Author The Lilly Commercial Team

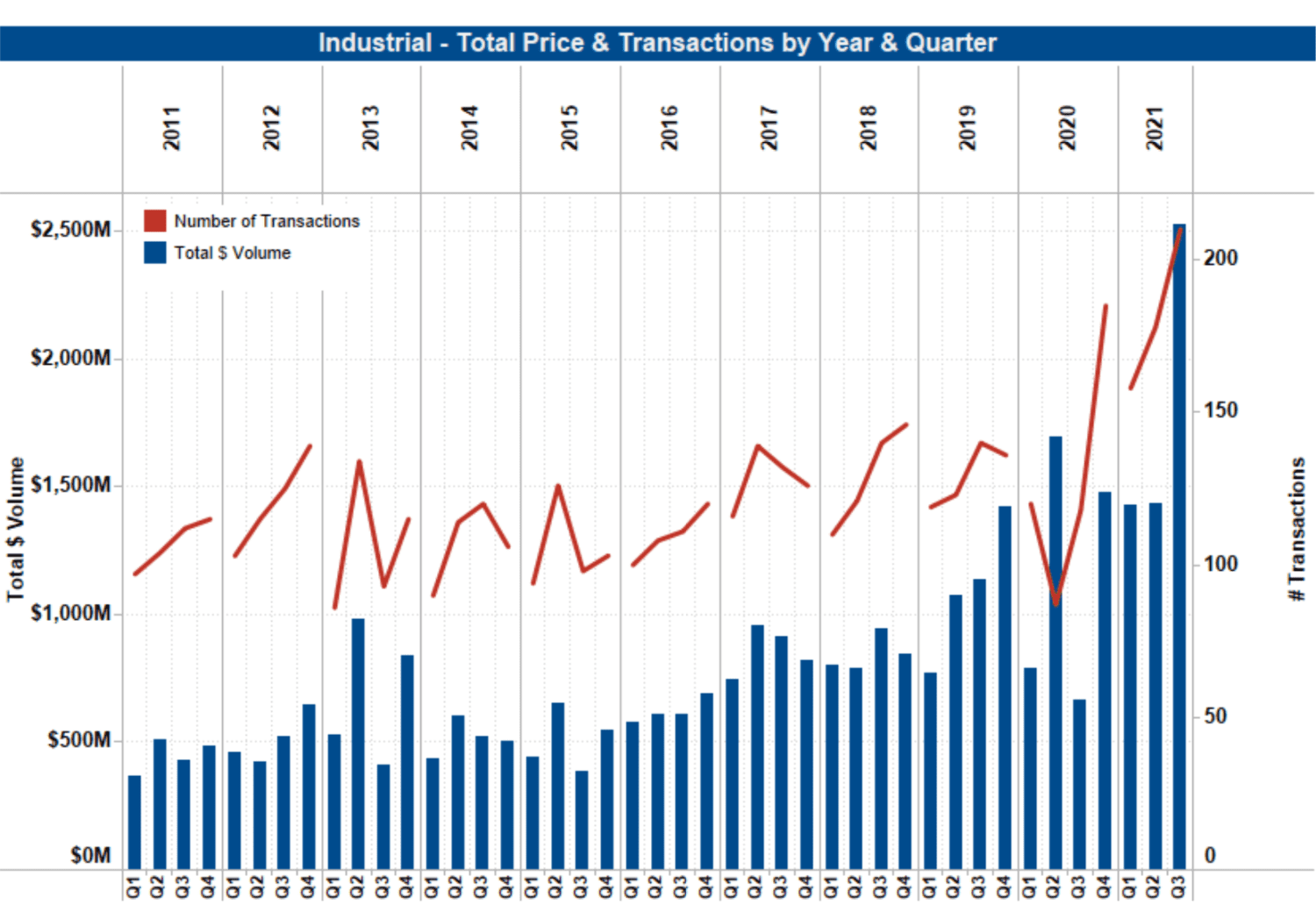

Greater Toronto Area Industrial Commercial Q3 2021 Statistics

Source Altus Group. Click here to read a full story

Starlight buys 68-building SW Ontario apartment portfolio

Starlight Investments is ending 2021 with a bang, acquiring a portfolio of 68 assets comprising 1,106 rental units across Southwestern Ontario. Starlight says this transaction completes its 2021 Canadian multiresidential acquisition plans.

The portfolio is comprised of low-rise properties of up to four storeys in the Kitchener-Waterloo, Cambridge, Stratford, Woodstock and Guelph areas. Starlight did not release financial details.

It includes 67 apartment buildings and one townhome complex, which offers 69 units. They encompass 43.57 acres of property, and include units from bachelors to three-bedroom apartments.

“Pursuant to our strategy of acquiring value-add properties and investing in them to increase their long-term value, this robust portfolio is a strong addition of our expanding multi-family residential platform,” said Daniel Drimmer, Starlight’s president and chief executive officer, in the announcement Friday morning.

“This well-maintained portfolio is located close to several of our existing properties, providing extensive operational efficiencies and management synergies.

“We continue to review and assess our portfolio, identifying opportunities to drive value for both our residents and investors.”

Signet Group has been contracted to manage the portfolio.

The portfolio, and amenities

Amenities across the portfolio are fairly consistent, with most being pet-friendly and many also including private balcony or patio space. The properties also generally include on-site laundry, bicycle storage, storage lockers and surface parking,

Starlight offered a synopsis of the properties:

– Leinster Street, Woodstock: This property includes 14 two- and three-storey brick buildings comprised of 45 one-bedroom units, 120 two-bedroom units and 45 three-bedroom units for a total of 210 units.

– Borden Street, Stratford: Two three-storey buildings comprised of 30 two-bedroom units which include private balcony or patio space.

– Borden Street and Essex Street, Stratford: Five four-storey brick buildings comprised of 60 one-bedroom units and 15 two-bedroom units for a total of 75 units.

– Home Street, Stratford: Seven three-storey brick buildings comprised of 60 one-bedroom units, 30 two-bedroom units and 15 three-bedroom units for a total of 105 units.

– Burns Drive, Guelph: This property includes five two-storey buildings containing 69 three-bedroom townhomes.

– Beck Street, Cambridge: Two three-storey buildings comprised of six one-bedroom units and 32 two-bedroom units for a total of 38 units.

– Woolley Street and Elgin Street South, Cambridge: This property includes four three-storey buildings comprised of four bachelor units and 72 two-bedroom units for a total of 76 units.

– Weber Street South And Allen Street East, Waterloo: Two three-storey buildings comprised of 11 two-bedroom units and 10 two-bedroom units for a total of 21 units.

– University Avenue West, Waterloo: The two three-storey buildings are comprised of one one-bedroom unit and 11 two-bedroom units in each building, for a total of 24 units.

– Milford Avenue and Barrie Place, Waterloo: This property includes two two-storey buildings and seven three-storey buildings containing 82 one-bedroom units, 30 two-bedroom units and 15 three-bedroom units for a total of 127 units.

– Amos Avenue and Erb Street West, Waterloo: This property includes four two-storey buildings and five three-storey buildings comprised of 74 one-bedroom units and 45 three-bedroom units for a total of 119 units.

– Adelaide Street and Belmont Avenue West, Kitchener: This property includes two three-storey buildings comprised of four one-bedroom units and 18 two-bedrooms for a total of 22 units.

– Union Boulevard, Kitchener: This three-storey building is comprised of five one-bedroom units and 30 two-bedroom units for a total of 35 units.

– Leacrest Court, Kitchener: This three-storey building is comprised of two one-bedroom units and 23 two-bedroom units for a total of 25 units.

– Fifth Avenue and Sixth Avenue, Kitchener: This property includes four three-storey buildings comprised of 14 bachelor units, 36 one-bedroom units and 42 two-bedroom units for a total of 92 units.

– Luella Street, Kitchener: This property includes one three-storey building and two two-storey buildings comprised of 38 two-bedroom units.

Starlight’s other recent activities

2021 has been a very active year for Starlight and its funds and ventures.

In the past couple of weeks, it has completed the IPO for one new fund, made several acquisitions and announced the IPO of a second fund.

Starlight’s U.S. Residential Fund acquired its first properties in November and has already built a portfolio of over 1,100 rentals. The fund was created with about $320 million in equity.

Its most recent acquisition, the Emerson at Buda apartments in Austin, Texas, is slated to close on Dec. 21. Starlight is paying $104 million for the 304-unit asset.

The preliminary prospectus for The Western Canada Multi-Family (No. 2) Fund is targeting between $42 million and $100 million in equity to focus on B.C. multiresidential assets.

Following completion of the offering, the fund intends to acquire 60 multiresidential suites at 733 Goldstream Ave. in Langford; and 251 apartments at 6035 Linley Valley Dr. and 4800 Uplands Dr. in Nanaimo.

Starlight also expanded its joint investments with BentallGreenOak. The partnership’s most recent deals include a 224-unit apartment complex in Burlington, Ont., and a newly constructed 113-suite luxury residential property in Victoria.

About Starlight Investments

Toronto-based Starlight Investments is a privately held, full-service, multiresidential and commercial real estate investment and asset management company. It currently employs a staff of over 300.

Starlight manages over $23 billion of direct real estate as well as real estate investment securities. Investment vehicles include institutional joint ventures, True North Commercial REIT, Starlight U.S. Multi-Family Funds, the Northview Canadian High Yield Fund and Starlight Capital Funds.

Starlight Investment’s portfolio consists of approximately 70,000 multiresidential units across Canada and the U.S., and over eight million square feet of commercial properties.

Source Real Estate News Exchange. Click here to read a full story

Triovest acquires industrial land in Markham, Pickering

Triovest and its partners have made two industrial development land acquisitions in the Greater Toronto Area (GTA) and anticipate closing on additional properties by early January.

“We’re still undersupplied in terms of high-quality space based on the demand that we’re seeing and the shifts in how people shop and the need for great warehouse space,” Triovest chief investment officer Prakash David told RENX.

The first deal involved 45.78 acres of industrial-zoned land in Markham (in the northern portion of the GTA). The site was acquired by Triovest and unnamed institutional partners, for $106.5 million, in an off-market deal brokered by an Avison Young team led by Ryan Hood, Eva Destunis and Brent McKean.

The second transaction involved Triovest and Northam Realty Advisors purchasing a 22-acre industrial development site in Pickering (Eastern GTA). The deal was brokered by Colliers’ Ryan Thomson and Gord Cook.

Markham industrial land deal

The Markham property in the Cathedraltown area at Woodbine Avenue and Elgin Mills Road, with frontage on Highway 404, was acquired from Lesso Mall Canada.

The Vaughan-based company is a subsidiary of China Lesso Group Holdings Limited, a large publicly traded Chinese industrial group which manufactures more than 10,000 types of building supplies and materials.

Lesso had acquired the Markham site for $41 million in June 2016 and had plans for a retail development there. Hood doesn’t know why the company sold the property, but he contacted Lesso when he learned it was interested in divesting the site.

The sale to Triovest and its partners came together so quickly it wasn’t marketed despite its appeal.

“There’s not a lot of gold out there, but there still is gold,” Hood told RENX, “and when you find it, you have to act fast.”

The GTA industrial vacancy rate is hovering around one per cent and developers have been aggressively pursuing land to meet demand for warehousing and logistics space as the land supply continues to shrink and the price per acre surges.

“We feel really good about the price we bought it for given the scale and the characteristics of the site,” said David.

Lesso also owns 40 acres at 5789-5951 Steeles Ave. E. in Scarborough where it’s contemplating a 700,000-square-foot commercial complex.

In addition, Lesso owns Milliken Crossing at 5631-5671 Steeles Ave. E.

The site is comprised of five single-storey retail buildings with 139,294 square feet of gross floor area and tenants including Shoppers Drug Mart, Field Fresh Supermarket, Tim Hortons, Popeyes, Subway and ICICI Bank Canada.

Triovest’s plans for Markham site

“We’ve been looking in various nodes and we think Markham is a best-in-class location, right on the 404 with two interchanges right there,” said David. “We thought this was a very strong piece of land and one owned by a client that we currently manage for.”

The fully integrated commercial real estate advisory and capital firm plans to build about one million square feet of industrial space in three zero-carbon buildings once it goes through the entitlement process and site plan approval is received.

“We’re hoping to accommodate large users and tenants that need anywhere from 100,000 square feet right up to 500,000 square feet in a single facility with great clear heights and plenty of doors,” said David.

“This expands our development program to in the range of $3 billion and will be our 33rd project on the go. We’ve got very strong conviction that there’s room to run in industrial real estate.”

Pickering site and future acquisitions

The Pickering industrial site, located south of Highway 401, was purchased from a private family for an undisclosed price.

“It’s a greenfield site with great highway access and great access to a labour pool, and can accommodate a range of tenant sizes up to 260,000 square feet,” said David. “We love the GTA East. It’s now an established node.”

While David said he can’t reveal any details at this point, Triovest expects to close on further acquisitions of industrial properties in Montreal and Vancouver in the next few weeks.

Source Real Estate News Exchange. Click here to read a full story

Morguard outlook forecasts growth for commercial real estate sector in 2022

The recently released Morguard Corporation 2022 Canadian Economic Outlook and Market Fundamentals Report forecasts recovery and growth for Canada’s commercial real estate sector in 2022 and increased investor activity following the anticipated post-pandemic full economic reopening.

The 24th annual edition of the report provides a detailed analysis of the 2021 Canadian real estate market as well as trends to watch for in 2022. It found investment performance remained strong in 2021 for industrial and multi-suite residential rental properties, indicates a release, adding office and retail showed signs of stabilization due to efforts to reduce the spread of COVID-19 and the subsequent easing of some restrictions.

The also report also found:

- Decreased levels of immigration and post-secondary students entering the country throughout 2021 contributed to reduced demand in the multi-suite residential segment. The national vacancy rate rose 1.0 per cent year-over-year in October 2021 to a four-year high of 3.2 per cent, with more pronounced vacancy in the country’s larger metropolitan areas.

- Despite the overall softening, investment demand surpassed supply as the segment’s sustained strength retained investors’ interest.

- With the reopening of Canada’s borders and continued job growth, rental demand is forecast to gradually grow in 2022.

- Investment activity in the office segment in 2021 was relatively muted given the uncertainty of when pandemic restrictions would lift.

- A total of $1.9 billion in office property sales was reported in the first half of 2021, down 37 per cent year-over-year from $3 billion reported in the same period in 2020.

- Industrial assets had record-low inventory levels across Canada in 2021. The national industrial availability rate reported a low of 2.3 per cent at the end of the first half of 2021 with even lower rates in Vancouver, Toronto and Montreal.

- Warehouses, logistics and e-commerce businesses continued expanding at a relatively rapid rate, continuing the trend seen since mid-2020.

- As leasing demand continues to outpace supply, tenants may have difficulty finding available industrial space in 2022 despite an anticipated pickup in construction activity.

- Continued restrictions for in-person shopping contributed to the retail segment’s reduced activity in 2021.

- Retail sector performance patterns will improve in 2022, with the loosening of pandemic restrictions and the return of shoppers to retail centres.

- Canada’s economy is expected to continue to bounce back from the pandemic-driven correction in 2022, with output rising between 4.0 per cent and 5.0 per cent on an annualized basis.

- The services sector will be a key driver of growth in the coming year, following proportionately stronger expansion in the goods production sector in the earlier stages of the pandemic.

- In 2022, Canada’s labour market will strengthen, driven by the largely positive economic growth trend.

- Retail consumption and housing market activity will support economic growth in 2022, in support of largely positive commercial real estate sector performance trends.

Source Morguard & ConstructConnect. Click here to read a full story

Northbridge buys ‘extremely rare’ 30-acre Vaughan industrial site

Northbridge Capital has acquired an “extremely rare” 30-acre industrial property with redevelopment potential in a prime area of the Greater Toronto Area city of Vaughan for $110 million.

The off-market transaction involves three parcels at 101/189/205 Doney Crescent. It’s situated along Highway 407 near Keele Street, bordering the CN MacMillan railyard, and just a short distance from Highway 7 and the rapidly intensifying Vaughan Metropolitan Centre.

Brokered by John Ursini and Paul Miceli of Vanguard Realty, the property was owned by a private family company and currently contains about 147,000 square feet of buildings with tenants mainly focused on trucking and distribution.

“To have that much acreage in one spot, in one package, in one deal, is extremely rare,” Ursini told RENX.

Northbridge partner Adam Lazier agreed, noting it took several years of contact between Vanguard, Northbridge and the vendor to acquire the site via an off-market arrangement.

“It’s really unique. It’s not often you can buy a 30-acre piece of land in Vaughan, and a great infill location,” Lazier said in a separate interview.

Northbridge’s plans for the property

While the per-acre price of $3.67 million might seem high for some investors, Lazier said his firm sees it as a great investment. With industrial vacancy in the GTA below one per cent, and leasing rates rapidly rising, he believes land values will also continue to rise.

“We personally think it’s undervalued,” Lazier said. “I think we paid a fair price for it today, but our view is, if you look at other land-constrained markets that have a lot of growth in them, I don’t think the price we paid per acre for this land is going to seem that expensive.”

He said depending on how Northbridge decides to redevelop the site, it could end up accommodating from 500,000 to about 700,000 square feet of space.

“From our point of view we are really focused . . . on infill employment land,” Lazier explained. “We see this Vaughan opportunity as a potential opportunity on that basis.

“Its close proximity to population and infrastructure are key things for us. At some point we definitely are looking at different alternatives from the point of view of redevelopment.

“I think our base case is to redevelop over the mid-term into a modern-format, last-mile distribution facility.”

Ursini said based on current demand, there are many options for a property such as Doney Crescent. Businesses and logistics firms of all sizes are seeking space.

“There is a wide spectrum, there are the end-users who would love to have their own space, even small, vis-a-vis an industrial condo which is also incredibly rare,” Ursini said.

“Let’s say from 1,500 to 3,000 square feet, there’s very high demand. That demand extends all the way to over 100,000 square feet, or 150,000, or 200,000-plus for logistics.”

Lazier family operates Northbridge

Lazier said Northbridge’s industrial and retail experience indicates there are classes of tenants which covet these prime locations, and state-of-the-art facilities, enough to pay the higher leasing rates which go along with such properties.

In particular are companies at the nexus of distribution, e-commerce and retail.

“The whole idea of industrial being a business model, obviously that has changed significantly,” he said.

“When we look at these really unique infill sites that can provide scale, there are so few of them certain tenants are going to be there, and they are going to pay, because they can’t deliver to their customers from Milton.”

Northbridge is operated by Adam and Michael Lazier, who with father Stuart (the board chair), all have extensive backgrounds in investment and commercial real estate. Based in Toronto, it owns a portfolio of commercial and multiresidential properties in Canada and the U.S.

“We started in 2016 to focus on value-add investing,” Adam Lazier said. “Typically we’ll partner; we have a number of private LPs which invest with us, and we also invest alongside with institutional partners.”

In this acquisition, Vancouver-based Nicola Wealth is a partner. Northbridge and Nicola have been involved in several previous acquisitions and projects, including a nearby 16-acre industrial development property along York Mills Road.

“We’re an equal-opportunity investor, in anything that has value opportunities,” Lazier said. “We own retail, office, industrial, industrial development land and multifamily.

“This year we’ve done about $300 million in Toronto in acquisitions, so it’s been a pretty good year.”

Although he said it’s too early to release any details, Northbridge has three other properties under contract.

Source Real Estate News Exchange. Click here to read a full story

Top-10 CRE transactions in the GTA in 2021

Commercial real estate investment activity in Ontario’s Greater Toronto Area (GTA) and Greater Golden Horseshoe (GGH) regions increased significantly this year over the previous two years.

Altus Group compiled transaction activity statistics and came up with a list of the biggest individual deals for 2021. Ray Wong, vice-president of data operations for the Data Solutions division, spoke with RENX about the findings.

“This year is reflective of the overall confidence in real estate,” said Wong. “A lot of investors are looking at the GTA, but they’re also looking at opportunities just outside the GTA.”

Commercial real estate investment in the GTA (through Dec. 22) was $25.9 billion, compared to $16.8 billion in 2020 and $22.6 billion in 2019. Investment in the GGH hit $10.3 billion during the same period, compared to $4.6 billion in 2020 and $4.9 billion in 2019.

Wong attributes some of the increases to the onset of the pandemic in 2020, which caused investors to re-examine strategies and building owners to look at rebalancing their portfolios. It took some time to market assets and some properties that may have been listed, or were under consideration to be sold, didn’t sell until 2021.

“We’re seeing larger transactions happen in 2021 because there was more certainty from both buyers and sellers,” said Wong.

Increased GTA transaction volume

Altus Group broke down 2019 and 2021 activity in the GTA by asset class (as of Dec. 22) and came up with these numbers:

– Residential land transactions were $7.97 billion in 2021 compared to $4.43 billion in 2019.

– Industrial transactions were $7.08 billion compared to $4.40 billion in 2019.

– Industrial, commercial and investment (ICI) land transactions were $4.86 billion compared to $2.97 billion in 2019.

– Apartment transactions were $3.59 billion compared to $3.76 billion in 2019.

– Retail transactions were $3.33 billion compared to $2.22 billion in 2019.

– Office transactions were $2.68 billion compared to $4.07 billion in 2019.

– Residential lot transactions were $986 million compared to $653.7 million in 2019.

– Hotel transactions were $224.9 million compared to $90.5 million in 2019.

Breaking down the asset classes

“Demand for ICI land is pushing down Highway 401 into southwestern Ontario,” said Wong, citing Amazon’s expansion in London as an example.

“There’s still demand for residential land based on the scarcity of inventory. It’s continuing to move north, west and east, which is reflected in the transactions.”

At a time when the pandemic has raised questions about the future of brick-and-mortar retail, the 50 per cent increase in activity shows there’s still interest in the sector — even if it’s not always for traditional reasons.

“Private investors are looking for redevelopment of some parcels for mixed-use development,” said Wong.

Companies are still trying to get a grasp on hybrid work models and how much office space will be needed to accommodate social distancing and increased collaboration space. Wong is interested in seeing how that plays out and affects the office market.

“Office transactions are still happening even though there’s some uncertainty in that area,” he said. “People still look at these types of assets as having good returns, which shows some confidence in the office market.”

Wong believes 2021’s strong transaction activity will carry over into 2022.

Top-10 GTA transactions of 2021

The biggest GTA commercial real estate transaction of 2020 was QuadReal’s Oct. 9 acquisition of a 0.453-acre parcel of residential land at 480 Yonge St. in Toronto for $171.93 million. QuadReal acquired it from the Ontario Superior Court of Justice after Cresford Developments purchased it in November 2016 for $67 million. Cresford had plans to develop the 39-storey, 425-unit Halo Residences condominium, but the project went into receivership while it was under construction.

That deal wouldn’t have even cracked the top 10 in 2021.

Here are the 10 biggest transactions which had been announced and closed through Dec. 22, except for the second deal on the list, which closed late in the month:

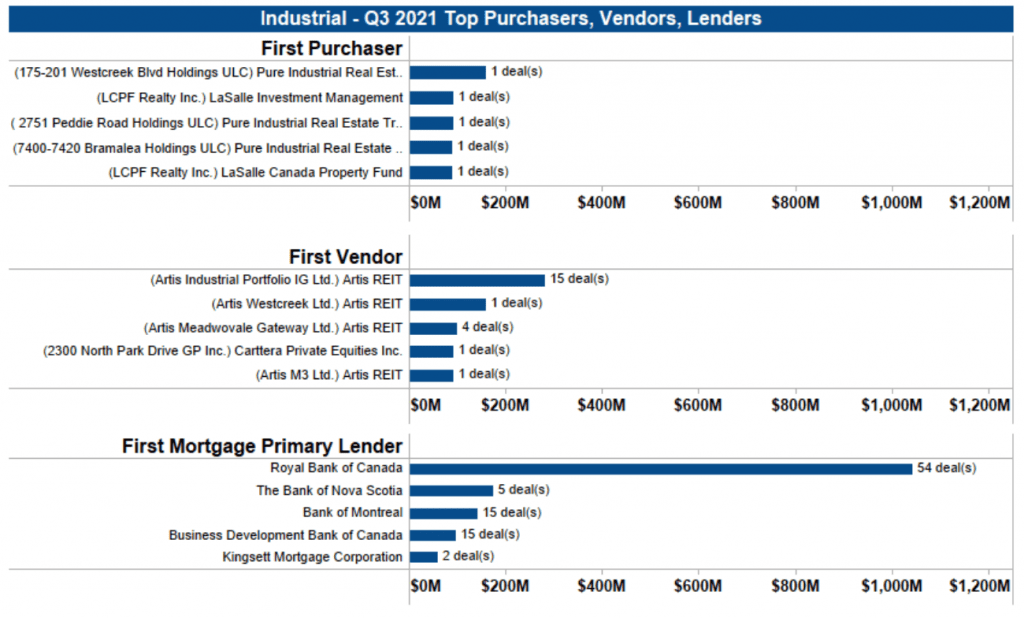

- Artis REIT sold a 26-property industrial portfolio with nearly 2.5 million square feet of gross leasable area to Pure Industrial for $724.38 million in July and August. The portfolio, with properties scattered throughout the GTA, represents one of the largest ever seen in terms of the number of properties and total sale price.

- SmartCentres REIT paid $513 million to acquire a two-thirds interest in 53 acres of land at the Vaughan Metropolitan Centre, making it the largest property owner at the huge redevelopment site which is delivering a new, dense downtown to the northern GTA city. Multiple towers are currently under development at the VMC.

- H&R REIT sold the three-building Bell Creekbank Campus, occupied by Bell Canada, to Chicago-based Oak Street Real Estate Capital in October for $443.43 million. The Mississauga complex contains approximately 1.1 million square feet of leasable area and sits on approximately 28 acres of land that provides future opportunities for intensification.

- Rockport Group sold 22 John Street, a 369-unit rental building built in 2019, and 33 King Street, a 472-unit rental building built in 1974, for $338 million in September. The two Toronto apartment buildings were acquired by a joint venture involving Dream Unlimited (33.3 per cent), Dream Impact Trust (33.3 per cent) and Dream Impact Fund (33.3 per cent).

- Another major residential land transaction was a 1.4-acre parcel at 27 and 37 Yorkville Ave. in Toronto that’s site plan-approved for a gross floor area of approximately 961,161 square feet. The property was sold under receivership and acquired by Pemberton Group for $300 million in March. The previous owner was Cresford Developments, which originally acquired the site from KingSett Capital in December 2017 for $268.5 million.

- An office and retail complex totalling 259,234 square feet of gross leasable area at 99 Atlantic Ave. and 40 Hanna Ave. in Toronto’s Liberty Village neighbourhood sold for $240 million in November. PSP Investments and Kevric were the previous owners; Kevric’s new partner is Blackstone.

- The largest retail transaction of the year was Kennedy Commons in Scarborough, which was sold in December for $215 million. A RioCan REIT and First Gulf 50/50 joint venture sold the property at the southeast corner of Highway 401 and Kennedy Road to a local private investor. The fully occupied centre’s tenants include Chapters, LCBO, Metro, PetSmart and Kitchen Stuff Plus. It sits on almost 31 acres, which allows for potential future intensification.

- A 95-per cent interest in the Steeles Technology Campus in North York was acquired by a consortium of investors that included Crestpoint Real Estate Investments Ltd., North American Development Group and Hazelview Investments for $207.1 million in September. PSP Investments and Crestpoint were the vendors. The 45.5-acre site is comprised of three addresses on Steeles Avenue East and two on Victoria Park Avenue. It offers future redevelopment opportunities in addition to the existing four buildings, comprised of 645,377 square feet of office space that was 99 per cent occupied at the time of the sale.

- Ford Motor Company sold a 980,000-square-foot former distribution centre on a 58.8-acre site at 8000 Dixie Rd. in south Brampton to Panattoni Development Company for $194.46 million in June. The site is close to Highways 410 and 407 and will likely be redeveloped for industrial uses.

- Armadale Properties Limited sold its 50 per cent interest in the Toronto Buttonville Municipal Airport property to Cadillac Fairview for $192.89 million in May, which made Cadillac Fairview the sole owner. The 169-acre site remains in use as an airport but will likely be redeveloped. Development applications submitted in 2011 proposed a master-planned phased development that would add approximately 10 million square feet of mixed-use space to the site. The applications were appealed to the Ontario Municipal Board and subsequently withdrawn. No new application had been submitted at the time of the sale.

A GGH transaction just missed the Top-10 list: A portfolio of three properties in Waterloo and one in Kitchener was sold by Stamm Investments Limited to Killam Apartment REIT for $190.5 million in June. It contained 11 buildings and 785 rental apartment units.

Killam now owns more than 1,200 units in the Kitchener-Waterloo area, with an additional 1,300 to be developed in the coming years.

Source Real Estate News Exchange. Click here to read a full story

Canada’s lease rates for offices increasing, despite soaring vacancies

Although Canada’s average office vacancy rate has increased by a staggering 33 per cent since the start of the pandemic, several factors point to the resilience of the sector, real estate experts say.

The shift to remote work has helped propel Canada’s office vacancy rate to a 25-year high of 15.7 per cent in the third quarter of 2021, according to commercial real estate firm CBRE.

Yet the same period “saw more positive indicators than we expected, especially in Toronto and Vancouver,” says Jason Kiselbach, managing director of CBRE Vancouver.

Vacancy rates are levelling, he says, and even slightly declining for the first time since March, 2020.

”As the economy recovers from the pandemic, which we’re already seeing, we’re anticipating a lot of growth in office-occupying employment sectors,” he adds. “I think we’re going to see significant declines in vacancy back to where we were and potentially lower than 2019.”

The idea that we’re all going to work from home on our computers – that’s simply unlikely to work for most people. We’re going to continue to see each other in person in the office.

— Andrey Pavlov, professor, Simon Fraser University

Even as office vacancy rates have risen, lease rates have remained remarkably stable, he points out. In fact, Canada’s average lease rate climbed 4 per cent, to $21.04 a square foot during the past year.

In the resilient Vancouver market, lease rates climbed almost 13 per cent from $26.50 to $29.93 a square foot, despite a 56-per-cent vacancy rate increase to 7.2 per cent (still the lowest major-market rate in the country).

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/BEIMCWRJTRFSXKH3HSM6POCBB4.jpg)

In Toronto, where the vacancy rate declined in the third quarter for the first time since the pandemic began to 8.5 per cent, rental rates year to year have increased by 12 per cent, to $24.31.

Even in Calgary, where vacancy rates are the highest in North America, hovering at about 30 per cent, lease rates eked out a 2-per-cent increase to $14 a square foot last year.

”It’s an interesting dynamic,” Mr. Kiselbach says of the situation, in which rents have increased despite an oversupplied market. But before the pandemic, many cities were experiencing record-breaking vacancy lows in the office sector, he explains.

“Toronto and Vancouver had two of the lowest vacancies rate in all of North America,” Mr. Kiselbach says. And despite the recent increases, “office vacancy rates in many Canadian markets are relatively low.”

“And for that reason, landlords are holding firm [on lease rates],” he says. “Landlords see this time as just a pause on demand, with no point in reducing rates to incentivize people to their buildings. They know where the market is going.”

Another reason for office market optimism: Sublease space decreased this quarter for the first time since the pandemic.

While the national average drop in sublease space is slight, in Vancouver, the space being offered by tenants diminished by almost 50 per cent, says Colin Scarlett, executive vice-president at Colliers Canada’s Vancouver office.

“A lot of people have now decided to take back their space. They plan to move back into the office.”

In November, Colliers surveyed almost 500 Canadian companies for The Great Experiment: Dawn of the Hybrid Era report. The results show that 85 per cent of businesses will have employees working in the office in some capacity by March, 2022.

Of those businesses, “66 per cent will adopt a hybrid work model, where employees will have an option to work remotely for a percentage of the week.”

The report then delves into ways a hybrid work force could affect office real estate.

Hybrid work, it was initially thought, would spur companies to become less reliant on traditional leased office space. But this hasn’t played out. Three-quarters of tenants surveyed reported they would either keep the same amount of office space in the future, or would need more space, or were unsure. About one-quarter of tenants reported that they would require an average of 36 per cent less space.

The report concludes that the “impact of hybrid work, as an isolated factor, would cause an increase in national office vacancy of approximately 5 per cent by 2024 from current levels.”

”Other factors, such as economic growth, could mitigate this vacancy increase, Mr. Scarlett says.

The Colliers survey is among a multitude of studies examining the implications of a massive shift to hybrid work. Undoubtedly the biggest work experiment ever, Forbes deems the current era “the Wild West of work.”

According to a March report by Statistics Canada, 90 per cent of at-home workers are completing the same or more work, compared to being in the office.

But employees don’t want to be at home all the time. A PwC Canadian work force study, conducted in July, indicated that 66 per cent of employees want to work in the office at least half the time.

And despite a September, 2021, report by Global Workplace Analytics showing large companies “could collectively save almost $11,000 annually for each employee who works at home half of the time” (owing to real estate savings, increased productivity, reduced staff turnover and other factors) – employers, too, want to see all employees in the office “between 1.5 and 3 days per week, depending on the role,” according to the Colliers report.

”Businesses are facing cultural challenges,” Mr. Scarlett says. “A lot of professional service firms’ competitive advantage is their ability to transfer knowledge as [spontaneously] as possible, and that knowledge transfer has been gone.”

Andrey Pavlov, a professor at Simon Fraser University, who specializes in real estate finance, believes work-from-home is here to stay. “But I think the change that we’ll see on the real estate market is going to be smaller than we think,” he says.

“The idea that we’re all going to work from home on our computers – that’s simply unlikely to work for most people. We’re going to continue to see each other in person in the office.”

Mr. Pavlov expects changes will occur in office design – and this was happening before the pandemic, when offices became like a “second home” for workers, especially for technology and creative companies.

“What was happening in office-design trends before the pandemic will accelerate,” Mr. Pavlov says. “Offices and cubicles will give way to shared, open space – where it almost feels like a coffee shop. You’ll want to hang out there.”

Mr. Pavlov suggests if the market decides that the office is still important – for productivity, identity, idea incubation – “it will have to become a destination of choice.”

Source The Globe And Mail. Click here to read a full story

SmartCentres to pay $513M, acquire 53 acres at Vaughan Metro Centre

SmartCentres REIT will pay $513 million to acquire a two-thirds interest in 53 acres of property at the massive Vaughan Metropolitan Centre (VMC) development just north of the City of Toronto, the trust has announced.

The property is part of the SmartVMC development, a 100-acre master-planned city centre which is being developed at the VMC, along Highway 7 at the terminus of the city’s TTC subway line.

“These 53 acres represent the most strategic property in the country for SmartCentres REIT,” said Mitchell Goldhar, executive chairman and CEO of SmartCentres, in the announcement. “With 45,000 people expected to ultimately call SmartVMC home, it is the jewel in the crown of SmartCentres’ portfolio.”

Goldhar’s privately owned Penguin Group of Companies owns the remaining 33.33 per cent of acquired lands, which will extend the SmartCentres/Penguin partnership to own the entire 105-acre SmartVMC City Centre. The transaction is scheduled to close on Dec. 31 and will make SmartCentres the largest property owner at the VMC.

The property is being acquired from an unnamed third-party vendor, a SmartCentres spokesperson wrote in reply to an email question from RENX.

Vaughan city centre to be 21 million-square-foot development

The city centre site is envisioned to contain 21 million square feet of development at full build-out. SmartLiving, SmartCentres’ in-house residential development platform, will manage the project.

“This is truly a unique situation. It is not every day a company can be involved in building an entire downtown,” Goldhar said in the announcement. “SmartVMC is at the confluence of $3.5 billion in public transportation infrastructure, including the TTC’s new Vaughan Metropolitan Centre subway station, connecting the site directly to downtown Toronto. While it may be difficult to imagine now, in time this will reveal itself as a new benchmark for modern living in our city and beyond.”

The city centre property has permissions in place for multiresidential, condominium, seniors’ residences, office, retail, recreational, entertainment and other uses.

Approximately 11 acres of the acquired lands are occupied by various retailers, including a 146,000-square-foot Lowe’s home improvement outlet and several quick-service restaurants, providing strong holding income.

SmartCentres and the Vaughan Metropolitan Centre

SmartCentres is heavily involved in the VMC site, recently announcing the formal kickoff of construction of Phase 1 at its latest development, known as ArtWalk. The first phase includes three towers of 38, 18 and six storeys as well as retail at ground level.

It is also the developer of the Transit City 1 and 2 towers, 55-storey multires buildings and a mixed-use 225,000-square-foot tower anchored by PwC’s offices.

Tuesday’s announcement says merging the two parcels of land allows for “the unleashing of creativity and maximizing of synergies, such as environmental sustainability, open space connectivity, renewable energy, and recycling management.”

The site will provide residents, workers and visitors with access to Highways 400 and 407, as well as Highway 7, the Vaughan Metropolitan Centre University line TTC subway station, a VIVA bus terminal and York Region bus terminal.

SmartCentres intends to partially fund the acquisition through the issuance of approximately $200 million in SmartCentres REIT LP units at $34.50 per unit, which will be exchangeable into SmartCentres REIT Units on a one-for-one basis.

The remaining $313 million is to be funded from debt facilities and cash on hand.

About SmartCentres

SmartCentres Real Estate Investment Trust is one of Canada’s largest fully integrated REITs, with a portfolio featuring 168 properties in communities across the country.

SmartCentres has approximately $10.2 billion in assets and owns 33.9 million square feet of income-producing retail space with 97.6 per cent occupancy, on 3,500 acres of owned land.

The REIT plans and develops connected, mixed-use communities on its existing retail properties.

Project 512, a $13.1 billion intensification program ($7.8 billion at SmartCentres’ share) represents the REIT’s major development focus on which construction is expected to commence within the next five years.

The intensification developments consist of rental apartments, condos, seniors’ residences and hotels under the SmartLiving banner, and retail, office, and storage facilities under the SmartCentres banner.

The program is expected to produce 54.7 million square feet (32.2 million square feet at SmartCentres’ share) of space, 27.0 million square feet (15.9 million square feet at SmartCentres’ share) of which has or will commence construction within the next five years.

Source Real Estate News Exchange. Click here to read a full story

Big opportunity to develop ‘small apartments’ in Canada: Lobo

B.C. and Alberta have proportionately more apartment transactions and more new apartment construction than Ontario and Quebec. The reason, SVN Rock Advisors Inc., Brokerage CEO Derek Lobo said, is 45 years of rent controls in the latter two provinces which have deterred development and contributed to affordable housing shortages.

“The industry collapsed because of rent controls and, now that it’s experiencing reinvigoration, it’s the bigger players with deeper pockets that are coming to the market,” Lobo said during the recent Affordable Housing and New Apartment Development conference in Toronto, which was billed as the first significant in-person commercial real estate event in Canada since the pandemic struck.

“But at the end of the day, I think there’s a significant opportunity to build small apartments. That’s historically what we’ve built and hopefully that will return.”

That regional disparity is evidenced in transaction activity, which might surprise those not closely involved with the sector.

Looking at on “new construction” trades – buildings built since 2000 – Lobo said Edmonton had 45 apartment transactions valued at $3 million or more from 2007 to 2021. Montreal is next with 25, followed by Vancouver with 23, Toronto with 16, Halifax with 15, Quebec City and Langford, B.C., with 14, Calgary and Ottawa with nine, and Granby, Que., Dieppe, N.B., London, Ont., and Spruce Grove, Alta., with seven.

During that same time frame across Canada, there have been 100 apartment transactions of less than $10 million, 83 of $10 million-$20 million, 60 of $20 million-$30 million, 46 of $30 million-$40 million, 30 of $40 million-$50 million, 14 of $50 million-$60 million, nine of $60 million-$70 million, five of $70 million-$80 million, and 11 of $100 million or more.

Small apartment buildings dominate market

The majority of apartment buildings in Canada are relatively small and Lobo said about 18,000 of the 25,000 in Ontario have fewer than 50 units.

London has had more apartment construction activity than any city in Canada, but just seven transactions as developers are holding on to their properties. The same is the case in Toronto, where large institutions are responsible for much of the recent apartment development.

Lobo estimates there are about 250 apartments being built and about 750 being planned across Canada. The average transaction price has been steadily increasing in this century and Lobo has noticed more interest in building apartments in secondary and tertiary markets since the pandemic started.

“The apartment sector is a strong sector,” said Lobo. “It’s recession-proof, it’s virus-proof, but it’s not government-proof.

“We really have to think about legislation that can happen in the future that can hurt our industry. One of the problems we have in our industry is that we don’t have a national association of apartment builders. Almost every large group has some representation in Ottawa, but there is no apartment-building group.”

Lobo also said he’d be interested in being part of a group to lobby for apartment developers federally, provincially and municipally.

What’s being built

SVN Rock Advisors, which organized the event, is a Burlington-based commercial real estate and consulting company with an exclusive focus on the apartment sector.

Before building an apartment, Lobo said developers should do a feasibility study to find out: if they should build; what they should build; how much rent they can charge; the depth of the market; how much money they can make if they build and sell; and how to minimize the tax paid on disposition.

Four-storey, wood-framed apartments with surface parking pencil out at the highest yield, according to Lobo.

He’s seeing more five- and six-storey apartments made with cold-rolled steel and hollow cores, which take about 15 months to build.

He said they work well as part of a campus, particularly in smaller markets, where you can build four 60-unit buildings in phases instead of one 240-unit building – because there’s less risk and you don’t have to build them all if they’re slow to lease up.

Many eight- to 15-storey pre-cast apartments are being built in Southwestern Ontario, said Lobo, who has seen fewer 20-plus-storey concrete apartments built in the past two years.

Infill and intensification opportunities

Lobo said many “tower-in-the-park” apartments were built in Canada in the 1950s and ‘60s, and they offer opportunities for infill and intensification. Adding a new apartment building with modern amenities to an existing site will also increase the value of the original apartment because they can share the new facilities.

“There may be opportunities for developers to work with longtime apartment owners, many of whom are now in the second and third generation and are wealthy families that don’t develop anymore and could work with a partner,” said Lobo.

Locations, unit design and size, amenities and a good property management platform drive rents, with amenities being more critical in downtown areas than in suburban areas, according to Lobo.

SVN Rock Advisors had no shopping centre clients 20 years ago. That group now comprises its largest percentage of clients, because owners are looking to redevelop sites since many of them have three quarters of their space dedicated to parking.

For retail owners looking to create a mixed-use community by adding apartment buildings, Lobo cautioned a good retail area isn’t necessarily a good apartment area, and vice versa.

“You may need to give up some of your prime retail space for a good rental entrance,” Lobo added. “In the rental business, the arrival experience is what your residents need to have to pay top rents.”

No concerns about apartment overbuilding

Lobo said there’s demand for new apartments and room to construct them, without concerns about overbuilding in most Canadian cities.

With some office buildings hit hard by COVID-19 and experiencing increased vacancy rates, Lobo said there’s a possibility of converting them to apartments.

“You need to price in the risk, but the reward can certainly be there . . . maybe office buildings are going to become cheaper in certain areas in certain cities.”

Now isn’t the time to be in the build-to-rent single-family rental business in Canada because the housing market is so hot, Lobo said.

However, there’s a definable, scalable and increasingly institutional business in the United States where developers build houses in subdivisions and then rent them. The model also provides the owner with the flexibility to sell individual houses.

Source Real Estate News Exchange. Click here to read a full story

Shut out of the residential housing investment market? Take a look at commercial

Properties that interest one broker: lakefront hotels, self-storage facilities near cities

The pandemic has been kind to Canada’s established real estate investors as skyrocketing home prices and rock-bottom mortgage rates have created a prime opportunity for them to turn their equity into expanded residential portfolios.

In Ontario alone, multi-property owners were responsible for more than a quarter of real estate transactions in the first eight months of 2021, according to a recent housing data report by Teranet property registry service in Toronto.

It’s a far more brutal environment for investors attempting to crack the residential market for the first time.

Housing prices went through the roof during the pandemic, but rent values have not kept pace, potentially affected by a lack of immigration and a reduced need for student housing during the crisis. Plunking down a million dollars for a property that leaves you with negative cash flow every month isn’t an ideal starting point.

What’s a burgeoning real estate mogul looking for appreciation and cash flow to do? Consider commercial.

The perks of commercial real estate investment

One thing the commercial real estate market has going for it is enormity.

Matt Rachiele, the Calgary-based senior vice president of investment sales for Colliers International, says the global commercial real estate market is worth more than $230 trillion.

“This is the world’s largest, and arguably one of its most important asset classes,” Rachiele says. “And unlike many other industries, no single group controls even one per cent of it globally. So the opportunities to participate are literally boundless.”

That wide openness means commercial investors can often be quite particular about the properties they buy and the kinds of tenants they rent to. That’s not always the case when you have an empty house and a $3,000 mortgage payment to make.

Because commercial leases tend to span years, investors can typically take more of a “set it and forget it” approach with their tenants. You won’t have to worry about any midnight move-outs or occupants who threaten to withhold rent because the shower takes more than five seconds to heat up. You can structure commercial leases so tenants are responsible for maintenance and repairs.

While financing a commercial property generally involves investors ponying up down payments between 20 and 35 per cent, your individual credit history doesn’t play as much of a factor. That can help commercial investors get their first properties.

“Lenders evaluate the property,” says Kirill Perelyguine, a commercial real estate broker for Royal LePage in Toronto. “So the bank’s looking not as much at you personally as what the property is, where it’s located, what kind of cash flow it produces.”

The state of Canada’s commercial real estate market

You might think that COVID-19 decimated the commercial space. But Canadian investors just spent a record $14 billion on commercial properties in the second quarter of 2021, according to the most recent Canada Investment MarketView from CBRE real estate in Toronto.

“Investment activity has built over the first half of 2021 due to significant capital backlogs, a growing pipeline of property listings and an improving COVID outlook,” CBRE writes, adding that the country is on pace to reach a full-year investment total of $49.6 billion, which would smash the previous record from 2018.

The most in-demand asset classes among investors are industrial and multi-family properties. The former continues to benefit from the rise of online retail, while high real estate prices bolster the latter by forcing Canadians to rent longer.

Retail properties are in the midst of a rebound, accounting for $2 billion in sales in Q2. Those properties, however, are highly sensitive to location and tenant mix; you’ll likely benefit from professional guidance when getting your feet wet in the commercial space.

“You should be ever mindful that you don’t know what you don’t know,” Rachiele says.

Commercial properties that intrigue Perelyguine include lakefront resorts and hotels, and self-storage facilities near major population centres.

A hidden gem?

Securing a quality property in Canada’s largest commercial markets — Toronto, Vancouver or Montreal — won’t be easy or cheap. The competition in the commercial space may not be quite as tight as it is in each city’s residential market, but it’s fervent enough to keep pushing prices higher.

Perelyguine says demand for industrial space in Toronto, for example, is “going absolutely nuts.”

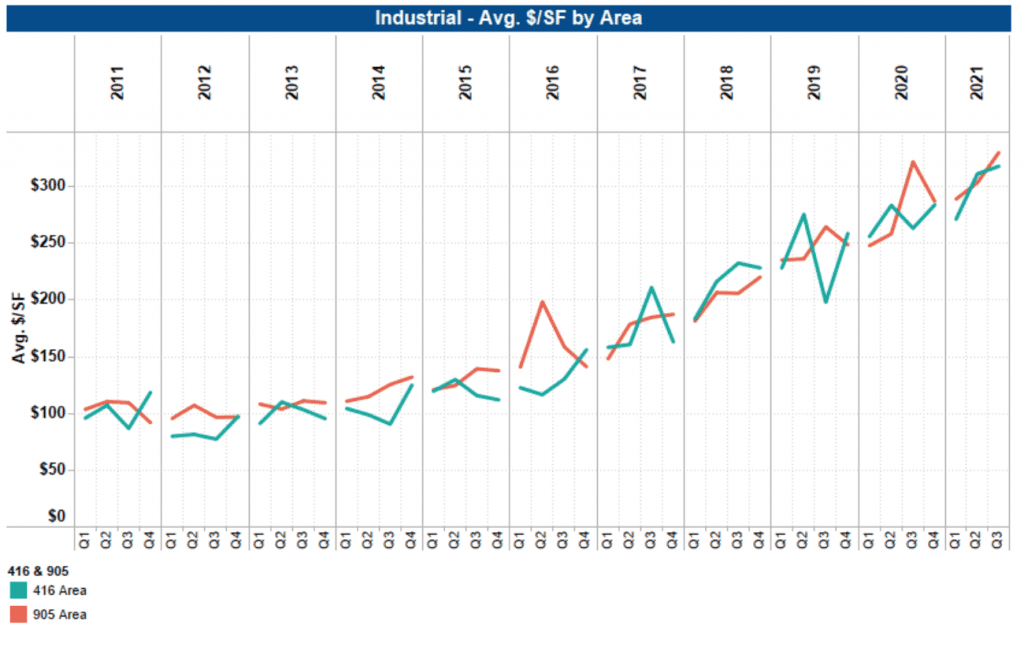

“The price per square foot went up from $200, just three years ago, to $400 or $450. I’ve seen $600 per square foot,” he says.

Rachiele says Calgary is home to a number of attractive no- to low-vacancy commercial assets, but to find them, investors may need to partner with an established fund or syndicate of limited partners.

“Part of the reason for that is that higher quality assets are more frequently traded off-market,” he says, “meaning you’ll never even get a crack at them unless you have boots on the ground here.”

Source The London Free Press. Click here to read a full story