Author The Lilly Commercial Team

Apple threatens to pull out of Sam Mizrahi’s Toronto condo project

Apple is threatening to pull out of a massive Toronto condo project, expected to be the tallest residential tower in Canada.

Over the past years, the 85-story skyscraper at Yonge and Bloor streets called The One has been under construction, with the final building set to host a unique space designed to host Apple’s flagship store, complete with an arresting glass architecture and soaring ceiling.

Now, however, the Cupertino company has reportedly told the developer Sam Mizrahi that it may pull out of the downtown building, due to missed deadlines.

According to The Globe and Mail, Apple has told Mizrahi Developments that it may exercise an option in its contract that would allow it to exit without penalties. The option comes into force if the project misses certain deadlines. The project has been slow-going due to COVID-19 and a plumber’s strike in 2019, says Mizrahi.

“[The One will] suffer irreparable harm from losing a world-class tenant that was intended to be an anchor tenant for a world-class property,” says the developer in court documents seen by the publication, “which is a loss that cannot be compensated in damages.”

The lease was for over 15,000 square feet, which included in excess of 9,000 square feet for retail on the project’s ground floor. Mizrahi Developments agreed to pay Apple’s design costs, estimated to be $6.24 million CAD, as part of the contract.

The planned retail space, designed by longtime Apple architects Forster & Partners, would feature seven layers of glass with no breaks, built from 34 custom-fabricated panels that cost over $400,000 CAD each.

Mizrahi says Apple’s “position flies in the face of the commercial and practical realities of the construction process for a project,” detailed court documents.

Source The Globe And Mail. Click here to read a full story

Art of the flip: Converting office buildings to apartments

The far-reaching effects and opportunities of the pandemic are countless, and doubtless you have probably educated yourself on the ones that are relevant to you. In this article, I’d like to highlight one which we think is a major opportunity globally for apartment developers.

It is no surprise that lockdowns and the continuing need for isolation and quarantining has had a major effect on the workforce, and particularly where they work from.

A McKinsey report suggests that 20 per cent of the workforce could work remotely for three to five days per week just as effectively as from an office. That is an increase of three to four times pre-pandemic levels.

We’re seen major companies like Amazon, Capital One, Facebook and Ford announce permanent remote work options for some of their staff, and probably everyone reading this has personally worked from home, for some period of time, successfully in the past two years.

The obvious consequence has been an increase in office vacancies in some markets.

Higher vacancy in older office buildings

Depending on the city, the office vacancy rate falls anywhere between nine and 24 per cent and this statistic does not count the many spaces available for sublease from tenants who are locked into long-term office leases they no longer need.

The highest vacancy rates are being seen in older, less desirable buildings as these tenants can upgrade to better quality office space that has become available.

With some experts predicting that vacancy rates will continue to rise through 2022, the picture does not look great.

Remember that because office leases need to recover operating costs, a building can only stay above water for so long.

Consider a 20,000-square-foot office building with $12 rent per square foot and $15 operating costs per square foot. At 100 per cent occupancy if you are recovering 100 per cent of your expenses, you are bringing in $240,000 in base rent and recovering $300,000 in expenses, for a total profit of $240,000.

In the event of having only 10,000 square feet leased (50 per cent vacancy), then you’re only earning $120,000 in base rent and only recovering $150,000. However, your costs are $300,000, so in a 50 per cent vacancy situation, you find yourself underwater by $30,000.

Factors in converting offices to apartments

There are three key factors that need to be properly met for an office building to be a candidate for conversion to apartments:

- Location: The first, as always in real estate, is location. The building needs to be in a good location where people will want to live.

- Price: Where an office building can be purchased for a low enough price, conversion to residential can be an economically appealing option. Since the building’s structure, elevators, stairs and parking lots can be reused, some of the costliest elements are already in place. As construction costs continue to increase, the idea of starting with some of your base building elements in place can be attractive.

- Layout: While there is no requirement for every cubicle and meeting space to have windows, every apartment needs to adhere to building codes and needs to have a certain number of windows. This means that narrower buildings are often easier to convert into residences. There is room to be creative, but the general shape and layout of a building will play an important role in the feasibility of a conversion project.

Adaptive reuse is not a new concept. In the United States, there are many examples of obsolete buildings being repurposed into schools, hotels and self-storage facilities as well as some unique ideas which have been successfully executed such as urban vertical farms and retail pick-up locations.

Calgary leading the way

Of the nearly 32,000 apartments created in the U.S. through adaptive reuse since the start of the decade, 41 per cent are in converted office buildings, according to an analysis by RentCafe.

Here in Canada, the City of Calgary – currently experiencing one of the highest vacancy rates for offices in the country – is leading the way with conversion projects and is offering an initiative to developers to incentivize these types of projects.

The city is offering owners of downtown office buildings $75/square foot, up to a maximum of $10 million per property to convert to residential buildings.

The city has allocated $45 million to this program in the hopes of spurring on such conversions.

Over the years, we have advised several our clients on office conversion projects across the country, including properties in Montreal and Calgary.

The pandemic is changing the way we work and live, hence we’re excited to be working with industry experts from Canada, the U.S. and Europe in order to provide strategy, discussion and case studies from around the globe – in order to bring the spotlight onto this opportunity.

Office conversion is a fast way to create supply and can help with rental availability and affordable housing solutions which are desperately needed.

Source Real Estate News Exchange. Click here to read a full story

New work routines fuel growth at IWG: 5 Spaces to open

Five new Spaces locations encompassing 173,500 square feet will soon be open across Canada, as increasing labour flexibility has increased demand for co-working spaces.

IWG Americas chief executive officer Wayne Berger told RENX his company — which operates the Regus, Spaces, No18, Basepoint, Openoffice and Signature brands, among others — had its two biggest demand months ever in January and February 2020 before COVID-19 began spreading widely.

Those previous record numbers have been surpassed during the pandemic and continue to increase.

“It’s growing still in core CBD markets, but it’s actually growing to a greater extent in a number of suburbs and tertiary markets,” said Berger, citing Belleville, Barrie, Kingston, Sarnia and Windsor in Ontario and Kelowna in British Columbia.

“Eighty-three per cent of companies are instituting a flexible working or hybrid working policy for their workers, so people are able to actually work differently today than how they were working prior to the pandemic,” said Berger.

“This notion of travelling to one office five days a week and working from 8:30 to five and dealing with long commutes on both sides of that work day are really becoming a thing of the past.”

New Canadian Spaces locations

Spaces just opened the 26,000-square-foot Zibi Ottawa cross-provincial facility. It’s in a revitalized four-storey former paper mill building at 4 Booth St. on Chaudière Island, which connects Ottawa and Gatineau, as part of the 34-acre Zibi mixed-use development.

It joins the 29,000-square-foot Spaces Zibi Gatineau which opened in spring 2021.

Also slated to open in coming months are:

– The 42,000-square-foot Spaces The Permanent will take up five floors at 320 Bay St. in downtown Toronto’s financial core when it opens this month.

– The 14,000-square-foot Spaces Burnside will offer 60 large and small private offices, fully equipped meeting rooms, dedicated desks and collaborative co-working space on the first and second floors of a newly built building at 2 Ralston Ave. in the Burnside Business Park in Dartmouth, N.S. It’s scheduled to open in May.

– The 40,000-square-foot Spaces West 8th Ave. is scheduled to open at 525 W. 8th Ave. in Vancouver’s Broadway Corridor, a medical and government corridor that’s on the boundary of the Mount Pleasant technology hub. It’s scheduled to open in May.

– The 51,500-square-foot Spaces King George Hub will be the anchor tenant of King George Hub, a mixed-use development at 9850 King George Blvd. in Surrey, B.C.

Later this year, IWG will unveil Spaces The Shift in Toronto’s downtown east and Spaces The Well in the large The Well mixed-use development.

At 123,982 square feet, Spaces The Well will be the largest North American Spaces location and is expected to have eight to 10 different working environments when it opens in July.

“When we have space that size, we want to be able to build it out where it provides all the amenities that not just workers need in that neighbourhood, but residents in that neighbourhood as well,” said Berger.

Reasons for flexible workspace growth

Increasing attention on health and wellness in attracting and retaining talent has been a driver of the move toward flexible work options as people may not want to spend all of their time in either a corporate or home office, so co-working spaces can offer an enticing alternative.

IWG has accelerated its growth to cater to such users and now has 135 Spaces locations comprising more than three million square feet of space in 52 North American cities.

Berger said IWG partners with 83 per cent of the Fortune 500 companies globally and invests $150 million in marketing annually.

Flexible workspace currently represents 1.9 per cent of commercial real estate and some analysts forecast it could rise to 30 per cent by 2030, Berger added.

Co-working location expansion is also being fuelled by companies looking at their real estate footprints differently and rationalizing their portfolios as a cost-saving measure.

Meanwhile, Berger said landlords are approaching IWG to see if they can incorporate flexible working spaces into their buildings and portfolios, because tenants are demanding it.

“They’re seeing it as an opportunity for growth because they can diversify their incomes and drive a premium in that space because flex space usually drives a higher profit in the space versus a traditional long-term lease.”

Most building owners don’t have expertise in creating their own flexible spaces, which is where IWG and other firms in the space come in.

“It’s more than just building a bunch of small offices and collecting some rent across a larger collection of tenants,” Berger said. “It actually is activating and providing hospitality in the space.”

Spaces Burnside partnership

Spaces just signed a partnership agreement with Office Interiors and Cabco Communications Group to open Spaces Burnside. It will be the first Spaces location in Atlantic Canada and Office Interiors would like to expand into other East Coast regions in coming years.

So would IWG, which has three Regus operations in Halifax and Dartmouth. Berger said it’s talking with potential partners to roll out locations in New Brunswick, Prince Edward Island and Newfoundland and Labrador.

Office Interiors and Cabco will invest in building out the Dartmouth location and hire outside staff, while Spaces will furnish, manage, market and provide back office infrastructure.

IWG wants to move more into the franchise business with all of its brands. Berger said it’s working on agreements with potential franchise partners but wasn’t ready to provide details.

Subscription service and consolidation opportunities

Another growth area for IWG is a subscription service which companies pay on behalf of their employees so they can access locations of any of IWG’s brands around the world. IWG has signed two million subscription memberships in the past year, according to Berger.

“It’s moving corporate real estate towards this true gig economy where it’s about network presence,” he said. “It’s about complete convenience and flexibility for a company to give their employees ability to work ubiquitously.”

While the co-working sector as a whole is growing, it’s fragmented and Berger said some providers have rationalized during the pandemic. That presents consolidation opportunities for operators like IWG, which is already the world’s largest flexible workspace and office provider.

Regus expansion and new brands for Canada

Regus is IWG’s core heritage brand, and its largest and most recognized, with locations in approximately 125 countries. It will continue to add more locations in Canada.

“People know the experience they will receive when they go to a Regus, regardless of the city, province or country they’re in,” said Berger. “It’s also a great brand that supports mixed-use real estate space as well as your traditional corporate building with a 15,000- to 20,000-square-foot plate.”

IWG is looking to launch its lower-cost HQ, upscale Signature and female-centric The Wing brands in Canada.

“Enterprise organizations really leverage the HQ brand for back-office teams, customer service organizations, data centres, et cetera,” said Berger. “Signature is very opulent, higher-end, and usually located in iconic or the best-built buildings in the country or city.”

IWG acquired The Wing in 2020 and sees plenty of growth potential for the brand that started in New York City and has spread across the U.S.

“It’s obviously all-inclusive, there’s no doubt about it, but it’s more geared towards female leaders and female workers,” said Berger.

Source Real Estate News Exchange. Click here to read a full story

In Ontario, the COVID-19 pandemic creates property tax winners and losers

In Ontario , the pandemic creates property tax winners and losers

Economic cross-currents from the past two years have transformed demand for commercial properties, but those changes aren’t showing up in property assessments and tax bills yet.

The COVID-19 pandemic has reshaped the real estate market in Ontario, as elsewhere in Canada, with the counties girding the Greater Toronto Area experiencing an unprecedented run-up in prices.The economic cross-currents of the past two years have transformed demand for commercial properties, too, with hotels, restaurants and other kinds of retail, for example, facing starkly different environments.

But those seismic shifts aren’t showing up in property assessments and tax bills – and won’t for at least another two years. That’s because the Ontario government has, again, delayed the provincewide assessment originally slated for 2020, leaving property valuations moored in the market conditions of Jan. 1, 2016.

The result is that property owners that have seen the biggest growth in values are getting a temporary break, at the expense of their peers with decreases or below-average increases, who are paying more than their fair share.“It builds in inequities,” says Terry Bishop, president of the Canadian property tax practice at Altus Group Ltd., which provides data, software and professional services for the commercial real estate sector. Commercial properties, in particular, are faced with paying taxes based on property values from a prepandemic economy that, for many firms, will never return. headtopics.com

Ontario has a revenue-neutral tax rule for rising property values. A rising real estate market doesn’t, by itself, generate an extra dollar in revenue for a municipality. A higher tax base generally means that the tax rate for a property category declines, leaving the total revenue constant.

But changing property values do determine how that tax burden is divided: The tax bill increases for properties with values that rise by more than the average, while falling for properties with decreasing values or below-average increases.Renters, here are seven financial advantages over homeowners

Homeowners, on average, in and around the cottage country town of Bancroft are winners in the assessment freeze, since property values in the area have nearly tripled since December, 2015, according to the Canadian Real Estate Association’s composite price index. The same is true in the markets of London and Brantford, southwest of Toronto, where property values have also surged much more than in other parts of the province

Meanwhile, average increases in Greater Toronto and Mississauga has been much lower, on a percentage basis, with those regions recording the smallest gains of the 26 major markets tracked by CREA. (For the purposes of property tax calculations, it’s the relative percentage change in property value that matters, not the dollar amount.) headtopics.com

The result: Residential property owners, on average, in Toronto and Mississauga are paying more in provincial education taxes than they would have had there been a fresh provincewide assessment. And residential property owners in Bancroft, London and Brantford are getting a temporary reprieve.

Ontario has a revenue-neutral tax rule for rising property values. A rising real estate market doesn’t, by itself, generate an extra dollar in revenue for a municipality. A higher tax base generally means that the tax rate for a property category declines, leaving the total revenue constant.

But changing property values do determine how that tax burden is divided: The tax bill increases for properties with values that rise by more than the average, while falling for properties with decreasing values or below-average increases.Renters, here are seven financial advantages over homeowners

Homeowners, on average, in and around the cottage country town of Bancroft are winners in the assessment freeze, since property values in the area have nearly tripled since December, 2015, according to the Canadian Real Estate Association’s composite price index. The same is true in the markets of London and Brantford, southwest of Toronto, where property values have also surged much more than in other parts of the province.

Meanwhile, average increases in Greater Toronto and Mississauga has been much lower, on a percentage basis, with those regions recording the smallest gains of the 26 major markets tracked by CREA. (For the purposes of property tax calculations, it’s the relative percentage change in property value that matters, not the dollar amount.) headtopics.com

The result: Residential property owners, on average, in Toronto and Mississauga are paying more in provincial education taxes than they would have had there been a fresh provincewide assessment. And residential property owners in Bancroft, London and Brantford are getting a temporary reprieve.

The same is true within a municipality, too. The owner of a property that has increased in value more than the average as part of the assessment would see their municipal tax bill rise; a property owner with property appreciation below that average would enjoy lower municipal taxes.

But that won’t happen until the 2024 tax year, at the earliest. A lag in property tax adjustments would happen even during normal economic times, since Ontario only issues a provincewide assessment every four years. Even then, higher assessments are phased in over four years, slowing down the shift in the tax burden.

The Municipal Property Assessment Corporation (MPAC), which conducts the provincewide valuation exercise, noted that property values do increase outside of provincewide assessments if improvements are made on a property, such as the construction of an addition. headtopics.com

With the assessment scheduled for 2020 delayed at least twice, most recently as part of the province’s economic and fiscal update in November, that four-year gap will stretch to six years. The province has yet to say when that assessment will take place. MPAC said it can begin that exercise on relatively short notice.

The distortions resulting from the additional delay of two years highlight the need for annual reassessments, as is the case in other provinces, Mr. Bishop said.Dan Kelly, president and chief executive officer of the Canadian Federation of Independent Business, wrote in an e-mail that his organization has heard from members who stand to benefit from the delay in a provincewide assessment, and those who are stuck with higher tax bills. Either way, he noted, it will be a “messy reset.”

In an e-mail, Ontario’s Finance Ministry said the provincial government’s priority is “maintaining stability” for taxpayers and municipalities, following public consultations. The ministry also noted there was support for the four-year assessment cycle during those consultations, but the government is willing to listen to further feedback.

The Ontario government has pointed to the pandemic as the reason for the delay in a provincewide assessment. But Mr. Bishop questioned whether the pandemic was to blame, since other provinces have managed to continue their annual assessments.Rather, he noted, the original schedule for a 2020 assessment would have resulted in rising 2021 tax bills for some property owners, ahead of an expected provincial election later this year.

Tax and Spend examines the intricacies and oddities of taxation and government spending.

Source Hot Topics. Click here to read a full story

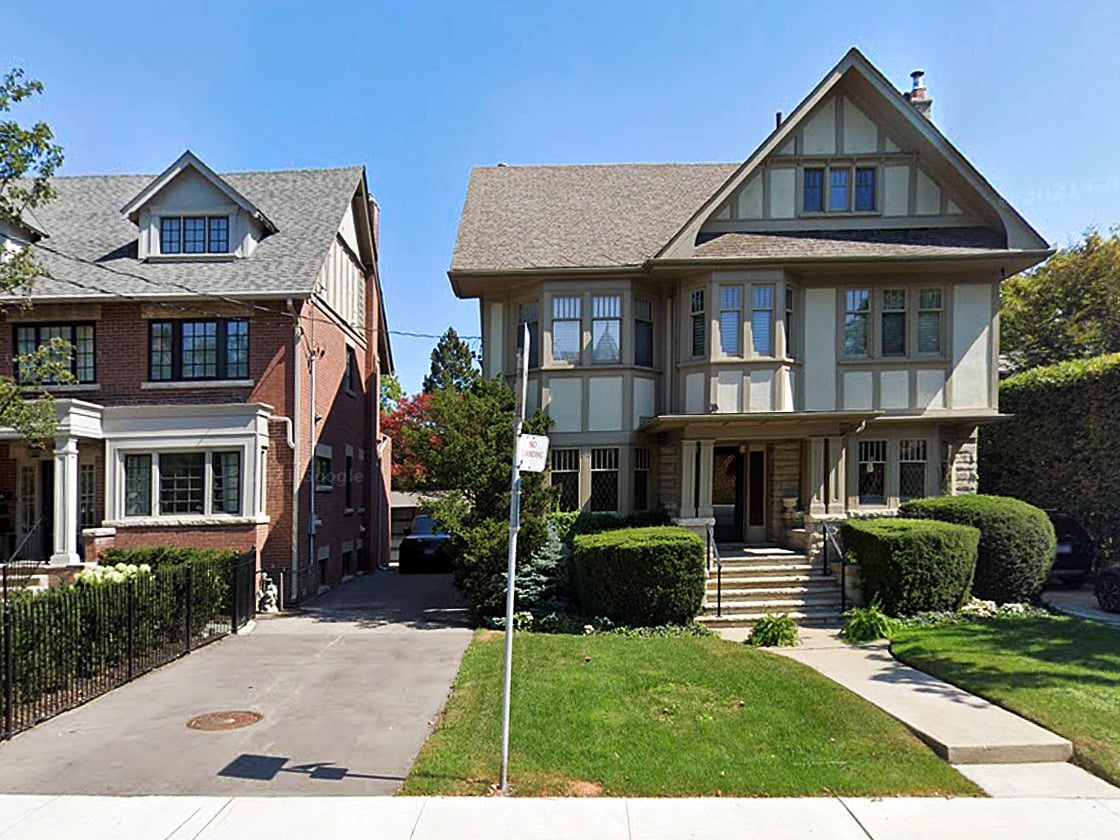

Why a 4-storey apartment could be coming to a residential street near you

Task force’s draft report makes 58 recommendations on improving housing supply

The task force asked to find ways to make Ontario housing more affordable wants to do away with rules that entrench single-family homes as the main option in many residential neighbourhoods, according to a draft report.

The nine-member Housing Affordability Task Force, chaired by Scotiabank CEO Jake Lawrence, wants to “create a more permissive land use, planning, and approvals systems” and throw out rules that stifle change or growth — including ones that protect the “character” of neighbourhoods across the province.

The wide-ranging 31-page draft report, which is making the rounds in municipal planning circles and could look much different when it’s officially released Jan. 31, makes 58 recommendations.

It includes discussions on speeding up approval processes, waiving development charges for infill projects, allowing vacant commercial property owners to transition to residential units, and letting urban boundaries expand “efficiently and effectively.”

It also calls for all municipalities — and building code regulations — not to make it just easier for homeowners to add secondary suites, garden homes, and laneway houses to their properties, but also to increase height, size and density along “all major and minor arterials and transit corridors” in the form of condo and apartment towers.

4-storey complexes in all neighbourhoods

But perhaps the most controversial recommendation is the one to virtually do away with so-called exclusionary zoning, which allows only a single-family detached home to be built on a property.

Instead, the task force recommends that in municipalities with a population of more than 100,000, the province should “allow any type of residential housing up to four storeys and four units on a single residential lot,” subject to urban design guidance that’s yet to be defined.

According to the report, Ontario lags behind many other G7 countries when it comes to the number of dwellings per capita. And housing advocates have long argued that more modest-projects — duplexes, triplexes, tiny homes and townhouses — are needed in established neighbourhoods, especially if the environmental and infrastructure costs of sprawl are to be avoided.

But neighbourhood infill and intensification is often a hard political sell.

“While everyone might agree that we have a housing crisis, that we have a climate emergency, nobody wants to see their neighbourhoods change,” said Coun. Glen Gower, who co-chairs Ottawa’s planning committee. “So that’s really the challenge that we’re dealing with in Ottawa and in Ontario.”

After last week’s housing summit with Ontario’s big city mayors, reporters repeatedly asked Municipal Affairs and Housing Minister Steve Clark if he supported doing away with zoning for single-detached homes, as other jurisdictions like Edmonton and major New Zealand cities have done.

Clark said he’d heard the idea but did not give a direct answer one way or the other.

Reduce construction barriers, approval requirements

Many of the recommendations revolve around making it easier and faster for builders to construct homes.

According to the draft report, not only would a streamlined process allow dwellings to get on the market faster, but reducing approval times would also save developers money which, in theory, could be passed onto residents.

The report cites an Ontario Association of Architects study from 2018 showing that costs for a 100-unit condo building increase by $193,000 for every month the project is delayed.

That’s why, for example, the task force is recommending that any “underutilized or redundant commercial properties” be allowed to be converted to residential units without municipal approvals.

The draft report also calls for quasi-automatic approval for projects up to 10 units that conform to existing official plans and zoning, and goes so far to recommend that municipalities “disallow public consultations” for these applications.

The report speaks to reducing what the task force characterizes as “NIMBY” factors in planning decisions, recommending the province set Ontario-wide standards for specifics like setbacks, shadow rules and front doors, while excluding details like exterior colour and building materials from the approval process.

The task force would even eliminate minimum parking requirements for new projects.

Politicians say more than just supply needed

The report touches on a number of subjects it believes unnecessarily delay the building of new homes, including how plans approved by city councils can be appealed.

It recommends the province restore the right of developers to appeal official plans — a power that was removed by the previous Liberal government.

And in an effort to eliminate what it calls “nuisance” appeals, the task force recommends that the fee a third party — such as a community group — pays to appeal projects to the Ontario Land Tribunal should be increased from the current $400 to $10,000.

That doesn’t sit well with NDP MPP Jessica Bell, the party’s housing critic.

“My initial take is that any attempt to make the land tribunal even more difficult for residents to access is concerning,” said Bell, adding the NDP is asking stakeholders and community members for feedback.

The tribunal can overturn a municipal council’s “democratically decided law,” she said, “and I would be pretty concerned if it costs $10,000 for a third party to go to the land tribunal and bring up some valid evidence.”

We need a more holistic and comprehensive approach than what we are seeing in this draft report right now.- NDP housing critic Jessica Bell

While she was pleased to see the task force address zoning reform to encourage the construction of townhomes, duplexes and triplexes in existing neighbourhoods — the so-called “missing middle” between single-family homes and condo towers — Bell said increasing supply is not enough to improve housing for all Ontarians.

“We need government investment in affordable housing,” she said.

“We need better protections for renters, and we need measures to clamp down on speculation in the housing market … We need a more holistic and comprehensive approach than what we are seeing in this draft report right now.”

(While the task force was directed by the province to focus on increasing the housing supply through private builders, it acknowledges in the report that “Ontario’s affordable housing shortfall was raised in almost every conversation” with stakeholders.)

Expanding urban boundaries another concern

From his first reading of the report, Ontario Green Party leader Mike Schreiner agreed with the zoning recommendations but said streamlined processes need to be balanced with maintaining public consultations and heritage designations.

“One of my concerns with my very quick read of the draft report is that it talks about expanding urban boundaries … and I’m opposed to that,” he told CBC.

“We simply can’t keep paving over the farmland that feeds us, the wetlands that clean our drinking water [and] protect us from flooding, especially when we already have about 88,000 acres within existing urban boundaries in southern Ontario available for development,” he said.

Schreiner said he’s also “deeply concerned” that the report discusses aligning housing development with the province’s plan for Highway 413 in the GTA.

“I simply don’t think we can spend over $10 billion to build a highway that will supercharge climate pollution, supercharge sprawl, making life less affordable for people and paving over 2,000 acres of farmland, 400 acres of the Greenbelt and crossing over 85 waterways,” he said.

According to the draft, the task force consulted with builders, planners, architects, realtors, labour unions, social justice advocates, municipal politicians, academics, researchers and planners.

Source CBC News. Click here to read a full story

Commercial real estate: What’s hot and what’s not

Experts tend to be bullish on industrial and warehouse property investments

Investors looking for income and an inflation hedge may want to consider commercial real estate, but some segments are more attractive than others.

“When you are in a world where bonds don’t return anything, real estate has been an effective substitute and we think that’s why it offers great diversification in one’s portfolio,” said Andrew Moffs, senior vice-president and portfolio manager with Toronto-based Vision Capital Corp.

In 2021, Canadian government bonds were generating negative returns. Meanwhile, as of December, inflation was 4.8% in Canada, the highest since 1991.

“Real estate is a classic hedge against inflation,” said Jon Love, CEO of KingSett Capital.

From 1960 through 2017, REITs averaged a 6.4% compound annual growth rate, compared to a 5.5% real return from global stocks, Vision Capital reported, quoting a Dutch study.

“In the present economic landscape, REITs are generally well positioned to outpace rising interest rates with earnings growth,” Vision Capital said in a report to investors released Jan. 15.

“We think it’s a good time to invest in real estate,” agreed Brookfield REIT CEO Zach Vaughan. “Remember, you actually own the underlying asset. You own the underlying land and improvements too, and good quality land also appreciates above inflationary rates over time.”

But not all commercial real estate is an attractive investment.

“You have to look by different asset classes and then you have to look by different geographies,” said Love, who has a generally positive outlook on office space in the core of a large city.

With the ongoing Covid pandemic, some office tenants are considering how to adapt to hybrid work — whether that means reducing space or increasing space, said Love.

“Most companies are protecting their space footprint,” Love said. “Having the right environment to keep and maintain and motivate and build your culture, with people, is a much more compelling element to be focused on, versus just the … rent cost.”

Other considerations are the growth of the overall economy — which generates demand for white-collar jobs — and how much new supply exists to meet an increasing demand for office space, Love said.

Vision Capital, however, maintains a short position in the office sector in its Strategic Opportunity Fund LP, a private equity fund focused on real estate securities. It has long positions in residential, industrial and shopping centres. “We are negative on office,” Moffs said.

One factor is companies delaying — or indefinitely postponing — having their employees return from working from home, Vision Capital said in its Jan. 15 letter to shareholders of the Strategic Opportunity Fund LP.

But the trend toward reducing office space predates Covid. “Law firms don’t need law libraries anymore,” for example, Moffs said.

To use another example, some global accounting firms no longer provide office space for the exclusive use of those firms’ partners, Moffs observed. Instead, when partners come into the office, they use a shared workspace.

While office properties have trended toward fewer square feet per worker, this could be offset by a desire for larger common areas such as kitchens, Moffs said.

For several reasons, Vision Capital has an optimistic view on the industrial class. These include the rise of online shopping (meaning a greater demand for warehouses to store goods that ship to consumers) and a “re-shoring of manufacturing” that started during the pandemic, Moffs said.

For its part, Brookfield REIT invests in “infill logistics,” which includes small warehouse facilities on existing land “that generally serve as the last or one of the last transfer points for goods as they are distributed to the end users,” Vaughan said.

Vaughan contrasts the infill logistics category with a huge distribution facility that serves a region.

Vaughan suggests investors want to avoid investing in properties for which it would be difficult to find a replacement tenant — or convert to a different type of use — if the current tenant were to move out.

By contrast, even vacant office property in a major centre such as Toronto may be attractive because of the underlying value of the land.

Vaughan suggested avoiding a property with all of the following characteristics:

- outside of a major centre;

- aside from its existing commercial or industrial use, there is no other use for that property;

- there are not many other tenants available who would want that building in that location; and

- the property cannot easily be converted to a different use.

“You could have a stranded, or an orphan asset, which is never a good thing.”

Source Advisor’s Edge. Click here to read a full story

Crestpoint Acquires 2.8 Million sf Amazon Distribution Centre

Crestpoint Real Estate Investments Ltd. (Crestpoint) today announced the acquisition of 222 CitiGate Drive, a 2.8 million square foot Amazon fulfillment centre located in CitiGate Corporate Business Park in Barrhaven, a suburb of Ottawa. It is the largest fulfillment centre ever built in Canada and uses the latest in smart, and automated and robotic technologies with capacity to handle over 100,000 packages a day. Constructed in 2021, the project is 100% leased to Amazon for 20 years. Crestpoint acquired a 90% interest in the property on behalf of its clients including the Crestpoint Core Plus Real Estate Strategy, Vestcor Inc., and Kiwoom Securities and Hangang Asset Management, a South Korean investment consortium. Broccolini, a Canadian developer, retained a 10% interest in the property.

The completion of the CitiGate acquisition brings Crestpoint’s assets under management to over $7.5 billion and caps off a very active and productive past 13 months, which saw the completion of over $1.9 billion of acquisitions involving office, industrial, retail and multi-family opportunities, adding over 6.5 million square feet to its portfolio. Highlights of the activity during this period include:

(i) The Firm’s initial foray into the multi-family residential sector, following the investment of ~$500 million in the acquisition of over 2,000 apartment units.

(ii) The completion of over $950 million of transactions in the industrial sector, including the acquisition of 4.25 million square feet of existing properties, along with over 260 acres of development land, which can support the future development of over 4.5 million square feet of industrial product.

(iii) The investment of ~$400 million into the office sector, most notably through the acquisition of two signature office complexes, specifically a 95% interest in Steeles Technology Campus in Toronto and a 50% interest in Place De Ville in downtown Ottawa. Together, the two properties represent over 1.2 million square feet of office product that add to the quality of Crestpoint’s office portfolio and are consistent with Crestpoint’s continued commitment to enhancing the overall environmental profile of its entire portfolio.

(iv) The consistent strong performance of the Crestpoint Core Plus Real Estate Strategy, Crestpoint’s diversified, open-end investment vehicle that celebrated its 10 year anniversary in Q1 2021.

(v) The addition of 14 new members to the team, bringing the total number of investment professionals at Crestpoint to 32.

“I am extremely proud of what Crestpoint has accomplished over the past 13 months. It is a testament to the skill and dedication of our entire team and our proven ability to identify opportunities and execute despite the challenges the market throws at us. We appreciate the continued support of our investors and partners and look forward to continued success in the future” said Kevin Leon, President and CEO of Crestpoint.

About Crestpoint

Crestpoint Real Estate Investments Ltd. is a commercial real estate investment manager, with $7.5 billion of gross assets under management, dedicated to providing investors with direct access to a diversified portfolio of commercial real estate assets. Crestpoint is part of the Connor, Clark & Lunn Financial Group, a multi-boutique asset management company that provides investment management products and services to institutional and high net-worth clients. With offices across Canada and in Chicago, London, and Gurugram, India, Connor, Clark & Lunn Financial Group and its affiliates are collectively responsible for the management of approximately $100 billion in assets.

Source Cision. Click here to read a full story

Toronto real estate investor to pump $85M into London industrial space

A Toronto real estate investor is spending big bucks in London.

Nexus Real Estate Investment Trust will invest more than $85 million in the city this year and next, buying industrial space after investing more than $56 million in 2021, as London has become a hot commercial real estate market, observers said.

“London is a fantastic market. There has been a migration from Toronto to secondary markets due to rents and that, combined with low vacancies, bodes well for the future,” said Kelly Hanczyk, chief executive of Nexus REIT.

“There is a significant demand for industrial space across Canada. Toronto is very pricey and secondary markets such as Cambridge, London and St. Thomas and Sarnia are all seeing industrial spaces snapped up rapidly. I don’t see that changing anytime soon.”

Nexus plans to spend:

- $35.7 million for three properties in London this year, totaling 340,000 sq. ft.

- $50.6 million in London in 2023 for a 325,000 sq. ft. industrial property with a 175,000 sq. ft. addition, now being built.

Hanczyk wouldn’t say where the buildings are because the purchase isn’t finalized.

In 2021, Nexus spent:

- $44.1 million for a 391,000 sq. ft. building at Wilton Grove and Pond Mills roads.

- $12.5 million for a 100,000 sq. ft. building at 1950 Oxford St. E.

“There is a lot going on and London and area has changed the strategy for these industrial guys,” said Brent Rudell, broker and vice-president with Cushman Wakefield, the London realty firm.

He agrees the Toronto area market is “out of control,” pushing investors to smaller, but stable, markets with lower costs and rents.

Article content

“In our market now, there is more traffic, more businesses and growth in the industrial and commercial market is really robust,” Rudell said.

The London market has some of Canada’s lowest industrial vacancy rates.

“There is no availability,” Rudell said. “It shows the London market is vibrant, it is a place for any business.”

REITs, or real estate investment trusts, typically amass a portfolio of a particular real estate sector, such as office, apartment, or commercial and industrial. Investors who buy shares in the REIT receive a monthly dividend. Nexus focuses on industrial portfolios.

REITs offer investors a chance to buy a portion of large holdings, such as a factory or a mall, Hanczyk said. “It is better to invest in a REIT versus going out and buying a building.”

In one sign of how hot London’s industrial sector is, a report this month from commercial realty firm CBRE pegged the vacancy rate at just 0.8 per cent, with only 328,000 sq. ft. of small- to mid-sized space available.

While there is nearly 900,000 square feet under construction, more than two-thirds of that is for one project: the 640,000 sq. ft. Maple Leaf Foods chicken processing plant.

To get more industrial land on the market, the city must revisit the development fees it charges builders for construction and speed development approvals, for zoning and site plans, for example, Rudell said.

“London needs more industrial space, there is no end in sight,” to the demand, he added.

“Put an empty industrial space on the market now and you’ll have 50 showings and 20 offers. It’s great for sellers, but a lot of people are not getting the space they want.”

London is not alone. Nationally, the industrial vacancy rate dropped below two per cent to 1.8 per cent and rents rose sharply in 2021, up nearly 11 per cent from 2020, the report said.

Source The London Free Press. Click here to read a full story

Skyline sells industrial portfolios in Ottawa, GTA for $217M

Skyline Commercial REIT has sold two industrial portfolios comprising 20 properties in Ottawa and the Greater Toronto Area for over $217 million.

The Guelph-based trust said in a release both transactions closed on Monday – the same day the unrelated sale of a massive 2.8-million-square-foot Amazon warehouse in Ottawa was also announced. In the Amazon transaction, developer Broccolini sold a 90.1 per cent stake to Crestpoint Real Estate Investments.

Both of the Skyline transactions were brokered by CBRE.

The Ottawa portfolio involves 18 small-bay properties which total 692,613 square feet of leasable space. The total sale price for the properties was $154.5 million.

The portfolio was sold to Woodbourne Capital Management and Epic Investment Services LP.

The Ottawa sale properties

“This acquisition capitalizes on very attractive market fundamentals coupled with our ability to drive value creation through operations,” said Aaron Moore, vice president, investments at Epic in a separate release. “These assets are located in a sound industrial market with demonstrated stability and growth, offering superior risk-adjusted returns.”

The multi-tenant light and small-bay industrial buildings are positioned in several industrial nodes in Ottawa, with proximity to major highways and arterial roads. There are 24 buildings at the 18 properties, of varied building sizes to accommodate a wide variety of tenant uses.

The properties are:

– 20 & 22 Gurdwara Ave.;

– 1257-1283 Algoma Rd.;

– 107, 111, 146 and 148 Colonnade Rd,;

– 2413 and 2415 Stevenage Drive and 3210 Swansea Cres.;

– 740, 770-790, 800, 830, 850, 855 and 855r Industrial Ave.;

– 1635-1647, 1655, 1665, 1675-1685 Russell Rd.;

– 5300, 5310, 5380, 5390 Canotek Rd.; and

– 2280-2300 Stevenage Dr.

“With Woodbourne, this is our second completed portfolio acquisition within five months and the first we have participated in as co-investor as we expand our industrial portfolio,” said Craig Coleman, co-CEO of Epic, in the announcement.

This transaction, combined with the Amazon fulfillment centre sale, means $650 million in Ottawa industrial property has transacted in the past few days.

Two GTA industrial properties

In the other transaction, Skyline disposed of two industrial properties in the Greater Toronto Area, totalling 207,689 square feet, to Pure Industrial for $62.8 million:

– 130-160 Bradwick Dr., Vaughan;

– 1655 Tricont Ave., Whitby.

“The capital from these sales will be redeployed toward our development pipeline of modern industrial assets and acquisitions involving primarily newer facilities,” said Michael Mackenzie, president of Skyline Commercial REIT, in the announcement.

“As always, our ultimate goal remains to create further value for Skyline Commercial REIT investors through capitalizing on opportunities that are accretive to unit value.”

About the vendor and buyers

Skyline Commercial REIT is a privately owned and managed portfolio of commercial properties, focused on acquiring industrial and logistics-centred properties along major highway corridors and transportation routes in Canada.

Skyline Commercial REIT is operated and managed by Skyline Group Of Companies.

Woodbourne is an investor, operator and developer of apartments, seniors’ housing, student housing, self-storage and other niche real estate assets located predominantly in urban areas across Canada.

Woodbourne invests on behalf of a broad base of institutional investors across the globe, including public and private pension funds, endowments, foundations and funds.

Epic Investment Services, which includes its wholly owned subsidiary MDC Realty Advisors in the U.S., is a fully integrated North American real estate platform.

Headquartered in Toronto and operating from offices in Canada and the U.S., Epic has over $17.5 billion in assets under management.

Epic’s portfolio comprises over 30 million square feet of office, retail, industrial and multiresidential properties.

Pure Industrial is a subsidiary of Blackstone Property Partners and Ivanhoé Cambridge.

The firm owns a portfolio of industrial assets across Canada, with a focus on major urban centres and the heavily populated Southern Ontario markets.

Source Real Estate News Exchange. Click here to read a full story

The industrial real estate market in Southwestern Ontario is nearly full

The industrial real estate market in Southwestern Ontario is nearly full, a new report finds, with some of the country’s most in-demand places found along Highway 401.

The report Another Year, Another Record, from commercial real estate brokerage CBRE, outlines the fourth quarter industrial real estate market in Windsor and surrounding area. It found that the availability rate in Southwestern Ontario — from Waterloo to Windsor — was far below national averages.

Waterloo reported the lowest industrial real estate availability rate in the county at 0.6 per cent — beating out major markets like Vancouver and Toronto — while London reported an availability rate of 0.8 per cent. Windsor clocked in at 1.4 per cent availability, following Montreal, Vancouver and Toronto tied at 0.9 per cent. The current national average is 1.8 per cent availability.

“The industrial market today has never been stronger,” said Brook Handysides, vice-president for CBRE in Windsor.

The CBRE report finds that in Windsor, asking prices for industrial real estate rose 35 per cent year-over-year in 2021 to a record-high $123 per square foot, while rents for industrial space rose about six per cent, to a new high of $8.22 per square foot.

The low availability rate can be a mixed bag, depending on whether you’re buying or renting as opposed to selling, said Brad Collins, a senior associate with CBRE.

“When we talk about 1.4 per cent availability, that is almost a fully occupied market,” Collins said. “I don’t know that you can call it good or bad — it depends what side of the coin you’re on. It’s definitely a challenging market.”

It does mean the Windsor and Essex County region is a desirable — and still relatively affordable — market for businesses to set up shop when compared to other hotspots in the province, mirroring a similar trend in residential real estate.

“We work with clients that are looking to grow here because of the price,” Collins said. “Markets like Toronto, where they’ve had to compete and either been priced out or just beat, and they’ve worked their way down to Windsor and see value.

“We’ve got unprecedented demand coming in from users looking to come to Windsor and obviously bring jobs … unless that demand tapers, or we get a substantial influx of new construction buildings, there’s really no end in sight.”

The trend is driven by high prices in the Greater Toronto Area trickling out to elsewhere in the province.

“Even though we’ve seen unprecedented growth in Windsor, you look at that in terms of what’s going on up the highway,” Handysides said. “Relatively speaking we still have a very well-priced market, even irrespective of the fact that sale prices and lease rates continue to accelerate in price.”

But an availability rate of just 1.4 per cent represents a market that is essentially full, Collins said, whereas a more balanced market might have a six to eight per cent availability rate.

The CBRE report also found there are 92,000 square feet of new industrial space in construction, all of which is pre-sold or leased, meaning it offers little relief on the supply side of the equation.

Windsor’s industrial availability has been trending down since about 2012, the report found. In the second quarter of 2012 availability for industrial real estate was 15 per cent, dropping to four per cent in 2017.

There aren’t any quick fixes, Handysides said. It’s about supply, and building more industrial real estate can be expensive and time-consuming — so low availability and growing prices for industrial real estate are likely to stick around, at least in the near future.

“Timelines for construction still may not go at the speed of business,” he said. “Our expectation is going forward is that these numbers will continue to tighten and become more aggressive.”

Source Windsor Star. Click here to read a full story