Author The Lilly Commercial Team

Top-35 Canadian CRE stories of 2021

As we enter the holiday season and the clock ticks down on another year, we once again offer our annual RENX Top-35 Canadian CRE Stories of 2021.

Top-35 you say? Well, yes. We started out trying to pare the list to 30 top stories, but after what is expected to be a record-breaking year of acquisitions, takeovers and other activity, we finally gave up. So, we’ve included 35 articles.

The list includes many of the largest and most significant transactions across the industry during the past 12 months.

And as 2021 was defined by many major multiresidential and industrial transactions, that is reflected in the selections. But the list also includes significant headlines from other sectors.

The ongoing pandemic is also a factor, but we haven’t focused on that because even as the COVID waves rise and fall, the commercial real estate industry continues to soldier on, doing what it always does.

The focus is on Canada

As always, we are focused on Canadian activities, and while some of the selections represent international transactions, or groups of transactions, a Canadian-based entity is at the core. While many of the articles appeared on RENX itself, some are curated from other sources, with links to the original articles s0 you can take a look back at the 2021 that was.

We’ve included our Top-10 list here in order of prominence. The remaining 25 stories are loosely grouped by sector and geography, where possible. The full list of articles appears in our RENX Top-35 Newsletter.

As always, we believe the fun of these lists is to consider the choices and compare them with your own personal priorities. We do hope you enjoy reading what we’ve compiled.

Finally, a heart-felt thanks to all our readers, advertisers, contributors and countless others who help us publish RENX every day. We appreciate your support and confidence.

Merry Christmas and Happy Holidays from all of us.

The RENX Top-10:

10) Brookfield Asset Mgmt. ups offer for BPY to US$6.5B

Brookfield Asset Management increased its original offer and reached agreement to take its Brookfield Property Partners subsidiary private. The new offer meant a $6.5-billion payout for shares it didn’t already control.

9) Oxford sells huge U.S. assets, acquires industrial

Oxford Properties transacted billions in U.S. properties: selling St. John’s Terminal (with CPP Investments) to Google for $2.6B; and One Memorial Drive in Cambridge, Mass. On the industrial side, it was a major international buyer; a $2.8B portfolio from KKR, and a $1.3B venture with EverWest.

8) Milton land, bought for $15.8M, sells for $165M

A tract of future industrial development land across from the planned new CN intermodal terminal in Milton sold for $165 million – more than 10 times what it was acquired for six years ago.

7) SmartCentres acquires 53 acres at VMC for $513M

SmartCentres REIT paid $513 million to acquire a two-thirds interest in 53 acres of property at the massive Vaughan Metropolitan Centre development just north of the City of Toronto. The acquisition means it is now the largest landowner at the VMC.

6) Panattoni builds 2.9M-sq.-ft. Amazon Edmonton facility

Panattoni Development Co. is building a massive robotic fulfillment centre for Amazon in Parkland County, just outside Edmonton, which will be one of the largest such distribution facilities in Canada when it opens in 2022.

5) CF acquires GTA’s Buttonville Airport property for $193M

Cadillac Fairview paid nearly $193 million to become the sole owner of the Toronto Buttonville Municipal Airport, a 169-acre property in Markham which for years has been considered a prime site for a major redevelopment.

4) Blackstone acquires WPT Industrial in US$3.2B deal

Blackstone Real Estate Income Trust acquired Toronto-based WPT Industrial REIT in an all-cash transaction for $3.2 billion US. WPT earlier sold a minority interest in a $370 million U.S. industrial portfolio in a JV with Investment Management Corporation of Ontario.

3) Tricon partners on billions in U.S., Canadian rental housing

Tricon Residential created partnerships to acquire/develop billions in rental housing, committing capital to partnerships which will: acquire up to 18,000 U.S. resale homes worth $6.4 billion; acquire $1.8 billion in new Sun Belt homes; and construct $500 million of GTA multresidential.

2) H&R REIT sells Calgary’s Bow tower, reorganizes

H&R REIT sold Calgary’s Bow office tower and Mississauga’s Bell office campus to Chicago-based Oak Street Real Estate Capital for $1.67 billion, two months before announcing a major repositioning of its portfolio.

1) Canderel-led group acquires Cominar in $5.7B transaction

In a landmark deal, Cominar REIT agreed to be acquired by a Canderel-led consortium in a transaction which values the trust at $5.7 billion. The arrangement, involving the sale of various parts of Cominar’s portfolio to different purchasers, was approved by unitholders on Dec. 21.

Source Real Estate News Exchange. Click here to read a full story

Omicron is Keeping Toronto’s Office Sector in a ‘Holding Pattern’

Toronto’s office sector showed signs of recovery during the last couple of quarters when COVID-19-related restrictions eased, but the Omicron variant spreading like wildfire has proven a spanner in the works.

A report from Colliers noted that office leasing in Q4-2021 was particularly strong in the FIRE (financial services and real estate) and PSTS (professional, scientific and technical services) sectors. According to Jamie Jackson, Managing Director, GTA Office Practice for Colliers, the GTA’s office vacancy rate still increased by 20 basis points on a quarterly basis to 8.7%, although that was also a function of new supply hitting the market. In simple terms, however, there’s no one-size-fits-all when it comes to who will return to offices.

“The [new supply] is one reason net asking rates are staying the same and inching ever so slightly higher — there’s more triple-A product coming onto market,” he said. “But companies are hesitant and delaying their expansion criteria because they don’t know how they’re going to use that space or how much they will need in [a] hybrid environment.

“From what I’ve heard from our clients, insurance actuaries are unlikely to come back to the office, and yet agile programming teams will be coming back to the office. The other takeaway is how companies are using their space is not a one-size-fits-all.”

But now with Omicron stalling employees’ return to offices, there’s a lot of uncertainty. While tours to view potential lease space are still on the rise, Jackson cautioned those are mostly the exceptions, companies that are growing so rapidly that their long-term plans are superseded by their immediate need for space.

“The other categories are people who can’t work from home, like lab workers, etc., and category No. 3 is organizations that have had extensive experience with hybrid work and have a pretty good view of how they will move forward,” he said.

However, one thing is for sure: Omicron is delaying companies’ leasing commitments until they can physically test the hybrid work model in their current offices to determine future needs.

Although it is too early to ascertain how Omicron will affect office demand through the first half of the year, Keith Reading, Director of Research at Morguard, says the latest COVID wave is inauspicious because it has jarred business confidence.

“Prior to the Omicron spike, there was a little bit of optimism building and companies were planning on going back to work. Just when there was a little bit of light at the end of the tunnel, we get hit with Omicron and it will delay people’s plans to go back to work,” he said. “Business confidence taking a hit is absolutely the biggest factor, because if businesses are confident they tend to look for opportunities, they look at their business lines and expanding or maybe relocating to nicer office space or hiring staff as a result of being confident in their revenue outlook, but this public health issue really throws a wrench in the works.”

Reading describes Toronto’s office market as returning to a holding pattern in which some companies are shelving hiring and growth plans. In other words, they’re taking a wait-and-see approach, especially because there’s scant reason not to expect another disruptive COVID-19 variant after Omicron.

“It’s the lack of leasing activity. There’s activity out there, but it’s not what we would call real growth, which is companies expanding their businesses,” continued Reading. “It becomes harder to gauge when your work force is not in the office.

“I think what you will see is more users are looking at this now and saying, ‘Here we go again. It’s worse in terms of infection rates and this could keep happening.’”

Jackson, however, believes business confidence is still robust because fundamentals in the general economy are still holding strong, and in Colliers’ case, Jackson says many clients’ businesses are, in fact, growing thanks to that fundamental economic structure.

“There’s uncertainty around how much space they might need and how they’ll use it, but that’s more a question about logistics than whether or not real estate will be part of their business,” he said. “Real estate will continue being a tool to help companies grow their businesses. It’s just a question of what that will look like in the future and how much space they will need per employee.”

Source Storeys. Click here to read a full story

CRE investment in Canada remains on record pace: Top execs

Commercial real estate investor sentiment has improved significantly over the past year, particularly over the past six months.

Peter Senst, president of Canadian capital markets for CBRE, moderated a four-person panel representing companies that are major investors in Canada and internationally during a session as part of the 30th annual Real Estate Forum at Toronto’s Fairmont Royal York on Dec. 1.

The mood was generally optimistic, with good reason.

There was $1.1 trillion in global transaction volume in 2018 and 2019, and sales are on pace to reach that number again this year, according to Senst. Canada is on track for an all-time record year of $55.3 billion in volume across 9,100 transactions, ahead of the previous peak of $49.3 billion across 7,145 deals in 2018.

“The intersection of Canada as a country and real estate as an asset class is where a lot of capital is coming,” said Senst.

The four senior executives shared thoughts on their companies, the markets and the outlook for 2022 during the session, which had both in-person and virtual attendees.

BentallGreenOak

BentallGreenOak is a real estate investment management advisor and real estate services provider with expertise in office, industrial, multiresidential, retail and hospitality properties. It serves over 750 institutional clients and had approximately $70 billion US worth of assets under management at the end of September. The company has offices in 24 cities in 12 countries.

“Fundamentals are strong and there’s a tremendous amount of global liquidity looking to invest in real estate,” said president Amy Price.

Four main trends Price said BentallGreenOak is thinking about, in terms of investment strategies, are:

– demographic shifts, including age, population, migration and immigration;

– technology, including robotics, artificial intelligence and block chain;

– climate change; and

– income inequality, as the middle class is evaporating and one per cent of the population holds 45 per cent of global wealth.

“It’s about focusing on those global trends and translating them down to a market-by-market level,” said Price.

Large institutional investors are under-allocated to real estate targets and Price believes those targets will increase. She also thinks interest rates will rise.

Apartment rents and occupancy rates have been increasing after taking an initial hit early in the pandemic. Price believes the same thing will happen with the best office assets despite ongoing uncertainty surrounding the asset class.

Determining how to turn environmental, social and governance initiatives into performance and value — as well as employment equity, diversity and inclusion — are BentallGreenOak priorities.

Price said companies need to be reflective of the cities where they invest and the tenants they lease to in order to make the best investment decisions.

Blackstone

Blackstone is a New York City-headquartered firm that invests across a variety of asset classes on behalf of pension funds and other leading institutions. It had $230 billion in real estate assets under management at the end of the third quarter.

Logistics properties are Blackstone’s top global priority. It owns 1.2 billion square feet of warehouse space around the world, which represents 40 per cent of its portfolio.

Blackstone is investing in rental housing since there’s a shortage in most of the markets where it’s involved.

Senior managing director and head of the Americas Nadeem Meghji said Blackstone is the largest private owner of life science office space in the world and the asset class has benefited from accelerated research and development spending since the pandemic started.

Blackstone is also becoming a larger owner of studio assets because of the increased focus on the streaming of original content shows and movies on different devices. Los Angeles is benefiting from this, Meghji noted.

While there’s a major dispersion among asset classes, Meghji called the commercial real estate market “pretty healthy” — with the best fundamentals ever in some sectors.

“Lending today is in check and is nothing like what we saw in 2007. So despite the fact that values are higher than they were, and some people might say as high as they’ve ever been in terms of yields, this is not being driven by some sort of debt-fuelled mania like we’ve seen at different moments in the past.”

Meghji noted:

– we’re in a low-yield fixed-income environment where commercial real estate returns are attractive;

– hard assets are coveted during inflationary periods like the one we’re in now;

– many institutions are under-allocated in real estate and looking for more;

– and investors want to deploy capital now before interest rates rise.

He therefore expects high transaction volumes to continue and for the first half of 2022 to look a lot like the second half of 2021.

CPP Investments

CPP Investments is a global investment management organization that invests the assets of the Canada Pension Plan. Its fund is diversified across 20 global markets and a variety of investment types and was valued at $541.5 billion at the end of September.

Managing director and global head of real estate Peter Ballon said there are three major levers CPP Investments can pull to create value: country selection, sector selection and asset selection.

Country selection has traditionally had the biggest impact on returns, but sector selection has become more important recently as logistics properties have made money globally and retail properties have generally lost money in developed markets.

While plenty of capital is flowing into commercial real estate, Ballon said much of it isn’t coming from traditional real estate investors. The source is those seeking the best returns at the moment, so they could move on if better returns can be found elsewhere.

Ballon said pent-up demand from 2020, when investors were unsure about what to do with their capital after the global pandemic hit, led to increased activity in 2021. Reallocating funds has also played a big role.

“A lot of investors realized they were exposed to sectors that traditionally had done very well and now they weren’t doing so well and they realized that they didn’t have enough diversification,” said Ballon. “People are reallocating between sectors, which is creating a lot of turn.”

Ballon doesn’t think more capital will come to commercial real estate as an alternative to fixed income, as interest rates are expected to rise, so he expects lower transaction volumes moving forward.

Oxford Properties

Oxford Properties is a Toronto-headquartered multinational with operations in real estate investment, development and property management. Its portfolio includes office, retail, industrial, multiresidential, life sciences and hotel assets. It’s backed by permanent capital from OMERS, one of Canada’s largest defined benefit pension plans.

Chad Remis, executive vice-president for North America, said Oxford had $70 billion in assets under management, including almost $50 billion in North America. It will do $16 billion in global transactions this year.

“When I joined the company inside a decade ago, we were a $16-billion organization,” said Remis. “There’s a lot of capacity in the system for liquidity and to transact.

“I think there are specific organizations, and we’re one of them, that are going to take advantage of that liquidity and that opportunity to move their portfolio into places where they would prefer their portfolio to be.”

Oxford is doing more deals for lower prices now than it has in the past, according to Remis. It’s particularly interested in investing in “beds, sheds and meds,” referring to multiresidential, logistics and life sciences properties.

“I don’t think private real estate markets were built to sustain this amount of volume and velocity,” Remis said of the hectic activity over the last six months, which he noted has led to back-ups with appraisals, rating agencies, lenders and due diligence.

Oxford will always have a disproportionate amount of money invested in Toronto, Vancouver and Montreal because it’s a Canadian company. Institutional capital likes predictability and Remis said Canadian real estate offers that, even if it takes longer to get in and out of projects because it’s a smaller market in a global context.

Remis expects more global capital to be invested in Canadian real estate in the next decade, which will “create a more dynamic market and a more efficient market with more liquidity.”

Source Real Estate News Exchange. Click here to read a full story

Commercial real estate investment activity in GTA increased significantly in 2021

Commercial real estate investment activity in Ontario’s Greater Toronto Area (GTA) and Greater Golden Horseshoe (GGH) regions increased significantly this year over the previous two years.

Altus Group compiled transaction activity statistics and came up with a list of the biggest individual deals for 2021. Ray Wong, vice-president of data operations for the Data Solutions division, spoke with RENX about the findings.

“This year is reflective of the overall confidence in real estate,” said Wong. “A lot of investors are looking at the GTA, but they’re also looking at opportunities just outside the GTA.”

Commercial real estate investment in the GTA (through Dec. 22) was $25.9 billion, compared to $16.8 billion in 2020 and $22.6 billion in 2019. Investment in the GGH hit $10.3 billion during the same period, compared to $4.6 billion in 2020 and $4.9 billion in 2019.

Wong attributes some of the increases to the onset of the pandemic in 2020, which caused investors to re-examine strategies and building owners to look at rebalancing their portfolios. It took some time to market assets and some properties that may have been listed, or were under consideration to be sold, didn’t sell until 2021.

“We’re seeing larger transactions happen in 2021 because there was more certainty from both buyers and sellers,” said Wong.

Increased GTA transaction volume

Altus Group broke down 2019 and 2021 activity in the GTA by asset class (as of Dec. 22) and came up with these numbers:

– Residential land transactions were $7.97 billion in 2021 compared to $4.43 billion in 2019.

– Industrial transactions were $7.08 billion compared to $4.40 billion in 2019.

– Industrial, commercial and investment (ICI) land transactions were $4.86 billion compared to $2.97 billion in 2019.

– Apartment transactions were $3.59 billion compared to $3.76 billion in 2019.

– Retail transactions were $3.33 billion compared to $2.22 billion in 2019.

– Office transactions were $2.68 billion compared to $4.07 billion in 2019.

– Residential lot transactions were $986 million compared to $653.7 million in 2019.

– Hotel transactions were $224.9 million compared to $90.5 million in 2019.

Breaking down the asset classes

“Demand for ICI land is pushing down Highway 401 into southwestern Ontario,” said Wong, citing Amazon’s expansion in London as an example.

“There’s still demand for residential land based on the scarcity of inventory. It’s continuing to move north, west and east, which is reflected in the transactions.”

At a time when the pandemic has raised questions about the future of brick-and-mortar retail, the 50 per cent increase in activity shows there’s still interest in the sector — even if it’s not always for traditional reasons.

“Private investors are looking for redevelopment of some parcels for mixed-use development,” said Wong.

Companies are still trying to get a grasp on hybrid work models and how much office space will be needed to accommodate social distancing and increased collaboration space. Wong is interested in seeing how that plays out and affects the office market.

“Office transactions are still happening even though there’s some uncertainty in that area,” he said. “People still look at these types of assets as having good returns, which shows some confidence in the office market.”

Wong believes 2021’s strong transaction activity will carry over into 2022.

Source Real Estate News Exchange. Click here to read a full story

Top-10 CRE transactions in the GTA in 2021

The biggest GTA commercial real estate transaction of 2020 was QuadReal’s Oct. 9 acquisition of a 0.453-acre parcel of residential land at 480 Yonge St. in Toronto for $171.93 million. QuadReal acquired it from the Ontario Superior Court of Justice after Cresford Developments purchased it in November 2016 for $67 million. Cresford had plans to develop the 39-storey, 425-unit Halo Residences condominium, but the project went into receivership while it was under construction.

That deal wouldn’t have even cracked the top 10 in 2021.

Here are the 10 biggest transactions which had been announced and closed through Dec. 22, except for the second deal on the list, which closed late in the month:

- Artis REIT sold a 26-property industrial portfolio with nearly 2.5 million square feet of gross leasable area to Pure Industrial for $724.38 million in July and August. The portfolio, with properties scattered throughout the GTA, represents one of the largest ever seen in terms of the number of properties and total sale price.

- SmartCentres REIT paid $513 million to acquire a two-thirds interest in 53 acres of land at the Vaughan Metropolitan Centre, making it the largest property owner at the huge redevelopment site which is delivering a new, dense downtown to the northern GTA city. Multiple towers are currently under development at the VMC.

- H&R REIT sold the three-building Bell Creekbank Campus, occupied by Bell Canada, to Chicago-based Oak Street Real Estate Capital in October for $443.43 million. The Mississauga complex contains approximately 1.1 million square feet of leasable area and sits on approximately 28 acres of land that provides future opportunities for intensification.

- Rockport Group sold 22 John Street, a 369-unit rental building built in 2019, and 33 King Street, a 472-unit rental building built in 1974, for $338 million in September. The two Toronto apartment buildings were acquired by a joint venture involving Dream Unlimited (33.3 per cent), Dream Impact Trust (33.3 per cent) and Dream Impact Fund (33.3 per cent).

- Another major residential land transaction was a 1.4-acre parcel at 27 and 37 Yorkville Ave. in Toronto that’s site plan-approved for a gross floor area of approximately 961,161 square feet. The property was sold under receivership and acquired by Pemberton Group for $300 million in March. The previous owner was Cresford Developments, which originally acquired the site from KingSett Capital in December 2017 for $268.5 million.

- An office and retail complex totalling 259,234 square feet of gross leasable area at 99 Atlantic Ave. and 40 Hanna Ave. in Toronto’s Liberty Village neighbourhood sold for $240 million in November. PSP Investments and Kevric were the previous owners; Kevric’s new partner is Blackstone.

- The largest retail transaction of the year was Kennedy Commons in Scarborough, which was sold in December for $215 million. A RioCan REIT and First Gulf 50/50 joint venture sold the property at the southeast corner of Highway 401 and Kennedy Road to a local private investor. The fully occupied centre’s tenants include Chapters, LCBO, Metro, PetSmart and Kitchen Stuff Plus. It sits on almost 31 acres, which allows for potential future intensification.

- A 95-per cent interest in the Steeles Technology Campus in North York was acquired by a consortium of investors that included Crestpoint Real Estate Investments Ltd., North American Development Group and Hazelview Investments for $207.1 million in September. PSP Investments and Crestpoint were the vendors. The 45.5-acre site is comprised of three addresses on Steeles Avenue East and two on Victoria Park Avenue. It offers future redevelopment opportunities in addition to the existing four buildings, comprised of 645,377 square feet of office space that was 99 per cent occupied at the time of the sale.

- Ford Motor Company sold a 980,000-square-foot former distribution centre on a 58.8-acre site at 8000 Dixie Rd. in south Brampton to Panattoni Development Company for $194.46 million in June. The site is close to Highways 410 and 407 and will likely be redeveloped for industrial uses.

- Armadale Properties Limited sold its 50 per cent interest in the Toronto Buttonville Municipal Airport property to Cadillac Fairview for $192.89 million in May, which made Cadillac Fairview the sole owner. The 169-acre site remains in use as an airport but will likely be redeveloped. Development applications submitted in 2011 proposed a master-planned phased development that would add approximately 10 million square feet of mixed-use space to the site. The applications were appealed to the Ontario Municipal Board and subsequently withdrawn. No new application had been submitted at the time of the sale.

A GGH transaction just missed the Top-10 list: A portfolio of three properties in Waterloo and one in Kitchener was sold by Stamm Investments Limited to Killam Apartment REIT for $190.5 million in June. It contained 11 buildings and 785 rental apartment units.

Killam now owns more than 1,200 units in the Kitchener-Waterloo area, with an additional 1,300 to be developed in the coming years.

Source Real Estate News Estate. Click here to read a full story

Commercial Investors Have Life Sciences on the Radar. Here’s Why

The life sciences sector is increasingly popular with investors, and while the emergent asset class has limitations in Canada that don’t exist south of the border, its relative nascence means there won’t be a better time to invest than the present.

“I think from a growth perspective, the macro thesis is one where demographics of an aging population, greater focus on health and wellbeing, and obviously the pandemic, means there’s a very strong tailwind behind the sector,” said Carl Gomez, Chief Economist and Head of Market Analytics Canada at CoStar Group.

“The other side of that too is from a technological standpoint: there’s more and more innovation from biomedicine and other forms of technology into the medical and life sciences field. Considerable research dollars are going there too, so from an investor standpoint, yeah, you really want to play in that space because there’s growth opportunity, and as with any type of investment, the most opportunity for growth and return comes from the entry point, the earliest point. And that’s where we are with that sector, which is why a number of investors are interested.”

Lease Cash-Flow Potential Can Offset Upfront Capital Investment

Life science facilities can be established in an office building or an industrial asset, but the upfront capital requisition could be prohibitive for some, Keith Reading, Director of Research at Morguard, tells STOREYS. However, in the US, where the life sciences sector is better established, rents can command as much as $40-100 USD per square foot, offsetting the steep capital costs for equipment and retrofits. Moreover, the race to find a COVID-19 vaccine drove substantial investment dollars into the sector, which Reading believes will continue growing significantly over the next decade.

“In Canada, rents go in the $35-45 [CAD] range, which is still a pretty high range,” Reading said. “A lot of investors and developers look at this as a source of growth. They look at what’s happening south of the border, where Boston is the primary life sciences market in the US, although there are other major ones too, like San Francisco and the Washington, DC and Virginia area. In Canada, prime real estate is controlled by pension funds and a few other institutions, so if you’re an investor who wants to be in real estate, you have to look at other alternatives, and we will see growth in life sciences.”

Getting In On the Ground Floor

However, there are risks with the asset class. Because it’s in its infancy, investors need to educate themselves, which is one reason they seek partners with extra teeth in the field. Life sciences requires a lot of expertise, Reading reminds, as evidenced by how few players there are in the established US market.

“If you look at it in the US, there’s been a lot of new development in life sciences and it’s been done by companies you can count on one hand,” he said. “That really tells you the expertise that’s required. There are three or four big life sciences developers in the US and they dominate the market because they have that expertise.”

The other risks are how expensive upgrading an existing building can be, and that some companies in the industry have difficult balance sheets because, often, after their initial round of funding, it’s anyone’s guess where additional funds will come from, and that could make investors, who prefer long-term security, circumspect.

“It’s not like developing an office building,” Reading said. “This requires a very specific skillset because there could be issues with draining, weighting on floors, and it requires specific equipment. If you look at what you’re dealing with, it can be things like infectious diseases and labs, and depending on the experiment, there are gasses and fluids, so you have to understand this asset class to be able to operate it.”

Canadian Marketplace Poses Unique Challenges

Gomez also says that, in Canada, the public healthcare system gives the government more oversight in growth and development, and that ultimately reduces opportunities for the private sector. Compared to the US, where life science facilities are an extension of private medicine, it is a modest asset class in Canada, especially because dedicated life science facilities seem to overlap with suburban office in many places.

But because public health is the preponderant player in Canada’s life sciences sector, institutional capital will likely stay away. Gomez says that if an institutional player has $20-billion worth of assets under administration, a smaller-scale investment isn’t worthwhile.

“But if you’re a smaller investor and you’re going to make an investment in that market, yeah, absolutely there are great opportunities because you can do a $10- 20-million building and lease that up with goods rents. You can do quite well,” Gomez said. “Depending on the size and scale of those investors, they might not be able to get scale in Canada because it’s smaller and more fragmented, so a pension fund or institutional investor might take a deeper dive in the United States. In Canada, from a development standpoint, a smaller merchant has opportunity.”

The life sciences market is presently underserved, providing yet more incentive for smaller investors to take a harder look. In the GTA, for example, the new Oakville Trafalgar Memorial Hospital is surrounded by employment land primarily dedicated to office and industrial units, but there are also medical office facilities too, indicating that locations can be versatile.

“COVID-19 absolutely has influenced growth in life sciences and it will continue to,” Reading said. “A lot of the money tends to come from venture capitalists and a lot of the work is coming out of universities with significant research platforms, as well as hospitals and other medical uses. There’s a big push and a lot of room for growth over the next 5-10 years. It’s not just COVID driving this, although that has been a big driver of late, it’s also the health field that’s driving this.”

Source Storeys. Click here to read a full story

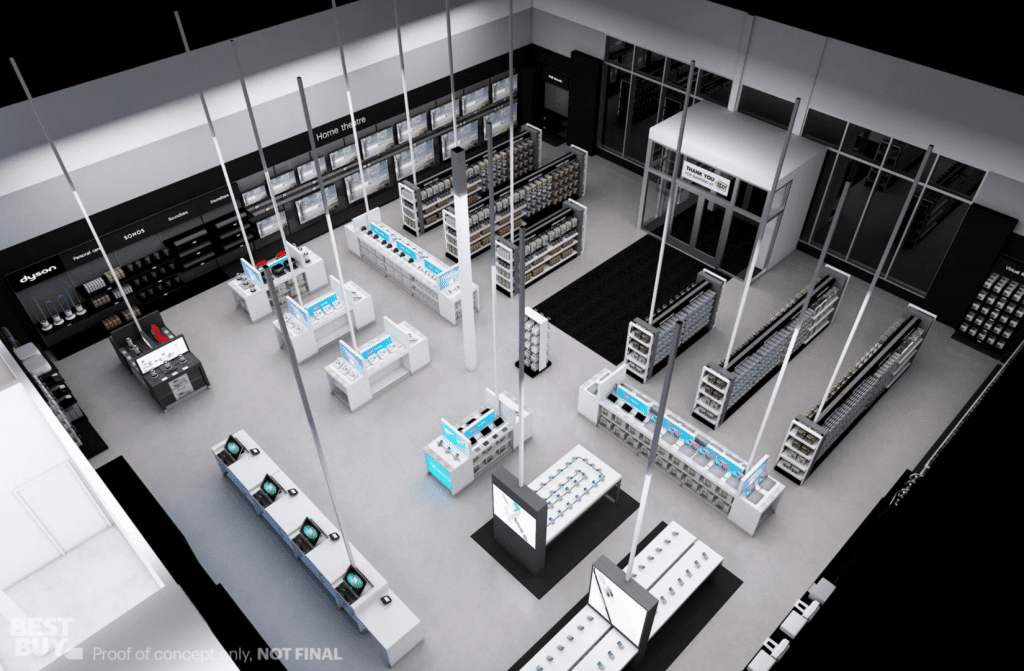

Best Buy Launching Smaller Store Format for Canadian Market

Canadian retailer Best Buy is launching a new smaller format store at the Sherwood Park Mall just outside of Edmonton.

Mat Povse, Senior Vice President, Best Buy Retail & Geek Squad Services, said through the two years of the pandemic people have become much more dependent on technology.

“They’re learning. They’re working. And they’re entertaining and they’re taking care of themselves more at home with the help of tech,” he said. “We’ve become very relevant in that regard. And customers have changed the way they’re shopping with retailers like Best Buy.

“We’ve learned as a retailer we’ve had to really adapt and figure out how we can serve those customers. One of the ways we’ve done that is we’ve asked our stores to do more than they do today. Asked our stores not to just help the customer that walks into the store but also to serve the customer who may not be stepping foot into a store. They’ve become part of the sort of support system for customers no matter how they choose to shop at Best Buy.”

“That means when customers buy online we have that inventory in their neighbourhood at a local store that we can ship from store or we can have it picked, packed and ready for curbside or in-store pickup. And you can imagine now as we think about this change that’s been happening we took a market like Edmonton and said to ourselves how can we continue to serve those customers better in this way with the use of our stores. We also identified that there are areas within Edmonton where we couldn’t actually install a Best Buy store and help serve and make access to customers in a certain community like Sherwood Park- a Best Buy they can depend on.”

So rather than building the same store the company has everywhere else it came up with the concept of the small format store. The store is scheduled to open in a few weeks in 7,700 square feet of space.

“More than half of the store is going to be allocated to warehouse space for inventory and the rest of the store will be allocated to really your traditional retail experience where there’s product on the display but one of the things you’ll notice is it’s going to have a central desk, or a central counter, where customers don’t have to navigate throughout a big store to find services for mobile activations or pay for the products. It’s now all centered in one part of the store,” said Povse.

“Rather than thinking of it as just another standalone store, it’s actually a store that gets added to the network of stores within the Edmonton market and all these stores cooperate together with shared inventory and a market-based approach to serving customers no matter how they choose to shop with Best Buy.”

The company does have one other small format in Canada in Cornwall, Ontario but it was designed in a different time. It too is small and has a warehouse in the back but the new store in Sherwood Park is different.

Best Buy Canada operates 159 retail locations across Canada including big box and Best Buy Mobile stores.

“The store isn’t just a small version of a Best Buy. It’s a store that does everything that Best Buy does. It’s got highly-trained blue shirts in there and you can do all the things you can do in a regular Best Buy store. It’s just much more convenient for you to get to. If you want the much more full-blown experience and walk through vendor displays in a 30,000-square-foot box, you drive 20 minutes and you’re in one of our big box stores,” said Povse.

“If you’re doing an online search and you want to buy that particular laptop and it’s in stock we can have it picked, packed and ready for you in 20 minutes, you show up and it’s there right in your neighbourhood. It’s a complement to our existing network of stores.”

Povse said Best Buy is playing with concepts as well for its existing stores, with inventory stores, and other small format stores.

“What we see here is an opportunity to look at other like markets and play around with our retail model to make sure that we’re building a much more elaborate and complementary ecosystem,” he said.

Source Retail Insider. Click here to read a full story

Industrial rental rates continue upward climb

Vacancy rate averages 1.3 per cent across 12 Canadian markets in Q4 2021

Industrial rental rates trended upward in 11 of the 12 metropolitan areas that Colliers Canada tracks during the fourth quarter of 2021. A newly released snapshot of Canadian markets finds vacancy rates below 1 per cent in five markets, and between 1 and 5.4 per cent in the seven other urban centres.

Topping the chart, industrial space in Victoria and Vancouver commanded average asking net rates of $16.47 and $16.31 per square foot (psf) respectively in markets where the vacancy rate has fallen below 0.5 per cent. That surpasses average asking rents for office space in five of the surveyed markets: Calgary; Regina; Winnipeg; Waterloo; and Halifax.

Across the 12 markets, Colliers pegs the vacancy rate at 1.3 per cent, with the availability rate at a somewhat roomier 2.2 per cent. That follows a year when nearly 39.5 million square feet of industrial space was absorbed and 21.7 million square feet of new supply came onto the market. Another 34.3 million square feet is under construction, but Colliers analysts foresee it will be leased quickly.

“Supply chain constraints have impacted the holiday season, with retailers unable to sell goods they don’t have. A shift from a just-in-time to a just-in-case inventory strategy is expected to drive demand for industrial over the foreseeable future,” they note.

Canada-wide, average asking net rents rose steadily over the course of 2021 to hit $9.65 psf by the fourth quarter. In addition to Vancouver and Victoria, asking rates in Saskatoon, Regina, Toronto, Ottawa and Halifax exceeded the national average. Elsewhere, lower rental rates still represent all-time market highs, such as in Waterloo, where industrial space commands an average net rent of $8.54 psf in a market where the vacancy rate has dipped to 0.9 per cent.

Toronto and Ottawa also posted record-high industrial rental rates of $12.66 and $12.22 psf respectively. Toronto’s vacancy rate has fallen to 0.3 per cent, while Ottawa’s sits at 1 per cent.

Toronto saw 13.6 million square feet of net absorption over the course of 2021 as about 11.5 million square feet of new supply was added to the market. About 10.2 million square feet is currently under construction, spurring competition among potential users.

“Actively marketed spaces are seeing multiple offers, highlighting the increasing importance of tenant covenants during the negotiation process,” Colliers analysts report. “Landlords now prefer deal terms between three to five years compared to the traditional 10-year term because of how fast rents are increasing. Annual rent escalations are starting at the 5 per cent range versus the 2 to 4 per cent range seen previously.”

Montreal’s average asking rents hovered just below the national average, at $9.23 psf, during Q4 2021, but they are projected to crack the $10 mark in the near future, as strong demand continues and industrial land constraints hinder delivery of new supply. As in Toronto, Colliers reports landlords are now favouring three-year deals.

Montreal’s industrial vacancy rate sits at 0.8 per cent. Last year saw 3.7 million square feet of net absorption with less than 770,000 square feet of new supply added to the market. About 3.9 million square feet is currently under construction, but Colliers analysts advise developers have been slow to deliver spec space.

“Land transactions remain highly competitive, resulting in developers pushing investment mainly to the South Shore (of the St. Lawrence River) for industrial development. Nine out of 16 land transactions since September 2021 have been in the South Shore,” they add.

With little open territory available, developers are looking to other options in Vancouver. About 6.3 million square feet of new space is currently under construction in a market with a 0.4 per cent vacancy rate — translating into less than 800,000 square feet of available space. There have been no vacancies in bulk or logistics space since mid-2020 and no spaces larger than 50,000 square feet have opened up for leasing since last March, even though about 3.2 million square feet of new supply was completed during 2021.

“Innovation from developers is occurring to meet these market conditions with various new forms of industrial development emerging, such as stacked industrial (both small and large bay), mixed-use with industrial on the ground floor and strata becoming increasingly common,” Colliers analysts state.

Calgary is viewed as something of a beneficiary of surging demand and tight supply in Toronto, Montreal and Vancouver. It offers the second highest vacancy rate — at 4.1 per cent — and the second lowest average net asking rent — at $8.31 psf — among the 12 surveyed markets, but both those tallies are indicators of marked improvement over the course of 2021. The vacancy rate dropped by more than 200 basis points from Q4 2020 in a year that registered more than 5.1 million square feet of positive absorption.

Nearly 1.6 million square feet of new supply came onto the market in 2021, and 7.3 million square feet is under construction, with 2.4 million square feet scheduled for completion before July this year. “The demand for mid-bay space is likely to result in more expansion in this segment compared to previous construction cycles,” Colliers analysts surmise.

Elsewhere on the prairies, Edmonton registers the highest vacancy rate among the 12 markets, at 5.4 per cent, while Winnipeg posts the lowest average asking rents at $7.95 per square foot. Winnipeg is the lone market of the 12 where rental rates slipped during Q4, but that follows the all-time high posted in third quarter. The vacancy rate also decreased over the last three months of the year, dropping to 2.8 per cent.

Outside of British Columbia and Ontario, Saskatchewan’s two cities boast some of the most robust trends in Canada. With a vacancy rate of 2.7 per cent, Saskatoon’s industrial space garnered average asking net rents of $12.31 psf in Q4. Regina recorded a 2.5 per cent vacancy rate and average asking net rents of $11.43 psf.

The sluggish pace of construction is believed to be contributing to the dynamic, as the arrival of new supply lags demand and developers also look to pass through their rising costs for construction materials and skilled labour. However, the markets appear well positioned for expected continue industrial demand. “With plenty of land inventory at the market’s disposal, Regina remains a prime location for growth,” Colliers analysts predict.

Looking east, Halifax is also enjoying buoyant industrial prospects, as average asking rents reached $9.89 psf in Q4 and the vacancy rate fell to 2.7 per cent. The market saw about 338,000 square feet of positive absorption in a year when no new supply was added. About 175,000 square feet is currently under construction.

“With limited new supply expected to be added to the market in 2022, the scarcity of options are leading tenants to reconsider their leasing strategy,” Colliers analysts report. “As developers are unable to keep up with demand for the foreseeable future, industrial vacancy is expected to remain low with rents set to continue to increase.

Source The Remi Networks. Click here to read a full story

Canada’s retail vacancy to be ‘stable’ through 2024

Despite the continuing economic challenges of the COVID-19 pandemic and the rise of e-commerce, the national retail vacancy rate is expected to see a slight decrease of less than one per cent by 2024, a new report by Colliers International predicts.

The report states growth in e-commerce is unlikely to significantly impact the total amount of retail space required.

“While e-commerce continues to grow, with expectations it could reach around 10 per cent of total retail sales in 2024, brick-and-mortar sales continue to grow as well,” says the report, titled Friends, not foes: E-commerce, brick and mortar, and the future of retail.

“As retailers battle with e-commerce’s limited profitability, they are keeping their stores, yet at the same time reconfiguring the physical unit to accommodate omnichannel sales.

“Our forecasting model predicts that national retail vacancy is expected to remain stable at current levels, approximately 8.5 per cent nationally, over the next two years. Our model accounts for growth in economic, retail sales, population and tenant side demand.

“We asked retailers whether the pandemic has changed the importance of physical retail space for their business, and if so, how much they would like to increase or decrease the amount of space they lease. In response, retailers said they are satisfied with the amount of space they currently lease. Those surveyed anticipate, on average, a total reduction of space of less than one per cent.”

Retail continues to ride out pandemic

Jane Domenico, senior vice-president and national lead, retail services for Colliers in Canada, said retail has fared better than most people outside of the industry might think during the ongoing COVID-19 pandemic.

She said retailers have shown they can pivot and change during the crisis of the past couple of years – it’s an ability at the core of a successful retailer.

“People have been saying the death knell of retailers and brick-and-mortar retailers. Our title (of the report) is intentionally grabbing, because e-commerce is a friend of bricks and mortar and it’s a friend of retailers. It’s not foes,” Domenico said.

“We talk about omnichannel as an industry and it’s not just retailers, it’s also the landlords.”

The hardest-hit retailers have also had the support of government programs during each new wave of COVID.

“The government is enacting this for the good of society and they need to help those businesses, and landlords will continue to work with our retailers. I always say your asset is only as good as the health of your retailers,” added Domenico.

New balance between e-commerce, brick and mortar

That means continuing to adapt to the changing retail environment. Domenico said property owners and managers must provide retailers with appropriate spaces to accommodate in-store pickup of online purchases and improved customer experiences.

The Colliers report states that while e-commerce sales continue to grow from the current figure of about seven per cent of total sales, brick-and-mortar sales continue to grow as well.

“As retailers battle with e-commerce’s limited profitability, they are keeping their stores, yet at the same time reconfiguring the physical unit to accommodate omnichannel sales,” it said. “E-commerce and brick-and-mortar retail are no longer mortal enemies.

“Retailer adaptations through the pandemic have shifted the industry away from a ‘zero sum’ forecasting relationship between growth in e-commerce and brick-and-mortar space needs.”

Domenico said successful retailers are increasingly using their back-of-store space for e-commerce platforms and an omnichannel experience.

“As developers, we’re changing the use of some of GLA (gross leasing area). So, in a mall that might have a vacancy rate, I bet you that there’s a residential play or an old age home or something that is a different-use category than what we currently have going on in that shopping centre, that enclosed mall, or that necessity-based retail centre,” she said.

“For tenants, their space requirements for their e-commerce platform . . . they’re actually going and looking for industrial space.”

The report says 16 per cent of retailers are leasing, or plan to lease, industrial space to help with online order fulfillment.

Accommodating omnichannel in stores

Many more have plans to use their stores to fulfill online orders. Higher e-commerce sales are leading 55 per cent of retailers to reconfigure existing physical units, increasing physical space reserved for inventory (back-of-house) and decreasing consumer sales areas (front-of-house).

Colliers said the forecasted growth in total Canadian retail sales over the next four years is attributable to an increase in both e-commerce and brick-and-mortar sales.

It reports 60 per cent of retailers are using and configuring their physical units for multiple selling touchpoints, including online order fulfillment and “buy online, pickup in store” (BOPIS).

“Omnichannel retail will become less of a choice for retailers and landlords in the future. Consumers expect a seamless retail experience, whether they are shopping online, in-store, or a combination of both. Omnichannel retail will drive synergies between all potential points of sale,” it said.

“According to our survey, 57 per cent of retailers say that e-commerce allows them to sell more products, yet only seven per cent indicate that online sales are more profitable than in-store sales.

“Through omnichannel retail, the benefits of each channel can be realized. For example, retailers who indicate that online customers spend extra when they BOPIS believe the average extra spend accounts to about 31 per cent of the original order.

“Omnichannel retail is becoming more important for retailers to embrace and landlords to support.”

Domenico said landlords need to ensure they continue to support and enhance the ability of retailers to provide an omnichannel experience for consumers.

Source Real Estate News Exchange. Click here to read a full story

Zara Billionaire Ortega to Buy Toronto’s Royal Bank Plaza

Amancio Ortega, the billionaire behind the Zara clothing chain, has agreed to buy Toronto’s Royal Bank Plaza skyscraper from two Canadian pension funds for about C$1.2 billion ($961 million).

The sale of the iconic, gold-clad tower in the heart of Canada’s financial capital is among the biggest transactions for an office building globally since the start of the Covid-19 pandemic. The skyscraper is being sold by Oxford Properties, the real estate arm of Ontario’s pension fund for municipal workers, and Canada Pension Plan Investment Board.

A representative for Ortega’s family office confirmed the transaction to Bloomberg News. The funds put the property up for sale last year and had been seeking at least C$1 billion, according to a person familiar with the matter who asked not to be identified because the matter is private.

The sale has been closely watched in the commercial real estate world for clues about the value of office properties since Covid-19 made remote work ubiquitous and raised questions about how much space companies need. Ortega’s deal comes amid early signs the office leasing market may be picking up: Toronto’s overall office vacancy rate fell for the second quarter in a row at the end of last year.

Royal Bank Plaza ranks as one of the most high-profile office buildings in Canada. Its two triangular towers boast layers of 24-carat gold on their 14,000 windows, a sight that’s rarely missed by visitors to the city thanks to its location at the foot of Bay Street, Canada’s answer to Wall Street. The building is the headquarters of Royal Bank of Canada, the country’s largest bank by market value, which moved in shortly after the first tower was completed in 1976.

For Ortega, the world’s 17th richest person, the purchase suggests the pandemic hasn’t shaken his faith in commercial real estate. He had already been engaged in a buying spree of North American assets before Covid-19, including everything from a Chicago hotel to two Seattle office buildings leased by Amazon.com Inc.

Ortega’s net worth stands at roughly $66.7 billion, according to the Bloomberg Billionaires Index, the majority of which derives from his controlling stake in Spain-based Inditex SA, the owner of Zara.

Source Bloomberg. Click here to read a full story