Author The Lilly Commercial Team

The brave new world of investor communications in CRE

Communicating with investors has always been vital, but the pandemic both created a greater demand and forced most firms to quickly change their interactions with clients and partners. Panelists during a June 17 webinar hosted by Juniper Square agreed those who successfully navigated the upheaval have reaped the benefits.

Juniper Square strategic account director James Harkness moderated the online panel comprised of Fiera Real Estate director of investor relations Kim Nguyen, NYX Capital Corp. chief financial officer Eileen Foroglou and Slate Asset Management managing director Katie Fasken.

The panelists discussed their strategies during the pandemic and how changes made during this time may affect future communications policies and practices.

“I think the reason people are in private real estate is that there is less volatility and, during the global financial crisis we did see the ability to weather through some of these storms,” said Harkness.

The third part of the webinar looked at: environmental, social and corporate governance (ESG); diversity, equity and inclusion (DEI) in the real estate industry; and how companies can give back to the communities in which they’re involved.

Fiera Real Estate

Fiera is an investment management company that provides direct real estate investment opportunities to institutional investors, foundation and endowment clients, and high-net-worth investors. It has Canadian offices in Toronto, Montreal and Halifax, and London in the United Kingdom. It has 336 properties valued at $6.4 billion under management globally.

Nguyen said investors had questions about Fiera’s operations, rent collections and how it planned to weather the storm when the pandemic first hit, and the company spent more time on breaking things down further in its explanations than it had in the past. Those queries started tapering off later in 2020, according to Nguyen.

“We have been very consistent and transparent in communicating and providing that sense of calm,” said Nguyen. “We can’t tell the future but we do know that, as a platform, we have these measures in place for events like this.”

Innovation has started to play a bigger role in how real estate companies operate. Nguyen said some administrative activities can now be taken care of through technology, freeing up resources for companies to dedicate more time to building relationships with investors at the human level.

Virtual meetings also enable regular communication with investors around the world, which Nguyen said was less common pre-COVID-19.

The majority of Fiera’s institutional investors already have ESG mandates and they’re seeking companies which can accommodate them.

“It’s always been a going concern, but what I’ve noticed in the last few quarters is a lot more conversations asking us about specific metrics that they will use to rate us as a manager on how serious we are taking this ESG journey,” said Nguyen.

As younger people become more involved with investment decisions, Nguyen believes ESG awareness will become more embedded: “It’s not just nice to add anymore, but kind of a requirement.”

Nguyen said Fiera is passionate about education and hosts case competitions at schools to give students a taste of what’s happening in the real estate industry by using examples from the firm.

Students compete to come up with creative solutions to problems and receive feedback, mentorship and support.

NYX Capital Corp.

Toronto-based NYX is a 16-person private equity firm with two million square feet of residential, commercial, self-storage and fitness space valued at about $700 million under management or development in the Greater Toronto and Hamilton Area.

Foroglou said investors wanted constant communication about things such as government-mandated lockdowns, rent collections, investment performance and work-from-home practices when the pandemic began because there was so much uncertainty. NYX was able to meet those demands.

“I’ve always been a big believer that to have successful investor communication is to always be consistent, transparent and honest,” said Foroglou.

Foroglou said ESG has been around for more than a decade and has become an increasingly large priority.

She noted portfolio managers and investors who have focused on ESG during the pandemic have reaped the benefits. High-net-worth investors who’ve seen large institutional investors pay more attention to ESG will follow that lead.

Foroglou said about two-thirds of NYX’s employees are from diverse backgrounds and the median age is in the early 30s. Because of the company’s relatively small size, it gets team members involved in some strategic leadership decision-making.

“It allows us to ensure that our team feels like they’re part of our business as we grow,” said Foroglou.

NYX tries to “select transit-oriented sites where we can bring some density through our planning while being mindful with the community and really reducing our carbon footprint overall in the city,” said Foroglou.

The company wants to add more affordable housing to its portfolio and is looking for technology and partnerships that can help it make a bigger community impact.

Slate Asset Management

Slate is a global real estate owner and operator headquartered in Toronto, with additional offices in Chicago, London and Frankfurt. It has $10 billion worth of assets under management.

“LPs (limited partners) were presented with so much uncertainty in their portfolios over the last 16 months,” said Fasken. “And our goal at Slate is to provide solutions, not to add to that uncertainty, but the truth is in those early days no one had the solution because we didn’t know the longevity and the severity of COVID.”

Slate sent out bi-weekly communications to all of its limited partners, summarizing what its investment and asset management teams were doing to manage portfolios. The communications included information about bespoke tenant strategies, rent collections, development updates and impacts, as well as market updates and the status of government support programs. Those communications eventually moved from bi-weekly to monthly.

Fasken said none of Slate’s investment strategies had to change course due to COVID-19. The firm has raised more than $1 billion in equity and acquired more than $3 billion worth of commercial real estate since the pandemic began.

“In a pre-COVID world, we travelled to almost every meeting in person,” said Fasken. “And this Zoom world has certainly allowed us to have more frequent informal touch points, which has worked really well for building relationships with LPs.”

Going forward, Fasken believes a hybrid model of travelling for in-person meetings and continued virtual meetings will become the norm.

“Our policy on DEI has never really been driven by investor demand,” said Fasken. “It’s really been driven by our desire to attract and retain the best talent we can.”

Fasken said about 45 per cent of Slate’s professional team is female and 25 per cent is black, Indigenous or people of colour, but there are still improvements to be made at the senior leadership level.

“To foster inclusion amongst our entire team, something unique that Slate offers is every employee is allowed to invest,” said Fasken. “Anyone from our receptionists to our partners are encouraged, but not mandated.”

Slate also offers “an exceptional maternity leave policy, unlimited vacations, bespoke family-first benefit packages and unlimited access to mental health services,” among other perks, Fasken added. Employees are also invited to share their thoughts, concerns and ideas about company policies with Slate’s leadership.

It also has a building rooftop where it keeps beehives to make honey, which it distributes, and provides free morning yoga classes to tenants.

“We also hire local artists from the community who have created numerous public art murals,” said Fasken. “We also hire them to create the hoarding for our development projects.”

Source Real Estate News Exchange. Click here to read a full story

Pure buys Brampton site, plans 625K sq. ft. of industrial buildings

Pure Industrial has acquired a 28-acre parcel of land along Hurontario Street in the Greater Toronto Area city of Brampton where it intends to construct two industrial buildings totalling about 625,000 square feet.

“We are pleased to be able to convert this site, which has been vacant for decades, into a hub of commerce and job-creating activity at one of Brampton’s most important intersections,” said David Owen, Pure’s chief operating officer, in the announcement. “We will continue to work closely with the City of Brampton and surrounding community to ensure the site is a positive addition to the area, especially from an aesthetic and environmental standpoint.”

The intention is to construct facilities focused on the logistics, distribution and transportation sectors. The development is still subject to approvals from the city, but Pure says it has received preliminary support from Brampton council.

About the Brampton property, project

The property is at the intersection of Hurontario Street and Sandalwood Parkway, one of the busiest corridors in the city and an area which is already developed as an industrial and logistics hub.

The site’s zoning allows for a wide range of uses including logistics, office, transportation, advanced manufacturing and distribution facilities, while also providing outside storage capabilities.

The two new buildings will offer state-of-the-art features including 36- to 40-foot clear ceiling heights, ample trailer parking, multiple points of ingress/egress and signalled traffic intersections.

The location provides access to an abundant labour pool and several major highways, as well as to Brampton’s Züm bus transit and GO Train service.

Pure is already heavily invested in the Brampton area, owning and managing 15 buildings and over 2.5 million square feet. It owns another property across the road on Sandalwood, a 764,000-square-foot warehouse which is fully leased to a food manufacturer.

“Pure has deep roots in Brampton,” said Charlie Deeks, the chief investment officer at Pure, in the announcement. “The city has an abundant and skilled workforce and a business-friendly mentality that helps our company grow and play a critical part in the Canadian supply chain.

“We are proud to be able to offer integrated, full-service solutions in strategic locations across Canada for our customers – from the first to the last mile.”

Pure Industrial active GTA developer

The firm has also been actively developing in the Greater Toronto Area, which has an industrial vacancy rate of just 1.7 per cent according to JLL’s most recent stats for Q1 2021. That rate has been under two per cent for 10 consecutive quarters and has sparked a rush to acquire and build.

Pure’s most recent project in the GTA was the completion of a 295,000-square-foot logistics facility at 75 Venture Dr. in Scarborough, in the east end of the region. That project involved demolishing an existing 150,000-square-foot manufacturing plant and building a modern facility with 36-foot clear heights.

In this case, while the property does have some existing buildings, it is largely undeveloped.

Pure has retained Hopewell Development as development manager for the Brampton site. The two groups have a long-standing history, having worked together on other developments across Canada — including 75 Venture Dr.

“We’re excited to be building once again with Pure Industrial and continue to expand on our partnership,” said Murray DeGirolamo, president at Hopewell, in the release. “We are enthusiastic about the project and it is a great opportunity for us both to contribute jobs and opportunities to the City of Brampton.”

Pure Industrial is one of Canada’s leading providers of industrial real estate, owning and managing over 21 million square feet concentrated in the Toronto, Montreal and Vancouver metro areas.

Pure is owned by funds affiliated with Blackstone Real Estate and Ivanhoé Cambridge.

Source Real Estate News Exchange. Click here to read a full story

Top tech trends impacting commercial and residential real estate

Over the past few years, we have witnessed the growing impact of technology within the real estate landscape. While the pandemic created many challenges for the industry, it also served to accelerate already-existing trends.

It has become clear that data, and technology overall, has and will continue to play an integral role in the industry’s ongoing transformation.

Clearly, the more data we have, the more data-driven decisions we can make. Data allows real estate professionals and organizations to compile information and track trends in order to offer the most up-to-date insights while allowing for transparency for current and potential property owners in the process.

However, despite all of the amazing insights data can provide, many often still associate technology in real estate with virtual signings or virtual home tours, when in reality there are so many more ways technology has and will continue to impact both commercial and residential real estate in Canada.

Top-3 technology trends impacting CRE Informing decisions through data and technology

The Canadian commercial real estate industry creates and captures a lot of data.

Data about properties, as well as Internet of Things (IoT) data about how a building operates, can be used to make operations more efficient, improve occupant (shopper, resident and patient) experiences and identify current or potential issues.

For example, for owners and property managers, gathering real-time and historical information about all kinds of building systems through data — such as electrical, HVAC, fire/life safety, utilities and telecommunications — can translate into proactive maintenance.

In some cases, it may even be able to predict and alert a property manager to an equipment failure before it happens, allowing them to source a replacement part before an issue occurs.

Direct digital engagement

Technology platforms are being used more and more to introduce prospective tenants to brokers and landlords, making it possible to connect, share files and track transactions and data in real time.

This direct digital engagement with the end-users of real estate ensures a safe and healthy environment, which has been especially important during the pandemic. It also automates traditional processes.

Technology simplifying processes

Robotic process automation (RPA) is currently playing a key role in transforming various industries, from banking and finance all the way to real estate.

With RPA, businesses can automate mundane rules-based business processes, enabling users to devote more time to serving customers or other higher-value work. Businesses across North America are realizing the potential of this process and incorporating it into their daily operations to stay competitive and profitable.

When it comes to real estate financing specifically, RPA can be used to improve operational efficiency and minimize costs by automating parts of the mortgage process.

While software and AI processes, such as RPA, are reshaping the digital landscape in Canadian construction, there are two technologies poised to reshape the industry’s physical landscape: prefabricated construction and 3D printing.

3D printing in construction works to automate the construction processes and has the potential to limit labour-intensive work, material waste, construction time, risky operation for humans and more.

Prefabricated construction can also help reduce many of these key pain points by building the majority of a structure in an off-site facility, then safely shipping the pieces to be easily assembled on-site. Both are likely to have ongoing impacts – and play larger roles – in the years to come.

Top four technology trends impacting residential real estate

Data and AI

AI and machine learning will help make the data being collected more actionable.

For example, several companies are working on technology that would allow real estate agents to conduct showings via a tablet or with a chatbot, allowing them to increase the number of showings they can conduct in a day.

AI will also be able to help predict pricing trends more accurately in the residential real estate industry. This type of technology would look at historical trends in the market for an area, while also taking into account crime, schools, transportation and marketplace activity.

Virtual and augmented reality

According to a survey by the National Association of Realtors, nearly half of all potential homebuyers search for properties on the internet before contacting a real estate professional. Virtual reality and augmented reality have the potential to make the online search and home buying experience even more exciting, and more importantly, accessible.

For new builds, virtual reality can create realistic architectural images and walkthroughs to help buyers understand and experience the property — even before construction begins. For property managers, creating a virtual reality tour might help new tenants get acquainted with their spaces.

For example, as opposed to lengthy written instructions on how to use the thermostat, a virtual tour could walk the tenant through the process, demonstrating each step along the way.

Drones

Digital, multi-perspective site visits are now possible, creating emotional storytelling around a particular property.

Drones can also be used to provide a tour of the area.

For new builds, a drone might capture the feel of a new neighbourhood. It could also help people considering a move to a new town or neighbourhood get a feel for the place before visiting.

Drones can also be used to spot potential risks or maintenance problems which could reduce the price of a property or be used in negotiations.

Smart homes and cities

A smart home allows homeowners to control appliances, thermostats, lights and other devices remotely using a smartphone or tablet through an internet connection.

Smart homes aim to provide homeowners with both convenience and cost savings. As such, the effective use of data within homes has now become a competitive advantage.

Smart technology is not limited to homes as cities are also catching on to this trend. Smart cities, which are quickly growing in popularity, install digital interfaces in traditional infrastructure or help to streamline city operations through technology.

However, that’s not all they do – the real objective behind smart cities is to put data and digital technology to work to make better decisions, solve public problems and improve quality of life for those who live in the city.

The road ahead

The Canadian real estate industry is uniquely positioned to continue to benefit from data and technology.

If the last few years have taught us anything, it’s that data has been and will continue to be integral to the ongoing transformation of both residential and commercial real estate.

Source Real Estate News Exchange. Click here to read a full story

Canadian commercial real estate may see post-COVID-19 economic upswing: report

CBRE says Canadian commercial real estate is pointing to a post-pandemic economic upswing.

The commercial real estate company says the pace of office vacancy increases eased in every major Canadian city in the second quarter and industrial demand picked up.

Downtown office leasing increased in major cities by the smallest amount since the pandemic’s onset last year with office tenants preparing to welcome employees back in the second half of the year.

CBRE says Canada has North America’s four tightest downtown office markets with Vancouver’s vacancy at 6.6 per cent, Toronto at 10 per cent, Ottawa at 10.6 per cent and Montreal at 11.1 per cent.

Halifax’s office vacancy decreased to 19.7 per cent downtown and 13 per cent in the suburbs in a possible sign of a return to normalcy as part of the reopening process.

Sublets, which flooded the market during the pandemic, are now in demand with some companies pulling the spaces off the market to reoccupy the offices.

The company says nearly 90,000 square metres of office space previously put up for sublease was cancelled or leased in downtown cores in the second quarter, with half of that in Toronto.

“Sublet listings can be knee-jerk reactions in a sudden market correction. The fact that sublets are being cancelled or leased up by new business is a very good sign and this only just the beginning of the trend,” says CBRE Canada vice chairman Paul Morassutti.

“Canada’s major office markets have fared well over the past year compared to our global counterparts and we can expect the momentum to continue to build as lockdowns are eased.”

Prime industrial real estate is in high demand, with Waterloo Region having the lowest industrial availability rate in North America at 0.9 per cent.

All markets outside the Prairies have availability rates of three per cent or less, with Toronto, Vancouver and Montreal at 1.2, 1.1 and 1.4 per cent, respectively.

Rising land and construction costs are limiting options for industrial businesses.

The amount of space for lease or purchase decreased in the quarter by 35 per cent in Vancouver, 28 per cent in Montreal and 25 per cent in Toronto. Calgary’s rates decreased by 1.2 per cent while Edmonton’s rate fall by 0.7 per cent.

“The level of industrial demand is unprecedented and is now running up against very real limitations,” added Morassutti.

“We don’t have enough space to accommodate business demand and can’t build new space fast enough.”

Source Global News. Click here to read a full story

Beedie grows in the GTA with two new industry-leading industrial condos

Founded in 1954, Beedie is one of Western Canada’s largest industrial developers and property owners, having completed more than 30 million square feet of new development since inception. Beedie made a splash in 2018 and 2019 with 4 land acquisitions totaling 54 acres throughout the Greater Toronto Area. After achieving strong success on their first project in Ontario, Legacy Business Centre located in Meadowvale, Beedie is poised to replicate their success with the recent launch of Lakeside Business Centre in Oshawa & Morningside Business Centre in Scarborough.

Lakeside Business Centre

Located at 1155 Boundary Road in Oshawa, Lakeside Business Centre offers 137,000 SF of state-of-the-art industrial condo in one of the fastest growing industrial nodes in the Greater Toronto Area. Units start at 13,600 SF including a walk up second floor and feature 28’ clear ceiling height, dock & grade loading per unit, 3-phase power, and high-efficiency LED lighting. The first-class finishes at Lakeside Business Center continue to build on Beedie’s strong reputation in the industrial market for designing and delivering a high-quality product that businesses and investors can take pride in.

“We recognize that for all of our clients, buying a Beedie built industrial condo represents a major investment in their business and their future. We take great care and pride in designing and building high-quality product that’s built to last. It is important to us that each of our clients are able to look back at their purchase in 10 or 15 years’ time and feel confident that they made a great investment.” Rowan Hicks, Director of Industrial Sales, Beedie.

In a market that is starved for quality small to mid-bay industrial product, Beedie offers a flexible solution for business owners to take advantage of modern industrial efficiencies in a smaller footprint. The demand for this type of product has been apparent as Lakeside Business Center is over 30% subscribed just two weeks after its release to the market.

“What really separates Beedie is their commitment to quality – they stand behind every inch of their product and no detail is overlooked. It is not surprising to see repeat purchasers that follow Beedie throughout the markets they are growing in” Daniel Hubert, Vice President, Cushman & Wakefield

Morningside Business Centre

The trend of success and demand Beedie has seen at Legacy and Lakeside has also been experienced at Morningside Business Centre, located in Scarborough at the intersection of Morningside Avenue and Neilson Road. Prior to the formal release to market, Beedie, through their trusted partners at Cushman & Wakefield – Daniel Hubert, James Mildon, Peter Schmidt and D’Arcy Bak – placed 7 units totaling over 70,000 SF under contract, with Rob Ironside of CBRE representing the purchasers of 3 of these units. The project will feature 3 separate buildings totaling 348,000 SF with units starting at 6,900 SF. Each unit will include a walk up second floor and best-in-class specifications including 28’ clear ceiling height, dock & grade loading, 3-phase power, and high-efficiency LED lighting.

“When prospective purchasers tour through Beedie’s existing product it becomes very clear that they are investing in a high-quality product. In my experience, the recurring message from purchasers has been “Why would I pay a similar price for a 12’-16’ clear, tired brick & block industrial building that likely needs significant work, when I can own a state-of-the-art 28’ clear facility that showcases my brand and company.” Beedie allows groups to practically double the cubic volume of their warehouse, it’s a no brainer.” Peter Schmidt, Executive Vice President, Cushman & Wakefield

GTA Lease rates on the climb

With lease rates in the GTA pushing well into the mid-teens on a per square foot basis, business operators are facing ever increasing costs of overhead and growing uncertainty in a highly competitive lease market. Beedie’s condo projects provide business owners with the opportunity to remove this uncertainty by owning their own tier 1 industrial facility and allowing them to build equity that can be used to grow and expand their business in the future. Owning a brand-new, high-quality industrial condo also reduces the financial risk associated with major capital repairs and replacements; obstacles which are often faced by businesses occupying older facilities.

Source Real Estate News Exchange. Click here to read a full story

Longer lease terms a sign of rebounding confidence in Canada’s office market?

More than 15 months after the onset of the COVID-19 pandemic in Canada, the country is starting to make some real progress toward a future return to “normal.”

With more than 66 per cent of the population having received at least one dose of a vaccine (as of June 21), the prospect of a meaningful re-opening is getting closer to reality in many parts of the country.

Canada’s office market is also sharing in the positive trend. Return-to-office discussions are taking place in cities where workers continue to work from home and an uptick in tour activity is occurring as occupiers begin to view their future circumstances as more concrete.

In addition, there are indications the national sublet pipeline might be starting to turn the corner, another sign of confidence returning to the market.

After so many months with limited (but now improving) leasing activity, it’s worth bringing some analysis gleaned from AVANT by Avison Young.

Average office lease terms in Canada

To get some perspective on office occupier confidence across Canada, it would be interesting to dive into the average lease term length for completed transactions over time.

When occupiers feel secure in their expectations of the future, they are willing to commit to longer lease terms – and on the flip side, in times of uncertainty, shorter lease terms provide flexibility for occupier companies to adapt to evolving future requirements.

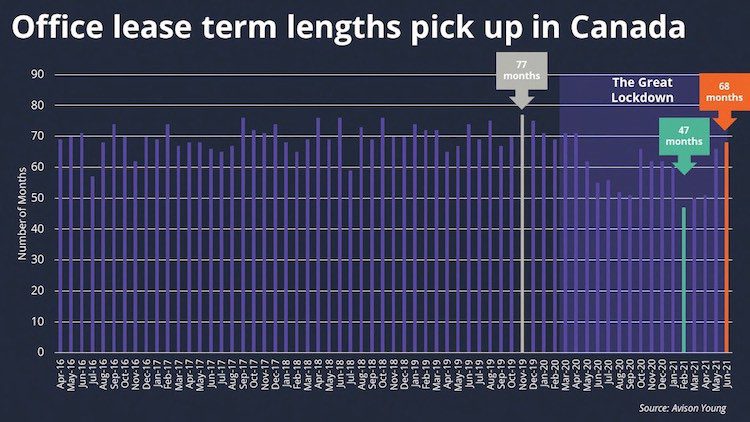

The chart above shows the average length of term for Canadian office leases signed in each month for the past five years. Some notable highlights revealed by this analysis include:

– for all deals signed from April 2016 to February 2020, the overall average lease term length was 70 months. For those signed between the onset of the pandemic in March 2020 and June 2021, that figure fell to 59 months – a 16 per cent decrease;

– lease term length peaked a few months prior to the onset of the COVID-19 pandemic, averaging 77 months of term for deals signed in November 2019;

– after entering the Great Lockdown, confidence in the market fluctuated throughout the summer and fall of 2020 as repeated lockdowns and re-openings played havoc with decision-making. These effects were also evident in a significant drop-off in leasing velocity and a rise in sublet availability, across the country;

– the pandemic low point was reached in February 2021, with an average lease term length of just 47 months;

– Since then, average term length has risen steadily month-over-month (especially in May and June) and as we approach the midpoint of the year, it has reached 68 months – up 45 per cent from the low point and representing the highest average lease term length since April 2020.

It’s great to see confidence returning among occupiers, as indicated by these trends.

As vaccination rates rise and return-to-office plans become more real, this could all translate into not only an increase in leasing activity but also the return of longer commitments as lease term lengths return to pre-pandemic levels.

Source Real Estate News Exchange. Click here to read a full story

TAS plans Leslieville development with its new LP 3 fund

During the past month, TAS has both closed a round of funding and launched a formal framework for how its work impacts people’s lives. President and CEO Mazyar Mortazavi says those two activities help illustrate what the Toronto developer is all about.

“It’s profit with purpose,” Mortazavi told RENX. “That’s our view of the world. And we think this kind of approach is only going to help to give back to future generations.”

On June 3, TAS announced the closing of its third diversified real estate fund, TAS LP 3, after raising $116.5 million from a mix of family office and institutional investors. Mortazavi said the firm now has approximately $300 million in funds under management.

The money will be deployed to expand the company’s existing pipeline of Greater Toronto and Hamilton Area (GTHA) projects and deliver social and environmental impacts with and for communities through its development and value-add projects.

TAS began raising funds for TAS LP 3 in 2019 and expected to close it during 2020, but COVID-19 delayed the process somewhat. The company expects to acquire between six and 10 properties in LP 3.

880 Eastern Avenue

One of those properties is an assembly bordered by Eastern Avenue, Knox Avenue and Sears Street in Toronto’s Leslieville neighbourhood that divides a residential area to the north and more industrial uses to the south. The site just east of the downtown core was acquired in early 2020 and is currently occupied by a mechanic and autobody workshop and a warehouse.

TAS is proposing the development of 157 new homes, with a mix of studios, one-, two- and three-bedroom units in an SvN Architects + Planners design that ranges from three to 12 storeys. It will have parking for 197 bicycles and 121 vehicles.

“We’re keeping our options open, but we’re quite keen on this being a rental building,” said Mortazavi.

The project will include sustainable building practices and heating and cooling systems designed to reduce environmental impact.

Ample natural light and cross-ventilation have been prioritized, with 55 per cent of units featuring two exposure frontages. More than 38 per cent of residents will be able to walk outdoors directly from their unit.

The development will also include a central courtyard and 10,000 to 15,000 square feet of commercial space that will serve the neighbourhood.

“As opposed to seeing it from purely as gentrification that drives displacement, our deep focus around this is how we seamlessly mix a range of housing types and integrate community-oriented commercial spaces and also provide ample opportunities for social connections,” said Mortazavi.

“This kind of integration is foundational to long-term resiliency. So for us the idea of impact is very multi-faceted in that we’ll be looking to deliver affordable housing and looking to drive commercial and light industrial uses, and then taking an integrated approach so that it acts as a community hub.”

The City of Toronto will host a public consultation regarding TAS’ plans this summer. Mortazavi anticipates construction starting in the fall of 2022 and for it to take two to three years to be completed.

Other TAS developments

Primarily residential developments which have been completed by TAS include: DIA at 30 Canterbury Place in North York; and Duke at 530 Indian Grove, Kingston & Co. at 1100 Kingston Rd., M5V at 375 King St. W. and ZED at 38 Niagara St. in Toronto.

Its operational office and commercial developments include: 860 Richmond Street West, Eglinton Avenue West Block at 453, 481 and 491 Eglinton Ave. W., and The Planet at 1655 Dupont St. in Toronto.

Mortazavi also highlighted two Toronto projects now under construction and two more that should begin next year.

TAS is partnered with BentallGreenOak on 299 Campbell Avenue, a 14-storey building with 236 purpose-built rental units, a Toronto Public Library branch and approximately 2,400 square feet of commercial space. The Teeple Architects-designed building in the Junction Triangle area is targeting late 2022 and early 2023 occupancies.

TAS and Fiera Capital are partners on The Keeley, a Teeple-designed 13-storey, 363-unit condominium at 3100 Keele St. About 90 per cent of the units are sold in the building that faces Downsview Park and connects to trails to York University. It should be completed next year.

Construction should start in 2022 on a large project on a five-acre site — north of a rail corridor, south of King Street West, adjacent to Fort York and close to parks. When completed, the 2 Tecumseth Street development will include approximately 1.2 million square feet of purpose-built rental units, for-sale condo units and affordable housing, as well as commercial, office, retail, light industrial, community and event spaces.

The development will include a 30-storey building, a 22-storey building, a seven-storey building and two two-storey buildings. There will be underground parking spaces for approximately 860 bikes and 400 vehicles. More than 62,300 square feet of public realm improvements and new parks, as well as a four-metre-wide bike path along the site’s southern boundary, will also be included.

“It’s an amazing downtown location that’s being designed as a very integrated campus-like precinct,” said Mortazavi.

TAS is targeting an early 2022 construction start for 3803 Dundas Street West, a SvN-designed 13-storey building with 297 purpose-built rental units and approximately 19,000 square feet of commercial space.

Sixty-three units will be designated as affordable and 45 will be designed as accessible. Completion is estimated for 2025.

Other TAS projects in development include: Connecting Cooksville in Mississauga; and 259 Geary Avenue, 38 Walmer Road, 385 The West Mall, 7 Labatt Avenue and 7 River Street and 888 Dupont Street in Toronto.

“We have about half-a-dozen sites under contract now that are going through various stages of diligence,” Mortazavi said of TAS’ acquisition pipeline.

“These are properties that span from Toronto all the way through to Hamilton. They’re a mix of development sites and income-producing properties.”

TAS’ impact framework

TAS is a Certified B Corporation, which means it’s legally required to consider the impact of its decisions on its workers, customers, suppliers, community and the environment. It launched its impact framework in mid-June to measure the delivery and impact of its environmental, social and corporate governance efforts.

“This was our commitment to both clearly articulating the work that we’re doing and driving deep accountability from within the organization and externally to all of our stakeholders to demonstrate the kind of impact we drive,” said Mortazavi.

“We can measure what we’re doing and then show the kinds of results that it’s having. The impact framework for us is the manifesto of what we do, how we do it and why it’s important.”

TAS has selected the Future-Fit Business Benchmark, which is grounded in the United Nations Sustainable Development Goals, to strategically anchor its framework. The benchmark is a self-assessment approach that equips companies to manage and improve their social and environmental performance.

“We’ve positioned what we do as being an impact company, as opposed to just doing impact projects,” said Mortazavi.

“The kind of city that we want and the kind of future that we want really requires a collective effort across our entire industry, and all of its various stakeholders in the city and the province, to be collectively thinking of how we drive deep resiliency long-term.

“We’ve been able to show consistently that this isn’t an approach where we’re looking to discount returns. We think we’re compounding our returns by having this kind of approach.”

Source Real Estate News Exchange. Click here to read a full story

Artis REIT to sell GTA industrial portfolio for $750M

Artis REIT (AX-UN-T) has announced a “milestone” transaction, an unconditional agreement to sell its 28-property, 2.5-million-square-foot Greater Toronto Area industrial portfolio for $750 million.

The transaction represents a per-square-foot price of $297 for the portfolio.

It also exceeds the REIT’s most recently reported fair value of $550.7 million for the properties by 36 per cent, as demand, asset prices and leasing rates continue to rise in the sector across the GTA.

In an interview with RENX, Artis president and chief executive officer Samir Manji said the transaction allows the REIT to make significant progress in the business transformation plan which was announced in March following a change in management.

“In that announcement, we conveyed that one of the near-term objectives was to fortify our balance sheet so as to No. 1 reduce our leverage and No. 2 at the same time provide financial flexibility to the REIT so as to enable us to pursue on a go-forward basis, opportunistically . . . investment opportunities that surface and that we identify,” he explained.

“This transaction and the effect it will have on our balance sheet, on our liquidity, on our debt reduction objective . . . all those boxes check off and hence the reference to the term milestone.”

Manji declined to identify the buyer.

New management’s most significant move

Artis’ GTA-and-area industrial portfolio includes properties stretching from Burlington and Oakville, north to Brampton and east to Markham and Scarborough. The buildings range up to about 160,000 square feet, with most in the 40,000- to 110,000-square-foot range.

“This translates into, on the GTA assets, a sub-three per cent cap rate based on our 2021 expected NOI. Granted, the buyer knows there is upside on the rent,” Manji said, which makes the deal attractive to both parties due to their differing strategies.

“As far as Artis is concerned and how we are looking at this from a capital allocation strategy standpoint, we think taking this liquidity opportunity, to then be able to redeploy that capital in opportunities where we think there is greater upside, that is where our thinking is.”

The transaction is the most significant since Manji and a group of dissident unitholders ousted Artis’ previous senior management group in 2020 after going public with their complaints about the REIT’s performance and operations.

Manji, also the founder and CEO of investment firm Sandpiper Group, became CEO pledging to improve on its track record and make a number of significant changes to its portfolio and strategies.

In March, Manji and Artis management announced Artis would focus on growing net asset value per unit and distributions through debt repayment, return of capital and value investing in real estate. It also identified industrial as an area of strength within the portfolio, and that it intended to capitalize on that.

Big interest in Artis REIT industrial holdings

“We, following our March 10 announcement had a significant inbound interest from principals, buyers of various real estate asset classes and unsurprisingly, where there was the greatest interest was in our industrial assets,” Manji said.

“From that universe of inbound interest, where we saw the strongest interest, including volume of inbounds, was with our GTA industrial. So we strategically, with the support of our board, made the decision to focus on that and evaluate how we might, based on that demand, monetize our GTA industrial assets.

“Suffice to say that we were able to meet and I would say exceed our expectation.”

After adjusting for the repayment of one outstanding mortgage of approximately $15.2 million and anticipated closing costs, the transaction will generate net proceeds of approximately $734 million. Manji said one option management will consider for redeploying some of those funds is more industrial development.

“We are still very bullish on industrial. We noted in our March 10 announcement that one of the areas we would look at from a value investing standpoint was new developments,” he said.

“This is an interesting scenario where, with the efforts of our teams on the ground, if we are able to identify within industrial development opportunities where we are confident and have a high conviction we could execute on our opportunity to develop a new industrial asset at a cap rate between 5.5 and 6.5 per cent, in a market where transactions are happening say at a four cap, that’s a pretty attractive delta.”

Manji said Artis has industrial developments underway in Houston and Phoenix and “we have others that we are exploring or considering.”

Retooling of Artis is a “marathon”

In terms of Artis’ overall strategy and its intention to rename and rebrand the trust, Manji said there are no other updates at this time.

“We’re not looking at this as a sprint, it’s a marathon. Having that financial flexibility to be opportunistic when it comes to value investing our owners’ capital on their behalf, we are going to be patient, thoughtful, disciplined and look forward to what lies ahead.”

He also said this does not change the status of about a half-dozen Artis retail and office assets which had been allocated for sale.

“This doesn’t change that,” he said. “I don’t anticipate in the back half of this year, (we) are going to see another transaction of this magnitude, but that’s not to say there won’t be other transactional activity.”

He also said while there are no current plans to sell additional industrial assets, Artis is always willing to listen to offers.

Artis is a diversified Canadian real estate investment trust with a portfolio of industrial, office and retail properties in Canada and the United States.

Source Real Estate News Exchange. Click here to read a full story

The pros and cons of investing in commercial real estate

If you have invested in residential real estate in the past and have been pleased with the outcome, you might be interested in exploring the world of commercial real estate.

What is considered commercial real estate?

Where residential real estate is exclusively used as a place to live, commercial real estate is property that is used for business-related purposes. This includes:

– Office buildings;

– Retail buildings;

– Industrial buildings;

– Warehouses;

– “Mixed-use” buildings where the property includes a variety of uses such as apartments and retail or office space.

The upside to investing in commercial real estate:

Here are some of the reasons you would want to consider commercial real estate in your investment strategy.

Higher rent yield

Commercial properties tend to come with higher rents and higher price tags, which results in higher potential returns. Instead of making a profit of a few hundred dollars on a residential property, there is a possibility of netting thousands on a commercial lease.

Commercial leases are also typically triple net. This essentially absolves the landlord of the most risk of any net lease. This means even the costs of structural maintenance and repairs must be paid by the tenant, in addition to rent, property taxes and insurance premiums.

A triple-net lease results in less overhead for the property owner, leading to a higher return on investment.

Longer leases and lasting business relationships

Commercial leases will typically run from one to 10 years and can run longer in some cases! This provides you with peace of mind in knowing you will have stable cash flow for a prolonged period.

Longer leases also means less costly turnover. As a new business occupies the property, it will need to adapt the space to its needs resulting in costly renovations.

Business owners also tend to take pride in their business and want to protect their livelihood. This helps to maintain a positive relationship with the property owner and tenant.

Diversification

If you are already invested in residential real estate, commercial real estate can be a wonderful way to diversify your portfolio. In 2020, we learned that not all real estate is created equal.

Where your local nail salon and movie theatre might have struggled, your local pharmacist or grocer would have seen remarkable success.

Therefore, it is valuable to spread your investment across a wider range of assets.

Cons

Here are some of the barriers you might discover when investing in commercial real estate.

Time commitment

Most commercial tenants operate their business during typical working hours. This leaves evenings and weekends to conduct any maintenance at the property.

You also run the possibility of managing multiple tenants which results in more maintenance issues and costs.

It is risky

Commercial properties typically have more public visitors, which leaves more opportunity for damage to be done to your property.

Accidents can happen in the parking lot, retail space is more likely to be broken into and vandalism is extremely common. If you are risk-averse, commercial real estate may not be the best investment for you.

Financing

Commercial property typically requires more up-front capital than a residential property. A larger, more unique space could also come with more unexpected expenses with a hefty price tag.

You will need help from the experts

Commercial real estate comes with an extremely specific range of needs.

You will need access to many tradespeople and specialists to handle maintenance and administrative tasks. This can cut into monthly cash flow and is difficult to do on one’s own.

Conclusion

There are many benefits to investing in commercial real estate. However, it can be challenging for someone who lacks the expertise and time to do so.

If you are interested in learning how you can invest in commercial real estate without the headache of being a property owner, a private REIT that invests in CRE is something you might want to consider.

Many investment firms give everyday investors access to income-producing commercial real estate options without them having to acquire this expertise or the resources required to manage such properties. If you are interested in exploring this type of investment, it’s strongly recommended that you seek out a professional to guide you through the process.

Source Real Estate News Exchange. Click here to read a full story

Death of the office, no. But there will be an evolution — RioCan CEO

As we look forward to a summer of possible ‘getting back to normal’, business and industries are faced with what ‘back to normal’ looks like when it comes to ‘back to work’. But what does that ultimately mean for commercial/retail/industrial landlords?

In this second of a two part-series on reopening on Down to Business, the Financial Post’s Larysa Harapyn talks to RioCan Real Estate Investment Trust CEO Jonathan Gitlin about how the pandemic has changed the commercial real estate landscape.

Listen on Apple Podcasts, Spotify, Stitcher and Google Play

Source Financial Post. Click here to read a full story