Author The Lilly Commercial Team

Toronto Neighbourhood Could Be Totally Transformed Over The Next Decades

A Toronto neighbourhood could see massive changes over the next few decades.

More than 500 acres around Downsview Airport and Downsview Park are part of a planning process to develop residential and non-residential property called id8 Downsview.

Northcrest Developments and Canada Lands, have named the planning process id8 (ideate) Downsview “because we know a lot of ideas will be shared and discussed between a lot of people to plan a future for these lands.”

The process began when Bombardier sold the Downsview Airport property to the Public Sector Pension Investment Board (PSP Investments – a federal Crown corporation that manages funds for the pension plans of the federal Public Service, the Royal Canadian Mounted Police, the Canadian Armed Forces, and the Reserve Force) in 2018.

Northcrest Developments was established a short time later to create a master plan and develop the Downsview Airport lands on behalf of PSP Investments. Downsview Airport is slated to close in 2023.

They hit a snag with some disagreement over rezoning employment lands as residential. Plans now state there will be a minimum 12 million square feet of non-residential space – including a recently announced film and television production facility.

Now id8 Downsview is preparing a proposal for the City of Toronto and is asking for feedback on plans for the property.

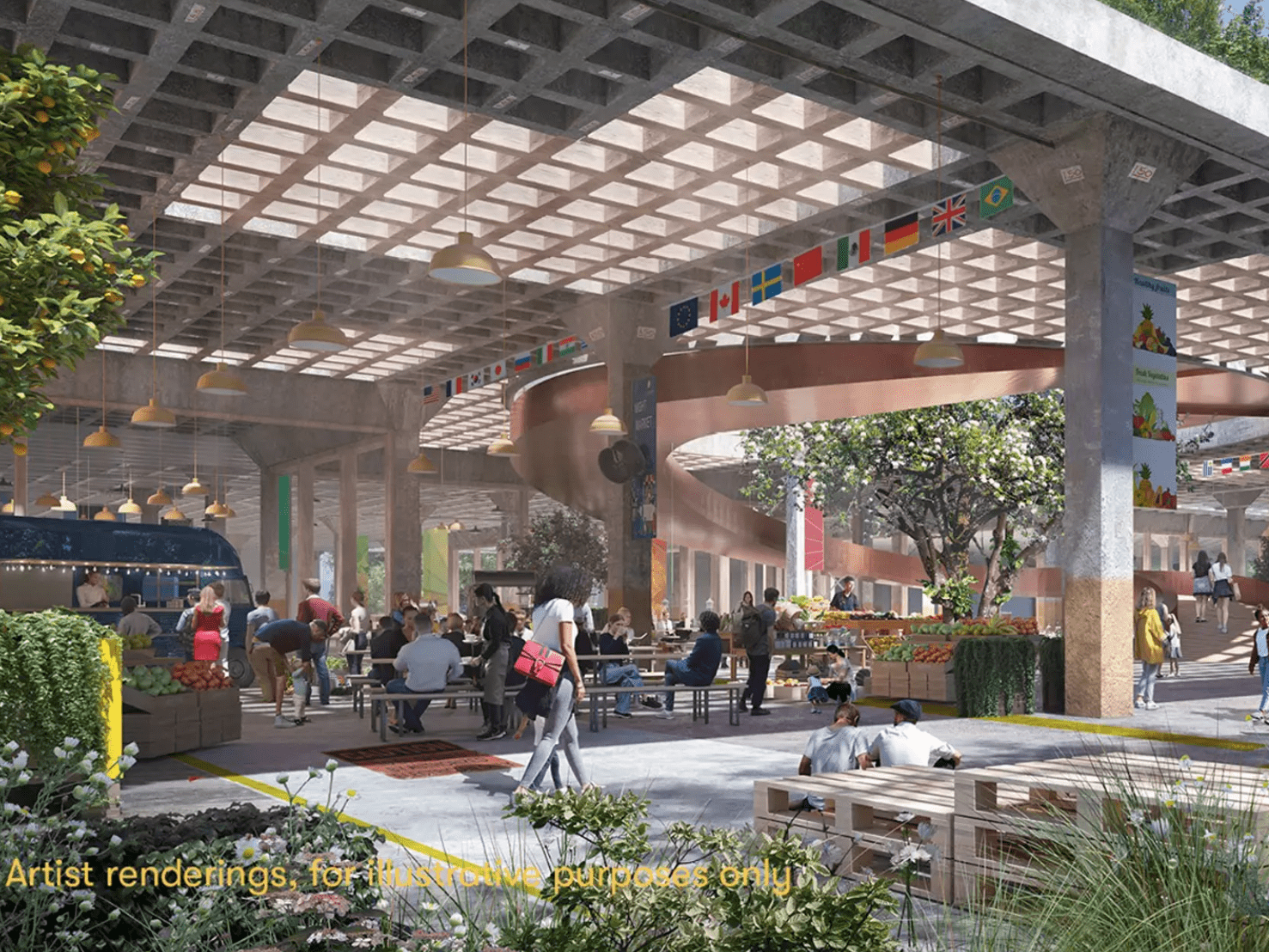

An early vision for the property includes three new mixed-use neighbourhoods anchored by Downsview Park and the airport. Mid-rise buildings and taller buildings near transit are mentioned in the plans.

Downsview Park won’t be cut.

“The size of the Park will not change and there will be additional green spaces added as we develop the neighbourhoods,” according to the website.

There are also suggestions to include new parks, re-use heritage buildings, celebrate Indigenous people and reimagine the airport runway.

With the departure of Bombardier and the availability of the airport lands along with a TTC subway extension and GO service expansion — there is a potential for development.

This is just the first step in what is likely a multi-decade process of “re-imagining this area of Toronto.”

Source BlogTO. Click here to read a full story

Allied Properties REIT says business districts will soon roar back to life

Some of Allied’s tenants are mapping out plans to bring more employees back in the weeks ahead, Chief Financial Officer Cecilia Williams says.

Allied Properties Real Estate Investment Trust, a Canadian landlord to companies including Aon Plc and Morgan Stanley, says the business districts of Toronto, Montreal and Vancouver will come roaring back to life. Not quite yet, but soon.

With more than 60 per cent of Canada’s population fully vaccinated against COVID-19, some of Allied’s tenants are mapping out plans to bring more employees back in the weeks ahead, Chief Financial Officer Cecilia Williams said in an interview.

“There’s going to be a bit of a transitional period, where they start on a rotating basis, but their plan is to ultimately bring everyone back,” Williams said, citing feedback from tenants.

The spread of the Delta variant, which has forced companies including Wells Fargo Co., BlackRock Inc., American Express Co. to delay their office plans, has not had a perceptible impact yet on Canadian firms’ outlook, she said.

“Things can change day to day — but I haven’t heard anything like that either in our portfolio or in the communities we operate,” Williams said. “If anything, we’ve seen some people make their plan earlier, with repopulating starting in August as opposed to Labor Day.”

Like other downtown property owners, Allied was hit hard by the swift change in investor sentiment when the COVID-19 pandemic arrived. The shares fell 27 per cent last year as Montreal and Toronto endured some of the strictest measures in North America, with emergency stay-at-home orders lasting for months.

Canada’s two largest cities represent 81 per cent of Allied’s gross leasable area, according to National Bank Financial.

Allied’s stock has rebounded 16 per cent this year. That still trails an index of Canadian real estate companies, but the easing of the pandemic should have a positive impact on the company’s leasing momentum, CIBC analyst Scott Fromson wrote after the second-quarter results.

Some of Canada’s largest employers, including Royal Bank of Canada and Sun Life Financial Inc., have already announced plans to keep flexible work arrangements in place over the long run. Those work models will evolve over time, said Williams.

“The hybrid model, which did exist pre-pandemic for certain situations, I think that will be more of a transitional phase than what the end state will be,” said Williams.

Whether or not that prediction turns out correct, the company recently increased its financial resilience, raising $500 million by issuing green bonds that mature in 2032. The proceeds will be used to repay borrowings due in coming years.

“We basically paid off most of our mortgages that we have on the books, now we have 97 per cent of our asset base unencumbered,” said Williams, adding that the company doesn’t have any maturities over the next four years. “We were able to fund all of our commitments for the next four quarters, so we don’t need to go to either of the capital markets until the middle of next year.”

Source Financial Post. Click here to read a full story

Soneil Investments Acquires Two GTA East Industrial Assets for $120M

Soneil Investments has purchased two industrial assets for $120 million in the eastern portion of the Greater Toronto Area. The two properties, acquired separately, are located at 1160-1170 Birchmount Rd. in Toronto, ON and 202 South Blair St. in Whitby, ON. Cumulatively, the assets contain three multi-tenant buildings of over 665,000 square feet on 41 acres of land. The transactions mark acquisitions surpassing $300 million year-to-date for Soneil as the company continues to execute its aggressive expansion strategy.

“We are excited to continue our 2021 momentum by adding these properties to our portfolio” says Neil Jain, President and CEO of Soneil Investments. “Both assets have rents 25-30% below market rent as well as excess land in the case of South Blair, which aligns perfectly with our add-value strategy.”

Industrial real estate has remained the most targeted asset class in commercial real estate, with Toronto in particular proving itself to be a leading North American city for investment. As vacancy rates remain at an all time low and surging rents are fueled by e-commerce-driven shifts in consumer habits, capital continues to flood the asset class searching for quality product.

“We’ve been acquiring industrial assets in GTA East since the early 2000’s” says Sach Jain, Chairman of Soneil Group of Companies. “The area has long been undervalued from an industrial perspective until the recent rise of rents over the last few years, so we look forward to the growth that these markets will continue to have.”

About Soneil Investments:

Soneil Investments is one of Canada’s leading private real estate corporations with a portfolio of over three million square feet. Soneil owns and manages office, industrial, and retail space across the Greater Toronto Area. Their core strategy lies in investing in assets with stable returns and uncovering opportunities to extract significant value. Soneil continues to seek further opportunities to invest in real estate investments, developments, and most recently to raise external capital.

Sorce Soneil Investments . Click here to read a full story

. Click here to read a full story

Rundown Corner On Yonge St. In Toronto Now For Sale For $27 Million

If the exorbitant prices of housing in Toronto aren’t quite enough to really bemuse and dispirit you, the city’s commercial real estate market will likely do it.

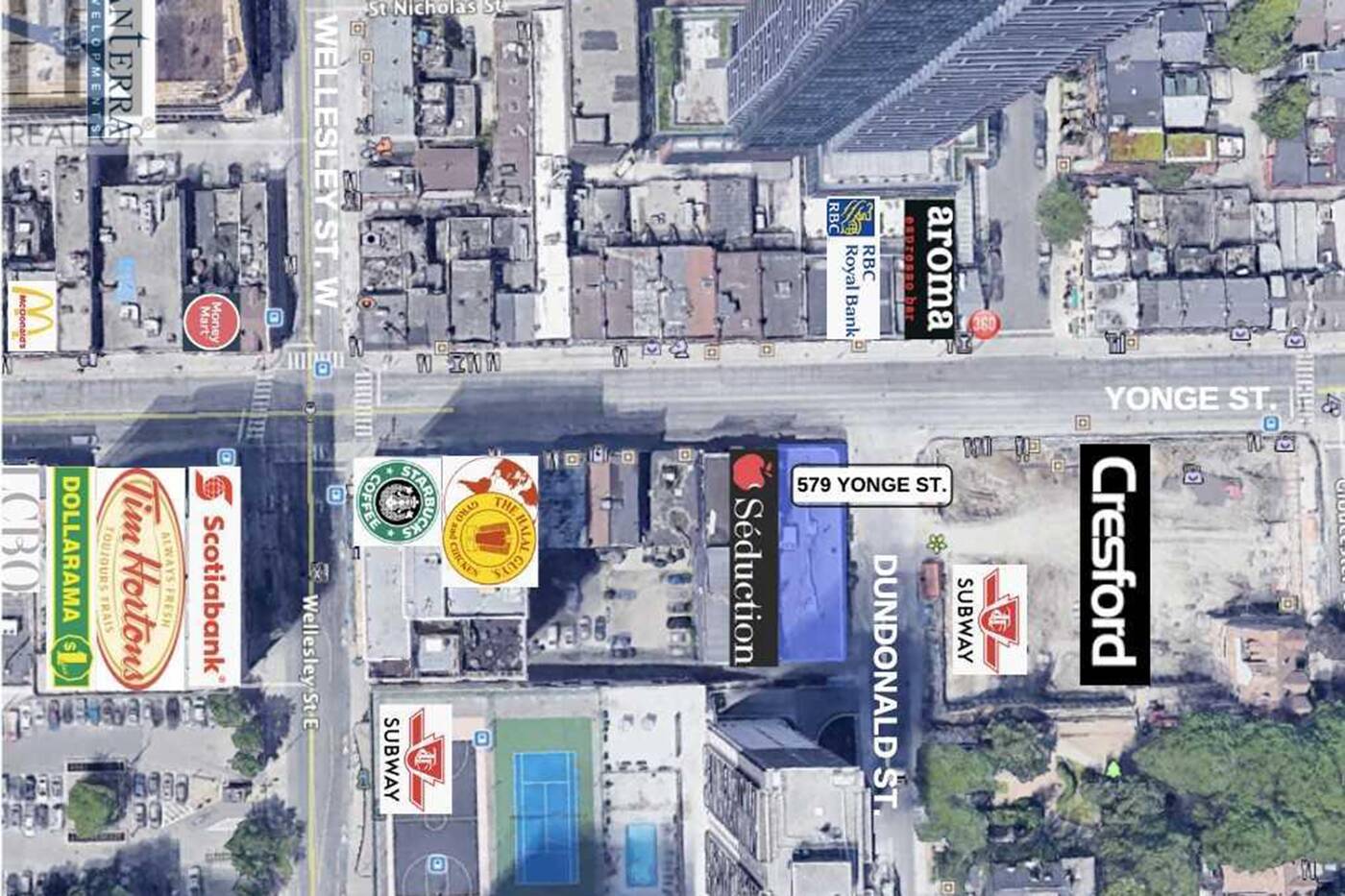

Take, for example, a corner lot on Yonge Street that is now going for a staggering $27 million — more than 15 times the cost of an average detached house in the city (a figure that is shocking on its own).

Evidently priced with condo developers in mind, the 39 by 100 foot lot at 579 Yonge just north of Wellesley has most recently been the home of Nick’s Sport Shop, a store that a few years ago started selling handguns to counter a firearm ban being pushed by Mayor John Tory.

It appears that the two-storey retailer was open until mid-June of this year, when it posted on social media that it was temporarily closing with no reopening date in mind.

“At this time we do not know when we will reopen. Emails will continue to be responded to but calls will go unanswered. Orders that have not been fulfilled will be canceled,” Nick’s wrote in an Instagram post on June 13.

The listing for the property refers to it as an “excellent corner redevelopment opportunity to own a commercial building in the heart of downtown Toronto,” also touting it as one of the last intersections on such a major street to be razed and turned into condos or office buildings.

It also notes that Nick’s will be fully out of the building — which has frontage on both Yonge, the city’s key thoroughfare, and Dundonald St. — by the time the sale closes, if buyers don’t balk at the price (with $135,008 in annual property taxes, to boot).

But, what the listing fails to mention is that the 10,000 square foot low-rise structure itself is registered as a heritage property as part of the Historic Yonge Street Heritage Conservation District — something that surely won’t please prospective developers.

Built in 1951, the corner building does visibly have a unique Art Moderne style with a curved corner, window lintels and other architectural features of the time.

But with the way Toronto seems to treat its few historical gems, keeping only an exterior facade, potentially to some Frankenstein-like effect, will likely be all that the property’s new owner will have to do.

Source BlogTO. Click here to read a full story

First Capital executes $400M in sales, development JVs

First Capital REIT has agreements to sell three of its Western Canadian shopping centres, and has entered into partnerships on two major Toronto development properties. In total the four transactions amount to approximately $400 million.

The REIT is selling neighbouring retail properties in Airdrie, Alta., the Towerlane Centre and Airdrie Village. It is also selling the Langley Mall in Langley, B.C.

In Toronto, First Capital is selling a 50 per cent interest in its Station Place mixed-use development at Dundas Street West and Aukland Road to Centurion Apartment REIT. It will also partner with Pemberton Group to develop the 28-acre former Christie Cookie factory site located at 2150 Lake Shore Blvd. W. at Park Lawn Road.

“Collectively, these transactions achieve several of First Capital’s strategic objectives, including crystallizing value created through the zoning, entitlement, and property development processes while also maintaining a share of future potential value growth, strengthening our balance sheet, and further aligning our real estate portfolio with our super-urban strategy,” said Adam Paul, the president and chief executive officer of First Capital, in the announcement Tuesday night. “Notably, we have met these objectives while selling the properties at prices that are well in excess of their respective IFRS values.

“In a broader sense, the transactions exemplify the significant future value enhancing opportunities embedded in First Capital’s deep development and density pipeline.”

First Capital is an owner, operator and developer of grocery-anchored and mixed-use properties in Canada’s largest cities. It has $10 billion of assets under management.

Pemberton partners on Lake Shore development

First Capital exercised its option to purchase CPP Investments’ 50 per cent interest of their 28-acre development site in Etobicoke for $56 million, and subsequently sold it to Pemberton Group for $156 million.

“The master plan is complete and zoning will soon be in place, permitting 7.5 million square feet of density plus many elements reminiscent of a complete community, including parks, public realm, transit and other infrastructure, as well as extensive community services,” Paul said during the REIT’s Aug. 5 Q2 2021 earnings call.

“Therefore, it is the appropriate time to add a strategic and aligned partner with deep residential and major construction expertise. We feel Pemberton Group, an existing partner of FCR, was a superb candidate, and we’re thrilled to expand our partnership on such an important development.”

The purchase price will be paid in three installments: $56 million on closing; $50 million on or before Dec. 31, 2022; and the remaining $50 million plus interest on or before the fifth anniversary of the closing.

Pemberton is one of the largest residential condominium developers in the Greater Toronto Area. It has completed more than 17,000 units and has 6,000 under construction.

This will be First Capital’s largest development and involves multiple phases spanning several years.

First Capital and CPP Investments acquired the site in 2016 to transform the large brownfield site. They engaged the U.K.-based Allies and Morrison architectural firm to help bring the project’s vision to life.

The next phase will include site and transit infrastructure improvements, followed by residential and mixed-use construction. Plans are for residential, retail and commercial uses, including approximately 750 affordable housing units and a minimum of 3,000 family-oriented units.

The development will also include: two large public parks; two civic squares; provision for two elementary schools; a covered retail galleria; a public library; a community recreation centre; public daycares; and a multi-modal transit hub integrating Toronto Transit Commission and upcoming GO Transit train service.

“Pemberton will provide all development and construction management services in connection with the residential and the infrastructure works,” First Capital executive vice-president and chief operating officer Jordie Robins said during the earnings call. “First Capital will act as development manager of the retail and commercial components and, upon completion, will act as property and leasing manager for the retail and commercial space.”

The Station Place partnership

First Capital has a binding agreement to sell a 50 per cent interest in Station Place to Centurion Apartment REIT. The agreement also involves its existing partner at the site, Main & Main.

When the transaction completes, which is expected in Q3 of 2021, First Capital’s stake in the property will be 35.4 per cent, down from 70.8 per cent currently.

Station Place is a purpose-built rental development consisting of a 40-storey tower containing 333 rental apartment units and 50,000 square feet of retail, anchored by Farm Boy. It’s nearing completion, with the first residential occupancies having commenced in June.

The property is adjacent to Kipling Station, a multi-modal transit hub with connectivity to the TTC, the GO train and the Metrolinx Kipling bus terminal.

“The transaction partners First Capital with an aligned residential owner and manager that has experience with multi-residential assets in Canada and the United States,” the announcement states.

Centurion will be the property manager on completion of the development.

Towerland Centre, Airdrie Village and Langley Mall

Located in the Calgary suburb of Airdrie, the Towerland and Airdrie Village centres are situated on 22 acres of land and anchored by Safeway, Dollarama, Staples, Shoppers Drug Mart and Goodlife Fitness. The properties have 250,000 square feet of net rentable area and are 95 per cent leased.

Langley Mall is a 137,000-square-foot shopping centre anchored by a No Frills grocery store and is 96 per cent leased. The property has long-term redevelopment potential but, like the two Airdrie properties, its demographic statistics are “notably inferior” to First Capital’s overall profile, the trust says in the announcement.

One of Langley Mall’s anchor tenants failed in early 2020. Owing to the tenant’s long-term lease at a below-market rate, the turnover created a substantial increase in property value and presented an opportunity for First Capital to divest.

Both the retail transactions are slated to close later in 2021.

All the transactions remain subject to customary closing conditions.

Source Real Estate News Exchange. Click here to read a full story

50-Storey Mixed-Use Tower Could Rise Near Yonge and Bloor

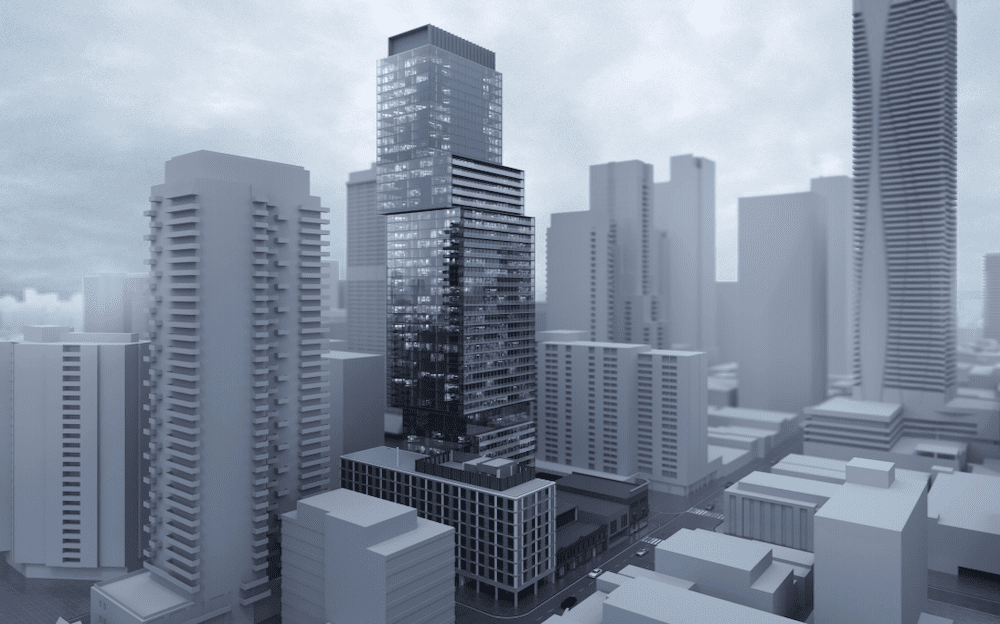

A stretch of land home to a mix of heritage office and commercial buildings two blocks south of Yonge and Bloor is on the path to be transformed into a 50-storey mixed-use tower.

Last month, Toronto-based developer Mattamy Homes — which recently announced it was going to be expanding into high-rise condo developments — submitted a Site Plan Approval application to city planners to build a mixed-use development, including a 50-storey residential tower designed by architectsAlliance that would hosue 465 residential units on the northern portion of the site while maintaining the conservation and retention of an 8-storey mid-century office building at 10 St Mary Street and retail storefronts along Yonge Street.

The development site is located just south of Bloor Street, bordered by St. Nicholas Street to the west, Yonge Street to the east, Charles Street to the north, and St. Mary Street to the south.

If the project gets the green light, the tower would have a non-residential gross floor area (GFA) of 9,081 square metres and a residential GFA of 32,433 square metres.

Eight properties currently occupy the site, including the aforementioned eight-storey office building, five commercial buildings at 710-718 Yonge Street, and a two-storey brick former stable building at 81-85 St. Nicholas Street. All of the properties are designated under the Ontario Heritage Act.

According to the project’s Heritage Impact Statement, many of the buildings that presently occupy the block bounded by Yonge, St. Mary, St. Nicholas, and Charles streets were constructed during the latter half of the 19th and early 20th centuries, following the extension of Charles Street westward from Yonge Street in the 1880s.

According to the application’s cover letter before Mattamy Homes acquiring the site, Lifetime St. Mary Inc. was the site’s previous owner. After submitting a rezoning application to the City for the demolition of the existing office building at 10 St. Mary Street, the application was appealed to the Ontario Municipal Board (now the Ontario Land Tribunal, or OLT) on July 16, 2015, for failure to decide within the prescribed timelines under the Planning Act.

The current owners acquired 10 St. Mary Street, along with 79-85 St. Nicholas Street and 718 Yonge Street, in 2016 and assumed the application and appeal from the previous owners. In 2017, the OLT approved zoning by-law amendments for a portion of the site, and the new owners expanded the site by acquiring a private laneway and the listed heritage properties at 710, 712, 714, and 716 Yonge Street.

A new settlement offer was then endorsed in 2019 by the City, after which updated proposed zoning by-law amendments for the additional properties were approved. Now, the new owners of the site are proposing minor revisions to the settlement plans.

The new owner is looking to slightly reduce the height of the tower from 51 to 50 storeys, with a minor increase to the building’s overall height. There is also a modest increase in the number of units — from 456 to 465 — with a slight increase in the residential GFA.

Of the 465 residences, the breakdown would include 25 bachelor suites, 211 one-bedrooms, 45 one-bedroom-plus-dens, 118 two-bedrooms, 16 two-bedroom-plus-dens, and 50 three-bedroom units according to the architectural plans. The units would be tenured as condos, as per the application’s project datasheet.

The development will continue to provide for an enhanced streetscape along St. Mary Street and provide for the conservation and retention of the 8-storey office building located at 10 St. Mary Street, with retail uses along Yonge Street and St. Nicolas Street behind the retained heritage facades.

The building will also feature indoor and outdoor amenity spaces, including two outdoor areas and an indoor pet spa.

A multi-level underground parking structure is also proposed, featuring four storeys of below-grade parking accessible off St. Nicolas Street via the existing parking garage entrance for the office building at 10 St Mary Street. There would be room for 105 vehicle parking spaces and bicycle and locker storage.

Source Storeys. Click here to read a full story

CIBC SQUARE South Tower Welcomes Tenants as North Tower Work Advances

The most significant Downtown Toronto office development since Brookfield Place was constructed in the 1990s, the CIBC SQUARE office complex by Hines and Ivanhoé Cambridge remains a hot topic on UrbanToronto. Designed by UK-based WilkinsonEyre Architects with Toronto’s Adamson Associates, the complex will consist of a matched pair of towers—turned at near 90-degree angles to each other—the first of which, the south tower, which recently began to welcome tenants, stands 49 storeys above the corner of Bay and Lake Shore.

The south tower construction is practically complete now, with landscaping and other public realm work among the final steps left in construction. Trees and shrubs have been planted, and new stone planters along with sidewalks added to form a welcoming face along Bay Street.

One of the most prominent remaining elements is a multi-level staircase that will soon give pedestrians access from street level to a new elevated park being built atop the rail corridor. The metal structure of this staircase is now fully in place, with vertical supports for railings partially obscured by temporary red safety fencing. While there will be other ways for office tenants and the public to access the elevated park, this prominent access point will serve as a visual cue directing pedestrians up from Bay Street.

The rail overbuild park is being constructed in phases, with the initial phase racing towards a projected late summer opening, hot on the heels of the first phase’s recent arrival of tenants. The second phase of the park is now well underway, its steel structure decking over the eastern approach to Union Station, eventually to extend the park as part of the 50-storey second phase tower now beginning construction to the north.

CIBC SQUARE’s second phase is being constructed on the site of the previous Union Station GO bus terminal. (The buses have since moved into a larger, fully-enclosed, more modern terminal in the south tower podium.) North tower construction began this past spring with the arrival of shoring rigs. Perimeter caisson drilling was completed in July, which allowed the large shoring rigs to be demobilized and for excavation to advance, since going deep enough to allow the start of tieback drilling to secure the shoring walls.

During the early stages of the excavation, the construction team encountered buried reinforced concrete foundations, part of the previous GO Bus Terminal which was on the property. They were addressed in a late July update posted to the project website stating: “While we continue to make significant progress at 141 Bay Street, please note that our crews have exposed abandoned foundations below grade at the site. These abandoned foundations must be removed promptly in order to maintain the construction schedule at CIBC SQUARE. As a result, our crews may be working earlier than previously communicated. The removal work on the abandoned foundations will be intermittent over the next few weeks, and is expected to be completed by the end of August.”

The team also had to remove I-beams—or W-sections—seen amongst machinery and equipment below, which were temporary supports from an early enabling slab needed for the project logistics to create a construction delivery/staging laneway on the site.

CIBC SQUARE’s north tower is expected to welcome its first tenants in 2024.

Source Urban Toronto. Click here to read a full story

Plaza Retail REIT Continues Construction Projects, Growth In Second Quarter

Plaza Retail REIT’s quarterly earnings report indicated strong continued growth in the second quarter of 2021.

The company says they have begun transitioning from pandemic recovery to looking for opportunities for growth.

“Our portfolio of essential needs and value retail open-air centres located in primary and strong secondary markets across a wide geography are performing well,” said Michael Zakuta, president and CEO of Plaza in a conference call to investors last Friday. “Our focus has clearly shifted from managing the effects of the pandemic to pursuing growth opportunities.”

Plaza Retail REIT’s stock was trading at $4.57 a share at the end of last week, up from $3.44 the same time last year. Their market cap sat at $463.16 million at the end of last week.

The company says rent collection remains high at 98.5 percent with $29.95-million in total revenue.

On the call, they noted that construction costs remain high, and the company is combatting this with higher rents and lower financing costs.

“It is not always possible to move rents higher, but we are benefiting from lower interest rates, and higher lower tax rates that help us to maintain our net development margins,” said Zakuta.

Some of the second quarter’s projects in Atlantic Canada during the second quarter of 2021 included construction on an IHOP and A&W in Bedford, Nova Scotia’s Hogan Court Plaza, as well as the opening of Global Pet Foods in Fredericton, New Brunswick, COBS Bread in Dartmouth, Nova Scotia, Pet Valu in Liverpool Nova Scotia’s Queens Place Drive Plaza, and an Esso in Bedford’s Hogan Court Plaza.

Plaza Retail REIT operates in Ontario, Quebec, and the Maritimes with a $1.2 billion total asset value. They are a leading property owner in Canada and are developers and managers of retail real estate.

Source Huddle. Click here to read a full story

Canadian office leasing market showed early signs of recovery in second quarter of 2021: Morguard

- Office leasing activity showed signs of increased business confidence due to a more optimistic economic and public health outlook

- Multi-suite residential rental and industrial properties remained popular with investors

- Demand for retail properties with defensive attributes remained relatively stable and positive

The Canadian office leasing market displayed early signs of recovery in the second quarter of 2021, according to Morguard’s 2021 Canadian Economic Outlook and Market Fundamentals Second Quarter Update (“Morguard”) (TSX: MRC). Investors continued to target multi-suite residential rental and industrial property acquisitions given the rising economic optimism. The brisk roll out of the nation’s vaccine program and resulting uptick in domestic demand is expected to continue to increase investor confidence across the major commercial real estate segments in the second half of 2021.

“Prime office sector investment properties and necessities-based retail were popular with investors, and multi-suite residential rental and industrial remained attractive investment options,” said Keith Reading, Director, Research at Morguard. “Positive shifts in the market moving forward, are attributable mostly to a return to post-pandemic normalcy and continued economic recovery.”

Multi-Suite Residential Rental Real Estate

The multi-suite residential rental segment experienced strong interest from investors in the second quarter of 2021. The brisk roll out of the nation’s vaccine program and relaxing of pandemic restrictions will support the return of foreign students and international immigrants in the late summer and early fall. As a result, multi-suite residential rental demand will increase substantially. With two quarters of consistent, strong performance, demand for multi-suite residential rental assets will remain robust among investors looking at assets with strong and sustained performance.

Commercial Real Estate

In the office segment, investors were generally cautious in the second quarter despite economic optimism as they focused largely on stabilized assets with strong tenant profiles in prime locations. Early signs of recovery were observed in Canada’s office leasing market as activity levels picked up between the beginning of April and the end of June. Renewal discussions increased in several markets, particularly in Canada’s downtown business districts. Demand for sublease space increased for the first time in the past year, and a growing number of tenants removed sublease space from the market for their own needs. Office market fundamentals are expected to gradually improve over the balance of 2021 as workplaces reopen and workers return to in-person configurations.

The industrial segment continued its impressive run during the second quarter of 2021 as transaction closing activity remained high with strong interest from institutional, private, and public capital groups. A limited supply of functional warehouse, distribution and logistics assets across the country resulted in aggressive bidding. Leasing conditions remained tight in the second quarter, with the national availability rate dropping to an all-time low of 2.3 per cent, leading to rent increases and increased investment demand. Industrial investment activity is expected to remain robust into the second half of 2021 and into 2022.

Demand for retail properties with defensive attributes, especially those with grocery, drug store, financial services, and liquor store tenants, remained relatively stable and positive. Despite increasing optimism for a return to in-store shopping, properties with non-essential services did not receive as much investor attention. Investors will continue to invest with caution until a more significant number of consumers return to retail destinations as provincial restrictions loosen and stores fully reopen.

Economic Factors

Restrictions on businesses and consumers designed to combat the third wave of the pandemic reduced economic output in the second quarter, with Canada’s economy contracting in April – the first time in a year. Labour market conditions softened, largely due to the public health measures which limited economic activity and reduced business confidence. The nation’s employment level stood 3.0 per cent below the pre-pandemic level of February 2020. Job growth is expected to steadily improve, recouping the second quarter losses. However, it may take time to fill some positions, particularly in the high-touch industries that lost the largest share of workers during the pandemic.

The Bank of Canada maintained its accommodative monetary policy during the second quarter. The Bank announced it would hold its overnight target rate and Bank Rate at 0.25 per cent and 0.5 per cent, respectively. The strength of the nation’s economic recovery is expected to be a key consideration in the bank’s monetary policy normalization schedule moving forward following a prolonged period of support.

Canada’s Consumer Price Index rose 3.6 per cent year-over-year in May 2021, representing the largest annual increase in a decade. A marked increase in consumer prices was reported in most tracked spending categories tracked. More moderate price growth is forecast for the second half of the year.

SOURCE Morguard Corporation. Click here to read a full story

Doug Ford’s Administration Accelerates Huge Futuristic Development Near Lake Simcoe

The province approved a special order to accelerate a development in Innisfil that will turn agricultural fields into a futuristic, traffic-oriented development surrounded by concentric rings of condominiums and townhouses.

Over the next 20 years, Orbit’s proposal (approved by the Minister’s Zoning Order, or MZO) will increase the population of Innisfil, which currently has fewer than 40,000 people by another 20,000. A proposed future phase of development would see the population grow by 150,000.

A local environmental group opposed to the project, given its potential impact on nearby Lake Simcoe already suffering due to development pressures, said the contentious project’s approval is the “last cut in the bureaucracy for developers.”

“Once again, the government has put development interests before environmental concerns and public transparency,” said Claire Malcolmson, executive director of the Rescue Lake Simcoe Coalition. “There is nothing in the MZO that talks about safeguarding the lake.”

Orbit was one of seven MZOs issued by Municipal Affairs Minister Steve Clark over the past two weeks. The Doug Ford administration has issued 53 MZOs since it came to power in 2018.

Clark called Orbit’s announcement “a good example of how our government is using the minister’s zoning orders, in partnership with municipalities, to help get shovels down quickly on important projects that will benefit residents for generations.” , in a statement issued by the city. from Innisfil on Monday.

The MZO for Orbit approved the first two phases of the three-part project on the 6th Line and the Metrolinx Rail Line, focusing on development around a GO station. The station will be built by Cortel Group, a company headed by Mario Cortellucci, a prominent developer and donor to Doug Ford’s 2018 election campaign.

In its statement, the city said the project was “designed to prevent urban sprawl.”

On its website, the city said it wanted to accelerate the project through an MZO to ensure the developer could “secure financing for the construction of the proposed station … and meet the designated construction deadline.”

On the same day the MZO was issued, the province also proposed a regulation that would require the Lake Simcoe Region Conservation Authority (LSRCA) to issue a permit for Orbit within 45 days of receiving the development request.

If finalized, the regulation will allow development to begin before a green compensation agreement is completed between the authority and the developer. The agreement is intended to offset any environmental impact on sensitive lands with money.

“This approach would accelerate development while still requiring compensation for ecological impacts,” according to the regulation.

Tim Cane, director of growth for the city of Innisfil, said he is not concerned about the fast-track green deal or the acceleration of development.

“LSRCA is a key partner for the city and they will be at the table as the city processes the subsequent required requests for the site plan and building permits,” said Cane.

Cane also said the MZO “includes the protection of environmental lands” and will have to comply with all local county and provincial policies, including the Simcoe Lake Protection Plan. He also said that environmental studies will be required.

But Malcolmson said this is an example of the “province changing the rules to give developers the upper hand.”

He also said that even though the project is presented as smart growth, it will not get people out of cars. A survey of potential GO users in the area found that the majority said they would drive to the station.

“If that was the end of the game, this GO station would have been planned next to an existing city, not in the middle of the agricultural field,” Malcolmson said. “People are not going to want to buy a condo on a train line in a farm field and I worry that at the end of the day we are just going to have more expansion.”

Recent Star research on MZOs found that companies associated with Cortellucci have received four MZOs. Orbit would be the fifth.

Source The Canadian. Click here to read a full story