Author The Lilly Commercial Team

Application Submitted to City to Transform Scarborough Church Into Rental Apartments

United Property Resource Corporation is looking to redevelop a site that currently houses the Church of the Master located at 3379 through 3385 Lawrence Avenue East in Scarborough. The developer has recently submitted a Zoning By-law application to the City of Toronto, and is proposing to build a 10-storey rental apartment building with 112 residential units on the south side of Lawrence east of Bellamy Avenue.

The surrounding area consists of a variety of residential, commercial, and community uses, including places of worship, low-rise residential uses, apartments, long term care facilities, commercial storefronts, and public parks. The Church of the Master that sits on the site was constructed in 1958, and was formerly known as Bendale United Church. The existing 6-storey apartment building that shares the site was constructed in 1992 and contains 48 units of subsidized rental housing. The redevelopment proposes the demolition of the existing church, the retention of the existing 6-storey residential apartment building, and the addition of a 10-storey rental apartment building along the eastern portion of the site.

The proposed development is designed by KPMB Architects to provide a transition in height from the northeast corner of the site, adjacent to Lawrence, towards the rear of the site where the height is reduced to 2 and 3 storeys. Along Lawrence Avenue East, a 10-storey height is proposed, with a 6.5 metre separation provided to the existing 6-storey residential apartment building.

The intent of the proposed development is to provide a much-needed mix of affordable and market rate rental housing on underutilized portions of the site, which include the existing surface parking lot, as well as the place of worship portions of the site. All proposed residential units within the new building are to be of rental tenure, with 30% to be affordable units at 80% of median market rent.

The proposed building has a total gross floor area (GFA) of 9,095m². With the existing residential building having 6,709m², the total GFA would be 15,804 m² for a total FSI of 2.6. The 112 new residential units include a mix of 1, 2, and 3 bedrooms. Beyond affordability, the proposed development would offer family friendly amenities, a large courtyard, timber construction, and passive ventilation. Passive House Certification and Zero On-Site Carbon are also being pursued, with geothermal to be explored throughout the development process.

The site is currently home to 48 surface-level parking spots. The proposed development would offer another 55 spots within a single underground parking level, which would bring the total number of spots to 103.There are also 148 bicycle parking spaces proposed.

The site is well-serviced by three TTC bus routes that stop directly in front of the site. The buses connect to the Line 2 and 3 trains, which can take riders downtown. Eglinton GO Station is also located approximately 2.5 kilometres south of the site, and can be accessed by a 4 minute car ride, 11 minute bike, or a 10 minute bus ride.

More information on this development will come soon, but in the meantime, you can learn more from our Database file for the project, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread, or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Walmart creating global tech hub in Toronto, part of $3.5-billion investment

Walmart Inc. is making Toronto one of a pair of new global tech hubs, with plans to hire hundreds of workers at the two sites.

The retail giant says it chose Canada’s largest city and Atlanta, Ga. as hubs because of their growing tech sector presence and their broad and diverse local talent pools.

“We are excited to join the vibrant and diverse tech communities in Toronto and Atlanta,” said Suresh Kumar, chief technology officer and chief development officer at Walmart.

“Work from these new hubs will impact millions of lives and transform the future of retail.”

The initial hiring phase in Toronto will include 45 full-time roles in software development, technical program management and product management. Initial hiring in Atlanta is expected to include 140 new full-time roles.

Walmart says deploying the latest technology is part of a $3.5 billion investment for Canada announced in 2020 to make the online and in-store experience simpler, faster and more convenient for its customers.

The company also says that the development of this technology hub will keep homegrown tech talent in Canada.

The expansion is part of Walmart Global Tech’s plan to hire more than 5,000 employees globally this fiscal year.

The addition of Toronto and Atlanta will increase the number of Walmart Global Tech hubs to 16, including Seattle and Chennai, India that launched last year. The number of global tech employees increased 26 per cent last year to 20,000.

“Canada has a dynamic and world leading tech community powered by talented people and innovation that is recognized on a global scale,” stated Nicolai Salcedo, chief technology and data officer of Walmart Canada in a news release.

Walmart’s 2020 decision to spend $3.5 billion in Canada over five years came as the COVID-19 pandemic accelerated e-commerce trends and altered the way people shopped.

Canadians are more familiar with online shopping than they were in 2019, and retailers are expanding their offerings through capsule collections, resale agreements and other initiatives.

The aim of Walmart’s Toronto tech hub investment is to keep up with these changes and boost the company’s presence in Canada, the company said.

The investment also includes the renovation of 150 stores.

Source CP24. Click here to read a full story

Fitzrovia’s The Grainger and The Sanderson Coming to Old Town Toronto

Toronto’s most historic area is soon to be home to Fitzrovia Real Estate’s latest purpose-built rental project. At King and Princess streets in Old Town Toronto, The Grainger and The Sanderson will each have their own unique personality and heritage charm. The Grainger is poised to appeal to down-sizers and young families, while young professionals will be drawn to the offerings of The Sanderson. The buildings will offer an opportunity for all kinds of residents, while opening up new residential possibilities in an area that is currently undersupplied in rental housing.

Located among the shops of the design district, the towers will be close to the financial district, St Lawrence Market, and the Distillery District. The area is home to some of Toronto’s most valued heritage buildings such as St Lawrence Hall, the Flatiron Building, and St James Cathedral, and The Grainger and The Sanderson will contribute to maintaining the character of the Old Town community by incorporating a number of its own heritage buildings – consisting of three- and five-storey red-brick buildings – into its podium.

Within its two Turner Fleischer Architects-designed towers rising to heights of 38 and 40 storeys, the project will become home to 770 units, with The Grainger holding 370, and The Sanderson offering 400. The buildings will feature a range of studios, one-, two- and three-bedroom units. Below its new facades will be the retained portions of four heritage buildings that currently sit on the site, dating back to the 1800s. This includes the Carter, Cummings Company Building at Adelaide and Ontario streets, Nobel’s Tavern on the northeast corner of King and Princess streets, the building known as the Drug Trading Company Warehouse fronting onto Ontario Street, and the Charles Steinle Meat Packing Company building facing King Street.

“This masterplan is a standout illustration of urban design,” said Adrian Rocca, CEO and founder of Fitzrovia, “The community will be centred around a spacious public park in the middle of the burgeoning King East office corridor.”

The courtyard that currently sits within the U-shaped configuration of heritage buildings will remain, and will become a 5,000 ft² public park. The base of the building that will surround the park will come to house both retail and loft-style office spaces. There will be 20,000 ft² of ground-floor retail space that will likely include food and beverage uses, as well as 50,000 ft² of office space that will feature restored and refurbished brick and beam interiors, carrying the heritage character of the exterior into the interior workspace.

“We are excited to work with Fitzrovia on a precedent setting purpose-built rental community. The Grainger and The Sanderson will be a world-class project taking inspiration from the preserved heritage buildings,” said Jamie Phelan, Creative Director at DesignAgency, the design firm heading the interiors of the project. “The design narrative will illuminate the story of those who once worked and walked through the spaces. By pairing historical materiality and detailing with contemporary lines and forms, the spaces will feel warm and inviting for residents of any age and background.”

The design of the new buildings has been drawn from the various historic influences. According to DesignAgency, three main design principles have been crafted to bring inspiration from different aspects of the history of the neighbourhood. Historically Tailored draws inspiration from old-world influences of the building’s history, like Nobel’s Tavern. The design will feature thoughtful details, warm lighting, and traditional styles with modern touches. Charismatic Character is influenced by the Second Empire and Neo-Gothic architecture of the buildings. Geometric and floral patterns will bring a sense of heritage contrasted with modern influences from the local design district. Finally, Ingenious Industry has been inspired by the industrial architecture of the Carter, Cummings Company and Drug Trading Company warehouse buildings, as well as their meatpacking, brewing, and medicinal manufacturing past. These industrial influences will inspire the design of the spaces.

“Our future residents will appreciate hotel-quality hospitality, a wide collection of amenities, and well-appointed finishes and best-in-class design,” said Rocca. The Grainger and The Sanderson are poised to include a slew of both indoor and outdoor amenities for its residents to enjoy. Indoor amenities are planned to include lounge and dining areas, a sports lounge, screening rooms, an entertainment kitchen, a bowling alley, commercial grade fitness centre and yoga studio, bike repair shop, a pet spa, and a spa for residents. Outdoor amenities will include resort-style pools, and a gas barbecue and terrace lounge area. The building will also have multiple child friendly options, including a Montessori school, and both indoor and outdoor playrooms. Fitzrovia also offers a number of non-physical perks for its residents, including a mobile app and curated monthly resident events that are complimentary and open for residents to participate in.

In terms of access to transit, the new building will front onto King Street, and therefore will have the King streetcar passing in front of it on a regular basis, and will be not far from the multiple bus routes that run along Sherbourne Street. The site is also just a short walk to both King and Queen subway stations. In the future, the new Corktown Station of the Ontario Line will be located a block east of the development, offering even more transit options to residents.

Demolition work on the property is expected to begin in the fourth quarter of 2022, once Fitzrovia receives vacant possession. Shoring and excavation are expected to begin next February or March. Rocca anticipates construction taking 38 months to complete, with occupancy for The Grainger and The Sanderson expected in the third quarter of 2025.

You can learn more from our Database file for the project, linked below. If you’d like, you can join in on the conversation in the associated Project Forum thread, or leave a comment in the space provided on this page.

Source Urban Toronto. Click here to read a full story

Canadian Real Estate Agents And Brokers See Record Revenues And Record Profits

Canada’s booming real estate market is making it rain for the industry. Statistics Canada (Stat Can) data shows agents and brokers collected record revenue in 2020. Despite a slow second quarter, elevated demand in the second half more than made up for the hiccup. Strong demand (and price growth) helped to drive the largest profit margins ever. The national statistics agency expects the following year’s numbers will be even larger.

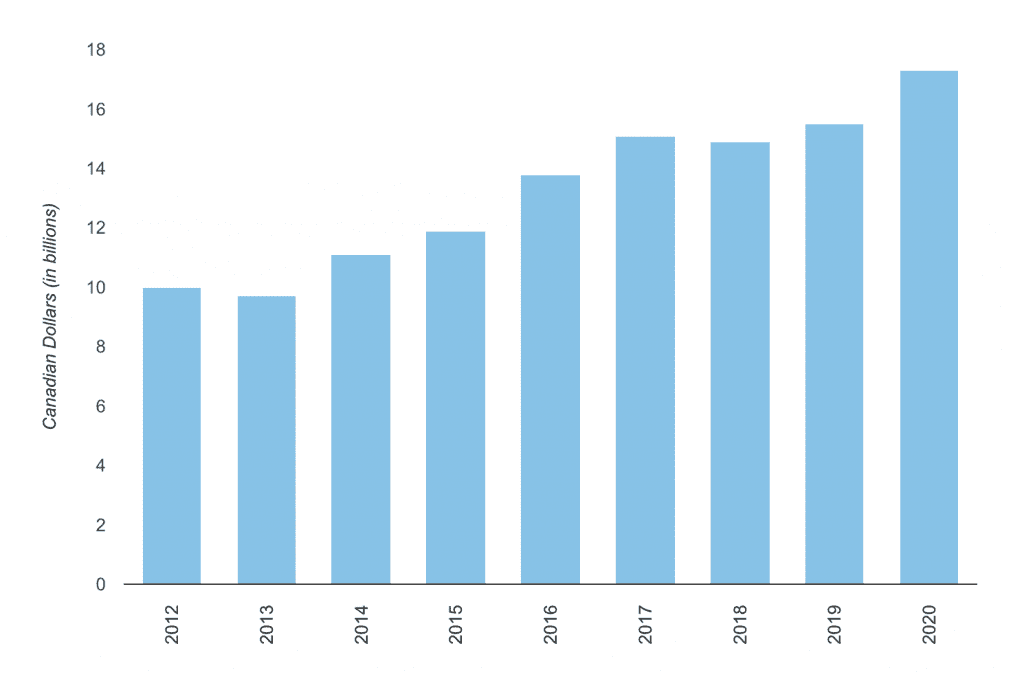

Canadian Real Estate Agents And Brokers See Highest Revenue Growth Since 2016

Canadian real estate agents and brokers pulled in record operating revenues. Revenues topped $17.3 billion in 2020, up 11.4% from the previous year. Even with the drop-off in sales for the second quarter, revenues saw the fastest growth since 2016. The remainder of the year more than made up for the brief slowdown.

Canadian Real Estate Brokerage Revenues

The annual revenue of real estate agents and brokers in Canadian dollars.

In Canada, it’s common for real estate agents and brokers to be compensated as a percentage of price. Surging prices and volumes predictably lead to higher compensation. Starting in 2020, both sales and prices began to take off, which is why the rise in revenue should be no surprise.

Nonetheless, the revenues are huge. Operating revenues are bigger than the Arts, Entertainment, and Recreation segment of GDP. Even pre-2020, before arts and recreation slowed. This isn’t all real estate either, but just the revenue agents and brokers collected.

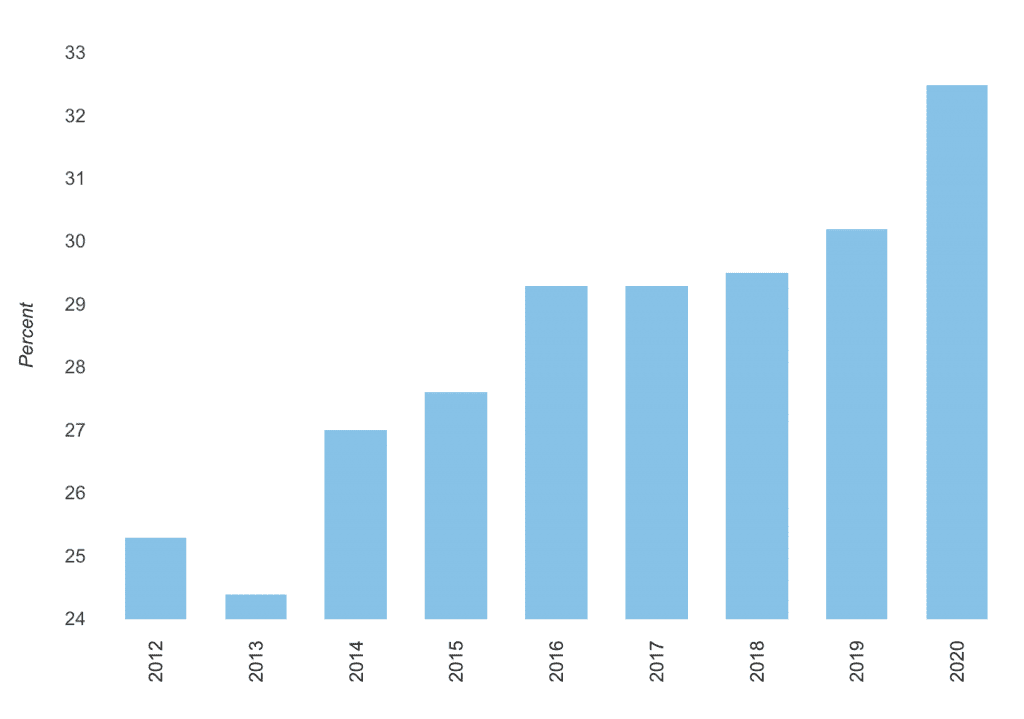

Operating Profits Reached A Record 32.5% In 2020

Operating profits have never been higher for real estate agents and brokers. The average profit margin jumped to 32.5% in 2020, up from 30.2% the previous year. Out of the $17.3 billion in gross revenue pulled in, $5.6 billion turned into operating profits. The industry has never seen such large margins, but once again this is somewhat expected.

Canadian Real Estate Sales Profit Margin

The profit margin for Canadian real estate agents and brokers, as a percent.

High demand, low inventory, and a central bank helicopter-ing debt were a big help. If buyers are circling the MLS for any new listings to bid on, it’s a lot cheaper to market properties. This isn’t always the case, but it most likely was the case in 2021 as well.

Compensation Grew At The Fastest Rate Since 2017

Real estate brokers and agent compensation, separate from profits, also hit a record. Agents, brokers, and admin were paid $1.77 billion in 2020, up 7.14% from the previous year. It was the largest jump since 2017, but not quite keeping up with the industry’s growth. To say Canada has a lot of real estate agents downplays it.

The compensation works out to just $12,142 per agent. Sales are also concentrated in a small share of top performers, leaving a lot earning close to nothing. Big numbers, but not considering how much of Canada’s economy is dependent on home sales.

The recent scorching hot market didn’t really take off until the year after. “It is expected that the real estate agents and brokers industry will reach new heights in 2021,” wrote the agency. Higher prices and increased dollar volumes are their reasoning for seeing records shattered in the next update.

Profitable and high-growth industries that persistently outperform lead to large misallocations of capital. This can be seen in a few areas, like the strong reliance on real estate prices as a share of Canada’s economy. Non-financial misallocation also occurs, such as a concentration of real estate sales people per capita. This makes it even more difficult for an efficient market to occur. However, the longer it persists, the stronger the misallocation becomes — making things worse.

Source Better Dwelling. Click here to read a full story

Commercial real estate sees record-breaking Canada-wide land rush

In Waterloo Region, in 2008, it cost $80,000 an acre to buy a vacant 28.5-acre site zoned for future industrial development. Demand for commercial land then soared, and a decade later, similar properties were selling for between $400,000 and $500,000 an acre.

But what seems like a remarkable appreciation pales in comparison to what’s happened to commercial land prices in the past year, real estate specialists say.

The Cambridge site on Maple Grove Road, for example, was just acquired by Dream Industrial REIT for $912,000 an acre. The plot received multiple bids as soon as it hit the market, even though the plot is irregularly shaped and wraps around other non-owned properties, making development a bigger challenge than a rectangular site.

“The Winnipeg market had been steady for the last 20 years, but what we have seen in the last 18 months has been insatiable demand for land and commercial space”

– Paul Kornelsen, vice-president of CBRE in Winnipeg

“Industrial, commercial and investment (ICI) land sales are on fire across Southwestern Ontario. We actually can’t find enough of it for those who want to buy it,” says Joe Benninger, vice-president with commercial real estate services firm CBRE’s Southern Ontario investment team. “The volume of land deals has been huge, and the momentum is expanding to cities that didn’t see much interest in the past.”

The rush is widespread, involving tens of thousands of acres of land in regions outside the Greater Toronto Area, including the Golden Horseshoe and all the way to Windsor, he adds. “Two years ago, we were talking between $300,000 to $450,000 per acre across Southwestern Ontario. Now it’s $800,000 to $1.5-million per acre.

“Take Hamilton: It used to be hard to sell ICI land there. Now there’s almost nothing left to buy, and prices are higher than ever,” Mr. Benninger adds. The 3,679 acres worth $498-million sold in Hamilton last year was an increase of 51 per cent from 2020, which was also a strong year for commercial land sales.

And the phenomenon is Canada-wide. Demand for distribution, warehousing and manufacturing sites is stripping supply and setting records, according to commercial real estate services firm JLL’s 2022 Canadian Real Estate Outlook.

Commercial space under construction across the country increased by 7.7 per cent quarter-over-quarter at the end of 2021 to 39.6 million square feet, well above the average in 2015-19. Both Montreal and Vancouver witnessed significant ground breakings on the quarter with minimal completions and were the primary drivers of the increase. The report concludes that “2022 is expected to see even greater deliveries as developers continue to race to satisfy demand.”

Across the country, vacancy rates are at historic lows and occupancy cost registered record highs. All local markets saw rental rates increase, with Montreal, Ottawa, Toronto and Vancouver all registering double-digit annual increases. Vacancy rates also declined in all markets, except Montreal, with Toronto and Vancouver sitting below 1 per cent vacancy.

Even Manitoba has experienced an unprecedented land rush. “The Winnipeg market had been steady for the last 20 years, but what we have seen in the last 18 months has been insatiable demand for land and commercial space,” says Paul Kornelsen, vice-president of CBRE in Winnipeg.

“Transactions are increasing; the number is triple what it was in 2019 and that doesn’t include owner occupiers who have small sites and build their own facilities,” he says. “We’re tracking the big institutional developers who are building on spec and finding tenants eager to lease.”

Prices per square foot in Winnipeg have gone from an average of $7 a square foot to $9 “and we’re projecting average lease rental rates to be at $10 in 2022,” Mr. Kornelsen says. New leases in new buildings are garnering up to $14.

Last year, there was a record-setting 1.2 million square feet of industrial property absorption in the city. Amazon opened two warehouses with a combined area of more than 200,000 square feet. These are much smaller than those in the Greater Toronto Area or Vancouver, but Calgary-based Hopewell Development Corp. alone is slated to build 300,000 square feet of new inventory in Manitoba this year. That number by itself would be a record for on-spec new development in a single year, he adds.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/BXXB333ZJZBIJGGE7NRX5KK2M4.JPG)

“We’re also seeing new entrants into the market – institutional developers who are in the city for the first time because it’s hard to buy land in Toronto, Montreal or Vancouver. They’re looking at Manitoba as an affordable alternative,” Mr. Kornelsen explains. “We’re also looking at a tenant whose lease has expired in Kelowna, and they cannot get space and [are] looking at Edmonton and Winnipeg as an alternative.”

It’s simply a matter of supply and demand, says Marshall Toner, executive vice-president and national lead industrial for JLL Canada. “You can’t just flip a switch. Land takes time to be zoned and serviced to be ready to develop.”

Markets that traditionally never had a high demand are now on the radar because there’s no other place for developers to go. Companies in Vancouver are looking in Alberta because there is not only land available but it’s at a significantly lower price and that can be sufficient to make them decide to change locales, Mr. Toner says.

“There’s such massive demand now that buyers don’t want to wait,” he adds. “If you have a piece of land that’s ready to go, there will be multiple bidders and the price is just going to continue to rise this year.”

The land rush phenomenon

- In Cambridge, Broccolini purchased an aggregate of 105 acres at Old Mill Road and Allendale Road for industrial development.

- In Waterloo region, Fieldgate Commercial bought 48.2 acres from Smart Centres for commercial development.

- In Hamilton, Broccolini purchased of a 178-acre industrial site on Dickenson Road West; Broccolini also bought a 90-acre industrial site on Glancaster Road in Hamilton.

- Near Hamilton airport, Fengate Capital Management bought a 75-acre industrial site on Homestead Drive. Hopewell Development also bought a 38-acre industrial site on Airport Road.

- In Winnipeg, a national developer bought 17 acres of land adjacent to InksPort Business Park for approximately $400,000 an acre. Three parcels in Winnipeg’s Brookside Business Park also changed hands for prices above $375,000 an acre.

Source The Globe And Mail. Click here to read a full story

Best practices for negotiating commercial real estate

There are many working parts in offering to purchase or lease a commercial real estate property.

Determining the strategy you will employ in a negotiation, however, can have a big bearing on the outcome.

I just received an offer on an industrial sale listing last week.

Prior to presenting the offer, the agent representing the buyer had pushed several specific questions which we respectfully answered in a timely manner.

We did however get to the point where we had to draw a line in the sand.

If the buyer was serious, he needed to bring us a conditional offer to demonstrate that he was real.

Reasonable expectations

It was obvious when we received the offer that the buyer had either not been properly coached in negotiation or wasn’t prepared to listen.

I understand that a prospective purchaser may be looking for a deal, but if that is the case at least show strength in the terms aside from price.

In this case the price was low, the deposit was half of what it should have been and the buyer was asking for a conditional period that was twice as long as the industry norm for this type of transaction.

The seller decided not to respond with a counter-offer unless the offer was revised with more realistic terms.

Providing strength and confidence

In another instance, I recently received an excellent offer on a property in a similar price range which we have been marketing for some time.

Although the buyer required a considerable conditional period to obtain zoning compliance and put together the financing on this development project, they were willing to offer a sum close to list price and provide non-refundable deposit money.

In this second example, the buyer had researched the motivation of the seller and determined the best negotiation approach.

While the buyer had asked a ton of questions in the first example, he didn’t try to seek information that would have helped him better position his offer, to be taken seriously.

It costs virtually nothing in lost interest to provide a healthy deposit. I typically recommend five to 10 per cent of the purchase price, depending on the length of time between condition removal and closing date.

If conditions are not removed, the contract can be structured so the buyer will receive their deposit back.

Building context

Find out if there have been any other offers, and if so, how long the property had been tied up?

Do your best to determine the expectations of the seller.

Often the most interesting part of an assignment is the negotiation.

Interview and engage an experienced commercial real estate broker to represent you.

Find out how many clients he or she has represented in the specific sector of your interest.

The outcome of your transaction will be greatly influenced by the legal, financing and brokerage team that you assemble.

Source Real Estate News Exchange. Click here to read a full story

The lure of single-tenant retail properties

While some kinds of retail property have fared better than others during the pandemic, one retail type has proven a clear winner.

Stand-alone retail properties, occupied by a corporate client such as a major bank, grocery store or big pharmacy, “have always been a preferred asset for investors, but now we are seeing a notable increase in buyers searching for this type of property,” according to Curtis Leonhardt, vice-president, investments, at commercial real estate firm Marcus & Millichap in Vancouver.

The appeal, Mr. Leonhardt says, is the security and stability offered by the strong covenants and long, triple-net terms that commonly govern the leases of these properties.

Triple-net leases usually cover 10 to 20 years, with annual rent increases, or escalators, built in. The tenant is provided near-total autonomy of the property and pays not just rent and utilities, but three additional categories of property expenses: property tax, insurance and most maintenance costs, such as landscaping and snow removal.

“They are virtually a hands-off investment,” says Mr. Leonhardt, who specializes in the niche market. “In many cases, owners are literally just collecting a cheque.”

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/XFHV3ZOGLZCS3LQ2BEEKWN4TSE.jpg)

Last year, in British Columbia, Marcus & Millichap completed 23 single-tenant property transactions with a total volume of more than $104-million. The company’s previous three-year volume averaged $81-million.

Mr. Leonhardt notes that “demand for quality assets continues to outpace supply.” With investors keen to capitalize on low interest rates in anticipation of higher borrowing costs in the latter half of 2022, “bidding wars” are not uncommon.

For example, Marcus & Millichap listed a CIBC bank property in Maple Ridge, B.C. In the first week, the sale drew multiple offers, with the winning $7.29-million bid dealt by a local, private investor.

The cap rates are no different for single-tenant properties than they are for multitenant properties. And you don’t have the management headaches.

– Gordon Beattie, president, Intercity Properties Ltd.

And recently, in North Vancouver, Marcus & Millichap listed a block of newer commercial strata units occupied by national tenants, including Bank of Nova Scotia and Pharmasave drugstore. Each unit was secured by a triple-net lease; prices ranged from $1.4-million to $4.3-million. Within days of the properties going to market, a single buyer purchased the entire offering.

With lower listing prices than multitenant buildings, stand-alone retail properties are a strong draw for private investors, says Mike Grewal, vice-president at Colliers’s Surrey, B.C., office.

Challenged by the acute supply shortage of industrial property and intensive management required for residential investment, “a lot of investors are chasing these single-tenant retail buildings,” Mr. Grewal says.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/GMXR22OURJH4FHSPIPGIFAXGY4.jpg)

A specialist in investment sales, Mr. Grewal speaks also from personal experience. As the owner of a couple of residential homes, he found the demands from the tenancy board so frustrating, he got to a point where he was “done with these investments.”

“So, I cashed out and now I’m looking for a commercial investment to plug my money into.”

According to CBRE, 2021 may turn out to be a record-breaking year for the number of “smaller commercial real estate” transactions. Figures are still being tallied, but the total is expected to reach 9,500 – surpassing the previous record by 2,000 transactions.

Canadian investors continue to be the most active buyer group, accounting for nearly half of all acquisitions. Foreign investors accounted for nearly 15 per cent.

Gordon Beattie, president of Surrey-based Intercity Properties Ltd., is a long-time investor in single-tenant retail properties. Since the mid-1970s, the chartered tax adviser has built a 40-building portfolio that extends from Ontario to British Columbia, of muffler shops, 7-Eleven and Mac’s convenience stores, Pizza Hut and KFC restaurants and other largely single-tenant properties.

Most recently, a Shoppers Drug Mart in Brandon fit the requirements he insists on when buying a single-tenant retail property.

“It’s like a points system,” explains Mr. Beattie, who is “constantly combing” commercial real estate websites in search of suitable properties. “I give points for location. Is it a corner? Is it in a populated centre?”

In the case of Shoppers Drug Mart, it is surrounded by seniors’ complexes and a regional hospital: It isn’t about to go out of business.

“Then there’s the tenancy,” he says. “Is it a national tenant? What are the terms? I look at the character of the building from an architectural standpoint. Does it have a degree of utility for subsequent tenants?”

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/W5KSESFUCJABJGYJYXLRI47PZA.JPG)

A crucial score point is capitalization rate, “the basis for valuing these properties,” he says. “The cap rates are no different for single-tenant properties than they are for multitenant properties. And you don’t have the management headaches. If [tenants] run their business to be successful, they make sure their building is well maintained.”

While Mr. Beattie owns properties on several main streets, such as Yonge Street in Toronto and Granville Street in Vancouver, he also favours secondary markets – “the Cranbrooks and the Kamloops of the world: There’s less competition and you can get better cap rates.”

Smaller markets are riskier, though. “It might be more difficult to maintain the rental value if you lose the tenant.”

Mr. Beattie maintains that land-value speculation isn’t a key factor in his purchasing rating system.

But in Metro Vancouver’s constricted market, Colliers’s Mr. Grewal says, many single-tenant retail property buyers are “speculating on the continuing increase of land value.”

It’s a bonus, he notes. The finale of a carefree, income-generating investment in a bank or drugstore building “could potentially be an up-zoning for higher-density development” – followed, most assuredly, by the sale of it. As he puts it, “who needs the headache?”

The rise of retail investment

Thanks largely to whopping sales of industrial and multifamily properties, commercial real estate investment in Canada has reached historic highs. But retail property investment across the country has also increased compared to pre-COVID-19 levels, according to the following CBRE statistics from January-September, 2021:

- 30 per cent: increase of retail property investment in Canada since pandemic

- 70 per cent: increase in industrial real estate

- 90 per cent: increase in multifamily real estate

Source The Globe And Mail. Click here to read a full story

Soneil tops $1B in AUM with 2 GTA industrial acquisitions

It took 15 years for Brampton-based Soneil Investments to acquire $100 million in commercial real estate. It has topped $1 billion in assets under management in just five years since, hitting the milestone with two Greater Toronto Area industrial acquisitions in recent days.

Soneil has acquired the 260,000-square-foot 8301 Keele St., in Vaughan, and a 205,000-square-foot building at 1055 Clark Blvd., in Brampton. They were purchased via separate off-market transactions for a total of $105 million.

“At its core our company is a family business, so we are immensely proud of this achievement, especially since we have never raised external capital,” Soneil president and CEO Neil Jain said in an interview with RENX. “One of the advantages we have in not raising external capital is we can be aggressive in targeting anything we see value in.

“And, we can pivot quickly and aggressively.”

Neil’s father Sach Jain created Soneil as a spinoff from his original business Soneil Electronics. Sach Jain remains the chairman of Soneil Group of Companies.

Soneil targets $2 billion in assets

“$1 billion in assets was always my biggest goal and I’m beyond proud to have reached it,” Sach Jain said in a prepared statement. “The next step is to continue this momentum towards $2 billion and beyond, and I have no doubt we will make it happen.”

Neil Jain agreed, noting he’s now looking ahead to that next goal.

“It’s almost something that you don’t imagine you’ll ever be able to reach,” Neil Jain said, “but when you get there, you tend to focus on the next step.”

Soneil’s portfolio comprises over 3.5 million square feet of industrial, office and retail properties.

Neil Jain said he’d like to see Soneil double its holdings again over the next three years. It will pursue that goal through opportunistic acquisitions.

For now, industrial is a major focus because of the demand and growth in the sector, but he said the firm isn’t married to any one sector or geographic location although it does plan to stay within the confines of the GTA.

“We typically don’t get pigeon-holed into specific locations, or frankly specific asset classes,” he explained. “Our strategy in terms of investment is we invest where we see opportunity.

“It just happens that the last five transactions we’ve done have been industrial. Prior to that we purchased four large office assets in a row.”

They are also open to acquisitions anywhere across the GTA, but want to stay within those boundaries to maximize their property management and leasing capabilities, which are handled in-house.

“We are very strict in staying within the GTA,” he said.

The Keele and Clark acquisitions

The Keele and Clark acquisitions fit well into Soneil’s strategy of acquiring assets in which it can unlock new value.

8301 Keele is located on an 11-acre property in the area of Langstaff Road and has clear heights of between 20 and 28 feet. Jain said it is in “great condition” and has a diverse roster of tenants both in terms of their economic activity and their size.

“There might be four or five main tenants and two or three smaller tenants, but it is diverse enough that there is not so much concentration of risk associated with one single tenant,” he explained. “The rents are the main driver behind where we see the value.

“They are probably at least 50 per cent below market rent compared to where things are in Vaughan. That’s really where we see the short- to mid-term value of that asset.”

1055 Clark has clear heights between 18 and 36 feet because the building was constructed in different stages and sits on 8.5 acres.

“In-place rents on that are a little bit closer to market,” he noted, “maybe 15 to 20 per cent below market rent.

“The short-term plan for us on this asset or any industrial asset we look at is always about bringing rents up to market, doing some capital improvements on the property to show tenants we are invested in the building, things like that.”

Future acquisitions

Jain said Soneil continues to actively pursue other potential acquisitions.

“As industrial continues to get more expensive, it’s a bit of a double-edged sword for us; the stuff we own appreciates immensely in value, but it becomes increasingly difficult to get your hands on more,” he said.

The firm continues to like the industrial sector, but “it doesn’t preclude us from looking at suburban office – which a lot of people are unsure about – or even retail if it’s grocery-anchored or convenience-store anchored, things like that.”

Source Real Estate News Exchange. Click here to read a full story

RioCan REIT will re-examine tenant mix, but says physical retail remains strong

RioCan Real Estate Investment Trust is “pruning” its tenant mix to ensure malls and other retail spaces it owns are filled with resilient businesses that are best positioned to weather any further COVID-19 upheaval.

Chief executive Jonathan Gitlin said Thursday that the Toronto-based commercial landlord’s close look at who is renting its spaces will result in the company shedding some assets in enclosed malls, “which are harder to evolve into today’s current demands from our tenants.”

“Within the properties that we are keeping, there is a tenant mix that in order to stay relevant and in order to stay on top of consumer trends, needs to continuously evolve and change,” he said on a call with analysts.

“We are switching over to more necessity-based purveyors and in some cases, it might not be tenants with amazing covenants, but they just have some great uses that will add to…the flavour of the shopping centre.”

Gitlin did not share which tenants could end up on the chopping block, but has often highlighted that the trust sees grocery, pharmacy and liquor store tenants, which make up just shy of 20 per cent of the company’s rent, as resilient.

His remarks come after Canadian retailers have spent roughly two years swinging between periods of intense lockdowns and cautious reopenings meant to quell the spread of COVID-19.

The rapidly changing restrictions have pushed many retailers to close their businesses entirely, rethink their brick-and-mortar strategies or struggle to pay rent and cover other bills.

“I am not going to downplay the challenges that the commercial real estate industry faced throughout the year,” Gitlin said.

“2021 was volatile and tenant shutdowns lasted into the summer and there was numerous restrictions on retail throughout 2021. The year ultimately ended with additional disruption courtesy of Omicron.”

But that volatility has yielded strength from many retailers and Gitlin said it has emphasized the importance of physical stores rather than diminishing brick-and-mortar shops like many expected when people moved to shopping online.

“Consumer behaviour confirms that Canadians want to control their shopping experience and physical retail stores will continue to play a critical part of their lives,” he said.

“E-commerce and physical retail don’t just coexist. They have got a relationship and there is every indication that well-placed, physical retail… plays a vital role in this relationship.”

Those findings were borne out when the company reported Wednesday that its rent collection rate reached 98.6 per cent in its most recent quarter, a slight climb from 96.2 per cent at the same time last year.

Its committed occupancy level across its portfolio of about 207 properties totalled 96.8 per cent in its fourth quarter, up from 95.7 per cent

Net income for the three months ended Dec. 31 amounted to $208.8 million, up from $65.6 million in the fourth quarter of 2020.

The results pushed the trust’s stock up by 58 cents or almost three per cent to $23.25 in mid-morning trading.

Along with earnings, the company also provided an update on the Well, a much-anticipated commercial and office property it is building in Toronto.

The site is due to house several tenants, including Shopify Inc., and the trust now says construction of commercial portions of the property is 82 per cent complete.

About 90 per cent of the office space and 50 per cent of the retail space is leased. The retail component is slated to open in spring 2023.

Source Toronto Star. Click here to read a full story

Colliers REMS assumes management of T.O.’s Royal Bank Plaza

Colliers played a major role in Pontegadea’s acquisition of Toronto’s Royal Bank Plaza and is now handling the building’s real estate management services.

Pontegadea is the family office of Spain’s Amancio Ortega, the main shareholder of multinational fashion group Inditex and the world’s 19th-wealthiest person with a fortune worth $62.3 billion US as of Feb. 2 (according to the Bloomberg Billionaires Index). It acquired the two-tower, 1.5-million-square-foot Royal Bank Plaza at 200 Bay St. for $1.2 billion ($920 million US) from Oxford Properties and CPP Investments in January.

“We provided buy-side advisory through Capital Markets and we also provided due diligence services,” Colliers Real Estate Management Services (REMS) president John Duda told RENX.

“That included valuation and taxation advice, capital management advice through Project Leaders, operational advice and an assessment of the building, and market office leasing rates through brokerage.”

Pontegadea became a Colliers REMS client when it purchased its first Canadian property, Toronto’s 270,000-square-foot 150 Bloor St. W. office and retail complex, from Kevric in 2014.

Colliers REMS also manages Pontegadea’s three-storey, 26,463-square-foot 777 Saint Catherine West retail property in Montreal, which was built in 1931 and acquired in 2016.

Transition from Oxford to Colliers REMS

Royal Bank Plaza serves as Royal Bank of Canada’s headquarters and is home to several other tenants, including banks, law firms and technology companies.

Colliers REMS is now responsible for Royal Bank Plaza’s property management and for overseeing capital expenditures and leasing management after taking over those roles from Oxford.

Duda said Oxford’s entire staff for the property, except for one person, moved over to Colliers REMS during the management transition after the purchase.

“It has gone extremely smoothly. Oxford is highly organized and very professional. My team was extremely familiar with the asset itself. It took approximately 30 days of planning,” he said.

“Normally it takes a little bit longer, but because we were doing the due diligence we had most of the information that we already needed in order to transition the asset.

“Everything was up and running on Day One. There were no hiccups and no problems.”

Oxford had reduced its staff at Royal Bank Plaza during the pandemic because the building was operating below capacity, with many people who would normally have been filling offices working from home.

“We transitioned over 17 staff,” said Duda. “As people come back to the office, that number will go up to 26, which is similar to what Oxford had before.”

Duda said landing Royal Bank Plaza was the culmination of a five-year strategy to develop an asset advisory service for first-class office space.

Colliers REMS now manages approximately 14 million square feet of office space classified as class-A and above. It also works with many class-B assets and a few class-C properties and has more than 30 million square feet of office space in total under management.

“The purpose of us focusing on the first-class is that I can easily use what’s in the platform for B-class assets and not have to charge them the same types of fees,” said Duda.

“It would be impossible for me to target a B-class platform and then try to service an A-class.”

Colliers REMS across Canada

Colliers REMS has more than 750 people specializing in retail, office and industrial asset classes, working with just over 65 million square feet at more than 1,000 properties from St. John’s to Victoria — with an emphasis on Vancouver, Calgary, Toronto and Montreal.

“We have different platforms with different features and benefits for each of the asset classes,” said Duda.

“We do original research with tenants. We have a proptech group and an ESG group. All of these things are catering to the trends that are taking place in the marketplace that affect all of the different asset types in different ways.”

Other prominent Canadian buildings Colliers REMS is responsible for include:

– Lansdowne Centre, which encompasses more than 600,000 square feet and more than 120 stores and services in Richmond, B.C.;

– the 31-storey, 372,000-square-foot The Exchange office and retail complex in Vancouver;

– Mississauga Executive Centre, which includes four 15-storey buildings with 1.04 million square feet of office and almost 42,000 square feet of retail space in Mississauga;

– and Desjardins Group’s 17-storey Toronto building at 95 St. Clair Ave. W. that received an International TOBY Award in the 250,000- to 499,999-square-foot office building category from BOMA International in 2020.

Source Real Estate News Exchange. Click here to read a full story