed those of the 2009 financial crisis. Even as restrictions eased in the second quarter of 2021, the latest April lockdown kept vacancy at 9.8 per cent.

However, now that over half of the Canadian population has been fully vaccinated, Toronto CRE is in for a revival. Remote employees are becoming eager to go back to offices and the “We’re back, Toronto” campaign is incentivizing some 550,000 daytime workers to re-enter the downtown.

Notable tenants are already paving the way, with brands such as Pinterest, Aurora Cannabis, Ryerson University, and Skip the Dishes signing leases in the city core.

Sublet market tightening

Over the past year and a half, sublets have been very much in demand. However, the market has started to tighten.

Almost one million square feet of office space listed for subleasing in downtown cores has been cancelled or leased out as companies rush to reopen their offices.

According to CBRE Canada vice-chairman Paul Morassutti, that is an excellent sign and “only just the beginning of the trend.”

High-end office buildings in demand

Perhaps the most exciting development with workers returning to offices is the rise in demand for high-end office buildings.

Tenants are starting to put more emphasis on better amenities, considering them as necessities rather than luxuries. Better HVAC systems, more space and touchless technology are just a few of the most sought-after amenities in post-pandemic offices.

Summary

While the Toronto CRE market has certainly struggled during the past year and a half, the tide is turning and downtown areas are set to buzz with activity once again.

With CRE vacancy rates dropping, sublets getting cancelled and high-end offices being more sought-after than ever before, we can expect some healthy development in Toronto.

Canadian CRE markets are reviving across the country, presenting lucrative opportunities for investors interested in diversifying their portfolios.

Source Real Estate News Exchange. Click here to read a full story