Author The Lilly Commercial Team

Looking into the future: Where will CRE be in 10 years?

The expanded role of governments, the expectations of investors, lenders and building occupiers, and the need for tougher ESG commitments were key topics when three senior executives recently pondered the state of commercial real estate 10 years from now.

The heads of RioCan REIT, Concert Properties and TD Asset Management’s global real estate investments tackled the issues in response to a REALPAC survey conducted in September and October. The discussion took place during a Dec. 1 panel at the 30th annual Real Estate Forum at Toronto’s Fairmont Royal York.

“There’s never been as much change in this industry as we’re seeing right now,” said REALPAC chief executive officer Michael Brooks, who moderated the panel which had both in-person and virtual audiences.

Thirty-three leaders representing 16,500 employees and $220 billion in assets under management responded to the survey, which focused on four areas: what society will be like; people and culture; strategy and leadership; and innovation and technology.

REALPAC is the national industry association dedicated to advancing the long-term vitality of Canada’s real property sector. Its more than 120 members represent about $1 trillion of assets under management and include publicly traded real estate companies, real estate investment trusts, private companies, pension funds, banks and life insurance companies with investment real estate in all asset classes.

Government intervention and political risk

Governments have played an even bigger role than normal in society as they have tried to guide constituents through the global COVID-19 health crisis.

While the panelists were thankful for the programs that have helped keep many individuals and companies afloat over the past 21 months, there are concerns about the government’s role in the coming years.

“We make a lot of assumptions when we put together a business model to build or buy something,” said Jonathan Gitlin, president and chief executive officer of RioCan REIT, which has more than 200 properties totalling around 37 million square feet and valued at $13.8 billion.

“But when you add to that the possibility of something politically motivated might turn your investment thesis on its head, that’s pretty scary and pretty daunting. I speak largely of housing policy and there’s already talk of enhanced rent control in Ontario and other provinces.”

Gitlin believes there’s already a clampdown on what developers can do and he’s concerned government intervention will exacerbate the housing supply crisis.

“We have to pick a long-term business strategy that works for us and manage appropriately because there’s always going to be volatility,” said Gitlin. “You can’t sway your business plans based on ever-changing political policies and landscapes.”

Need to engage with governments

“As industry leaders, we have an obligation to engage with all levels of government, all task forces and all agencies that are influencing policies going forward in order to try and get balanced policies out of our governments,” said Brian McCauley, president and CEO of Concert Properties, which owns more than $7 billion worth of rental apartments, condominiums, seniors communities, industrial and commercial properties, and public infrastructure projects.

“It’s very frustrating, but we have to keep at it because otherwise we’re going to get exactly what we deserve, which is policy that is not well thought out and has a ton of unintended consequences.”

Colin Lynch is the managing director and head of global real estate investments for TD Asset Management, which has almost $400 billion of total Canadian assets under management. He said the Canadian commercial real estate industry has to invest time through industry associations and government relations to do more to educate governments and not merely criticize them.

“Engagement across the political spectrum matters. Ultimately, I think there’s a lack of understanding in political circles of commercial real estate and the economics behind it.”

Dealing with political risks means running more pro formas for projects in order to be prepared for different variables and scenarios, Lynch added.

Dealing with investors and lenders

The survey indicated the biggest investor requirement moving forward will be strong performance, followed closely by environmental, social and governance (ESG).

“In order for us to truly make a difference on climate change and deal with some of the affordable housing and other social issues, it will impair returns,” said McCauley. “Those two are not exclusive.

“I think it’s going to be interesting to see whether investors have the patience to do what they know needs to be done from a socially responsible perspective and whether they’ll accept some impact on returns going forward.”

McCauley said it’s been an incredibly risk-free lending environment for most banks over the past couple of decades and he’d like lenders to take more risks alongside their clients.

“We’re going to need them to show up in order to help us invest the capital that we need to in order to modernize our buildings and hit some of those ESG objectives.”

Lynch said ESG and returns seem to be mutually exclusive, particularly in the industrial asset class, but he thinks that will change in 10 years or less.

Gitlin said there are costs to being better at ESG, but they’re worthwhile because they’ll enhance the ability to do business in the long run.

Customer and tenant expectations

Lynch said the Canadian office market is still in a health crisis and not a stabilized environment, so it’s too early to know if the current large number of office workers doing their jobs from home will continue when COVID-19, hopefully, plays a much smaller role in people’s lives.

He believes well-located, high-quality, transit-connected office space will be resilient, but for now he’s “seeing a lot more flexible lease term requests and shorter lease terms, and a lot more need for flexible space.”

“There’s no question that each and every one of our customers, no matter what asset class we’re in today, are going to require faster and more professional service from each and every one of us,” said McCauley. “Technology has a big role to play in our interface with our purchasers and our tenants going forward.”

Climate change and reducing carbon emissions

All buildings Concert starts by 2026 will produce zero carbon, according to McCauley. He said building owners are initially dealing with the low-hanging fruit, where they can make the fastest and easiest changes to reduce carbon emissions. Future moves to get to net-zero will be more difficult.

“We’ve invested a lot of time, money and effort into ensuring that we have internal expertise so it can educate the rest of our organization,” Gitlin said of RioCan’s commitment to saving energy and reducing carbon emissions.

“With everything we build, everything we buy and everything we manage, we’re focused on ensuring that we’re doing the right thing and making it part of each individual employee’s scorecards when they’re judged and compensated at RioCan.”

TD Asset Management screens for environmental risks for all properties acquired, both domestically and globally.

“I think that physical risk is underappreciated, undervalued and undercapitalized by our industry,” said Lynch.

Source Real Estate News Exchange. Click here to read a full story

Next-generation buildings create S. Ontario smart industrial hub

A smart industrial hub extending beyond the Greater Toronto Area (GTA) into much of Southern Ontario isn’t just changing the way business is being done, but also the buildings in which that business is being conducted.

The observation is contained in a recent Savills white paper authored by Toronto-based senior vice-president Allen Grinberg and corporate real estate consultant Graham Booth, which explores the hub and its impact. They represent industrial tenants as part of their work for the commercial real estate advisory firm, which was formed in London, England in 1855 and now has offices around the world.

Logistics facilities, warehouses, manufacturing plants and data centres using the Internet of Things, robots, sensors, drones and wearable technology are becoming more and more common as the speedy delivery of goods and knowledge has become a bigger priority in society.

“It’s been in the works for many years, but with technology getting better and better it’s been coming online faster and faster,” Grinberg told RENX. “It utilizes space and labour very efficiently. It improves the well-being in the workplace for the humans that are there. It increases the productivity and energy savings and enhances logistics efficiencies.

“Most importantly, I think it’s starting to change public perception as we get more and more goods delivered on time and when we want them.”

Low vacancy rate and high rents

The GTA had an industrial vacancy rate of just 1.5 per cent in Q2 2021, while the average net asking rent rose to $10.45 per square foot — 50 per cent higher than three years earlier. That vacancy is continuing to tighten, and rates continue to increase.

“For a long time Toronto was a cheap industrial market,” said Grinberg. “Twenty years ago in Toronto rents were a buck or two a foot. Ten years ago it was around six or seven dollars.

“Now, new product coming out in Vaughan is $14 net with bumps of four per cent per annum.”

In the landlord-friendly market, many are becoming more choosy about their tenants. Savills recently represented a clean manufacturing tenant turned down from a space because the landlord wanted to lease only to a logistics company that just needed to install racks — rather than the additional infrastructure required by manufacturers — in case the tenant went into default.

Booth said owners are now also often unwilling to lease a building to multiple tenants. They will wait until a larger tenant comes along and takes all of the space because they don’t want to deal with the additional work or expense of subdividing a structure.

Industrial occupiers need to rethink priorities

With Ontario’s Greenbelt restricting the availability of land for development near Toronto, and increasing demand from e-commerce and logistical facilities in the GTA expected in the short- to medium-term, the white paper says occupiers need to rethink traditional aspects of industrial facilities in order to remain sufficiently close to integrate into the “smart” city.

The report includes a checklist of what industrial space occupiers should consider when assessing their needs and integrating into the Southern Ontario smart hub. They include:

– the current and future needs, including space and technology needs, of the business;

– where they should be located;

– the best type of building to achieve the company’s goals;

– whether to lease or own;

– sustainability and environmental concerns;

– occupancy costs;

– accessibility to a skilled workforce;

– and available support and incentives programs.

With some shopping malls struggling and looking to branch into mixed-use to make better use of their space, one might think some industrial users would look at them for conversions.

However, Grinberg hasn’t seen much of that and Booth could think of just one example – a fulfillment company client that took over a former Target store as a short-term fix of under two years.

Southern Ontario manufacturers rely on organizations such as the Automotive Parts Members Association, NGen, the Autonomous Vehicle Innovation Network and the Refined Manufacturing Acceleration Process network to support their investments in technology and promote innovation within the region.

They also offer opportunities for collaboration that can lead to solutions to upgrade facilities and supply chains.

Booth said the goal of such organizations, as well as regional innovation centres, is to “accelerate innovation, create jobs and promote Ontario’s economy.”

Increasing clear heights

Smart warehouses can store higher inventory volume and product variety, so ceiling heights are rising accordingly. A 20-year-old warehouse would typically have a ceiling height up to 24 feet.

Now, with Industrial Internet of Things advancements, technology allows robots to reach higher racks and a minimum of 28 feet is now expected. Clear heights of 36 feet or more are becoming common as the cost per cubic foot drops significantly thanks to the higher ceilings.

Promoting efficient use of a facility’s cubic footage, for which rent isn’t directly applied, allows occupiers to minimize square footage for which rent is applied. Those savings can be applied in other areas.

Grinberg said some older buildings are being retrofitted, citing a company that specializes in roof-lifting and will increase a 14-foot clear height to 28 feet. However, if a building is aging and has other inefficiencies, it may make more sense to demolish it and build new.

However, Grinberg pointed out older facilities with money invested in their infrastructure and an ample power supply generally don’t need large clear heights to house data centres, so some of those are being retrofitted.

Source Real Estate News Exchange. Click here to read a full story

City of Toronto and CreateTO announce development partner for the $250 million Basin Media Hub

Mayor John Tory announced that Hackman Capital Partners (HCP) and its affiliate The MBS Group (MBS) will develop and operate the Basin Media Hub; a $250 million, purpose-built, state-of-the-art film, television and digital media hub to be located on an 8.9-acre waterfront development parcel in Toronto’s Port Lands, located at 29, 35, 41 Basin St.

The HCP-MBS proposal approved by CreateTO and City Council includes eight purpose-built sound stages, production office space, along with workshop and production support space. This $250 million investment in the development will be one of the most significant contributions to Toronto’s film and television production ecosystem in more than two decades.

In addition to providing much-needed studio and production space within the city, the proposed development will provide the opportunity for HCP-MBS to partner with the City to deliver a public promenade along the water’s edge, helping to further transform this area of the Port Lands into a healthier and more liveable space for workers and visitors alike.

The Basin Media Hub presents an important opportunity to support the ongoing development of Toronto’s film industry and the Media City District. After completion of the construction phase, the expected economic impact of on-going film studio operations includes $280 million in economic activity, $119 million in net contribution to GDP and $32 million in tax revenues across all levels of government. The partnership is expected to create 750 jobs on-site as well as 880 indirect or induced jobs in the broader community.

Construction is planned to begin on the Basin Media Hub by 2023.

Through its proposal, HCP-MBS has committed to establishing a Basin Media Hub endowment for a local training program with a $1 million initial investment and funding for a Program Coordinator. HCP-MBS will provide training space onsite and support site visits, talks and work experience opportunities for local schools in order to promote a diverse range of careers in the film industry and support training and jobs for people from equity-seeking groups. The training program will be managed by MBS University (MBSu), a division of MBS that has a wealth of experience in creating customized programs for hands-on practical crew training.

HCP-MBS has also committed to establishing a $1 million fund to support and encourage Canadian content creation.

The HCP-MBS partnership was selected through a competitive market offering process launched by CreateTO, on behalf of the City, in 2020 and concluded in 2021. HCP is a privately-held real estate investment and operating company that specializes in buying, renovating and re-imagining commercial, vintage industrial and studio properties. MBS is an industry-leading studio operations, production services and studio-based equipment provider.

Quotes:

“The development of the Basin Media Hub in the heart of the Media City District will help us increase production capacity in the film, television and digital media sector, create new jobs and employment training opportunities and further enhance our ability to attract and retain production investment from around the world. This is a major investment in the future of Toronto’s screen industry and I look forward to seeing this $250 million project get underway – it will help ensure that our city comes back stronger than ever.”

– Mayor John Tory

“Not only will the Basin Media Hub add approximately 500,000 sq. ft. of state-of-the-art sound stages and office space to support film, television, and digital production in the city, but this project will also provide training space and work experience opportunities to develop a workforce for a diverse range of careers in the media production industry, with a particular focus on people in equity deserving groups.”

– Councillor Paula Fletcher (Toronto-Danforth) and Chair of the Film, Television & Digital Media Board

“Today’s announcement reflects the growing importance of Toronto’s $2.2 billion screen industry. I am encouraged that a global leader in studio production will build a critical studio expansion that will strengthen our film and television sector and boost Toronto’s economy.”

– Deputy Mayor Michael Thompson (Scarborough Centre), Chair of the Economic and Community Development Committee

“CreateTO implemented a multi-stage offering process to select the proponent for the Basin Media Hub and the proposal submitted by Hackman Capital Partners and The MBS Group represents a tremendous opportunity for the City. The development of this studio complex signifies a major step forward in the continued revitalization of the Port Lands and is the kind of city building CreateTO is mandated to do. This is an exciting addition to Toronto’s east end and I look forward to its completion.”

– Steven Trumper, Chief Executive Officer, CreateTO

“It’s a privilege to be selected as the developer and operator of the Basin Media Hub. The City of Toronto is an economic hub for the creative economy in Canada and already a film and television production powerhouse. We’re very much looking forward to getting this project under way, helping the city expand its studio footprint, and supporting all who are interested in working in the screen industry.”

– Michael Hackman, Chief Executive Officer, Hackman Capital Partners

CreateTO was formed in 2018 as the City of Toronto’s real estate agency. The organization brings together stakeholders, partners and community members to ensure the best use of the City’s real estate assets for today and tomorrow. CreateTO manages the City’s $27 billion real estate portfolio, develops City buildings and lands for municipal purposes and delivers client focused real estate solutions – ensuring a balance of both community and economic benefits.

Source City of Toronto. Click here to read a full story

QuadReal acquires ‘trophy’ 60-acre GTA industrial property

One of the most coveted industrial development properties in the Greater Toronto Area, a 60-acre site at 1700 Derry Road in Mississauga, has been acquired by BCIMC’s real estate arm QuadReal.

The transaction closed nine months after QuadReal got the site under contract in February. It paid $115 million for the property, which backs onto Toronto Pearson International Airport and is bisected by Etobicoke Creek. It is estimated to have about 35 acres of developable land and also fronts onto Dixie Road.

“Lots of investors have been trying to pry it loose for a long time,” said QuadReal director of investments Ed Lam in an exclusive interview with RENX. “We’re excited to begin working on this property and look forward to building first-class industrial space in this fantastic location.”

The land had been held by a private family for over 70 years, and the multigenerational ownership presented a number of challenges in getting the transaction finalized. Lam believes QuadReal’s straight-forward approach was a key factor in its success.

QuadReal developed relationship with vendor

“Ultimately, we worked closely with the vendor to build a mutual understanding of deal issues. We approached the transaction with full transparency and with fair consideration of the vendor’s concerns,” he explained, noting QuadReal was up-front about how much of the land can be developed, ecological constraints and restrictions posed by its proximity to the airport – it literally backs onto a main east-west runway.

“As a vertically integrated institutional owner/operator, QuadReal takes a long-term approach to vendor, broker and tenant relationships. Trust is a two-way street and this was a textbook example of how we executed a deal that was a win for all parties involved.”

The transaction was brokered jointly by Taso Boussoulas of Lennard Commercial Realty and Bill Pitt of IPA, in conjunction with their respective teams.

“Every major industrial developer has wanted to buy this, unsuccessfully. Many have tried,” Boussoulas told RENX, noting there were “high fives” all around when it closed. “This is unquestionably a trophy employment land property.”

Year-long process led to decision to sell

Boussoulas met the vendor through a mutual friend and thus began a year-long process to facilitate the sale. He brought longtime friend Pitt onboard and they initiated an off-market process to find a suitable buyer.

Because it was not formally on the market, and because the owners had spurned all previous offers for decades, Boussoulas said some potential buyers were skeptical.

“Everybody wanted to buy this (but) Bill and I, between us we spoke to everybody and they didn’t even want to offer on it because they were, ‘Oh, that will never happen.’ ” he said. “Just about everybody didn’t want to bother, unless we actually listed it and took it to market. They said, ‘it’s just impossible, it can’t done, because we’ve all tried.’

“But we did.”

The Derry and Dixie property

The property currently contains a Husky gas station on the northeast corner, which will remain in place. A small retail building beside the gas station and a small-bay industrial plaza fronting Dixie Road will be demolished to make way for the new buildings when their leases expire, Lam said.

“Our plans are to build three buildings, roughly 660,000 square feet,” he said. “The development timeline from start to finish – and it’s really variable based on what the leasing market is like – but we are conservative and we think that when it’s all said and done and completely stabilized it will be about five years.”

Lam said QuadReal must still determine exactly how many acres can be developed, which will be done in conjunction with the Toronto Region Conservation Authority after a detailed assessment. There will also be a height restriction for a portion of one of the buildings, due to the adjacent runway.

Due to its location near the airport, major highways and in the heart of one of the GTA’s most intensive industrial areas, the range of potential tenants is very wide. This includes firms which require proximity to air freight, or bonded operations.

QuadReal plans to hold on to property

“There is a very strong possibility the value could become much greater if this were to become a bonded warehouse,” Lam said. “But in terms of the real height for the rest of what we call spec product, our standard at QuadReal right now is that everything targets 40-foot clear.

“We bought the site to own for 50 or 100 years. We are just trying to future-proof it without (impacting) our returns today, so we are targeting 40-foot clear. If we get a user who is really interested in the site, if they want a warehouse, or whether it’s multilevel, we will explore all those options over the next two years.”

Boussoulas said while the purchase price might seem steep, the property has already appreciated in value.

“This is like the Yonge and Bloor of industrial,” he said, citing one of the most coveted downtown intersections for commercial real estate. “When we look at rental rates today for industrial, we are starting to see deals in the upper teens and we believe in the next two to three years industrial rents could touch $20 a square foot.

“You might think, ‘Oh my god I can’t believe what they paid for it.’ The reality is from the time they went under contract until today, it’s worth a lot more. The rates are what drives everything.”

Severe space crunch in GTA

Pitt concurred, noting there is almost no space available in the heavily-industrialized corridor which leads into Brampton. Vacancy is at one per cent or less across the region.

“Mississauga is considered probably centre ice for industrial products. The industrial fundamentals now, being that it’s one per cent or less vacancy rate and the rental rates are rising on a quarterly basis, since 2015 the rental rates have increased 15 per cent per annum,” he said.

“Groups like QuadReal are creating their build-to-core strategies. They’re saying ‘where do we find land, and where are the tenants going?’ The tenants and occupiers are very robust in Mississauga and Brampton and Milton, call it GTA West, (but) there is a finite amount of serviced ready-to-go land in Mississauga. Land has almost doubled in the last 24 months.”

Pitt and Boussoulas are both veterans in the Toronto commercial real estate market, and both also have extensive industrial backgrounds. They agree the market today is as hot as it has ever been during their time in the business.

“More bullish” on industrial than ever

“I’m a little bit conservative by nature so I’ve always, for the last five years, said lease rates are tapped out, and there’s going to be a correction,” Pitt said. “Now as we finish the year I’m more bullish about the industrial landscape than I’ve ever been.

“This deal appears to be frothy on a per-acre price but given the location I think QuadReal is going to do just fine and by the time the building is built they might get $20 rents.”

Lam said with most of the industrial product in the area having been built in the 1960s or 1970s, there is a chance to add a premier, modern space to the market.

“This is where Torbram (Road) starts. This is where Bramalea Road starts, and if you look at the industrial product around the airport, 18-foot clear, 20 and 22, it’s really a cross-section of the different timelines in which product was built,” he said.

“We are surrounded by product that was built in the 1960s, and this is going to be a crown jewel that will tower over everything else.”

Source Real Estate News Exchange. Click here to read a full story

Toronto Offices Are Finally Looking More Normal As People Get Back to Work

The pandemic has left Toronto’s usually bustling Financial District a complete ghost town for the majority of the last 20 months, with a glut of available office space flooding onto the market and countless nearby businesses forced to shutter permanently amid record low foot traffic.

Though a hybrid work model with at least some time from home is the inevitable future for many industries — backyard offices are the latest trend, while homes with potential office space are more valuable than ever — new data shows that people are indeed slowly returning to work hubs.

According to recent figures from commercial real estate firm CBRE, buildings in downtown Toronto were an entire 20 per cent busier in November than in August, with 2.5 million square feet of space leased out to employers in the second half of 2021 — the exact amount that was suddenly and concerningly freed up in 2020.

In fact, there has been more leasing activity in these spaces over the last five months than during the whole 15 months from April 2020 to June 2021, and companies are now jumping into new office spaces faster than even pre-COVID.

CBRE is calling this rebound “a clear signal that businesses are returning to the office and making investments to occupy space long term,” and note the confidence that many big players have shown, with brands like Scotiabank, RBC, Sun Life and Apple sharing clear plans for return-to-work.

The demand for larger spaces is also going up, with many companies looking for more than 100,000 square feet to bring their staff back into.

It helps that Toronto has recently been ranked the top locale for high-tech job growth, one of the smartest cities in the world and a hub for tech growth, with companies like Google, Amazon, Netflix, Reddit, TikTok, DoorDash, Uber, Pinterest, Wayfair and setting up shop here.

But still, it’s been a hard road to get back to something resembling a normal work environment, even before all of the rigorous health and safety guidelines that now come into play.

A whopping 77 per cent of residents who worked out of an office in the Financial District during the before times have still yet to return, though this spike in new commercial leases means their employers are preparing for it.

Also, things are looking better across Toronto more widely, like midtown, where offices are more closely resembling their 2019 selves.

While the City of Toronto announced a plan over the summer to get workers back to the office, with COVID case counts rising once more and the new threat of Omicron, the provincial government has now advised companies to continue to let their staff work from home.

Source BlogTO. Click here to read a full story

Commercial real estate trends show opportunity

Many industries struggled with the uncertainty of the last few years. The pandemic and aftermath impacted all commercial real estate asset classes, but has also shown that innovative solutions in the market have made way for opportunities.

The pandemic put significant pressure on property types like hotel, retail and office. As the return-to-normal continues to trend strongly in the later half of 2021, these and other property types of asset classes, especially multi-family, single family and for industrial asset classes are showing strong metrics.

Trez Capital is a leading private real estate investment firm, dedicated to building a better future throughout North America, applying a process of creative solutions, rigour and due diligence to every loan. Trez Capital tracks trends and opportunities in order to bring borrower and developers’ visions to life while supporting the needs of those living and working in the end products.

A return to urban living and working

With vaccine uptake, both the Canadian and U.S., economies are set to continue to benefit from tailwinds through the rest of 2021 and into 2022. With full reopenings occurring in parts of the U.S. and beginning in Canada, there is a trend of heading back to the office at least a few days a week and a return to urban homes. The states where Trez Capital is active in providing debt and equity solutions made up 68.2% of net U.S. employment growth between 2010 and 2020 and future projections show this trend continuing.

Tenant demand in apartments is supported throughout North America with the improving economic conditions and new strength in the labour market. Renting has been a long-accepted trend in Europe, but people in North America typically opted for owning a home. An emerging trend is that many North Americans no longer view renting as a temporary stage, but instead as opting for flexibility. More than one-third of Americans live in rented housing and over 32% of Canadian homes are rentals. The traditional definition of family rentals is changing. An example of this change is a recent Trez Capital Canadian loan to finance the renovation and conversion of underutilized single family homes in southern Ontario into affordable duplex and triplex rental options that will support a growing community.

Migration trends

People are returning to city living and in-office work schedules, but are not necessarily returning to where they left off from. Migration during the pandemic accelerated trends, especially in the U.S., to warmer climates that offer business friendly environments and low taxation. The states where Trez Capital is active, including but not limited to; Texas, Arizona, Colorado, Utah, Florida, South Carolina and Georgia, make up 68.5% of net projected U.S. population growth from 2021 to 2026.

In Canada, migration and immigration are boosting the country’s population in three major cities: Toronto, Vancouver and Montreal with more than 60% of immigrants choosing these large cities to live in. Trends for 2022 show more immigration into Canada, which will continue to boost demand for multi-family, single family and for lease products. In Canada, immigrants are projected to make up 30% of Canada’s population by 2036, which will likely mean that the major cities will see exponential growth.

Demand for housing

The accelerated growth in the regions that Trez Capital operates in are seeing increased housing demand to unprecedented levels. Across Canada, demand for condominium apartments in the resale and new build sectors was up during the third quarter of 2021. Record-low mortgage rates and shifts in housing preferences, both in type and geography will support development across many locations in Canada and the U.S. in 2022 and beyond. As residential vacancy rates drop from highs during the pandemic, we are again seeing upward pressure on rental rates in many urban centres.

With loans up to $100 million and up to 36-month term for first and second mortgages, Trez Capital tracks trends and lends in areas with high growth projections in both employment and housing that drives the demand for multi-family and single family housing.

Since 2015, Trez Capital has financed the development and construction of nearly 80,000 homes across North America. Strong and growing communities also rely on other real estate classes such as industrial, self-storage, office and retail. Trez Capital has financed the development of over 20,000 acres, and of over 75 million square feet across all asset classes. In 2021 alone, Trez Capital is on track for nearly $4 billion in loan commitments, which will aid in building important communities across North America.

Leveraging trends

More investors are looking to add real estate as part of their investment portfolio. While mortgage funds have become more accessible to a broader range of clientele, that has not been the case for private equity real estate. Trez Capital Private Real Estate Fund Trust (TPREF) allows investors to access development real estate in their investment portfolios.

After 18 months of development, the Trez Capital Private Real Estate Fund Trust (TPREF) was successfully launched on August 31, 2021. TPREF allows investors to invest in an open-ended structure to increase their exposure to ground-up development and long-term asset management. This means direct ownership in income-producing properties. It is difficult to invest in development projects without taking concentrated risk and Trez Capital is offering Canadian investors an alternative.

Source Commercial Real Estate News Exchange. Click here to read a full story

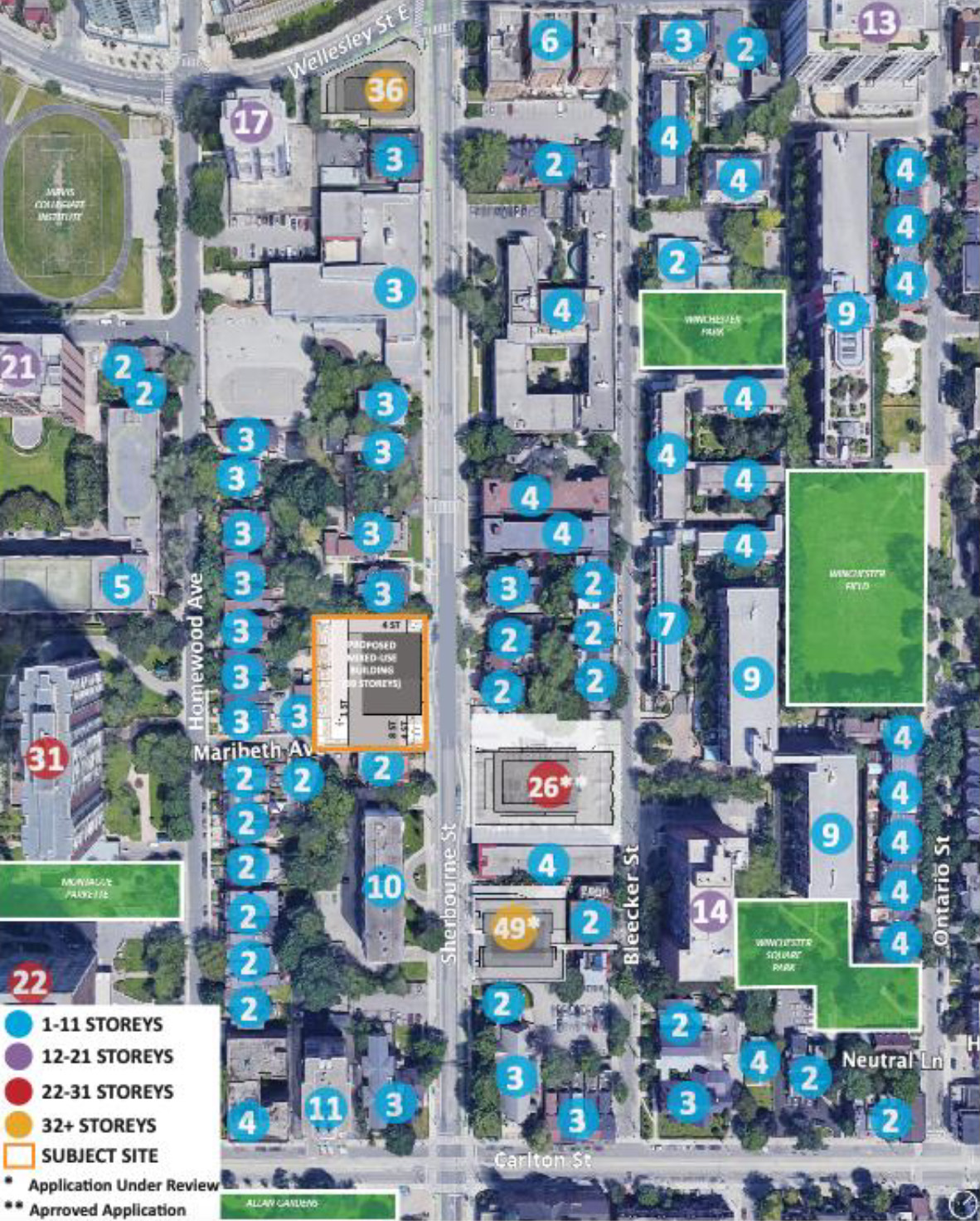

Sorbara Group Proposes to Replace the Phoenix with 39-Storey Condo

A proposed development by the Sorbara Group at 410 Sherbourne for a new 39-storey residential condo building would bring 456 units to the Cabbagetown–South St James Town neighbourhood of Downtown Toronto. The tower would replace the Phoenix Concert Theatre, a music venue that has played a significant role in Toronto’s diverse music scenes and communities for over 70 years.

The half-acre subject site is located on the west side of Sherbourne Street, mid-block between Carlton Street and Wellesley Street East. It is currently home to a four-storey medical office building and the two-storey auditorium with a musical past: while it’s been known as the Phoenix Concert Theatre since 1991, before that it was Club Harmonie (1951- early 1980s) and The Diamond Club (1984-1991). While the Heritage Impact Statement by ERA found that “the site does not have physical/design or contextual value”, it has an “intangible historical/associative value, through its direct association with three significant historical tenancies which represent different eras of the site’s history.”

The largely residential neighbourhood consists of a mix of low and high-rise built form. The adjacent property to the south is a three-storey semi-detached dwelling, and to the north, a rooming house that is listed on the City of Toronto’s Heritage Register and is formerly known as the St Leonard Hotel.

Across the street are a series of historic homes recognized by the Cabbagetown Northwest Heritage Conservation District, which now host a mix of office and residential uses, including supportive housing. Subject to approval are also two proposed developments: 26-storey mixed-use residential building (Housing Now) on a parking lot, and a 49-storey mixed-use tower at 383-387 Sherbourne Street.

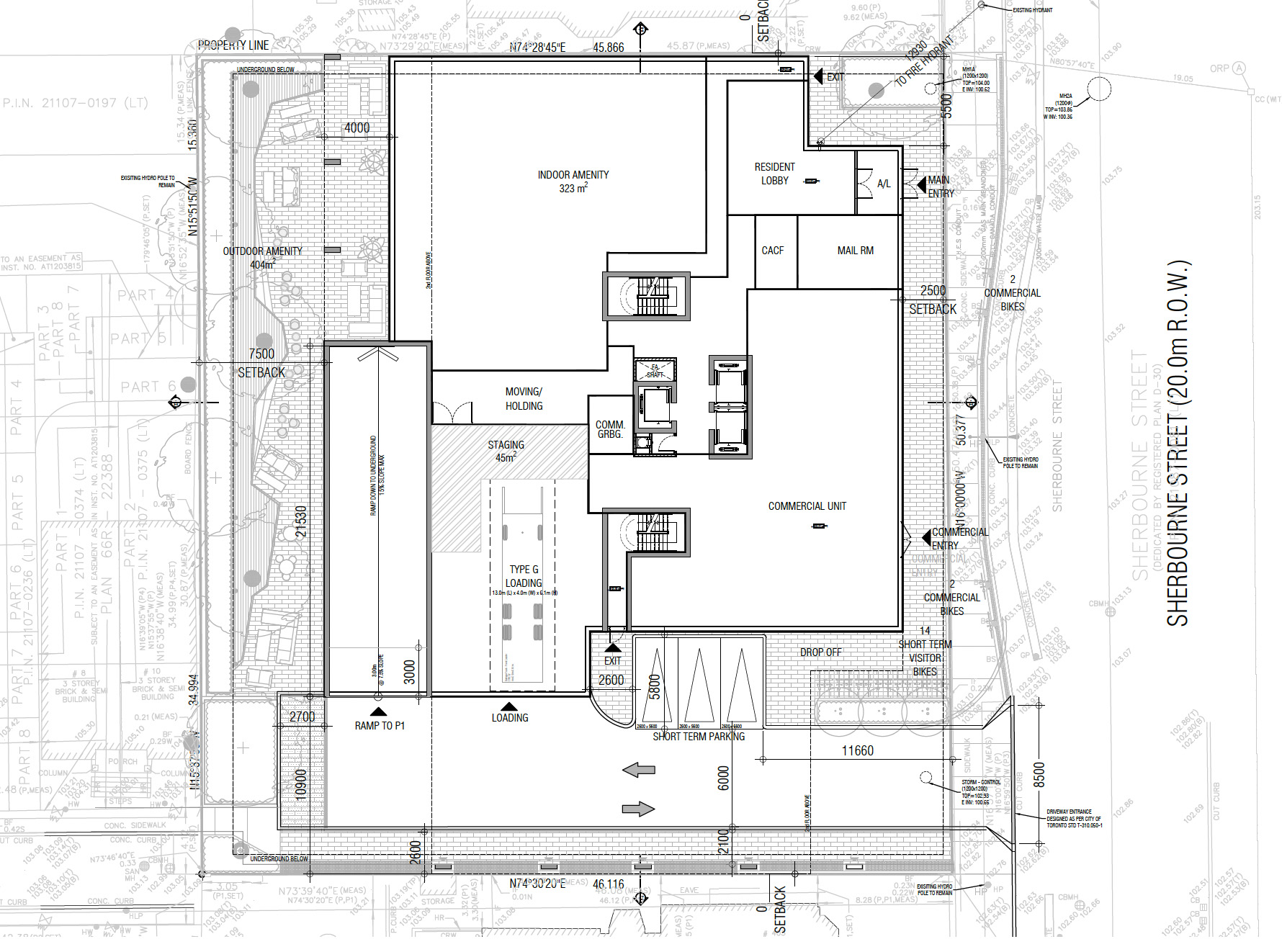

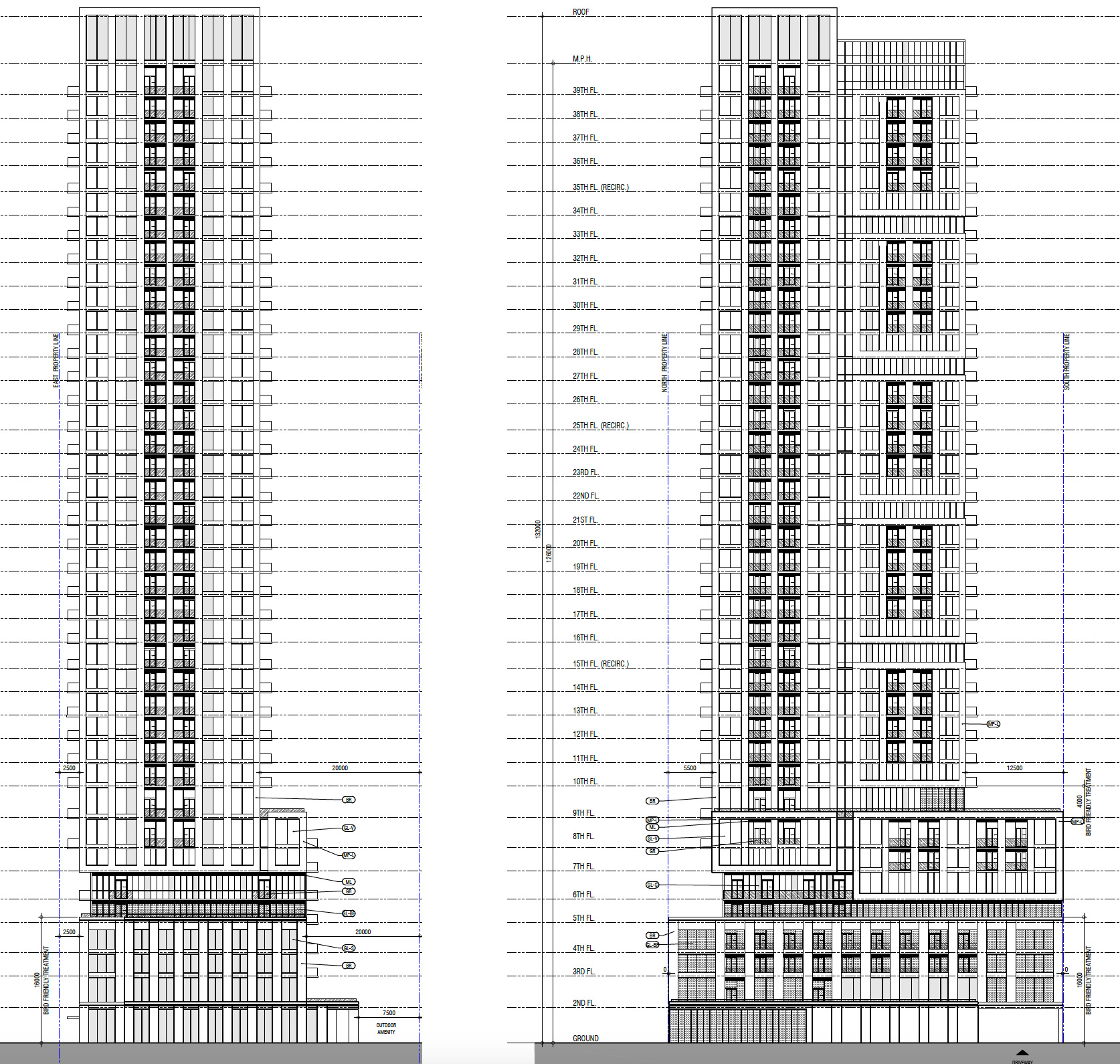

To replace the extant buildings at this site, Sorbara engaged Graziani + Corazza Architects to design a 39-storey residential tower with retail at grade. The building’s podium massing references adjacent building forms and ranges in height from one-storey at its rear, four-storey at its north end and atop the driveway entrance, and an eight-storey massing in other areas. The total GFA is 30,419m², for a site density of 13.26 (FSI).

Next to the small residential lobby fronting Sherbourne Street, 281m² is proposed to be used either for retail or for community purposes with programmable space to address the needs of the local artistic community and honour the site’s history of live music performance. The use of this space is proposed to be facilitated by way of the community benefits process and considered an in-kind benefit.

Driveway access is provided at the building’s southeast corner, leading to the loading area and underground parking. The second through eighth storeys of the podium are held aloft over this driveway entrance, which is otherwise unenclosed, providing pedestrian connectivity through the site to Maribeth and Homewood Avenues.

The podium volume is clad in red-brick masonry and features punched window openings arranged in a rectilinear grid pattern, and is detailed in glass and opaque white panels above. The fourth and fifth floors are fully glazed, further differentiating the podium and tower volumes. The tower is clad in glass, red-brick masonry, and the white panels, with window openings and balconies arranged in vertical columns.

The development would yield a total of 456 dwelling units in the following mix: 4 studios (1%), 299 one-bedrooms (65%), 121 two-bedrooms (27%), and 32 three-bedrooms (7%).

The design provides 917m² of indoor amenity space and an equal amount of outdoor space. The shared interior spaces and adjacent exterior terraces — located the ground level, 2nd, and 9th levels — form a contiguous space for residents.

A two level underground garage would provide 94 parking spaces.

Source Urban Toronto. Click here to read a full story

Bigger, stacked buildings and tech keys to future-proofing warehousing

It’s no secret Canada’s big-city industrial markets are out of balance. For too long, there’s been too much demand and too little space.

That’s an especially pressing issue when it comes to warehouse space in Vancouver, Toronto and Montreal, which all face industrial vacancies that are flirting with sub-one per cent.

Given the insatiable demand for space by owners and occupiers, why should developers, builders and owners of warehouses even care at all about future-proofing their spaces? Isn’t having four walls, a roof and some parking spaces sufficient?

The truth is it’s not enough. Our economy is changing and diversifying, and our industrial warehouses and logistics spaces need to evolve as well if our big-city markets and the country’s overall economy are going to keep inflation under control while ensuring essential products are moving into, out of and around the country in a coherent manner.

Demand for warehouse spaces remains strong

Canada’s overall industrial market continues to experience strong demand across the country, with distribution, logistics and warehouse space being quickly snapped up by e-commerce, warehousing, manufacturing and other users, according to Colliers’ Q3 Canada overview report.

While there is nearly 32 million square feet of industrial space currently being built across the country, developers are losing the war with demand.

This means vacancy rates will continue to sink, while leasing rates and land prices surge.

Canada’s overall industrial vacancy is at 1.5 per cent. That’s a recipe that threatens to drag down Canada’s economy while seeing inflation worsen for consumer products, building materials, mechanical items and everything else Canadians and their businesses need to function.

E-commerce fuels demand acceleration

When it comes to our big-city industrial markets in Toronto, Montreal and Vancouver, the source of demand is pretty clear: logistics, logistics, logistics!

Right across the United States and Canada we’re seeing shoppers increasingly shifting to online retail. The pandemic has accelerated e-commerce and we’re likely to see our online retail rate double in Canada in coming years.

Meanwhile, we’re seeing our urban population increasing. Canada is poised to welcome hundreds of thousands of new immigrants in the next few years and many of these newcomers will settle in our largest cities, adding more demand to consumerism while establishing new businesses that require workspace.

Canada’s biotech industry is another bright light that will continue to expand, while the film industry in Metro Vancouver continues to punch well above its weight, creating competition for sound stages and industrial buildings that can be relied on for show business.

The future is huge

The first step toward future-proofing our warehousing market is to start planning, designing and building massive warehouse spaces.

Spaces larger than one million square feet will generate more interest than ever before as retailers and distributors and the Amazons of the world consolidate operations and try to keep pace with online buying power.

Not only should we build larger, but we also must build higher. The threshold today in terms of what would be considered the gold standard for large-bay ceiling heights is 40-feet clear.

Prologis is working on a project right now in Tracy, Calif., that’s being used as a test model that will include 50-feet clear ceiling heights.

It’s a 1.1-million-square-foot cross-loaded warehouse being built on spec that also includes 10-inch-thick reinforced concrete floors, a massive 8,000-amp power supply, a higher-than-typical number of trailer parking and auto stalls, and a 70-foot speed, or staging, bay. The building is also targeting LEED Silver certification.

Warehouse users of the future will increasingly demand features like these, as well as more spacious bays with fewer columns and larger staging areas of at least 60 feet across.

We need more tech-ready buildings

While we have yet to realize the potential of pure automation or robotics-driven distribution centres in Canada, it is coming.

There are companies spending significant capital on developing, building and installing automation and robotics systems that will require more flexible and tech-ready warehouse spaces.

The labour shortage challenges that have emerged during the COVID-19 pandemic have likely forced many logistics companies to speed up these plans to keep their operations moving forward, with or without people.

Robotics can work 24/7, so you’re getting a lot more output. The feedback has generally been “Yeah, we’re looking at robotics.”

Meantime, smart technologies that promote energy use reduction and touchless tech and improve security will also be must-haves in the coming years and decades.

Prioritize higher-density buildings in urban cores

Another key measure to future-proof our warehouses is to locate last-mile warehouse buildings near people, transit, amenities and services. That means putting up new high-density buildings near, or in, urban cores instead of in far-flung areas that are hard to get to and disincentivize talent recruitment and retention.

This will require more permitting, design and construction of stacked, or multilevel, industrial buildings that blend light industry, office space, food and beverage, and other creative- or service-oriented businesses.

The closer you are to people, the more simplified the distribution process becomes.

While our current industrial landscape in Canada suggests that simply adding space to the market will be sufficient to protect the future, it’s essential that we take measure of our economy and think about the businesses of tomorrow when planning our next generation of warehousing.

Source Real Estate News Exchange. Click here to read a full story

Parkit to Acquire $18,000,000 Oakville, Ontario Property

Parkit Enterprise Inc. is pleased to announce that it has agreed to acquire an industrial property in Oakville, Ontario.

Acquisition of Property

Parkit has entered into an asset purchase agreement, with an arms length vendor (the “Vendor”), pursuant to which Parkit has agreed to acquire 1485 Speers Road, Oakville, Ontario (the “Property”) for an aggregate purchase price of $18,000,000, subject to customary adjustments (the “Acquisition”). It is anticipated that the Acquisition will be completed on or before December 15, 2021. The Property is approximately 101,500 square feet on approximately 6.7 acres of land. Parkit will take vacant possession and plans to expand the gross leasable area on the Property.

Purchase Price and Payment

The purchase of the Property for $18,000,000, subject to standard adjustments, and is payable by the issuance of $1,000,000 of Parkit common shares based on the share price from the prior day to closing, with the remainder of the aggregate purchase price being paid with funds on hand.

Steven Scott, the Chair of Parkit, stated, “This high quality acquisition in an excellent location follows our plan of adding great assets in strategic locations throughout Canada.”

Other Information

The TSX Venture Exchange has in no way passed upon the merits of the Acquisition and has neither approved nor disapproved the contents of this news release. No new insiders will be created, nor will any change of control occur, as a result of the Acquisition.

About Parkit Enterprise Inc.

Parkit is an industrial real estate platform focused on the acquisition, growth and management of strategically located industrial properties across key markets in Canada, with a focus on the GTA+, Ottawa and Montreal, to complement its parking assets across the United States. Parkit’s Common Shares are listed on TSX Venture Exchange (Symbol: PKT).

Source Newsfile. Click here to read a full story

Laurentian Bank to cut leased office space by 50%

Laurentian Bank of Canada has announced a series of operational changes as a result of a strategic review, including a plan to slash its leased office space in Montreal, Toronto and Burlington by half.

The bank plans to stick with a longer-term hybrid work-from-home model for many of its employees, though Laurentian said this will not affect its branch footprint.

The move will result in a charge of $49 million against earnings to facilitate the space reduction, it says in the announcement made Tuesday morning.

Among its other moves are: 64 job cuts, mostly in Ontario; a suspension of phase two of upgrades to its core banking technology upgrades as the bank pivots to newer, more modern technology; and an increase in allowances and provisions for credit losses.

The changes are forecast to result in a $209-million reduction in pre-tax reported earnings during Q4.

“These difficult but necessary changes make us more confident than ever about our future,” said Rania Llewellyn, president and chief executive officer, in the announcement. “As an organization we have never been more unified, with a renewed management team and employees that are focused on our customers.

“We continue to maintain a strong capital and liquidity position that support our strategic investments in the bank’s future and reposition us for sustainable, long-term profitable growth.”

Laurentian Bank HQ in Montreal

Laurentian Bank is headquartered in Montreal and is currently the anchor tenant at 1360 Rene-Levesque Blvd. W. Laurentian consolidated most of its head office operations in the building in 2016, from several previous locations in Montreal.

In Toronto, Laurentian bases several of its offerings at 199 Bay St., while its LBC Capital Inc. arm is located at 5035 South Service Rd. in Burlington.

Full details about the bank’s future direction are to be unveiled during an investor day on Dec. 10.

During the bank’s Q3 2021 financials call, Llewellyn had telegraphed its return-to-office stance.

“One thing we’ve learned (during the pandemic) is that a one-size-fits-all strategy is not realistic, and that we must adapt to new ways of working,” Llewellyn said. “That’s why we will be pursuing an employee-centric strategy and adopting a hybrid model, where working from home is our first approach for all tasks that can be performed remotely.”

While the bank is the first in the sector to announce a major shift in its office use culture, Colliers president of real estate management services John Duda said this is not an indication of what others might do.

“It doesn’t worry me at all, at least not at this point in time,” Duda told RENX.

The bank is restructuring its entire business under a new CEO as it fights to keep and regain market share, not just looking at how it uses office space. That sets it apart from Canada’s biggest banks, which occupy huge swathes of real estate in downtown Toronto and the country’s other other banking centres.

“The fact Laurentian bank made this decision – and I look at how they are restructuring the entire bank – I’m not really surprised. It doesn’t shock me in any way,” said Duda, noting Colliers recently released insights from a national survey of how employers are approaching return-to-office plans.

Study finds co-working could be in demand

Colliers canvassed occupiers from a variety of office sectors within its portfolio in major markets across Canada and found on average, they estimate a five per cent reduction in leased space. However, there was a flip side to that.

“What I found really interesting was the amount of co-working space that they want – it doesn’t mean they have it, they want it – has increased to seven per cent of their total space.

“That is a one per cent increase in the total amount of space needs,” he observed, noting the co-working sector currently comprises just one per cent of Canadian office space. “We’ll see what happens.”

Another factor in the outlook is that most of the major banks have inked long-term leases for the majority of their space. Breaking those leases would be very expensive.

“I look at CIBC and their lease is minimum 30 years, RBC’s lease at WaterPark Place 30 years, RBC at Simcoe Place 30 years. They could take a billion-dollar write -down, (but) I’m not sure they would favour that.

“There is no need for a knee-jerk reaction.”

While hybrid work will likely result in some shifts in the office market, he said corporations want to maintain employee productivity and continue to be able to build their cultures. The best place to do that is in offices.

“My gut says, when this is said and done, companies will just be more flexible.”

About Laurentian Bank

Founded in 1846, Laurentian Bank Financial Group currently has about 2,900 employees. The group has $45.2 billion in balance sheet assets and $29.2 billion in assets under administration.

The announcement had an immediate impact on the bank’s stock price, which was off $2.02 at $39.31 (about five per cent) in mid-day trading.

Source Real Estate News Exchange. Click here to read a full story